THERE IS A REASON WHY THE BILLIONAIRE CLASS ARE DEMOCRATS AND LOVE JOE BIDEN!

While Biden was championing that idea, though, “dark money” groups were mobilizing to see him elected president. As Breitbart News reported in October 2020, a super PAC backed by Silicon Valley donors and boosted by “dark money” spent substantially to run attack ads against Trump in the final weeks of the White House contest.

"The reference to what “Trump’s done” is a fraud, since the both the Democrats and Republicans endorsed, on a nearly unanimous basis, the multi-trillion dollar bailout of Wall Street in March."

"Biden reassured Wall Street and the billionaires, “I’m not looking to punish anyone.”

Three Foreign Billionaires Finance the

Dem Dark Money Machine

A Swiss human experimenter, a Hungarian Nazi collaborator, and an Iranian tech tycoon walk into Washington D.C.

Daniel Greenfield, a Shillman Journalism Fellow at the Freedom Center, is an investigative journalist and writer focusing on the radical Left and Islamic terrorism.

A Swiss human experimenter, a Hungarian Nazi collaborator, and an Iranian tech tycoon walk into Washington D.C. What do you call them? The absentee owners of the Democrat Party.

It’s not a joke. Unfortunately it’s grimly serious.

Politico recently reported that the Sixteen Thirty Fund, the leading dark money machine of the Left, had pumped $410 million into Dem 2020 efforts to defeat Trump and Republicans.

The Sixteen Thirty Fund had raised a record $390 million that year and half the money came from just 4 donors. While the names of the donors are secret, the article did note the names of three major known STF backers: Pierre Omidyar, Hansjörg Wyss, and George Soros.

Aside from their support for leftist causes, the three billionaires have another thing in common.

Hansjörg Wyss, the richest man in Switzerland, may not even be a United States citizen. The article notes that his $135 million in STF dark money donations were "earmarked for non-electoral purposes".

George Soros illegally immigrated to the United States in the 1950s. Aside from his history of Nazi collaboration which should have barred his entry and made him deportable, an account states that his visa was based on a false affidavit filed on his behalf.

His Open Society Foundations have invested an estimated $17 million into STF in 2020.

Pierre Omidyar, an Iranian immigrant, currently the richest man in Hawaii, is a Big Tech billionaire born to wealthy foreign students in Paris, who brought him here as a child. His mother, a Berkeley academic, heads a pro-Iran group financed by her son’s fortune.

Omidyar injected an estimated $45 million into an STF fund.

There is something remarkably striking about three foreign billionaires, two of whom have been accused of immoral atrocities, funding the dark money machine behind leftist politics.

Together the three men account for nearly $200 million in outlay just to STF.

The three men, two of them European and one Middle Eastern, are a study in contrasts and similarities. Wyss was born Christian, Soros was born Jewish, and Omidyar was born Muslim, only for them to have shed their past histories and adopted the generic identities of globalist megalomaniacs convinced that the fate of the planet and of humanity is in their hands.

The three immigrant billionaires inhabit estates in the ultra-luxurious Kahala neighborhood of Honolulu, in Wilson, Wyoming, and Bedford, New York and employ former Secret Service agents to guard them.

The three leftist billionaires made their money in transnational industries, finance, the internet, and medical technology that welcomed talented immigrants. Their allegiance to the country whose territories host their wealth and mansions varies from non-existent to outright antipathy.

Their true allegiance is to overriding social and technological philosophies, partly of their own devising, and they use their massive wealth to impose them on Americans. While their open advocacy has a fairly poor track record (how many people actually read Soros’ books, Omidyar’s thoughts on capitalism, or Wyss’ thoughts on environmentalism), they have learned that they can covertly buy influence by building their own manipulative political networks.

Dark money machines are unsurprising investments for men who avoid basic transparency and treat the American political system like a game of shadows that they can rig with their money.

Omidyar finances both Black Lives Matter and Never Trumpers. The eBay billionaire is the hidden hand behind the fake “Facebook whistleblower” advocating censoring conservatives. He has a project to “reimagine capitalism” while funding The Intercept which openly touts Marxism.

Soros is equally devious, having secretly funded J Street so that the anti-Israel group could pretend to be moderate opponents without being associated with a noted enemy of the Jewish State. Publicly, he bashes Xi and China, while his Quincy Institute defends the People’s Republic of China and advocates alongside the “Squad” against any anti-China measures.

Wyss has plowed a fortune into American politics without ever even going on the record as to whether he holds American citizenship. Meanwhile Wyss' Hub Project, operating out of STF, set up fronts like Floridians for a Fair Shake, Keep Iowa Healthy, and North Carolinians for a Fair Economy that went after Republicans. This isn’t politics: it’s a hostile foreign takeover.

Soros and Omidyar both benefited from economic disruption, technological and financial, that enabled them to get rich while inflicting heavy costs on existing industries and businesses. Like much of the Big Tech sector, they’re convinced that they’re geniuses and that their Nietzschean superiority gives them the right to destroy what exists in favor of their egotistical ideologies.

The two old men of the group, Soros and Wyss, have been accused of paving their path to wealth through horrifying crimes, whether it was Soros’ participation in the seizure of Jewish properties in Hungary, or the illegal medical experimentation on patients that sent multiple executives of the company that serves as the source of Wyss’ wealth to prison.

Wyss was reportedly “deliriously happy” when he learned that he would not be indicted over the experiments that had been tested on pigs, before killing the pigs, only to then be injected into human beings. “They do not have enough on me. They don’t have enough emails on me,” he reportedly boasted.

Their vast wealth and megalomania cannot be separated from the images of elderly patients dying on operating tables while representatives of Wyss’ company looked on and watched them suffer, or Tivadar Soros, the billionaire's father, writing that he sent George off to participate in antisemitic war crimes with a Nazi collaborator "to cheer the unhappy lad up" where "surrounded by good company, he quickly regained his spirits.”

“It is a sort of disease when you consider yourself some kind of god, the creator of everything, but I feel comfortable about it now since I began to live it out,” George Soros once quipped.

Omidyar and Wyss seem to know better than to announce their megalomania quite as nakedly, and even Soros scaled back his more outrageous boasts after increasing public scrutiny.

The three foreign billionaires named in the Politico article shared a common megalomania, filtered through the lenses of their own ideologies, and little attachment to the United States. American industries and companies made them fabulously rich, but their horizons have always been international, and they view America as little more than just another tool for their visions.

When Americans, the ordinary sort of people, don’t go all along, they manipulate them. Despite their official fealty to democracy, to open societies, and public discourse, their dark money investments reflect their determination to sideline the public and impose their will on America.

Democrats often complain about money in politics, but they are the worst offenders. Some of the richest men and the wealthiest zip codes buy up elections for them across the country. And they seem uninterested whether the billionaires buying them even have American citizenship.

Three foreign billionaires are engaged in a hostile foreign takeover of the Republic. The Democrats call this democracy. The rest of us call it ideological imperialism and colonial tyranny.

House Democrats pass stripped-down social welfare bill with massive tax cut for the rich

On Friday morning, the House of Representatives passed its version of President Joe Biden’s $1.75 trillion “Build Back Better” social welfare and climate bill. As expected, the measure was approved on a party-line vote, with 220 Democrats voting “Yes” and all 212 Republicans voting “No.” One Democrat, Jared Golden of Maine, a conservative former Marine who served tours of duty in Iraq and Afghanistan, broke ranks and voted in opposition to the bill.

Golden had announced that he would oppose the bill because it included a massive tax break for the wealthy. The outcome of months of internal Democratic Party wrangling was the decision of the Biden White House and the party leadership to strip the bill of all major tax increases opposed by big business and slash the top line figure for social programs and climate protection in half, from $3.25 trillion to $1.75 trillion over 10 years.

That, however, did not satisfy the Wall Street and corporate interests that dictate government policy and control both major parties. Earlier this month, House Speaker Nancy Pelosi incorporated into the bill a measure demanded by wealthy donors in high-tax states such as New York, New Jersey and California. It was the lifting of a $10,000 cap on deductions on federal income taxes to compensate for state and local taxes. The cap was imposed as part of the Trump tax bill passed in December of 2017, which slashed taxes for corporations and the wealthy.

Until then, there was no limit on the amount of federal tax deductions for state and local taxes that wealthy people in generally pro-Democratic high-tax states could claim by itemizing their federal tax returns. In imposing the limit, Trump and the Republicans were targeting states that historically vote “blue” in federal elections.

This infuriated the Democrats’ wealthy backers, who demanded that the Biden budget bill raise the limit on so-called SALT (state and local tax) deductions. The Democrats acceded by adding to the bill a provision raising the limit to $80,000 for each of the next nine years.

The Congressional Budget Office estimates that this tax windfall for the wealthy will cost the federal government $285 billion over the 10-year span covered by the bill, making it the second most costly item in the legislation. It is topped only by a combined $390 billion for universal pre-school for three- and four-year-old children and limited subsidies for child care.

It is considerably higher than the allocation for clean energy and climate resilience ($220 billion), four weeks of paid family and medical leave ($195 billion), clean energy and electricity tax credits ($190 billion), affordable housing ($170 billion), Medicaid home- and community-based services ($150 billion), a one-year extension of the expanded child tax credit ($130 billion), and tax credits for health insurance premiums under Obamacare ($125 billion).

It would help pay for programs that were severely cut or dropped outright from the bill under pressure from big business and its most open mouthpieces in the Democratic Party, such as senators Joe Manchin of West Virginia and Kyrsten Sinema of Arizona. These include free community college (eliminated); the ability of Medicare to negotiate drug prices with the pharmaceutical industry, thereby lowering their costs (reduced to a shell program affecting only a handful of drugs and not even starting until 2024); and Medicare coverage for dental, hearing and vision (reduced to limited subsidies for hearing aids).

According to an analysis by the Tax Policy Center, the SALT tax provision will overwhelmingly benefit the top 10 percent of income earners, with virtually nothing going to the remaining 90 percent, i.e., the working class and lower-middle class. The measure will particularly benefit the top one percent, those who make over $867,000 a year. They will see a tax cut in the tens of thousands of dollars.

“Anything you do to eliminate the SALT cap is going to be regressive, because that tax is overwhelmingly paid by very high-income people,” said Howard Gleckman of the Tax Policy Center. “Anything you do to lower that tax doesn’t matter for most people.”

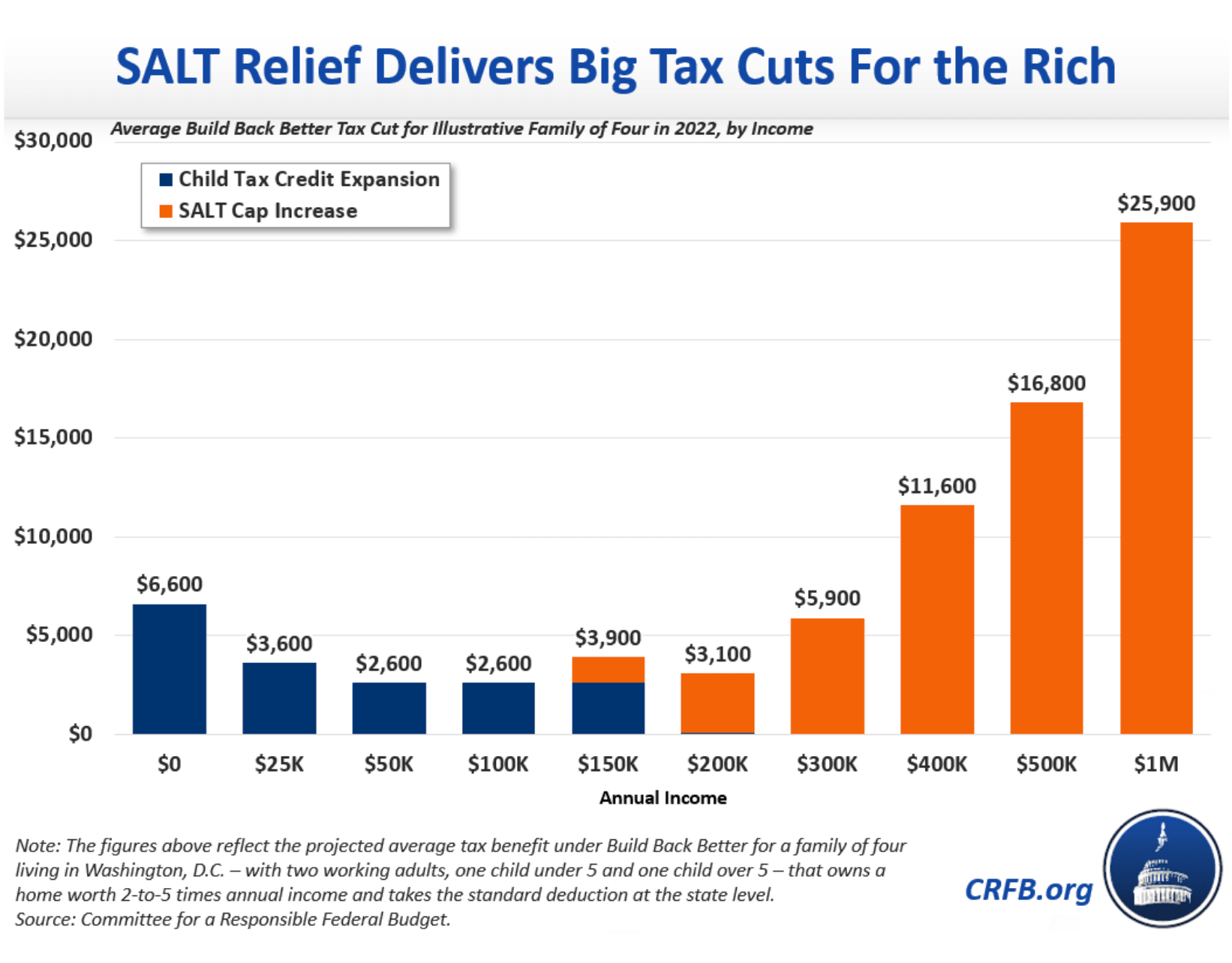

The Committee for a Responsible Federal Budget (CRFB) reported that a family of four in Washington D.C. making $1 million per year would receive 10 times as much tax relief next year from expanding the state and local tax deductions as a middle-class family would receive from an expansion of the child tax credit. The CRFB said that two-thirds of households making more than $1 million a year would get a tax cut under the legislation because of the increase in the state and local property tax deduction.

Pointing to the brazen hypocrisy of Biden and the Democratic Party, Marx Goldwein, senior policy director at the CRFB, said, “We’re debating about whether to give lower- and middle-class families a thousand dollars more a year through the child tax credit, while giving upper-class families $10,000 or more through SALT. That’s counter to everything the Democrats have been saying Build Back Better is about and everything they said about the Trump tax cuts.”

According to a report from the Tax Foundation, raising the SALT cap would more than offset other tax increases for the wealthy in 2022 included in the House bill. These include a 15 percent minimum corporate tax, a 1 percent tax on stock buybacks, increased taxes on US companies’ foreign profits, and a surtax of 5 percent on those with adjusted gross income over $10 million and 8 percent on those making more than $25 million.

In a column in the Financial Times on Thursday, Edward Luce alluded to the Democrats’ obsession with identity politics and linked it to the Build Back Better bill:

The result is a bill that caters best to the most powerful slice of Americans—the very wealthy. They can sleep easy now that the carried interest loophole, which allows private equity partners to be taxed at lower than ordinary income rates—as Warren Buffett pointed out, they pay a lower tax rate than their secretaries—is probably safe. As it stands, the bill will also give wealthy Americans a bigger tax cut than they got from Trump’s big 2017 tax bill.

Even this miserable travesty of social reform will be further gutted if not blocked outright in the Senate, where passage will require the support of all 50 Democrats. Neither Manchin nor Sinema has signed on to the bill, the former having declared his opposition to even a completely inadequate a four-week paid leave provision, while calling for means testing and work requirements for other social benefits.

The so-called “progressives”—Bernie Sanders, Elizabeth Warren in the Senate, the more than 100-strong House Progressive Caucus—capitulated to the demand of Biden and the most right-wing factions in the Democratic caucuses to pass the $1 trillion bipartisan infrastructure bill. This bill was backed by virtually every corporate lobby group, without having secured the agreement of Manchin and Sinema to support Senate passage of the broader “Build Back Better” social spending bill, against which the corporations have waged a massive lobbying campaign.

Sanders, for his part, has denounced the inclusion of the SALT provision in the House bill but is supporting a modified version in the Senate bill, according to which eligibility for expanded tax deductions would be limited to people making less than $400,000 a year. On the other hand, Senate Majority Leader Chuck Schumer, widely known as the “senator from Wall Street,” is supporting an even bigger deduction than that provided by the House.

He has announced that he will bring up the National Defense Authorization Act, which allocates $778 billion for the military in a single year (nearly half the 10-year Build Back Better budget) and the anti-China United States Innovation and Competition Act before taking up the social/climate measure passed by the House. This could delay consideration of Build Back Better until next year, something Manchin has hinted at, likely killing the legislation.

All of the so-called “progressives” promoted by the pseudo-left, including Democratic Socialists of America (DSA) members Alexandria Ocasio-Cortez, Jamaal Bowman, Ilhan Omar and Cori Bush, voted for the House bill on Friday, demonstrating the DSA’s role as an arm of one of the two main parties of US imperialism.

During the 2020 Democratic primaries, every candidate pledged to repeal the Trump tax cut for the rich. Biden has repeatedly called his domestic agenda a “blue collar” program. While declaring ad nauseam that “I am a capitalist,” who has nothing against people becoming billionaires, he has called on Wall Street to “pay their fair share.”

Now it is perfectly clear what this actually means. Under conditions where the Democrats control the White House and both houses of Congress, they have dropped any attempt to raise corporate or personal income tax rates for the wealthy The only significant change Biden and the Democrats are seeking to make to Trump’s multitrillion-dollar tax giveaway to the oligarchy is to increase its scale.

This is a devastating exposure of the fraudulent claims of the DSA and similar organizations of the upper-middle class that progressive change is possible within the framework of the capitalist two-party system and that the Democratic Party can serve as an instrument of social change.

Wolff Responds: Capitalism's False Defenses

Ten Years Ago: Corporate & Household Debt [10th Anniversary of Economic Update with Richard

Wolff]

CEO RESIGNATIONS INCREASE, ECONOMIC COLLAPSE GAINS SPEED, YOU CAN'T PRINT\

PROSPERITY

Insiders Just Exposed That A Terrifying Stock Market Crash Forecast Is About To Come True

Democrats Approve Billion-Dollar Tax Cut for Their Rich, Blue State Donors

House Democrats approved hundreds of billions of dollars in tax cuts for their wealthy, blue state donors with the passage of President Joe Biden’s “Build Back Better Act.”

On Monday, House Speaker Nancy Pelosi (D-CA) oversaw the passage of the filibuster-proof $1.75 billion budget reconciliation package that would deliver billions in tax breaks to the wealthiest residents of blue states if approved by the Senate and signed by Biden.

As part of the package, the State and Local Tax (SALT) deduction cap would be increased from its current $10,000 to $80,000 which would effectively amount to a $625 billion tax cut for the wealthiest Americans living in blue states — paid for by working and middle class Americans.

The Committee for a Responsible Federal Budget (CRFB) has noted that “a household making $1 million per year will receive ten times as much from SALT cap relief as a middle-class family will receive from the child tax credit expansion.”

“Roughly 98 percent of the benefit from the increase would accrue to those making more than $100,000 per year, with more than 80 percent going to those making over $200,000,” CRFB analysis has found.

The left-wing Tax Policy Center has assailed the tax cuts for billionaires, comparing it to the package’s tax increases on middle class Americans.

For instance, the package gives a tax cut to 66 percent of Americans earning more than $1 million annually while 78 percent of Americans earning $500,000 to $1 million will get a tax cut. At the same time, 27 percent of Americans earning $75,000 to $100,000 would see a tax increase along with 19 percent of Americans earning $50,000 to $75,000.

John Binder is a reporter for Breitbart News. Email him at jbinder@breitbart.com. Follow him on Twitter here.

WE KNOW WHAT OBAMA-HOLDER-BIDEN DID FOR THEIR CRONY BANKSTERS! THEIR CRIME TIDAL WAVE IS NOT OVER AND NONE HAVE GONE TO PRISON!

As a senator, Biden vigorously voted for several similar bills. In short, based on his voting record, Joe Biden is not (and never was) a champion of disadvantaged Americans, unless you consider multi-billion-dollar credit card corporations and millionaires “disadvantaged.”

This year, it’s Mr. Biden. Financial industry cash flowing to Mr. Biden and outside groups supporting him shows him dramatically out-raising the president, with $44 million compared with Mr. Trump’s $9 million.

"The reference to what “Trump’s done” is a fraud, since the both the Democrats and Republicans endorsed, on a nearly unanimous basis, the multi-trillion dollar bailout of Wall Street in March."

"Biden reassured Wall Street and the billionaires, “I’m not looking to punish anyone.”

I’ve also fallen toward a consultant theory of change — or like, a process theory of change. So a lot of people on the left would say that the Hillary Clinton campaign largely ignored economic issues, and doubled down on social issues, because of the neoliberal ideology of the people who worked for her, and the fact that campaigning on progressive economic policy would threaten the material interests of her donors.

Build Back Better Act Offers Media Billions To Go After Republicans

Give the media $1.9 billion and they promise to stop Republicans from winning elections.

18 comments

Daniel Greenfield, a Shillman Journalism Fellow at the Freedom Center, is an investigative journalist and writer focusing on the radical Left and Islamic terrorism.

Biden claims that the Build Back Better Act will help ordinary Americans, but the legislation, like so much in Washington D.C., is a collection of pork for corrupt special interests. One of those special interests is the media which suppressed negative stories about Biden and the Democrats, like the FBI investigation of Hunter Biden, while promoting disinformation, like the Steele Dossier, targeting President Trump: Biden’s opponent in the presidential election.

The media operates like a Democrat messaging operation and its partisanship has undermined its business model, especially for local news outlets which, unlike major national outlets, cannot simply ignore their existing readers and viewers to focus exclusively on radical urban leftists.

Congressional Democrats, with the complicity of some Republicans, had previously proposed media subsidy schemes that included tax credits for media companies, tax breaks for subscribing to papers, and even a $5,000 tax credit for taking out an ad in the local paper.

The media subsidy scheme in Biden’s Build Back Better Act offers $1.9 billion to the media with a payroll tax credit covering 50% of salaries, as much as $25,000, for the Democrat propagandists on media company payrolls, and another 30% over the next four years.

While the Democrats claim that this $1.9 billion special interest giveaway to the media is helping "local news", it's capped at 1,500 employees. The Washington Post has only a little over 1,000 “journalists” on its payroll. The legislation is written in a typically convoluted fashion, so it’s not altogether clear if the premier propaganda outlet of the Democrats, owned by the richest man in the country, would qualify for these subsidies at a time when Americans are struggling to get by.

Lest there be any doubt that the so-called "local journalism" provision is a State Media scheme to subsidize hit pieces on Republicans, Democrats explained that's exactly what it's there for.

Rep. Earl Blumenauer touted the ability of "local journalism" to stop Republican candidates like Edward Durr, a truck driver who spent $153 to defeat New Jersey Senate boss Steve Sweeney: the biggest Democrat power broker in the state.

“There was no opportunity for local media to provide even basic information about the candidates,” Rep. Blumenauer whined. “The guy would never have been elected if he had gotten any scrutiny at all.” By scrutiny, the leftist Democrat means hit pieces, of the kind that the media belatedly began generating after the truck driver’s unexpected election night win.

Give the media $1.9 billion in subsidies and they can stop the next truck driver from beating their Senate boss through lies, smears, intimidation, and disinformation campaigns.

If this dirty deal were any more corrupt, it would be taking place in a brothel.

But Democrats are not just relying on the innate biases of the media. One of the biggest dark money investments of their political machines have been fake news local operations.

Democrat groups like Report for America and Courier Newsroom have embedded subsidized reporters and created fake local news outlets to push leftist agendas. Report for America is funded by the usual Democrats megadonors, the Ford Foundation, the MacArthur Foundation, and the Knight Foundation, as well as by Big Tech monopolies like Google and Facebook.

Courier Newsroom, backed by the controversial Acronym/Pacronym network, had begun generating fake local news sites for the 2020 election with names like “UpNorth News” in Wisconsin. It's being rebooted with the backing of George Soros and LinkedIn founder Reid Hoffman who had previously been caught pushing fake news through the Alabama Project.

The Alabama Project had, in its own words, targeted the state's Senate election, by having "orchestrated an elaborate ‘false flag’ operation that planted the idea that the Moore campaign was amplified on social media by a Russian botnet.”

The LinkedIn co-founder apologized, claimed that he knew nothing and that it would never happen again. And here he is, alongside Soros, backing Good Information Inc. which will fund non-profit propaganda media and invest in for-profit media that pushes its political agenda.

Good Information Inc., is just a rebooted version of Courier Newsroom’s fake news network.

The Build Back Better Act’s $1.9 billion media subsidy isn’t just funding an industry aligned with the Democrats, but one that has become a false flag operation for its messaging apparatus.

The Dems might just as well add $1.9 billion in subsidies for their own political consultants.

The connection between the media’s political fake news operations and the pork isn’t even being disguised.

CNN’s Brian Stelter quotes “Report for America co-founder Steven Waldman, who has helped lead the drive for the tax credit”, saying, "It's a huge breakthrough for local news if it becomes law.” Report for America is indeed vocally advocating for the Democrat media subsidy. And it would be a “huge breakthrough” if part of the cost of Democrat messaging operations were being subsidized by American taxpayers freeing Dem megadonors to wage war elsewhere.

But the core business model of the leftist machine has been to not simply establish political operations that can swing elections, but figuring out how to make them into permanent taxpayer-funded features of public life so they can move on to their next “startup”.

Waldman, like CNN and Report for America, not to mention many of RFA’s megadonors, operate out of New York City. Their interest isn’t in local news, it’s in winning elections. Local elections are now routinely swung by rivers of cash coming out of New York and California. Not satisfied with using billions to rig local elections in places they would never visit, they want American taxpayers to subsidize their political activists and their fake news operations.

The media has gone to work telling Americans that giving them billions is actually a wonderful idea in the ultimate example of a conflict of interest. What the media neglects to mention is that its outlets are facing hard financial times because they have alienated two thirds of their audience. Unable to convince Americans to watch, read, and pay for their lies, they’re now resorting to extracting the money through the politicians they’ve been working to elect.

The same radical shift in the media that alienated its readers and viewers also vested the industry with the political power to steal billions from Americans and put it in their pockets.

The media is no longer an independent industry, it’s an arm of the ruling party.

The $1.9 million in media subsidies is a timely reminder that the only thing that the trillions in special interest pork are actually “building back better” is the Democrat Party.

LIKE ANY LAWYER, BIDEN HAS SPENT HIS POLITCAL LIFE LYING AND GAMING IT TO PUT IT IN HIS POCKET. THAT IS WHY THE CRIMINALS ON WALL STREET LOVE THEIR BOY SO MUCH!4

Report: Biden’s Campaign Benefited from Record Amount of ‘Dark Money’

President Joe Biden’s successful 2020 White House bid benefited from an extensive record-breaking amount of “dark money,” according to a new report.

Bloomberg News noted earlier this week that outside political groups—not officially associated with Biden’s campaign, but working to support his chances at victory—spent and raised more than $145 million from anonymous donors.

“That amount of dark money dwarfs the $28.4 million spent on behalf of his rival, former President Donald Trump,” Bloomberg reported. “And it tops the previous record of $113 million in anonymous donations backing Republican presidential nominee Mitt Romney in 2012.”

The money, while significant, was only a fraction of the $1.5 billion spent on Biden’s behalf this last cycle. The president, himself, raised more than $1 billion through his own campaign committee, according to the Center for Responsive Politics.

A further $578 million was raised by Super PACs and other political groups. This figure includes the $145 million in “dark money” that was raised by political non-profits that are not required by law to disclose their donors.

Generally, such non-profits either raise the money and spend it themselves or transfer it to larger Super PACs working on a candidate’s behalf. Although Super PACs are not allowed to coordinate directly with the campaigns of specific candidates, there is no limit to how much they can raise on that candidate’s behalf, provided they disclose every donor. Political non-profits, however, often act as a shield since they too can raise unlimited amounts of money without having to disclose their donors.

During the 2020 election cycle, such practices heavily benefited Democrats. The Center for Responsive Politics notes that more than $326 million in “dark money” was spent to aid Democrats this last cycle. Meanwhile, only $148 million was used to support Republican groups.

Democrats, including Biden, accepted the help from “dark money” groups, even as they argued in favor of tighter regulations on campaign spending. Biden, in particular, unveiled a proposal last year that specifically called for an “end [to] dark money groups.”

While Biden was championing that idea, though, “dark money” groups were mobilizing to see him elected president. As Breitbart News reported in October 2020, a super PAC backed by Silicon Valley donors and boosted by “dark money” spent substantially to run attack ads against Trump in the final weeks of the White House contest.

Biden Backed by $174 Mil in 'Dark Money'

Democrats and their media keep talking about the influence of big money. And they know exactly what they're talking about because the big money is always on their side. And the money is often unseen. It creeps through cracks and pours through indirectly. Government money fuels their community groups. And then there's the vast river of dark money out of Silicon Valley and Wall Street that swings the country their way.

Where did the dark money go in 2020? This is just a small part of the big picture.

Of donations and spending reported to the FEC, liberal groups directed more than $514 million in dark money into the 2020 election, overshadowing around $200 million that boosted Republicans.

Anonymous donors poured record amounts of money into groups backing President Joe Biden in the 2020 contest, leaving the public without a full accounting of who helped him win the White House.

Biden’s presidential bid attracted around $174 million in support from anonymous donors, more than six times the $25.2 million in dark money contributions and spending boosting President Donald Trump’s unsuccessful re-election effort.

Of course, this turns into a pitch for HR-1's pitch to kill free elections and turn America into California. Anyone who isn't suffering from a short memory though remembers that campaign finance reform is how we got into this mess. Instead of taking money out of politics, it poured a lot more money into it while shifting the center of power over to an ideological monopoly that helped push the country much further leftward.

If HR-1 were to become a nightmarish reality, you know that the power to determine elections would shift even further leftward, and more money than ever would pour into its political coffers.

The Left never dismantles its own power. It only strengthens it.

No comments:

Post a Comment