VIDEO SHOWING THE CRIMINALS

It’s Time To Start Blaming The Right People

15 Facts That Show Rising Prices Are Absolutely Eviscerating America’s Shrinking

Middle Class

20 Signs That American Families Are Being Economically Destroyed

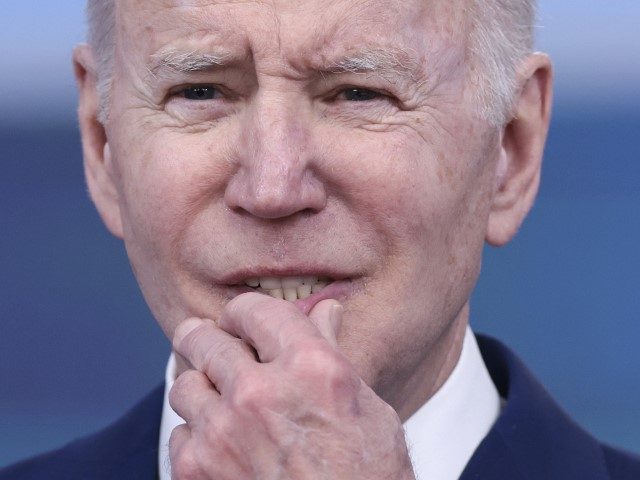

Poll: Just 16 Percent Strongly Approve of Joe Biden

Just 16 percent of Americans strongly approve of President Joe Biden, a Wednesday Morning Consult/Politico poll reveals.

Meanwhile, 40 percent strongly disapprove of Biden, a 24-percent gap.

Overall, the poll marks Biden’s approval at just 41 percent. A massive 55 percent disapprove of Biden. Biden’s approval numbers have remained about the same for the last couple of weeks.

The lowest approval rating Biden has ever received was 33 percent, according to a Quinnipiac poll in January.

Biden’s approval rating mirrors respondents’ opinions on whether the nation is headed in the wrong or correct direction. Only 31 percent said the nation is headed in the right direction. Sixty-nine percent said the nation is headed in the wrong direction, a 38-point gap.

Biden’s sagging poll numbers are bleeding into the midterms. Respondents trusted Republicans more than Democrats to handle the most important issues, according to the poll:

- Economy (48 percent trusted Republicans -34 percent trusted Democrats)

- Jobs (48-37 percent)

- Inflation (48-30 percent)

- Immigration (47-36 percent)

- Energy (42-40 percent)

- National Security (49-33 percent)

- Gun Policy, (45-36 percent)

The poll numbers reveal that Republicans may have a huge election victory in November. And the Democrats’ position could become worse.

According to the poll, Americans’ top concerns are inflation, jobs, and wages. But Democrats are struggling to reduce inflation and increase wages. As a result, Americans’ jobs may be impacted by a recession. Deutsche Bank Economists are predicting a recession within the next two years.

“Two shocks in recent months, the war in Ukraine and the build-up of momentum in elevated U.S. and European inflation, have caused us to revise down our forecast for global growth significantly,” they wrote. “We are now projecting a recession in the U.S. and a growth recession in the euro area within the next two years.”

On Tuesday, Labor Department numbers showed the consumer price index has soared 8.5 percent in one year, the largest year-over-year increase since 1981. The inflated prices will reportedly cost consumers an extra $5,200 in 2022, or $433 per month. Inflation already cost consumers an estimated $3,500 in 2021, impacting low-income families the hardest, according to the University of Pennsylvania’s Wharton School.

No comments:

Post a Comment