August Unemployment Rate Jumps, Employment in June and July Revised Downward

In August, the unemployment rate jumped 0.3 points, from 3.5% 3.8%, as the number of long-term unemployed increased, the U.S. Bureau of Labor Statistics (BLS) reported Friday.

The nation’s unemployment rate jumped 0.3 percentage point to 3.8% in August, as the number of unemployed persons increased by 514,000 to 6.4 million.

Among the unemployed, the number of job losers and persons who completed temporary jobs increased by 294,000 to 2.9 million in August, offsetting a decrease of 280,000 in July.

The rise in the unemployment rate, coupled an increase in job losers, highlights ongoing challenges in the economy. Meanwhile, the number of persons employed part-time for economic reasons remained unchanged.

Key economic measures for August:

- The number of unemployed persons increased by 514,000 from July.

- Increases were recorded in both the number of persons unemployed less than 5 weeks, at 2.2 million, and the number of long-term unemployed (those jobless for 27 weeks or more), at 1.3 million.

- The long-term unemployed accounted for 20.3% of all unemployed persons.

- Labor force participation rate rose by 0.2 percentage points, to 62.8%.

By sector:

- Total nonfarm payroll employment increased by 187,000.

- Employment continued to trend up in sectors like health care, leisure and hospitality, social assistance, and construction.

- Employment in transportation and warehousing fell.

By demographic group:

- Unemployment rates for adult men, whites, and Asians rose

- Rates for adult women, teenagers, Blacks, and Hispanics showed little change

The increases in health care, leisure and hospitality, social assistance, and construction continue a positive trend, as these industries have been leading the way in job growth. However, there was a decline in employment in the transportation and warehousing sector, which could be attributed to various factors such as supply chain disruptions and labor shortages.

The rise in the unemployment rate was primarily driven by an increase in the number of unemployed persons, which now stands at 6.4 million, after increasing by more than a half million from July.

Adding to concerns, the BLS reported that the economy’s picture in recent months wasn’t as rosy as it initially reported:

- Total nonfarm payroll employment for June was revised down by 80,000, from +185,000 to +105,000.

- July was revised down by 30,000, from +187,000 to +157,000.

- Due to these revisions, employment in June and July combined was actually 110,000 lower than previously reported.

- The downward revisions make August look better in comparison, by comparing it to lower numbers in June and July.

The September employment report is scheduled to be released October 6, 2023.

The business and economic reporting of CNSNews is funded in part with a gift made in memory of Dr. Keith C. Wold.

61% Are Now Living Paycheck-to-Paycheck; Personal Savings Rate Falls

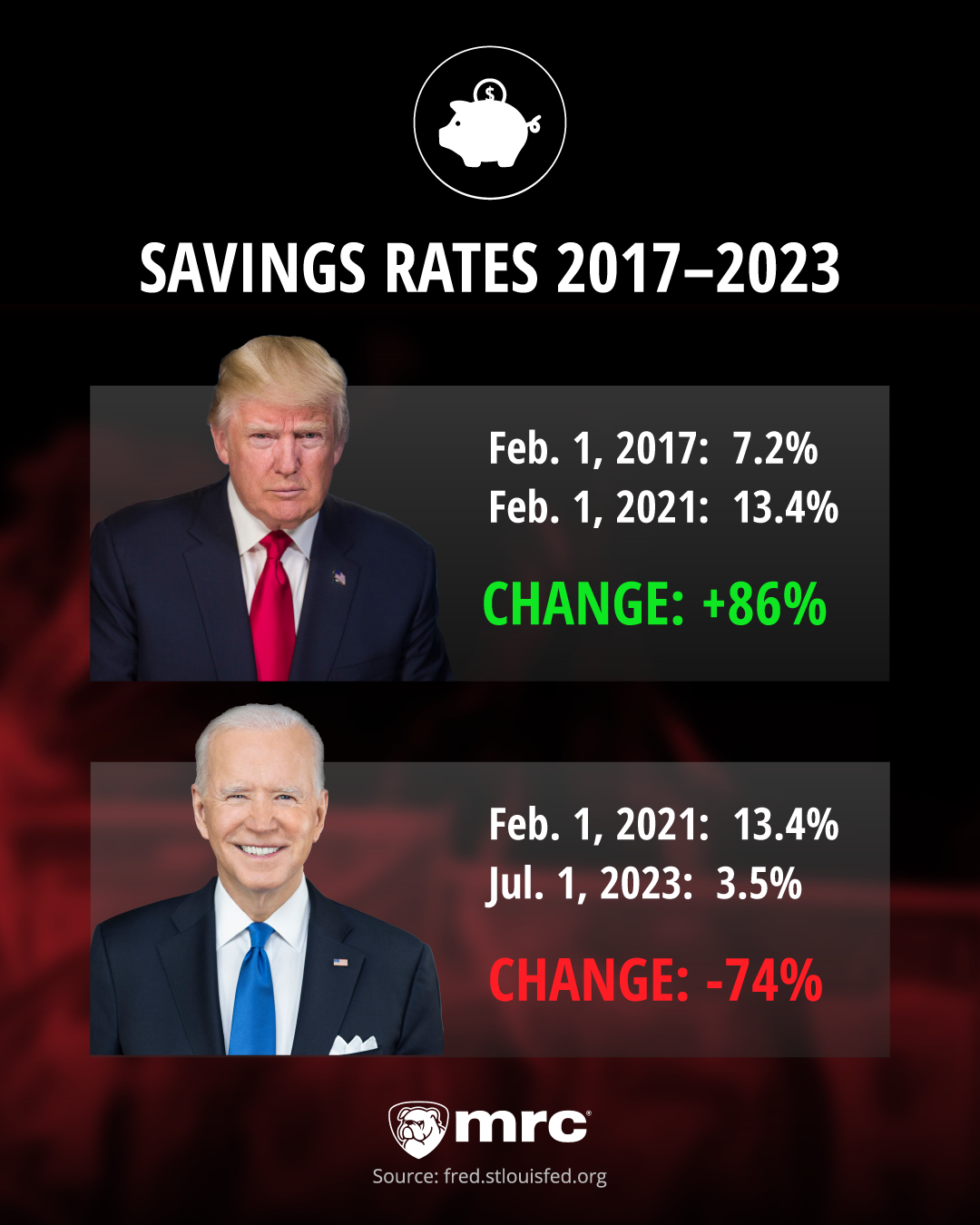

As of July, Americans are saving less – and more than half are living paycheck-to-paycheck – new reports reveal.

“61% of Americans are living paycheck to paycheck — inflation is still squeezing budgets,” CNBC reported on Thursday, citing a new Lending Club study on July 2023 consumer trends.

Also on Thursday, the U.S. Bureau of Economic Analysis (BEA) released its “Personal Income and Outlays” report for July, revealing that Americans’ average personal savings rate fell from 4.3% in June to 3.5% in July.

July’s 3.5% savings rate is a mere quarter of its 13.4% level when former Pres. Donald Trump left office and more than twice the 7.2% savings rate recorded during Trump’s first full month in the White House.

Adjusted for inflation, “real” disposable personal income (DPI) for July - personal income less personal current taxes – fell, compared to the previous month, the BEA reports:

- Total personal income increased $45.0 billion, at a 0.2% monthly rate, in July.

- Disposable personal income was virtually unchanged from June.

- “Real” disposable personal income decreased 0.2% for the month.

- “Real” personal consumption expenditures increased 0.6% in July, reflecting increases of 0.9% in spending on goods and 0.4% in spending on services.

- The Personal Consumption Price Index increased 0.2%, compared to the previous month.

The business and economic reporting of CNSNews is funded in part with a gift made in memory of Dr. Keith C. Wold.

eBOOK AVAILABLE FOR FREE ON AMAZON

ISBN eBOOK 978-1-7374087-3-4

ISBN BOOK 978-1-7374087-2-7

Things happen and at times love prevails no matter what we throw at it. Justin Swingle

Peter loves Maggie. Maggie loves Peter.

Alice loves Peter, too.

Mary, Maggie’s mum loves her daughter.

Maggie loves her mum and Louisa also loves Maggie’s mum.

And Brandon, he loves money even if it isn’t his.

It got tangled!

London, 1948. The city is putting itself together again after the Second World War, and people and families are trying to find a way forward. It’s a struggle for all.

Peter is a young man who works at the library. He has hopes and dreams of one day being a novelist. His dreams and fantasies help him escape his day to day life where his somber habits inhabit his ways with women. But then he meets the woman with the bright red lips like a movie star.

Maggie is a young woman of prominent cheekbones and startling ambition, who wants to be a film star – or, failing that, a novelist. She’s about as predictable as a thunderstorm.

Alice is the girl next door and works for a literary agent. She loves Peter’s writing – and Peter too. But will she find the courage to tell him so?

In a slippery tale of stolen hearts and purloined novels, secret loves and hidden ambitions, these lives become irretrievably tangled.

Who will end up with whom? Who will end up rich and celebrated? And will art – and love – win out in the end?

.jpg)

.jpg)

No comments:

Post a Comment