The former Goldman Sachs executive who helped one of the biggest banks profit off the nation’s housing collapse in 2008 is pouring hundreds of thousands of dollars into Democrat presidential candidate Joe Biden and Sen. Kamala Harris’s (D-CA) campaign.

Report: Apple and Goldman Sachs Are Developing a Fancy Form of Consumer Debt Stephanie Keith/Getty

LUCAS NOLAN

17 Jul 2021 107

2:07

Apple is reportedly working with Goldman Sachs to develop a new consumer debt scheme for customers that is internally being called “Apple Pay Later.’

Apple Insider reports that Apple is rumored to be working with Goldman Sachs to launch “Apple Pay Later,” a “buy now, pay later” payment system for Apple Pay users. Currently, there are only a few companies involved in the buy now, pay later (BNPL) market, but it’s fast becoming a profitable industry as worldwide spending habits change.

The Financial Times states that BNPL is best used for expensive purchases. The FT cites the Affirm BNPL company’s partnership with Peloton to spread the cost of a $1,900 exercise bike over a number of months as an example of how the system is most often used.

The FT also notes that many users are taking advantage of the low initial cost to buy not one expensive item, but many cheap ones. Around one-fifth of the UK population has used BNPL in the last year, with 90 percent of transactions being for fashion and footwear.

BNPL becomes particularly profitable after the initial interest-free period ends. The FT reports that the Klarna BNPL service currently offers credit up to 18.9 percent APR when a user defers payments between 6 and 36 months. Similarly, Affirm can charge between 10 percent and 30 percent APR.

Apple launched its own credit card, the Apple Card, with the promise of making repayments easy and clear. It would appear that “Apple Pay Later” would aim to do the same thing while also putting products in the hands of consumers that they might not be able to afford.

Read more at Apple Insider here.

Lucas Nolan is a reporter for Breitbart News covering issues of free speech and online censorship. Follow him on Twitter @LucasNolan or contact via secure email at the address lucasnolan@protonmail.com

Economy Tech Apple Goldman Sachs Masters of the Universe

A Homeless Village Is Growing on Apple’s Silicon Valley Property 7,849 The Associated Press

LUCAS NOLAN

16 Jul 2021 718

2:18

According to recent reports, a growing homeless encampment has been set up on dozens of acres of undeveloped land in the heart of Silicon Valley owned by tech giant Apple.

VICE News reports that despite Apple committing billions of dollars to fix California’s housing crisis, an encampment of homeless people living in RVs, shacks, and tents has taken over dozens of acres of undeveloped land owned by Apple in the center of Silicon Valley.

Between 30 to 100 homeless people have reportedly set up camp on the property owned by Apple in North San Jose. The area covers about 55 acres according to the local CBS affiliate KPIX . Some current residents of the site say that they feel they can be left alone there, despite the area’s proximity to PayPal’s corporate headquarters and other office buildings.

Before the start of the coronavirus pandemic, around 6,000 homeless people lived in San Jose with fewer than 1,000 beds available to them. It’s common for homeless people living outdoors and in vehicles across the Bay Area to be moved from place to place by security and police, those staying on the Apple property have largely been left alone according to Renee Corona who has lived in an RV on the property for nearly two years.

Corona, who receives disability payments but cannot afford to live in San Francisco where she was raised, stated: “This is an area where you’re secluded from the city. I don’t think a lot of people knew about this.” She added: “I’m grateful that they don’t kick us out. I just want to say thank you. They don’t bother us.”

San Jose City Council member David Cohen, whose district includes the property, told VICE News that his office is trying to schedule a meeting with Apple to discuss the site. “We’re setting up a meeting so that I can begin to talk to them about what we might be able to do to help the people who are living there, and to figure out some plan for offering services,” Cohen said.

Read more at VICE News here.

Lucas Nolan is a reporter for Breitbart News covering issues of free speech and online censorship. Follow him on Twitter @LucasNolan or contact via secure email at the address lucasnolan@protonmail.com

Wall Street, Big Banks Spend $74 Million Trying to Get Joe Biden Elected Drew Angerer/Getty Images

JOHN BINDER

29 Oct 2020 330

3:03

Wall Street donors from the nation’s biggest banks will end up spending about $74 million trying to get Democrat presidential candidate Joe Biden elected.

BLOG EDITOR: THE BANKSTERS KNOW HOW WELL THE

BANKSTER REGIME OF SOCIOPATH LAWYER BARACK

OBAMA, 'CREDIT CARD BIDEN, AND BANKSTERS'

RENT BOY LAWYER ERIC HOLDER DID FOR THEM.

DESPITE ALL BUT BRINGING DOWN THE U.S. ECONOMY

AND DESTROYING THE LIFE SAVINGS AS INFEESTED IN

OUR HOMES, NOT EVEN ONE OF THESE FUCKERS WENT

TO PRISON.

The latest financial report from the Center for Responsive Politics reveals that Biden is set to rake in more than $74 million from Wall Street, which is more than the financial industry gave President Obama in his 2008 and 2012 campaigns combined.

CNBC reports :

The sum includes contributions that began in 2019 and continued through the first two weeks of October to Biden’s joint fundraising committees and outside super PACs backing his run. Former Goldman Sachs President Harvey Schwartz gave $100,000 this month to the Biden Action Fund , a joint fundraising committee for the campaign, the Democratic National Committee and state parties. [Emphasis added]

Biden also received a ton of financial support from leaders on Wall Street in the third quarter . Going into the final two weeks of the election, Biden, the DNC and their joint fundraising committees had over $330 million on hand. That’s $110 million more than for Trump, the Republican National Committee and their joint committees. Biden’s campaign is on track to raise $1 billion in the six days until Election Day. [Emphasis added]

…

Biden’s campaign chairman, Steve Ricchetti, met with finance executives in January to encourage them to back his candidate , CNBC reported at the time. Attendees included Evercore founder Roger Altman, longtime investor Blair Effron, Blackstone Chief Operating Officer Jonathan Gray, former Citigroup executive Ray McGuire, Centerbridge Partners co-founder Mark Gallogly, and former U.S. Ambassador to France Jane Hartley. [Emphasis added]

Biden, by November 3, will have raised just about $13 million less from Wall Street than Hillary Clinton in her failed 2016 presidential run.

President Trump has received just a fraction of what Biden has taken from Wall Street. By November 3, Trump will finish the race with more than $18 million from Wall Street executives and employees — a whopping $56 million less than Biden’s total.

CNN analysis from September noted that “all the big banks” are backing Biden against Trump this election, as they backed Clinton against Trump in 2016.

Moody’s Analytics and Goldman Sachs reports to investors have sought to boost Biden’s chances against Trump by cheering a potential “blue wave” on election day. Biden has reportedly promised Wall Street donors, behind closed doors, a return to a globalized, economic status quo that has forced working and middle-class American communities into a managed decline for decades.

John Binder is a reporter for Breitbart News. Follow him on Twitter at @JxhnBinder .

THE LOOTING OF AMERICA:

BARACK OBAMA AND HIS CRONY BANKSTERS set themselves on America’s pensions next! The new aristocrats, like the lords of old, are not bound by the laws that apply to the lower orders. Voluminous reports have been issued by Congress and government panels documenting systematic fraud and law breaking carried out by the biggest banks both before and after the Wall Street crash of 2008. Goldman Sachs , JPMorgan Chase, Bank of America and every other major US bank have been implicated in a web of scandals, including the sale of toxic mortgage securities on false pretenses, the rigging of international interest rates and global foreign exchange markets, the laundering of Mexican drug money, accounting fraud and lying to bank regulators, illegally foreclosing on the homes of delinquent borrowers, credit card fraud, illegal debt-collection practices, rigging of energy markets, and complicity in the Bernie Madoff Ponzi scheme. Goldman Sachs Executive Who Profited Off Housing Collapse Pours $200K into Joe Biden Campaign JOHN BINDER

The former Goldman Sachs executive who helped one of the biggest banks profit off the nation’s housing collapse in 2008 is pouring hundreds of thousands of dollars into Democrat presidential candidate Joe Biden and Sen. Kamala Harris’s (D-CA) campaign.

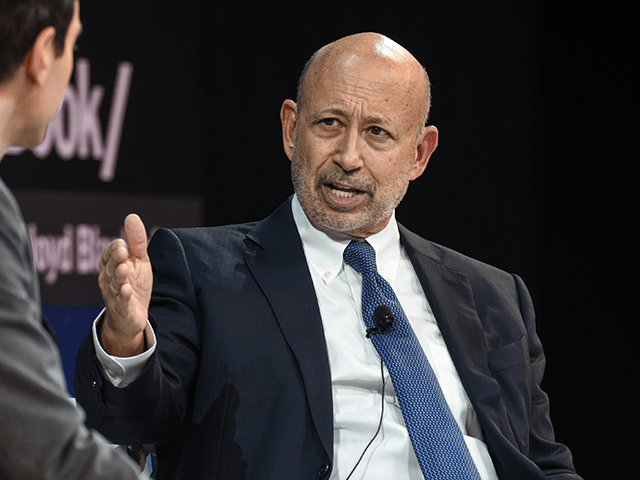

Former Goldman Sachs Chief Pours $100K into Joe Biden’s Campaign JOHN BINDER

26 Oct 2020 374

1:41

A former Goldman Sachs president made a huge, last-minute donation to Democrat presidential candidate Joe Biden’s campaign against President Trump.

Harvey Schwartz, former president of Goldman Sachs, donated about $100,000 to the Biden Action Fund in October, according to Federal Election Commission data.

CNBC reports :

The filing lists Schwartz and a New York address and describes his work profession as “self employed.” The contribution was processed on Oct. 5, records show.

Schwartz retired from the bank in 2018 after being its president for just over a year. Prior to that role he was Goldman’s chief financial officer.

Wall Street executives and employees has been a major donor to the Biden campaign. One of the donors is a former Goldman Sachs executive who profited from the housing crisis.

While Biden has taken about 184 separate contributions from Goldman Sachs executives and employees, President Donald Trump has taken just 41 contributions from the big bank. Trump’s contributions from Goldman Sachs total less than $7,500.

As Breitbart News has noted , recent CNBC analysis revealed that Wall Street has donated more than $50 million to Biden’s campaign this election cycle. CNN analysis found that “all the big banks” are backing Biden against Trump.

John Binder is a reporter for Breitbart News. Follow him on Twitter at @JxhnBinder .

Joe Biden-Donor-Rich Goldman Sachs Admits to Record $1.6B Bribery Scheme JOHANNES EISELE/AFP via Getty Images

JOHN BINDER

25 Oct 2020 711

2:30

Goldman Sachs, home to many big donors to Democrat presidential candidate Joe Biden’s campaign, has admitted to a record-setting $1.6 billion foreign bribery scheme this week.

The Justice Department announced charges against Goldman Sachs for their executives’ involvement in a foreign bribery scheme, the largest in United States history. As a result, Goldman Sachs will pay more than $2.9 billion as part of a settlement.

“Goldman Sachs today accepted responsibility for its role in a conspiracy to bribe high-ranking foreign officials to obtain lucrative underwriting and other business relating to [1Malaysia Development Bhd.],” said acting Assistant Attorney General Brian Rabbitt of the Justice Department’s Criminal Division said in a statement.

“Today’s resolution, which requires Goldman Sachs to admit wrongdoing and pay nearly three billion dollars in penalties, fines, and disgorgement, holds the bank accountable for this criminal scheme and demonstrates the department’s continuing commitment to combatting corruption and protecting the U.S. financial system,” Rabbitt said.

The revelations of Goldman Sachs’ involvement in the foreign bribery scheme comes as Biden has accepted hundreds of thousands of dollars in campaign contributions from executives and employees at the big bank.

Kathy Matsui and Richard Friedman, in executive and banker roles at Goldman Sachs, have donated nearly $105,000 to the Biden Victory Fund and the Biden Action Fund in June. Just this week, news broke that the former Goldman Sachs executive who profited off the U.S. housing crash has donated $200,000 to the Biden Victory Fund.

While Biden has taken about 184 separate contributions from Goldman Sachs executives and employees, President Donald Trump has taken just 41 contributions from the big bank. Trump’s contributions from Goldman Sachs total less than $7,500.

As Breitbart News has noted , recent CNBC analysis revealed that Wall Street has donated more than $50 million to Biden’s campaign this election cycle. CNN analysis found that “all the big banks” are backing Biden against Trump.

John Binder is a reporter for Breitbart News. Follow him on Twitter at @JxhnBinder .

Wall Street Praises Kamala Harris as Joe Biden’s VP: ‘What’s Not to Like?’ AP Photo/Richard Drew

JOHN BINDER

13 Aug 2020 996

4:20

Wall Street executives are praising Democrat presidential nominee Joe Biden’s choosing Sen. Kamala Harris (D-CA) as his running mate against President Trump, feeling they dodged a bullet from a progressive insurgency.

In interviews with the Wall Street Journal , CNBC , and Bloomberg , executives on Wall Street expressed relief that Biden picked Harris for vice president on the Democrat ticket, calling her a “normal Democrat” who is a “safe” choice for the financial industry.

Morgan Stanley Vice Chairman Tom Nides told Bloomberg that across Wall Street, Harris joining Biden “was exceptionally well-received.”

“How damn cool is it that a Black woman is considered the safe and conventional candidate,” Nides said.

Peter Soloman, the founder of a multinational investment banking firm, told Bloomberg he believes Harris is “a great pick” because she is “safe, balanced, a woman, diverse, what’s not to like?”

As the Journal notes, many on Wall Street see Harris is another conscious decision by the Democrat establishment to stave off populist priorities to reform Wall Street:

To some Wall Street executives, Ms. Harris’s selection signals a more moderate shift for the Democratic Party, which its progressive flank has pushed to the left in recent years. [Emphasis added]

“While Kamala is a forceful, passionate and eloquent standard-bearer for the aspirations of all Americans, regardless of their race, gender or age, she is not doctrinaire or rigid,” said Brad Karp, chairman of law firm Paul Weiss, who co-led a committee of lawyers across the country who supported Ms. Harris during the primary. [Emphasis added]

Marc Lasry, CEO of Avenue Capital Group, called Harris a “great” pick for Biden. “She’s going to help Joe immensely. He picked the perfect partner,” Lasry told CNBC.

Executives at Citigroup and Centerview Partners made similar comments about Harris to CNBC and the Journal , calling her a “great choice” and “direct but constructive.”

Founder of financial consulting firm Kynikos Associates Jim Chanos was elated in an interview with Bloomberg over Harris joining Biden on the Democrat ticket:

“She’s terrific,” said Chanos, founder of Kynikos Associates. “She’s got force of personality in a good way. She takes over a room. She certainly has a charisma and a presence which will be an asset on the campaign.” [Emphasis added]

Harris is no stranger to praise from Wall Street executives. In the 2019 Democrat presidential primary, Harris won over a number of financial industry donors, even holding a fundraiser in Iowa that was backed by Goldman Sachs Group, Inc.

While criticizing “the people who have the most” in Democrat primary debates, Harris raked in thousands in campaign cash from financial executives from firms such as the Blackstone Group, Morgan Stanley, Bank of America, Goldman Sachs, and Wells Fargo.

This month, the New York Times admitted the “wallets of Wall Street are with Joe Biden” in a gushing headline about the financial industry’s opposition to Trump:

Financial industry cash flowing to Mr. Biden and outside groups supporting him shows him dramatically out-raising the president, with $44 million compared with Mr. Trump’s $9 million.

Harris’s views on trade and immigration, two of the most consequential issues to Wall Street, are in lockstep with financial executives’ objective to grow profit margins and add consumers to the market.

On trade, Harris has balked at Trump’s imposition of tariffs on foreign imports from China, Mexico, Canada, and Europe — using the neoliberal argument that tariffs should not be used to pressure foreign countries to buy more American-made goods and serve as only a tax on taxpayers.

Likewise, the Biden-Harris plan for national immigration policy — which seeks to drive up legal and illegal immigration levels to their highest levels in decades — offers a flooded labor market with low wages for U.S. workers and increased bargaining power for big business that has long been supported by Wall Street.

John Binder is a reporter for Breitbart News. Follow him on Twitter at @JxhnBinder.

Goldman Sachs fined $2.9 billion over role in 1MDB corruption case Goldman Sachs has been fined $2.9 billion by the US Department of Justice (DoJ) in a deal announced yesterday that closes one of the biggest corruption cases in the history of Wall Street.

Together with a settlement reached with Malaysian authorities in July, Goldman Sachs will pay more than $5 billion for its involvement in the 1MDB scandal.

While the amounts are large, the settlement follows the pattern of earlier deals on corruption. In return for an agreement to pay fines out of corporate revenue, the company and its executives escape prosecution for criminal activity. The financial penalties are simply written off as a cost of making profit.

Besides avoiding prosecution, Goldman will also escape the appointment of a government monitor to oversee its compliance department which had earlier been put forward by officials involved in pursuing the case.

While the financial penalties amount to around two-thirds of its annual profits, Goldman had already taken them into account, as they had been mooted for some time. Company shares actually rose by more than 1 percent after a report earlier this week by Wall Street Journal about the expected action by the DoJ.

Following the DoJ announcement, the bank’s share price barely moved. “This is already priced in. The stock price is already reflecting this kind of action,” Sumit Agarwal, finance professor at Singapore’s National University told the Financial Times .

Goldman’s involvement with 1MDB was in response to the situation it confronted in the wake of the financial crisis in 2008, as its earnings prospects in the US declined and it went in search of profitable opportunities. The Malaysian government had launched the 1MDB fund, supposedly to finance infrastructure development. Goldman stepped forward to organise the sale of $6.5 billion in bonds, with the aim of collecting large fees, in 2012 and 2013.

The whole operation saw the development of a vast corruption ring. According to the prosecution, around $2.7 billion was stolen from 1MDB and more than $1.6 billion was paid out in bribes.

Much of the money was stolen by an adviser to the fund, businessman Jho Low, who was aided by two Goldman bankers working for its Malaysian subsidiary as well as associates in the Malaysian government. It is claimed that the former Malaysian Prime Minister Najib Razak, now serving a 12-year jail term, received $700 million.

The DoJ said Goldman had played a “central role” in the looting of 1MDB and should have detected warning signs. The acting head of the DoJ’s criminal division, Brian Rabbitt, said: “Personnel at the bank allowed this scheme to proceed by overlooking or ignoring a number of clear red flags.”

The attempts to claim that one of the largest corruption operations in history was a matter of oversight simply does not pass muster. In court yesterday, Karen Seymour, Goldman’s senior counsel, admitted its Malaysian subsidiary had paid bribes “in order to obtain and retain business for Goldman Sachs.”

According to court papers, when an employee told an unnamed senior executive he was concerned that a 1MDB deal was being delayed because one of the participants was seeking a bribe, he was told: “What’s disturbing about that? It’s nothing new, is it?”

The deals were organised by two Goldman bankers, Timothy Leissner and Roger Ng. Leissner, the former head of Goldman’s Southeast Asian business, pleaded guilty to his role in the 1MDB case in 2018. He received more than $200 million from 1MDB and paid bribes to government officials.

Goldman chief executive David Solomon, who took over from Lloyd Blankfein—author of the infamous comment in 2009 that big profits for banks meant they were doing “God’s work”—said: “We recognise that we did not adequately address red flags and scrutinise the representations of certain members of the deal team.”

As details of the corruption began to emerge, Goldman sought to blame its involvement on “rogue operators.” In fact, their activities were encouraged. According to the Wall Street Journal , one of the 1MDB bond deals organised in 2012, “won one of Goldman’s most prestigious internal awards, praised for its ‘spirit of creativity and entrepreneurial thinking’.”

In an effort to clean up its image, Goldman announced that four senior executives, including CEO Solomon, would forfeit $31 million in pay this year, and that it would attempt to claw back bonuses paid to Blankfein in the past. But the penalty imposed on current executives amounts only to about one-third of what they were paid in 2019.

The notion that Goldman was somehow the victim of “rogue” activity and that its involvement in massive corruption is simply the result of oversight is belied by its history, in particular, the role it played in the lead-up to the financial crisis of 2008.

The Senate investigation into the crisis, which found that the financial system was a “snake pit rife with greed, conflicts of interest, and wrongdoing,” singled out Goldman for special mention.

In 2006, Goldman determined that subprime mortgage assets it was selling to clients were destined to flounder. Goldman went short in the market in the expectation that it would crash and it would make a profit on the other side of the very trades it had been promoting. The sums were not small. At one point the firm held short positions amounting to $13 billion.

In an email, referring to an unsuspecting investor, a Goldman executive wrote: “I think I found a white elephant, flying pig and unicorn all at once.”

But the exposure of criminal activity did not bring any prosecutions, let alone jail terms, merely fines, which Goldman and others simply wrote off. In 2013, President Obama’s attorney-general, Eric Holder, clearly recognising the extent of the malfeasance, said that prosecutions would impact on the stability of the US and global banking system.

Since 2008, notwithstanding claims by authorities that there would be a clamp down, the corrupt practices have extended, of which Goldman’s involvement in 1MDB is only one expression.

Last month, documents published by BuzzFeed News from the US Treasury’s Financial Crimes Enforcement Network, known as FinCEN, showed that between 1999 and 2017, major banks has been involved in financial transactions of $2 trillion flagged as potentially involving money laundering. The banks involved were some of the biggest in the world including JP Morgan, HSBC and Standard Charter Bank.

Earlier this month, JPMorgan Chase was fined $920 million over “spoofing” activity involving the quick placing and withdrawal of buy and sell orders to create the impression there was a surge of activity around a particular financial asset in order to create a profitable opportunity.

According to one of the lead investigators in the case, “a significant number of JP Morgan traders and sales personnel openly disregarded US laws that serve to prevent illegal activity in the marketplace.”

But despite the fact that the practice was not only well known but was actively promoted, no one in the upper echelons was prosecuted, and the fine has been written off as an operating expense.

The issue which clearly arises is: what is the underlying cause of this system of corruption and illegality?

Commenting on the latest Goldman case, Seth DuCharme, the acting US attorney in Brooklyn, might have gone further than he intended when he remarked: “This case is … about the way our American financial institutions conduct business.”

It certainly is. However, it would be wrong to simply ascribe it to the greed of the financial executives and others, and thereby able to be countered through tighter regulations.

Of course the greed of executives and others exists in abundance. But their activities are, in the final analysis, the expression of processes rooted at the very heart of the profit system—they are the personification of objective tendencies.

While the aim and driving force of the capitalist system is the accumulation of profit the mode of accumulation has undergone profound changes, above all in the US. No longer is the chief source of profit investment and production in the real economy.

It occurs through operations in the financial system based on speculation, clever trades, the securing of fees for the passage of money (without questioning its source) and where the “value” of assets is determined by arcane algorithms and other forms of “financial engineering.”

Consequently, in conditions where profits are increasingly divorced from the underlying real economy, lies, deception, misinformation, corruption and criminality come to dominate the entire financial system.

Goldman Sachs Executive Who Profited Off Housing Collapse Pours $200K into Joe Biden Campaign JOHN BINDER

The former Goldman Sachs executive who helped one of the biggest banks profit off the nation’s housing collapse in 2008 is pouring hundreds of thousands of dollars into Democrat presidential candidate Joe Biden and Sen. Kamala Harris’s (D-CA) campaign.

Donald Mullen Jr., as first noted by the Washington Free Beacon, gave $200,000 to the Biden Victory Fund in August. Mullen was a key architect of the “Big Short” scheme that allowed Goldman Sachs to profit from the housing collapse.

New York Magazine detailed the scheme:

In the years leading up to the financial crisis, a team of mortgage executives and traders at Goldman Sachs predicted that the housing market was in trouble. So they designed a massive bet against it, using a bunch of esoteric financial instruments known as collateralized debt obligations that would pay off in the event that housing prices fell and homeowners defaulted on their mortgages . [Emphasis added]

That bet, now known colloquially as “the big short,” allowed Goldman and its clients (including hedge-fund managers like John Paulson) to avoid losses and make billions of dollars when the housing market collapsed , at the same time that people around the country lost their homes to foreclosure. [Emphasis added]

Meanwhile, millions of America’s working and middle class lost their homes, as Business Insider reported in 2018:

After the real estate bubble burst in 2008, many families living in the US found that the cost of running their homes was no longer affordable , resulting in many of those people losing their homes. [Emphasis added]

The widespread consequences were that, between 2006 and 2014, nearly 10 million homeowners in America saw the foreclosure sale of their own homes , which entailed having to give up their property to lenders or selling it as quickly as possible via an emergency sale, according to the Süddeutsche Zeitung. [Emphasis added]

Livelihoods were threatened and the financial damage was colossal — not to mention the emotional damage suffered by victims of the crisis — a 2014 study shows a correlation between the crisis and an increased suicide rate. But where are the victims of the real estate and financial crisis now? [Emphasis added]

It’s not just Mullen Jr. who is showering Biden with campaign cash to defeat President Trump on November 3. Biden has taken nearly 200 contributions from employees at Goldman Sachs — including contributions of nearly $50,000 to $55,000 from the bank’s top executives.

Altogether, a recent CNBC analysis revealed, Wall Street has donated more than $50 million to Biden’s campaign this election cycle and CNN has noted that “all the big banks” are backing Biden and Harris against Trump.

John Binder is a reporter for Breitbart News. Follow him on Twitter at @JxhnBinder .

OBAMA AND HIS BANKSTERS:

And it all got much, much worse after 2008, when the schemes collapsed and, as Lemann points out, Barack Obama did not aggressively rein in Wall Street as Roosevelt had done, instead restoring the status quo ante even when it meant ignoring a staggering white-collar crime spree. RYAN COOPER

The Rise of Wall Street Thievery How corporations and their apologists blew up the New Deal order and pillaged the middle class.

by Ryan Cooper

MAGAZINE

A merica has long had a suspicious streak toward business, from the Populists and trustbusters to Bernie Sanders and Elizabeth Warren. It’s a tendency that has increased over the last few decades. In 1973, 36 percent of respondents told Gallup they had only “some” confidence in big business, while 20 percent had “very little.” But in 2019, those numbers were 41 and 32 percent—near the highs registered during the financial crisis.

Clearly, something has happened to make us sour on the American corporation. What was once a stable source of long-term employment and at least a modicum of paternalistic benefits has become an unstable, predatory engine of inequality. Exactly what went wrong is well documented in Nicholas Lemann’s excellent new book, Transaction Man . The title is a reference to The Organization Man , an influential 1956 book on the corporate culture and management of that era. Lemann, a New Yorker staff writer and Columbia journalism professor (as well as a Washington Monthly contributing editor), details the development of the “Organization” style through the career of Adolf Berle, a member of Franklin D. Roosevelt’s brain trust. Berle argued convincingly that despite most of the nation’s capital being represented by the biggest 200 or so corporations, the ostensible owners of these firms—that is, their shareholders—had little to no influence on their daily operations. Control resided instead with corporate managers and executives.

Transaction Man: The Rise of the Deal and the Decline of the American Dream by Nicholas Lemann Farrar, Straus and Giroux, 320 pp.

Berle was alarmed by the wealth of these mega-corporations and the political power it generated, but also believed that bigness was a necessary concomitant of economic progress. He thus argued that corporations should be tamed, not broken up. The key was to harness the corporate monstrosities, putting them to work on behalf of the citizenry.

Berle exerted major influence on the New Deal political economy, but he did not get his way every time. He was a fervent supporter of the National Industrial Recovery Act, an effort to directly control corporate prices and production, which mostly flopped before it was declared unconstitutional. Felix Frankfurter, an FDR adviser and a disciple of the great anti-monopolist Louis Brandeis, used that opportunity to build significant Brandeisian elements into New Deal structures. The New Deal social contract thus ended up being a somewhat incoherent mash-up of Brandeis’s and Berle’s ideas. On the one hand, antitrust did get a major focus; on the other, corporations were expected to play a major role delivering basic public goods like health insurance and pensions.

Lemann then turns to his major subject, the rise and fall of the Transaction Man. The New Deal order inspired furious resistance from the start. Conservative businessmen and ideologues argued for a return to 1920s policies and provided major funding for a new ideological project spearheaded by economists like Milton Friedman, who famously wrote an article titled “The Social Responsibility of Business Is to Increase Its Profits.” Lemann focuses on a lesser-known economist named Michael Jensen, whose 1976 article “Theory of the Firm,” he writes, “prepared the ground for blowing up that [New Deal] social order.”

Jensen and his colleagues embodied that particular brand of jaw-droppingly stupid that only intelligent people can achieve. Only a few decades removed from a crisis of unregulated capitalism that had sparked the worst war in history and nearly destroyed the United States, they argued that all the careful New Deal regulations that had prevented financial crises for decades and underpinned the greatest economic boom in U.S. history should be burned to the ground. They were outraged by the lack of control shareholders had over the firms they supposedly owned, and argued for greater market discipline to remove this “principal-agent problem”—econ-speak for businesses spending too much on irrelevant luxuries like worker pay and investment instead of dividends and share buybacks. When that argument unleashed hell, they doubled down: “To Jensen the answer was clear: make the market for corporate control even more active, powerful, and all-encompassing,” Lemann writes.

The best part of the book is the connection Lemann draws between Washington policymaking and the on-the-ground effects of those decisions. There was much to criticize about the New Deal social contract—especially its relative blindness to racism—but it underpinned a functioning society that delivered a tolerable level of inequality and a decent standard of living to a critical mass of citizens. Lemann tells this story through the lens of a thriving close-knit neighborhood called Chicago Lawn. Despite how much of its culture “was intensely provincial and based on personal, family, and ethnic ties,” he writes, Chicago Lawn “worked because it was connected to the big organizations that dominated American culture.” In other words, it was a functioning democratic political economy.

Then came the 1980s. Lemann paints a visceral picture of what it was like at street level as Wall Street buccaneers were freed from the chains of regulation and proceeded to tear up the New Deal social contract . Cities hemorrhaged population and tax revenue as their factories were shipped overseas. Whole businesses were eviscerated or even destroyed by huge debt loads from hostile takeovers. Jobs vanished by the hundreds of thousands.

And it all got much, much worse after 2008, when the schemes collapsed and, as Lemann points out, Barack Obama did not aggressively rein in Wall Street as Roosevelt had done, instead restoring the status quo ante even when it meant ignoring a staggering white-collar crime spree. Neighborhoods drowned under waves of foreclosures and crime as far-off financial derivatives imploded. Car dealerships that had sheltered under the General Motors umbrella for decades were abruptly cut loose. Bewildered Chicago Lawn residents desperately mobilized to defend themselves, but with little success. “What they were struggling against was a set of conditions that had been made by faraway government officials—not one that had sprung up naturally,” Lemann writes.

T oward the end of the book, however, Lemann starts to run out of steam. He investigates a possible rising “Network Man” in the form of top Silicon Valley executives, who have largely maintained control over their companies instead of serving as a sort of esophagus for disgorging their companies’ bank accounts into the Wall Street maw. But they turn out to be, at bottom, the same combination of blinkered and predatory as the Transaction Men. Google and Facebook, for instance, have grown over the last few years by devouring virtually the entire online ad market, strangling the journalism industry as a result. And they directly employ far too few people to serve as the kind of broad social anchor that the car industry once did.

In his final chapter, Lemann argues for a return to “pluralism,” a “messy, contentious system that can’t be subordinated to one conception of the common good. It refuses to designate good guys and bad guys. It distributes, rather than concentrates, economic and political power.”

This is a peculiar conclusion for someone who has just finished Lemann’s book, which is full to bursting with profoundly bad people—men and women who knowingly harmed their fellow citizens by the millions for their own private profit. In his day, Roosevelt was not shy about lambasting rich people who “had begun to consider the government of the United States as a mere appendage to their own affairs,” as he put it in a 1936 speech in which he also declared, “We know now that government by organized money is just as dangerous as government by organized mob.”

If concentrated economic power is a bad thing, then the corporate form is simply a poor basis for a truly strong and equal society. Placing it as one of the social foundation stones makes its workers dependent on the unreliable goodwill and business acumen of management on the one hand and the broader marketplace on the other. All it takes is a few ruthless Transaction Men to undermine the entire corporate social model by outcompeting the more generous businesses. And even at the high tide of the New Deal, far too many people were left out, especially African Americans.

Lemann writes that in the 1940s the United States “chose not to become a full-dress welfare state on the European model.” But there is actually great variation among the European welfare states. States like Germany and Switzerland went much farther on the corporatist road than the U.S. ever did, but they do considerably worse on metrics like inequality, poverty, and political polarization than the Nordic social democracies, the real welfare kings.

Conversely, for how threadbare it is, the U.S. welfare state still delivers a great deal of vital income to the American people. The analyst Matt Bruenig recently calculated that American welfare eliminates two-thirds of the “poverty gap,” which is how far families are below the poverty line before government transfers are factored in. (This happens mainly through Social Security.) Imagine how much worse this country would be without those programs! And though it proved rather easy for Wall Street pirates to torch the New Deal corporatist social model without many people noticing, attempts to cut welfare are typically very obvious, and hence unpopular.

Still, Lemann’s book is more than worth the price of admission for the perceptive history and excellent writing. It’s a splendid and beautifully written illustration of the tremendous importance public policy has for the daily lives of ordinary people.

Ryan Cooper is a national correspondent at the Week. His work has appeared in the Washington Post, the New Republic, and the Nation. He was an editor at the Washington Monthly from 2012 to 2014.

Fact Check: Big Banks that Kamala Harris ‘Took on’ Now Support Her 2020 Democratic National Convention / YouTube

Volume 90%

JOHN BINDER

19 Aug 2020 17

2:53

CLAIM: Former Labor Secretary Hilda Solis suggested that because Sen. Kamala Harris (D-CA) “took on” the big banks as attorney general of California, she will stand up to them as vice president.

VERDICT: While Harris was among 49 state attorney generals who secured a $25 billion settlement from big banks, many executives from those banks now support her as Democrat nominee Joe Biden’s vice presidential choice.

“When millions of families lost their homes, my friend in California, Sen. Kamala Harris, took on the big banks and won,” Solis said in reference to the case which involved Bank of America, Wells Fargo, JPMorgan Chase, Citigroup, and Ally Bank.

BLOG EDITOR: AS ATTORNEY GENERAL OF CALIFORNIA, KAMALA HARRIS REFUSED TO CRIMINAL PROSECUTE ANY OF HER GENEROUS BANKSTERS DESPITE THAT FACT THAT CA WAS GROUND ZERO FOR BANKSTER-CAUSED MORTGAGE MELTDOWN AND FORECLOSURE!

A number of executives on Wall Street with links to Wells Fargo, Citigroup, and Bank of America now support Harris in her effort with Biden to defeat Trump.

As Breitbart News reported recently, Wells Fargo Vice Chairman for Public Affairs Bill Daley, who served as Obama’s chief of staff from 2011 to 2012, called a Harris a “reasonable, rational person who has worked in the system.”

Citigroup executive Ray McGuire called Harris a “great choice” for vice president. During the Democrat presidential primary, Harris raked in campaign donations from executives and employees with Bank of America.

In These Times reported the donations at the time:

Then there’s Cal�i�for�nia Sen. Kamala Har�ris, who received a total of $44,947 from these 12 firms. Har�ris, who was once brand�ed a “bankster’s worst night�mare,” and has tout�ed her pros�e�cu�to�r�i�al record against banks as evi�dence of her pro�gres�sive cred�i�bil�i�ty, received dona�tions from five exec�u�tives of these firms. They include Black�stone man�ag�ing direc�tor Tia Break�ley, Mor�gan Stan�ley’s new head of inter�na�tion�al wealth man�age�ment Col�bert Nar�cisse, Bank of Amer�i�ca senior vice pres�i�dent for diver�si�ty and inclu�sion Alex Rhodes, and Gold�man Sachs vice pres�i�dent of finan�cial crime com�pli�ance Mar�garet Cullum. [Emphasis added]

Har�ris’s most enthu�si�as�tic source of sup�port among these firms, how�ev�er, is Wells Far�go, from whose employ�ees she received a total of $16,713 — the most fund�ing from the bank out of any oth�er can�di�date exam�ined. The donors span mul�ti�ple tiers of the bank’s hier�ar�chy, from bankers and con�sul�tants, to a region�al direc�tor and a man�ag�er, to exec�u�tives like Nation�al Head of Cards and Retail Ser�vices Bev�er�ly Ander�son, both of whom gave the max�i�mum indi�vid�ual dona�tion of $2,800 to Harris. [Emphasis added]

John Binder is a reporter for Breitbart News. Follow him on Twitter at @JxhnBinder .

Goldman Sachs Bankster “King of the Foreclosures” Treasury Secretary Steven Mnuchin vows that the Goldman Sachs infested Trump Admin will hand no-strings massive socialist bailouts to Trump Hotels. Mnuchin says the welfare will exceed the Bankster-owned Democrat Party’s massive bailout of Obama crony Jamie Dimon of J P Morgan’s bailout in 2008 OBAMA CRONY DONORS Goldman Sachs, JPMorgan Chase, Bank of America and every other major US bank have been implicated in a web of scandals, including the sale of toxic mortgage securities on false pretenses, the rigging of international interest rates and global foreign exchange markets, the laundering of Mexican drug money, accounting fraud and lying to bank regulators, illegally foreclosing on the homes of delinquent borrowers, credit card fraud, illegal debt-collection practices, rigging of energy markets, and complicity in the Bernie Madoff Ponzi scheme.

Treasury Secretary Steven Mnuchin embodies the plutocratic principle that a crisis is a terrible thing to waste. By Eric Levitz @EricLevitz

Steve Mnuchin knows his way around a crisis. Twelve years ago, the Treasury secretary was still a middling multi-millionaire of little renown or historical import. But whenever God closes a door on an underwater home-owner, he opens a window to an unscrupulous speculator, and in 2008, the Big Man began closing a lot of doors. Mnuchin didn’t miss his opening. He may have been just a humble Goldman Sachs nepotism hire turned Hollywood financier back then, but he had a few million dollars to play with and a few friends with many millions more. Together, they bought up a failing mortgage lender, rapidly foreclosed on thousands of borrowers, and resold the homes at a nifty profit. By the end of his tenure as a bank CEO, Mnuchin had earned himself the title “Foreclosure King” — and a return of $200 million. That’s the kind of money that can buy you entrance into the good graces of a Republican nominee, especially if he’s already alienating a lot of the party’s biggest donors. And from there, it’s walking distance to the White House.

Thus far, the COVID-19 crash has been as kind to Mnuchin as the Great Recession once was. If the last global economic crisis made him rich enough to purchase a lofty perch in our government, this one is making the Treasury secretary powerful enough to claim a prominent place in U.S. history. Before the novel coronavirus made its presence felt, Mnuchin’s most memorable achievement as a public servant may have been commandeering a government plane for a solar-eclipse-themed day trip. Since the pandemic sickened global markets, he has brokered the largest stimulus legislation ever passed and won control of a multi-trillion-dollar bailout fund .

Which is to say: We’ve put one of the primary beneficiaries of America’s inequitable response to the last economic crisis in charge of crafting our nation’s response to this one.

Of course, it wasn’t really God who opened the window to Mnuchin’s foreclosure profiteering or the profiteering of all the well-heeled investors who bought low during the financial crisis, then sold high amid the bailout-buoyed recovery (the Almighty contracts out those jobs to protect his brand integrity). Rather, it was an economic system that keeps a wide swath of Americans one bad break from financial ruin — and another tiny class draped in gold-plated armor.

From the first capital-gains-tax cut of the modern era in Jimmy Carter’s day to the supply-side bonanza of Donald Trump’s, this system’s essential rationale has remained the same: If capitalists cannot reap big rewards from their winning bets, they will have no incentive to take the great personal risks that fuel collective prosperity.

Mnuchin’s career and the pandemic response he has overseen belie most of that sentence’s premises. In truth, the Treasury secretary owes his success to a series of low-risk, high-reward bets of little-to-negative social value. Which makes sense. After all, if America’s brand of capitalism actually required the superrich to assume great personal risk in order to reap outsize returns, they wouldn’t be so invested in it.

Steve Mnuchin wasn’t born on third base so much as a few inches to the left of home plate. His grandfather co-founded a yacht club in the Hamptons. His father was a Yale-educated partner at Goldman Sachs. If his family’s name didn’t secure Steve’s own Yale admission, its wealth certainly covered his tuition, books, personal Porsche, and “dorm” at New Haven’s Taft Hotel. From this perch, it would have been harder for Mnuchin to tumble down America’s class ladder than to climb higher still. The former would have required prodigious acts of self-destruction; the latter mere fluency in ruling-class social mores and the art of strategic sycophancy — and the wallflower cipher Steve Mnuchin is a master of both.

At Goldman, Mnuchin’s colleagues did not consider him “especially book smart.” And some have suggested that his steady ascent at the firm was fueled less by merit than pedigree (Mnuchin’s elevation to partner in 1996 came at the expense of Kevin Ingram, an African-American trader who’d risen from a working-class childhood up through MIT’s engineering school, then Goldman’s ranks, where he struck one colleague as both “much smarter than Steven” and more “accomplished”).

After Mnuchin paid his dues at Goldman, he founded a hedge fund called Dune Capital and a motion-picture-financing company called Dune Entertainment (both named after a stretch of beach near his house in the Hamptons). He helped bankroll Avatar and the X-Men franchise, hobnobbed in Beverly Hills, and hoarded his investment profits in a tax haven. He had everything America’s “temporarily embarrassed millionaires” imagine a person could want. But Mnuchin longed for higher things. And when the housing market collapsed, he knew he was in luck.

Early in his career, Mnuchin had watched his superiors turn America’s savings-and-loan crisis into their own buying-and-selling bonanza. In the summer of 2008, Mnuchin was watching television in his New York office when an invitation to emulate his old mentors flashed across the screen: Out in California, frightened depositors were lined up outside IndyMac, one of the nation’s largest mortgage lenders, waiting to withdraw their cash. “This bank is going to end up failing, and we need to figure out how to buy it,” Mnuchin told a colleague. “I’ve seen this game before.”

He played it like a natural. Mnuchin reached out to George Soros, John Paulson, and other billionaires whose trust he’d cultivated. They marshaled a $1.6 billion bid. Eager to unload the bank — whose balance sheet was chock-full of toxic assets — the FDIC agreed to cover any losses that might accrue to the investors above a certain threshold. Which is to say, the government agreed to partially socialize Mnuchin & Co.’s downside risk. This public aid came with one major condition: The new bank, which Mnuchin dubbed OneWest, would need to make a good-faith effort to help homeowners avoid foreclosure. The FDIC would ultimately pay OneWest more than $1.2 billion.

This was not enough to buy Steve Mnuchin’s good faith.

Purchasing IndyMac secured OneWest a claim on a lot of undervalued housing. The catch, of course, was that much of it was full of broke people. And California’s foreclosure laws make the process of separating low-net-worth humans from high-value housing stock long and arduous. But this was nothing a little entrepreneurship couldn’t solve: Mnuchin’s bank (ostensibly) bet it could get away with “robo signing” and backdating documents to expedite foreclosures. One-West got caught red-handed on the first count but emerged with a slap on the wrist. Investigators at the California attorney general’s office concluded the bank was guilty on the second and requested authorization to pursue an enforcement action. It’s unclear exactly why then–Attorney General Kamala Harris denied this request. But as the investigators themselves noted, to pursue legal action against an entity with OneWest’s resources would mean investing years of time — and large sums of the public’s money — in a deeply uncertain enterprise. The government could afford to take only so many risks, which meant the idea that the state could hold all its superrich residents accountable to its laws was a bluff. Mnuchin called it.

In the spring of 2016, another promising investment opportunity caught the eye of the now-former One-West CEO. Mnuchin had crossed paths with Trump several times over the years; his hedge fund had invested in (at least) two of the mogul’s projects. So when Donald invited Steve to swing by his tower on the night he won the New York primary, Mnuchin obliged. A dozenish hours (and a glass or two of Trump-branded wine) later, Mnuchin agreed to become the finance chairman of the future GOP nominee’s campaign.

This decision baffled some of Mnuchin’s Hollywood pals. The bankroller of The LEGO Batman Movie didn’t strike them as a political animal, let alone a Trumpist. But his motives weren’t mysterious. For someone in Mnuchin’s socioeconomic position, Trump’s presidential campaign was just another low-risk, high-reward bet. Or, as Mnuchin himself put it in an interview in August 2016, “Nobody’s going to be like, ‘Well, why did he do this?,’ if I end up in the administration.”

Mnuchin is the last of the “adults in the room” — that cabal of semi-credentialed advisers whose presence in the West Wing eased the troubled minds of Never Trump pundits circa 2017. None of the others — not Rex Tillerson, Gary Cohn, James Mattis, H. R. McMaster, or John Kelly — could marshal the requisite combination of unscrupulous sycophancy and patient politicking to weather each turn in Trump’s tempestuous moods. Only the former Foreclosure King has what it takes to unequivocally defend the president’s kind words for alt-right marchers in Charlottesville or echo his attacks on NFL players who dared to protest police abuse. So when the biggest economic crisis since the Great Depression hit, Mnuchin became — in The Wall Street Journal ’s appellation — “Washington’s indispensable crisis manager.” Unburdened by ideological conviction or economic literacy, Mnuchin has proved to be the GOP’s most able dealmaker. Working out of a temporary office in the Capitol’s Lyndon Baines Johnson Room, Mnuchin spent the closing weeks of March running (and massaging) messages between the Senate’s Democratic and Republican camps as they sought consensus on a gargantuan coronavirus relief bill. “Mnuchin played the middleman, and he must have been in my office 20 times in three days,” Senate Minority Leader Chuck Schumer told the Journal, going on to praise the reliability of the Treasury secretary’s word. House Speaker Nancy Pelosi has said that she and Mnuchin can communicate through a “shorthand” devoid of time-wasting “niceties or anything like that.”

The soft skills Mnuchin had once deployed to ink billion-dollar investment deals now eased the passage of a $2.2 trillion economic-relief package. And there was much to admire in the legislation’s headline provisions: an unprecedented expansion in federal unemployment benefits that would leave many laid-off workers with as much — if not more — income than they’d earned at their old jobs, forgivable loans for small businesses that agreed to forgo layoffs during the crisis, and onetime cash payments to all nonaffluent Americans.

But this is still a Republican stimulus, however much schmoozing Steve has done with Chuck and Nancy this spring. Congress’s persistent underfunding of the small-business aid has kept America’s most vulnerable mom-and-pops out in the cold. And our nation’s decrepit unemployment-insurance offices have struggled to administer benefits as the ranks of the jobless grow millions stronger every week. The Treasury Department has allowed debt collectors to garnish the relief checks of cash-strapped Americans, and Congress has essentially refused to bail out hospitals whose budgets have suddenly been destroyed by COVID-driven shortfalls, meaning that over the next few years, whole essential health systems and services could abruptly be suspended.

Most of all, the legislation’s largest appropriation — $454 billion to backstop a $4 trillion Federal Reserve lending program to large corporations — gives Mnuchin significant personal discretion over which firms will have access to low-cost credit and on what terms, thereby leaving a connoisseur in the art of subverting federal crisis management for personal profit in charge of preventing America’s corporate titans from subverting federal crisis management for personal profit.

The White House’s next big idea for promoting economic recovery is, reportedly, to formally suspend the enforcement of labor and environmental regulations on small businesses, a measure that would enable petit bourgeois tyrants to suspend all pretense of concern for their workers’ health and well-being in the midst of a pandemic.

Nevertheless, could we have reasonably expected anything better, all things considered? A GOP president and Senate majority were always going to comfort the comfortable and toss crumbs to the afflicted. And when Congress approved $2.2 trillion in coronavirus relief funds last month, nurses were intubating patients without proper PPE, grocery-store clerks were jeopardizing their health to keep others fed, and delivery drivers were forfeiting the security of social distancing so others could more comfortably enjoy it. The legislation included zero dollars in hazard-pay benefits for those workers. It did, however, provide $90 billion in tax cuts to the owners of pass-through businesses, such as, for instance, the Trump Organization. Such “relief” was necessary, the American Enterprise Institute later explained, to mitigate the “penalty” on economic risk-takers.

Add the Banksters’ rent boy Eric Holder (LAWYER) and the up and coming Swamp Empress Kamala Harris (LAWYER)…but keep counting….(LAWYER) Brian Deese, Obama-Biden’s loot-for-Wall Street guy.

Hauser also didn’t like the prevalence of Big Law talent on the Department of Justice team, which signaled to him that the Biden administration could go soft on corporate malefactors.

BLOG EDITOR: WHAT WOULD WE DO WITHOUT THE PARASITE LAWYERS?!?

“But that, in short, is the job description for Brian Deese, a not-quite graduate of Yale Law School who had never set foot in an automotive assembly plant until he took on his nearly unseen role in remaking the American automotive industry.”

Big Tech and Big Law dominate Biden transition teams, tempering progressive hopes

Alexander Nazaryan administration takes office in January.

WASHINGTON — For six years, Brandon Belford worked as an economic policy adviser to President Barack Obama in the White House and federal agencies. He moved to the Bay Area when Donald Trump became president, part of a massive flight of Obama officials from Washington to Silicon Valley, Wall Street and Hollywood. He took high-ranking positions with Apple and then Lyft, where he is currently the ride-sharing company’s chief of staff.

Now Belford is back, as part of one of the “transition teams” named by President-elect Joe Biden to restock a federal government that has been battered after four years of Trump by hiring new officials and advising the incoming administration on what its first governing steps should be.

Those steps could be timid, judging by the composition of those teams, where Obama-era centrism prevails. That has some progressives worried that Biden represents nothing more than a return to normal, at a time when many of them believe the nation is ready to embrace policy ideas well to the left of center.

“The status quo is killing us,” says former Bernie Sanders press secretary Briahna Joy Gray, who now hosts a podcast called “ Bad Faith .”

Belford is joined by dozens of other Democratic operatives who have spent the past four years working at prestigious law firms and think tanks. On these “agency review teams” are high-ranking executives from Amazon, partners at white-shoe law firms like Covington & Burling and enough experts from D.C. center-left think tanks — including six from the Brookings Institution alone — to fill a center-left think tank.

Progressives knew this was coming. “I am very concerned about the role Uber executives would play in this administration,” Rep. Alexandria Ocasio-Cortez D-N.Y., told Yahoo News. Even though she also effusively praised the appointment of Ron Klain as the incoming White House chief of staff, Ocasio-Cortez vowed that corporate America would not “pull the wool over our eyes” when it came to crafting the Biden presidency.

Some have put it less bluntly. “Biden’s transition team is full of wealthy corporate executives who are completely disconnected from the struggles of the working class,” complains left-leaning activist Ryan Knight , whose Twitter handle is @ProudSocialist.

App-based drivers from Uber and Lyft protest in a caravan in front of City Hall in Los Angeles on October 22, 2020 where elected leaders hold a conference urging voters to reject on the November 3 election, Proposition 22, that would classify app-based drivers as independent contractors and not employees or agents. (Photo by Frederic J. BROWN / AFP) (Photo by FREDERIC J. BROWN/AFP via Getty Images)More

He was presumably referring to the two dozen agency review team officials who come from law firms like Arnold & Porter. Or to the 40 or so members of the Biden transition who are current or recent lobbyists .

The agency review teams are not exactly settling into their cubicles just yet. For one, President Trump has not yet conceded the election, and the transition has been hindered in part by Republican operatives at the General Services Administration . And agency review is an enormously complex process, one that actually began months ago. The transition teams are supposed to ensure a “smooth transfer of power,” in large part by making sure that capable officials are ready to get to work in their respective agencies the moment Biden lifts his hand from the Lincoln Bible.

Speaking on the condition of anonymity, one member of the Biden campaign working on agency-related matters says teams were primarily tasked with surveying the landscape of the federal bureaucracy. She says that the transition teams would make some hiring recommendations, but only as a secondary function.

With a single exception, the agency review team members mentioned in this article did not respond to requests for comment.

One with a typically impressive biography is that of Aneesh Chopra, who served as the U.S. chief technology officer for Obama before starting his own medical data logistics company, CareJourney. Now he is on the transition team for the U.S. Postal Service, where he will presumably work to undo the alleged damage by another logistics maven: Trump appointee Louis DeJoy .

Of course, most progressives are glad that there’s a Biden transition to speak of, instead of a second Trump term. But they also recognize their own role in the Democratic candidate’s victory.

“Everyone fell into line and did everything they could to get Joe Biden elected,” says Max Berger , a progressive activist who worked for Elizabeth Warren’s presidential campaign and Justice Democrats, the group that helped elect Ocasio-Cortez to the House in 2018.

Berger recognizes that progressives will be a “junior partner” to the establishment Democrats with whom Biden has been ideologically and temperamentally aligned for a good half-century. They want to be partners all the same, not just the loyal opposition.

Many are cheered by some of the agency review teams. For one, they are notably more diverse, a stark contrast to Trump’s reliance on white males for so much of his advice. On the transition team for the National Aeronautics and Space Administration is Jedidah Isler, the Dartmouth professor who in 2014 became the first Black woman to earn a doctorate in astrophysics from Yale. The transition team for the Small Business Administration includes Jorge Silva Puras, a political leader in Puerto Rico who also teaches entrepreneurship at a community college in the Bronx.

“The presence of labor officials throughout many of the groups is notable,” says David Dayen, executive editor of the American Prospect. In the Department of Education team, for example, are several executives from the American Federation of Teachers.

He called the Federal Reserve and Treasury teams “all-stars,” a sentiment shared by other progressives interviewed for this article. On the Treasury team is Mehrsa Baradaran, a progressive economist who has written on the racial wealth gap . She is also on the Federal Reserve team, along with Reena Aggarwal , a corporate governance expert.

Progressive strategist Elizabeth Spiers says the finance-related teams are not “not quite Elizabeth Warren levels of aggressiveness but also not stuffed with finance people.” Biden’s advisers appear to have learned the lessons of his former boss. During Obama’s first year, he relied on banking executives to help quell the financial crisis. They did so in ways that steered the new president away from progressive proposals, such as nationalizing those very same banks .

There is not a single current executive from Citibank or Goldman Sachs on any of the transition teams. Bank of America has also been shut out. JPMorgan can boast a single toehold in the agency review process: Lisa Sawyer of the Pentagon team. A spokesman for JPMorgan told Yahoo News that the bank was “following the appropriate election laws” and that Sawyer was “not on an agency review team that will touch any banking issues.”

“I think the Biden administration is going to be surprising to progressives in some ways and disappointing in others, and the agency review teams reflect that,” Dayen says. During the summer, the American Prospect published a lengthy exposé about Biden’s foreign policy advisers’ lucrative foray into corporate America .

Many are set to return to the highest echelons of official

Washington.

“I have to be cautiously optimistic,” says Waleed Shahid, communications director for the Justice Democrats.

Relatively young progressives like Shahid are less likely to wax romantic about the way things were in Washington. They are less interested in experience than conviction. But for many in Biden’s camp, a lack of experience was among the several fatal flaws of the Trump years.

“Everyone — right or left — has made the mistaken assumption for years that governing is easy,” says “The Death of Expertise” author Tom Nichols, who teaches at the Naval War College and is an ardently anti-Trump Republican .

“After having a bunch of nitwits and cronies loose in the government,” Nichols wrote in an email, “I think a lot of people on the left are really giving in to the assumption that as long as you’re not Trump, or not a complete idiot, anyone can do it.”

Given the title and theme of his book, Nicholas cautioned against that approach. “It’s a childish and silly approach to government, but it’s a bipartisan problem,” he told Yahoo News.

While progressive may not see their stars like Sens. Bernie Sanders or Elizabeth Warren occupying the Treasury Department, they do very much hope that a Biden presidency amounts to more than a third Obama term. It was unaddressed economic inequality, they believe, that bred the populist resentment that gave Trump an opening in 2016. The coronavirus has only made that inequality worse. That will only increase populist resentment, they worry, to be exploited by a Trump acolyte — or perhaps Trump himself, again — in 2024.

Addressing that inequality, for now, falls to transition team officials like Mark Schwartz of Amazon and Ted Dean of Dropbox, as well as Arun Venkataraman of Visa and David Holmes of defense contractor Rebellion Defense, in which Eric Schmidt of Google is an investor . Many of these officials are veterans of the Obama administration or Democratic offices on the Hill.

“There is a lot of corporate influence there,” says Maurice Weeks, co-founder of the Action Center on Race and the Economy. “And that is troubling.” But he is encouraged by the presence of “hard-core progressives” like Sarah Miller , a former Treasury deputy who is both an anti-Facebook activist and the executive of the American Economic Liberties Project, which seeks to curb corporate power. She is now on the Treasury transition team.

In some ways, the difference is between former Obama officials who, like Miller, went on to become activists and those who moved on to become rich. The latter did only what many government officials had done before them. But at a time of mass unemployment, a stint at the corporate law firm Latham & Watkins (three transition team members) may not seem as impressive as it may have when Obama was president.

“We don’t just want to rewind the clock by four years,” Weeks says.

For many progressives, Trump was a singular threat to important institutions of the federal government, but rebuilding those institutions is simply not as important as rebuilding entire communities shattered by economic, social and racial inequalities.

It doesn’t help matters that, today, tech giants are distrusted by conservatives and progressives alike. Firms that were run out of Palo Alto garages now chafe at antitrust laws like the railroad companies of a century ago.

And like those companies, they know how to use their influence. In 2019 alone, two of the biggest and most influential technology firms — Amazon and Facebook — each spent $17 million on “government affairs,” better known as lobbying .

Ocasio-Cortez’s reference to Uber may have been a subtle warning to the incoming administration: The brother-in-law of Vice President-elect Kamala Harris is Tony West, who worked for the Department of Justice under President Bill Clinton and is now the chief counsel at Uber. Jake Sullivan, another top Biden adviser, also worked for Uber .

The company recently won a major victory in California with Proposition 22 , a successful response to legal efforts to make Uber drivers and other “gig workers” employees, not contractors. That’s exactly the kind of labor policy, Ocasio-Cortez says, the Biden administration must avoid.

Many top Obama staffers went to Silicon Valley in 2017. They could be returning to Washington with a new appreciation for free market capitalism at a time when “socialism” is no longer a dirty word.

“Joe Biden’s transition is absolutely stacked with tech industry players,” noted Protocol , an online publication that covers technology.

That’s exactly what worries Jeff Hauser, executive director of the Revolving Door Project, which tracks what Trump has called, without much affection, “the swamp.” He notes that the transition team for the Office of Management and Budget appears to have borrowed rather avidly from Silicon Valley, with team members hailing from Lyft, Airbnb and Amazon.

The budget office wields an “enormous amount of power,” says Hauser, including in both how congressionally appropriated money is doled out and how certain rules are implemented. Though it had a supporting role in Trump’s impeachment drama over foreign aid , OMB is otherwise obscure, making it a perfect site for covert exercises of federal power.

Hauser also didn’t like the prevalence of Big Law talent on the Department of Justice team, which signaled to him that the Biden administration could go soft on corporate malefactors.

Watching the transition, Gray, the former Sanders adviser, recalled an old saying: “The fish rots from the head.” The head, in this case, is Joe Biden, of whom Gray has long been a skeptic .

“He’s a fundamentally conservative man,” Gray says. She reasons that if Biden was “unmoved by the largest protest movement in American history” to endorse Medicare for All, he can’t be trusted to do much for conservative causes like a $15 minimum wage and the Green New Deal.

Still, she believes that Biden can be made to hear the voices of progressives — if, Gray says, they are loud enough. She points out that there is widespread support for progressive legislation like the $15 minimum wage in Florida , even though Trump won the state.

Biden easily won Oregon , but a push to legalize small amounts of drugs, known as Measure 110 , was even more popular than he was.

She sees that as evidence that progressive ideas are more popular than Biden himself. “Progressives should never stop screaming that reality from the rooftops,” Gray told Yahoo News. And she vowed to keep fighting, even with Trump gone and a Democratic president in the Oval Office once again.

“I don’t accept resignation,” she said.

Cover thumbnail photo: Jonathan Ernst/Reuters

THE LONG HISTORY OF OBAMA-BIDENomics:

The “managed bankruptcy” of GM and Chrysler ordered by the Obama administration set into motion the destruction of tens of thousands of jobs, including 35,000 GM production jobs in the US alone, the shuttering of dozens of assembly and parts plants and the closing of more than 1,000 car dealerships. Obama worked with the United Auto Workers to slash the wages of new hires in half, abolish the eight-hour day, ban strikes for six years and relieve the corporations of retiree health care obligations by handing the provision and cutting of retiree medical benefits to the UAW.

The executive from the giant investment firm BlackRock played a leading role in the destruction of autoworkers’ jobs and living standards during the 2009 restructuring of GM and Chrysler.

Who is Biden’s top economic adviser Brian Deese? ·

·

President-elect Joe Biden has reportedly selected Brian Deese, an executive at the Wall Street investment firm BlackRock, as director of the National Economic Council, according to several major news outlets. “In his new post, which doesn’t require Senate confirmation, Mr. Deese will play a lead role in implementing Mr. Biden’s economic agenda,” the Wall Street Journal wrote Monday.

While Deese was not among those Biden introduced Tuesday as his “economic team,” an announcement is expected soon. Deese, the Global Head of Sustainable Investment at BlackRock, would be the second executive chosen by the incoming administration from the world’s largest asset manager, which controls $7 trillion in assets and is a major shareholder in Deutsche Bank, Wells Fargo, Apple, Microsoft and other global corporate giants.

On Tuesday, Adewale “Wally” Adeyemo, a former chief of staff to BlackRock’s CEO Larry Fink, was named top deputy to Janet Yellen, the former Federal Reserve Chairwoman who Biden picked for Secretary of the Treasury. Tom Donilon, chairman of BlackRock Investment Institute and brother of Biden’s chief campaign political strategist, had been considered for the director of the Central Intelligence Agency, but the Wall Street Journal reported Monday that Donilon decided to stay in the “private sector.”

Brian Deese (Source: BlackRock)

The selection of Deese and Adeyemo—who both previously served in the Obama administration—exemplifies the revolving door between Wall Street and Washington, DC, which operates constantly, regardless of which party controls the White House.

It is a further signal to the financial oligarchy that a Biden administration will dispense with its rhetoric about raising taxes on the wealthy and continue funneling trillions into the stock markets. “By picking folks with deep ties to large asset managers,” Tyler Gellasch, executive director of investor trade group Healthy Markets Association, told the Journal , “the administration can help assuage financial executives’ concerns. It sends a clear signal to the industry to breathe easier: They can plan for stability without likely facing massive new regulatory or tax risks.”

After working on Obama’s 2008 election campaign, Deese was appointed Special Assistant to the President for economic policy and served on the National Economic Council as Obama took over the Troubled Asset Relief Program (TARP) from the outgoing George Bush administration, and pumped massive resources into the same banks and financial institutions whose criminal activities had crashed the economy.

Deese, who had no formal training as an economist, then made a name for himself for being the most aggressive advocate of throwing General Motors and Chrysler Corp. into bankruptcy in 2009.

In a May 2009 New York Times article, headlined “The 31-Year-Old in Charge of Dismantling G.M.,” David Sanger wrote, “It is not every 31-year-old who, in a first government job, finds himself dismantling General Motors and rewriting the rules of American capitalism.

BLOG EDITOR: WHAT WOULD WE DO WITHOUT THE PARASITE LAWYERS?!?

“But that, in short, is the job description for Brian Deese, a not-quite graduate of Yale Law School who had never set foot in an automotive assembly plant until he took on his nearly unseen role in remaking the American automotive industry.”

Deese was part of the White House Auto Task Force, which was made up of Wall Street asset strippers, including billionaire investor and Democratic Party fundraiser Steven Rattner and Ron Bloom, another Wall Street “turnaround specialist” with a long history of collaborating with the unions during the bankruptcy restructuring of the airline and steel industry.

While publicly claiming that they wanted to avoid bankruptcy, court document would show that Deese and others in Obama’s inner circle were determined to force the auto companies into a forced restructuring from the earliest days of the new administration.

After Rick Wagoner, GM’s former chief executive, said publicly that bankruptcy was not a viable option, the administration would fire him and threaten to withhold any further money from GM unless it imposed far more “painful” cuts than outlined in its initial plan, which called for the elimination of 47,000 jobs worldwide, including 21,000 hourly workers in the US.

The “managed bankruptcy” of GM and Chrysler ordered by the Obama administration set into motion the destruction of tens of thousands of jobs, including 35,000 GM production jobs in the US alone, the shuttering of dozens of assembly and parts plants and the closing of more than 1,000 car dealerships. Obama worked with the United Auto Workers to slash the wages of new hires in half, abolish the eight-hour day, ban strikes for six years and relieve the corporations of retiree health care obligations by handing the provision and cutting of retiree medical benefits to the UAW.

As the wrote at the time, “Obama’s Auto Task Force has focused on one thing from the beginning: how to exploit the crisis of the auto industry to create conditions for Wall Street to reap huge profits. Its leading figures—Secretary Treasurer Timothy Geithner and White House economic [adviser] Lawrence Summers—played a key role in the Wall Street bailout, opposing the slightest restrictions on compensation paid to banking executives receiving public money. When it has come to the auto industry, however, they have demanded the most brutal job cuts and wage and benefit concessions from autoworkers.

“The outcome of the dismantling of the auto industry,” the continued, “will mean that the industrial base of the US will shrink even more and the economy will be further dominated by the type of reckless and socially destructive speculation that is responsible for the worst economic and social crisis since the 1930s.”

A year after the forced bankruptcies, Citi Investment Research analyst Itay Michaeli boasted that GM’s fixed cost per vehicle would drop from $10,400 in 2009 to $7,280 in 2010 and fall to $5,772 by 2012. In the five years following, labor costs at GM and Chrysler—which declared bankruptcy on April 30, 2009—were predicted to be lower than any Japanese automaker operating nonunion plants in the US, making it profitable for the company to build small cars in the US, rather than in Mexico.

The auto restructuring became a template for the decimation of wages throughout the working class during the eight years of the Obama administration, which oversaw the greatest transfer of wealth from the bottom to top in US history up until today.