Obama Endorsed Candidates Falter in Virginia, Despite Democrat Statehouse Sweep

6:57

Former President Barack Obama may live a stone’s throw away from Virginia now, but his sway over the state’s political landscape came up short on Tuesday.

Obama, who lives in the elite Washington, DC, enclave of Kalorama, has taken an interest in Virginia politics since leaving the White House. In 2017, the former president endorsed a slate of Democrat candidates running for Virginia’s top three statewide offices. The following year, Obama actively actively hit the campaign trail to see Sen. Tim Kaine (D-VA), a former chairman of the Democratic National Committee and failed vice presidential candidate, reelected.

This year was no different, especially with control of the Virginia General Assembly up for grabs.

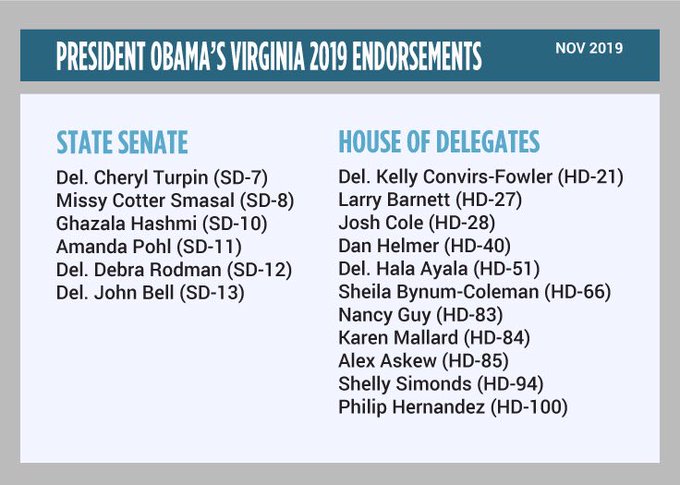

Last weekend, as election day neared, Obama issued an endorsement of 17 legislative candidates, he claimed were ready to advance a slew of liberal priorities in Virginia. Most of the candidates were first time office seekers, with a few incumbents thrown into the mix.

“Proud to endorse an outstanding group of Virginia Democrats in Tuesday’s election—candidates who’ll not only advance the causes of equality, justice, and decency, but help ensure that the next decade of voting maps are drawn fairly,” the former president wrote on social media. “That’s good policy—and good for our politics.”

Proud to endorse an outstanding group of Virginia Democrats in Tuesday’s election—candidates who’ll not only advance the causes of equality, justice, and decency, but help ensure that the next decade of voting maps are drawn fairly. That’s good policy—and good for our politics.

14.7K people are talking about this

Despite the former president’s rousing endorsement, along with a hefty cash infusion from his allies across the country, a majority of the candidates failed to be elected on Tuesday. The losses by Obama’s preferred candidates came even as Democrats Virginia swept to power in both chambers of the Virginia legislature, setting themselves to control all three branches of state government for the first since 1993.

Such an accomplishment, while significant, cannot be attributed to Obama. Of the six Democrats the former president endorsed for the Virginia State Senate only two succeeded in garnering support at the ballot box, while three lost outright. One of the races is still too-close to call, but Republicans maintain a strong lead.

Obama endorsed the Democrat candidates in Virginia Senate races in the 7th, 8th, 10th, 11th, 12th, and 13th districts, and lost the 7th, 8th, and 11th districts. The 12th district has the Republican leading by two percent but has not yet been called, meaning Obama only won in the 10th and 13th districts.

That means the former president went two for six in state Senate races, a measly 33 percent win rate.

Obama had a slightly better, but far from perfect, track record in House of Delegates races. In the House of Delegates races, Obama endorsed the Democrat candidates in the 21st, 27th, 28th, 40th, 51st, 66th, 83rd, 84th, 85th, 94th, and 100th districts. Democrats won the 21st, 28th, 40th, 51st, 85th, and 94th districts, and lead a not-yet-called race in the 83rd. Republicans won the 66th and 100th, and currently lead not-yet-called races in the 27th and 84th. Assuming those final margins hold, that means of the 11 candidates Obama endorsed for the House of Delegates, Obama won 7 of them–and the GOP won 4–and went just over 60 percent there.

The losses by the Obama-endorsed candidates came even as many led their Republican opponents handily in campaign contributions. Missy Cotter Smasal, a small business owner from Virginia Beach, Va., raised $550,000 more than the incumbent Republican she was vying to unseat, according to the Virginia Public Access Project (VPAP). Some of those funds came from top Obama donors like Michael Bills, who along with his donated more than $130,000 to Smasal’s campaign, and groups allied with the former president, including Everytown for Gun Safety. The cash lead did not translate to votes tough, as Rodman lost to the incumbent by five percentage points.

There is also some evidence that victories by the two Obama-endorsed senate candidates result from factors beyond the former president’s control.

In Senate District 10, Ghazala Hashmi defeated incumbent Republican Sen. Glen Sturtevant by slightly more than 8,000 votes after an expensive campaign in which both candidates raised more than two million each. Sturtevant, who won the seat in 2015, was considered the Senate’s most vulnerable Republican because his district, which includes portion of the city of Richmond, is heavily Democratic. According to the VPAP, the 10th Senate District voted for former Secretary of State Hillary Clinton over President Donald Trump by a margin of 53 percent to 41 percent in 2016. The district has only grown to favor Democrats in the years since, voting for Gov. Ralph Northam (D-VA) by a 15 percentage points in 2017 and for Kaine by 24 percentage points in 2018.

A similar situation played out in Senate District 13 where Obama’s endorsed candidate, John Bell, won an open seat. Bell, who represented portions of the district in the Virginia House of Delegates, easily bested his Republican opponent, the Trump-endorsed Geary Higgins, by more than 7,000 votes. The results were not that surprising given Bell’s fundraising advantage—$2.1 million to Higgins’ $1.3 million—and the district’s Democrat lean. In 2016, Clinton carried it by a margin of six percentage points. Meanwhile, Northam carried it by 11 percentage points on his way to the governorship in 2017 and Kaine won it overwhelmingly by 18 points last year.

Although both victories helped ensure Democrat control of the state senate, losses by the four other Obama-endorsed candidates, like Smasal, means the party is likely to only have a one seat majority in the chamber.

The former president had more luck with the candidates he endorsed for the Virginia House of Delegates, albeit still failed to see them all elected. In total, six of the 11 Democrats that Obama backed won, while four lost. One race is still outstanding, but the Republican candidate is leading.

As with the senate races, there were a bevy of factors behind the results. Two of the candidates Obama threw his support behind, Delegates Hala Ayala and Kelly Convirs-Fowler, were incumbents running for reelection. Both women led the money race by heavy margins, with Ayala raising nearly a million dollars more than her Republican challenger, and were running in territory favorable to Democrats. In fact most of the districts Obama-endorsed candidates won and lost were carried by Clinton in 2016 and Kaine in 2018.

Some, like House District 28 in Northern Virginia, were carried by Democrats on Tuesday by small margins than in prior years. In 2016, Clinton won the district by four percentage points, before Kaine carried it by 12 points on his way to reelection last year. On Tuesday, though, the Obama-endorsed Joshua Cole only won the district by a slim margin of roughly four percentage points.

A comparable political environment existed in House District 100 on Virginia’s eastern shore, an area that has become increasingly friendly to Democrats in recent years. Even though Kaine won the district by 12 points in his 2018 reelection bid, the Obama-endorsed candidate, Phil Hernandez, failed to unseat the longtime Republican incumbent, Rob Bloxom. Hernandez’s three point loss was especially surprising given that he had out-raised Bloxom by more than $500,000.

The failure of Obama-backed candidates like Hernandez’s ensures that Democrats will have a slim majority in the Virginia House of Delegates next session. In a twist of irony, the Democrats narrow majority could end up slowing the very advancements in “equality, justice, and decency” the former president invoked when issuing his endorsements last week.

The Obamas tackle climate change and wealth inequality

Sharing with

the less fortunate: During

the five years from 2000-2004, a period when they earned $1.2 million,

Barack and Michelle Obama donated less than one percent of their income to charity, ten

times less than the tithing guidelines of their professed Christian faith.

Only when Obama decided to run for president did the couple’s charitable

instincts improve.

Nolte:

Michelle Obama Condemns ‘White Flight’ After Purchasing Home in Martha’s

Vineyard

Former first lady Michelle Obama condemned white

people for fleeing minority neighborhoods just weeks after she and her

husband purchased a $15

million estate in Martha’s Vineyard.

Diamond Life: Michelle Obama rents out $23-million Hollywood

Hills mansion for a night

OBAMAnomics:

Billionaire

Class Enjoys 15X the Wage Growth of American Working Class

The

billionaire class — the country’s top 0.01 percent of earners — have enjoyed

more than 15 times as much wage growth as America’s working and middle class

since 1979, new wage data reveals.

Study: Elite Zip Codes

Thrived in Obama Recovery, Rural America Left Behind

Wealthy

cities and elite zip codes thrived under the slow-moving economic recovery of

President Obama while rural American communities were left behind, a study

reveals.

Record

high income in 2017 for top one percent of wage earners in US

Graph from the Economic

Policy Institute

THE STAGGERING ECONOMIC INEQUALITY UNDER OBAMA'S ADMINISTRATION SERVING THE BILLIONAIRE CLASS.

OBAMA: SERVANT OF THE 1%

Richest one percent controls nearly half of global wealth

Millionaires projected to own 46

percent of global private wealth by 2019

Millionaires projected to own 46 percent of global private

wealth by 2019

By Gabriel Black

Millionaires

projected to own 46 percent of global private wealth by 2019

By

Gabriel Black

"During the month, some 432,000 people in the US gave up looking for a job." EVEN AS JEB BUSH, HILLARY CLINTON and BERNIE SANDERS PREACH AMNESTY! AMNESTY! AMNESTY!

"The American phenomenon of record stock values fueling an ever greater concentration of wealth at the very top of society, while the economy is starved of productive investment, the social infrastructure crumbles, and working class living standards are driven down by entrenched unemployment, wage-cutting and government austerity policies, is part of a broader global process."

HILLARY CLINTON'S BIGGEST DONORS ARE OBAMA'S CRIMINAL CRONY

BANKSTERS!

"A defining expression of this crisis is the dominance of financial speculation and parasitism, to the point where a narrow international financial aristocracy plunders society’s resources in order to further enrich itself."

Federal Reserve documents stagnant state of US economy

Federal Reserve documents stagnant state of US economy

By Barry Grey

The intractable nature of this crisis, within the framework of capitalism, is underscored by the IMF’s updated World Economic Outlook, released earlier this month, which projects that 2015 will be the worst year for economic growth since the height of the recession in 2009.

The Obamas tackle climate change and wealth inequality

In a remarkable commitment to their

tireless fight against climate change and wealth inequality, Barack and

Michelle Obama reportedly are purchasing a magnificent $15-million oceanfront mansion in Martha’s Vineyard, presumably as

a much-needed retreat to supplement the $9-million mansion they already own in

one of the most exclusive areas of the nation’s capitol.

A fierce opponent of fossil fuels and

wealth inequality, the former president has harshly criticized rich people for

the oversized, carbon-gluttonous houses they buy. On April 25, 2010, the

president who would become fabulously wealthy in retirement scolded Wall Street CEOs with this admonition:

I do think at

a certain point you’ve made enough money.

His views about the sin of making too much

money haven’t changed. During a speech last year in South Africa, this

shining example of environmental stewardship and unparalleled concern for the

poor spoke passionately about the unfairness of some people having more money

than others in blasting rich people for their excessively lavish lifestyles:

There’s only

so much you can eat; there’s only so big a house you can have; there’s only so

many nice trips you can take. I mean, it’s enough.

That direct quote came from the lips of a

man who, along with his wife, is sitting atop a nest egg estimated at a

meager $135 million. But don’t feel sorry for them, because there’s much more

to come: with money barreling their way like a runaway train, the concerned

couple is rapidly becoming a billion-dollar brand.

Protecting

the planet: During his

first full day in the White House, President Obama was photographed without his

suit jacket. Senior advisor David Axelrod explained: “He’s from Hawaii,

okay? He likes it warm. You could grow orchids in there.”

While campaigning, Obama vowed to exhibit environmental leadership if elected: “We can’t drive our

SUV’s and eat as much as we want and keep our thermostats set at 72 degrees.

That’s not leadership. That’s not going to happen [with me].”

In decreeing that rich people make too

much money and that global warming is an imminent threat to our very survival,

this ultra-wealthy man and his ultra-wealthy wife decided to indulge themselves

in another opulent mansion, this one sitting on 29 oceanfront acres on one of

the most exclusive islands in the world. While homeless people are

sleeping on the streets and our planet is being destroyed by CO2, the Obamas

are living large, a pitifully small reward for two remarkable people who bend

over backwards to show leadership in the fight against climate change and

wealth inequality.

An electrical engineering graduate of

Georgia Tech and now retired, John Eidson is a freelance writer in

Atlanta. American

Thinker recently published related article of his titled "Harrison Ford, Climate Hypocrite" and "A $600 fill-up?"

HE OBOMBS HAVE ALWAYS

LIVED LIKE THE 1% WHOM THEY SERVED AND GROVELED AT THE FEET OF.

Nolte:

Michelle Obama Condemns ‘White Flight’ After Purchasing Home in Martha’s

Vineyard

Gerardo Mora/Getty Images

JOHN NOLTE

31 Oct 2019113

5:28

Former first lady Michelle Obama condemned white

people for fleeing minority neighborhoods just weeks after she and her

husband purchased a $15

million estate in Martha’s Vineyard.

Martha’s

Vineyard is almost as white as an Elizabeth Warren rally.

Martha’s

Vineyard is whiter than my subdivision here in rural North Carolina.

Martha’s

Vineyard is whiter than MSNBC.

During a

Tuesday appearance at the Obama Foundation Summit in Chicago, she said, “But

unbeknownst to us, we grew up in the period — as I write — called ‘white

flight.’ That as families like ours, upstanding families like ours … As we

moved in, white folks moved out because they were afraid of what our families

represented.”

“And I

always stop there when I talk about this out in the world because, you know, I

want to remind white folks that y’all were running from us.” She went on, “This

family with all the values that you’ve read about. You were running from us.

And you’re still running, because we’re no different than the immigrant families

that are moving in … the families that are coming from other places to try to

do better.”

Did I mention that Michelle and

Barry just purchased a $15 million estate in Martha’s Vineyard, which is 95

percent white?

Oh, and did I mention the Obamas own

a second home, an $8 million mansion, in the exclusive DC neighborhood of Kalorama, which is

80 percent white and just four percent black.

Oh, and did I mention the Obamas

have a third home, a $5.3 million mansion, in Rancho Mirage, California, which

is 89 percent white and just 2.6 percent black.

Oh, sure, the Obamas still own their

Chicago home in Hyde Park, which is at least 26 percent black. But you would

think they could do better than 26 percent!

I like

Michelle Obama. I have always liked Michelle Obama. I’ve never said an unkind

word about her, quite the opposite, and while I find her politics ignorant, she

was a terrific first lady.

But this

is nuts…

Not only

is she attacking white people for seeking a better standard of living, which I

can assure you (as I will explain below) has little to do with racism, she is

also attacking whites after she herself “fled” to 95 percent white Martha’s

Vineyard (I will never stop repeating this point) and two other homes in areas where

the black population is less than 5 percent.

Worse

still, she is putting white people in a position where they can never win,

where they are damned if they do or don’t, where they are always and forever

racist.

If white

people move out of a black neighborhood, they’re racists engaging in white

flight.

But…

And this

is important…

If white

people move into a minority neighborhood, they are also racists for either

engaging in gentrification — which is just another form of cultural genocide,

donchaknow — or cultural appropriation.

Now I’m

going to tell you a little something about white flight, from my own

experience…

Because I

was poor, back in the mid-eighties, I lived in the inner-city of Milwaukee for

two years. My wife and I did not flee (my wife is not white, by the way)

because of “icky minorities” (did I mention my wife is not white?), we fled

because it was not safe to live there. It was never safe. Over those two years,

we had been mugged, robbed, and had our car stolen. That’s why we left.

And when

we fled, it was to a community that was still not as white as *ahem* Martha’s

Vineyard.

In 2002,

my wife and I moved to California for nine years and lived in an East Los

Angeles neighborhood that was just four percent white. For nearly a decade, I was

outnumbered 96-4 and never gave it a thought because I was not outnumbered. A

darker skin tone, an accent, and different religious traditions did not make my

neighbors any less American than me, and when I am among Americans I am among

my own. We left because predominantly white leftists are destroying California.

Then

there’s my poor dad…

He moved

to the Northside of Milwaukee in 1980, and spent decades, a lot of money, and a

ton of sweat, remodeling his home, building a garage, and paying that home off.

He intended to retire there. And yes, there were black people in his

neighborhood when he moved in, and for most of his adult life he worked in

predominantly black institutions. He never intended to move, and held on for as

long as he could… He didn’t flee because of black people. He was not forced to

start all over at age 67 because he suddenly decided he didn’t like blacks. He

left because he was robbed, because gangs started tagging his house and garage,

because it was no longer safe to live there.

You know…

If we’re

going to shame people for such things, what does it say to black people when

other black people, especially the first black president and his family, reject

them? What the hell kind of message is this to send to black Americans,

especially when the Obamas can afford the security to live safely in any

neighborhood they choose?

And if

the Obamas wanted to live in Southern California, why choose Rancho Mirage over

Ladera Heights, the Black Beverly Hills, a predominantly black neighborhood as

swank as any in America?

Shame on

Michelle and Barack Obama. They have the money and profile to make an important

statement on this issue, but they obviously prefer to live in overwhelmingly

white neighborhoods.

Diamond Life: Michelle Obama rents out $23-million Hollywood

Hills mansion for a night

Apparently,

a hotel, even a luxury hotel, was not good enough.

Former

first lady Michelle Obama had to go big, renting out a $23-million Hollywood

Hills mansion for...a night. The New York Post has the pictures of it here. Several news

accounts explained it as possibly a rental to try and buy, something most

home-buyers don't get to do. Whether she actually paid is also a big

question mark, and if so, whether she paid market value (which would have

cost more than a fancy hotel) or received her night there a

"gift," which presents its own ethics problems.

The Shark House, which is located in the 9200

block of Swallow Drive, is thus named due to its open air shark aquarium. It

also has a full spa, a humidor room, movie theater and walk-in wine room.

It's on the market, currently listed for a cool

$22.9 million.

A source told TMZ the Obamas may be looking at

real estate in the Hollywood Hills area, but that was not confirmed.

If

they're in the market to buy that, they've got a lot more money than the press

is reporting. We know they're loaded. But not that

loaded. Not Louis XIV loaded, which is about the range for this

sort of place. Or is it a sweetheart deal in the works we're talking

about? Maybe they'll end up buying it for "a

dollar." Don't know yet, but neither possibility makes them

look good.

It's

all part and parcel of the Obamas' long, luxurious post-presidency,

a nonstop vacay that costs taxpayers millions. It's as though

we're financing kings now, not retired presidents. For a while

there, the Obamas were jetting around with billionaires and

staying on private islands. Then they bought that expensive Kalorama

mansion in Washington, D.C., all supposedly for the benefit of their daughter

Sasha, who was finishing high school. Surprise, surprise, it

actually seems to primarily serve as a political watch post for longtime Obama

loyalist and consigliere Valerie Jarrett. They did some audience

tours and hung out with more billionaires. There were those

lucrative Goldman Sachs speeches by the celebrity

president (which certainly weren't based on economics anyone would want to

trade on).

And

all of this has been financed by taxpayers, who pay his $207,000 pension, along with bennies

such as unlimited air travel, transition expenses, office expenses,

presidential library funds, and lifetime Secret Service detail.

Apparently,

to the Obamas, there's no reaching that "certain point" at which

"you've made enough money."

For

Michelle, just call her "Mooch." Is this really what an

ex-presidency is supposed to be like? Hitting the money

jackpot? What he makes on his own is his own business (subject to

bribery laws), but taxpayers shouldn't be financing this level

of movie-star billionaire luxe life. Maybe it's time for some

pension reform from Congress. Would be quite a thing to see that

idea presented to the House's ruling Democrats.

OBAMAnomics:

Billionaire

Class Enjoys 15X the Wage Growth of American Working Class

The

billionaire class — the country’s top 0.01 percent of earners — have enjoyed

more than 15 times as much wage growth as America’s working and middle class

since 1979, new wage data reveals.

Between 1979 and 2017, the wages of the bottom 90 percent — the

country’s working and lower middle class — have grown by only about 22 percent,

Economic Policy Institute (EPI) researchers find.

Compare that small wage

increase over nearly four decades to the booming wage growth of America’s top

one percent, who have seen their wages grow more than 155 percent during the

same period.

The top 0.01 percent — the

country’s billionaire class — saw their wages grow by more than 343

percent in the last four decades, more than 15 times the wage growth of the

bottom 90 percent of Americans.

In 1979, America’s working

class was earning on average about $29,600 a year. Fast forward to 2017, and

the same bottom 90 percent of Americans are earning only about $6,600 more

annually.

The almost four decades of wage

stagnation among the country’s working and middle class comes as the national

immigration policy has allowed for the admission of more than 1.5 million

mostly low-skilled immigrants every year.

(Public Citizen)

In the last decade, alone, the U.S. admitted ten million legal

immigrants, forcing American workers to compete against a growing population of

low-wage workers. Meanwhile, employers are able to reduce wages and drive up

their profit margins thanks to the annual low-skilled immigration scheme.

The Washington, DC-imposed mass immigration policy

is a boon to corporate executives, Wall Street, big business, and multinational

conglomerates as every one percent increase in the immigrant composition of an

occupation’s labor force reduces Americans’ hourly wages

by 0.4 percent. Every one percent increase in the immigrant workforce reduces

Americans’ overall wages by 0.8 percent.

Mass immigration has come at

the expense of America’s working and middle class, which has suffered from poor

job growth, stagnant wages, and increased public costs to offset the

importation of millions of low-skilled foreign nationals.

Four million young Americans enter the workforce every year, but

their job opportunities are further diminished as the U.S. imports roughly two

new foreign workers for every four American workers who enter the workforce.

Even though researchers say 30 percent of the workforce could lose their jobs due to

automation by 2030, the U.S. has not stopped importing more than a million

foreign nationals every year.

For blue-collar American workers, mass immigration has not only

kept wages down but in many cases decreased wages, as Breitbart News reported. Meanwhile, the U.S. continues

importing more foreign nationals with whom working-class Americans are

forced to compete. In 2016, the U.S. brought in about 1.8 million

mostly low-skilled immigrants.

Study: Elite Zip Codes

Thrived in Obama Recovery, Rural America Left Behind

4:49

Wealthy

cities and elite zip codes thrived under the slow-moving economic recovery of

President Obama while rural American communities were left behind, a study

reveals.

The Economic Innovation Group research, highlighted by Axios, details the massive

economic inequality between the country’s coastal city elites and middle America’s

working class between the Great Recession in 2007 and Obama’s economic recovery

in 2016.

Between 2007 and 2016, the

number of residents living in elite zip codes grew by more than ten million,

with an overwhelming faction of that population growth being driven by mass

immigration where the U.S. imports more than 1.5 million illegal and legal

immigrants annually.

The booming 44.5 million immigrant populations are concentrated mostly in the country’s

major cities like Los Angeles, California, Miami Florida, and New York City,

New York. The rapidly growing U.S. population — driven by immigration — is set

to hit 404 millionby 2060, a boon for real estate

developers, wealthy investors, and corporations, all of which benefit greatly

from dense populations and a flooded labor market.

The economic study found that

while the population grew in wealthy cities, America’s rural population fell by

nearly 3.5 million residents.

Likewise, by 2016, elite zip

codes had a surplus of 3.6 million jobs, which is more than the combined bottom

80 percent of American zip codes. While it only took about five years for

wealthy cities to replace the jobs lost by the recession, it took “at risk”

regions of the country a decade to recover, and “distressed” U.S. communities

are “unlikely ever to recover on current trendlines,” the report predicts.

A map included in the research

shows how rich, coastal metropolises have boomed economically while entire

portions of middle America have been left behind as job and business gains

remain concentrated at the top of the income ladder.

(Economic Innovation

Group)

(Economic Innovation Group)

Economic growth among the

country’s middle-class counties and middle-class zip codes has considerably

trailed national economic growth, the study found.

For example, between 2012 and

2016, there were 4.4 percent more business establishments in the country as a

whole. That growth was less than two percent in the median zip code and there

was close to no growth in the median county.

The same can be said of employment

growth, where U.S. employment grew by about 9.3 percent from 2012 to 2016. In

the median zip code, though, employment grew by only 5.5 percent and in the

median county, employment grew by less than four percent.

“Nearly three in every five

large counties added businesses on net over the period, compared to only one in

every five small one,” the report concluded.

Elite zip codes added more

business establishments during Obama’s economic recovery, between 2012 and

2016, than the entire bottom 80 percent of zip codes combined. For instance,

while more than 180,000 businesses have been added to rich zip codes, the

country’s bottom tier has lost more than 13,000 businesses even after the

economic recovery.

(Economic Innovation

Group)

(Economic Innovation Group)

The gutting of the American manufacturing base, through free

trade, has been a driving catalyst for the collapse of the

white working class and black Americans. Simultaneously, the outsourcing of the

economy has brought major wealth to corporations, tech conglomerates, and Wall

Street.

The dramatic decline of U.S. manufacturing at the hands of free

trade—where more than 3.4 million American jobs have been

lost solely due to free trade with China, not including the American jobs lost

due to agreements like the North American Free Trade Agreement (NAFTA) and the

United States-Korea Free Trade Agreement (KORUS)—has coincided with growing

wage inequality for white and black Americans, a growing number of single mother

households, a drop in U.S. marriage rates, a general stagnation of

working and middle class wages, and specifically, increased black American

unemployment.

“So, the loss of manufacturing

work since 1960 represents a steady decline in relatively high-paying jobs for

less-educated workers,” recent research from economist Eric D. Gould has

noted.

Fast-forward to the modern economy and the wage trend has been

the opposite of what it was during the peak of manufacturing in the U.S. An

Economic Policy Institute studyfound this year that been 2009 and 2015, the top one

percent of American families earned about 26 times as much income as the

bottom 99 percent of Americans.

Record

high income in 2017 for top one percent of wage earners in US

In 2017, the top one percent of US wage earners received

their highest paychecks ever, according to a report by the Economic Policy

Institute (EPI).

Based on newly released data from the Social Security

Administration, the EPI shows that the top one percent of the population saw

their paychecks increase by 3.7 percent in 2017—a rate nearly quadruple the

bottom 90 percent of the population. The growth was driven by the top 0.1

percent, which includes many CEOs and corporate executives, whose pay increased

eight percent and averaged $2,757,000 last year.

The EPI report is only the latest exposure of the gaping

inequality between the vast majority of the population and the modern-day

aristocracy that rules over them.

The EPI shows that the bottom 90 percent of wage earners

have increased their pay by 22.2 percent between 1979 and 2017. Today, this

bottom 90 percent makes an average of just $36,182 a year, which is eaten up by

the cost of housing and the growing burden of education, health care, and

retirement.

Meanwhile, the top one percent has increased its wages by

157 percent during this same period, a rate seven times faster than the other

group. This top segment makes an average of $718,766 a year. Those in-between,

the 90th to 99th percentile, have increased their wages by 57.4 percent. They

now make an average of $152,476 a year—more than four times the bottom 90

percent.

Decades of decaying capitalism have led to this

accelerating divide. While the rich accumulate wealth with no restriction,

workers’ wages and benefits have been under increasing attack. In 1979, 90

percent of the population took in 70 percent of the nation’s income. But, by

2017, that fell to only 61 percent.

Even more, while the bottom 90 percent of the population

may take in 61 percent of the wages, large sections of the workforce today

barely pull in any income at all. For example, Social Security

Administration data found that the bottom 54 percent of wage earners in the

United States, 89.5 million people, make an average of just $15,100 a year.

This 54 percent of the population earns only 17 percent of all wages paid in

America.

However unequal, these wage inequalities still do not fully

present the divide between rich and poor. The ultra-wealthy derive their wealth

not primarily from wages, but from assets and equities—principally from the

stock market. While the bottom 90 percent of the population made 61 percent of

the wages in 2017, they owned even less, just 27 percent of the wealth

(according to the World Inequality Report 2018 by Thomas

Piketty, Emmanuel Saez, and Gabriel Zucman).

The massive increase in the value of the stock market,

which only a small segment of the population participates in, means that the

top 10 percent of the population controls 73 percent of all wealth in the

United States. Just three men—Jeff Bezos, Warren Buffet and Bill Gates—had more

wealth than the bottom half of America combined last year.

Wages are so low in the United States that roughly half of

the population falls deeper into debt every year. A Reuters report from July

found that the pretax net income (that is, income minus expense) of the bottom

40 percent of the population was an average of negative $11,660.

Even the middle quintile of the population, the 40th to 60th percentile, breaks

even with an average of only $2,836 a year.

As the Social Security Administration numbers show, 67.4

percent of the population made less than the average wage, $48,250 a year in

2017, a sum that is inadequate to support a family in many cities—especially,

with high housing costs, health care, education, and retirement factored in.

For the ruling class, though, workers’ wages are already

too much. The volatility of the stock market and the deep fear that the current

bull market will collapse has made politicians and businessmen anxious of any

sign of wage increases.

In August, wages in the US rose just 0.2 percent above the

inflation rate, the highest in nine years. Though the increase was tiny, it was

enough to encourage the Federal Reserve to increase the interest rate past two

percent for the first time since 2008. Raising interest rates helps to depress

workers’ wages by lowering borrowing and spending. As the Financial

Times noted, stopping wage growth was “central” to the Federal

Reserve’s move.

Further analysis of the Social Security Administration data

shows that in 2017, 147,754 people reported wages of 1 million dollars or

more—roughly, the top 0.05 percent. Their combined total income of $372 billion

could pay for the US federal education budget five times over.

These wages, however large, still pale in comparison to the

money the ultra-rich acquire from the stock market. For example, share buybacks

and dividend payments, a way of funneling money to shareholders, will eclipse

$1 trillion this year.

Whatever the immediate source, the wealth of the rich

derives from the great mass of people who do the actual work. Across the United

States and around the world, workers, young people, and students have entered

into struggle this year over pay, education, health care, immigration, war and

democratic rights. This growing movement of the working class must set as its

aim confiscating the wealth and power of this tiny parasitic oligarchy.

Society’s wealth must be democratically controlled by those who produce it.

THE STAGGERING ECONOMIC INEQUALITY UNDER OBAMA'S ADMINISTRATION SERVING THE BILLIONAIRE CLASS.

THE ENTIRE REASON BEHIND AMNESTY IS TO KEEP WAGES

DEPRESSED AND PASS ALONG THE REAL COST OF "CHEAP" MEXICAN LABOR TO

THE AMERICAN MIDDLE CLASS.

AND IT'S WORKING!

SEN.

BERNIE SANDERS

“Calling

income and wealth inequality the "great moral issue of our time,"

Sanders laid out a sweeping, almost unimaginably expensive program to transfer

wealth from the richest Americans to the poor and middle class. A $1 trillion

public works program to create "13 million good-paying jobs." A $15-an-hour

federal minimum wage. "Pay equity" for women. Paid sick leave and

vacation for everyone. Higher taxes on the wealthy. Free tuition at all public

colleges and universities. A Medicare-for-all single-payer health care system.

Expanded Social Security benefits. Universal pre-K.” WASHINGTON

EXAMINER

YOU

THOUGHT OBAMA INVITED OBAMANOMICS and started the assault on the American

middle-class?

NOPE!

“By the time of Bill

Clinton’s election in 1992, the Democratic Party had completely repudiated its

association with the reforms of the New Deal and Great Society periods. Clinton

gutted welfare programs to provide an ample supply of cheap labor for the rich

(WHICH NOW MEANS OPEN BORDERS AND NO E-VERIFY!), including a growing layer of

black capitalists, and passed the 1994 Federal Crime Bill, with its notorious

“three strikes” provision that has helped create the largest prison population

in the world.”

Clinton Foundation Put On Watch List Of Suspicious

‘Charities’

OBAMA: SERVANT OF THE 1%

Richest one percent controls nearly half of global wealth

The

richest one percent of the world’s population now controls 48.2 percent of

global wealth, up from 46 percent last year.

The report found that the

growth of global inequality has accelerated sharply since the 2008 financial

crisis, as the values of financial assets have soared while wages have

stagnated and declined.

Millionaires projected to own 46

percent of global private wealth by 2019

Households with more than a million (US) dollars in private wealth are

projected to own 46 percent of global private wealth in 2019 according to a new

report by the Boston Consulting Group (BCG).

This large percentage, however, only includes cash, savings, money market

funds and listed securities held through managed investments—collectively known

as “private wealth.” It leaves out businesses, residences and luxury goods,

which comprise a substantial portion of the rich’s net worth.

At the end of 2014, millionaire households owned about 41

percent of global private wealth, according to BCG. This means that

collectively these 17 million households owned roughly $67.24 trillion in

liquid assets, or about $4 million per household.

In total, the world added $17.5 trillion of new private wealth between

2013 and 2014. The report notes that nearly three quarters of all these gains

came from previously existing wealth. In other words, the vast majority of

money gained has been due to pre-existing assets increasing in value—not the

creation of new material things.

This trend is the result of the massive infusions of cheap credit into

the financial markets by central banks. The policy of “quantitative easing” has

led to a dramatic expansion of the stock market even while global economic

growth has slumped.

While the wealth of the rich is growing at a breakneck

pace, there is a stratification of growth within the super wealthy, skewed

towards the very top.

In 2014, those with over $100 million in private wealth saw their wealth

increase 11 percent in one year alone. Collectively, these households owned $10

trillion in 2014, 6 percent of the world’s private wealth. According to the

report, “This top segment is expected to be the fastest growing, in both the

number of households and total wealth.” They are expected to see 12 percent

compound growth on their wealth in the next five years.

Those families with wealth between $20 and $100 million also rose

substantially in 2014—seeing a 34 percent increase in their wealth in twelve

short months. They now own $9 trillion. In five years they will surpass $14

trillion according to the report.

Coming in last in the “high net worth” population are those with between

$1 million and $20 million in private wealth. These households are expected to

see their wealth grow by 7.2 percent each year, going from $49 trillion to

$70.1 trillion dollars, several percentage points below the highest bracket’s

12 percent growth rate.

The gains in private wealth of the ultra-rich stand in sharp contrast to

the experience of billions of people around the globe. While wealth

accumulation has sharply sped up for the ultra-wealthy, the vast majority of

people have not even begun to recover from the past recession.

An Oxfam report from January, for example,

shows that the bottom 99 percent of the world’s population went from having

about 56 percent of the world’s wealth in 2010 to having 52 percent of it in

2014. Meanwhile the top 1 percent saw its wealth rise from 44 to 48 percent of

the world’s wealth.

In 2014 the Russell Sage Foundation found that between 2003 and 2013, the

median household net worth of those in the United States fell from $87,992 to

$56,335—a drop of 36 percent. While the rich also saw their wealth drop during

the recession, they are more than making that money back. Between 2009 and

2012, 95 percent of all the income gains in the US went to the top 1 percent.

This is the most distorted post-recession income gain on record.

As the Organization for Economic Co-operation and Development (OECD) has

noted, in the United States “between 2007 and 2013, net wealth fell on average

2.3 percent, but it fell ten-times more (26 percent) for those at the bottom 20

percent of the distribution.” The 2015 report concludes that “low-income

households have not benefited at all from income growth.”

Another report by Knight Frank, looks at those with wealth

exceeding $30 million. The report notes that in 2014 these 172,850

ultra-high-net-worth individuals increased their collective wealth by $700

billion. Their total wealth now rests at $20.8 trillion.

The report also draws attention to the disconnection between the rich and

the actual economy. It states that the growth of this ultra-wealthy population

“came despite weaker-than-anticipated global economic growth. During 2014 the

IMF was forced to downgrade its forecast increase for world output from 3.7

percent to 3.3 percent.”

DICK

MORRIS:

On America’s First

Family of Crime….. NO! Not the Bushes again!

Clinton global

hucksterism – Selling out America like they sold out the Lincoln Bedroom.

HILLARY CLINTON: CRONY

CLASS’ “Hope and Change” huckster’s successor!

“I serve Obama’s cronies

first, illegals second and together we will loot the American middle-class to

double our figures. It’s called BAILOUTS! Evita Peron Clinton

At this point, Clinton is the choice of most multimillionaires

to be the next occupant of the White House. A recent CNBC poll of 750

millionaires found 53 percent support for Clinton in a contest with Republican

Jeb Bush, 14 points better than Obama’s showing in the 2012 election with the

same group.

Sen. Bernie Sanders –

America’s answer to Wall Street’s looting, the war on the American middle-class

and jobs for legals!

“At

this point, Clinton is the choice of most multimillionaires to be the next

occupant of the White House. A recent CNBC poll of 750 millionaires found 53

percent support for Clinton in a contest with Republican Jeb Bush, 14 points

better than Obama’s showing in the 2012 election with the same group.”

THE CRONY CLASS:

OBAMACLINTONOMICS was created by BILLARY

CLINTON!

Income inequality grows FOUR TIMES FASTER under Obama than

Bush.

“By the time of Bill

Clinton’s election in 1992, the Democratic Party had completely repudiated its

association with the reforms of the New Deal and Great Society periods. Clinton

gutted welfare programs to provide an ample supply of cheap labor for the rich

(WHICH NOW MEANS OPEN BORDERS AND NO E-VERIFY!), including a growing layer of

black capitalists, and passed the 1994 Federal Crime Bill, with its notorious

“three strikes” provision that has helped create the largest prison population

in the world.”

“Calling

income and wealth inequality the "great moral issue of our time,"

Sanders laid out a sweeping, almost unimaginably expensive program to transfer

wealth from the richest Americans to the poor and middle class. A $1 trillion

public works program to create "13 million good-paying jobs." A

$15-an-hour federal minimum wage. "Pay equity" for women. Paid sick

leave and vacation for everyone. Higher taxes on the wealthy. Free tuition at

all public colleges and universities. A Medicare-for-all single-payer health

care system. Expanded Social Security benefits. Universal pre-K.” WASHINGTON

EXAMINER

OBAMA’S

WALL STREET and the LOOTING of AMERICA – SECOND TERM

The corporate cash hoard has likewise reached

a new record, hitting an estimated $1.79 trillion in the fourth quarter of last

year, up from $1.77 trillion in the previous quarter. Instead of investing the

money, however, companies are using it to buy back their own stock and pay out

record dividends.

Megan

McArdle Discusses How America's Elites Are Rigging the Rules - Newsweek/The

Daily Beast special correspondent Megan McArdle joins Scott Rasmussen for a

discussion on America's new Mandarin class.

PATRICK BUCHANAN: OBAMA’S ASSAULT ON

AMERICA BEGINS AT OUR BORDERS

WHO REALLY PAYS FOR THE CRIMES OF OBAMA’S

CRONY DONORS???

LAST WEEK BARACK OBAMA CELEBRATED FIVE YEARS OF THE LOOTING BY

HIS WALL STREET BANKSTERS… now it’s back to cutting social programs to pay for

all that rape by the 1% he represents. The following week it will be back to

the AMNESTY HOAX to legalize Mexico’s looting of America and make it legal that

Mexicans get our jobs first… they already do!

As in previous budget crises under the Obama administration, the

events are being stage-managed by the two corporate-controlled parties to give

the illusion of partisan gridlock and confrontation over principles—in this

case, whether to go forward with the implementation of the Obama health care

program—while behind the scenes all factions within the ruling elite agree that

massive cuts must be carried through in basic federal social programs.

OBAMA’S CRONY CAPITALISM – A NATION RULED BY

CRIMINAL WALL STREET BANKSTERS AND OBAMA DONORS

GET

THIS BOOK

Culture of Corruption: Obama and His Team of

Tax Cheats, Crooks, and Cronies

by Michelle Malkin

In her shocking new book, Malkin digs deep into the records

of President Obama's staff, revealing corrupt dealings, questionable pasts, and

abuses of power throughout his administration.

PATRICK BUCHANAN

After Obama has completely destroyed the

American economy, handed millions of jobs to illegals and billions of dollars

in welfare to illegals…. BUT WHAT COMES NEXT?

OBAMANOMICS:

IS IT WORKING???

Millionaires projected to own 46 percent of global private

wealth by 2019

By Gabriel Black

18 June 2015

Households

with more than a million (US) dollars in private wealth are projected to own 46

percent of global private wealth in 2019 according to a new report by the Boston

Consulting Group (BCG).

This

large percentage, however, only includes cash, savings, money market funds and

listed securities held through managed investments—collectively known as

“private wealth.” It leaves out businesses, residences and luxury goods, which

comprise a substantial portion of the rich’s net worth.

At

the end of 2014, millionaire households owned about 41 percent of global

private wealth, according to BCG. This means that collectively these 17 million

households owned roughly $67.24 trillion in liquid assets, or about $4 million

per household.

In

total, the world added $17.5 trillion of new private wealth between 2013 and

2014. The report notes that nearly three quarters of all these gains came from

previously existing wealth. In other words, the vast majority of money gained

has been due to pre-existing assets increasing in value—not the creation of new

material things.

This

trend is the result of the massive infusions of cheap credit into the financial

markets by central banks. The policy of “quantitative easing” has led to a

dramatic expansion of the stock market even while global economic growth has

slumped.

While

the wealth of the rich is growing at a breakneck pace, there is a

stratification of growth within the super wealthy, skewed towards the very top.

In

2014, those with over $100 million in private wealth saw their wealth increase

11 percent in one year alone. Collectively, these households owned $10 trillion

in 2014, 6 percent of the world’s private wealth. According to the report,

“This top segment is expected to be the fastest growing, in both the number of

households and total wealth.” They are expected to see 12 percent compound

growth on their wealth in the next five years.

Those

families with wealth between $20 and $100 million also rose substantially in

2014—seeing a 34 percent increase in their wealth in twelve short months. They

now own $9 trillion. In five years they will surpass $14 trillion according to

the report.

Coming

in last in the “high net worth” population are those with between $1 million

and $20 million in private wealth. These households are expected to see their

wealth grow by 7.2 percent each year, going from $49 trillion to $70.1 trillion

dollars, several percentage points below the highest bracket’s 12 percent

growth rate.

The

gains in private wealth of the ultra-rich stand in sharp contrast to the

experience of billions of people around the globe. While wealth accumulation

has sharply sped up for the ultra-wealthy, the vast majority of people have not

even begun to recover from the past recession.

An

Oxfam report from

January, for example, shows that the bottom 99 percent of the world’s

population went from having about 56 percent of the world’s wealth in 2010 to

having 52 percent of it in 2014. Meanwhile the top 1 percent saw its wealth

rise from 44 to 48 percent of the world’s wealth.

In

2014 the Russell Sage Foundation found that between 2003 and 2013, the median

household net worth of those in the United States fell from $87,992 to

$56,335—a drop of 36 percent. While the rich also saw their wealth drop during

the recession, they are more than making that money back. Between 2009 and

2012, 95 percent of all the income gains in the US went to the top 1 percent.

This is the most distorted post-recession income gain on record.

As

the Organization for Economic Co-operation and Development (OECD) has noted, in

the United States “between 2007 and 2013, net wealth fell on average 2.3

percent, but it fell ten-times more (26 percent) for those at the bottom 20

percent of the distribution.” The 2015 report concludes that “low-income

households have not benefited at all from income growth.”

Another

report by Knight Frank, looks at those with wealth exceeding $30

million. The report notes that in 2014 these 172,850 ultra-high-net-worth

individuals increased their collective wealth by $700 billion. Their total

wealth now rests at $20.8 trillion.

The

report also draws attention to the disconnection between the rich and the

actual economy. It states that the growth of this ultra-wealthy population

“came despite weaker-than-anticipated global economic growth. During 2014 the

IMF was forced to downgrade its forecast increase for world output from 3.7

percent to 3.3 percent.”

THE CRONY

CLASS:

OBAMACLINTONOMICS was created by BILLARY

CLINTON!

Income inequality grows FOUR TIMES FASTER under Obama than

Bush.

“By the time of Bill Clinton’s election in

1992, the Democratic Party had completely repudiated its association with the

reforms of the New Deal and Great Society periods. Clinton gutted welfare

programs to provide an ample supply of cheap labor for the rich (WHICH NOW

MEANS OPEN BORDERS AND NO E-VERIFY!), including a growing layer of black

capitalists, and passed the 1994 Federal Crime Bill, with its notorious “three

strikes” provision that has helped create the largest prison population in the

world.”

*

“Calling

income and wealth inequality the "great moral issue of our time,"

Sanders laid out a sweeping, almost unimaginably expensive program to transfer

wealth from the richest Americans to the poor and middle class. A $1 trillion

public works program to create "13 million good-paying jobs." A $15-an-hour

federal minimum wage. "Pay equity" for women. Paid sick leave and

vacation for everyone. Higher taxes on the wealthy. Free tuition at all public

colleges and universities. A Medicare-for-all single-payer health care system.

Expanded Social Security benefits. Universal pre-K.” WASHINGTON

EXAMINER

OBAMA’S

WALL STREET and the LOOTING of AMERICA – SECOND TERM

The corporate cash hoard has likewise reached

a new record, hitting an estimated $1.79 trillion in the fourth quarter of last

year, up from $1.77 trillion in the previous quarter. Instead of investing the

money, however, companies are using it to buy back their own stock and pay out

record dividends.

Megan

McArdle Discusses How America's Elites Are Rigging the Rules - Newsweek/The

Daily Beast special correspondent Megan McArdle joins Scott Rasmussen for a

discussion on America's new Mandarin class.

POLL: MOST

INCOMPETENT AND DISHONEST PRESIDENT SINCE…. Well, isn’t Obama merely Bush’s

THIRD and FOURTH TERMS??

OBAMA’S

CRONY CAPITALISM

A NATION

RULED BY CRIMINAL WALL STREET BANKSTERS AND OBAMA DONORS

PATRICK

BUCHANAN

After Obama

has completely destroyed the American economy, handed millions of jobs to

illegals and billions of dollars in welfare to illegals…. BUT WHAT COMES NEXT?

OBAMANOMICS: IS IT WORKING???

Millionaires

projected to own 46 percent of global private wealth by 2019

By

Gabriel Black

18 June 2015

Households with more than a million (US)

dollars in private wealth are projected to own 46 percent of global private

wealth in 2019 according to a new report by the Boston Consulting

Group (BCG).

This large percentage, however, only

includes cash, savings, money market funds and listed securities held through

managed investments—collectively known as “private wealth.” It leaves out

businesses, residences and luxury goods, which comprise a substantial portion

of the rich’s net worth.

At the end of 2014, millionaire households

owned about 41 percent of global private wealth, according to BCG. This means

that collectively these 17 million households owned roughly $67.24 trillion in

liquid assets, or about $4 million per household.

In total, the world added $17.5 trillion

of new private wealth between 2013 and 2014. The report notes that nearly three

quarters of all these gains came from previously existing wealth. In other

words, the vast majority of money gained has been due to pre-existing assets

increasing in value—not the creation of new material things.

This trend is the result of the massive

infusions of cheap credit into the financial markets by central banks. The

policy of “quantitative easing” has led to a dramatic expansion of the stock

market even while global economic growth has slumped.

While the wealth of the rich is growing at

a breakneck pace, there is a stratification of growth within the super wealthy,

skewed towards the very top.

In 2014, those with over $100 million in

private wealth saw their wealth increase 11 percent in one year alone.

Collectively, these households owned $10 trillion in 2014, 6 percent of the

world’s private wealth. According to the report, “This top segment is expected

to be the fastest growing, in both the number of households and total wealth.”

They are expected to see 12 percent compound growth on their wealth in the next

five years.

Those families with wealth between $20 and

$100 million also rose substantially in 2014—seeing a 34 percent increase in

their wealth in twelve short months. They now own $9 trillion. In five years

they will surpass $14 trillion according to the report.

Coming in last in the “high net worth”

population are those with between $1 million and $20 million in private wealth.

These households are expected to see their wealth grow by 7.2 percent each

year, going from $49 trillion to $70.1 trillion dollars, several percentage

points below the highest bracket’s 12 percent growth rate.

The gains in private wealth of the

ultra-rich stand in sharp contrast to the experience of billions of people

around the globe. While wealth accumulation has sharply sped up for the ultra-wealthy,

the vast majority of people have not even begun to recover from the past

recession.

An Oxfam report from January,

for example, shows that the bottom 99 percent of the world’s population went

from having about 56 percent of the world’s wealth in 2010 to having 52 percent

of it in 2014. Meanwhile the top 1 percent saw its wealth rise from 44 to 48

percent of the world’s wealth.

In 2014 the Russell Sage Foundation found

that between 2003 and 2013, the median household net worth of those in the

United States fell from $87,992 to $56,335—a drop of 36 percent. While the rich

also saw their wealth drop during the recession, they are more than making that

money back. Between 2009 and 2012, 95 percent of all the income gains in the US

went to the top 1 percent. This is the most distorted post-recession income

gain on record.

As the Organization for Economic

Co-operation and Development (OECD) has noted, in the United States “between

2007 and 2013, net wealth fell on average 2.3 percent, but it fell ten-times

more (26 percent) for those at the bottom 20 percent of the distribution.” The

2015 report concludes that “low-income households have not benefited at all

from income growth.”

Another report by Knight Frank,

looks at those with wealth exceeding $30 million. The report notes that in 2014

these 172,850 ultra-high-net-worth individuals increased their collective

wealth by $700 billion. Their total wealth now rests at $20.8 trillion.

The report also draws attention to the

disconnection between the rich and the actual economy. It states that the

growth of this ultra-wealthy population “came despite weaker-than-anticipated

global economic growth. During 2014 the IMF was forced to downgrade its

forecast increase for world output from 3.7 percent to 3.3 percent.”

OBAMA-CLINTONomics:

the never end war on the American middle-class. But we still get the tax bills

for the looting of their Wall Street cronies and their bailouts and billions

for Mexico’s welfare state in our borders.

While

the wealth of the rich is growing at a breakneck pace, there is a

stratification of growth within the super wealthy, skewed towards the very top.

In 2014, those with over $100 million in

private wealth saw their wealth increase 11 percent in one year alone.

Collectively, these households owned $10 trillion in 2014, 6 percent of the

world’s private wealth. According to the report, “This top segment is expected

to be the fastest growing, in both the number of households and total wealth.”

They are expected to see 12 percent compound growth on their wealth in the next

five years.

In 2014

the Russell Sage Foundation found that between

2003 and

2013, the median household net worth of those in

the United

States fell from $87,992 to $56,335—a drop of 36

percent.

While the rich also saw their wealth drop during the

recession,

they are more than making that money back.

Between

2009 and 2012, 95 percent of all the income gains in

the US

went to the top 1 percent. This is the most distorted

post-recession

income gain on record.

INCOME

PLUMMETS UNDER OBAMA AND HIS WALL STREET CRONIES

collapse of household income in the US… STILL

BILLIONS IN WELFARE HANDED TO ILLEGALS… they already get our jobs and are

voting for more!

INCOME PLUMMETS UNDER OBAMA… most jobs go to

illegals.

AS HIS CRONY BANKSTERS CONTINUE TO LOOT, INCOMES PLUMMET FOR

AMERICANS (LEGALS).

GOOD TIME FOR AMNESTY FOR MILLIONS OF LOOTING MEXICANS?

MORE HERE:

http://mexicanoccupation.blogspot.com/2014/09/and-still-democrat-party-wants-millions.html

“The yearly income of a typical US household dropped by a

massive 12 percent, or $6,400, in the six years between 2007 and 2013. This is

just one of the findings of the 2013 Federal Reserve Survey of Consumer

Finances released Thursday, which documents a sharp decline in working class

living standards and a further concentration of wealth in the hands of the rich

and the super-rich.”

"During the month, some 432,000 people in the US gave up looking for a job." EVEN AS JEB BUSH, HILLARY CLINTON and BERNIE SANDERS PREACH AMNESTY! AMNESTY! AMNESTY!

"The American phenomenon of record stock values fueling an ever greater concentration of wealth at the very top of society, while the economy is starved of productive investment, the social infrastructure crumbles, and working class living standards are driven down by entrenched unemployment, wage-cutting and government austerity policies, is part of a broader global process."

HILLARY CLINTON'S BIGGEST DONORS ARE OBAMA'S CRIMINAL CRONY

BANKSTERS!

"A defining expression of this crisis is the dominance of financial speculation and parasitism, to the point where a narrow international financial aristocracy plunders society’s resources in order to further enrich itself."

Federal Reserve documents stagnant state of US economy

Federal Reserve documents stagnant state of US economy

By Barry Grey

21 July 2015

The US Federal Reserve

Board last week released its semiannual Monetary Policy Report to Congress,

providing an assessment of the state of the American economy and outlining the

central bank’s monetary policy going forward. The report, along with Fed Chair

Janet Yellen’s testimony before both the House of Representatives and the

Senate, as well as a speech by Yellen the previous week in Cleveland, present a

grim picture of the reality behind the official talk of economic “recovery.”

In her prepared remarks to Congress last Wednesday and Thursday, Yellen said, “Looking forward, prospects are favorable for further improvement in the US labor market and the economy more broadly.”

She reiterated her assurances that while the Fed would likely begin to raise its benchmark federal funds interest rate later this year from the 0.0 to 0.25 percent level it has maintained since shortly after the 2008 financial crash, it would do so only slowly and gradually, keeping short-term rates well below historically normal levels for an indefinite period.

This was an expected, but nevertheless welcome, signal to the American financial elite, which has enjoyed a spectacular rise in corporate profits, stock values and personal wealth since 2009 thanks to the flood of virtually free money provided by the Fed.

"But as Yellen’s remarks and the Fed report indicate, the explosion of asset values and wealth accumulation at the very top of the economic ladder has occurred alongside an intractable and continuing slump in the real economy."

In her prepared testimony to the House Financial Services Committee and the Senate Banking Committee, Yellen noted the following features of the performance of the US economy over the first six months of 2015:

* A sharp decline in the rate of economic growth as compared to 2014, including an actual contraction in the first quarter of the year.

* A substantial slackening (19 percent) in average monthly job-creation, from 260,000 last year to 210,000 thus far in 2015.

* Declines in domestic spending and industrial production.

In her July 10 speech to the City Club of Cleveland, Yellen cited an even longer list of negative indices, including:

* Growth in real gross domestic product (GDP) since the official beginning of the recovery in June, 2009 has averaged a mere 2.25 percent per year, a full one percentage point less than the average rate over the 25 years preceding what Yellen called the “Great Recession.”

* While manufacturing employment nationwide has increased by about 850,000 since the end of 2009, there are still almost 1.5 million fewer manufacturing jobs than just before the recession.

* Real GDP and industrial production both declined in the first quarter of this year. Industrial production continued to fall in April and May.

* Residential construction (despite extremely low mortgage rates by historical standards) has remained “quote soft.”

* Productivity growth has been “weak,” largely because “Business owners and managers… have not substantially increased their capital expenditures,” and “Businesses are holding large amounts of cash on their balance sheets.”

* Reflecting the general stagnation and even slump in the real economy, core inflation rose by only 1.2 percent over the past 12 months.

The Monetary Policy Report issued by the Fed includes facts that are, if anything, even more alarming, including:

* “Labor productivity in the business sector is reported to have declined in both the fourth quarter of 2014 and the first quarter of 2015.”

* “Exports fell markedly in the first quarter, held back by lackluster growth abroad.”

* “Overall construction activity remains well below its pre-recession levels.”

* “Since the recession began, the gains in… nominal compensation [workers’ wages and benefits] have fallen well short of their pre-recession averages, and growth of real compensation has fallen short of productivity growth over much of this period.”

* “Overall business investment has turned down as investment in the energy sector has plunged. Business investment fell at an annual rate of 2 percent in first quarter… Business outlays for structures outside of the energy sector also declined in the first quarter…”

The report incorporates the Fed’s projections for US economic growth, published following the June meeting of the central bank’s policy-setting Federal Open Market Committee. They include a downward revision of the projection for 2015 to 1.8 percent-2.0 percent from the March projection of 2.3 percent to 2.7 percent.

That the US economy continues to stagnate and even contract is indicated by two surveys released last week while Yellen was testifying before Congress. The Fed reported that factory production failed to increase in June for the second straight month and output in the auto sector fell 3.7 percent. The Commerce Department reported that retail sales unexpectedly fell in June, declining by 0.3 percent.

These statistics follow the employment report for June, which showed that the share of the US working-age population either employed or actively looking for work, known as the labor force participation rate, fell to 62.6 percent, its lowest level in 38 years. During the month, some 432,000 people in the US gave up looking for a job.

The disastrous figures on business investment are perhaps the most telling indicators of the underlying crisis of the capitalist system. The Fed report attributes the sharp decline so far this year primarily to the dramatic fall in oil prices and resulting contraction in investment and construction in the energy sector. But the plunge in oil prices is itself a symptom of a general slowdown in the world economy.

Moreover, a dramatic decline in productive investment is common to all of the major industrialized economies of Europe and North America. In its World Economic Outlook of last April, the International Monetary Fund for the first time since the 2008 financial crisis acknowledged that there was no prospect for an early return to pre-recession levels of economic growth, linking this bleak prognosis to a general and pronounced decline in productive investment.

The American phenomenon of record stock values fueling an ever greater concentration of wealth at the very top of society, while the economy is starved of productive investment, the social infrastructure crumbles, and working class living standards are driven down by entrenched unemployment, wage-cutting and government austerity policies, is part of a broader global process.

The economic crisis in the US and internationally is not simply a conjunctural downturn. It is a systemic crisis of global capitalism, centered in the US. A defining expression of this crisis is the dominance of financial speculation and parasitism, to the point where a narrow international financial aristocracy plunders society’s resources in order to further enrich itself.

While the economy is starved of productive investment, entirely parasitic and socially destructive activities such as stock buybacks, dividend hikes and mergers and acquisitions return to pre-crash levels and head for new heights. US corporations have spent more on stock buybacks so far this year than on factories and equipment.

In her prepared remarks to Congress last Wednesday and Thursday, Yellen said, “Looking forward, prospects are favorable for further improvement in the US labor market and the economy more broadly.”

She reiterated her assurances that while the Fed would likely begin to raise its benchmark federal funds interest rate later this year from the 0.0 to 0.25 percent level it has maintained since shortly after the 2008 financial crash, it would do so only slowly and gradually, keeping short-term rates well below historically normal levels for an indefinite period.

This was an expected, but nevertheless welcome, signal to the American financial elite, which has enjoyed a spectacular rise in corporate profits, stock values and personal wealth since 2009 thanks to the flood of virtually free money provided by the Fed.

"But as Yellen’s remarks and the Fed report indicate, the explosion of asset values and wealth accumulation at the very top of the economic ladder has occurred alongside an intractable and continuing slump in the real economy."

In her prepared testimony to the House Financial Services Committee and the Senate Banking Committee, Yellen noted the following features of the performance of the US economy over the first six months of 2015:

* A sharp decline in the rate of economic growth as compared to 2014, including an actual contraction in the first quarter of the year.

* A substantial slackening (19 percent) in average monthly job-creation, from 260,000 last year to 210,000 thus far in 2015.

* Declines in domestic spending and industrial production.

In her July 10 speech to the City Club of Cleveland, Yellen cited an even longer list of negative indices, including:

* Growth in real gross domestic product (GDP) since the official beginning of the recovery in June, 2009 has averaged a mere 2.25 percent per year, a full one percentage point less than the average rate over the 25 years preceding what Yellen called the “Great Recession.”

* While manufacturing employment nationwide has increased by about 850,000 since the end of 2009, there are still almost 1.5 million fewer manufacturing jobs than just before the recession.

* Real GDP and industrial production both declined in the first quarter of this year. Industrial production continued to fall in April and May.

* Residential construction (despite extremely low mortgage rates by historical standards) has remained “quote soft.”

* Productivity growth has been “weak,” largely because “Business owners and managers… have not substantially increased their capital expenditures,” and “Businesses are holding large amounts of cash on their balance sheets.”

* Reflecting the general stagnation and even slump in the real economy, core inflation rose by only 1.2 percent over the past 12 months.

The Monetary Policy Report issued by the Fed includes facts that are, if anything, even more alarming, including:

* “Labor productivity in the business sector is reported to have declined in both the fourth quarter of 2014 and the first quarter of 2015.”

* “Exports fell markedly in the first quarter, held back by lackluster growth abroad.”

* “Overall construction activity remains well below its pre-recession levels.”

* “Since the recession began, the gains in… nominal compensation [workers’ wages and benefits] have fallen well short of their pre-recession averages, and growth of real compensation has fallen short of productivity growth over much of this period.”

* “Overall business investment has turned down as investment in the energy sector has plunged. Business investment fell at an annual rate of 2 percent in first quarter… Business outlays for structures outside of the energy sector also declined in the first quarter…”

The report incorporates the Fed’s projections for US economic growth, published following the June meeting of the central bank’s policy-setting Federal Open Market Committee. They include a downward revision of the projection for 2015 to 1.8 percent-2.0 percent from the March projection of 2.3 percent to 2.7 percent.

That the US economy continues to stagnate and even contract is indicated by two surveys released last week while Yellen was testifying before Congress. The Fed reported that factory production failed to increase in June for the second straight month and output in the auto sector fell 3.7 percent. The Commerce Department reported that retail sales unexpectedly fell in June, declining by 0.3 percent.

These statistics follow the employment report for June, which showed that the share of the US working-age population either employed or actively looking for work, known as the labor force participation rate, fell to 62.6 percent, its lowest level in 38 years. During the month, some 432,000 people in the US gave up looking for a job.

The disastrous figures on business investment are perhaps the most telling indicators of the underlying crisis of the capitalist system. The Fed report attributes the sharp decline so far this year primarily to the dramatic fall in oil prices and resulting contraction in investment and construction in the energy sector. But the plunge in oil prices is itself a symptom of a general slowdown in the world economy.

Moreover, a dramatic decline in productive investment is common to all of the major industrialized economies of Europe and North America. In its World Economic Outlook of last April, the International Monetary Fund for the first time since the 2008 financial crisis acknowledged that there was no prospect for an early return to pre-recession levels of economic growth, linking this bleak prognosis to a general and pronounced decline in productive investment.