August Inflation Fueled by Higher Cost of Shelter, Gasoline

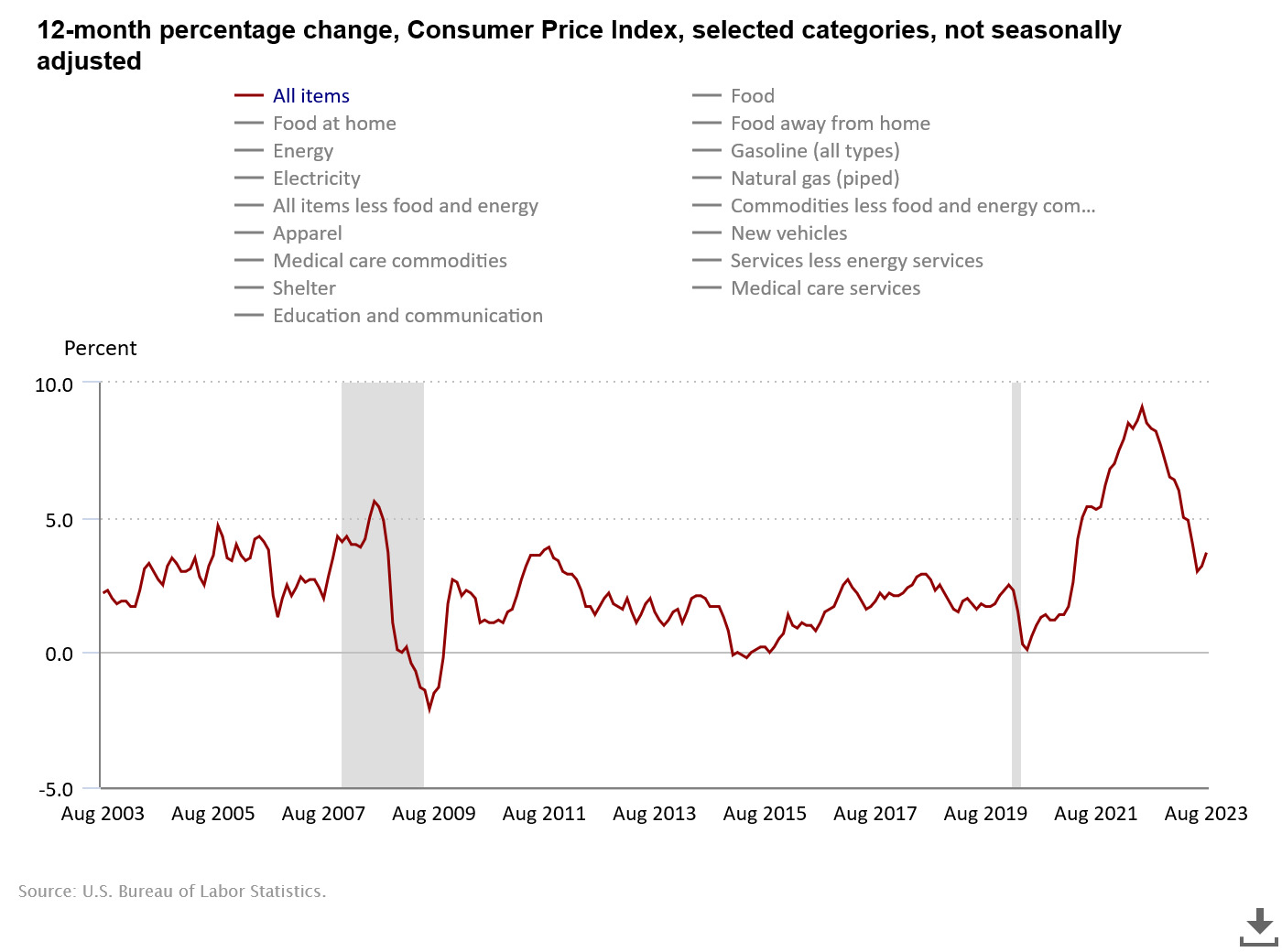

In August, the seasonally adjusted Consumer Price Index (CPI) for all urban consumers rose 0.6% from July, the U.S. Bureau of Labor Statistics (BLS) reported Wednesday.

The all-items index increased 3.7% for the 12 months ending August, up from the 3.2% year-over-year rise in July. Comparisons to year-ago had fallen for 12 consecutive months, before turning upward in July.

The “core” index, all items less food and energy, rose 4.3% over the last 12 months. The seasonally adjusted index for all items less food and energy rose 0.3% in August, ticking up from a 0.2% monthly increase in July.

The index for gasoline (up 10.6%) was the largest contributor to the rise in the monthly index for all-items, accounting for over half of the increase.

The energy index rose 5.6% in August, as all the major energy component indexes increased:

- Energy Commodities: 10.5%

- Gasoline (all types): 10.6%

- Fuel Oil: 9.1%

- Energy Services: 0.2%

- Electricity: 0.2%

- Utility (piped) gas service: 0.1%

The 0.3% rise in the cost of shelter – the 40th straight monthly increase - also contributed to the August monthly increase in prices.

Compared to August 2022, the price of shelter was up 7.3%, accounting for more than 70% of the total increase in all items, less food and energy. The shelter index was also the largest factor in the monthly increase in the index for all items less food and energy.

The food index increased 0.2% in August, matching its July increase. The index for food at home increased 0.2% over the month, while food away from home rose 0.3%.

The cost of motor vehicle insurance was up 19.1%, year-to-year, and 2.4% from July). The cost of new vehicles increased 2.9% from year-ago and 0.3% from July, while used car and truck prices fell 6.6% and 1.2%, respectively.

The business and economic reporting of CNSNews.com is funded in part with a gift made in memory of Dr. Keith C. Wold.

THE MEXICAN DRUG CARTELS CONTRO U.S. BORDER BRINGING JOE'S UNREGISTERED DEM VOTERS OVER THE BORDER

Full Interview: Robert F. Kennedy Jr.

DOC VIDEOS

America Lost (PBS, 2019)

MASSIVE Economic CRISIS In 6-12 Months In The U.S.: Watch These 3 Indicators Collapse

The Unthinkable Has Begun As A Major Bank Warns Of A Deep Dark Winter

Americans Worked More, But Earned Less, as August’s Inflation Reduced Real Earnings

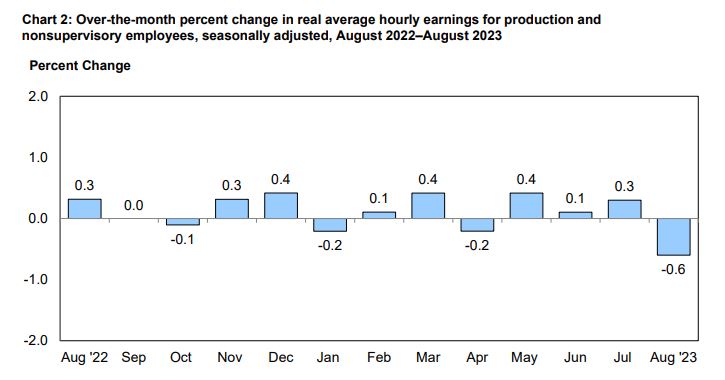

Adjusted for inflation, Americans earned less in August – even though they worked more hours – the U.S. Bureau of Labor Statistics (BLS) reported Wednesday.

Due to a seasonally-adjusted 0.6% jump in the Consumer Price Index for All Urban Consumers (CPI-U) compared to July, real average weekly earnings decreased 0.1% over the month, despite a 0.3% increase in the average number of hours worked.

August’s 0.2% improvement in average weekly earnings from July fell short of the month’s 0.6% increase in prices, resulting in the dip in real average weekly earnings.

For production and nonsupervisory employees, the loss in real wages was even more severe. Here, real average weekly earnings decreased 0.3% over the month, as a 0.3% increase in the average workweek failed to offset a 0.6% drop in real average hourly earnings.

In August, a seasonally-adjusted 10.6% increase in the cost of gasoline was the largest contributor to the 0.6% spike in the price index for all-items, accounting for over half of the rise from July. A 0.3% rise in the cost of shelter – the 40th straight monthly increase - also contributed to the increase in prices.

The business and economic reporting of CNSNews.com is funded in part with a gift made in memory of Dr. Keith C. Wold.

UPDATE-Bidenomics: Five Charts the Media Don’t Want You to See

UPDATED 9/14/23

Liberal media are declaring Bidenomics a success - but, hard numbers tell a much different story – regardless of whether the measure is how much Americans are paying, earning or saving.

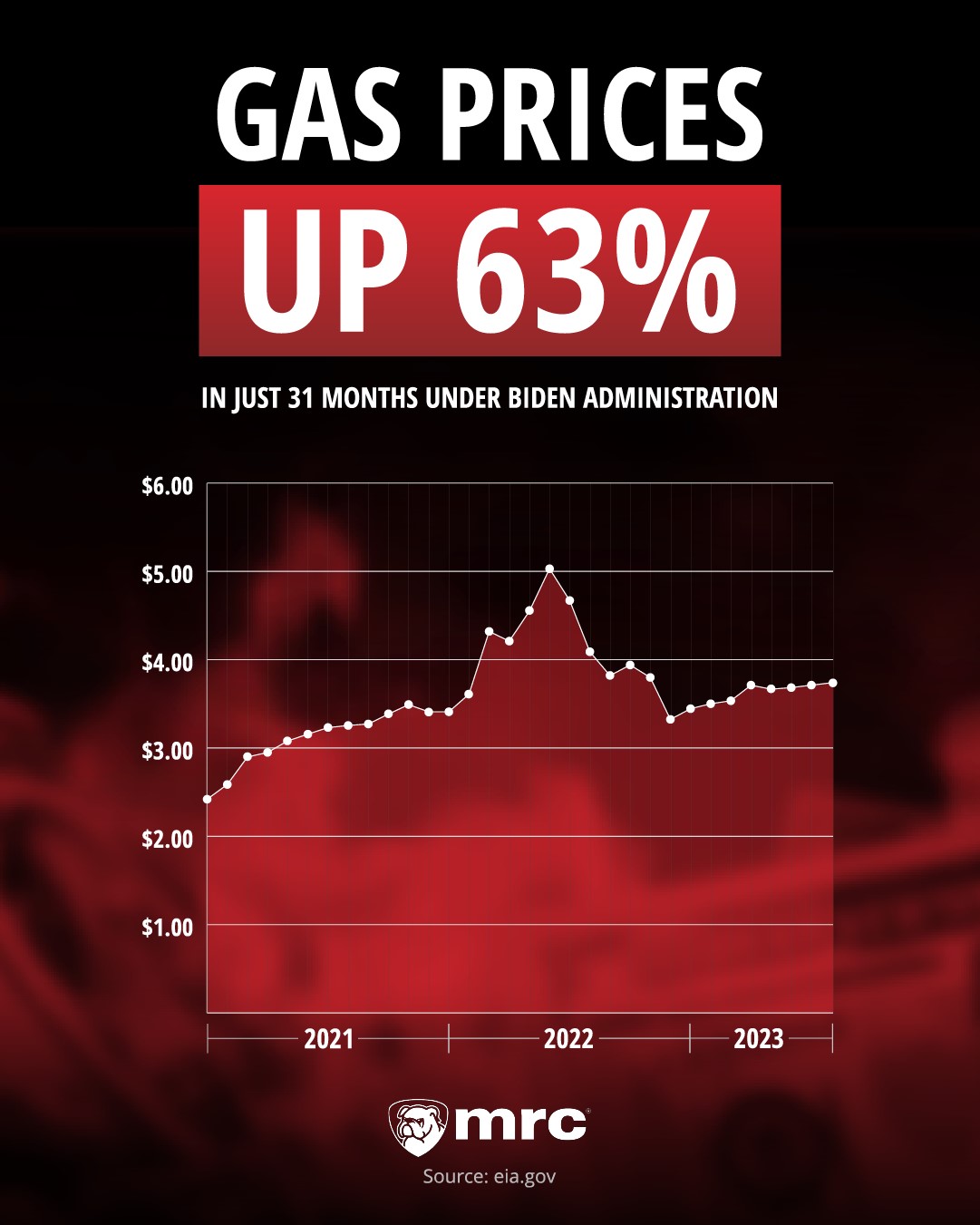

Gas prices:

While gas prices held steady under Pres. Donald Trump (down four cents a gallon), they’ve surged 63% in the first 31 months of Pres. Joe Biden’s term. From January 2021 to August of this year, the average price of a gallon of gas (all grades) has increased from $2.42 to $3.95, according to the U.S. Energy Information Administration.

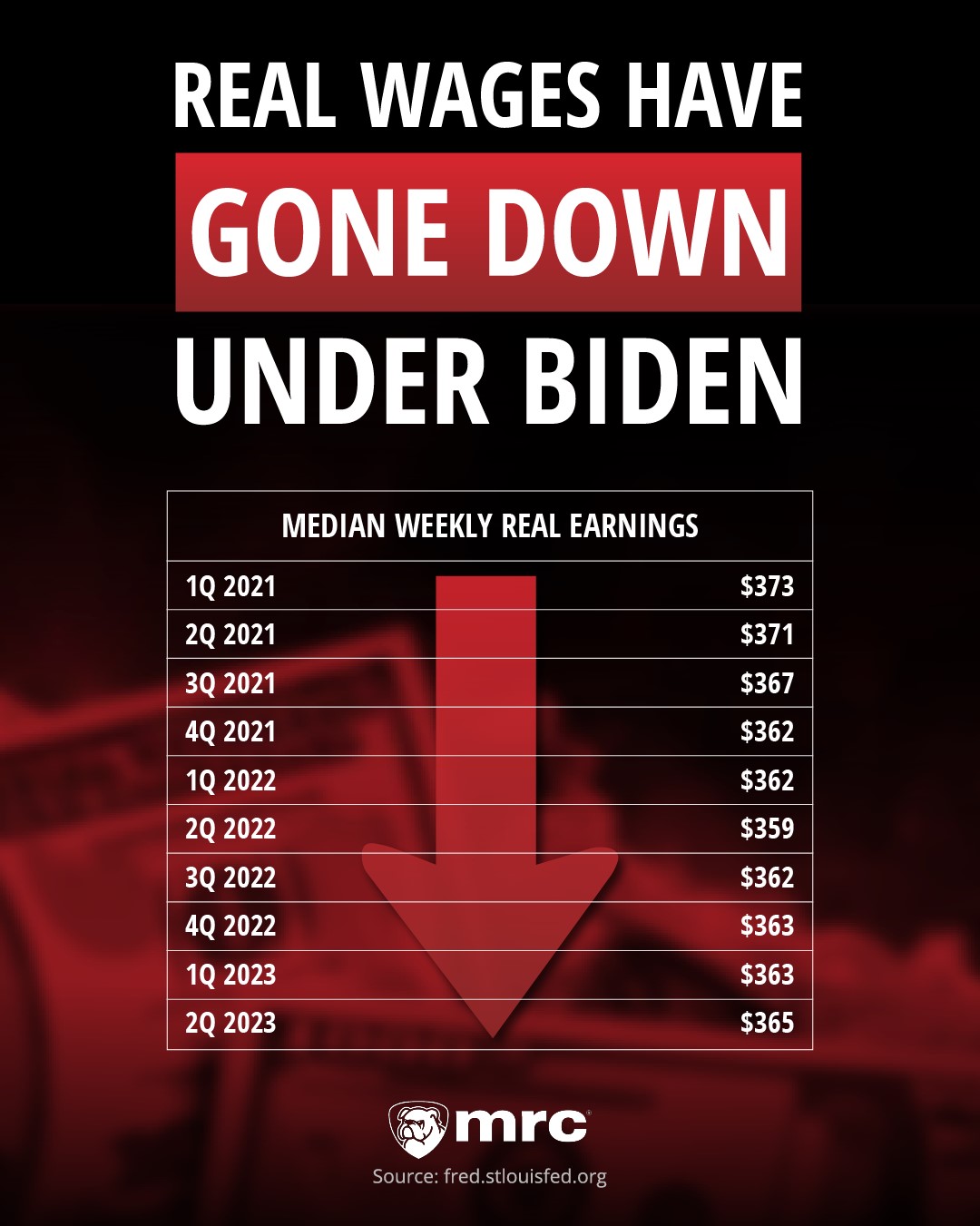

Real Wages:

After accounting for inflation, real wages earned by Americans have declined under Biden. In the first quarter of 2021, median weekly real earnings averaged $373. But, by the second quarter of this year, average real earnings had fallen to $365.

Under Trump, however, real wages rose from $352 on January 1, 2017, to $373 on January 1. 2021.

Real wages are calculated using Bureau of Labor Statistics (BLS) median usual weekly earnings for full-time employees at least 16 years old and are represented in terms of quarterly 1982-84 Consumer Price Index (CPI) seasonally-adjusted dollars.

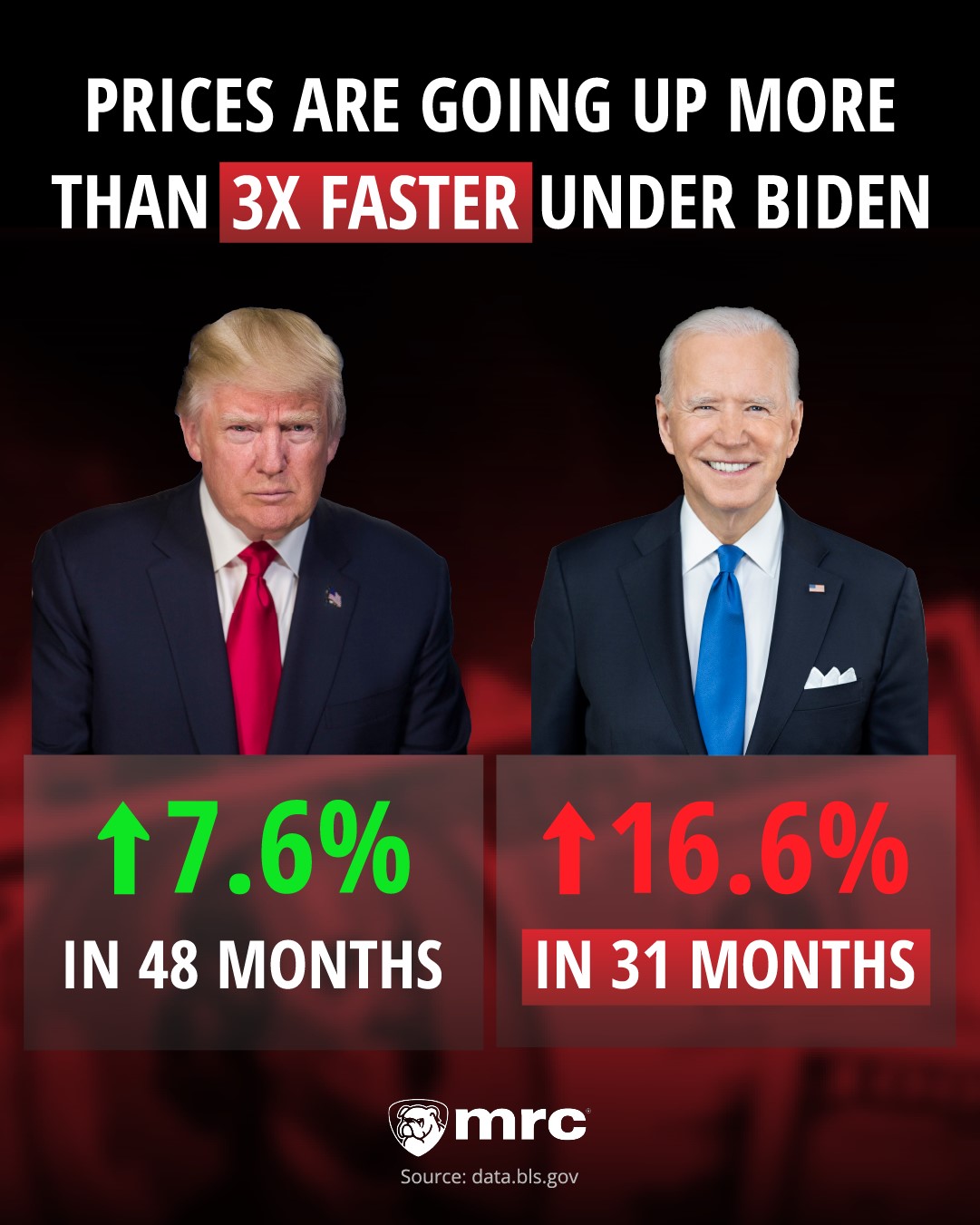

Consumer Price Index:

Consumer prices rose 7.6% in the 48 months of the Trump Administration, from a CPI of 243.618 in January 2021 to one of 262.035 in December 2020.

In contrast, prices have already risen more than twice as much, 16.6%, in just 31 months under Biden. Less than two-thirds of the way through his term, the CPI has risen from 262.650 in January of 2021 to 306.269 last month (August 2023), putting it on pace to increase more than three times as much as it did during Trump's full, four-year term.

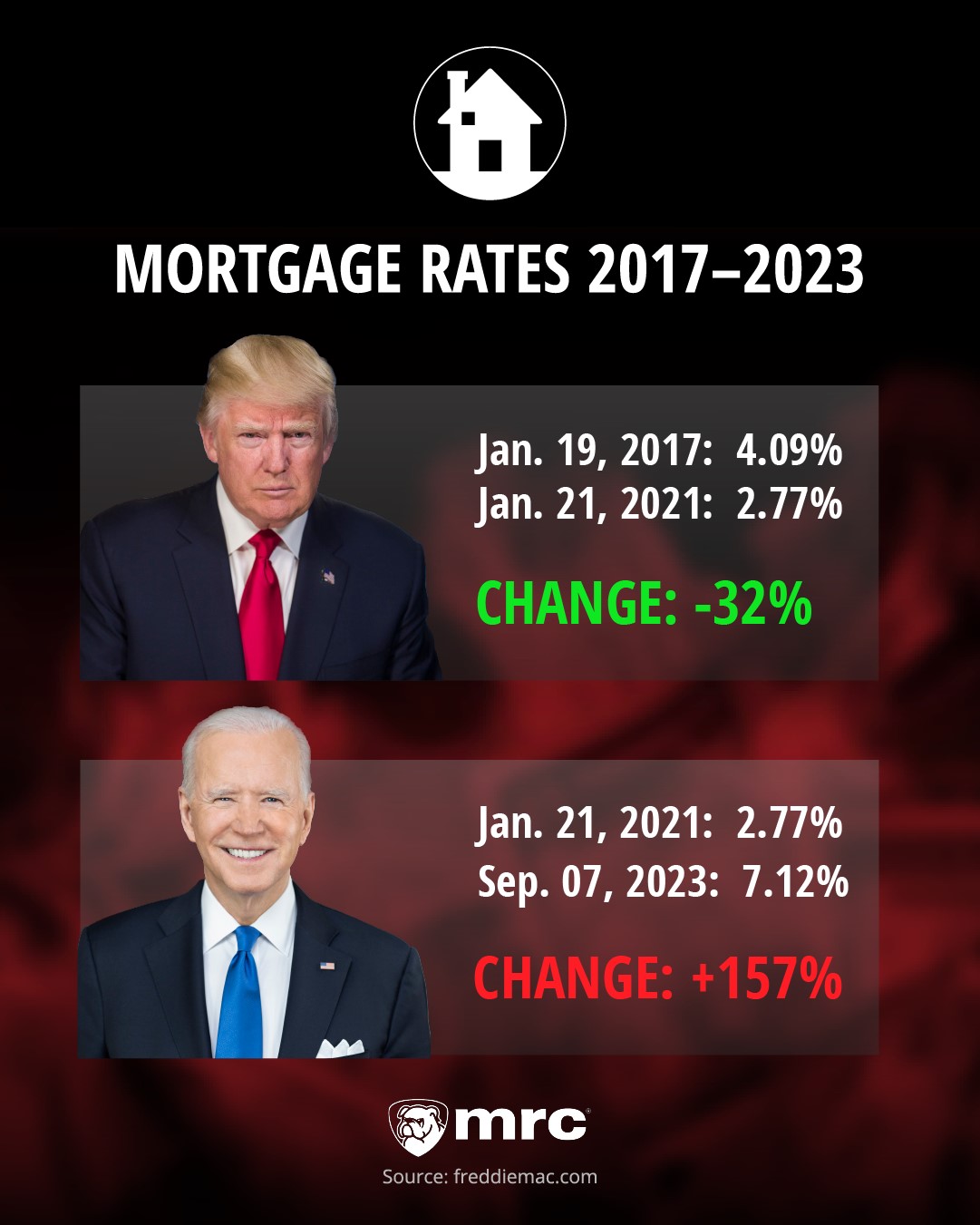

Mortgage Rates:

It’s also costing far more to finance a home purchase, under the Biden Administration.

Mortgage rates today are more than twice the average rate home buyers paid when Trump left office, Freddie Mac data reveal. Under Biden’s predecessor, the average 30-year fixed mortgage rate fell by a third, from 4.09% to 2.77%. But, by September 7, 2023, mortgage rates had more than doubled, increasing by more than four percentage points, to 7.12%.

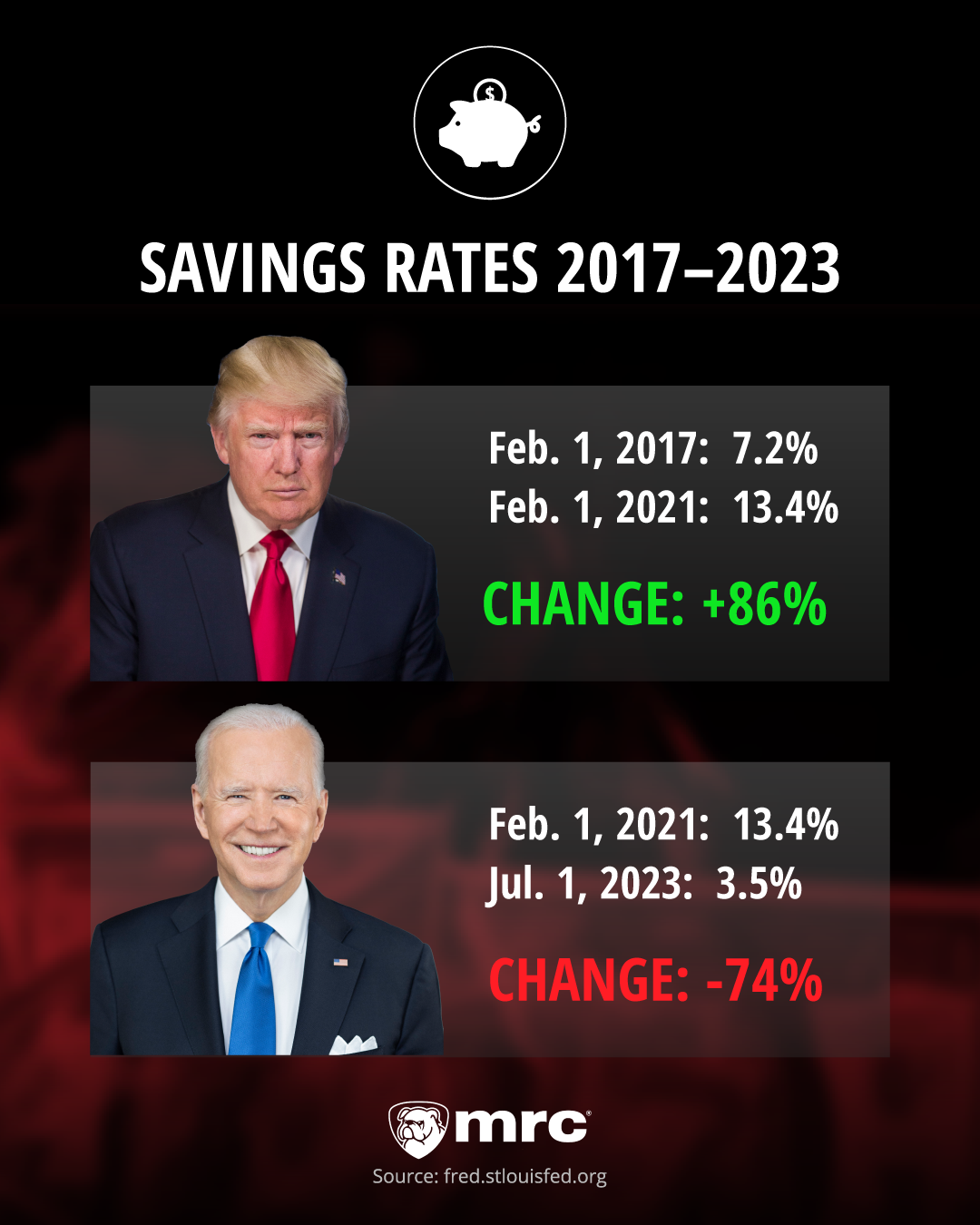

Savings Rates:

With Americans earning less and spending more, their average savings rate has declined under Biden.

From February 1, 2017 to February 1, 2021, the average personal savings rate increased 86%, from 7.2% to 13.4%. But, by July1 of this year, it had plummeted to 3.5% - a mere quarter of its pre-Biden level – according to Federal Reserve Bank of St. Louis (FRED) calculations, incorporating BLS data.

The business and economic reporting of CNSNews is funded in part with a gift made in memory of Dr. Keith C. Wold.

No comments:

Post a Comment