JANET YELLEN, U.S. TREASURY SECRETARY: I don’t believe that we’re at risk of hyperinflation. We’ve had several months of high inflation that most economists including me believe will be transitory as our economy gets back in full swing after the pandemic.

(END VIDEO CLIP)

CARLSON: It’s just transitory, it’s the price of progress, seven-dollar bacon. Yes, but look what you’re getting in return. Aren’t things great?

Hannity reveals why 'Let's go Brandon' chants are breaking out nationwide

DEMOCRATE SANCTUARY STATES IN ECONOMIC MELTDOWN

https://www.youtube.com/watch?v=iJuVkO2sFuU

Build Back Pricier: Business Inflation Expectations Stuck at Record High

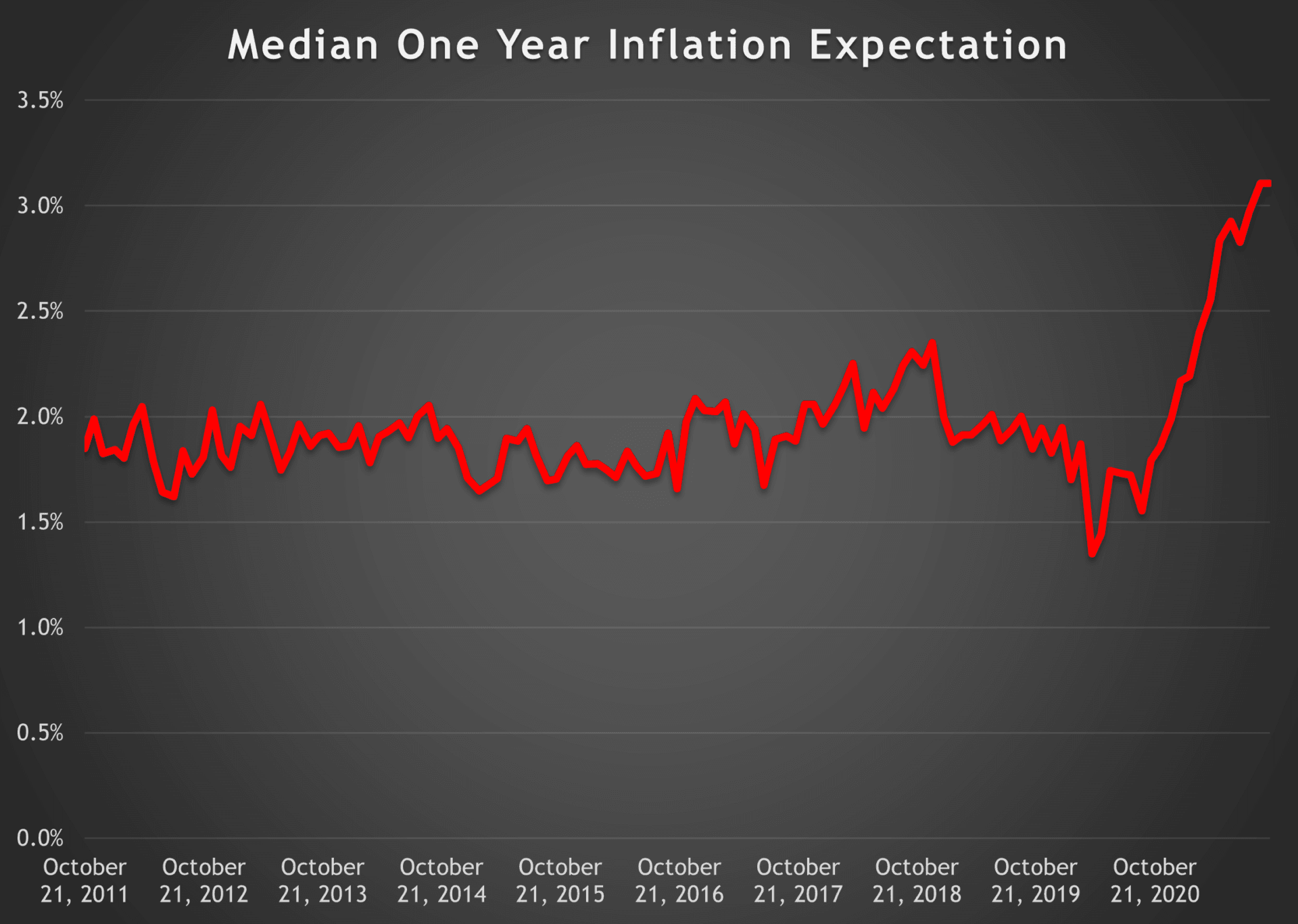

A key signal of future inflation has settled in at a highly elevated rate, a development that should jolt the Federal Reserve out of its confidence that the recent inflation surge will fade soon.

A survey of business conducted by the Federal Reserve Bank of Atlanta found that the median expectation for inflation 12 months from now remained at 3.1 percent for the second straight month. That is the highest reading detected in the nearly 10-year-old survey.

It is well above the two percent inflation rate that the Fed says it targeting. Last year, the Fed changed its approach after years of consistently undershooting the target. Now the Fed says it hopes to achieve an average of two percent over time, an indication that it will allow inflation to run over the target for some time to balance out the earlier bouts of low inflation.

Fed officials tend to believe that inflation expectations can become self-fulfilling prophecies, powerfully influencing the path of future inflation by changing the behavior of businesses and consumers.

In the decade prior to the pandemic, businesses expected around 1.9 inflation on average. This year the average has been 2.7 percent and has been climbing most months.

In theory, businesses attempt to set prices based on what they expect inflation to be in the future. Businesses see prices rising for both themselves and their competitors and conclude that rising inflation gives them room to raise prices and raise wages.

In a speech yesterday, Atlanta Fed President Raphael Bostic said that persistently high inflation risked pushing up inflation expectations, a process Fed officials refer to as “unanchoring.”

“Up to now, indicators do not suggest that long-run inflation expectations are dangerously untethered,” Bostic said in a speech to the Peterson Institute for International Economics. “But the episodic pressures could grind on long enough to unanchor expectations.”

A recent paper by one Fed economists, however, challenged the view that expectations play a large role in controlling the path of inflation. Staff economist Jeremy Rudd’s paper says the faith in expectations rests on “shaky foundations.” Instead, he argues that it is actual inflation that changes the behavior of consumers, workers, and businesses.

That could be even more troubling given that inflation is now running at a very high level. In a separate report Wednesday, the Department of Labor said that its Consumer Price Index had jumped 5.4 percent on an annual basis in September, a one-tenth of a point acceleration from August and higher than forecast.

In his speech, Bostic said that the staff at the Atlanta Fed have stopped using the word “transitory” to describe current inflationary pressures, believing that the supply chain disruptions that are fueling higher prices are likely to persist for longer than initially expected.

The high level of inflation expected by businesses in the Atlanta Fed survey supports these concerns.

A report released by the New York Fed on Tuesday showed that U.S. consumers’ near-term and medium-term inflation expectations had continued to rise in September to new record highs. Consumers now expect prices to be 5.3 percent higher one year from now.

Like business expectations, consumer expectations are thought to change behavior. When consumers expect prices to rise, they demand higher wages to compensate. Businesses, expecting rising revenue due to price hikes, are more willing to grant those raises.

Businesses in the survey do not expect inflation to moderate next year. In fact, the median expected inflation for 2022 was four percent, indicating an acceleration. Over the next five years, inflation is expected to run at three percent.

By contrast, the median expectation of members of the Federal Reserve’s Federal Open Market Committee is for inflation measured by the Commerce Department’s Personal Consumption Expenditure Price Index to run at 2.2 percent next year, 2.1 percent the year after that, and 2.0 percent over the long-run. The PCE price index tends to run slightly below the more familiar Consumer Price Index compiled by the Department of Labor.

Jim Banks Reveals the ‘Mind-Blowingly Corrupt’ Carveouts in $3.5 Trillion Infrastructure Bill

Rep. Jim Banks (R-SC), the chairman of the Republican Study Committee (RSC), detailed many of the most radical aspects of the $3.5 trillion infrastructure bill.

Biden has gambled his legislative majority on passing two infrastructure bills, the $1.2 trillion bipartisan infrastructure bill, or the Infrastructure Investment and Jobs Act, and the $3.5 trillion reconciliation infrastructure bill, otherwise known as the Build Back Better Act.

Democrats hope to pass their mammoth, $3.5 trillion legislation through reconciliation, which allows the Senate to pass legislation with only a simple majority.

Although Democrats have not agreed to the final tenets of the legislation, Americans can see the tentative details of the Democrats’ marquee legislation.

Rep. Jim Banks (R-IN), the chairman of the Republican Study Committee (RSC), released an exhaustive list of some of the most radical aspects of the Democrats’ “socialist takeover bill.”

Banks’ press release hopes to serve as messaging House Republicans can use to rally against Biden’s marquee bill.

The RSC contended in a press release Tuesday that Democrats plans to hide the bill text to prevent Americans from knowing how radical the bill is.

“They’ve played ‘hide the ball’ with the bill text so as not to tip off the public as to what they’re putting in their bills. Then, they bring it to the floor and tout some poll numbers and scare their members into voting for it,” the RSC wrote.

The RSC noted the bill would:

- Perpetuates labor shortage: Continues welfare benefits without work requirements for able-bodied adults without dependents at a time where there are 10.1 million job openings—more openings than there are people looking for work.

- Commissions a climate police: Democrats stuffed $8 billion into the bill to commission a cabal of federally funded climate police called the Civilian Climate Corps (CCC) who will conduct progressive activism on taxpayers’ dime (pages 8, 21, and 926).

- Pushes Green New Deal in our public schools: Requires funding for school construction be used largely on enrollment diversity and Green New Deal agenda items (page 55).

- Pushes Green New Deal in our universities: Democrats include a $10 billion “environmental justice” higher education slush fund to indoctrinate college students and advance Green New Deal policies (page 1,935).

- Forces faith-based child care providers out: The bill blocks the ability of many faith-based providers from participating in the childcare system and will lead to many of their closures (page 280).

- Hurts small and in-home daycares: Requires pre-K staff to have a college degree. (page 303)

- Includes new incentives for illegal immigration: Illegal immigrants will be eligible to take advantage of Democrats’ new ‘free’ college entitlement (page 92) as well be eligible for additional student aid (page 147) and the enhanced child tax credit (page 1,946).

- Includes legislative hull for Biden’s vaccine mandate: Increases OSHA penalties on businesses that fail to implement the mandate up to $700,000 per violation and includes $2.6 billion in funding for the Department of Labor to increase enforcement of these penalties (page 168).

- Gives unions near-total control: The bill includes insane prohibitions that would bind employers’ hands in union disputes and dangerously tilt the balance of power, subjecting employers to penalties that exempt union bosses and officials… among other things this bill would prevent employers from permanently replacing striking workers (page 175). It coerces businesses to meet union boss demands by increasing Fair Labor Standards Act penalties by an astronomical 900% (page 168).

- Makes unions bigger and more powerful: The bill would subsidize union dues that would only serve to strengthen the influence of union bosses and not American workers (page 2323).

- Pushes Democrats’ wasteful and confusing school lunch agenda: $643 million for, among other things, “procuring…culturally appropriate foods” (page 333).

- Furthers radical abortion agenda: Does not include the Hyde amendment and would mandate taxpayers pay for abortions (page 198) & (page 336).

- Drives up costs on Americans’ utility bills: Issues a punitive methane tax (page 367) and includes a tax on natural gas up to $1,500 per ton that could cost the American economy up to $9.1 billion and cost 90,000 Americans their jobs (page 368).

- Includes dangerous & deadly green energy mandate: Effectively forces Americans to get 40% of their energy from wind, solar and other unreliable forms of energy within 8 years (page 392). Reliance on these energy sources has proven deadly.

- Includes kickbacks for the Left’s green energy special interest network: $5 billion for “environmental and climate justice block grants” (page 377) and another $100 billion in green energy special interest subsidies, loans and other carve outs.

- Gives wealthy Americans tax credits: $222 billion in “green energy” tax credits will be given to those who can afford expensive electric vehicles and other “green” innovative products (page 1832).

- Furthers Democrats’ social justice agenda: Includes “equity” initiatives throughout the bill and, in one instance, Democrats inserted “equity” language into a title which should have been focusing on the maintenance of the United States’ cyber security efforts (page 897).

- Grants amnesty for millions of illegal immigrants: House Democrats have included in their reconciliation bill a plan to grant amnesty to around 8 million illegal immigrants at a cost of around $100 billion over ten years that would largely be spent on welfare and other entitlements (page 901). Trillions more would be spent long term on their Social Security and Medicare.

- Opens border even wider: The bill would waive many grounds for immigration inadmissibility, including infection or lack of vaccination status during a Pandemic, failure to attend removal proceedings in previous immigration cases, and the previous renouncement of American citizenship. DHS may also waive previous convictions for human trafficking, narcotics violations, and illegal voting (page 903).

- Increases visa limit: At least 226,000 family-preference visas would be administered each year (page 905).

- Grants fast-tracked green cards for those seeking middle-class careers in America: Language included in the bill exempts certain aliens from the annual green card statutory limits and has been described as a “hidden pipeline for U.S. employers to flood more cheap foreign graduates into millions of middle-class careers needed by American graduates” (page 910).

- Includes pork for Nancy Pelosi: $200 million is earmarked for the Presidio Trust in Speaker Pelosi’s congressional district (page 933).

- Increases energy dependence on OPEC, Russia and China: The bill prohibits several mineral and energy withdrawals (page 979). It overturns provisions included in the Tax Cuts and Jobs Act that authorized energy production in the Arctic that will result in 130,000 Americans losing their jobs and $440 billion in lost federal revenue (page 983) and the mineral withdrawals it prohibits would, ironically, include minerals necessary for renewable energy sources (pages 934, 940, 943).

- Exacerbates the chip shortage: The bill would mandate the conversion of the entire federal vehicle fleet from internal combustion engines to electric engines at a time when there is a global microchip shortage and crippled supply chains (page 1,043).

- Democrats’ feckless China bill is included: Concepts from the insanely weak Endless Frontier Act included, including $11 billion in research funding that will likely result in American intellectual property going to China (page 1079 – 1081).

- Chases green energy pipe dreams: $264 million to the EPA to conduct research with left-wing environmental justice groups on how to transition away from fossil fuels (page 1063).

- Fixes “racist” roads and bridges: Adds a nearly $4 billion slush fund that would help left-wing grassroots organizations that, among other things, want to tear down and rebuild or otherwise alter infrastructure deemed “racist” (page 1183).

- Punishes red states for failing to adopt Green New Deal provisions: Mandates “consequences” for conservative states that don’t meet the radical Left’s “green” climate standards while at the same time adding nearly $4 billion for “Community Climate Incentive Grants” for cooperating states (page 1179).

- Includes new massive, bankrupting entitlement: The new paid leave entitlement would mandate workers get 12 weeks of paid leave and would cost $500 billion over ten years according to the CBO (page 1245). It would apply to those making up to half a million dollars a year (page 1254).

- Advances a totalitarian and paternalistic view of the federal government: Includes grants for organizations to treat individuals suffering from “loneliness” and “social isolation.”

- Further detaches individuals from employment and more reliant on government handouts: The bill spends $835 billion on welfare through manipulating the tax code [not including the expansions of Obamacare subsidies] (page 1943).

- Tax benefits for the top 1%: The bill will possibly lift the SALT deduction cap meaning many of the top 1% wealthiest Americans would pay less in taxes.

- Tax credit for wealthy donors who give to woke universities: The bill creates a new tax credit program that gives tax credits worth 40% of cash contribution that are made to university research programs (page 2094).

- Expands worst parts of Obamacare: Obamacare’s job-killing employer mandate will become more severe by adjusting the definition of “affordable coverage” to mean coverage that costs no more than 8.5 percent of income rather than current law’s 9.5 percent of income (page 2041).

- Increases taxes on Americans at every income level: $2 trillion in tax hikes will fall on those making under $400,000 per year, contrary to what the White House says. Individuals at all income levels will be affected (Ways and Means GOP).

- Lowers wages for working families: The corporate tax rate will increase by 5.5%, meaning American companies will face one of the highest tax burdens in the world. According to analysis, two-thirds of this tax hike will fall on lower- and middle-income taxpayers (page 2110).

- Penalizes marriage: The bill would permanently double the EITC’s marriage penalty on childless worker benefits (page 2036).

- Imposes crushing taxes on small business: Guts the Tax Cuts and Jobs Act small business deductions that reduced pass-through entity taxes to keep them comparable to taxes imposed on corporations (page 2235) as well as hammer small businesses that file as individual tax earners with the 39.6% rate (page 2221) and Obamacare’s 3.8% tax on net investment income.

- Crushes family businesses and farms: The bill would impose a 25% capital gains rate (page 2226) and makes alterations to the Death Tax including cutting the Death Tax exemption in half (page 2240).

- Violates Americans’ financial privacy: $80 billion slush fund to hire an 87,000-IRS-agent army to carry out the Biden administration’s plan to review every account above a $600 balance or with more than $600 of transactions in a year. (page 2283).

- Increases out of pocket costs for those who rely on prescription drugs: The bill repeals the Trump-era Rebate Rule which passes through rebates directly to consumers at the point of sale (page 2465).

- Imports policies from countries with socialized medicine: The bill includes healthcare policies imported from systems in Australia, Canada, France, Germany, Japan and the United Kingdom—all countries that have government-run healthcare systems (page 2349).

The bill also has other lesser-known provisions, including:

- $5 million per year for the Small Business Administration for an entrepreneurial program for formerly incarcerated individuals.

- $2.5 billion for the Department of Justice (DOJ) to award competitive grants or contracts to local governments, community-based organizations, and other groups to support “intervention strategies” to reduce community violence.

“Each of these 42 bullets is enough to vote against the bill. Taken together—it’s mind-blowingly corrupt. We need to loudly oppose it,” Banks charged in the release.

He added, “Democrats are scattered. The Biden agenda is in question. It’s the perfect opportunity to build public sentiment against this bill. The American people need us to be the vanguard against the Left’s radical plans.”

“It’s not an understatement to say this bill, if passed, will fundamentally change our country forever—Americans will wake up in a few years and wonder what happened to their freedom. We can’t let that happen,“ Banks concluded.

Sean Moran is a congressional reporter for Breitbart News. Follow him on Twitter @SeanMoran3.

FNC’s Carlson: Inflation Caused by ‘Decades of Policy that Have Enriched a Few and Impoverished the Many’

Tuesday on FNC’s “Tucker Carlson Tonight,” host Tucker Carlson warned how Federal Reserve monetary policy is responsible for the inflation that is plaguing the American economy.

Carlson said that inflation is a product of long-standing monetary policy, which benefiting the rich while hurting others.

Transcript as follows:

CARLSON: There’s probably no institution in American life that has more effect on how you live but that we talk about less than the Federal Reserve. People don’t care to talk about the Federal Reserve because it seems very complex, and a lot of what it does is, in fact, complex unless you have a grounding in monetary policy, it is hard to know exactly what’s going on.

But the basics aren’t that complicated, actually, and here are a few of them.

The Federal Reserve was created way back in 1913 by an act of Congress, and it had really two main goals: Maximize employment and keep prices stable. Keep inflation under control. Those are virtuous goals, but it may be a measure of the way that bureaucracies work that over time, the Federal Reserve has actively undermined both of those objectives. It’s the classic story of the fireman turned arsonist, or for that matter the COVID czar who helped create COVID — irony of ironies, it seems like we read a lot of those lately.

In the case of the Federal Reserve, consider something called quantitative easing. That’s the main thing the Fed has been doing since the financial crisis of 2008. Every month, Federal Reserve officials print more than $100 billion new in American currency, and then they inject those dollars into our financial system by buying assets like bonds and securities.

This is not a normal thing to do, it’s a radical thing to do, and it was supposed to be temporary. It was in response to a crisis. In medical terms, quantitative easing is like chemotherapy. There are times when it can save your life, but fundamentally it’s poison. If you keep taking it, it will kill you. Pretty much everyone agrees on that. And pretty much everyone understands that ultimately quantitative easing causes horrible inflation, and it’s easy to understand why. You don’t need to be an expert.

The more money you print, the less that money is worth. It is supply and demand. You buy diamonds by the karat, but you buy dirt by the yard. Overabundance decreases value.

So every new dollar you print buys less. If you keep printing them, you wind up devaluing your own currency. That’s one thing a responsible government should never do. It may enrich banks and a tiny number of big investors who give to the Democratic Party, but devaluing your currency screws everyone who works and who saves, and that’s immoral.

Those are exactly the people that a legitimate government ought to be trying to help as its core mission, and yet they’re not. All these years later, quantitative easing continues. They are still doing it.

On Wall Street, they joke about how it is going to go on forever. They call it QE-infinity. It’s an incredibly reckless policy and everybody knows it, very much including the people who are getting rich from it.

So, for the better part of a year, Fed officials have been promising they are going to stop doing this. They have sworn they will get sober. They have vowed to begin a process called tapering, that means they’ll start to gradually slow the money they print.

At a Fed meeting in April, officials said they would start to do this very soon, they would taper, but they never did. They made the same promise throughout this summer, but again they didn’t. The binge continued.

This morning, the Vice Chairman of the Fed, Richard Clarida once again insisted that tapering is almost here, we’re about to do it. The conditions to begin detox, he said, have all but been met. And yet as of tonight, the Fed is still partying with your currency like this is the richest country in the world and always will be.

So what are the effects on our country of this? Well, in the short term as with vodka, it makes everybody feel pretty good. It’s 3:00 a.m., your lips are numb, and you can barely see and yet somehow, the breakfast meeting downtown you’ve got in five hours, the one you’re going to have to give a detailed presentation to your boss seems like no problem at all. You’ve got this.

Except you don’t have it at all. Morning always comes. It is always worse than you think.

America’s quantitative easing hangover is going to be ugly. Beneath the manufactured euphoria of our top-line economic numbers — Google is killing it, record profits for Amazon, says CNBC — beneath all of that garbage, the actual American economy is in trouble and there are many signs of it.

Labor markets are tight right now because a lot of Americans have simply dropped out of the labor force, 4.3 million people walked off the job last month, some of them were forced out by Joe Biden’s vaccine mandates.

Projections for GDP growth just dropped from six percent to one and a half percent. Small businesses across the country are dying. And maybe most ominous of all, inflation is here. It’s not just a temporary problem caused by COVID disrupted supply chains, it is absolutely real.

(BEGIN VIDEO CLIP)

UNIDENTIFIED FEMALE (voice-over): The American economy is starting to sizzle once again as it emerges from the pandemic and workers’ paychecks are, too with businesses practically begging for help.

But there’s a flip side to all the raises and that’s inflation. Prices rising at the fastest rate since 2008, everything from washing machines, up almost 30 percent, to furniture, up 11 percent and television sets up eight percent.

(END VIDEO CLIP)

CARLSON: So it’s happening throughout the economy, it’s not just washing machines and television sets, consumer electronics. It is everything including the big things. Try to buy a house, it’s now more expensive to buy a home than it has ever been at any time in American history.

The median existing-home price last year was $310,000.00. It is now over $356,000.00 and a lot more in the zip codes you might want to live in. Part of the reason is the cost of building materials. They are completely out of control.

Last October, lumber went for about $580.00 per thousand board feet. As of last week, it was $712.00.

Last August, used cars which you might need were selling for an average price of $21,000.00. This August, a year later they were almost $28,000.00. Same car, seven grand more.

Over the same period by the way, as you well know, the price of gas jumped a full dollar a gallon and a lot more than that in some places.

Been to the grocery lately? The cost of a pound of steak is up by two bucks, a pound of bacon costs over seven dollars right now. And suddenly, everything costs more. Eggs, milk, coffee, mustard, et cetera, et cetera, et cetera. These are not luxury items. This is not a trip to St. Bart’s. These are things you buy every week and you have to buy.

The question is, are your wages rising as fast as your costs? Well, let’s see. Vegetable oil is up 60 percent, so probably not, and that means you’re getting poorer whether you realize it or not. But that’s what inflation does, it causes poverty.

So because we can prove that the population of the United States is getting poorer by the day, you’d think the Biden administration would be actively concerned about this and working to make it better, but they’re doing the opposite. They are actively making it much worse.

And here’s how they’re doing it: By spending.

No government in the history of the world has ever spent more money than Joe Biden is spending right now. That is a fact.

In fiscal year 2019, just the other day, the entire Federal government spent $6.6 trillion, then COVID hit the following year and those numbers went up, they went up by 40 percent. Federal spending in 2020 jumped to $9.1 trillion. Was that too much? Of course, it was. What do we get for it? Not enough.

But here’s the shocking thing. Under Joe Biden, as COVID recedes, it’s going up even higher, because they’re no longer using COVID as a pretext.

Through the end of this August, which is to say a month and a half ago, the Federal government has already spent more in 2021 than it did over the entire calendar years of 2019 and 2018.

So all of this drives inflation to scary levels, but they’re not scary to everyone.

If you’re a massively leveraged financial institution that owes a lot of money to a lot of people and that’s how you’re making your money, this is not necessarily bad news. If money is worth less, that means that your debt service costs less. You don’t fear inflation, inflation helps you. The problem is it crushes the American middle class.

Now in a normal country, this would be a huge concern, but because the people who make our policy don’t care about the middle class, this is a bargain well worth making.

Bloomberg News just published a piece with this headline which we’re not making up. They’re celebrating the disaster, quote: “America needs higher longer-lasting inflation.” If you can even imagine writing something like this. Does America need more emphysema, too? It’s grotesque.

Now, most people may not know this is happening, normal people don’t read Bloomberg News, they may be unaware that these attitudes even exist in what they assumed was their country and the Biden administration would like to keep it that way. They’d like to keep the population from finding out what’s happening.

So here is the Treasury Secretary Janet Yellen. She is the reptile who once ran the Federal Reserve and is, therefore, more responsible than any single living person for your growing poverty. Here she is assuring you that seven-dollar bacon isn’t actually a problem. That’s not really inflation, it’s something called transitory inflation.

(BEGIN VIDEO CLIP)

JANET YELLEN, U.S. TREASURY SECRETARY: I don’t believe that we’re at risk of hyperinflation. We’ve had several months of high inflation that most economists including me believe will be transitory as our economy gets back in full swing after the pandemic.

(END VIDEO CLIP)

CARLSON: It’s just transitory, it’s the price of progress, seven-dollar bacon. Yes, but look what you’re getting in return. Aren’t things great?

Until just a few hours ago, that was the official line in Washington, along with those Southwest delays were caused by weather, and our withdrawal from Afghanistan was actually a huge success. What are you talking about? That’s what they were telling us.

And then the President of the Atlanta Fed, a man called Raphael Bostic admitted what was very obvious to anyone who goes to the grocery store. This actually is inflation, it is real inflation. It is not transitory inflation and it’s going to be here for a long time.

What he didn’t say was that this is not an Act of God. This isn’t a hurricane, it’s not an earthquake, it’s not something we can’t control. This is the result of decades of policy that have enriched a few and impoverished the many.

WELOME TO JOE BIDEN'S NEO-FASCISM FOR WALL STREET

Eric Holder didn't send a single banker to jail for the mortgage crisis. Is that justice?

US attorney general’s tenure has proven unhelpful to the five million victims of mortgage abuses in the US

Yellen: IRS Plan to Monitor $600+ Bank Transactions ‘Absolutely Not’ Spying — ‘There’s a Lot of Tax Fraud’

Treasury Secretary Janet Yellen said on Tuesday’s broadcast of “CBS Evening News” that the proposed $600 IRS reporting requirement for banks is “absolutely not” a way for the government to spy on Americans.

Anchor Norah O’Donnell asked, “You want banks to report transactions of 600 dollars or more? That is what the IRS wants. Does this mean that the government is trying to peek into our pocketbooks? If you want to look at $600 transactions?”

Yellen replied, “Absolutely not. I think this proposal has been seriously mischaracterized. The proposal involves no reporting of individual transactions of any individual. The big picture is, look, we have a tax gap that over the next decade is estimated at $7 trillion. Namely, a shortfall in the amount the IRS is collecting due to a failure of individuals to report the income that they have earned.”

O’Donnell said, “But that is among billionaires, is that among people who are transfers 600 dollars?”

Yellen said, “No, it tends to be among high-income individuals whose income is opaque, and the IRS doesn’t receive information about it. If you earn a paycheck, you get a W-2 the IRS knows about it. High-income individuals with opaque sources of income that are not reported to the IRS, there is a lot of tax fraud and cheating that is going on. All that is involved in this proposal is a few arrogate numbers about bank accounts, the amount that was received in the course of a year, the amount that went out in the course of a year.”

Follow Pam Key on Twitter @pamkeyNEN

No comments:

Post a Comment