Richest 400 Americans paid lower taxes than everyone else in 2018

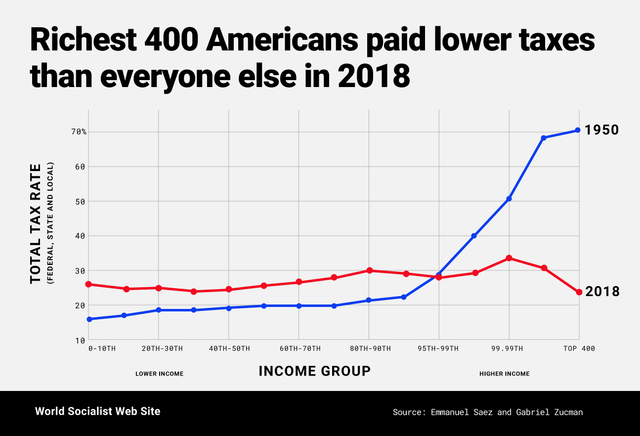

According to an analysis by noted economists Emmanuel Saez and Gabriel Zucman, previewed this week by New York Times columnist David Leonhardt, the wealthiest American households paid a lower tax rate last year than every other income group for the first time in the country’s history.

Saez and Zucman, both professors at the University of California Berkeley, detail the phenomenon of declining taxes for the richest Americans in their soon-to-be released book, The Triumph of Injustice .

The pair compiled a historical database composed of the tax payments of households in various income percentiles spanning all the way back to 1913, when the federal income tax was first implemented. Their research uncovered that in the 2018 fiscal year the wealthiest 400 Americans paid a lower tax rate—accounting for federal, state, and local taxes—than anyone else.

The overall tax rate paid by the richest .01 percent was only 23 percent last year, while the bottom half of the population paid 24.2 percent. This contrasts starkly with the overall tax rates on the wealthy of 70 percent in 1950 and 47 percent in 1980.

Los 400 estadounidenses más ricos pagaron menos impuestos que el resto en 2018

Los 400 estadounidenses más ricos pagaron menos impuestos que el resto en 2018

The taxes on the wealthy have been in precipitous decline since the latter half of the 20th century as successive presidential administrations enacted tax cuts for the rich, suggesting that they would result in economic prosperity for all. Taxes that mostly affect the wealthy, such as the estate tax and corporate tax, have been drastically cut and lawyers have been hard at work on behalf of their wealthy patrons, planning out the best schemes for tax avoidance, seeking to drive tax rates as close to zero as possible. The impetus for the historical tipping point was the Trump Administration’s 2017 tax reform, which was a windfall for the super-rich.

Supported by both the Republicans and Democrats, the two parties of Wall Street, Trump’s tax cuts were specifically designed to transfer massive amounts of wealth from the working class to the ruling elite.

The story is different for many middle- and working-class Americans. According to multiple analyses of the 2017 tax reform, 83 percent of the tax benefits will go to the top 1 percent by 2027, while 53 percent of the population, or those making less than $75,000 annually, will pay higher taxes. At the same time, the reform will sharply increase budget deficits and the national debt, serving as the pretext for the further destruction of domestic social programs.

Furthermore, a majority of Americans are paying higher payroll taxes, which cover Medicare and Social Security. The tax increased from 2 percent just after World War II, to 6 percent in 1960, to 15.3 percent in 1990, where it stands today. It has risen to become the largest tax that 62 percent of American households pay.

The result of the multitude of changes to the US tax system over the last three-quarters of a century is one that has become less progressive over time. The 2017 tax reform effectively set the foundation for a regressive tax policy where the wealthy pay lower tax rates than the poor.

The implementation of a regressive tax structure has played a major role in engineering the redistribution of wealth from the bottom to the top that has brought social inequality in America to its highest level since the 1920s.

According to Leonhardt’s preliminary Times review of The Triumph of Injustice, Saez and Zucman offer a solution to the current unjust tax system in which the overall tax rate on the top 1 percent of income earners would rise to 60 percent. The pair claim that the tax increase would bring in approximately $750 billion in taxes. Their tax code also includes a wealth tax and a minimum global corporate tax of 25 percent, requiring corporations to pay taxes on profits made in the United States, even if their headquarters are overseas.

In an interview with Leonhardt, Zucman states that history shows that the US has raised tax rates on the wealthy before so therefore it should be possible to do so now.

However, the last half century of counterrevolution waged against the working class makes the parasitic nature of the ruling elite absolutely clear, and underscores the well-known fact that the US is ruled by an oligarchy that controls the political system. Neither the Democrats nor the Republicans, who both represent this oligarchy and bear responsibility for the tax system, will make any effort to implement Saez and Zucman’s modest proposal.

Economists:

America’s Elite Pay Lower Tax Rate Than All Other Americans

Getty Images

The

wealthiest Americans are paying a lower tax rate than all other Americans,

groundbreaking analysis from a pair of economists reveals.

Census Says U.S. Income Inequality Grew ‘Significantly’ in 2018

Economists:

America’s Elite Pay Lower Tax Rate Than All Other Americans

8 Oct

201918

2:46

The

wealthiest Americans are paying a lower tax rate than all other Americans,

groundbreaking analysis from a pair of economists reveals.

For

the first time on record, the wealthiest 400 Americans in 2018 paid a lower tax

rate than all of the income groups in the United States, research highlighted by

the New York Times from

University of California, Berkeley, economists Emmanuel Saez and Gabriel

Zucman finds.

The

analysis concludes that the country’s top economic elite are paying lower

federal, state, and local tax rates than the nation’s working and middle class.

Overall, these top 400 wealthy Americans paid just a 23 percent tax rate, which

the Times‘ op-ed

columnist David Leonhardt notes is a combined tax payment of “less than

one-quarter of their total income.”

This

23 percent tax rate for the rich means their rate has been slashed by 47

percentage points since 1950 when their tax rate was 70 percent.

(Screenshot via the New York Times)

The

analysis finds that the 23 percent tax rate for the wealthiest Americans is

less than every other income group in the U.S. — including those earning

working and middle-class incomes, as a Times graphic

shows.

Leonhardt

writes:

For

middle-class and poor families, the picture is different. Federal

income taxes have also declined modestly for these families, but they haven’t

benefited much if at all from the decline in the corporate tax or estate tax. And

they now pay more in payroll taxes (which finance Medicare and Social

Security) than in the past. Over all, their taxes have remained fairly flat.

[Emphasis added]

The

report comes as Americans increasingly see a growing divide between the rich

and working class, as the Pew Research Center has found.

Sen.

Josh Hawley (R-MO), the leading economic nationalist in the Senate, has warned

against the Left-Right coalition’s consensus on open trade, open markets, and

open borders, a plan that he has called an economy that works solely for the

elite.

“The

same consensus says that we need to pursue and embrace economic globalization

and economic integration at all costs — open markets, open borders, open trade,

open everything no matter whether it’s actually good for American national

security or for American workers or for American families or for American

principles … this is the elite consensus that has governed our politics

for too long and what it has produced is a politics of elite ambition,”

Hawley said in an

August speech in the Senate.

That

increasing worry of rapid income inequality is only further justified by

economic research showing a rise

in servant-class jobs, strong economic recovery for elite zip codes but

not for working-class regions, and skyrocketing wage growth for the billionaire

class at 15 times the rate of

other Americans.

Census Says U.S. Income Inequality Grew ‘Significantly’ in 2018

(Bloomberg) -- Income inequality in America widened

“significantly” last year, according to a U.S. Census Bureau report published

Thursday.

A measure of inequality known as the Gini index rose to 0.485

from 0.482 in 2017, according to the bureau’s survey of household finances. The

measure compares incomes at the top and bottom of the distribution, and a score

of 0 is perfect equality.

The 2018 reading is the first to incorporate the impact of

President Donald Trump’s end-2017 tax bill, which was reckoned by many

economists to be skewed in favor of the wealthy.

But the distribution of income and wealth in the U.S. has been

worsening for decades, making America the most unequal country in the developed

world. The trend, which has persisted through recessions and recoveries, and

under administrations of both parties, has put inequality at the center of U.S.

politics.

Leading candidates for the 2020 Democratic presidential

nomination, including senators Elizabeth Warren and Bernie Sanders, are

promising to rectify the tilt toward the rich with measures such as taxes on

wealth or financial transactions.

Just five states -- California, Connecticut, Florida, Louisiana

and New York, plus the District of Columbia and Puerto Rico -- had Gini indexes

higher than the national level, while the reading was lower in 36 states.

No comments:

Post a Comment