Poll: Gas Prices, Economy, Crime Dominate Midterm Issues

Record high gas prices, the economic recession, and soaring crime are the top three issues for voters heading into the November midterm elections, a Rasmussen Reports poll found Tuesday.

As the establishment media push climate change and the war in Ukraine as the top issues, voters remain unconvinced. They are more worried about issues that directly impact their lives.

Ninety-two percent are concerned about rising gas prices, while 68 percent are very concerned. Ninety-one percent are concerned about President Joe Biden’s economic recession. Sixty-six are very concerned. And 86 percent are concerned about violent crime. Sixty-one percent are very concerned.

Breaking the top ten concerns are also Biden’s energy policies (86 percent), inflation (85 percent), election integrity (80 percent), local school issues (76 percent), election cheating (75 percent), abortion (70 percent), and illegal immigration (69 percent).

Meanwhile, the poll found the top issues for the establishment media are climate change (62 percent), the war in Ukraine (60 percent), January 6 (57 percent), coronavirus (57 percent), and LGBTQ issues (42 percent).

The poll sampled 1,000 voters from August 17-18 with a two point margin of error.

The polling comes as Republicans are looking to retake the House and the Senate. The House is more likely to flip Republican than the Senate because the GOP in 2022 is defending far more key Senate battleground states than Democrats are.

But midterm polling favors Republicans. According to a NBC News poll over the weekend, Republicans are the preferred party to win in November. When voters were asked, “What is your preference for the outcome of this November’s congressional elections?” Some 47 percent chose Republicans. Only 45 percent selected Democrats. In March, Republicans were also favored by two points (46-44 percent).

Additionally impacting the midterms is the state of Biden’s America.

The NBC News poll showed only 22 percent of voters say Biden’s America is headed in the right direction. Seventy-four percent say its going down the wrong track.

Just 42 percent approved of Biden, while 55 percent disapproved of him. Biden’s net approval rating is -13 percent, matching his underwater approval rating in March.

Follow Wendell Husebø on Twitter @WendellHusebø. He is the author of Politics of Slave Morality.

Services Sector Collapsed in August as Demand Cratered and Economy Shrank for Second Straight Month, Survey Indicates

The services sector in the U.S. unexpectedly tanked in August, plunging private-sector business activity into a second month of contraction.

The S&P Global flash composite purchasing managers index fell to 45 in August, the lowest since February of 2021, from 47.7 in July. Readings below 50 indicate contraction.

The rate of contraction was the fastest recorded outside of the initial pandemic outbreak since the series began nearly 13- years ago.

The further deterioration was unexpected. Economists had expected the index to rise to 49.2.

“August flash PMI data signaled further disconcerting signs for the health of the US private sector. Demand conditions were dampened again, sparked by the impact of interest rate hikes and strong inflationary pressures on customer spending, which weighed on activity,” said Sian Jones, senior economist for S&P Global Market Intelligence.

The services sector PMI dropped to 44.1 from 47.3 last month. Economists had expected it to improve to 49. The manufacturing PMI fell to 51.3, indicating mild expansion.

“Gathering clouds spread across the private sector as services new orders returned to contraction territory, mirroring the subdued demand conditions seen at their manufacturing counterparts. Excluding the period between March and May 2020, the fall in total output was the steepest seen since the series began nearly 13 years ago,” Jones said.

There is also signs that the labor market, which has been incredibly strong this year, is beginning to roll over.

“Lower new order inflows and continued efforts to rein in spending led to the slowest uptick in employment for almost a year. Reports of challenges finding suitable candidates started to be countered by those companies noting that voluntary leavers would not be replaced with any immediacy due to uncertainty regarding demand over the coming months,” Jones said.

Inflationary pressures appear to be easing, although inflation remains historically elevated.

“One area of reprieve for firms came in the form of a further softening in inflationary pressures. Input prices and output charges rose at the slowest rates for a year and-a-half amid reports that some key component costs had fallen. Although pointing to an ongoing movement away from price peaks, increases in costs and charges remained historically robust,” Jones said.

S&P Global said that customer demand has been depressed by material shortages, delivery delays, hikes in interest rates, and inflationary pressures.

VIDEO

AND THEIR LIES JUST KEPT COMING, AND COMING AND COMING.... and so did the depression

The Next Crisis is Months Away as Defaults Have Started

Home Sales COLLAPSE to 10 Year Low (Realtors Freaking Out)

GOP Rep. Wenstrup: We Should Go after Hundreds of Billions in COVID Relief Fraud, Not Increased IRS Audits

On Friday’s broadcast of the Fox Business Network’s “Mornings with Maria,” Rep. Brad Wenstrup (R-OH) said that if Congress is interested in trying to increase the amount of money in the federal treasury, it should do more work on getting back the unemployment relief money obtained through fraud during the coronavirus pandemic, which is estimated to be between $100 billion and $400 billion instead of increasing audits on non-wealthy taxpayers through the Inflation Reduction Act.

Wenstrup said, “[Y]ou know what’s really interesting too, in all of this, you’re trying to recoup money, how about all the fraud that has taken place from the unemployment insurance, the unemployment benefits that went out during COVID? It’s estimated $400 billion, and you know, when we were having the mark-up on Ways and Means for Build Back Better, after an amendment to go after fraud, the Democrats voted it down. They voted it down. Most of this is foreign anyway and we should be actually going after all of that. … Nothing has happened there.”

Follow Ian Hanchett on Twitter @IanHanchett

Scalise: House Dems Know IRS Will Go after Non-Wealthy and Voted to Let Them after CBO Confirmation

On Friday’s broadcast of the Fox Business Network’s “Mornings with Maria,” House Minority Whip Rep. Steve Scalise (R-LA) stated that House Democrats knew that the Inflation Reduction Act reconciliation bill would violate President Joe Biden’s vow not to raise taxes on people making under $400,000 because an analysis by the Congressional Budget Office (CBO) confirmed that the bill would generate $20 billion in taxes from people making less than $400,000 through increased audits.

Scalise said, “[L]ook, the contrast has never been more clear, you were talking about this a little bit earlier, every single Democrat just voted for a bill that not only raises $730 billion in new taxes and new spending, which will increase inflation, but every single Democrat also voted — House and Senate — also voted to add those 87,000 new IRS agents, more than doubling the size of the agency, even after in the House it was confirmed that they’re going to be going after people making under $400,000 a year, which is a direct violation of President Biden’s promise, yet everybody knows that’s who they’re going after. They’re going to be going after them to the tune of over $20 billion in new taxes, just for lower-income families.”

Follow Ian Hanchett on Twitter @IanHanchett

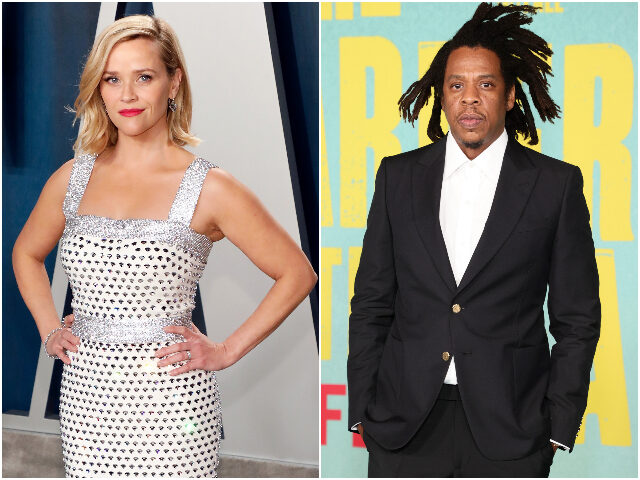

Report: Wealthy Celebrity Elites Including Reese Witherspoon, Jay-Z Benefited from PPP Loans; Most Have Been Forgiven

Wealthy celebrities including Reese Witherspoon, Khloe Kardashian, Jay-Z, and the rock bands Pearl Jam and Green Day have benefited from government-issued Paycheck Protection Program (PPP) loans handed out at the height of the coronavirus pandemic — nearly all of which have been forgiven by Uncle Sam, according to a new report from the Daily Mail.

The result is that taxpayers will end up footing the bill for the millions of dollars that businesses associated with the celebrities don’t have to repay.

Reese Witherspoon’s clothing company, Draper James LLC, received $975,472 in the first PPP round to meet payroll and rent. The entire loan has reportedly been forgiven. The Legally Blonde star is worth an estimated $400 million.

Rapper Jay-Z is associated with two companies approved for loans two years ago. Malibu Entertainment is tied to his streaming platform Tidal and received $2,106,398 in order to keep 95 jobs. The loan amount was reportedly forgiven in its entirety.

Jay-Z is estimated to be worth more than a $1 billion.

His champagne brand Armand De Brignac Holdings, of which he owns a 50 percent stake, borrowed $293,119 to meet payroll and was reportedly fully disbursed. It remains unclear if the loan was repaid.

Sean Combs, also known Puff Daddy or just Diddy, saw his cable network, Revolt Media and TV LLC, receive $1,929,252 for 134 jobs. That loan was forgiven.

Host Sean ‘Diddy’ Combs speaks onstage during the 2022 Billboard Music Awards at MGM Grand Garden Arena on May 15, 2022 in Las Vegas, Nevada. (Ethan Miller/Getty Images)

Combs is worth an estimated $900 million.

The rock band Pearl Jam’s touring company reportedly had its $629,335 loan forgiven after saving 28 jobs.

Green Day received three loans between two companies, Green Day Inc and Green Day Touring Inc.. The loans, which were worth $452,302 for 39 jobs, were nearly all forgiven.

Reality star and fashion mogul Khloe Kardashian’s denim brand Good American LLC received a loan of $1,245,405, mostly for the payroll of 57 workers. The full amount, plus interest, was reportedly forgiven.

Other PPP loan recipients span the political spectrum, including companies affiliated with Jared Kushner; Paul Pelosi, the husband of House Speaker Nancy Pelosi (D-CA); Kanye West; and football great Tom Brady. In some cases, the status of their loans remains unknown.

Paul Pelosi and Nancy Pelosi attend the TIME 100 Gala Red Carpet at Jazz at Lincoln Center on April 23, 2019 in New York City. (Dimitrios Kambouris/Getty Images for TIME)

The federal loan program is estimated to have cost taxpayers $953 billion. About 15 percent, or $76 billion, of PPP claims were fraudulent, according to a University of Texas study.

Follow David Ng on Twitter @HeyItsDavidNg. Have a tip? Contact me at dng@breitbart.com

What’s Happening:

The media has been hiding economic reports over the last few weeks. As we get closer to the midterms, they will be doing what they can to protect Democrats.

But Americans continue to suffer from inflation, high gas prices, and other stains on their wallets. And now, another sign has come out that the recession is already on us.

From Washington Examiner:

Housing starts measure the annualized change in the number of new residential buildings that began construction. Last month, they declined by a hefty 9.6% to a 1.45 million annualized rate after posting slight gains in June, according to a Tuesday report from the Commerce Department.

If the rising price of ground beef or unleaded regular didn’t tip you off that the economy isn’t great, this will.

The number of housing starts in July fell a steep 9.6%. This number measures how many new residential buildings begin construction.

Even a slight drop suggests a weakening economy. The housing market is always the first industry to suffer in a recession (or a depression).

When things are bad, people cut back on spending. The bigger expenses, like houses and cars, are cut first.

Then everything else quickly follows. These cutbacks force companies to make cuts themselves. In some cases, they lay off as many workers as possible.

So, this number is much more important than you might realize. New housing products dropped last month.

That’s consistent with other numbers that have come out recently. Inflation is hitting construction, as everything is costing more.

The housing bubble from 2020 long burst. Americans don’t want to risk moving or buying a new home, because it’s just too expensive.

The rest will come shortly, whether Biden believes it or not.

UPDATE: And just in, now housing sales just smashed through the floor. From CNBC:

Sales of previously owned homes fell nearly 6% in July compared with June, according to a monthly report from the National Association of Realtors.

Sales dropped about 20% from the same month a year ago.

“In terms of economic impact we are surely in a housing recession because builders are not building,” said Lawrence Yun, chief economist for the Realtors.

The fallout from Biden’s leadership just keeps piling up, folks.

Key Takeaways:

- The number of housing starts dropped in July by 9.6%, a sign of a recession.

- Inflation is driving up the price of homes, discouraging Americans to buy.

- Joe Biden continues to ignore signs we are in a recession, as the economy suffers.

Source: The Washington Examiner, CNBC

No comments:

Post a Comment