Small Businesses Getting Crushed, ADP Jobs Report Shows

Small business payrolls shrank in May and the private sector added far fewer jobs than expected, a report released Thursday showed.

Businesses with fewer than 50 employees lost 91,000 workers last month, the May ADP National Employment Report said.

Medium-sized business, defined as having more than 50 and less than 500 employees, added 97,0000 jobs. The headcount at larger businesses jumped by 122,000 jobs.

As a whole, private sector payrolls rose by 128,000. That was far less than the gain of 299,000 expected.

The ADP jobs estimate is meant to provide a preview to the official estimate from the Bureau of Labor Statistics that typically comes out the following Friday. But throughout the pandemic, the two measures have fallen badly out of sync and both have been subject to larger than usual revisions in subsequent months.

ADP last month that the economy added roughly 250,000 private jobs in April. The BLS report said the economy added 406,000 private jobs. The numbers were closer in March, when ADP reported 455,000 jobs and the BLS reported 424,000. In February, though, ADP reported 475,000 and the BLS 714,000. ADP initially said that private employers cut 301,000 jobs in January. The BLS figure showed private payrolls grew by 444,0000.

Economists are forecasting that the BLS will report between 250,000 and 370,000 jobs added in May. The median forecast is for 325,000 jobs, including 310,000 private sector jobs.

It is not just ADP, of course. Economists on Wall Street and at the Federal Reserve have had forecasts of growth, employment, and inflation upended by the pandemic slump, recovery, reopening, and variant waves. Perhaps more interesting than the failure of forecasts to accurately predict the economy has been the failure of reports to accurately depict the economy. Revisions in many categories of economic data have been larger than usual. The economy has become harder to read, it seems.

By subscribing, you agree to our terms of use & privacy policy. You will receive email marketing messages from Breitbart News Network to the email you provide. You may unsubscribe at any time.

Thursday’s ADP report showed service sector providers added 104,000 jobs in May. Leisure and hospitality businesses increased headcount by just 17,000, a very low number. Goods producers added 24,000 jobs, including 22,000 in manufacturing.

This week the government’s Job Openings and Labor Turnover Survey, or JOLTS, showed there were 11.4 million job vacancies in the U.S at the end of April. Openings at businesses with 250 to 999 employees declined but openings at larger businesses increased. The hiring rate fell at businesses with 50 to 249 employees but increased at those with 5,000 or more. The quits rate increased at businesses with 250 to 4,999 employees but fell at those with between 10 and 49 employees.

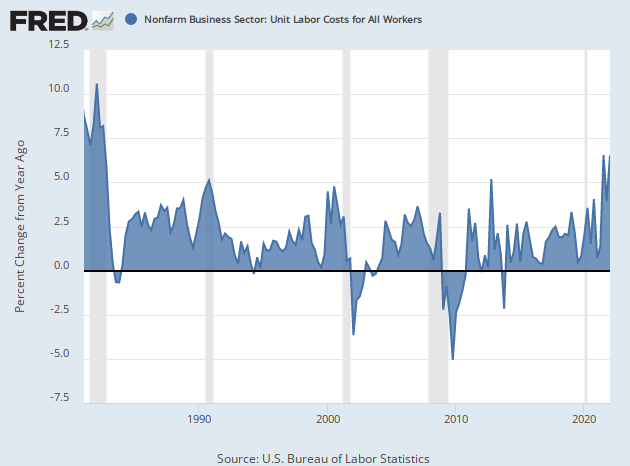

Bidenflation: Labor Costs Rise at Fastest Pace in 40 Years

The labor costs in the U.S. rose sharply in the first three months of the year, reflecting the highly inflationary environment and adding even more upward pressure on consumer prices.

Unit labor costs jumped 12.6 percent in the first quarter, a big increase from the initial estimate of 11.6 percent, data from the Department of Labor showed Thursday. Economists had forecast no change from the initial estimate.

Over the past year, labor costs are up 8.2 percent, the largest four-quarter gain since 1982.

The Bureau of Labor Statistics calculates unit labor costs as the ratio of hourly compensation to labor productivity. Increases in hourly wages and benefits tend to increase unit labor costs and increases in productivity tend to reduce them.

Labor costs tend to rise when inflation is high. Economic studies indicate that increases in broad measures of prices paid by governments, investors, consumers, and foreign purchasers of U.S. goods and services tend to push up labor costs over time.

The relationship between labor costs and consumer prices is more complex. Similar to what we see in broad measures of inflation, higher prices of goods purchased by consumers appear to push wages higher. But higher wages also tend to push consumer prices higher. This two-way causality is not observed in measures that include exports, investment, and government purchases. It is often referred to as a ‘wage-price spiral.’

The forty-year high in labor cost increases also saw the Consumer Price Index rise at its fastest pace in 40 years in March.

No comments:

Post a Comment