Police State: IRS pays a visit to Matt Taibbi on same day he testifies before Congress on government abuses

What is anyone supposed to think of this?

According to the New York Post:

An IRS agent stopped by the home of Twitter Files journalist Matt Taibbi the same day of his congressional testimony on the weaponization of the government, according to House Judiciary Chairman Jim Jordan, who’s demanding an explanation over the oddly timed visit.Jordan sent a letter to IRS Commissioner Daniel Werfel and the Department of Treasury on Monday in hopes of getting to the bottom of why the federal agent appeared at Taibbi’s New Jersey home on March 9 and left a note, according to an editorial in The Wall Street Journal that cited the letter.The note reportedly instructed Taibbi to call the IRS four days later.When he did, an agent told him his 2018 and 2021 tax returns had both been rejected due to identity theft concerns.

Yellen Calls for Emergency Meeting as Surging Depositor Outflows Threaten to Crash More

https://www.youtube.com/watch?v=XRlWbKOEGXo

“Attorney General Eric Holder's tenure was a low point even within the disgraceful scandal-ridden Obama years.”

DANIEL GREENFIELD / FRONTPAGE MAG

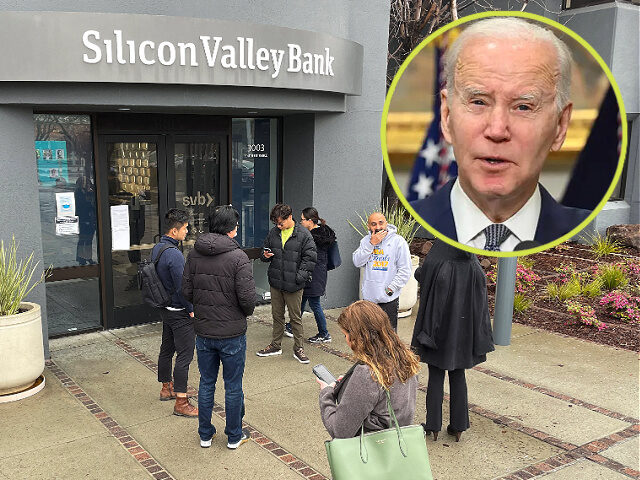

Silicon Valley Bank Board Included Barack Obama, Hillary Clinton Donors

Failed bank's board revealed to be packed with Democrats

AREN'T THEY ALL?

“This was not because of difficulties in securing indictments or

convictions. On the contrary, Attorney General Eric Holder

told a Senate committee in March of 2013 that the Obama

administration chose not to prosecute the big banks or their

CEOs because to do so might “have a negative impact on the

national economy.” AS THEY LOOTED TRILLIONS FROM

THE ECONOMY AND THEN PASSED ALONG SOME OF THE

LOOT IN THE FORM OF 'SPEECH FEE' BRIBES!

During his presidency, Obama bragged that his administration was “the only thing between [Wall Street] and the pitchforks.”

In fact, Obama handed the robber barons and outright criminals responsible for the 2008–09 financial crisis a multi-trillion-dollar bailout. His administration oversaw the largest redistribution of wealth in history from the bottom to the top one percent, spearheading the attack on the living standards of teachers and autoworkers.

The Republican staff of the US House Committee on Financial Services released a report Monday presenting its findings on why the Obama Justice Department and then-Attorney General Eric Holder chose not to prosecute the British-based HSBC bank for laundering billions of dollars for Mexican and Colombian drug cartels.

“This was not because of difficulties in securing indictments or convictions. On the contrary, Attorney General Eric Holder told a Senate committee in March of 2013 that the Obama administration chose not to prosecute the big banks or their CEOs because to do so might “have a negative impact on the national economy.”

As for the release of Democratic Party emails, even if one accepts the unsubstantiated claim that it was Russian operatives who turned them over to WikiLeaks, what the emails revealed were true facts about the operations of Clinton and the Democratic National Committee (DNC)—facts that the electorate had every right to know. Among the documents released were Clinton’s speeches to Goldman Sachs and other banks, for which she was paid hundreds of thousands of dollars. Other leaked emails exposed the corrupt efforts of the DNC to rig the primaries against Bernie Sanders.

HA, HA, HA! YOU BELIEVE THIS SHIT FROM THE RACIST WATERS?

Maxine Waters Plans to Return Donations from Collapsed Silicon Valley Bank’s PAC

Maxine Waters Plans to Return Donations from Collapsed Silicon Valley Bank’s PAC

AP Photo/Evan Vucci Rep. Maxine Waters (D-CA), the ranking member on the House Financial Services Committee, said she plans to give back the campaign donations she received from the political action committee for Silicon Valley Bank.

Rep. Maxine Waters (D-CA), the ranking member on the House Financial Services Committee, said she plans to give back the campaign donations she received from the political action committee for Silicon Valley Bank.

Waters: Raising Interest Rates ‘Has Not Been Working’ and May Cause a Recession, But It’s ‘All that We Have’ to Fight Inflation

On Saturday’s broadcast of MSNBC’s “Velshi,” House Financial Services Committee Ranking Member Rep. Maxine Waters (D-CA) stated that raising interest rates to lower inflation “has not been working in the way that it should.” And “it doesn’t look good right now. We may be in for a recession.” But interest rate hikes are “all that we have as a traditional way of containing inflation” and “We don’t have” an answer to lower inflation.

Waters said, “[R]aising interest rates is the traditional way. It is supposedly the intellectual way. It is the way by which you contain inflation. It has not been working in the way that it should. Now, what he did — what Powell did in this last raise was he tried to keep it low to 25 basis points. But, of course, it doesn’t look good right now. We may be in for a recession. And he’s got to do everything that he possibly can. Everybody’s got to weigh in. If there is a better answer, we’ve got to find it. We’ve got to find that answer. We don’t have it now. This is all that we have as a traditional way of containing inflation, is a rise in interest rates. I don’t like it. My constituents don’t like it. Young people who want to buy a house don’t like it because the interest rates are just too high. There are some people, of course, who make money off of rising interest rates, but the average person does not. And so, no, we’re in a point in time in the history of our economics that the answers do not appear to be there, but we’ve got to do everything that we can to bring down inflation and contain the rise in interest rates.”

Follow Ian Hanchett on Twitter @IanHanchett

Nearly $120 Billion of Deposits Were Pulled From Small Banks as Silicon Valley Failed

Customers of small U.S. banks pulled a record $119.9 billion of deposits in the seven days ending March 15, data released by the Federal Reserve showed Friday.

The decline in deposits at small U.S. banks was the largest in records going back to 1973.

That figure is seasonally adjusted. On a not-seasonally adjusted basis, small banks lost $107.8 billion.

Much of those deposits went to large banks. These saw deposits rise by $66.7 billion on a seasonally adjusted basis and $119.8 billion before seasonal adjustment.

On the whole, deposits at commercial banks in the U.S. fell by a seasonally adjusted $98.4 billion, according to the Fed data. Not seasonally adjusted, the decline was $52.8 billion.

The data cover the seven days that ended on Wednesday, March 15.

Large banks are defined as the top 25 domestically chartered commercial banks, ranked by domestic assets. So Silicon Valley Bank, which was the 18th largest bank by assets, would be counted among the large banks that, as a group, gained deposits. In other words, the decline in deposits among small banks does not include deposits that were withdrawn from Silicon Valley Bank.

...... and the 'speech fee' bribes rolled in!

“Attorney General Eric Holder's tenure was a low point even within the disgraceful scandal-ridden Obama years.”

DANIEL GREENFIELD / FRONTPAGE MAG

Silicon Valley Bank Board Included Barack Obama, Hillary Clinton Donors

Harvard Prof., Fmr. IMF Economist Rogoff: Fed, Treasury Support for Bailouts of Billionaire Depositors Will Incentivize Risk, Create Problems

On Wednesday’s broadcast of “PBS NewsHour,” Harvard University Economics Professor and former Chief Economist at the International Monetary Fund Ken Rogoff said that the Federal Reserve and Treasury Department have signaled that they’ll “protect depositors, even ones with billions of dollars they’ve bailed out with Silicon Valley Bank” and this will lead to bankers engaging in more risky behavior and “bigger problems in the future.”

Rogoff stated, “I feel like the Federal Reserve and the Treasury have kind of broadcast that they’re going to protect depositors, even ones with billions of dollars they’ve bailed out with Silicon Valley Bank. I think they’re going to continue that. That has a lot of problems, because bankers will do more risky things. It’s going to lead to bigger problems in the future. But they’ve really telegraphed that. The problem is, the other side of the coin is that everyone’s worried the banks will not be able to lend as much. The regulators are going to be looking harder. They’re going to have to raise deposit rates, and they’ll have [fewer] profits to lend out. So, for the moment, it looks like they’ve contained the panic. But, longer term, bankers do risky stuff, and they certainly aren’t reining that in. And the more they regulate it, the harder it’s going to be to get loans. So, there are certainly problems ahead.”

Follow Ian Hanchett on Twitter @IanHanchett

Dem Rep. Sherman: FDIC Insurance Used to Backstop SVB Depositors Is ‘Not Free’ and ‘Cost Is Passed on to the Depositor’

On Friday’s broadcast of Bloomberg’s “Balance of Power,” Rep. Brad Sherman (D-CA) stated that the FDIC insurance that was used to backstop depositors at Silicon Valley Bank (SVB) and that federal officials have said could be used in the future to backstop depositors “is not free” and “Ultimately, that cost is passed on to the depositor.”

Sherman said that he supports increasing the deposit insurance limit, and “If you’re using the bank as a utility, as a system to pay your bills, then you shouldn’t have to check to see whether that bank is strong or very strong, you should be able to use it as a utility. A million or even higher might be in order. Whereas, if you’re making a million-dollar investment, there’s some onus on you to determine that you’re investing in a sound bank.”

He continued, “The other thing is that FDIC insurance is not free. Ultimately, that cost is passed on to the depositor. If you’re putting — giving your money to the bank on an interest-free basis in a non-interest-bearing account, there’s no way for them to lower the interest rate any lower and so depositors don’t suffer. On the other hand, if you impose this cost on people buying certificates of deposit or other investment accounts, then the bank is going to pass through the cost of the insurance and there’s going to be a real detriment to depositors.”

Follow Ian Hanchett on Twitter @IanHanchett

Treasury secretary Yellen twists to the power of money

As if caught in an ever more powerful vortex, US treasury secretary Janet Yellen was this week wrenched this way and that over the issue of how much support the government and financial authorities should provide to wealthy uninsured bank depositors.

On Tuesday, she told a meeting of bankers the government was ready to extend the bailout of Silicon Valley Bank and Signature Bank depositors, some of them holding tens of millions of dollars in their accounts, to such depositors at other banks if necessary.

This was correctly recognized as an implicit guarantee by the government that it was backing all the money held in the US banking system, a total of more than $17 trillion, and there was “free market” based criticism, most notably from the Wall Street Journal.

The chief concern of the WSJ is not the handing out of money to the rich and super rich per se but what such a guarantee ultimately means for the stability of government finances and US capitalism as a whole if the market cannot do its work in carrying out necessary purges.

In response to this and other criticism, the next day Yellen told a Senate committee that financial authorities were not contemplating “blanket” coverage for deposits above the limit covered by legislation of $250,000.

Wall Street gave Yellen’s remarks the thumbs down. It fell sharply in the last half hour of trading on Wednesday with the Dow dropping more than 500 points.

The treasury secretary, who, like all government officials, attempts to portray herself as a servant of the mass of the population, got the message from the real powers that be.

On Thursday, she reversed course in remarks to a House of Representatives hearing, going back to what she had told the assembled bankers two days before.

“We have used important tools to act quickly to prevent contagion,” she said. “And they are tools we could use again. The strong actions we have taken ensure that Americans’ deposits are safe. Certainly, we would be prepared to take addition actions if warranted.” Following her remarks Wall Street steadied.

To get a grasp of what is involved in the issue of deposit guarantees it is worthwhile probing behind the immediate figures.

Deposits of up to $250,000 are automatically guaranteed by the Federal Deposit Insurance Corporation based on legislation.

The cut off point is well above the amount held by millions of American families who live from pay check to pay check, often having to resort to their credit cards just to make ends meet.

According to official figures, the median balance held by US citizens in their accounts is just $5,300.

Less than half of US households, around four in ten, said they would be able to cover an unexpected expense of $1,000 in January 2022, and that number has probably fallen since then under the impact of continued wage suppression and rising inflation, especially in basic items.

But the wealthy and super-wealthy occupy an entirely different world, and they are demanding it be protected at all costs.

The “Americans” whose deposits Yellen said she was acting to protect are not ordinary workers and their families who have nowhere near $250,000 in their accounts. They are figures such as the venture capitalist Peter Thiel, who disclosed that he had $50 million deposited with the failed SVB even after advocating that others not continue to use it. Perhaps he regarded the millions he left there as loose change.

The back and forth of Yellen on the issue of support for the ultra-wealthy and the financial elites is by no means an isolated incident.

Rather, it is a particular expression of the central policies of the Fed, regulatory authorities and the government. Whatever acknowledgements they may make on occasions about the need for sound public policy, they always return to their key mission—the protection of the financial oligarchy that dominates the economy.

That was seen in 2008 when the speculative, and at times outright criminal, activities of finance capital brought about a meltdown of the financial system. Banks and corporations were bailed out to the tune of hundreds of billions of dollars and the Fed made available trillions of dollars under its quantitative easing (QE) program, enabling the speculation to continue.

The working class was made to pay as the unemployment rate rose to double digits, homes were repossessed and exploitation in the factories intensified often through the widespread adoption of the two-tier wage system and temporary working.

The 2008 bailout, QE, and the rampant speculation which resulted meant that when the pandemic struck in early 2020, the administration refused to implement a policy of elimination, fearing the necessary public health measures would bring about a collapse of the financial house of cards.

Accordingly, the Trump administration, with the support of the Democrats under the leadership of House Speaker Nancy Pelosi, passed the CARES Act, handing out billions to the corporations while providing some minor concessions to the mass of the population to try to assuage social anger.

The Fed stepped up again and in response to the March 2020 market freeze pumped in another $4 trillion, acting as the guarantor for every section of the financial system.

But these measures had consequences.

The refusal to eliminate COVID created a supply chain crisis, sparking a jump in inflation. Price hikes were intensified by the flood of cheap money, profit gouging by food and energy companies, commodity market speculation financed by the essentially free money provided by the Fed and other central banks, and the consequences of the US-led NATO war against Russia in Ukraine.

The eruption of the highest inflation in four decades changed the landscape. Now the Fed was confronted with its greatest fear—the development of an upsurge of the working class and intensification of the class struggle artificially suppressed over the previous three decades and more.

The Fed then made a turn. It started interest rate hikes in March 2022, under the mantra of the need to fight inflation. It is vital to understand the class dynamic at work here for it is the key to understanding the present situation, what is in store, and what must be the response of the working class.

Its measures—the lifting of interest rates from near zero to more than 4.5 percent over a year—have nothing to do with bringing down prices but are directed to suppressing the wages movement of the working class.

This is to be achieved by ending what Fed chair Jerome Powell continually refers to as the “very tight” labour market, through the slowing of the economy, driving up unemployment and inducing a recession if that is considered necessary.

The interest rate hikes have now set in motion a financial crisis, which was exemplified in the collapse of SVB. Flush with money because of the Fed’s QE policies, it placed its funds in Treasury bonds, supposedly the safest financial asset. But as interest rates were hiked, the market value of those bonds fell below their book value.

As long as money kept flowing in this was not a problem. But when money started to flow out, as depositors drew down on their holdings, the bonds had to be sold and the losses realised.

Powell and others have referred to SVB as an “outlier.” But analysis has revealed that its structure is replicated widely. It has been calculated that the market value of bonds held by American banks is down by $1.7 trillion, not far below their capital base of around $2 trillion, essentially wiping it out if these losses had to be realised.

Moreover, small- and medium-sized banks, such as SVB, also hold a major portion of interest rate-sensitive commercial real estate and property development loans, which are being widely predicted as the next shoe to drop.

The development of this crisis has sent a wave of fear through the ultra-rich monied classes. When the problems of SVB surfaced, hedge fund operator Bill Ackman immediately jumped onto Twitter to call for a major intervention, without which the economy could not function properly.

Such reactions reveal that the fabulously wealthy and super-rich have caught a whiff of death as if rising from a grave opening before them.

But does not mean they will somehow advocate reforms—they have none in any case —or their toxic system will simply collapse of its own accord.

Rather, drawing on their long history of repression and violence, their growing fears mean they will implement ever greater attacks on the working class, just as they did after 2008, and demand the continued supply of money from the capitalist state to maintain their world of wealth and privilege at the expense of society.

For the working class, the developing crisis poses a direct challenge. It is confronted with the task of making a new world, one based on social equality. That can only be realised through a political struggle to end the capitalist profit system, thereby opening the way for the establishment of socialism, a challenge which must be met by building the revolutionary party to lead this fight.

Carney on ‘Kudlow’: Janet Yellen Was More Concerned About Climate Change Than Looming Banking Crisis

Treasury Secretary Janet Yellen was more concerned about climate change than the looming risks to our banking system brought on by the rapid rise of interest rates, Breitbart Economics Editor John Carney told Fox Business host Larry Kudlow.

During a panel discussion with Carney on Kudlow’s Friday show, Fox News contributor Liz Peek noted that Yellen was asleep at the switch in the run-up to the current banking crisis.

“Everybody was watching last year as interest rates went up, by the way, [at] the sharpest rate of ascent in modern times,” Peek said. “So, you would think that the regulators—Janet Yellen and that group that she has [of] the financial organizers of our country—would have been watching to see what the impact was on the banks and in particular on the tech sector, which it completely wiped out… It’s offensive that Janet Yellen acts now like she has a plan. She doesn’t have a plan. We know she doesn’t have a plan. But where was she? Where has she been during this period?”

“Well, we know where she’s been,” Carney interjected. “They’ve been sitting there worried about climate change the whole time. Climate change risk all the way. Interest rate risk, the basics of banking—they weren’t paying any attention to.”

“Larry Summers said this—he said instead of worrying about inflation and interest rates, they are worried about climate change. And that’s not the role of central bankers,” Kudlow added.

“By the way, the Financial Stability Oversight Council—which met today, I guess, because they actually realized they have a problem on their hands—in the February meeting, read the readout. It’s available on their website. They were talking about climate. Their ’22 annual report was about climate. I mean, you really can’t make this up. That’s what they were worried about,” Peek noted.

Kudlow also brought up Yellen’s conflicting statements about whether the uninsured depositors of all or only some banks would get a bailout.

“It sounds to me like we will bail out uninsured deposits and every other damn thing,” Kudlow said.

“We almost have to because we’re setting up the expectation,” Carney replied. “It looks very bad if you say, ‘Yeah, we bailed out Silicon Valley Bank, but you other guys, you’re not going to get the bailout’—because then people will start trying to guess who gets a bailout, who doesn’t. You have more banks fail because people flee when they say, ‘Oh, I’m in the bank that doesn’t get it.’”

Carney highlighted an observation the economist Anna Schwartz made about the destabilizing role uncertainty played in the 2008 financial crisis. Schwartz and fellow economist Milton Friedman co-authored the influential 1963 book A Monetary History of the United States, 1867–1960, which argued that the Federal Reserve’s changing monetary policies played a large role in causing the Great Depression.

“Back in 2008, my brother Brian did an interview with Anna Schwartz, who is a co-author of the book on the Great Depression with Milton Friedman,” Carney said. “One of the things she said was that we were doing things wrong in 2008 because we weren’t following a set rulebook, and we were just doing everything ad hoc. If you do it like that, nobody knows the rules of the road. That creates more instability rather than less.”

Pivoting from the banking crisis, Kudlow asked Carney about the Federal Reserve’s prediction that the economy would contract this year, which, as he noted, was the topic of Thursday’s Breitbart Business Digest.

“If you look at where the Fed thinks growth is going to be this year—full year—it’s 0.4 percent, down a little bit from back in December,” Carney explained. “So, if we’re growing at 2 percent now, we’re probably going to be growing more than one percent in the second quarter… How do you get it all the way down to 0.4? You have to have a pretty steep contraction in the third or fourth quarter. The Fed—they hate to say that. They don’t want to admit it. But that is what those numbers mean. They’re saying we’re predicting a very steep downturn in the second half of this year.”

As Carney noted in Friday’s Breitbart Business Digest:

There are plenty of reasons why Fed officials do not want to forecast a recession. For one thing, [Federal Reserve] Chairman Jerome Powell still maintains that there exists “a path” to a soft landing. For another, the Fed is hesitant to appear to be rooting for a recession and the hardships recessions bring. By admitting that its policy choices are consistent with a recession, the Fed would be confessing to causing one.

Peek agreed with Carney’s analysis and predicted that Powell will pause his rate hiking and abandon his two percent inflation target in the face of a recession.

“We’re going to enter a slowdown,” Peek said. “The political heat on Jay Powell is going to be scorching, and he’s going to change the target by the end of the year… It is two percent. My guess is we’ll start hearing, well, three is pretty reasonable, 3.2, 3.5, which is kind of what the Fed is expecting by the end of the year. They’re not going to go to two percent.”

Changing the target is a “terrible idea,” Carney said. “If the Fed does back off of the two percent target, which they will feel pressured to, I think that’s going to be a disaster because how do you trust the three percent target? Or the four percent target?”

Kudlow offered a succinct history of the last time the nation faced an inflation crisis and how we got out of it—a topic of which he has personal knowledge from his days serving in the Reagan administration.

“This is where I came in professionally in the 1970s because we were always going to ‘Whip Inflation Now,’ but we never did,” he said. “And then the peaks got higher and the troughs got higher, until a guy named Paul Volcker came and just slayed the monster altogether, and we started from scratch, which I might add, with Reagan’s tax cuts, gave us three decades of prosperity.”

Unfortunately, Peek predicted that Powell would not have the same fortitude as his predecessor Paul Volcker, and the pressures of an election year recession might prove too much for him to withstand.

“Jay Powell is proven to be, I think, a very political animal,” Peek said. “Look at already [Massachusetts Democratic Senator] Elizabeth Warren and a lot of senators are coming out and saying, ‘Oh, we can’t raise rates anymore. This is harsh. This is going to lead to unemployment.’ Yes, that’s what Jay Powell has said he wants to do. It’s unacceptable for the Democratic Party trying to keep the Oval Office next year.”

Bank Bailouts and the Chaotic Consequences of Redefining Rules

Referees aren’t supposed to change the rules in the middle of the game, but that’s exactly what federal government officials like Treasury Secretary Janet Yellen have been doing in financial markets over the last two weeks.

The result is a chaotic mess wherein no one knows what the rules will be tomorrow and no one can plan for the future. What is allegedly a highly regulated sector of the economy feels more like a roll of the dice lately. The economy needs stable banks, which requires stable rules.

Silicon Valley Bank’s collapse earlier this month is the second-largest bank failure in American history, and the federal government’s response has been inconsistent at best.

Regulators previously declared the bank not to be a systemic risk to the banking system, meaning the bank’s potential failure would not pose a threat to the rest of the banking system. Yet when it was clear Silicon Valley Bank would fail, the rules changed and the bank was declared a systemic risk.

On that basis, the Department of the Treasury and the Federal Reserve stepped in to prevent the bank’s liquidation. But they decided to change yet another rule in the process—deposit insurance.

Bank customers’ deposits are ordinarily insured by the Federal Deposit Insurance Corp. up to $250,000, and private insurance is available for additional coverage beyond that. Silicon Valley Bank’s customers chose not to avail themselves of that protection, however, despite over 96% of the bank’s depositors having cash at the bank in excess of the $250,000 FDIC guarantee.

To prevent those large depositors from losing any of their money, the Treasury and the Fed decided to guarantee all deposits at Silicon Valley Bank, despite the fact that the FDIC clearly does not offer unlimited deposit coverage. Millionaires who had their money at the bank are now receiving the benefit of insurance even though they never paid for it.

Imagine a person who could buy flood insurance for his home but chooses not to do so and then the home is destroyed in a flood. That person is not entitled to a bailout from the government—at taxpayer expense.

This unprecedented expansion of FDIC coverage was followed by statements from the Biden administration that Americans could rest assured that all deposits are safe.

But the rules were about to change again. Yellen was asked during her Senate testimony a few days ago whether all depositors at regional banks, like Silicon Valley Bank, are covered by the recent change in the rules regarding the FDIC. Shockingly, Yellen said no.

Only deposits at banks deemed systemically important could be guaranteed coverage, regardless of the size of the deposit. Which regional banks are systemically important? Yellen couldn’t say—that determination would be made on a case-by-case basis going forward. She reiterated this vague canon on Tuesday when she told the American Bankers Association, “Similar actions could be warranted if smaller institutions suffer deposit runs that pose the risk of contagion.” That’s hardly black and white.

Not only have the rules changed again, but now the referees can’t even clearly articulate them. The result has been a flood of large deposits fleeing smaller banks for larger banks that have already been declared systemic risks requiring government support. That cash drain from the smaller banks could put them at risk and precipitate even more problems in the already-troubled banking sector.

One of the reasons for these troubles is because banks are holding so many low-interest rate bonds. But that situation is itself a result of the federal government changing the rules of the game. When the Fed kept interest rates too low for too long in order to finance trillions of dollars in government deficit spending, the yield on bonds plummeted, and the banks buying those bonds took on tremendous interest rate risk.

Those banks were encouraged to continue that behavior because the Fed continued offering forward guidance that rates would remain low and that inflation was transitory. But that narrative changed one year ago, in March 2022, and interest rates began to rise. Just a few months after that initial rate hike, Fed Chair Jerome Powell said a larger 75-basis-point hike was “off the table,” and the Fed promptly followed that pronouncement by delivering four such rate hikes in a row.

It’s no fun if a party host randomly changes the rules of a game when everyone is in the middle of playing. But at least the trouble ends there. When the government changes the rules of banking without warning, the results can be financial disaster that cascades through the economy for years to come.

“Attorney General Eric Holder's tenure was a low point even within the disgraceful scandal-ridden Obama years.”

DANIEL GREENFIELD / FRONTPAGE MAG

Silicon Valley Bank Board Included Barack Obama, Hillary Clinton Donors

David McNew/Getty Images Several Silicon Valley Bank (SVB) board of directors have donated thousands of dollars or have direct ties to prominent Democrat politicians like Hillary Clinton, former President Barack Obama, and Rep. Nancy Pelosi (D-CA).

CUT AND PASTE YOUTUBE LINKS

Several Silicon Valley Bank (SVB) board of directors have donated thousands of dollars or have direct ties to prominent Democrat politicians like Hillary Clinton, former President Barack Obama, and Rep. Nancy Pelosi (D-CA).

CUT AND PASTE YOUTUBE LINKS

Failed bank's board revealed to be packed with Democrats

AREN'T THEY ALL?

“This was not because of difficulties in securing indictments or

convictions. On the contrary, Attorney General Eric Holder

told a Senate committee in March of 2013 that the Obama

administration chose not to prosecute the big banks or their

CEOs because to do so might “have a negative impact on the

national economy.” AS THEY LOOTED TRILLIONS FROM

THE ECONOMY AND THEN PASSED ALONG SOME OF THE

LOOT IN THE FORM OF 'SPEECH FEE' BRIBES!

During his presidency, Obama bragged that his administration was “the only thing between [Wall Street] and the pitchforks.”

In fact, Obama handed the robber barons and outright criminals responsible for the 2008–09 financial crisis a multi-trillion-dollar bailout. His administration oversaw the largest redistribution of wealth in history from the bottom to the top one percent, spearheading the attack on the living standards of teachers and autoworkers.

The Republican staff of the US House Committee on Financial Services released a report Monday presenting its findings on why the Obama Justice Department and then-Attorney General Eric Holder chose not to prosecute the British-based HSBC bank for laundering billions of dollars for Mexican and Colombian drug cartels.

“This was not because of difficulties in securing indictments or convictions. On the contrary, Attorney General Eric Holder told a Senate committee in March of 2013 that the Obama administration chose not to prosecute the big banks or their CEOs because to do so might “have a negative impact on the national economy.”

As for the release of Democratic Party emails, even if one accepts the unsubstantiated claim that it was Russian operatives who turned them over to WikiLeaks, what the emails revealed were true facts about the operations of Clinton and the Democratic National Committee (DNC)—facts that the electorate had every right to know. Among the documents released were Clinton’s speeches to Goldman Sachs and other banks, for which she was paid hundreds of thousands of dollars. Other leaked emails exposed the corrupt efforts of the DNC to rig the primaries against Bernie Sanders.

Janet Yellen Raked in $7.2M from Wall Street, Corporations Since 2019

President-elect Joe Biden’s nominee to head the Treasury Department, Janet Yellen, raked in millions from Wall Street firms and multinational corporations for “speaking fees” over just the past two years, financial disclosure reports reveal.

Between 2019 to 2020, Yellen accepted more than $7.2 million from Wall Street firms and big banks like Citibank, Bank of America, Citadel, Barclays, ING, UBS, and Goldman Sachs, as well as multinational corporations like Deloitte, Google, Salesforce, and HSM.

Yellen, former Federal Reserve chair for President Barack Obama, took nearly $1 million to give nine speeches to Citibank — which is one of the largest banks in the United States. Likewise, Yellen accepted more than $800,000 from the hedge fund Citadel.

Yellen’s speaking fees from Wall Street firms and corporations range anywhere between $17,100 to nearly $300,000, according to the financial disclosures. Her latest paid speeches came in November 2020 when she cashed in $67,500 in fees from Deloitte, $72,000 from Daiwa Securities Group, and $45,000 from Magellan Financial Group.

Biden tapped Yellen as his nominee to lead the Treasury Department where she would become the first woman to lead the agency if confirmed by the U.S. Senate. Glenn Greenwald, an independent journalist, called Democrats “a neoliberal party” that “hide” behind diversity to avoid questions regarding cronyism.

“The Dems are a neoliberal party which serves Wall St & corporate power,” Greenwald wrote on Twitter. “They are overwhelmingly led by extremely rich people who serve these power centers. Touting diversity is how they try to hide that, and bad faith bigotry accusations are how they punish those who report it.”

Nolte: Bribes and Payoffs Disguised as ‘Speaking Fees’ for Treasury Secretary Janet Yellen

Janet Yellen, the former chairwoman of the Federal Reserve who is now His Fraudulency Joe Biden’s Treasury Secretary, made millions off Wall Street “speaking fees” over the past two years.

In some cases, she didn’t even have to show up to speak. Her appearance was “virtual.”

In just two years, according to the Wall Street Journal, Yellen pulled in “more than $7 million in speaking fees during more than 50 in-person and virtual engagements … according to financial disclosures[.]”

The far-left Politico adds:

Yellen listed $952,200 in income from speeches to Citi, one of the nation’s largest banks. She also disclosed speaking fees from PIMCO, Barclays (BCS), Citadel, BNP Paribas, UBS (UBS), Credit Suisse (CS), ING, Standard Chartered Bank and City National Bank.

Nearly a million bucks … from one bank!

Fox Business reports:

Other companies shelling out big bucks for Yellen’s words of wisdom have included Goldman Sachs, Google, City National Bank, UBS, Citadel LLC, Barclays and Salesforce, according to the report.

So when the White House was asked this week if Yellen’s speaking fees have created a painfully obvious conflict of interest as it relates to this Gamestop/Robinhood/Reddit story, Press Secretary Lyin’ Ginger sputtered:

I don’t have anything further for you on it, except for to say, separate from this Gamestop issue, the Treasury Secretary is a world-renowned expert on the economy.

It should not be a surprise to anyone that she was paid to give her expert advice before she came into office.

Oh, well, that certainly puts the issue to rest!

I mean the fact that (as Real Clear Politics perfectly summarized it) “Citadel, the firm that bailed out the first hedge fund to be bankrupted by the crowd-sourced stock-buying bonanza this week, has paid Yellen more than $800,000 in speaking fees in recent years,” is nothing to be concerned about! Not even as we watch a countless number of everyday retail investors getting shut down in an effort to protect Yellen’s billionaire pals at Citadel and elsewhere.

If you want a look at how this grift works, Jack Posobiec tweeted out a bare bones list of Yellen’s Wall Street speaking fees, and this simple list is more striking than any newspaper write-up. The numbers are outrageous. Why would anyone drop hundreds of thousands of dollars to have some former fed chair come in to tell tired war stories and do some punditry?

What I mean by that is: What’s the benefit to the financial firm shelling out all this money (plus airfare and fancy accommodations)?

Even more, what’s the benefit if she appears virtually from her kitchen at home?

Does the presence of a 74-year-old former-Fed Chair bring these financial firms more customers? Does the prestige and star power of such an appearance increase the firm’s client list?

Of course not.

You wouldn’t walk across the street to see Janet Yellen for free, even if free lunch was served.

So what does this tell us about these speaking fees?

Sorry, but these speaking fees are nothing more than America’s elites figuring out a way to legalize bribes and payoffs. That’s it. That’s all that’s going on here.

While it may not be legal for me to hand you an envelope full of cash, it’s perfectly legal for me to fly you out in a private plane (or first class), put you up in a suite, wine you and dine you, and then hand you a gazillion dollar check for an hour’s work because wink-wink-nod-nod-knowwhatImean-knowwhatImean?

We see the same thing all the time with book advances.

Some pol is paid an exorbitant amount of money to write a ghost-written book no one reads…

Get this…

In 2014, Gov. Andrew “Grandma Slayer” Cuomo (D-NY) was paid a $783,000 advance by Harper Collins to write his memoirs, which sold exactly 3,800 total copies. Harper Collins lost a fortune.

So why did the company do it?

Why would a publisher be willing to take a beating like that?

Gee, could it be that Harper Collins is New York-based and Cuomo is New York’s governor and this was a legal way to funnel him close to a million dollars in the form of legalized graft?

It gets worse…

Cuomo has so far refused to disclose how much Penguin Random House paid for his 2020 book American Crisis: Leadership Lessons from the COVID-19 Pandemic last year, but what we do know is that another major publisher gave this proven-failure of an author a second money grab.

The whole system is rigged, y’all.

The political media, the politicians, the government, and the financial media all attack who? The robber barons in these hedge funds who organize to make billions by destroying a company? No, they illegally shut down and smear the everyday guys on Reddit who had the temerity to play the same game and win.

Funnel a few million to Yellen, give CNNLOL and CNBC some nifty stock tips… That’s all it costs Wall Street to protect its billions and destroy the Reddit barbarians, whose only sin is outsmarting you.

And it’s all legal.

Rigged. Rigged. Rigged.

Follow John Nolte on Twitter @NolteNC. Follow his Facebook Page here.

GOP Rep. Steube: Yellen Getting Speaking Fees from Banks She’ll Decide on Bailouts for Is ‘Corruption’ ‘Beyond the Pale’

On Tuesday’s broadcast of the Fox Business Network’s “Evening Edit,” Rep. Greg Steube (R-FL) stated that there is a “level of corruption in Washington” that “is beyond the pale” and cited Treasury Secretary Janet Yellen received $7 million in speaking fees before she took the office, including from major financial institutions “that she’s going to decide to bail out.”

Host Elizabeth MacDonald asked, [relevant exchange begins around 2:15] “I’ve been covering bank crises since the ’80s, S&L crisis, then Long-Term Capital Management, then the 2007 — the dotcom bust, they did corporate accounting scandals, then in 2007-2008, Congressman, nobody ever said back up uninsured deposits ever. This is because of a few banks that made bad bets, and all of a sudden, the Biden White House gets to change the rules that have been the gold standard forever, when even FDR said do not insure bank deposits, bankers will roll the dice and ruin things. So, where do you go from here, Congressman, will you guys try to stop this push that’s now — it’s moving, that could happen? What do you think?”

Steube responded, “Well, we will absolutely, in the House and Chair McHenry (R-NC), we were all together, the caucus was together in Orlando today. And he said he doesn’t support bank bailouts. He didn’t support it before. He doesn’t support it now. That’s the Chairman of the Financial Services Committee. You’re not going to not see the Republicans support that at all. And what I find very interesting is Yellen herself got millions of dollars, $7 million in speaking fees before where she’s at now from some of the banks that she’s going to decide to bail out. The level of corruption in Washington is beyond the pale.”

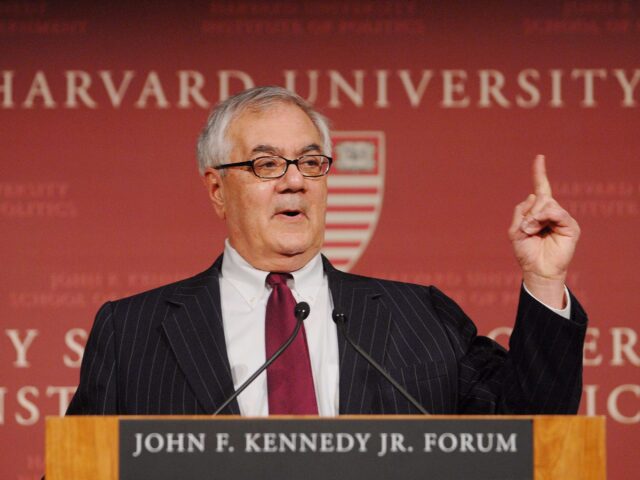

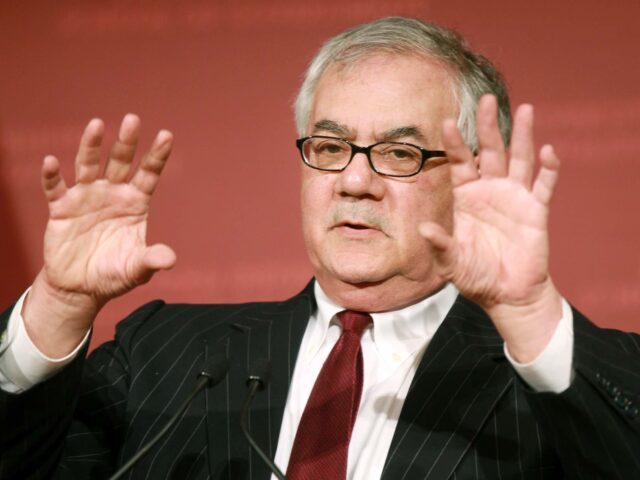

Summers: First Republic Bank Rescue Package Seems ‘Corporatist and Deal-Based Between the Government and Big Banks’

1:32 During an interview aired on Friday’s broadcast of Bloomberg’s “Wall Street Week,” Harvard Professor, economist, Director of the National Economic Council under President Barack Obama, and Treasury Secretary under President Bill Clinton Larry Summers stated that the rescue package for First Republic Bank “was not an objective private sector assessment to have confidence in First Republic.” And “seemed a little corporatist and deal-based between the government and big banks to me.”

Summers said, “It was JPMorgan and a number of other banks who were apparently corralled by the secretary and by JPMorgan. I don’t know what to make of it. The government has committed to put money in there at par above the market value of securities for a year. The fact that the banks made a commitment for 120 days so they can get out well ahead of the government at an interest rate that we don’t yet know what it is, with what the understandings in the agreement with the Treasury are. I suppose the fact that everybody’s acting will make people a little more confident. But it made me nervous. This was not an objective private sector assessment to have confidence in First Republic. So, I’m not sure what to make of it. It seemed a little corporatist and deal-based between the government and big banks to me. But we’ll have to see how it unfolds. And I hope there will be total transparency on all the understandings.”

Follow Ian Hanchett on Twitter @IanHanchett

During an interview aired on Friday’s broadcast of Bloomberg’s “Wall Street Week,” Harvard Professor, economist, Director of the National Economic Council under President Barack Obama, and Treasury Secretary under President Bill Clinton Larry Summers stated that the rescue package for First Republic Bank “was not an objective private sector assessment to have confidence in First Republic.” And “seemed a little corporatist and deal-based between the government and big banks to me.”

Summers said, “It was JPMorgan and a number of other banks who were apparently corralled by the secretary and by JPMorgan. I don’t know what to make of it. The government has committed to put money in there at par above the market value of securities for a year. The fact that the banks made a commitment for 120 days so they can get out well ahead of the government at an interest rate that we don’t yet know what it is, with what the understandings in the agreement with the Treasury are. I suppose the fact that everybody’s acting will make people a little more confident. But it made me nervous. This was not an objective private sector assessment to have confidence in First Republic. So, I’m not sure what to make of it. It seemed a little corporatist and deal-based between the government and big banks to me. But we’ll have to see how it unfolds. And I hope there will be total transparency on all the understandings.”

Follow Ian Hanchett on Twitter @IanHanchett

Here Are the Tech Companies, Liberal Media Outlets, and Prominent Democrats Saved by Biden's Bank Bailout

Getty Images Prominent tech companies, liberal news outlets, and a Democratic politician’s vineyards are among the thousands of businesses that breathed a sigh of relief on Sunday when the Biden administration moved to bail out Silicon Valley Bank.

Silicon Valley Bank maintained $209 billion in assets and $175.4 billion in total deposits, making it the 16th-largest bank in the country. It was the second-largest bank to fail in American history when the Federal Deposit Insurance Corporation took control of the institution on Friday.

President Joe Biden has insisted that the FDIC's move was not a bailout, and claimed his administration is working to protect "American workers and small businesses." But average Americans won't benefit the most from the bailout. Ninety-three percent of the bank’s depositors kept more than $250,000 in the bank.

While the California bank was famous for its rolodex of tech clients, it happily accepted deposits from all manner of people, including some of the individuals and institutions involved in pushing the Biden administration’s bailout.

Here are just a few.

Gavin Newson

California Gov. Gavin Newsom’s (D.) trio of wineries are clients of the failed financial institution, as is the governor himself. He has maintained personal accounts at the failed bank for years, the Intercept reported, citing a former Newsom aide. Newsom’s efforts to rescue Silicon Valley Bank’s clients could also put him on the wrong side of the law. California law prohibits elected officials from influencing official matters in which "the official has a financial interest," Insider reported.

Newsom was instrumental in convincing Biden over the weekend that a bailout of the failing bank was necessary. He was also one of the first politicians nationwide to hail the president’s swift move on Sunday to make all of Silicon Valley Bank’s clients whole. Newsom was one of many high-profile Democrats who received money from Silicon Valley Bank, whose employees have also given tens of thousands of dollars to Democratic candidates and causes.

The emotional toll Newsom may have faced had his wineries failed amid Silicon Valley Bank’s implosion would have likely been equally as devastating as the impact on his bottom line. He refused to sell his businesses when he first ran for governor in 2018, saying: "These are my babies, my life, my family. I can’t do that. I can’t sell them."

BuzzFeed

Liberal online media company BuzzFeed revealed to investors Monday that it held $56 million in cash and cash equivalents as of the end of 2022, the majority of which was held at Silicon Valley Bank. The news capped off a not-so-banner 2022 fiscal year for BuzzFeed, in which the company weathered a net loss of $201.3 million, laid off 40 percent of its newsroom, and saw its stock price plummet by 90 percent.

BuzzFeed has placed little focus on the bank’s collapse, having mentioned the story in its morning newsletter, a quiz published Wednesday, as well as a passing reference in a Tuesday story about a "viral alpha male finance podcast parody sketch." None of the stories mentioned BuzzFeed’s financial connection to the bank.

As part of its efforts to right its ship, BuzzFeed announced it would leverage artificial intelligence to spin up viral listicles and quizzes. BuzzFeed News editor in chief Karolina Waclawiak also told the company’s remaining editorial staffers at a recent meeting to shift away from long-form news reporting and prioritize click-bait celebrity news, the Wall Street Journal reported.

Vox Media

Vox Media, the parent company of dozens of liberal news companies including Vox, New York magazine, the Verge, and Polygon, disclosed in news stories that it banked with Silicon Valley Bank before its collapse.

Unlike BuzzFeed, Vox has disclosed its financial connection to the failed bank in news stories this week. That hasn’t stopped the outlet, however, from carrying water for the Biden administration. On Tuesday, for example, it published a story mocking concerns that Silicon Valley Bank’s fixation on woke initiatives may have contributed to its demise.

Vox spokeswoman Lauren Starke told the Washington Post that the company doesn’t anticipate "any significant impact" due to the bank’s failure but added that it has suffered "logistical issues such as the temporary suspension of accounts and company credit cards."

In a Monday piece on Silicon Valley Bank’s collapse, Vox competitor the Dispatch parenthetically disclosed it had been a Silicon Valley Bank customer.

Black Lives Matter

While Black Lives Matter isn’t a known client of Silicon Valley Bank, the bank’s untimely failure marks the end of a significant gravy train for the movement.

Silicon Valley Bank and its employees contributed more than $73 million to the Black Lives Matter movement and related causes since 2020, according to a database maintained by the Claremont Institute.

The Green Energy Racket

Silicon Valley Bank’s failure could have delivered a seismic blow to the climate change industry and the more than 1,550 technology companies that specialize in solar, hydrogen, and battery storage solutions that held funds at the bank, had Biden not bailed the institution out.

Still, the bank’s failure will have lingering effects for the industry, with insiders warning that Silicon Valley Bank was often the only institution willing to lend funds for their projects.

"Silicon Valley Bank was in many ways a climate bank," Kiran Bhatraju, the chief executive of the nation’s largest community solar manager, Arcadia, told the New York Times. "When you have the majority of the market banking through one institution, there’s going to be a lot of collateral damage."

Wedbush Securities technology sector analyst David Ives added that the bank’s failure is a "major blow to early-stage and even late-stage tech startups."

Silicon Valley Bank "was the bank that would always pick up the phone when other large money center banks wouldn’t," Ives told Politico.

HA, HA, HA! - LOTS OF LAUGHS! WATCH IT NOT HAPPEN!

Prominent tech companies, liberal news outlets, and a Democratic politician’s vineyards are among the thousands of businesses that breathed a sigh of relief on Sunday when the Biden administration moved to bail out Silicon Valley Bank.

Silicon Valley Bank maintained $209 billion in assets and $175.4 billion in total deposits, making it the 16th-largest bank in the country. It was the second-largest bank to fail in American history when the Federal Deposit Insurance Corporation took control of the institution on Friday.

President Joe Biden has insisted that the FDIC's move was not a bailout, and claimed his administration is working to protect "American workers and small businesses." But average Americans won't benefit the most from the bailout. Ninety-three percent of the bank’s depositors kept more than $250,000 in the bank.

While the California bank was famous for its rolodex of tech clients, it happily accepted deposits from all manner of people, including some of the individuals and institutions involved in pushing the Biden administration’s bailout.

Here are just a few.

Gavin Newson

California Gov. Gavin Newsom’s (D.) trio of wineries are clients of the failed financial institution, as is the governor himself. He has maintained personal accounts at the failed bank for years, the Intercept reported, citing a former Newsom aide. Newsom’s efforts to rescue Silicon Valley Bank’s clients could also put him on the wrong side of the law. California law prohibits elected officials from influencing official matters in which "the official has a financial interest," Insider reported.

Newsom was instrumental in convincing Biden over the weekend that a bailout of the failing bank was necessary. He was also one of the first politicians nationwide to hail the president’s swift move on Sunday to make all of Silicon Valley Bank’s clients whole. Newsom was one of many high-profile Democrats who received money from Silicon Valley Bank, whose employees have also given tens of thousands of dollars to Democratic candidates and causes.

The emotional toll Newsom may have faced had his wineries failed amid Silicon Valley Bank’s implosion would have likely been equally as devastating as the impact on his bottom line. He refused to sell his businesses when he first ran for governor in 2018, saying: "These are my babies, my life, my family. I can’t do that. I can’t sell them."

BuzzFeed

Liberal online media company BuzzFeed revealed to investors Monday that it held $56 million in cash and cash equivalents as of the end of 2022, the majority of which was held at Silicon Valley Bank. The news capped off a not-so-banner 2022 fiscal year for BuzzFeed, in which the company weathered a net loss of $201.3 million, laid off 40 percent of its newsroom, and saw its stock price plummet by 90 percent.

BuzzFeed has placed little focus on the bank’s collapse, having mentioned the story in its morning newsletter, a quiz published Wednesday, as well as a passing reference in a Tuesday story about a "viral alpha male finance podcast parody sketch." None of the stories mentioned BuzzFeed’s financial connection to the bank.

As part of its efforts to right its ship, BuzzFeed announced it would leverage artificial intelligence to spin up viral listicles and quizzes. BuzzFeed News editor in chief Karolina Waclawiak also told the company’s remaining editorial staffers at a recent meeting to shift away from long-form news reporting and prioritize click-bait celebrity news, the Wall Street Journal reported.

Vox Media

Vox Media, the parent company of dozens of liberal news companies including Vox, New York magazine, the Verge, and Polygon, disclosed in news stories that it banked with Silicon Valley Bank before its collapse.

Unlike BuzzFeed, Vox has disclosed its financial connection to the failed bank in news stories this week. That hasn’t stopped the outlet, however, from carrying water for the Biden administration. On Tuesday, for example, it published a story mocking concerns that Silicon Valley Bank’s fixation on woke initiatives may have contributed to its demise.

Vox spokeswoman Lauren Starke told the Washington Post that the company doesn’t anticipate "any significant impact" due to the bank’s failure but added that it has suffered "logistical issues such as the temporary suspension of accounts and company credit cards."

In a Monday piece on Silicon Valley Bank’s collapse, Vox competitor the Dispatch parenthetically disclosed it had been a Silicon Valley Bank customer.

Black Lives Matter

While Black Lives Matter isn’t a known client of Silicon Valley Bank, the bank’s untimely failure marks the end of a significant gravy train for the movement.

Silicon Valley Bank and its employees contributed more than $73 million to the Black Lives Matter movement and related causes since 2020, according to a database maintained by the Claremont Institute.

The Green Energy Racket

Silicon Valley Bank’s failure could have delivered a seismic blow to the climate change industry and the more than 1,550 technology companies that specialize in solar, hydrogen, and battery storage solutions that held funds at the bank, had Biden not bailed the institution out.

Still, the bank’s failure will have lingering effects for the industry, with insiders warning that Silicon Valley Bank was often the only institution willing to lend funds for their projects.

"Silicon Valley Bank was in many ways a climate bank," Kiran Bhatraju, the chief executive of the nation’s largest community solar manager, Arcadia, told the New York Times. "When you have the majority of the market banking through one institution, there’s going to be a lot of collateral damage."

Wedbush Securities technology sector analyst David Ives added that the bank’s failure is a "major blow to early-stage and even late-stage tech startups."

Silicon Valley Bank "was the bank that would always pick up the phone when other large money center banks wouldn’t," Ives told Politico.

HA, HA, HA! - LOTS OF LAUGHS! WATCH IT NOT HAPPEN!

DNC, Joe Biden Will Return Campaign Donations Tied to SVB

Justin Sullivan/SAUL LOEB/AFP via Getty Images The Democratic National Committee (DNC) and President Joe Biden’s presidential campaign stated they would return political donations tied to the collapsed Silicon Valley Bank on Friday, according to USA Today.

The DNC told the publication that the money would be returned following last week’s bank collapse. The announcement was made the same day the bank’s parent company, SVB Financial Group, filed for Chapter 11 protection in New York bankruptcy court.

A spokesperson from the DNC told USA Today that Biden’s 2020 presidential campaign and the DNC would donate the contributions from 2020 or later from SVB CEO Greg Becker and the bank’s managing director, Gerald Brady.

USA Today reported that Biden’s presidential campaign and aligned PACs received at least $11,900 from SVB executives, including Brady, and the former brand ambassador and head of startup banking, who took over one of Brady’s roles running a division of the bank, Claire Lee. Additionally, the DNC took at least $32,250 over the years from Brady, Lee, and other former SVB executives.

The report also noted that Becker donated $2,800 to Biden’s campaign, and Brady donated $5,500. Brady also gave $12,050 to the DNC. Reportedly, Biden’s presidential campaign will return $8,400, and the DNC will return $12,050.

Last week, Silicon Valley Bank collapsed when panicked customers suddenly withdrew tens of billions of dollars after it announced a loss of approximately $1.8 billion from selling its investments in U.S. treasuries and mortgage-backed securities. Ultimately, regulators shut Silicon Valley Bank down, and the Federal Deposit Insurance Corporation (FDIC) took control of the bank and said they would protect insured deposits.

On Sunday, the U.S. Treasury, the Federal Reserve, and the FDIC announced that they would be taking “decisive actions to protect the U.S. economy by strengthening public confidence in [the U.S.] banking system” by effectively making deposits above the FDIC’s $250,000 limit available this past Monday. The bank failed to be auctioned off last weekend after none of the largest U.S. banks bid, but there is supposed to be another attempt at auctioning the bank off on Friday, according to multiple reports.

Jacob Bliss is a reporter for Breitbart News. Write to him at jbliss@breitbart.com or follow him on Twitter @JacobMBliss.

The Democratic National Committee (DNC) and President Joe Biden’s presidential campaign stated they would return political donations tied to the collapsed Silicon Valley Bank on Friday, according to USA Today.

The DNC told the publication that the money would be returned following last week’s bank collapse. The announcement was made the same day the bank’s parent company, SVB Financial Group, filed for Chapter 11 protection in New York bankruptcy court.

A spokesperson from the DNC told USA Today that Biden’s 2020 presidential campaign and the DNC would donate the contributions from 2020 or later from SVB CEO Greg Becker and the bank’s managing director, Gerald Brady.

USA Today reported that Biden’s presidential campaign and aligned PACs received at least $11,900 from SVB executives, including Brady, and the former brand ambassador and head of startup banking, who took over one of Brady’s roles running a division of the bank, Claire Lee. Additionally, the DNC took at least $32,250 over the years from Brady, Lee, and other former SVB executives.

The report also noted that Becker donated $2,800 to Biden’s campaign, and Brady donated $5,500. Brady also gave $12,050 to the DNC. Reportedly, Biden’s presidential campaign will return $8,400, and the DNC will return $12,050.

Last week, Silicon Valley Bank collapsed when panicked customers suddenly withdrew tens of billions of dollars after it announced a loss of approximately $1.8 billion from selling its investments in U.S. treasuries and mortgage-backed securities. Ultimately, regulators shut Silicon Valley Bank down, and the Federal Deposit Insurance Corporation (FDIC) took control of the bank and said they would protect insured deposits.

On Sunday, the U.S. Treasury, the Federal Reserve, and the FDIC announced that they would be taking “decisive actions to protect the U.S. economy by strengthening public confidence in [the U.S.] banking system” by effectively making deposits above the FDIC’s $250,000 limit available this past Monday. The bank failed to be auctioned off last weekend after none of the largest U.S. banks bid, but there is supposed to be another attempt at auctioning the bank off on Friday, according to multiple reports.

Jacob Bliss is a reporter for Breitbart News. Write to him at jbliss@breitbart.com or follow him on Twitter @JacobMBliss.

Failed bank's board revealed to be packed with Democrats

Maxine Waters Unfit to Chair House Financial Services Committee

Considering her record and documented history of poor ethical and moral fitness, it’s outrageous that Maxine Waters is up for chair of the ultra-powerful House Financial Services Committee, which has jurisdiction over the country’s banking system, economy, housing, and insurance.

Judicial Watch investigated the scandal and obtained documents from the U.S. Treasury related to the controversial bailout. The famously remiss House Ethics Committee, which is charged with investigating and punishing corrupt lawmakers like Waters, found that she committed no wrongdoing. The panel bought Waters’ absurd story that she allocated the money as part of her longtime work to promote opportunity for minority-owned businesses and lending in underserved communities even though her husband’s bank was located thousands of miles away from the south Los Angeles neighborhoods she represents in Congress.

HA, HA, HA! - LOTS OF LAUGHS! WATCH IT NOT HAPPEN!

Maxine Waters Plans to Return Donations from Collapsed Silicon Valley Bank’s PAC

Considering her record and documented history of poor ethical and moral fitness, it’s outrageous that Maxine Waters is up for chair of the ultra-powerful House Financial Services Committee, which has jurisdiction over the country’s banking system, economy, housing, and insurance.

Judicial Watch investigated the scandal and obtained documents from the U.S. Treasury related to the controversial bailout. The famously remiss House Ethics Committee, which is charged with investigating and punishing corrupt lawmakers like Waters, found that she committed no wrongdoing. The panel bought Waters’ absurd story that she allocated the money as part of her longtime work to promote opportunity for minority-owned businesses and lending in underserved communities even though her husband’s bank was located thousands of miles away from the south Los Angeles neighborhoods she represents in Congress.

HA, HA, HA! - LOTS OF LAUGHS! WATCH IT NOT HAPPEN!

Maxine Waters Plans to Return Donations from Collapsed Silicon Valley Bank’s PAC

AP Photo/Evan Vucci Rep. Maxine Waters (D-CA), the ranking member on the House Financial Services Committee, said she plans to give back the campaign donations she received from the political action committee for Silicon Valley Bank.

Following the bank’s collapse last week, Waters said she would return the $2,500 from the bank’s PAC she took in late 2020 when she was chair of the Financial Services Committee in the Democrat majority.

“Yes, I will send it back,” she told Politico on Tuesday. “Everybody knows I have an open-door policy.”

A pedestrian passes a Silicon Valley Bank branch in San Francisco, Monday, March 13, 2023. As the primary regulator of the bank, the Federal Reserve is coming under sharp criticism from financial watchdogs and banking experts. (AP Photo/Jeff Chiu)

The congresswoman’s decision comes after some initial political blowback happened over the weekend with the bank’s collapse after federal investigators had reportedly decided to open a probe into the bank’s failure.

Waters told Politico that she recalled talking to someone from the bank around 2020 about FinTech but did not remember many details.

DOJ is on the Silicon Valley Bank case as many had been expecting. Story with @ktbenner https://t.co/ZZp10Sj5vi

— Matthew Goldstein (@MattGoldstein26) March 14, 2023

Waters also told Politico that she has not spoken to the bank about a 2018 bill that loosened up regulations for some, such as Silicon Valley Bank. Lobbyists for Silicon Valley Bank were among those who lobbied for a bipartisan measure in 2018, which Waters opposed.

Philosophically, I’m opposed to deregulation, always have been, been consistent on it, and will continue to be,” she noted.

The Silicon Valley Bank collapsed last week when panicked customers suddenly withdrew tens of billions of dollars after the bank announced a loss of approximately $1.8 billion from selling its investments in U.S. treasuries and mortgage-backed securities. Ultimately, regulators shut Silicon Valley Bank down, and the Federal Deposit Insurance Corporation (FDIC) took control of the bank and said they would protect insured deposits.

On Sunday, the U.S. Treasury, the Federal Reserve, and the FDIC announced that they would be taking “decisive actions to protect the U.S. economy by strengthening public confidence in [the U.S.] banking system” by effectively making deposits above the FDIC’s $250,000 limit available Monday. Over the weekend, the Silicon Valley Bank failed to be auctioned off after none of the largest U.S. banks bid. However, the FDIC reportedly plans to attempt a second auction for the bank.

Politico noted that Silicon Valley Bank’s PAC had given more than $50,000 in campaigns contribution to nearly two dozen senators and representatives from 2017 to 2022. The donations mainly went to Republicans and Democrats who served on the relevant committees such as House Financial Services Committee or Senate Finance Committee.

Jacob Bliss is a reporter for Breitbart News. Write to him at jbliss@breitbart.com or follow him on Twitter @JacobMBliss.

Biden Is Now Resurrecting One of Obama’s Most Treacherous Initiatives

Rep. Maxine Waters (D-CA), the ranking member on the House Financial Services Committee, said she plans to give back the campaign donations she received from the political action committee for Silicon Valley Bank.

Following the bank’s collapse last week, Waters said she would return the $2,500 from the bank’s PAC she took in late 2020 when she was chair of the Financial Services Committee in the Democrat majority.

“Yes, I will send it back,” she told Politico on Tuesday. “Everybody knows I have an open-door policy.”

A pedestrian passes a Silicon Valley Bank branch in San Francisco, Monday, March 13, 2023. As the primary regulator of the bank, the Federal Reserve is coming under sharp criticism from financial watchdogs and banking experts. (AP Photo/Jeff Chiu)

The congresswoman’s decision comes after some initial political blowback happened over the weekend with the bank’s collapse after federal investigators had reportedly decided to open a probe into the bank’s failure.

Waters told Politico that she recalled talking to someone from the bank around 2020 about FinTech but did not remember many details.

DOJ is on the Silicon Valley Bank case as many had been expecting. Story with @ktbenner https://t.co/ZZp10Sj5vi

— Matthew Goldstein (@MattGoldstein26) March 14, 2023

Waters also told Politico that she has not spoken to the bank about a 2018 bill that loosened up regulations for some, such as Silicon Valley Bank. Lobbyists for Silicon Valley Bank were among those who lobbied for a bipartisan measure in 2018, which Waters opposed.

Philosophically, I’m opposed to deregulation, always have been, been consistent on it, and will continue to be,” she noted.

The Silicon Valley Bank collapsed last week when panicked customers suddenly withdrew tens of billions of dollars after the bank announced a loss of approximately $1.8 billion from selling its investments in U.S. treasuries and mortgage-backed securities. Ultimately, regulators shut Silicon Valley Bank down, and the Federal Deposit Insurance Corporation (FDIC) took control of the bank and said they would protect insured deposits.

On Sunday, the U.S. Treasury, the Federal Reserve, and the FDIC announced that they would be taking “decisive actions to protect the U.S. economy by strengthening public confidence in [the U.S.] banking system” by effectively making deposits above the FDIC’s $250,000 limit available Monday. Over the weekend, the Silicon Valley Bank failed to be auctioned off after none of the largest U.S. banks bid. However, the FDIC reportedly plans to attempt a second auction for the bank.

Politico noted that Silicon Valley Bank’s PAC had given more than $50,000 in campaigns contribution to nearly two dozen senators and representatives from 2017 to 2022. The donations mainly went to Republicans and Democrats who served on the relevant committees such as House Financial Services Committee or Senate Finance Committee.

Jacob Bliss is a reporter for Breitbart News. Write to him at jbliss@breitbart.com or follow him on Twitter @JacobMBliss.

Kevin Dietsch/Getty Images The following content is sponsored by InvestorPlace.

If you think your money is safe in your bank account, Biden has other plans.

A former bank insider is going public with a warning. He’s uncovered how Biden plans to take control of American bank accounts.

In his controversial message, this insider holds nothing back:

“I believe [Biden’s new program is] now designed to target ALL American citizens who dare disagree with the Dems’ progressive agenda.”

Perhaps most disturbing of all is how this program was the original brainchild of Obama.

For decades, this insider has helped the financial elite avoid some of the worst financial bloodbaths in American history – including the Black Monday crash in 1987, the dot-com crash in 2000, and even the 2008 financial crisis.

His name is Louis Navellier, and he manages over $1 billion in private client money.

These days, when he delivers an urgent warning, he gets attention.

Even though he frequently appears on national news to deliver his expertise, Mr. Navellier’s exposé on Biden is far too controversial for the mainstream media. He chose to release his findings on his website.

This disturbing move by Biden could send an earthquake through our country’s entire financial system. Mr. Navellier’s message reveals the immediate steps you need to take.

If you’re concerned about what’s happening to this country, you’re going to want to see what Mr. Navellier has to say. (His message is available here for a limited time.)

Within the first 30-45 seconds, you’ll see how Biden plans to target certain Americans.

We can’t promise that viewing this will be easy. But it could help you stay safe.

To see Louis Navellier’s warning, click here right now.

CUT AND PASTE YOUTUBE LINKS

Silicon Valley Bank Board Included Barack Obama, Hillary Clinton Donors

The following content is sponsored by InvestorPlace.

If you think your money is safe in your bank account, Biden has other plans.

A former bank insider is going public with a warning. He’s uncovered how Biden plans to take control of American bank accounts.

In his controversial message, this insider holds nothing back:

“I believe [Biden’s new program is] now designed to target ALL American citizens who dare disagree with the Dems’ progressive agenda.”

Perhaps most disturbing of all is how this program was the original brainchild of Obama.

For decades, this insider has helped the financial elite avoid some of the worst financial bloodbaths in American history – including the Black Monday crash in 1987, the dot-com crash in 2000, and even the 2008 financial crisis.

His name is Louis Navellier, and he manages over $1 billion in private client money.

These days, when he delivers an urgent warning, he gets attention.

Even though he frequently appears on national news to deliver his expertise, Mr. Navellier’s exposé on Biden is far too controversial for the mainstream media. He chose to release his findings on his website.

This disturbing move by Biden could send an earthquake through our country’s entire financial system. Mr. Navellier’s message reveals the immediate steps you need to take.

If you’re concerned about what’s happening to this country, you’re going to want to see what Mr. Navellier has to say. (His message is available here for a limited time.)

Within the first 30-45 seconds, you’ll see how Biden plans to target certain Americans.

We can’t promise that viewing this will be easy. But it could help you stay safe.

To see Louis Navellier’s warning, click here right now.

CUT AND PASTE YOUTUBE LINKS

David McNew/Getty Images Several Silicon Valley Bank (SVB) board of directors have donated thousands of dollars or have direct ties to prominent Democrat politicians like Hillary Clinton, former President Barack Obama, and Rep. Nancy Pelosi (D-CA).

Federal investigators are now looking into the role the board may have played in the bank’s abrupt collapse, as the board members failed to prevent its failure.

Although there are 12 board members, several are under scrutiny for their donations and connections to Democrat politicians.

For example, director Kate Mitchell is a Clinton mega-donor who prayed at a shrine after Clinton’s 2016 loss to former President Donald Trump.

“I prayed for me and us to get beyond our grieving and shock and to figure out how to engage and listen to what happened and come back together,” Mitchell said.

Mitchell also donated $50,000 to Clinton’s victory fund, the New York Post reported.

Next on the list of Democrat donor SVB board members is Garen K. Staglin, who owns a vineyard less than 15 minutes from the Pelosi family’s Napa Valley estate.

As the New York Post detailed:

He gave the Biden Victory Fund $10,000 in 2020, sent $54,000 to Clinton’s Hillary Victory Fund in 2016 (on top of $25,000 the previous year), backed Obama with $35,800 in 2011 and gave the Democratic National Committee $10,000 last year.

Some board members also donated to political action committees for Democrat Senate Leader Chuck Schumer (D-NY) and Sen. Mark Warner (D-VA), who sits on the Senate Banking Committee, the Post reported.

Another SVB board member with ties to prominent Democrats is Mary J. Miller, who served as Obama’s domestic finance undersecretary at the Treasury Department for two years.

As the Post noted, the “only real banker” on the Silicon Valley Bank board is Tom King, the board’s newest director. King brings 35 years of experience in investment banking to the board, having spent years at Citigroup and Barclays.

The Post also reported that the Democrat donations were part of SVB’s business model. “Everyone knew it was the go-to bank for woke CEOs,” one source told the outlet. “They knew they were aligned politically. The companies SVB loaned money to all had a woke agenda.”

Jordan Dixon-Hamilton is a reporter for Breitbart News. Write to him at jdixonhamilton@breitbart.com or follow him on Twitter.

Several Silicon Valley Bank (SVB) board of directors have donated thousands of dollars or have direct ties to prominent Democrat politicians like Hillary Clinton, former President Barack Obama, and Rep. Nancy Pelosi (D-CA).

Federal investigators are now looking into the role the board may have played in the bank’s abrupt collapse, as the board members failed to prevent its failure.

Although there are 12 board members, several are under scrutiny for their donations and connections to Democrat politicians.

For example, director Kate Mitchell is a Clinton mega-donor who prayed at a shrine after Clinton’s 2016 loss to former President Donald Trump.

“I prayed for me and us to get beyond our grieving and shock and to figure out how to engage and listen to what happened and come back together,” Mitchell said.

Mitchell also donated $50,000 to Clinton’s victory fund, the New York Post reported.