But the distribution of income and wealth in the U.S. has been worsening for decades, making America the most unequal country in the developed world. The trend, which has persisted through recessions and recoveries, and under administrations of both parties, has put inequality at the center of U.S. politics.

“Our entire crony capitalist system, Democrat and

Republican alike, has become a kleptocracy approaching par with

third-world hell-holes. This is the way a great country is raided by

its elite.” ---- Karen McQuillan AMERICAN THINKER.com

#1 New York Times Bestseller!

Peter Schweizer

has been fighting corruption―and winning―for years. In Throw Them All Out, he

exposed insider trading by members of Congress, leading to the passage of the

STOCK Act. In Extortion,

he uncovered how politicians use mafia-like tactics to enrich themselves. And

in Clinton Cash,

he revealed the Clintons’ massive money machine and sparked an FBI

investigation.

Now he explains

how a new corruption has taken hold, involving larger sums of money than ever

before. Stuffing tens of thousands of dollars into a freezer has morphed into

multibillion-dollar equity deals done in the dark corners of the world.

An American bank

opening in China would be prohibited by US law from hiring a slew of family

members of top Chinese politicians. However, a Chinese bank opening in America

can hire anyone it wants. It can even invite the friends and families of

American politicians to invest in can’t-lose deals.

President Donald

Trump’s children have made front pages across the world for their dicey

transactions. However, the media has barely looked into questionable deals made

by those close to Barack Obama, Joe Biden, John Kerry, Mitch McConnell, and

lesser-known politicians who have been in the game longer.

In many parts of

the world, the children of powerful political figures go into business and

profit handsomely, not necessarily because they are good at it, but because

people want to curry favor with their influential parents. This is a relatively

new phenomenon in the United States. But for relatives of some prominent

political families, we may already be talking about hundreds of millions of

dollars.

Deeply researched and packed with shocking revelations, Secret Empires identifies

public servants who cannot be trusted and provides a path toward a more

accountable government.

Breitbart News senior contributor Peter Schweizer, author of “Secret Empires: How the American Political Class Hides Corruption and Enriches Family and Friends,”

The number of U.S. companies paying zero federal taxes DOUBLED when Trump's tax plan took effect in 2018

· 60 large companies managed to escape 2018 taxes under Trump's new plan

The Triumph of Injustice, by Emmanuel Saez and Gabriel Zucman: How tax cuts for the rich fuel inequality

The Triumph of Injustice, by economists Emmanuel Saez and Gabriel Zucman (2019, W. W. Norton), documents how governments have systematically allowed the wealthy to dodge taxes, and then cut corporate tax rates in the name of “closing tax loopholes,” helping to fuel runaway inequality.

Saez and Zucman are world-renowned experts in the economics of social inequality. In recent years, they have turned their attention to documenting the prevalence of tax evasion by the super-rich. The results of this research are condensed into a 232-page volume.

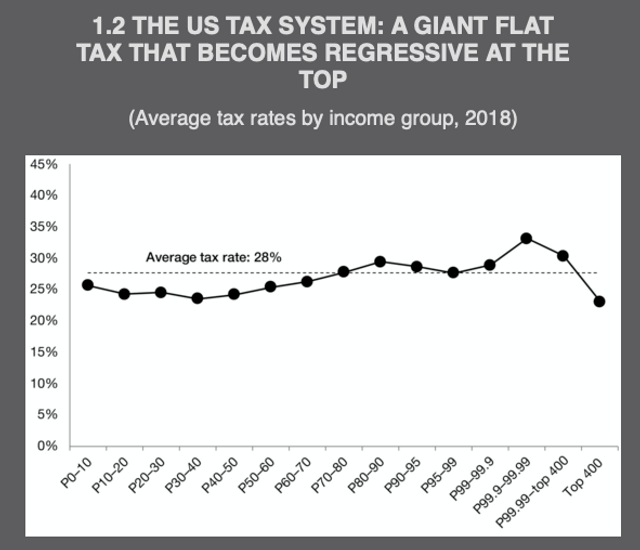

The two economists demonstrate that for the first time in modern US history, the very rich in 2018 paid a lower percentage of their income in taxes than the average worker, and that the US tax system, far from being progressive, as commonly claimed, is regressive.

The second half of the book consists of policy proposals. Saez and Zucman advocate a form of capitalist reformism similar to that of Bernie Sanders and Elizabeth Warren, who consulted the two economists in formulating portions of her program.

We do not share the view of Saez and Zucman that social inequality can be fought outside of a struggle against the capitalist social order. But their presentation of the growth of social inequality in the United States and the role that tax policy has played is vital and should be widely read.

The book begins with a description of the scale of social inequality in the United States:

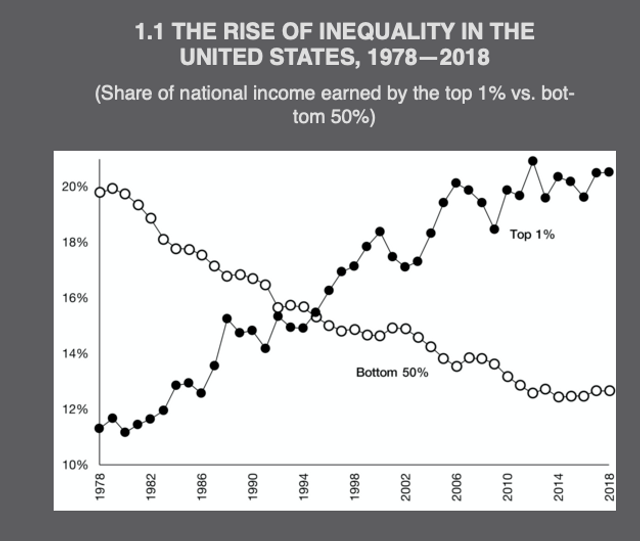

In 1980, the top 1 percent earned a bit more than 10 percent of the nation’s income, before government taxes and transfers, while the bottom 50 percent share was around 20 percent. Today, it’s almost the opposite: the top 1 percent captures more than 20 percent of national income and the working class barely 12 percent. In other words, the 1 percent earns almost twice as much income as the entire working class population, a group fifty times larger demographically. And the increase in the share of the pie going to 2.4 million adults has been similar in magnitude to the loss suffered by more than 100 million Americans.

The book proceeds to describe the incomes of the various sections of American society:

Let’s start with the working class, the 122 million adults in the lower half of the income pyramid. For them, the average income is $18,500 before taxes and transfers in 2019. Yes, you are reading this correctly: half of the US adult population lives on an annual income of $18,500.

This contrasts sharply with the lives of the affluent upper-middle class—those in the 90th to 91st percentile:

With an average income of $220,000 and everything that goes with it—spacious suburban houses, expensive private schools for their children, well-funded pensions, and good health insurance—they are not struggling.

At the top are the 2.4 million wealthiest people in the United States, part of the top 1 percent, “whose members make $1.5 million in income a year on average.”

Saez and Zucman argue that this level of social inequality is the outcome of deliberate policy choices on the part of lawmakers. They describe how for decades, successive administrations have slashed taxes on the wealthy and corporations, leading to a massive increase in social inequality.

They note that “confiscatory” taxes levied on the very wealthy under the New Deal helped rein in the social inequality of the 1920s, leading to a more equitable distribution of wealth in the middle of the 20th century:

From 1930 to 1980, the top marginal income tax rate in the United States averaged 78 percent. This top rate reached as much as 91 percent from 1951 to 1963. Large bequests were taxed at quasi-confiscatory rates during the middle of the twentieth century, with rates nearing 80 percent from 1941 to 1976 for the wealthiest Americans.

They continue:

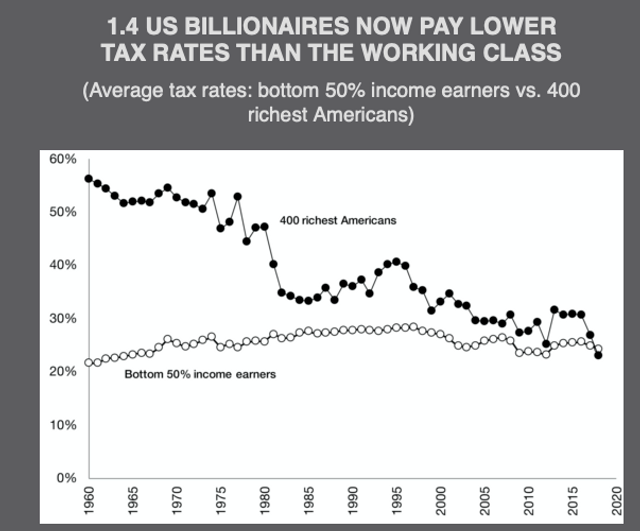

In 1970, the richest Americans paid, all taxes included, more than 50 percent of their income in taxes, twice as much as working-class individuals. In 2018, following the Trump tax reform, and for the first time in the last hundred years, billionaires have paid less than steel workers, schoolteachers, and retirees.

In fact,

The wealthy have seen their taxes rolled back to levels last seen in the 1910s, when the government was only a quarter of the size it is today.

They argue that, more and more, the capitalist class is being exempted from taxation:

The explosive cocktail that is undermining America’s system of taxation is simple: capital income, in varying degrees, is becoming tax-free.

Such a social order has much in common with the tax collection practices of the French monarchy, which are described in detail:

French kings pampered the affluent and bludgeoned the populace. France had an income tax (taille), whose main claim to fame was that it exempted almost all privileged groups: the aristocracy, the clergy, judges, professors, doctors, the residents of big cities, including Paris, and, of course, the tax collectors themselves—known as the fermiers généraux (tax farmers). The most destitute members of society, at the same time, were heavily hit by salt duties—the dreaded gabelle—and sprawling levies (entrées and octrois) on the commodities entering the cities, including food, beverages, and building materials.

The perpetual lowering of taxes on the wealthy has had a symbiotic relationship with the systematic toleration of tax evasion by the rich on the part of the US government, which is particularly evident in the effective elimination of the estate tax.

While estate and gift tax revenues amounted to 0.20 percent of household net wealth in the early 1970s, since 2010 they have barely reached 0.03 percent–0.04 percent annually—a reduction by a factor of more than five.

The authors provide further documentation of this “collapse in enforcement:”

In 1975, the IRS audited 65 percent of the 29,000 largest estate tax returns filed in 1974. By 2018, only 8.6 percent of the 34,000 estate tax returns filed in 2017 were examined.The capitulation has been so severe that if we take seriously the wealth reported on estate tax returns nowadays, it looks like rich people are either almost nonexistent in America or that they never die.

Saez and Zucman document the extent to which US corporations dodge taxes by booking profits in offshore tax havens.

Today, close to 60 percent of the—large and rising—amount of profits made by US multinationals abroad are booked in low-tax countries. Where exactly? Primarily in Ireland and Bermuda.

They explain how a massive industry exists to help companies evade taxes, making clear that most of these tax dodges are illegal because US law prohibits any investment decision whose sole aim is to evade taxes.

For decades, systematic tax evasion by major corporations was used as a pretext for lowering corporate tax rates, in the name of supposedly “closing loopholes.” The claim that “closing loopholes” would compensate for lost tax revenues resulting from lower corporate tax rates, while supposedly accelerating economic growth, has constituted the bipartisan consensus on tax policy, and remains so to this day. The authors write:

For the majority of the nation’s political, economic, and intellectual elites, slashing the corporate tax rate was the right thing to do. During his presidency, Barack Obama had advocated in favor of reducing it to 28 percent, with a lower rate of 25 percent for manufacturers.

The capstone of this was Trump’s 2018 tax bill, which slashed the corporate income tax rate from 35 percent to 21 percent. This was part of an international process:

As Trump’s bill passed, French president Emmanuel Macron vowed to cut the corporate tax from 33 percent to 25 percent between 2018 and 2022. The United Kingdom was ahead of the curve: it had started slashing its rate under Labour Prime Minister Gordon Brown in 2008 and was aiming for 17 percent in 2020. On that issue, the Browns, Macrons, and Trumps of the world agree.

Having presented this analysis, Saez and Zucman explain what they propose to do about it. They argue for increasing taxes on the wealthy, including a tax on wealth, increasing the top income tax bracket, and raising the corporate tax rate.

While taxation would be used broadly to redistribute income to the level of inequality that existed in the 1930s, the vast bulk of the cost of constructing a social welfare state would be borne by an effective tax increase on working people.

The majority of tax revenue would be raised with a flat “national income tax,” affecting workers and capitalists alike. This “national income tax,” falling disproportionately on workers, would then be used to finance a government-run health insurance program, public child care and free education.

The authors write:

The good news is that we can fix tax injustice, right now. There is nothing inherent in globalization that destroys our ability to tax big companies and the wealthy. The choice is ours…When it comes to the future of taxation, everything is possible. From the disappearance of the income tax—a plausible outcome if the trend of the last four decades is sustained—to levels of progressivity never seen before, there is an infinity of possible futures ahead of us.

But this “infinity of possible futures” does not include the overthrow of capitalism. Saez and Zucman argue on the basis of a premise which they never state, much less seek to defend: that private ownership of the means of production should be continued and maintained.

They want to treat the symptom (inequality) of the disease (capitalism) without attempting to argue against those who say that the symptom cannot be treated outside of eradicating the disease.

The word “capitalism” appears only twice throughout the book. This is not surprising, because the volume treats the capitalist socioeconomic order as effectively the fixed basis of analysis.

Saez and Zucman never attempt to answer the most important question: What happens when the wealthy resist paying more in taxes? What political means are required to end inequality?

The unstated premise is that this change can be carried out through the Democratic Party, including candidates such as Elizabeth Warren and Bernie Sanders who advocate policies similar to those of the authors.

But since Saez and Zucman don’t argue for this course of action, they don’t have to deal with the myriad problems that arise from it. How will the Democrats, the party that first cut taxes on the rich (under Johnson) and presided over the deregulation of Wall Street (under Clinton), then bailed out the banks (Obama), be made into the instrument of, as the authors call it, “confiscatory” taxation?

Within the book’s analytical framework, if governments reduced taxes on the rich, it was because opinions changed. If opinions can be changed back, then governments can undo the policies that led to the growth of inequality.

Except, there must have been some reason that opinions changed. Saez and Zucman do not attempt to root the phenomenal processes they discuss in broader historical changes.

What, after all, is the relationship between the fact that the 20th century was viewed as the so-called “American century,” based on American global economic hegemony, and the socially redistributive character of the New Deal, as well as the “confiscatory” tax policy of Roosevelt and Eisenhower? Leon Trotsky did not beat around the bush when he declared, “America’s wealth permits Roosevelt his experiments.”

The fact is that a return to the New Deal is simply not possible. The financial oligarchy would fight such a plan tooth and nail. There is no wing of the ruling elite, as there was in Roosevelt’s day, which argues that US capitalism should reduce social inequality to head off revolution.

There is, of course, is an enormous constituency for social redistribution: the working class. But its struggles will be animated in the coming period not by a desire to put patches on capitalism, but to do away with it altogether.

White House, congressional Republicans accelerate drive for corporate tax cut worth trillions

The push is accelerating for an overhaul of the US tax system that will divert trillions of additional dollars to the corporate aristocracy, widen the gap between the rich and the working class and set the stage for the destruction of basic social programs.

On Thursday, the Republican-controlled House Ways and Means Committee passed a White House-backed tax bill on a party-line vote, after which House leaders said the measure would come to the House floor for a vote next week. On the same day, the Republican-controlled Senate released its version of the measure, with plans for a floor vote in the upper chamber before the Thanksgiving holiday later this month.

If passed, the two versions will be reconciled and a final bill will be moved through the two chambers and signed into law by President Trump.

The Trump administration and congressional Republicans are pushing for passage of the handout to the richest 5 percent by Christmas. The Democrats are putting on a show of opposition that is cynical to the core. They are denouncing the Republican bills for skewing the tax benefits to the wealthy, while fully supporting the centerpiece of the legislation, a huge tax cut for US corporations.

While there are differences between the House and Senate bills, both versions adhere to the same basic framework. The corporate tax rate is to be permanently reduced from the current level of 35 percent to 20 percent, saving US corporations $2 trillion in taxes and generating an additional $6.7 trillion in revenues over the next decade. The House bill enacts the corporate tax cut in 2018, while the Senate bill, in order to reduce the projected deficit from lost federal revenues, delays the corporate tax cut one year, until 2019.

The House bill keeps the top federal tax bracket at 39.6 percent (down from 70 percent in 1980), but applies it to households making more than $1 million a year, as compared to the current threshold of $500,000. The Senate version provides a bigger windfall for the very rich by reducing the top bracket to 38.5 percent.

Both bills eliminate the alternative minimum tax, which almost exclusively impacts the wealthy, and they both slash the tax rate on so-called “pass-through” income reported by business owners.

Each bill allows corporations that have stashed hundreds of billions of dollars overseas to avoid US taxes, such as Apple and Amazon, to repatriate their profits at a sharply discounted tax rate even lower than the new 20 percent corporate rate.

The bills either sharply restrict or eliminate outright the estate tax, which is currently paid by the wealthiest 0.2 percent of households. The House bill doubles the exemption for an individual to $11 million and eliminates the estate tax entirely in 2025. The Senate version doubles the exemption but does not repeal the tax.

Either way, the change underwrites the right of the richest households to pass on their wealth to succeeding generations, institutionalizing the transformation of the United States into an oligarchy, presided over by a semi-hereditary dynastic caste.

Other boons to business are included in both bills, including an immediate 100 percent tax write-off for capital investments. Neither bill eliminates or reduces the so-called “carried interest” loophole that allows hedge fund, private equity and real estate speculators (such as Donald Trump) to pay only 20 percent on their income instead of the normal tax rate, currently almost twice as high.

This is in line with the legislation as whole. While shifting the tax code to further redistribute the social wealth from the bottom to the top, it particularly favors the most parasitic sections of the ruling class, those engaged in financial manipulation.

In order to promote the fiction that the overhaul is geared to the “middle class,” the bills include certain tax breaks, such as a doubling of the standard deduction for taxpayers who do not itemize and an increase in the child tax credit. However, they also rein in or eliminate existing tax deductions that benefit working class and middle class households.

This is driven above all by the need to keep the total ten-year deficit resulting from the legislation to $1.5 trillion. That limit must be met in order to move the tax overhaul on an expedited basis through the Senate, where the Republicans have only a 52 to 48 majority, ruling out a filibuster and enabling passage by a simple majority.

The House bill eliminates the federal tax credit for state and local income and sales taxes, but continues the write-off for state and local property taxes, capping it at $10,000. It reduces the existing tax reduction on mortgage interest payments as well as a tax break on medical expenses. It also eliminates tax credits for student loan payments and imposes a tax on graduate student stipends. These measures amount to a tax surcharge on workers, young people and the elderly to help pay for the tax boondoggle for the rich.

The Senate version calls for a somewhat different package of added tax burdens for the working class and middle class. It eliminates all state and local tax deductions but retains the tax credits for mortgage interest, student loan payments and medical expenses.

The Republicans are resorting to brazen lying to present the legislation as a boon to “hard-working middle class Americans.” Typical is an op-ed column published Friday in the Washington Post by Orrin Hatch of Utah, the chairman of the Senate Finance Committee. “For too long, middle-class Americans have struggled with stagnant wages, sluggish labor markets and economic growth well below the historic average,” he writes. “It is time to pay attention to those Americans who have felt left behind in economic stagnation, by providing tax relief and economic opportunity.”

The line is that corporate America will use the trillions in tax savings to buy new equipment, build new factories, hire more workers and raise wages. This ignores the fact that US corporations already have access to cheap credit, are making bumper profits, and are sitting on trillions of dollars in cash. It also ignores the past record of tax cuts for big business, whether under Reagan or George W. Bush, which pushed up stocks and the wealth of the ruling elite while accelerating the destruction of jobs and working class living standards. The same lying pretext was used to justify Obama’s bailout of the banks.

In fact, the extra trillions will be used to buy more and bigger yachts, private planes, mansions, penthouses, private islands and gated communities and bribe more politicians to do the bidding of the oligarchs.

One indication of the two-faced character of the Democrats’ opposition is the fact that interest groups backed by Republican billionaires such as the Koch brothers and Sheldon Adelson have thus far spent almost $25 million on TV ads to promote the Republican tax plan, while Democratic groups have spent less than $5 million to oppose the plan.

An updated analysis of the House bill published Wednesday by the non-partisan tax center spells out in detail how the tax overhaul is designed to sharply increase the wealth of the richest 5 percent, and especially the richest 1 percent and 0.1 percent, and vastly increase over the next decade the concentration of wealth at the very top.

Under the so-called “Tax Cuts and Jobs Act,” in 2018, taxpayers in the top 1 percent (with income above $730,000) will receive nearly 21 percent of the total tax cut, an average of about $37,000, or 2.5 percent of after-tax income.

Those in the top 5 percent income bracket, and especially the top 1 percent and top 0.1 percent, will get by far the biggest percentage gains in after-tax income. In other words, if you are among the very rich, the rate of increase you receive will be far higher than for the lower 95 percent. That means the plan is designed to widen the gap between the very rich and everybody else.

In 2018, the top 20 percent of income earners will get 56.6 percent of the total federal tax cut. Within the top 10 percent, the 90-95 percent group will get 7.4 percent of the total, the 95-99 percent group will receive 14.8 percent, the top 1 percent will get 20.6 percent and the top 0.1 percent will receive 10 percent. In other words, within the richest 10 percent, the benefits are skewed dramatically to the richest of the rich.

One decade out, by 2027, the transfer of social wealth to the very rich will be even more pronounced. In 2027, taxpayers in the bottom two quintiles (those with income less than about $55,000) will see little change in their taxes, with a tax decrease of $10-$40. Taxpayers in the middle of the income distribution will see their after-tax incomes increase by only 0.4 percent. Taxpayers in the top 1 percent will receive nearly 50 percent of the total benefit.

Someone in the top 1 percent will get a break of $52,780. Someone in the top 0.1 percent will get a tax cut of $278,370.

In total, 12.8 million households will have a bigger tax bill in 2018 under the law, including more than three million earning between $48,600 and $86,100. By 2027, more than 11 million households in this income group will see their tax bills increase. Overall, by 2027, 47.5 million households, a quarter of the total, will have a tax increase.

"At the same time, the tax cuts for big business are fueling the federal deficit, which will be used by both Democratic and Republican politicians to call for further cuts in social spending. The February monthly federal deficit hit an all-time high of $234 billion this year, as a result of a 20 percent drop in corporate tax revenue. The deficit for the first half of 2019 is projected at $961 billion, and the deficit for the fiscal year ending September 30 is expected to reach $1.1 trillion, as bad as the deficits posted in the immediate aftermath of the 2008 financial crash."

US Tax Day 2019: Sixty giant corporations pay zero income tax

Dozens of giant US corporations, including 60 of the Fortune 500, used deductions, credits and other tax loopholes to avoid paying any federal income tax for 2018, according to an analysis issued by the Institute on Taxation and Economic Policy (ITEP). The report was published April 11, just in time for the April 15 deadline for most American working people to file their tax returns.

The 60 companies in the Fortune 500 who paid no federal income tax had net incomes just from US operations of nearly $80 billion ($79,025,000,000, to be exact). They include such household names as Amazon, Chevron, Deere, Delta Air Lines, General Motors, Goodyear, Halliburton, Honeywell, IBM, Eli Lilly, Netflix, Occidental Petroleum, Prudential Financial and US Steel.

Meanwhile, millions of moderate-income families are finding that their income taxes have either increased or their expected tax refunds have evaporated because of restrictions on the itemization of tax deductions, the imposition of a $10,000 cap on state and local tax deductions and a cut in the mortgage interest deduction.

Nearly all of the 60 companies that paid no taxes qualified to receive a refund from the US Treasury, although most will not collect a check, instead using the credit to offset future taxes. But whatever the bookkeeping process, American taxpayers are effectively paying money to them, despite their vast profits. The biggest refunds include those going to Prudential, $346 million (added to its $1.44 billion in profits); Duke Energy, a whopping $647 million (added to $3.02 billion in profits); and Deere, $268 million (added to $2.15 billion in profits).

Among the report’s most outrageous findings:

Amazon more than zeroed-out its tax bill on $10.8 billion in profits, making use of accelerated depreciation deductions on equipment as well as favorable tax treatment of stock-based compensation for executives like CEO Jeff Bezos, the wealthiest man in the world. The stock compensation deduction alone was worth $1 billion. Amazon will actually show a credit of $129 million from the US Treasury, not paying one cent in federal income taxes.

IBM is another corporate giant that has gamed the tax system by shifting earnings to its foreign operations to escape US taxation. The company reported worldwide profits of $8.7 billion, but only $500 million in the United States. It will reap a $342 million credit from the Treasury.

Delta Airlines accumulated $17.1 billion in federal pre-tax net losses as of 2010, partly as a consequence of a protracted crisis of the airline industry, partly as a result of the 2008 Wall Street crash. It has used these losses as well as the accelerated depreciation credit for purchase of new planes to “dramatically reduce their tax rates,” according to the ITEP report, receiving a credit of $187 million in 2018 despite net profits of more than $5 billion. According to Delta’s chief financial officer, the actual tax rate the company expects to pay going forward is between 10 and 13 percent, far below what a typical Delta worker pays on his or her income.

EOG Resources, a renamed remnant of Enron, perpetrator of the biggest corporate fraud in American history, can collect $304 million from US taxpayers on top of $4.07 billion in profits.

For one company, the federal tax refund would actually exceed net profits. Gannett made a $7 million profit, while showing an additional $11 million credit from the Treasury, giving the newspaper publishing giant an effective tax rate of negative 164 percent.

IBM’s tax rate was a negative 68 percent, while software maker Activision Blizzard and construction company AECOM Technology both posted effective tax rates of negative 51 percent.

Sixteen of the 60 companies made more than a billion dollars in net income on their US operations, to say nothing of foreign subsidiaries. Oil and gas producers and utilities comprised more than one-third of the total, led by Chevron and Occidental among the oil companies, and DTE Energy, American Electric Power, Duke Energy and Dominion Resources among the utilities.

The 60 companies profited enormously because the Trump tax cut bill cut the basic rate for corporations from 35 percent to 21 percent, while not eliminating the loopholes they had previously used to keep their taxes low. They had the best of both worlds, paying lower rates while still enjoying loopholes.

Overall, according to the Joint Committee on Taxation, an arm of Congress, the cut in the corporate tax rate alone will pump $1.35 trillion into the pockets of the corporations over the next 10 years. For this year alone, corporate taxes have been cut by 31 percent.

For the 60 companies in the ITEP report, “Instead of paying $16.4 billion in taxes, as the new 21 percent corporate tax rate requires, these companies enjoyed a net corporate tax rebate of $4.3 billion, blowing a $20.7 billion hole in the federal budget last year.”

This figure by itself is an irrefutable answer to all the bogus claims—made to workers in every part of the United States—that there is “no money” to pay for needed social programs, for wage and benefit increases, or to hire additional workers to reduce overwork and understaffing. The $20.7 billion would pay for a $7,000 bonus to every public school teacher in America.

The bonanza that these 60 corporations are enjoying is three times the amount that Trump proposes to cut from the budget of the Department of Education. It is 10 times the total amount budgeted for the Bureau of Indian Affairs, which provides services for more than 2 million Native Americans. It is nearly 20 times the budget of the Occupational Safety and Health Administration, which conducts workplace safety inspections.

The ITEP report, issued by a group with close ties to the Center on Budget and Policy Priorities, a liberal Washington think tank, warns of the explosive political consequences of the corporate plundering of the Treasury. “The specter of big corporations avoiding all income taxes on billions in profits sends a strong and corrosive signal to Americans: that the tax system is stacked against them, in favor of corporations and the wealthiest Americans,” the report says.

At the same time, the tax cuts for big business are fueling the federal deficit, which will be used by both Democratic and Republican politicians to call for further cuts in social spending. The February monthly federal deficit hit an all-time high of $234 billion this year, as a result of a 20 percent drop in corporate tax revenue. The deficit for the first half of 2019 is projected at $961 billion, and the deficit for the fiscal year ending September 30 is expected to reach $1.1 trillion, as bad as the deficits posted in the immediate aftermath of the 2008 financial crash.

The number of U.S. companies paying zero federal taxes DOUBLED when Trump's tax plan took effect in 2018

· 60 large companies managed to escape 2018 taxes under Trump's new plan

· Many of those corporations actually received tax rebates totaling $4.3 billion

· The businesses include: Amazon, Netflix, Chevron, Delta Airlines, JetBlue Airways, IBM, General Motors, Goodyear, Eli Lilly and United States Steel

· The result is a $20.7 billion budget hole that is adding to America's federal debt

President Donald Trump's tax policy doubled the number of highly profitable companies that were able to avoid paying any federal taxes in 2018, according to a new report.

Amazon, Netflix, Chevron, Delta Airlines, IBM, General Motors and Eli Lilly were among those who managed to escape taxes for last year, according to the study by the Institute on Taxation and Economic Policy.

'Instead of paying $16.4 billion in taxes, as the new 21 percent corporate tax rate requires, these companies enjoyed a net corporate tax rebate of $4.3 billion, blowing a $20.7 billion hole in the federal budget last year,' the report says.

The Washington, D.C. think tank analyzed America's 560 largest publicly held companies, finding that 60 of them paid nothing in taxes for last year – double the average of roughly 30 companies that got away scot-free each year from 2008-2015.

Republicans in Congress pushed through the tax law signed by Trump in 2017, and its policies favoring the richest Americans and most valuable U.S. companies took effect in 2018.

Scroll down for the full list of companies and rebates

·

This graph illustrates the amount of money that 60 of America's largest companies were billed for taxes last year - along with the actual money they ended up getting back instead of having to pay. Source: Institute on Taxation and Economic Policy

The change cut the tax rate from 35 percent to 21 percent and allowed companies to take advantage of deductions, tax credits and rebates. That change alone is projected to save corporations $1.35 trillion over the next decade, according to the Joint Committee on Taxation.

'We know that there's this pretty glaring contrast between what the proponents of this tax law promised back in 2017 and what it's delivering now,' lead author Matthew Gardner told DailyMail.com.

'The whole argument was that the reason companies were avoiding taxes is because tax rates are so high,' he added. 'What we're seeing is that isn't coming to pass.'

Collectively, the 60 companies that avoided all taxes last year managed 'to zero out their federal income taxes on $79 billion in U.S. pretax income,' according to the study, which was first reported on by the Center for Public Integrity and NBC News.

For example, the John Deer farm equipment company earned $2.15 billion before taxes, yet owed no U.S. taxes and used deductions and credits to extract $268 million from the federal government.

Nationally, corporate tax revenues decreased 31 percent in 2018 to $204 billion.

'This was a more precipitous decline than in any year of normal economic growth in U.S. history,' wrote Gardner, a senior fellow for the Institute on Taxation and Economic Policy, in the report.

We know that there's this pretty glaring contrast between what the proponents of this tax law promised back in 2017 and what it's delivering now. -Matthew Gardner, Institute on Taxation and Economic Policy

Trump had said that the corporate tax cut would pay for itself by sparking a business boom that would create more jobs, thus generating growing income tax revenues for the nation.

That reality hasn't emerged. Instead the nation's budget deficit is higher than it's ever been in this nation's history.

That's despite Trump's campaign promise to eliminate the $19.9 trillion national debt in eight years. So far it has ballooned 41.8 percent in the first four months of the 2019 fiscal year (which runs October 1 – September 30.

The Government Accountability Office announced in April that the 'federal government's current fiscal path … (is) unsustainable.'

Presidential economic adviser Larry Kudlow has said that 'economic growth' has 'paid for a good chunk' of the tax cuts, and that the budget's outlook is 'not as bad' as it's perceived.

+2

·

This table lists the amount of money that 60 of America's largest companies were billed for taxes last year - along with the actual money they ended up getting back instead of having to pay. Source: Institute on Taxation and Economic Policy

Richest 400 Americans paid lower taxes than everyone else in 2018

According to an analysis by noted economists Emmanuel Saez and Gabriel Zucman, previewed this week by New York Times columnist David Leonhardt, the wealthiest American households paid a lower tax rate last year than every other income group for the first time in the country’s history.

Saez and Zucman, both professors at the University of California Berkeley, detail the phenomenon of declining taxes for the richest Americans in their soon-to-be released book, The Triumph of Injustice .

The pair compiled a historical database composed of the tax payments of households in various income percentiles spanning all the way back to 1913, when the federal income tax was first implemented. Their research uncovered that in the 2018 fiscal year the wealthiest 400 Americans paid a lower tax rate—accounting for federal, state, and local taxes—than anyone else.

The overall tax rate paid by the richest .01 percent was only 23 percent last year, while the bottom half of the population paid 24.2 percent. This contrasts starkly with the overall tax rates on the wealthy of 70 percent in 1950 and 47 percent in 1980.

The taxes on the wealthy have been in precipitous decline since the latter half of the 20th century as successive presidential administrations enacted tax cuts for the rich, suggesting that they would result in economic prosperity for all. Taxes that mostly affect the wealthy, such as the estate tax and corporate tax, have been drastically cut and lawyers have been hard at work on the beliefs of their wealthy patrons planning out the best schemes for tax avoidance, seeking to drive tax rates as close to zero as possible. The impetus for the historical tipping point was the Trump Administration’s 2017 tax reform, which was a windfall for the super-rich.

Supported by both the Republican and Democratic Parties, the two parties of Wall Street, Trump’s tax cuts were specifically designed to transfer massive amounts of wealth from the working class to the ruling elite.

The corporate tax rate was permanently slashed from 35 percent to 21 percent, potentially increasing corporate revenues by more than $6 trillion in the next decade. The bill also reduced the individual federal income tax rate for the wealthy and included a number of other provisions to further ease their tax burden.

The story is different for many middle- and working-class Americans. According to multiple analyses of the 2017 tax reform, 83 percent of the tax benefits will go to the top 1 percent by 2027, while 53 percent of the population, or those making less than $75,000 annually, will pay higher taxes. At the same time, the reform will sharply increase budget deficits and the national debt, granting the pretense for the further destruction of domestic social programs.

Furthermore, a majority of Americans are paying higher payroll taxes, which cover Medicare and Social Security. The tax increased from 2 percent just after World War II, to 6 percent in 1960, to 15.3 percent in 1990, where it stands today. It has risen to become the largest tax that 62 percent of American households pay.

The result of the multitude of changes to the US tax system over the last three-quarters of a century is one that has become less progressive over time. The 2017 tax reform effectively set up the foundation for a regressive tax policy where the wealthy pay lower tax rates than the poor.

The implementation of a regressive tax structure has played a major role in engineering the redistribution of wealth from the bottom to the top that has brought social inequality in America to its highest level since the 1920s.

According to Leonhardt’s preliminary Times review of The Triumph of Injustice, Saez and Zucman offer a solution to the current unjust tax system in which the overall tax rate on the top 1 percent of income earners would rise to 60 percent. The pair claim that the tax increase would bring in approximately $750 billion in taxes. Their tax code also includes a wealth tax and a minimum global corporate tax of 25 percent, requiring corporations to pay taxes on profits made in the United States, even if their headquarters are overseas.

In an interview with Leonhardt, Zucman states that history shows that the US has raised tax rates on the wealthy before so therefore it should be possible to do so now.

However, the last half century of counterrevolution waged against the working class makes the parasitic nature of the ruling elite absolutely clear, and underscores the well-known fact that the US is ruled by an oligarchy that controls the political system. Neither the Democrats nor the Republicans, who both represent this oligarchy and bear responsibility for the tax system, will make any effort to implement Saez and Zucman’s modest proposal.

California became a Democratic stronghold not because Californians became socialists, but because millions of socialists moved there. Immigration turned California blue,

and immigration is ultimately to blame for California's high poverty level.

Economists: America’s Elite Pay Lower Tax Rate Than All Other Americans

Getty Images

The wealthiest Americans are paying a lower tax rate than all other Americans, groundbreaking analysis from a pair of economists reveals.

For the first time on record, the wealthiest 400 Americans in 2018 paid a lower tax rate than all of the income groups in the United States, research highlighted by the New York Times from University of California, Berkeley, economists Emmanuel Saez and Gabriel Zucman finds.

The analysis concludes that the country’s top economic elite are paying lower federal, state, and local tax rates than the nation’s working and middle class. Overall, these top 400 wealthy Americans paid just a 23 percent tax rate, which the Times‘ op-ed columnist David Leonhardt notes is a combined tax payment of “less than one-quarter of their total income.”

This 23 percent tax rate for the rich means their rate has been slashed by 47 percentage points since 1950 when their tax rate was 70 percent.

(Screenshot via the New York Times)

The analysis finds that the 23 percent tax rate for the wealthiest Americans is less than every other income group in the U.S. — including those earning working and middle-class incomes, as a Times graphic shows.

Leonhardt writes:

For middle-class and poor families, the picture is different. Federal income taxes have also declined modestly for these families, but they haven’t benefited much if at all from the decline in the corporate tax or estate tax. And they now pay more in payroll taxes (which finance Medicare and Social Security) than in the past. Over all, their taxes have remained fairly flat. [Emphasis added]

The report comes as Americans increasingly see a growing divide between the rich and working class, as the Pew Research Center has found.

Sen. Josh Hawley (R-MO), the leading economic nationalist in the Senate, has warned against the Left-Right coalition’s consensus on open trade, open markets, and open borders, a plan that he has called an economy that works solely for the elite.

“The same consensus says that we need to pursue and embrace economic globalization and economic integration at all costs — open markets, open borders, open trade, open everything no matter whether it’s actually good for American national security or for American workers or for American families or for American principles … this is the elite consensus that has governed our politics for too long and what it has produced is a politics of elite ambition,” Hawley said in an August speech in the Senate.

That increasing worry of rapid income inequality is only further justified by economic research showing a rise in servant-class jobs, strong economic recovery for elite zip codes but not for working-class regions, and skyrocketing wage growth for the billionaire class at 15 times the rate of other Americans.

Census Says U.S. Income Inequality Grew ‘Significantly’ in 2018

(Bloomberg) -- Income inequality in America widened “significantly” last year, according to a U.S. Census Bureau report published Thursday.

A measure of inequality known as the Gini index rose to 0.485 from 0.482 in 2017, according to the bureau’s survey of household finances. The measure compares incomes at the top and bottom of the distribution, and a score of 0 is perfect equality.

The 2018 reading is the first to incorporate

the impact of President Donald Trump’s end-

2017 tax bill, which was reckoned by many

economists to be skewed in favor of the

wealthy.

the impact of President Donald Trump’s end-

2017 tax bill, which was reckoned by many

economists to be skewed in favor of the

wealthy.

But the distribution of income and wealth in the U.S. has been worsening for decades, making America the most unequal country in the developed world. The trend, which has persisted through recessions and recoveries, and under administrations of both parties, has put inequality at the center of U.S. politics.

Leading candidates for the 2020 Democratic presidential nomination, including senators Elizabeth Warren and Bernie Sanders, are promising to rectify the tilt toward the rich with measures such as taxes on wealth or financial transactions.

Just five states -- California, Connecticut, Florida, Louisiana and New York, plus the District of Columbia and Puerto Rico -- had Gini indexes higher than the national level, while the reading was lower in 36 states.

No comments:

Post a Comment