BRIBES SUCKER JOE BIDEN HAS DESTROYED AMERICA'S ECONOMY AS FAST AS HE DESTROYED OUR BORDERS AND HE'S STILL LYING ABOUT LIKE A SOCIOPATH GAMER LAWYER!

Oxfam report: As millions face starvation food giants’ profits soar

Hundreds of millions of people around the world are being hit by unprecedented food price inflation and shortages and are confronting outright starvation. But the giant companies that dominate food production and distribution are raking in money like never before.

The food crisis, resulting from total subordination of the means of life to capitalist profit, forms a centrepiece of the latest update on global inequality prepared by the UK-based aid agency Oxfam. This is in advance of the World Economic Forum meeting, the gathering of the world’s economic and financial elites, being held in Davos, Switzerland, this week.

The inflationary food crisis, set off as a result of the refusal of capitalist governments to take action to eliminate the COVID-19 pandemic, has been intensified by the US-led NATO proxy war against Russia in Ukraine.

Last week UN Secretary-General Antonio Guterres said global hunger levels were at a new high, with the number of food insecure people doubling from 135 million to 276 million in the past two years.

With the supplies of fertilisers and other agricultural inputs severely disrupted, the crisis has no end in sight.

The latest Oxfam report details how global agribusinesses, as well as the energy companies, are profiting out of this human misery.

Global food prices have risen by 33.5 percent in the past two years and are expected to rise by another 23 percent this year. March recorded the biggest leap in food prices since the UN began collecting food price data in 1990.

“Corporations and the billionaire dynasties who control so much of our food system are seeing their profits soar. the report said, noting that 62 food billionaires had been created in the last two years.

The report directed particular attention to the global food giant Cargill, one of the world’s largest private companies and one of four firms that control more than 70 percent of the global market for agricultural products.

The combined wealth of Cargill family members has increased by $14.4 billion since 2020, a rise of 65 percent. It grew by almost $20 million a day during the pandemic, driven by food price rises, especially for grains.

The company had a net income of $5 billion during 2021, the biggest in its history, and paid out $1.13 billion in dividends largely to family members. It is expected to make record profits again this year.

Cargill is not the only one raking in the money. One of its main rivals, the agricultural trading firm Louis Dreyfus reported that its profits surged by 82 percent last year on the back of rising grain and oilseed prices.

At the other end of the food supply chain, Oxfam noted that the US supermarket chain Walmart paid out $16 billion last year in the form of dividends and share buybacks to holders of its stock. Just 5.9 percent of an average basket of groceries went to small-scale farmers.

The average annual salary for the Walmart employee is just $20,942 but if the money handed out to shareholders was devoted to the company’s 1.6 million employees average wages would rise to $30,904 per week.

The other major beneficiary of the inflation crisis, driving down the living conditions of workers all over the world, are the major oil companies which have doubled their profit margins in the two years of the pandemic. The price of crude oil has risen by 53 percent over the past year and natural gas by 148 percent. The energy price hikes are a significant contributor to the rise in food and transport costs.

“The companies that are part of the world’s energy supply chain are making a killing [quite literally in view of the threat of starvation] out of these prices increases. Over the past year, profits across the energy sector have increased by 45 percent… Billionaires in the oil, gas and coal sector have seen their wealth increase by $53.5 billion [24 percent] in real terms in the past two years,” the report said.

The same picture is revealed in the pharmaceutical industry where the pandemic has resulted in the creation of 43 new billionaires, “profiting from the monopolies their companies hold over vaccines, treatments, tests and personal protective equipment.”

When such issues are raised, the reply of the “free market” defenders is that this wealth is the justifiable “reward” for entrepreneurship and spending on research without which the development of new drugs and vaccines would not take place.

This has always been a lie and never more so. As the report noted, most of the fortunes of the new pharma billionaires “is thanks to billions in public funding—for instance, from R&D grants and procurement” by governments.

Moderna, whose only product is a COVID-19 vaccine, has a 70 percent profit margin. “It has been immensely successful in turning $10 billion government funding in the US… into around $12 billion vaccine profits to date.”

The company has created four vaccine billionaires with a combined personal wealth of $10 billion while just 1 percent of its vaccines have gone to poorer countries. At the same time, it has refused to cooperate with efforts to establish local manufacturing in low- and middle-income countries.

The story is the same at Pfizer. The profit margin on its vaccine is 43 percent and last year it paid out $8.7 billion in dividends. In order to protect its profit flow, Pfizer has joined with other pharmaceutical companies to prevent the waiver of intellectual property rights that would see vaccine prices fall sharply. Millions of dollars have been spent on lobbying operations to try to prevent this happening.

In its overall analysis of the inflationary crisis and the explosion of billionaire wealth, the report noted that billionaires have increased their wealth as much in 24 months as they did in the previous 23 years, with those in the food and energy sectors increasing their fortunes by a billion dollars every two days.

A new billionaire “has been minted on average every 30 hours during the pandemic,” while in the same amount of time one million people are being pushed into extreme poverty.

It noted that the increase in billionaire wealth has resulted from the injection of trillions of dollars into the financial system. On top of this, there has been a “profit bonanza” and the strengthening of monopoly control over the economy with estimates that in the US “expanding corporate profits are responsible for 60 percent of increases in inflation.”

The report continued Oxfam’s advocacy for a series of wealth taxes, noting that a progressive wealth tax starting at 2 percent for those with wealth above $5 million and rising to 5 percent for wealth above $1 billion could generate $2.52 trillion worldwide, enough to lift 2.3 billion people out of poverty and provide health care for 3.6 billion lower income countries.

Such calculations are valuable in as much as they demonstrate there are more than sufficient resources available to reconstruct the global economy on the basis of social equality. But the political perspective being presented, namely that reasonable measures can be advanced to convince the ruling elites to change course, is bankrupt.

In fact, it is refuted by some of the concluding comments in the report: “Oxfam is above all underlining that the rapid rise in billionaire wealth today and the cost-of-living crisis faced by billions of people are one and the same phenomenon. This is not something that is just happening on their watch but that has been deliberately crafted with their support.”

This makes clear the pursuit of a reformist perspective aimed at trying to convince capitalist governments, the servants of this oligarchy, to somehow change course is futile. The only viable and realistic policy is the political struggle by the working class in every country for the program of international socialism so that the wealth produced by the labour of billions can be utilised for their social advancement.

Breitbart Business Digest: The Public Demands Action to Fight Inflation

Joe Biden is discovering a political truth that no president has had to confront in decades: Americans hate inflation.

The most recent evidence comes from a CBS News/YouGov poll released Sunday. The poll found that just six percent of the public think things are going very well in America today, joined by another 20 percent who say things are going somewhat well. Thirty-three percent say things are going somewhat badly, and 41 percent say things are going very badly.

The numbers are similar when it comes to the economy. Six percent say the economy is doing very well, and 20 percent say it is doing fairly well. Thirty percent say the economy is fairly bad, and 39 percent say it is very bad. Five percent say they aren’t sure, which is hardly an endorsement of the Biden administration’s policies.

Biden’s overall approval rating is pretty bad, although according to the CBS poll it improved two points to 44 percent in May. On the economy, however, he gets worse marks. Just 36 percent say they approve of Biden’s handling of the economy. When it comes to inflation, just 30 percent approve. Sixty-five percent of the public say Biden is slow to react to important issues, as he quite obviously has been on inflation. Just 45 percent say Biden is fighting hard to address our problems, 57 percent describe the president as distracted rather than focused, and 51 percent say he is incompetent.

Given that the Dow Jones Industrial Average just went on the longest losing streak in 90 years, it’s not terribly surprising that Americans are not optimistic about the stock market. Just 33 percent say they are optimistic about stocks. Similarly, only 32 percent say they are optimistic about the national economy. Only 23 percent say they are optimistic about the prices of goods and services, while 77 percent are pessimistic. Fifty-seven percent are pessimistic about their plans for retirement, which makes sense in an atmosphere of rising prices and falling stocks.

The gloominess is all the more extraordinary given the very low level of unemployment and the very high number of open jobs. Even the historically tight labor market only generates a bare majority—52 percent—saying they are optimistic about jobs in their community. Most likely this too is related to inflation. Nearly half of the public seems to understand that the Federal Reserve’s campaign against inflation is likely to come at the cost of higher unemployment.

The centrality of inflation to the public’s pessimism can be seen in the poll’s questions on what issues congressional candidates should focus on. Eighty-three percent say they would like to see Democratic candidates focus on inflation. Eighty-one percent said this should be the focus of Republican candidates. Among Democrats, 89 percent say Democratic candidates should focus on inflation. Among Republicans, 90 percent say their party’s candidates should focus on inflation. Among Trump voters, 94 percent want Republican congressional candidates to focus on inflation.

Keep in mind that inflation is not usually considered central to the role of Congress. Mainstream economics generally assigns inflation fighting to the Federal Reserve. It is considered an issue of monetary policy, whereas Congress has authority over fiscal policy. This bout of inflation, however, may be different. It was preceded by an enormous fiscal expansion to fight the effects of the pandemic, and Biden’s $1.9 trillion American Rescue Plan pushed inflation even higher than it would otherwise have been.

By subscribing, you agree to our terms of use & privacy policy. You will receive email marketing messages from Breitbart News Network to the email you provide. You may unsubscribe at any time.

Perhaps the public is not so much convinced that there’s a lot Congress can do about inflation. Perhaps they just want someone to do something. The Biden administration’s inept policies have accomplished zilch. The Fed is badly behind the curve. So, if you ask people what should congressional candidates be focused on, they answer inflation because that’s become the focus of their lives. Everything is getting more expensive, and no one appears to be helping.

Republicans should be cautious here. The poll shows that 51 percent of the public trusts Republicans more than Democrats on the issue of inflation, a razor thin majority. If Republicans want to make an issue of inflation in the midterm elections, they still have some work to do to persuade Americans they have better solutions than the Democrats.

The Fed Says Things Are Great

In a different survey, Americans reported the highest level of financial well-being than at any point in almost a decade. This comes from the Federal Reserve’s ninth annual Survey of Household Economics and Decisionmaking, or SHED. The data, however, is old. The survey was taken last fall, before inflation hit 40-year highs and when officials were still declaring that it was likely a “transitory” problem.

A big part of this well-being stems from the stimulus checks and other measures that inflated bank accounts last year. Seventy-eight percent of adults said they were either doing okay or living comfortably. That’s the highest share since the survey began in 2013. Note, however, that it is only three points higher than in 2020. That seems like a very small amount of progress given the trillions in deficit spending undertaken.

There’s also something a bit off about the Fed’s analysis. The Fed touts the fact that 68 percent of adults said they could cover a $400 emergency expense exclusively using cash or its equivalent, up from 50 percent when the survey began. This figure partly reflects the fact that $400 just is not what it used to be. The dollar has lost about a quarter of its value over the last nine years. Something that costs $400 today would have cost around $322.32 back in 2013. To look at it another way, the $400 expense in 2013 would be nearly $500 today. So the Fed thinks it is measuring an improvement in the financial security of American families, but part of this is just inflation.

Bostic Still Seems Overly Dovish

Atlanta Fed President Raphael Bostic said on Monday that it “might make sense” for the Federal Reserve to pause further interest rate hikes following expected half-point rate increases in June and July. Since there is no meeting in August or October, pausing hikes at the September meeting would mean that the Fed would be putting monetary policy at a standstill for three months.

The idea of a pause is inherently dovish. It shows that Bostic—and likely other Fed officials—is more concerned that the Fed’s actions might slow the economy too much than he is that the Fed’s actions might not get inflation under control. A more balanced approach would be to say that the Fed could pause if inflation falls or it could accelerate if it does not. That was not the message Bostic sent on Monday.

It’s also not the message Americans want to hear from the folks who are supposed to be taming the inflation beast.

Goldman Sachs to Joe Biden: Import Workers to Cut Wages by $100 Billion

President Joe Biden should cut roughly $100 billion from Americans’ wages in one year by importing 2.5 extra million foreign workers, says Wall Street’s leading investment firm, Goldman Sachs.

After President Donald Trump’s migration cuts, “the substantial gap between the number of workers and the number of jobs … has led to wage growth of 5 1/2% over the last year,” the firm complained on May 23.

“We have estimated that the [worker] gap would need to close by around 2 ½ million [extra migrants] to return wage growth to the 4-4½% range,” the report concluded.

The longed-for cut of 1.25 percent in Americans’ wages would take $137 billion from voters’ pocketbooks, each year, in perpetuity, according to data provided by another Wall Street firm, Moody’s Analytics.

Moreover, Goldman’s focus is on stock values. Those stock values are based on Wall Street’s predictions of future profits over the next 20 years. So Goldman’s one-year migration surge and one-year wage cut of $100 billion could boost stock values by about $2 trillion.

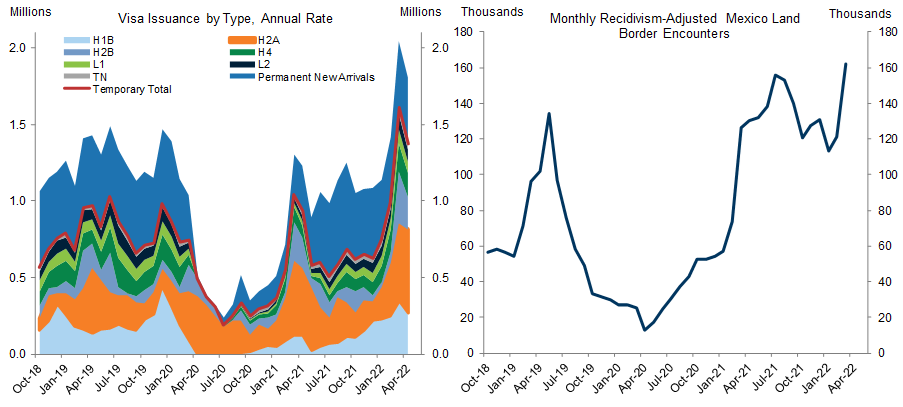

The transfer of wealth from employees to investors accelerated after 1990 when a bipartisan bill doubled the inflow of migrants and created new white-collar visa-worker programs.

Since 1990, the value of the Dow Jones Index has grown tenfold, while median wages and salaries have remained flat. During the same period, the NASDAQ grew 14-fold, as blue-collar and white-collar workers were forced to share their labor market with millions of foreign workers extracted from poor countries.

By subscribing, you agree to our terms of use & privacy policy. You will receive email marketing messages from Breitbart News Network to the email you provide. You may unsubscribe at any time.

However, Goldman admitted that Congress is very unlikely to pass another “Comprehensive Immigration Reform” wealth-transfer law: “Recent polling from Morning Consult suggests that among President Biden’s major executive actions over his first year in office, reversing the Trump Administration’s immigration restrictions are some of the least popular.”

Many polls show the unpopularity of Goldman’s high-migration/low-wages agenda.

But Goldman’s authors suggested that Washington could market the labor-supply changes as popular inflation-fighting measures:

Still, there are reasons to believe some liberalization of immigration policies could be politically beneficial. Inflation ranks as a higher priority than immigration among voters of all parties, with the greatest difference among Democrats.

And those stock-boosting changes could be established by Biden’s deputies, not Congress, Goldman reports:

While major changes might be too politically controversial, smaller changes—particularly around temporary work visas and potentially regarding green card recapture—might be in the realm of political reality.

But the Goldman report has some good news for investors and migrants from their allies in Biden’s pro-migrant agencies:

More recently, immigration has rebounded. Green card issuance to new arrivals has roughly returned to its pre-pandemic level, and temporary work visas have gotten close to normal levels in just the last few months.

Goldman’s report is a self-serving fix for the benefit of investors and CEOs, but not for the nation’s economic strength, Kevin Lynn, founder of U.S. Tech Workers told Breitbart News. He continued:

What it should show everyone is that corporate America is concerned about the next quarter and earnings per share. They’re not concerned about productivity. They’re not concerned about innovation. The CEOs are concerned about how they’re compensated and they’re compensated on maximizing profit. That’s not necessarily good for the corporation, and it’s not necessarily good for America.

And Americans know this. This is why [investors] have to sneak [migration] in through rules and regulation changes because these things are so unpopular. The average American knows that unbridled immigration harms them.

But Goldman’s immigration-as-inflation-cure theme is already commonplace among pro-migration writers and reporters.

Biden “has in plain sight several measures that would reduce inflation significantly, and yet appears hesitant to take them,” the Indian-born columnist Fareed Zakaria wrote on May 19 in the Washington Post, adding:

This is the time to reverse more of Trump’s restrictions on immigration, many done by executive action and hundreds of which are still in effect, which have caused severe worker shortages in industries such as farming, construction and health care.

RollCall.com reported on May 9:

As concerns about rising levels of migration to the southwest border dominate discussions on Capitol Hill, lawmakers and advocates are pointing to high inflation rates and critical labor shortages in a push for the Senate to take action soon on more narrow immigration bills that could boost the U.S. economy.

“Anyone that will report on what’s in the best interest of the wage-earning classes simply isn’t going to be long for the job,” said Lynn. The journalists with jobs “are following the narrative. … [so] there’s a distinct lack of critical thinking,” he added.

However, Biden put the kybosh on that plan in his 2022 State of the Union, saying:

We have a choice. One way to fight inflation is to drive down wages and make Americans poorer. I have a better plan to fight inflation. Lower your costs, not your wages. Make more cars and semiconductors in America. More infrastructure and innovation in America. More goods moving faster and cheaper in America. More jobs where you can earn a good living in America. And, instead of relying on foreign supply chains – let’s make it in America.

Overall, Biden has zig-zagged between isolated calls for a popular, wage-raising, tight labor market — “Rising wages aren’t a bug; they’re a feature” — and reckless invitations to migrants. That Biden welcome allowed his deputies to begin reinflating the post-1990s cheap-labor bubble with at least 1 million extra workers via the southern border in 2021.

Each year roughly 4 million young Americans enter the labor market in search of wages needed for their own homes and families.

But the federal government also imports roughly one million legal immigrants, and roughly one million temporary workers, and does little to return at least 11 million illegal migrants to their home countries.

Extraction Migration

Since at least 1990, the D.C. establishment has extracted tens of millions of migrants and visa workers from poor countries to serve as legal or illegal workers, temporary workers, consumers, and renters for various U.S. investors and CEOs.

This economic strategy of Extraction Migration has no stopping point. It is brutal to ordinary Americans because it cuts their career opportunities, shrinks their salaries and wages, raises their housing costs, and has shoved at least ten million American men out of the labor force.

Extraction migration also distorts the economy, damages professionals‘ clout, and curbs Americans’ productivity, partly because it allows employers to use stoop labor instead of machines.

Migration also reduces voters’ political clout, undermines employees’ workplace rights, and widens the regional wealth gaps between the Democrats’ big coastal states and the Republicans’ heartland and southern states.

An economy built on extraction migration also alienates young people and radicalizes Americans’ democratic, compromise-promoting civic culture because it allows wealthy elites to ignore despairing Americans at the bottom of society.

The economic policy is hidden behind a variety of high-minded narratives. These include the claim that the U.S. is a “Nation of Immigrants,” that Americans have a duty to accept foreign refugees, or that the government needs a different population. But the progressives’ colonialism-like economic strategy reduces overseas investment, kills many migrants, exploits poor people, and splits foreign families as it extracts human-resources wealth from the poor home countries.

The economic policy is backed by progressives who wish to transform the U.S. from a society governed by European-origin civic culture into a progressive-directed empire of feuding identity groups. “We’re trying to become the first multiracial, multi-ethnic superpower in the world,” Rep. Rohit Khanna (D-CA) told the New York Times on March 21. “It will be an extraordinary achievement … we will ultimately triumph,” he boasted.

Not surprisingly, the wealth-shifting extraction migration policy is very unpopular, according to a wide variety of polls. The polls show deep and broad public opposition to labor migration and the inflow of foreign contract workers into jobs sought by young U.S. graduates.

The opposition is growing, anti-establishment, multiracial, cross-sex, non-racist, class-based, bipartisan, rational, persistent, and recognizes the solidarity that Americans owe to one another.

No comments:

Post a Comment