Stocks fell sharply in the final hour of trading, accelerating the decline that began anew Sunday night in the futures market and took down the major indexes at the open of trading Monday morning.

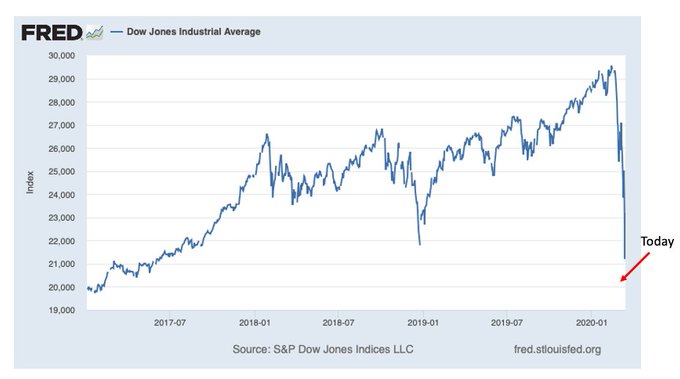

The Dow Jones Industrial Average fell by 2.997 points, or 12.93 percent. The S&P 500 fell 11.98 percent. The Nasdaq Composite fell 12.32 percent. The Russell index of smaller companies fell 14.27.

This was the worst percentage drop since October 1987 for the Dow and S&P 500. It was the worst drop ever for the Nasdaq.

Every sector of the S&P 500 was down, with nine out of eleven down by double digits. Consumer staples were down by 6.99 percent and heath care stocks were down 9.99 percent.

All 30 Dow stocks were down for the day. The best performer was Walgreens Boots Alliance, which fell 2.4 percent. The worst four were Boeing, down 23.85 percent, Travelers, down 20.8 percent, Home Depot, down 19.79 percent, and Intel, down 18.04%.

The sell-off in stocks became more intense after the Trump administration announced new recommendations for dealing with the coronavirus that made the likely economic toll look more severe. Those include the recommendation that bars, restaurants, and public gathering places be closed and that people avoid gathering in groups of more than 10. The Trump administration also said schooling and work should be done at home and discretionary travel should be avoided.

President Donald Trump acknowledged that stocks have fallen sharply but said that the administration would focus on combating the virus rather than worry about the stock market.

“The market will take care of itself,” Trump said. “The market will be very strong as soon as we get rid of the virus.”

No comments:

Post a Comment