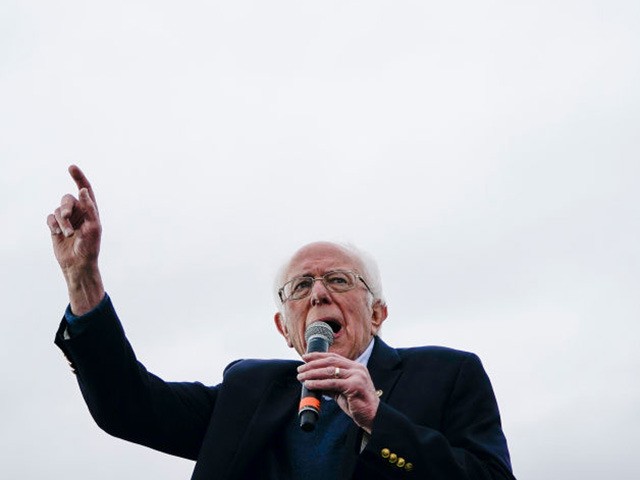

Bernie Sanders to Fund ‘Major’ Multitrillion-Dollar Plans with Military Cuts, Taxes, Lawsuits

6:12

Sen. Bernie Sanders (I-VT) on Monday released a fact sheet explaining how he will fund his “major” multitrillion-dollar campaign proposals — the Green New Deal, free college, housing for all, etc. — and revealed that he will pay for them through a combination of cutting military spending, creating new taxes, and enacting penalties on the fossil fuel industry in the form of lawsuits.

While Sanders has released a suite of lofty plans with the promise to improve the lives of middle class and low income Americans, critics have repeatedly asked the socialist senator to explain how his administration will pay for his grandiose proposals.

His campaign released a fact sheet on Monday listing each of his “major plans” and providing a line on how he will make it a reality.

His $16.3 trillion Green New Deal plan, perhaps one of his most prolific proposals, will be paid for, he claims, through a variety of methods including slashes in military spending and lawsuits against the fossil fuel industry.

He is calling to reduce defense spending by $1.215 trillion “by scaling back military operations on protecting the global oil supply.” His campaign claims he will raise $3.085 trillion by “making the fossil fuel industry pay for their pollution, through litigation, fees, and taxes, and eliminating federal fossil fuel subsidies.” He expects to garner another $6.4 trillion “from the wholesale of energy produced by the regional Power Marketing Administrations.”

“This revenue will be collected from 2023-2035, and after 2035 electricity will be virtually free, aside from operations and maintenance costs,” his website states.

Sanders also claims his Green New Deal plan will create 20 million jobs, which will effectively create a new tax base and eliminate the need for $1.31 trillion in “federal and state safety net spending due to the creation of millions of good-paying, unionized jobs.”

His campaign actually argues that enacting his multitrillion-dollar climate change proposal will save the United States $2.9 trillion in the next decade, $21 trillion over the next 30 years, and $70.4 trillion over the next 80 years.

“If we do not act, the U.S. will lose $34.5 trillion by the end of the century in economic productivity,” he claims.

That is far from Sanders’ only proposal. Offering free college and cancelation of student debt will cost, according to his estimates, $2.2 trillion. Sanders claims the plan is “fully paid” for with a “modest tax on Wall Street speculation,” contending that it will raise more than enough — $2.4 million over the next decade.

Sanders says his $1.5 trillion housing for all plan and $1.5 trillion universal child care/pre-K plan will be paid for with “a wealth tax on the top one-tenth of one percent – those who have a net worth of at least $32 million.” He claims it will raise “a total of $4.35 trillion.”

His other plans rely almost entirely on new taxes on the wealthy. His vow to erase $81 billion past-due medical debt will be “fully paid for by establishing an income inequality tax on large corporations that pay CEOs at least 50 times more than average workers.” Additionally, Social Security expansion will be paid for, he says, with a tax on Americans with incomes over $250,000.

Instead of explicitly stating how Sanders will fund his Medicare for All plan, which some experts say could cost over $60 trillion over the next decade, the fact sheet simply touts a “menu of financing options that would more than pay for the Medicare for All legislation he has introduced,” which includes raising taxes on the middle class.

Per the fact sheet, those options include:

- Creating a 4 percent income-based premium paid by employees, exempting the first $29,000 in income for a family of four.

- Imposing a 7.5 percent income-based premium paid by employers, exempting the first $1 million in payroll to protect small businesses.

- Eliminating health tax expenditures, which would no longer be needed under Medicare for All.

- Raising the top marginal income tax rate to 52% on income over $10 million.

- Replacing the cap on the state and local tax deduction with an overall dollar cap of $50,000 for a married couple on all itemized deductions.

- Taxing capital gains at the same rates as income from wages and cracking down on gaming through derivatives, like-kind exchanges, and the zero tax rate on capital gains passed on through bequests.

- Enacting the For the 99.8% Act, which returns the estate tax exemption to the 2009 level of $3.5 million, closes egregious loopholes, and increases rates progressively including by adding a top tax rate of 77% on estate values in excess of $1 billion.

- Enacting corporate tax reform including restoring the top federal corporate income tax rate to 35 percent.

- Using $350 billion of the amount raised from the tax on extreme wealth to help finance Medicare for All.

The release of the fact sheet follows Sanders growing frustration over the mounting questions over the costs of his massive proposals.

Anderson Cooper grilled Sanders on the costs of his various proposals during the presidential hopeful’s recent sit-down interview with 60 Minutes.

“But you say you don’t know what the total price is, but you know how it’s going to be paid for. How do you know it’s going to be paid for if you don’t know how much the price is?” Cooper asked.

“I can’t rattle off to you every nickel and every dime,” Sanders said. “But we have accounted for — you talked about Medicare for All — we have options out there that will pay for it.”

Josh

Hawley: GOP Must Defend Middle Class Americans Against ‘Concentrated Corporate

Power,’ Tech Billionaires

The Republican Party must defend America’s working and middle

class against “concentrated corporate power” and the monopolization of entire

sectors of the United States’ economy, Sen. Josh Hawley (R-MO) says.

The wealthiest

Americans are paying a lower tax rate than all other Americans, groundbreaking

analysis from a pair of economists reveals.

Census Says U.S.

Income Inequality Grew ‘Significantly’ in 2018

TRUMPERNOMICS:

Billionaires’ wealth surged in 2019

28

December 2019

Rep. Mo Brooks

(R-AL) says the “Masters of the Universe” want more legal immigration to the

United States to further diminish the incomes of American working and

middle-class families.

A new Gilded Age

has emerged in America — a 21st century version.

The

wealth of the top 1% of Americans has grown dramatically in the past four decades, squeezing both

the middle class and the poor. This is in sharp contrast to Europe and Asia,

where the wealth of the 1% has grown at a more constrained pace.

Josh

Hawley: GOP Must Defend Middle Class Americans Against ‘Concentrated Corporate

Power,’ Tech Billionaires

The Republican Party must defend America’s working and middle

class against “concentrated corporate power” and the monopolization of entire

sectors of the United States’ economy, Sen. Josh Hawley (R-MO) says.

In an interview on The Realignment podcast,

Hawley said that “long gone are the days where” American workers can depend on

big business to look out for their needs and the needs of their communities.

Instead, Hawley explained that increasing “concentrated

corporate power” of whole sectors of the American economy — specifically among

Silicon Valley’s giant tech conglomerates — is at the expense of working and middle

class Americans.

“One of the things Republicans need to recover today is a

defense of an open, free-market, of a fair healthy competing market and the

length between that and Democratic citizenship,” Hawley said, and continued:

At the end of the day, we are trying to support and sustain here

a great democracy. We’re not trying to make a select group of people rich.

They’ve already done that. The tech billionaires are already billionaires, they

don’t need any more help from government. I’m not interested in trying to help

them further. I’m interested in trying to help sustain the great middle of this

country that makes our democracy run and that’s the most important challenge of

this day.

“You have these businesses who for years now have said ‘Well,

we’re based in the United States, but we’re not actually an American company,

we’re a global company,'” Hawley said. “And you know, what has driven profits

for some of our biggest multinational corporations? It’s been … moving jobs

overseas where it’s cheaper … moving your profits out of this country so you

don’t have to pay any taxes.”

“I think that we have here at the same time that our economy has

become more concentrated, we have bigger and bigger corporations that control

more and more of our key sectors, those same corporations see themselves as

less and less American and frankly they are less committed to American workers

and American communities,” Hawley continued. “That’s turned out to be a problem

which is one of the reasons we need to restore good, healthy, robust

competition in this country that’s going to push up wages, that’s going to

bring jobs back to the middle parts of this country, and most importantly, to

the middle and working class of this country.”

While multinational corporations monopolize industries, Hawley

said the GOP must defend working and middle class Americans and that big

business interests should not come before the needs of American communities:

A free market is one where you

can enter it, where there are new ideas, and also by the way, where people can

start a small family business, you shouldn’t have to be gigantic in order to

succeed in this country. Most people don’t

want to start a tech company. [Americans]

maybe want to work in their family’s business, which may be some corner shop in

a small town … they want to be able to make a living and

then give that to their kids or give their kids an option to do that. [Emphasis

added]

The problem with corporate

concentration is that it tends to kill all of that. The worst thing about corporate concentration is that it

inevitably believes to a partnership with big government. Big business and big government always get

together, always. And that is exactly what has happened now with the tech sector,

for instance, and arguably many other sectors where you have this alliance

between big government and big business … whatever you call it, it’s a problem

and it’s something we need to address. [Emphasis added]

Hawley blasted the free trade-at-all-costs doctrine that has

dominated the Republican and Democrat Party establishments for decades,

crediting the globalist economic model with hollowing “out entire industries,

entire supply chains” and sending them to China, among other countries.

“The thing is in this country is that not only do we not make

very much stuff anymore, we don’t even make the machines that make the stuff,”

Hawley said. “The entire supply chain up and down has gone overseas, and a lot

of it to China, and this is a result of policies over some decades now.”

As Breitbart News reported,

Hawley detailed in the

interview how Republicans like former President George H.W. Bush’s ‘New World

Order’ agenda and Democrats have helped to create a corporatist economy that

disproportionately benefits the nation’s richest executives and donor class.

The billionaire class, the top 0.01

percent of earners, has enjoyed more than 15 times as much

wage growth as the bottom 90 percent since 1979. That economy has been

reinforced with federal rules that largely benefits the wealthiest of

wealthiest earners. A study released last month

revealed that the richest Americans are, in fact, paying a lower tax rate than

all other Americans.

Economists: America’s Elite Pay Lower Tax Rate Than All Other

Americans

The wealthiest

Americans are paying a lower tax rate than all other Americans, groundbreaking

analysis from a pair of economists reveals.

For the

first time on record, the wealthiest 400 Americans in 2018 paid a lower tax

rate than all of the income groups in the United States, research highlighted by the New York Times from

University of California, Berkeley, economists Emmanuel Saez and Gabriel

Zucman finds.

The

analysis concludes that the country’s top economic elite are paying lower

federal, state, and local tax rates than the nation’s working and middle class.

Overall, these top 400 wealthy Americans paid just a 23 percent tax rate, which

the Times‘ op-ed columnist David Leonhardt notes is a

combined tax payment of “less than one-quarter of their total income.”

This 23

percent tax rate for the rich means their rate has been slashed by 47

percentage points since 1950 when their tax rate was 70 percent.

(Screenshot

via the New York Times)

The

analysis finds that the 23 percent tax rate for the wealthiest Americans is

less than every other income group in the U.S. — including those earning

working and middle-class incomes, as a Times graphic shows.

Leonhardt

writes:

For

middle-class and poor families, the picture is different. Federal

income taxes have also declined modestly for these families, but they haven’t

benefited much if at all from the decline in the corporate tax or estate tax. And

they now pay more in payroll taxes (which finance Medicare and Social

Security) than in the past. Over all, their taxes have remained fairly flat.

[Emphasis added]

The

report comes as Americans increasingly see a growing divide between the rich

and working class, as the Pew Research Center has found.

Sen. Josh

Hawley (R-MO), the leading economic nationalist in the Senate, has warned

against the Left-Right coalition’s consensus on open trade, open markets, and

open borders, a plan that he has called an economy that works solely for the

elite.

“The same

consensus says that we need to pursue and embrace economic globalization and

economic integration at all costs — open markets, open borders, open trade,

open everything no matter whether it’s actually good for American national

security or for American workers or for American families or for American

principles … this is the elite consensus that has governed our politics

for too long and what it has produced is a politics of elite ambition,”

Hawley said in an August speech in the

Senate.

That increasing

worry of rapid income inequality is only further justified by economic

research showing a rise in servant-class jobs,

strong economic recovery for elite zip codes but not for working-class

regions, and skyrocketing wage growth for the billionaire class at 15 times

the rate of other Americans.

Census Says U.S.

Income Inequality Grew ‘Significantly’ in 2018

(Bloomberg) -- Income

inequality in America widened “significantly” last year, according to a U.S.

Census Bureau report published Thursday.

A measure of inequality

known as the Gini index rose to 0.485 from 0.482 in 2017, according to the

bureau’s survey of household finances. The measure compares incomes at the top

and bottom of the distribution, and a score of 0 is perfect equality.

The 2018 reading is the

first to incorporate

the impact of President Donald Trump’s end-

2017 tax bill, which was reckoned by many

economists to be skewed in favor of the

wealthy.

the impact of President Donald Trump’s end-

2017 tax bill, which was reckoned by many

economists to be skewed in favor of the

wealthy.

But the distribution of

income and wealth in the U.S. has been worsening for decades, making America

the most unequal country in the developed world. The trend, which has persisted

through recessions and recoveries, and under administrations of both parties,

has put inequality at the center of U.S. politics.

Leading candidates for

the 2020 Democratic presidential nomination, including senators Elizabeth

Warren and Bernie Sanders, are promising to rectify the tilt toward the rich

with measures such as taxes on wealth or financial transactions.

Just five states --

California, Connecticut, Florida, Louisiana and New York, plus the District of

Columbia and Puerto Rico -- had Gini indexes higher than the national level,

while the reading was lower in 36 states.

TRUMPERNOMICS:

Billionaires’ wealth surged in 2019

28

December 2019

As the second decade of the 21st century comes to a close, its

most salient feature—the plundering of humanity by a global financial

oligarchy—continues unabated.

Amidst trade war and the growth of militarism and authoritarianism

on the one side, and an eruption of international strikes and protests by the

working class against social inequality on the other, the stock market is

hitting record highs and the fortunes of the world’s billionaires are

continuing to surge.

On Friday, one day after all three major US stock indexes set

new records, Bloomberg issued its end-of-year survey of the world’s 500 richest

people. The Bloomberg Billionaires Index reported that the oligarchs’ fortunes

increased by a combined total of $1.2 trillion, a 25 percent rise over 2018.

Their collective net worth now comes to $5.9 trillion.

To place this figure in some perspective, these 500 individuals

control more wealth than the gross domestic product of the United States at the

end of the third quarter of 2019, which was $5.4 trillion.

The year’s biggest gains went to France’s Bernard Arnault, who

added $36.5 billion to his fortune, bringing it above the rarified $100 billion

level to $105 billion. He knocked speculator Warren Buffett, at $89.3 billion,

down to fourth place. Amazon boss Jeff Bezos lost nearly $9 billion due to a

divorce settlement, but maintained the top position, with a net worth of $116

billion. Microsoft founder Bill Gates gained $22.7 billion for the year and

held on to second place at $113 billion.

The 172 American billionaires on the Bloomberg list added $500

billion, with Facebook’s Mark Zuckerberg recording the year’s biggest US gain

at $27.3 billion, placing him in fifth place worldwide with a net worth of

$79.3 billion.

It is difficult to comprehend the true significance of such

stratospheric sums. In his 2016 book Global Inequality, economist

Branko Milanovic wrote:

"A billion dollars is so far outside the usual experience

of practically everyone on earth that the very quantity it implies is not

easily understood… Suppose now that you inherited either $1 million or $1

billion, and that you spent $1,000 every day. It would take you less than three

years to run through your inheritance in the first case, and more than 2,700

years (that is, the time that separates us from Homer’s Iliad) to

blow your inheritance in the second case."

The vast redistribution of wealth from the bottom to the top of

society is the outcome of a decades-long process, which was accelerated following

the 2008 Wall Street crash. It is not the result of impersonal and simply

self-activating processes. Rather, the policies of capitalist governments and

parties around the world, nominally “left” as well as right, have been

dedicated to the ever greater impoverishment of the working class and

enrichment of the ruling elite.

In the US, the top one percent has captured all of the increase

in national income over the past two decades, and all of the increase in

national wealth since the 2008 crash.

The main mechanism for this transfer of wealth has been the

stock market, and the policies of the US Federal Reserve and central banks

internationally have been geared to providing cheap money to drive up stock

prices. The cost of this massive subsidy to the financial markets and the

oligarchs has been paid by the working class, in the form of social cuts, mass

layoffs, the destruction of pensions and health benefits, and the replacement

of relatively secure and decent-paying jobs with part-time, temporary and contingent

“gig” positions.

Since Trump was inaugurated in January of 2017, pledging to

slash corporate taxes, lift regulations on big business and dramatically

increase the military budget, the Dow has surged by 9,000 points. This year,

Trump and the financial markets applied massive pressure on the Fed to reverse

its efforts to “normalize” interest rates. The Fed complied, carrying out three

rate cuts and repeatedly assuring the markets it had no plans to raise rates in

2020.

This windfall for the banks and hedge funds was supported by the

Democrats no less than the Republicans. In fact, Trump’s economic policy has

been given de facto support by the Democratic Party all down the line—from his

tax cuts for corporations and the rich to his attack on virtually all

regulations on business. Even in the midst of impeachment—carried out entirely

on the grounds of “national security” and Trump’s supposed “softness” toward

Russia—the Democrats have voted by wide margins for Trump’s budget, his

anti-Chinese US-Mexico-Canada trade pact and his record $738 billion Pentagon

war budget.

This has included giving Trump all the money he wants to build

his border wall and carry out the mass incarceration and persecution of

immigrants.

Trump’s pro-corporate policies are an extension and expansion of

those pursued by the Obama administration. It allocated trillions in taxpayer

money to bail out the banks and flooded the financial markets with cheap

credit, driving up stock prices, while imposing a 50 percent across-the-board

cut in pay for newly hired autoworkers in its bailout of General Motors and

Chrysler. Obama oversaw the closure of thousands of schools and the layoff of

hundreds of thousands of teachers, and enacted austerity budgets that slashed

social programs.

Two of those running for the 2020 Democratic presidential

nomination are billionaires—Tom Steyer and Michael Bloomberg. The latter, with

a net worth of $56 billion, is the ninth richest person in the US. He entered

the race as the spokesman for oligarchs outraged over talk from Bernie Sanders

and Elizabeth Warren of token tax increases on the super-rich.

The oligarchs are not frightened by Sanders and Warren—two

longstanding defenders of the American ruling class, who seek to mask their

subservience to capital with talk of making the oligarchs pay “their fair

share,” a euphemism for defending their right to pillage the population. The

billionaires are frightened by the growth of mass opposition to capitalism that

finds a distorted expression in support for the phony “progressives” in the

Democratic fold.

Between them, Bloomberg and Steyer have already spent $200

million of their own money in an effort to buy the election outright.

The impact of the policy of social plunder is seen in the

deepening of a malignant social crisis in country after country. In the US,

society is marching backwards, as the crying need for schools, hospitals,

affordable housing, pensions, the rebuilding of decrepit roads, bridges,

transportation, flood control, water and sewage, fire control and electricity

grids is met with the official response: “There is no money.”

The result? Three straight years of declining life expectancy,

record addiction and suicide rates, devastating wildfires and floods,

electricity cut-offs by profiteering utility companies. And a climate crisis

that cannot be addressed within the framework of a system dominated by a

money-mad plutocracy.

Not a single serious social problem can be addressed under

conditions where the ruling elite—through its bribed parties and politicians,

aided by its pro-capitalist trade unions and backed up by its courts, police

and troops—diverts resources from society to the accumulation of ever more

luxurious yachts, mansions, private islands and personal jets.

Where social reform is impossible, social revolution is

inevitable. The solution to the impasse is to be found in the growth of the

class struggle. The movement of workers and youth all over the world—from mass

strikes in France to strikes by autoworkers and teachers in the US, protests in

Chile, Bolivia, Ecuador and Brazil, strikes and mass demonstrations in Lebanon,

Iran, Iraq and India—reveals the social force that can and will put an end to

capitalism.

The watchword must be—in opposition to the Corbyns, the Sanders,

the Tsiprases and their pseudo-left promoters—“Expropriate the super-rich!”

Exclusive–Mo

Brooks: ‘Masters of the Universe’ Want More Immigration to ‘Decrease Incomes of

Americans’

Bob Gathany / AL.com via AP

3:19

Rep. Mo Brooks

(R-AL) says the “Masters of the Universe” want more legal immigration to the

United States to further diminish the incomes of American working and

middle-class families.

In an exclusive interview with SiriusXM Patriot’s Breitbart News Tonight, Brooks said

recent demands to increase the number of foreign workers coming to the U.S. to

compete against American citizens for jobs is merely an effort by corporations

to deplete the earnings of Americans.

Brooks said:

I’m not a part of the Masters of the Universe crowd who thinks we

ought to be bringing in all this foreign labor and the reason for it is pure economics. This is the chance for Americans and lawful immigrants who are already here who are working

in the blue-collar trades, who are working in the places where

wages are not as high they ought to be, this is their chance to prosper. [Emphasis added]

And to the extent you import a lot of foreign labor, then you are

artificially increasing the labor supply which in turn means that you’re

artificially suppressing the wages of American families who are often hard-pressed to make ends meet So I

respectfully disagree that we need more foreign labor, to the contrary, I would like to see us reduce the foreign labor that comes into

America so that American families who are struggling to make ends meet, particularly those of us who are earning the least

amounts, would be better to take care of their own families and less likely

to be dependent on the welfare. [Emphasis added]

Brooks said Democrats support for mass legal immigration is

centered on the premise that increasing the number of foreign workers in the

U.S. will decrease Americans’ wages, thus forcing many into poverty and

becoming welfare recipients. This, Brooks said, is how Democrats create a

permanent dependent class of Democrat voters.

“Don’t get me wrong, [Democrats] want to decrease the incomes of

Americans so that they’re dependent on welfare,” Brooks said.

That makes them in turn likely Democrat voters and the best way to

do that is to have a huge surge in the labor supply, particularly illegal

aliens, that will depress their wages therefore creating more Democrats who are dependent on welfare at the same time as they

bring in illegal aliens who also under Democrat doctrine will be allowed to

vote and those types of voters, they’re also dependent on welfare. [Emphasis

added]

“About 70 percent of illegal alien households are on welfare …

plus this is a bloc of voters that seems unusually susceptible to the racial

divisions that the Democrats advance,” Brooks said. “You have to look at the

big picture in all of this, and to me, we should not be importing as much

foreign labor as we are. We should be helping the least among us earn more and

importing foreign labor that suppresses wages is not the way to do that.”

Currently, the U.S. admits more than 1.2 legal immigrants

annually, with the vast majority deriving from chain migration, whereby newly

naturalized citizens can bring an unlimited number of foreign relatives to the

country. In 2017, the foreign-born population reached a record high of 44.5 million.

The U.S. is on track to import about 15 million new foreign-born voters in the next

two decades should current legal immigration levels continue. Those 15

million new foreign-born voters include about eight million who will arrive in

the country through chain migration, where newly naturalized citizens can bring

an unlimited number of foreign relatives to the country.

Breitbart News Tonight broadcasts live on SiriusXM Patriot Channel 125

from 9:00 p.m. to Midnight Eastern (6:00 p.m.-9:00 p.m. Pacific).

More Americans Are Going on Strike

For decades, the

decline of the American labor movement corresponded to a decline in major

strike activity. But new data released by the Bureau of Labor Statistics, or

BLS, indicates a recent and significant increase in the number of Americans who

are participating in strikes or work stoppages. As a report from the

left-leaning Economic Policy Institute explained on Tuesday, strike activity

“surged” in 2018 and 2019, “marking a 35-year high for the number of workers

involved in a major work stoppage over a two-year period.” 2019 alone marked

“the greatest number of work stoppages involving 20,000 or more workers

since at least 1993, when the BLS started providing data that made it possible

to track work stoppages by size.” Union membership is declining, but workers

themselves are in fighting shape.

EPI credits the

strike surge to several factors. Unemployment is low, which bestows some

flexibility on workers depending on their industry. If a work environment

becomes intolerable or an employer penalizes workers for striking or

organizing, a worker could find better employment elsewhere. (Though federal

labor law does prohibit employers from retaliating against workers for

participating in protected organizing activity, employers often do so anyway,

and under Trump, the conservative makeup of the National Labor Relations Board

disadvantages unions when they try to seek legal remedies for the behavior.)

The other reason

undermines one of Donald Trump’s central economic claims. Though the president

points to low unemployment as proof that his policies are successful, the

economy isn’t booming for everyone. Wage growth continues to underperform.

People can find jobs, in other words, but those jobs often don’t pay well. As the

costs of private health insurance rise, adding another strain on household

budgets, Americans are finding that employment and prosperity are two separate

concepts.

Without a union,

exploited workers have few options at their disposal. They can take their

concerns to management, and hope someone in power feels pity. They can stage

some kind of protest, and risk the consequences. Or they can find another job,

and hope their new workplace is more equitable than the last. Lackluster wage

growth suggests that this last option is not as viable as some right-to-work

advocates claim. Unions afford workers more protection. Not only do they

bargain for better wages and benefits, union contracts typically include

just-cause provisions, which make it more difficult for managers to arbitrarily

fire people for staging any sort of protest at work. Discipline follows a set

process, which gives a worker chances to improve. Retaliation still happens,

but would likely happen more often were it not for union contracts, which are

designed to act as a layer of insulation between workers and managers with ill

intent.

The new BLS data

reveals that despite their relatively small numbers, unionized workers are

exercising the power afforded them by their contracts. Elected officials ought

to listen to what this activity tells them. A strike wave is a symptom that the

economy is actually not as healthy as it superficially looks. Nobody withholds

their labor unless they’ve exhausted all other options. Strikes and stoppages

stem from exasperation, sometimes even desperation. Workers know they’re

playing a rigged game, and they’re running out of patience.

Donald Trump is ‘just wrong’ about

the economy, says Nobel Prize-

winner Joseph Stiglitz

the economy, says Nobel Prize-

winner Joseph Stiglitz

President Donald Trump told business and political

leaders in Davos, Switzerland last week that the economy under his tenure has

lifted up working- and middle-class Americans. In a newly released interview,

Nobel Prize-winning economist Joseph Stiglitz sharply disagreed, saying Trump’s

characterization is “just wrong.”

“The Washington Post has kept a tab of how many lies and

misrepresentations he does a day,” Stiglitz said of Trump last Friday at the

annual World Economic Forum. “I think he outdid himself.”

In Davos last Tuesday, Trump said he has presided over a

“blue-collar boom,” citing a historically low unemployment rate and surging

wage growth among workers at the bottom of the pay scale.

“The American Dream is back — bigger, better, and stronger than

ever before,” Trump said. “No one is benefitting more than America’s middle

class.”

Stiglitz, a professor at Columbia University who won the Nobel

Prize in 2001, refuted the claim, saying the failure of Trump’s economic

policies is evident in the decline in average life expectancy among Americans

over each of the past three years.

“A lot of it is what they call deaths of despair,” he says. “Suicide,

drug overdose, alcoholism — it’s not a pretty picture.”

The uptick in wage growth is a result of the economic cycle, not

Trump’s policies, Stiglitz said.

“At this point in an economic recovery, it’s been 10 years since

the great recession, labor markets get tight, unemployment gets lower, and that

at last starts having wages go up,” Stiglitz says.

“The remarkable thing is how weak wages are, how weak the

economy is, given that as a result of the tax bill we have a $1 trillion

deficit.”

As the presidential race inches closer to the general election

in November, Trump’s record on economic growth — and whether it has resulted in

broad-based gains — is likely to draw increased attention.

BLOG: THE GREATEST TRANSFER OF WEALTH TO THE RICH OCCURRED

DURING THE OBAMA-BIDEN BANKSTER REGIME

“The middle class is getting killed; the middle class is getting

crushed," former Vice President Joe Biden said in a Democratic

presidential debate last month. "Where I live, folks aren't measuring the

economy by how the Dow Jones is doing, they're measuring the economy by how

they're doing," added Pete Buttigieg, a Democratic presidential candidate

and former Mayor of South Bend, Indiana.

Trump has criticized Democrats for tax and regulatory policies

that he says will make the U.S. less competitive in attracting business

investment.

“To every business looking for a place where they are free to

invest, build, thrive, innovate, and succeed, there is no better place on Earth

than the United States,” he said in Davos.

Stiglitz pointed to Trump’s threats last week of tariffs on

European cars to demonstrate that turmoil in U.S. trade relationships may

continue, despite the recent completion of U.S. trade deals in North America

and China.

“He can’t help but bully somebody,” Stiglitz said.

Max Zahn is a reporter for Yahoo Finance. Find hi

No comments:

Post a Comment