WHAT HAPPENED TO AMERICA?

START WITH BILL CLINTON AND JOE BIDEN'S NAFTA!

Modern ABANDONED Mall With Terrifying Sears

Here's what downtown Seattle, Washington looks like these days.

Biggest share of Americans since 1940s say their financial health will get worse in year ahead

VIDEO

BIDENOMICS: THE RICH GET MUCH RICHER, THE REST GET THE SHAFT!

30 Facts American Families Are Getting Pulverized By This Economy

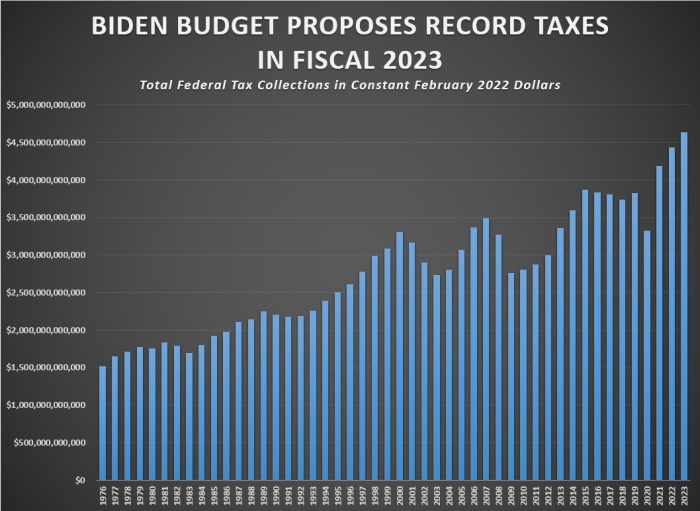

$4,638,000,000,000: Biden’s Budget Calls for Record Taxes in 2023

(CNSNews.com) - President Joe Biden’s budget proposal, which the president released today, calls for the federal government to collect a record $4,638,000,000,000 in taxes in fiscal 2023.

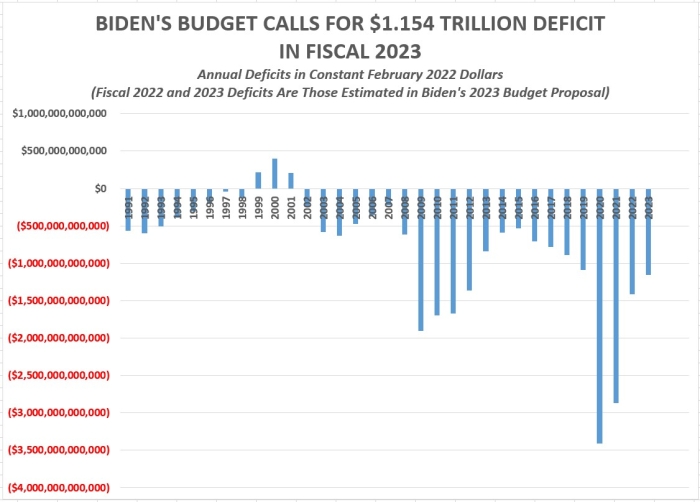

At the same time that the federal government is collecting those record taxes, according to Biden’s proposal, it would also spend $5,792,000,000,000—resulting in a fiscal 2023 deficit of $1,154,000,000,000.

The record $4,638,000,000,000 in taxes Biden proposes collecting next year is up from the $4,437,000,000,000 it estimates the federal government will collect this year and the $4,184,714,000,000 (in constant February 2022 dollars) that the federal government did in fact collect in fiscal 2021.

So far, the $4,184,714,290,000 (in constant February 2022 dollars) that the federal government collected in total taxes in fiscal 2021 is the record amount in federal taxes ever collected.

According to Table S-4 in Biden’s budget proposal, the federal government will run a cumulative deficit of $14,421,000,000,000in the ten years from fiscal 2023 to fiscal 2032

According to the same table, federal individual income taxes were $2,044,000,000,000 in fiscal 2021, when Biden took office. This year, they will increase to $2,263,000,000,000. In fiscal 2023, under Biden’s proposal, they will climb again to $2,345,000,000,000.

Social Security payroll taxes brought in $952,000,000,000 in fiscal 2021. This year, according to Biden’s budget estimate, they will increase to $1,047,000,000,000. Next year, they would climb to $1,101,000,000,000.

Medicare payroll taxes brought in $295,000,000,000 in fiscal 2021. This year, according to Biden’s budget estimate, they will increase to $329,000,000,000. Next year, they would climb to $342,000,000,000.

Excise taxes brought in $75,000,000,000 in fiscal 2021. This year, according to Biden’s budget estimate, they will climb to $84,000,000,000. Next year, they would climb to $91,000,000,000.

By contrast, estate and gift taxes and customs duties would decline in the next year.

According to Biden’s budget, estate and gift taxes brought in $27,000,000,000 in fiscal 2021. This year, according to the budget’s estimate, they will drop to $26,000,000,000. Next year, under Biden’s proposal, they would drop to $25,000,000,000.

Customs duties, meanwhile brought in $80,000,000,000 in fiscal 2021, according to Biden’s budget. This year, they are estimated to climb to $93,000,000,000. But next year, according to Biden’s proposal, they would drop to $54,000,000,000.

The $1,154,000,000,000 deficit the Biden budget proposes running in fiscal 2023 is the smallest federal deficit it anticipates in any of the next ten years.

In fiscal 2021, according to Table S-4 in Biden’s budget proposal, the federal deficit was $2,775,000,000,000.

In fiscal 2022, the Biden budget proposal estimates it will drop to $1,415,000,000,000.

In fiscal 2023, as mentioned, the Biden budget estimates the deficit will be $1,154,000,000,000.

In fiscal 2024, according to Table S-4, the deficit will by $1,201,000,000,000. In fiscal 2025, it will be $1,330,000,000,000. In fiscal 2026, it will be $1,328,000,000,000. In fiscal 2027, it will be 1,352,000,000,000. In fiscal 2028, it will be $1,533,000,000,000. In fiscal 2029, it will be $1,443,000,000,000. In fiscal 2030, it will be $1,614,000,000,000. In fiscal 2031, it will be $1,682,000,000,000. In fiscal 2032, it will be $1,784,000,000,000.

In a section headlined “Building a Better America,” the Biden budget credits President Biden for living up to what it calls his “commitment to fiscal responsibility.”

“The Budget also delivers on the President’s commitment to fiscal responsibility,” it says.

“The deficit is on track to drop by more than $1 trillion this year, the largest-ever one-year decline,” it continues. “Under the Budget policies, annual deficits would fall to less than half of last year’s levels as a share of the economy, while the economic burden of debt would remain low.

“The Budget’s investments,” it says, “are more than paid for through additional tax reforms than ensure corporations and the wealthiest Americans pay their fair share, allowing us to cut costs for American families, strengthen our economy, and cut deficits and debt by more than $1 trillion over the coming decade.”

“My Administration is on track to reduce the federal deficit by more than $1.3 trillion this year, cutting in half the deficit from the last year of the previous Administration and delivering the largest one-year reduction in the deficit in U.S. history,” President Biden said in his statement releasing the budget proposal.

(Historical fiscal numbers in this story were converted into constant February 2022 dollars using the Bureau of Labor Statistics inflation calculator.)

WHAT HAPPENED TO AMERICA?

START WITH BILL CLINTON AND JOE BIDEN'S NAFTA!

Modern ABANDONED Mall With Terrifying Sears

Here's what downtown Seattle, Washington looks like these days.

Bidenflation: Expected Prices Hikes Hit Record High in Dallas Fed Survey

Inflationary pressures in Texas ratcheted up even further in March, a survey released Monday by the Federal Reserve Bank of Dallas showed.

The prices paid for raw materials index of the Dallas Fed’s monthly survey of manufacturers rose six-tenth of a point to 74, with 77.7 percent of respondents reporting that prices rose for the month. The index of expectations for raw materials also 6.9 points to 58, with 60.5 percent of manufacturers saying they expect to pay higher prices six months from now.

The index that tracks the prices charged for finished goods jumped 3.2 points to 47.8. The expectations for prices soared 13.8 points to 59.2, the highest ever recorded in data going back to June of 2004. The previous record high was 57.8 in the summer of 2008.

The production index, a key measure of state manufacturing conditions, dipped slightly to 13.2

The general business activity index unexpectedly fell five points to 8.7, below Wall Street’s expectation for a March reading of 12.5. The company outlook index fell 7.1 points to a negative 0.7, which the Dallas Fed says indicates that companies were nearly evenly split on whether their outlooks improved or worsened over the past month.

The wages and benefits index shot up 11 points to a new high of 55.2.

Biggest share of Americans since 1940s say their financial health will get worse in year ahead

VIDEO

BIDENOMICS: THE RICH GET MUCH RICHER, THE REST GET THE SHAFT!

30 Facts American Families Are Getting Pulverized By This Economy

4 Out Of 5 Independents Rate Biden Badly On Economy

"I'll take holes you can't dig yourself out of for $100, sorry that's now $200. More inflation? Okay $400."

Ukraine, whatever one thinks of it, is not a kitchen table concern, and, as I recently noted, is not going to turn around Biden's poll numbers. It's the economic numbers that matter and right now they're catastrophically bad.

An Associated Press/NORC poll earlier this week indicated that 43 percent of adults approve of Biden’s job performance and 56 percent disapprove — a finding essentially unchanged from the last survey from the same organizations, which was conducted just before the Russian invasion.

A NewsNation/Decision Desk HQ poll, also released in recent days, showed the same pattern.

The NewsNation poll had 44 percent of registered voters approving of Biden’s overall job performance and 56 percent disapproving. Those results were virtually identical to a previous survey late last month, right before Biden’s State of the Union address.

The overall numbers matter less than what independents think of the economy. And what do they think of the economy?

Independents took an unfavorable view of Biden’s economic performance by a massive 60-point margin, with just 18 percent approving and 78 percent disapproving.

This is massively bad. When 4 out of 5 swing voters hate your performance on the issue that matters most to them and 1 in 5 approve, your odds are worse than a hedgehog trying to play soccer.

But approval numbers are not the same as election numbers. Even Biden knows that.

The Dems look set to take a beating in the midterms. But Biden's old boss survived poor economic numbers to win a second term. There were however some different variables there. The economy wasn't the disaster area it was now. We'll see how things look in 2024, but people aren't likely to be seeing gas prices rising every few days two years from now. (If we are, things will be even worse than anyone would have imagined.) Still, they're likely to be bad. But the Democrats bet big on black turnout and convincing them that Republicans were out-of-touch rich guys who didn't care about them. It worked well enough.

Biden's people would love to run the same play again. But I'm skeptical that they can pull it off.

Biggest share of Americans since 1940s say their financial health will get worse in year ahead

VIDEO

BIDENOMICS: THE RICH GET MUCH RICHER, THE REST GET THE SHAFT!

30 Facts American Families Are Getting Pulverized By This Economy

Wall Street bonuses surge to record high

The New York State Comptroller Thomas P. DiNapoli issued a press release on Wednesday reporting that estimated bonuses for New York City’s financial industry grew by 20 percent in 2021 to a record average of $257,500 per employee.

New York state’s top fiscal officer issued his statement as part of the state’s annual report. It showed that the pretax profits from which cash payouts were made to Wall Street bankers totaled $45 billion in the first three quarters of the year, the largest amount on record. There were approximately 180,000 employees in the state’s industry, the same number as 2020.

“The numbers pop out … and are higher than what had been projected,” DiNapoli said of the report. He also called it “welcome news” because the Wall Street employees account for 18 percent, or nearly $15 billion, of New York tax revenue even though they represent just 5 percent of the state’s private sector workforce.

Although the numbers for 2021 are not yet available, the average annual income of Wall Street employees in 2020 was $483,370 or nearly five times the income of others in New York’s private sector. Bonuses paid out to securities industry employees in 2020 were $213,700, an increase of 28 percent from the previous year.

The report says that fourth quarter 2021 Wall Street financial results have not yet been released but, “they are expected to show continued profitability, which would represent the sixth consecutive year of growth in profits since 2015.” Profits are likely “to reach the second-highest level on record after 2009 (which saw $61.4 billion).”

The payout of massive bonuses to those who buy and sell financial assets and instruments for various Wall Street securities firms over the past two years is further proof that the capitalist elite has exploited the coronavirus pandemic to further enrich themselves, while the rest of the population has been thrown into economic crisis and have faced the public health devastation of COVID-19.

Trillions of dollars have been funneled to the big corporations and Wall Street through bailouts and the intervention of the Federal Reserve over the last two years while at least 1 million Americans have succumbed to the virus and tens of millions more have been infected. Rapidly rising inflation meanwhile is undermining workers’ living standards.

As every section of the working class has been forced to return to their jobs over the past year to ensure the continued growth of corporate profits—with the state and federal governments having removed any measures to stop the pandemic—a recent state comptroller report said that the securities industry employees continue to work from home at rates that are two to three times greater than any other industry. Wall Street has by far the highest share of employees able to work from home, at 98.5 percent.

As DiNapoli said, “Wall Street’s soaring profits continued to beat expectations in 2021 and drove record bonuses.” However, the comptroller warned that “recent events are likely to drive near-term profitability and bonuses lower.” He said that the markets are “turbulent” and recovery in other sectors “remains sluggish and uneven.” DiNapoli also pointed to Russia’s war in Ukraine as a threat to Wall Street’s ever rising indexes.

While the stock market has risen by 80 percent since February 2020, fueled by trillions of dollars in Federal Reserve Bank asset purchases, New York City’s employment in the retail, restaurant, art and tourism industries is down by 10, 26, 20 and 34 percent, respectively.

Meanwhile, for the working class, wages have been effectively cut by the 40-year record inflation rate of 7.9 percent. With the Federal Reserve raising interest rates to push down demand for wage increases and the cutoff of supplemental unemployment benefits by both Democrats and Republicans in Congress and the White House, workers are facing a combined assault on incomes and living standards.

Wealth and income inequality in the US and around the world had already reached historic proportions prior to 2020 but they have been vastly accelerated during the pandemic. According to the 2022 Knight Frank report on the super-rich, there was an increase in the number of ultra-high net worth individuals (UHNWI)—those with assets of $30 million or more—of 9.3 percent to a total of 610,569 in 2021. The largest number of these individuals, 233,590 people, live in North America.

The world’s richest person, Elon Musk, now claims a net worth which exceeds $270 billion, thanks in large part to the continued inflation of the stock market. The combined net worth of the six richest men in the world has topped $1 trillion, equivalent to the gross domestic product of Indonesia, a country of 273 million.

In modern-day America, if you can keep yourself from getting evicted by your landlord or prevent your home from being foreclosed, and if you’re able to put food on the table every day, and put clothes on the backs of your children, then you’re extremely lucky because there are millions out there that don’t have the conditions to do so. This once was a nation for the great. But now, the American dream has turned into a horrifying nightmare. n today’s video, we compiled 30 facts that prove that the average American family is getting absolutely pulverized by this economy.

Biden’s student debt scam: Restructuring debt, not forgiveness

An email from the Department of Education obtained by National Public Radio (NPR) indicates that the Biden administration may extend the freeze on student loans, started under the Trump administration, for a fourth time. The email directed loan servicing companies not to reach out to borrowers about the May 1 deadline, despite these companies being required to give a month's notice before repayment begins.

The email follows on the heels of an appearance by White House Chief of Staff Ron Klain on the podcast Pod Save America where he hinted that it was possible the repayment pause could be extended beyond the May 1 deadline.

There is no doubt that the motivation behind the delay in restarting the debt payments is a cynical political calculation. The Democratic Party is planning to use the delay to posture as proponents of some form of debt forgiveness in the midterm elections.

While campaigning for president Biden declared repeatedly that “we should forgive a minimum of $10,000/person of federal student loans, as proposed by Senator Warren and colleagues.”

However, those who hold student loan debt must be warned, the current proposal under consideration for “forgiveness” is actually a restructuring of student debt, a far cry from Biden’s original pledge.

The magnitude of the proposed “relief” pales in comparison to the mountain of student debt.

Even if his campaign promise was applied to all the 43.4 million federal student loan borrowers, it would entail $434 billion in forgiven loans, only a little more than a quarter of the $1.61 trillion in federal student loans. Outstanding private student loans, which stand at $136.31 billion according to Nerdwallet, would not be canceled under this arrangement. Moreover, “Total Parent Plus debt,” where parents take on debt on behalf of their student children, constituting $103.6 billion in debt and 3.6 million borrowers, would be untouched.

Even more importantly, there is no plan to reduce, let alone eliminate the astronomical education costs that currently prevail. This means that the one-time forgiveness would not do anything for future borrowers. Students would still go into massive amounts of debt because of the astronomical cost of college. Loan companies and the federal government would continue to profit off of student loans, and higher education would continue on its trajectory towards being a privilege afforded to the wealthy instead of a public good for all.

Despite this reality, the mainstream media has sought to portray Biden’s actions on student debt as somewhat progressive. Forbes recently reported, for example, that Biden has forgiven $15 billion in debt. Not only does this figure represent a drop in the bucket of the total debt, but it also covers up more devious actions. The figure cited by Forbes includes people involved in public service loan forgiveness, which has existed for decades. Nerdwallet accurately described it as “a federal program designed to encourage students to enter relatively low-paying careers,” forgiveness of now-defunct ITT Tech student loans (ITT is a private university that abruptly closed in 2016), and Borrower Defense to Repayment, which covers loans to defunct institutions.

That is, a small section of student loan borrowers have become disabled and are unable to make repayments, been able to prove they were defrauded by either a scam or hold a degree from a non-existent institution, or work a low-paying job and have therefore been granted “forgiveness.”

Additionally, the Department of Education identified 100,000 borrowers with $6.2 billion in cancellable debt as part of an October 2021 change to the Public Service Loan Forgiveness rules, which has also been touted in the media as a great victory for students. This figure constitutes a fraction of the total student loan borrowers and total debt (0.2 percent and 0.4 percent, respectively). Moreover, this change mainly involves adjustments in how payments are counted towards forgiveness, such as counting prior student loan payments towards forgiveness, payments made before loans are consolidated, getting credit towards forgiveness if the wrong repayment plan was used, and similar matters.

Even the debt forgiveness plans that are presented as more radical, upon closer look, are incredibly limited and unserious. For example, Senate Majority Leader Chuck Schumer and Senator Elizabeth Warren proposed student loan cancellation be limited to student loan borrowers who earn up to $125,000, with the possibility of Congress or the president setting an even lower threshold, much like the stimulus check for the COVID-19 pandemic which had a $75,000 income threshold.

Democratic Senator Patty Murray, chairwoman of the Senate Health, Education, Labor and Pensions Committee, who advocated extending the payment freeze to at least 2023 explained that her reason for continuing the freeze is to fix the “broken” repayment system. The Washington Post wrote at the time that “Murray said she is pleased to see the administration considering another extension because there is plenty of work to do before payments resume.“

“Chief on the list is to finalize a new income-driven repayment plan.” The “fix” consists of consolidating four “income driven plans” into one, a far cry from canceling student debt, let alone making higher education affordable.

Student loans are also on the government's balance sheet, meaning that any forgiveness would be paid for by a cut to social spending.

Just as the Democrats have removed all remaining pandemic protections amid mass death and infections so that big banks and corporations could continue to profit, they are moving to shift ever more money towards the military as part of the drive by US imperialism to war with Russia and China. The US military budget passed in the Senate stands at a whopping $782 billion. While both parties claim there is no money for student loan forgiveness or for making higher education free, trillions are expended on war and propping up Wall Street.

Biden himself holds a great deal of responsibility for the student debt crisis from his time as a US senator from Delaware. His home state is infamous as the location of choice for giant corporation headquarters seeking to evade taxes, regulations and scrutiny of all kinds, something which the president often brags about. In 2005, along with 17 other Democratic senators, he voted to pass the Bankruptcy Abuse Prevention and Consumer Protection Act, which tightened the bankruptcy code so that private student loans were stripped of bankruptcy protections.

Biden received hundreds of thousands of dollars in campaign contributions from credit card companies preceding the vote. The tightening of bankruptcy protections led to the tripling of debt over the course of a decade, locking student debtors in endless ruinous payments.

For the Biden administration, “student debt forgiveness” is a convenient slogan used to try to deceive a section of young voters.

Workers and youth looking for a solution to this crisis or any of the other major crises must take up the fight for socialism, independent from the parties and representatives of Wall Street.

Democrats are actively hostile to middle- and working-class Americans. Republicans whose fealty belongs to the Chamber of Commerce (open borders and no tariffs) are passively hostile to middle- and working-class Americans. Until Americans start electing politicians who put America first, our political class will continue to destroy us. One day, it’ll be we Americans who are making cheap gimcracks for China, with our salaries clocking in at the $1 a day that was once the going rate for slave labor in China.

Joe Biden takes a major step to prop up the Chinese economy

One of the great things Trump did for America was to impose tariffs on Chinese goods that the Chinese government was subsidizing as part of its goal to continue destroying America’s manufacturing sector. Last week, Biden lifted 64% of those tariffs on a broad range of productes.

When globalism first become a thing, probably around the Bronze Age (approximately 3300 B.C. to 1190 B.C.), trade meant getting from another country something that couldn’t possibly come from your own country. That’s what globalism meant right up until the post-WWII period.

In the post-war years, Asian countries started competing with America for manufacturing. American companies, both large and small, learned that everything they made in America could be made more cheaply in Asia. Regulations were few or non-existent, and labor costs were de minimis, while costly labor unions were non-existent.

For those Americans who weren’t laid off when factories closed, Asian manufacturing meant an endless cornucopia of cheap goods. Eventually, Japan and Taiwan stopped making garbage and started making goods of superior quality. Once again, American manufacturing was locked out and consumer prices rose—but if you bought a Japanese jigsaw or a Taiwanese computer monitor, you were getting value for the money.

China was different, though. China has never made quality goods. Nor has it ever truly competed in a free market, unlike other Asian countries. Instead, the government subsidizes Chinese products to ensure that American companies abandon their home country for China.

If you’ve tried to stop buying Chinese goods, you’ve discovered how few American-made products there are. Everything (including most of our prescription medicines, except those from India) comes from China.

Thus, we no longer look to globalism to bring to America exotic goods we can’t get elsewhere. Instead, we’ve made ourselves utterly dependent on China to provide the basic materials that underlie American life—and China means to keep it this way, thanks to that government underwriting, along with corrupt trade practices, and the use of prison and Uyghur slave labor.

President Trump recognized this dangerous dependency on China. If we cannot make any of the basic staples of modern life, China can extort us at any time. Therefore, he offended libertarians and other free traders by imposing significant tariffs on China, in part to punish its trade cheating, and in part to encourage manufacturers to return to America.

Image: Made in China label by Bill Bradford. CC BY 2.0.

Then, Biden got himself into the White House—the same Biden who dragged his debauched, untalented, drug-addicted son with him on official government trips to China. Once there, that same son magically acquired $1.5 billion in business contracts from entities that are basically fronts for the Chinese Communist Party.

While Biden was out of the White House, the Chinese might have wondered whether that $1.5 billion investment was worth it. Now, though, the Chinese know their ship’s about to come in. Sure, Biden’s made nasty remarks about China but the Chinese understand that he’s got to maintain the façade of a president “tough on China.” What’s important is what Biden does for China.

Last week, Biden did something very big for China:

President Joe Biden’s administration has eliminated United States tariffs on more than 350 products made in China, nearly all of which could be made in the U.S. or other countries.

The Section 301 tariffs on billions of dollars worth of China-made products were first imposed by former President Trump after a decades-long free trade consensus in Washington, D.C., that has eliminated 3.7 million American jobs from the U.S. economy from 2001 to 2018.

Late last week, Biden’s U.S. Trade Representative (USTR) Katherine Tai announced that after an extensive review process on nearly 550 China-made products subject to U.S. tariffs, the administration would eliminate tariffs on 352 of those products.

The China-made products that will escape U.S. tariffs thanks to Biden include breast pumps, solar water heaters, garage door openers, X-ray tables, and thermostats, as well as food products from China such as crab meat, Dungeness crab, and Alaskan sole.

And where were the Democrats as these deals were being cut? Well, quite a few of them were in the background, cheering Biden on. Per Breitbart reporting, numerous Republicans were part of a bipartisan consortium urging Biden to stop protecting American manufacturing. The Republicans include Representatives Darin LaHood (R-IL), Jackie Walorski (R-IN), Ron Kind (D-WI), Suzan DelBene (D-WA), Kevin McCarthy (R-CA), Cathy McMorris Rodgers (R-WA), Burgess Owens (R-UT), Nicole Malliotakis (R-NY), Ken Buck (R-CO), Young Kim (R-CA), and Anthony Gonzalez (R-OH).

Democrats are actively hostile to middle- and working-class Americans. Republicans whose fealty belongs to the Chamber of Commerce (open borders and no tariffs) are passively hostile to middle- and working-class Americans. Until Americans start electing politicians who put America first, our political class will continue to destroy us. One day, it’ll be we Americans who are making cheap gimcracks for China, with our salaries clocking in at the $1 a day that was once the going rate for slave labor in China.

BIDENOMICS: THE MAN WHO DESTROYED OUR BORDERS IS WORKING HARD TO ACCOMPOLISH THE SAME ON OUR ECONOMY. VISUALIZE IMPEACHMENT.

Our Worst Nightmare Just Became REAL...

https://www.youtube.com/watch?v=mIiVntHNAeY

The Economic Collapse Just Got Real! Car Price Nightmare, Housing Bubble Worsens, Wages Fail

https://www.youtube.com/watch?v=s-5zR2Xk5GU

Food Shortage Aggravates As Supply Chain Breakdown Trigger Panic At Local Supermarkets

Shocking Signs That Show That The Middle Class In The U.S. Is Being Systematically Destroyed

https://www.youtube.com/watch?v=cYenuu1qeM

BIDENOMICS: THE RICH GET MUCH RICHER, THE REST GET THE SHAFT!

30 Facts American Families Are Getting Pulverized By This Economy

US auto companies complain of “labor shortage” as temporary workers denied profit sharing

Detroit-based automakers continue to find it difficult to hire and retain enough temporary workers to maintain full production during the ongoing pandemic, given the deplorable wages, benefits and working conditions that temporary part-time autoworkers must endure. To add insult to injury, these workers are denied thousands of dollars in so-called profit-sharing payments which full-time workers receive.

Since the start of the pandemic, thousands of autoworkers have been sickened and hundreds have perished from COVID-19, although neither the auto companies or the United Auto Workers have released the full numbers to the public. Absenteeism has also soared as workers have taken sick leave or simply stayed home to prevent getting themselves and their family infected. To keep the factories running, all the major auto companies and parts suppliers have hired large numbers of temporary part-time and other contingent workers.

Starting pay for temporary part-time or “supplemental” workers at Detroit area auto plants is just $15.78 per hour, the rate now paid by many fast-food restaurants. Despite working 40 hours or more a week, supplementals are not eligible for profit-sharing checks, saving the company countless millions of dollars. Stellantis recently issued checks of up to $14,670 to full-time employees. General Motors and Ford handed out $10,250 and $7,377 respectively.

The term “temporary part-time” is totally deceptive. These workers can be forced to work 12-hour shifts and 40 hours or more a week, including weekends and holidays. They can be employed for years with no guarantee of ever becoming full time. They can be shifted from plant to plant as needed. While paying union dues, they have virtually no protections under the United Auto Workers labor agreement and can be fired for minor infractions with no right to file a grievance.

Conditions at the Stellantis Warren Truck Assembly Plant located just outside Detroit highlight the abusive conditions supplemental workers face. As one supplemental worker at Warren Truck wrote to the WSWS Autoworker Newsletter, “I never imagined that a McDonald’s worker or an Amazon worker would be offered better incentives than an employee of the world’s third-largest automaker.”

The treatment of supplemental workers has evoked outrage from full-time workers, who understand that the abuse of temp workers threatens all workers. A recent letter distributed by rank-and-file workers at the Warren Truck break room stated, “Profit Sharing checks will go out March 11 to some employees. The untold story is of the thousands of Supplemental employees who won’t receive a dime. No matter how many hours they worked last year, (many averaged over 40 hours a week) they get nothing.”

A supplemental worker at Warren Truck told the Autoworker Newsletter, “There are many supplemental employees who should have been converted to full time and entitled to those checks,” based on their hire dates. He said Stellantis and the UAW used “a pick and choose” conversion process over the last two years in which supplemental employees who had less time on the job were converted ahead of workers with longer service.

He continued, “They’re trying to bring in a lot more new people. The last batch was so young, I think they’re getting them straight out of high school. I’ve trained a few of the new hires. They don’t even get a week of training. They get a day and they’re on their own. Learning what they can on the shop floor.

“If they brought in a hundred, they might be in good shape. But they may at most get 50 or 60. But they come in like 12 or 13 at a time. Last week we got a few and the week before we got a few more. It’s slow here now. But a lot of them don’t last. Once they get here, they hear stories that ‘we’re not being hired.’ [full time] So many don’t last long.”

On March 3, the UAW announced that it had agreed with management to drop masking requirements at plants not deemed “high risk” under the Centers for Disease Control and Prevention’s emasculated standards. Another Warren Truck worker told the Autoworker Newsletter, “We got [COVID] infections in the plant now. Yesterday there was a worker who had a 103-degree fever in here. They’re getting rid of masks, but I am going to wear mine.” A coworker added, “All they care about is keeping the factories going and making money. They figure if one of us dies, they’ll just replace us and keep the line moving.”

According to a recent report in the Detroit Free Press the labor shortage is so serious that the Michigan Manufacturers Association has brought in a new director of workforce development focused on aggressively promoting recruitment of autoworkers. According to the Bureau of Labor Statistics the number of automotive sector jobs declined in January by 3,500 and another 18,000 in February despite aggressive attempts at hiring by auto and auto parts companies.

The Free Press report cites a UAW official at the General Motors Bowling Green, Kentucky, assembly plant who reports, “It has become common for GM to hire 10 temps and only six to eight show up for their first day on the job.”

Under conditions where many fast food and retail chains are paying wages of $15 an hour and more, the grueling work in auto plants, where thousands of workers often work in close proximity with COVID-19 still rampant, is a hard sell.

A worker in the Detroit area who recently went through the job interview process with Stellantis spoke to the Autoworker Newsletter. “They have established that you are not going to have a life. You are on call with a starting wage of $15.78 and may require overtime Saturday and holidays.

“My greatest fear was getting fired. They have the right to fire you out of the blue.

“I have a disability and a conviction. I was honest on my application, but they never asked me about it. They were supposed to give me a physical as part of the hiring process; but never gave one. I take a lot of expensive medicines and they may not like paying for that.

“We are in a pandemic, and you have to work in close proximity. Every week there are fewer and fewer people wearing masks. What happens if you are a supplemental and you get sick? Are you going to be able to keep your job? What happens if you get Long COVID?

“At the orientation session it was full. I was in an auditorium, and they had 300 people easy. On the job description it says you must work different shifts, work weekends and holidays, work in hot and cold environments, work safely around heavy equipment, stand or walk long periods of time each day, frequently bend or stoop, reach and lift up to 40 pounds and work in tight closed spaces… They are asking for a lot and not paying you.

“There are three shifts, but they don’t tell you what shift. They want workers, but they won’t answer basic questions. Their attitude is ‘just be thankful for the job,’” he said.

In addition, he said, “You have to pay $50 in union initiation dues off the top. I am supposed to pay them, but the union is not guaranteeing they have my back. They just want money; that’s gangsterism.”

Primary responsibility for these conditions rests with the UAW. In a series of concessionary contracts, the bribed officials of the UAW, many now sitting in prison, agreed to the spread of low-paid labor, including multiple wage tiers and the virtually unlimited employment of temporary workers.

The UAW and the Democratic administration of Detroit Mayor Mike Duggan have collaborated to tap impoverished inner-city areas as a source of low-paid labor through such measures as the Detroit Works program and Community Benefits Ordinance.

At his annual State of the City speech earlier this month Duggan spoke of the shortage of qualified workers in Detroit, citing “13,000 vacant jobs.” The situation is so acute the city is even paying young people who failed to graduate from high school $10 an hour to attend literacy classes so they can pass their high school equivalency test (GED) and is offering free paid community college and four-year college tuition to all Detroit residents.

Duggan’s speech, given at “Factory Zero,” the newly re-tooled General Motors electric vehicle plant in Detroit, hyped the supposed comeback of Detroit under his administration. However, the corporate money invested in the city has primarily focused on the redevelopment of certain high-profile sites downtown, while a mere pittance has been spent on public transport, affordable housing and schools. Corporations like Stellantis, Lear, Flex-N-Gate and other auto parts makers have been enticed to build new factories in the city through the offer of cheap land, tax breaks and ready access to a supply of low-paid labor.

While the 2019 UAW national contract supposedly addressed the issue of the abuse of temporary workers by providing a “pathway” to full-time positions, the pandemic has been used to toss this out the window. This underscores the role played by the UAW as a corrupt extension of corporate management. The demand must be raised for the immediate full-time hiring of all temp workers, the abolition of tiers and the payment of all profit-sharing and bonuses given to full time workers.

Biggest share of Americans since 1940s say their financial health will get worse in year ahead

Consumer sentiment index slips in March to 59.4 — pessimism even worse than early in pandemic

High inflation got you down? Americans are worried about rising prices and aren’t sure the government will succeed in bringing price pressures down quickly.

STEFANI REYNOLDS/AGENCE FRANCE-PRESSE/GETTY IMAGESReferenced Symbols