Overall, between March 15, 2020 and May 27, 2021 Clark County (Las Vegas) had an estimated 22,400 eviction filings, which is more than any other similarly sized area studied by the researchers. For comparison’s sake, Dallas County, Texas, which has a larger population than Clark County, had nearly 4,000 fewer evictions, 18,600, over the same time period. Philadelphia County in Pennsylvania recorded 5,200 evictions total.

Yellen Sees ‘Several More Months of Rapid Inflation’ — Worries About Housing Impact

Treasury Secretary Janet Yellen said Thursday on CNBC’s “Closing Bell” that the U.S. economy will have “several more months of rapid inflation.”

Yellen said, “We will have several more months of rapid inflation. So I’m not saying that this is a one-month phenomenon. But I think over the medium term, we’ll see inflation decline back toward normal levels. But, of course, we have to keep a careful eye on it. Measures of inflation expectations, I think, still look quite well contained over the medium term. Those expectations are actually a driver of price-setting behavior. So it is important that we monitor it carefully, but I believe fundamentally, you know, that this is something that will settle down.”

She continued, “We have seen a big increase in housing prices. In part due in part to changes in the pandemic and the low-interest-rate environment we have. The lending that’s taking place is to creditworthy borrowers. I don’t think that we’re seeing the same kinds of danger in this that we saw in the run-up to the financial crisis in 2008. It’s a very different phenomenon. I do worry about affordability and the pressures that higher housing prices will create for families that are first-time homebuyers or have less income. And a portion of the plans that will be under consideration by Congress will be intended to boost affordable housing, the supply of affordable housing.”

Follow Pam Key on Twitter @pamkeyNEN

Inflation is Surging as Wages are Falling - People are Unprepared

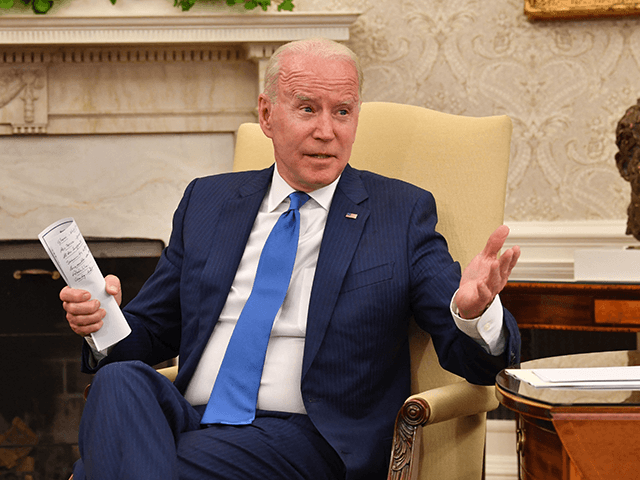

Biden's American Jobs Plan Is Devoid of Moral Values and Economic Realities

The American Jobs Plan is premised chiefly upon investing $621 billion in America's crumbling transportation infrastructure. The Biden administration claims, "Decades of declining public investment has left our roads, bridges, rail, and transit systems in poor condition, with a trillion-dollar backlog of needed repairs. More than 35,000 people die in traffic crashes on U.S. roads each year, and millions more are seriously and often permanently injured." These statistics related to infrastructure are misleading. While traffic deaths have risen appreciably from 2020 despite fewer people driving, the preponderance were caused by aberrant behavior, not infrastructure. National Highway Traffic Safety Administration statistics show that deaths resulting from impaired driving rose more than 9% since 2019, and failure to wear safety belts increased 15%. There can be little doubt that the White House's distortion of the causes of death is based on ulterior motives.

It is more likely that the vast investment in infrastructure is driven by the desire of progressives to consolidate economic and political power. It can scarcely be called legitimate. The most damning evidence for this view is that specific places and people that such projects are intended to help are strikingly absent. Similarly, the costs for each of the (unnamed) projects are not supplied, nor are safeguards to control cost overruns included. In fact, the Plan is alarming for anyone who typically asks, Why? What? Where? When?

Another commentator has already noted a similar lack of specificity in Biden's so-called Fact Sheet on Domestic Terrorism. The so-called jobs "Plan" provides a lot of vacuous generalities that serve the purpose of dramatically expanding the federal government but vacuously ignore specifics.

Economically, there is no long-term financial plan to pay for improvements without both raising taxes across the board and further increasing already burgeoning national debt. Think of the fabulous expansion of railroads in the 19th century. The government did not pay for the expansion of the railroads, but incentivized the railroads to invest in the project by providing land grants to the railroads for every mile of new track laid. They found a way for the government to support the private sector to accomplish infrastructure goals.

So many economic issues affecting the USA are ignored by this document. Honest hardworking people are becoming increasingly alarmed about the loss of our energy independence, acerbated by the shutdown of the Keystone XL pipeline, resulting in higher fuel prices and transportation costs of goods to market. More importantly, the shutdown led to the loss of thousands of jobs. The shift away from natural gas– and oil-generated power in favor of electric power for cars, and solar power and windmills for homes, will lead to tremendous employment dislocation. Yet these likely dislocations are not addressed in a meaningful way by the so-called Plan. As a Plan, it is therefore strangely disconnected from the stated goals of the administration.

The issue of job development cannot be properly addressed without seriously addressing inflation. Despite the attempts of Janet Yellen to downplay the threat of inflation even as our national debt surges to unprecedented levels under the Democrat give-away-the-store public spending, this elephant in the room is not addressed in the Jobs Plan even in passing. The consumer price index has already risen 1.4% in the past year. Earnings have begun to stagnate while taxes reflexively will escalate to meet the rising demand for increased social services, which the administration is ready to offer to non-citizens as well as citizens. These are portents of trouble.

When the many key issues of economics are not properly addressed by a document that is more propaganda and posturing than truly analytical and issue-oriented, many bad consequences are sure to follow. Why? The answer is simple: the fiscal and philosophical fundamentals have not changed. The virulent evil of China's communist dictatorship and its footprint in our national economy must be reckoned with. We must avoid becoming a command economy like China, but compete under free market strategies, meanwhile shrinking our reliance on government. If we are to survive, we must shrink, not increase, our dependence on a government-driven and controlled economy. If America is still to be the dominant economic powerhouse, our strategy must change. So must our priorities.

The moral dimension of jobs and work requires that we determine our own future through the classical dignities of work and self-reliance. How ironic that we citizens are offered an American Jobs Plan while thousands of illegal so-called refugees are being admitted who will undermine our economy. They will take jobs away from actual citizens, and they will depend upon social services that will drain and undermine the economic life of citizens through excessive taxation and a skyrocketing national debt. The American Jobs Plan is for Americans, yet without borders, there is no country. We control who comes here and how. This does not make us racist, narrow-minded or xenophobic. It is the rule of law, what makes us American.

We cannot endure as a country by leveraging large amounts of long-term debt and cultivating an inflationary economy. American life is and should always be a renewal movement built upon the dignity of being an American — a living hope directed by discipline, virtue, and above all order. It therefore takes time, energy, and courage. Most of all, it requires character and a manifestation of moral truth to set the example. We do not need the stream of ideological pap and "green" thinking that has been emanating from the Democrats. We do not need a jobs plan that has no plans. Moral realities combined with non-green economic realities must be embraced and put forward as an alternative to the bogus jobs plan of this administration.

Image: Gage Skidmore via Flickr, CC BY-SA 2.0.

WSJ: Elite Schools Leave Grad Students Buried Under Mountains of Debt

Elite universities continue to push master’s programs that don’t pay off, as the jobs that graduates get with their degree from top institutions fail to generate enough income to pay down their six-figure federal loans, according to the Wall Street Journal.

Master’s students lured in by the idea of acquiring a degree from prestigious institutions have taken on debt beyond what their salary after graduation can support, according to a report by the Wall Street Journal.

Recent film program graduates of Columbia University who took out federal student loans had a median debt of $181,000, and two years after obtaining their degrees, half of the borrowers are earning less than $30,000 a year, the report added.

Columbia’s program is reportedly the most extreme example of how top universities have recently been awarding thousands of master’s degrees that don’t result in enough early career earnings for graduates to start paying down their massive student loans.

Recent Columbia film alumni had the highest debt compared with earnings among graduates of any major university master’s program in the United States, the Journal reports.

Meanwhile, at New York University, graduates with a master’s degree in publishing borrowed a median $116,000, and had an annual median income of $42,000 two years after graduating, the report added.

At Northwestern University, half of the students who earned degrees in speech-language pathology reportedly borrowed $148,000 or more, and are earning a median income of $60,000 two years later.

As for University of Southern California’s marriage and family counseling program, graduates borrowed a median $124,000, and half earned $50,000 or less two years later.

While undergraduate students have been facing inflating loan balances for years, now it’s graduate students who are accumulating the most burdensome debts, reports the Journal.

And unlike undergraduate loans, the federal Grad Plus loan program has no fixed limit on how much graduate students can borrow. The limitless loans make master’s degrees a goldmine for universities, which have gone on to expand their graduate school offerings since the creation of the Grad Plus in 2005.

And now, for the first time ever, graduate students are on track to have borrowed as much as undergraduates in the 2020-2021 academic year, the report adds.

Zack Morrison, who earned a Master of Fine Arts in film from Columbia in 2018, told the Journal that his graduate school loan balance now stands at nearly $300,000, including accrued interest.

Morrison added that he has been making between $30,000 and $50,000 a year as a Hollywood assistant, and from side gigs working in commercial video production and photography.

“There’s always those 2 a.m. panic attacks where you’re thinking, ‘How the hell am I ever going to pay this off?'” he said.

It’s the taxpayers, however, who will end up being responsible for whatever is left unpaid by graduates who took out the staggering loans.

Combined US federal and state unemployment claims rose to 470,000 last week

The release Thursday of the Department of Labor’s (DOL) latest weekly unemployment claims report gives an indication of the economic and social crisis facing workers and their families more than 16 months into the coronavirus pandemic. According to the report, 373,000 jobless workers applied for state unemployment benefits, a slight increase over the previous week, and an additional 99,000 filed for assistance under the Pandemic Unemployment Assistance (PUA) program.

The report was received with consternation within corporate boardrooms and both big business parties. They had hoped that the early termination of supplementary unemployment benefits by over half of the states would have forced more workers to accept dangerous and low-paying jobs, despite the new surge in COVID-19 infections fueled by the reopening of businesses and schools and the lifting of virtually all remaining social distancing and safety measures, carried out in the face of the spread of the virulent Delta variant.

The DOL report also found that more than 14.2 million Americans were still receiving some form of unemployment payment through June 19. Meanwhile, economists estimate that there are some nine million job openings across the US, the majority centered in the low-paying service, retail and seasonal tourist industries.

The 472,000 combined state and federal claims filed for the week ending July 3, which is double the pre-pandemic average, came despite the fact that 26 states have announced plans or have already begun to eliminate the meager $300-a-week federal supplement included in the Biden administration’s “American Rescue Plan,” which was signed into law this past March.

Biden has already announced that he will not seek to extend the federal benefit when it expires on September 6, and the White House has explicitly endorsed the “right” of Republican-led state governments to turn down the federal funding and terminate the program prematurely, on the grounds that the extra $300 a week is a “disincentive” to work.

In plain English, this translates into: Either work for poverty wages and risk infection and possible death from COVID, or starve!

Economists estimate that cutting unemployment pay prematurely in the 26 states will force some four million jobless workers and their families to participate in what NBC News described last month as a “bold experiment” in compelling workers to fully resume pumping out corporate profits.

However, the “bold experiment” has to date fallen short of expectations. Economists with Morgan Stanley in a recent analysis reported by Forbes found that: “... generous [sic] unemployment benefits are likely no more of a factor than other impediments, including childcare, transportation and health concerns, to workplace re-entry.”

The same report found that states that eliminated benefits on June 19, including Alabama, Idaho, Nebraska, New Hampshire, North Dakota, West Virginia and Wyoming, had only slightly larger declines in continued unemployment claims through May compared to states that are eliminating benefits but have not yet done so—12 percent compared to 8.7 percent. States that have not announced plans to terminate benefits early saw a 4 percent decline in continued unemployment claims through May.

The group of economists, led by Sarah Wolfe and Ellen Zentner, wrote that they could find “only mixed evidence” that ending benefits early had an effect on workers seeking employment, adding: “Stripping out the disincentive effect of unemployment benefits on the labor market recovery is not simple.”

As the ruling class and the entire political establishment rush to fully “reopen” the economy, they are centrally concerned by the development of a tight labor market, which gives workers, particularly lower paid workers, a degree of leverage in seeking better-paying positions and, in general, pushing for wage increases after decades of stagnating or declining wages. This hinders the drive to utilize the pandemic to further cut wages and increase the exploitation of the working class.

The Biden administration’s response is three-pronged: Allow the pandemic-triggered relief to expire, support the corporatist trade unions in their efforts to suppress mounting working class militancy, and promote identity, and particularly racial, politics to divide and disorient the working class.

Even with the temporary $300-a-week federal supplement, the combined total of state and federal benefits falls far short of meeting the basic needs of working class families. In many states, the amount does not replace even half of a worker’s normal earnings.

Despite having control of both houses of Congress and the presidency, the Democratic Party has not lifted a finger to preserve the $300-a-week stipend, which is already a 50 percent cut from the $600-a-week supplement passed as part of last year’s CARES Act.

The coming expiration of federal unemployment benefits, coupled with the ending of the Centers for Disease Control eviction moratorium at the end of July, has pushed thousands of families into homeless shelters, tents or cramped living situations with friends or relatives.

This past week, the Eviction Lab at Princeton University made public data collected in conjunction with the Las Vegas Review-Journal over the past year showing that despite the moratorium, thousands of evictions have been processed in metro-Las Vegas, including 4,559 in November 2020 alone.

“The fact that in November filings were 50 percent above what they are normally—that’s not the case in really any of the other cities we track,” Jacob Hass, a research specialist at the Eviction Lab, told the newspaper. Haas noted that the November spike occurred after Democratic Governor Steve Sisolak allowed the state-wide moratorium to expire on October 15, before renewing it on December 14.

Overall, between March 15, 2020 and May 27, 2021 Clark County (Las Vegas) had an estimated 22,400 eviction filings, which is more than any other similarly sized area studied by the researchers. For comparison’s sake, Dallas County, Texas, which has a larger population than Clark County, had nearly 4,000 fewer evictions, 18,600, over the same time period. Philadelphia County in Pennsylvania recorded 5,200 evictions total.

Inflation Worries Grow

The American public is increasingly worried about inflation.

Twenty-six percent of adults say that inflation is a bigger problem than unemployment, a poll by The Economist and YouGov shows. Twenty-one percent say unemployment is the bigger problem. Forty-two percent said both are equally as important.

The public also rates price level as the most important economic indicator. Forty-two percent say the prices of goods and services they buy are the most important economic indicator, followed by 25 percent who said unemployment and jobs reports. Ten percent said their personal finances are the most important and six percent said the stock market is the most important.

This is a big change. In January, just 24 percent told pollsters that the most important economic indicator was prices. Forty-two percent said unemployment and jobs reports.

The government will release its Consumer Price Index for June on Tuesday. Economists expect the pace of monthly price increases to tick down from 0.6 percent in May to 0.5 percent. CPI has come in hotter than expected for three months.

Former IMF Economist: America’s Inflation Is Beginning to Resemble a Latin American Country

Desmond Lachman, an economist and senior fellow with the American Enterprise Institute (AEI), told Breitbart News on Sunday that the U.S. is beginning to resemble a Latin American country given its inflation, government spending, and printing of money.

Government borrowing and spending — marketed as economic “stimulus” by its proponents — combines with growing government debt and expansion of the money supply to drive inflation, Lachman explained.

“The real reason that one should be worried about inflation is that there’s far too much stimulus in this economy,” he remarked. “We’ve got the largest peacetime budget stimulus that this country has ever known. We talk about something like 12-13 percent of GDP, which is a massive budget stimulus by any reckoning.”

He continued, “But on top of that, we’ve got the Federal Reserve that keeps printing money. … We are seeing the money supply now growing well over 20 percent [year-over-year]. If you look at the broad money supply, that’s the fastest money supply [expansion] that we’ve seen in many, many years.”

Lachman spoke with Reuters last month, when the outlet reported on the Federal Reserve’s unprecedented printing of money:

Money supply — which measures outstanding currency and liquid assets — rose 12% year-over-year in April, according to The Center for Financial Stability’s Divisia M4 index including Treasuries.

The measure has been running between 22% and 31% each month since April 2020, fueled by unprecedented economic stimulus from the Federal Reserve and U.S. government. That compares with annual growth of around 3-7% that was common from 2015 to early 2020.

He concluded, “Milton Friedman’s argument — which is widely accepted — is that inflation is everywhere a monetary phenomenon, So if you’ve got this rapid rate of money growth, you should be expecting that this inflation isn’t transitory. This could be here for awhile.”

Breitbart News Sunday broadcasts live on SiriusXM Patriot 125 from 7:00 p.m. to 10:00 p.m. Eastern.

No comments:

Post a Comment