Stock Market Crash: The Shape Of The Future

Let’s say it for the record. This is not going to be a V shaped crash. The acute reactions to this crisis are going to bake chronic problems into the global economy that will take months and perhaps even years to wash out.

The act of digesting the vast bailouts being slung around is enough to cause long-term indigestion on their own, even if the funds magically hit the bullseyes they are aimed at.

However, we aren’t looking for a rock to roll under, we want to know, ‘What next?’

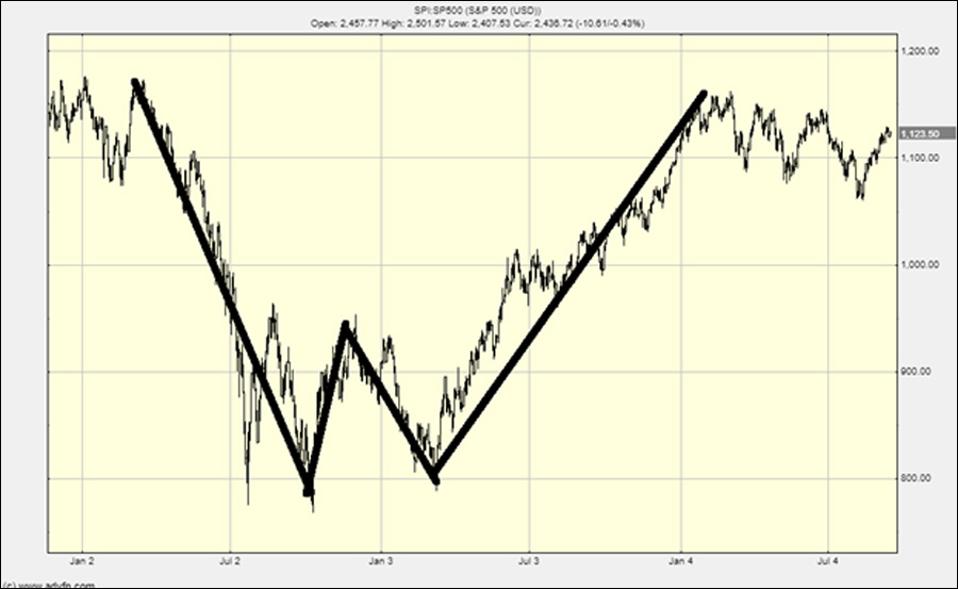

Happily we have some good guidelines to look at. Firstly, consider the V shaped bottom. The market goes down, it goes up. That is the V and that is rare. More common is the down, dead cat bounce, fall back then recovery. That is a W shaped bottom.

Here is one:

Today In: Investing

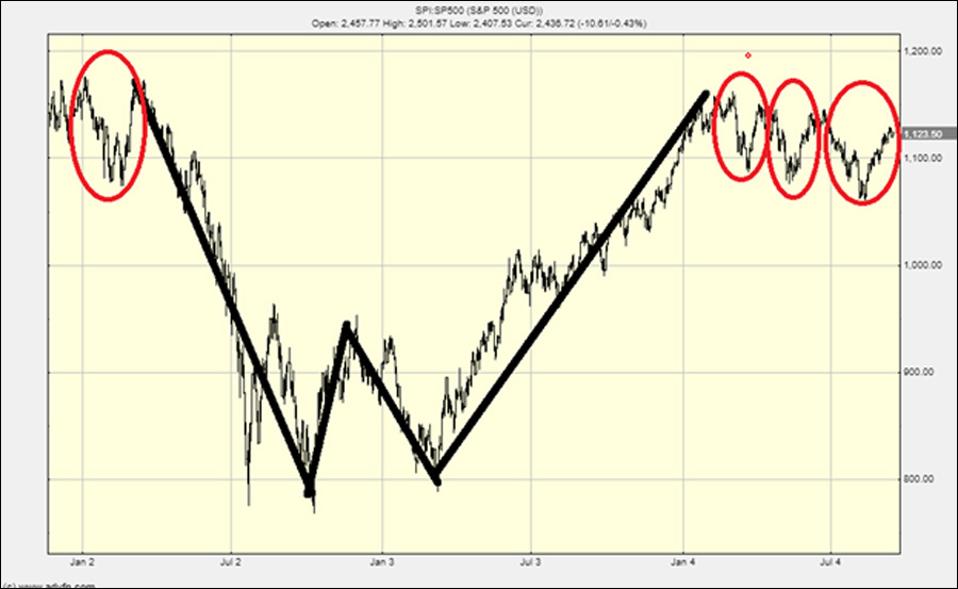

This is how to look at it:

This is all to do with geometry and randomness and if you go looking for W shaped bottom in corrections and crashes you will see them everywhere:

It may be mumbo jumbo but it has been a most profitable superstition for me thus far.

So that was the S&P 500 in 2002 and here is the S&P again in 2008-2009:

So here we are:

Now I admit I’ve been buying too hungrily and risking the wrath of the “dead cat bounce” (a brief price recovery). I’m about 50% back. So now the test will be not to be eager with the other half and try to keep away for long enough to keep the average low, to capture a near bottom without giving up too much upside or risking too much downside.

The thing to do is to let the dead cat bounce pass and then invest the further 50% but that would be strictly market timing, which is impossible or at least extremely difficult. Instead I will focus on blue-chip buys in their moments of distress or topping up on the ones I’ve already grabbed.

Everything is a special situation now but great companies with great cash flow will ride this out and pay off handsomely but they have to have solid balance sheets and a history of dividends and have suffered a mighty drop.

The next 12 months will be incredibly bumpy because there will be oceans of government money, trying to wash away rivers of corporate red ink. The West is swapping an acute health problem for a chronic economic one and unless this bad hand is played with great skill the outcome will be lose-lose.

If this is not the bottom then the bottom is as much again and we will have to watch out for the after-bounce slump, to make sure we aren’t off down into the crash of a lifetime. That is perhaps a less than 50/50 likelihood so my 50% in and 50% cash is sensible.

These are still early days and the final outcome is yet to be decided but on balance it remains a good time to be averaging into the market when you see great companies on sale.

However, if global lockdown starts to look like going on past April, it will be time to reassess, because shutting down the global economy for much longer will collapse it and no amount of money printing will avoid that. That will be a cliff edge and it will be approached.

——-

Clem Chambers is the CEO of private investors website ADVFN.com and author of 101 Ways to Pick Stock Market Winners and Trading Cryptocurrencies: A Beginner’s Guide.

Chambers won Journalist of the Year in the Business Market Commentary category in the State Street U.K. Institutional Press Awards in 2018.

I am the CEO of stocks and investment website ADVFN . As well as running Europe and South America’s leading financial market website I am a prolific financial writer. I

…

No comments:

Post a Comment