Sixty million people in the United States, nearly 1 in 5, received assistance from food banks and similar organizations in 2020 according to the nonprofit Feeding America, representing a 50 percent increase over the prior year. According to a research brief by The Conversation, the sharpest increase in the rate of food insufficiency was among so-called middle-income households, households that make $50,000 to $75,000 per year, rising from 0.98 percent to 1.48 percent.

Cars line up for food at the Utah Food Bank’s mobile food pantry at the Maverik Center Friday, April 24, 2020, in West Valley City, Utah [Credit: AP Photo/Rick Bowmer] Food insufficiency increased among Americans at all income levels according to The Conversation’s analysis of Census Bureau survey data after April 23. American households earning less than $50,000 have the highest level of food insufficiency, with each lower income bracket tracking with a higher level, with 4.4 percent of those under $25,000 food insecure. That is, this is a problem that affects primarily the working class.

Food insufficiency, according to the US Department of Agriculture (USDA), “is a more severe condition than food insecurity and measures whether a household generally has enough to eat. In this way, food insufficiency is closer in severity to very low food security than to overall food insecurity.”

As defined by the USDA, “Food insecurity is the limited or uncertain availability of nutritionally adequate and safe foods, or limited or uncertain ability to acquire acceptable foods in socially acceptable ways.” The USDA reports that overall food insecurity has rose in the US from 9.5 percent of the population as of April 23, 2020, to 13.4 percent as of December 21, 2020.

As of the end of August, according to the US Census Bureau’s weekly Household Pulse survey, more than 7 percent of all households and 9 percent of households with children said they sometimes or often did not have enough to eat.

Feeding America also projected that 54 million Americans didn’t have enough food to eat in 2020, a 46 percent increase over 2019.

As of March 2021 more than 42 million Americans received Supplemental Nutrition Assistance Program (SNAP) benefits, an increase of 5 million from the previous March.

While Congress passed a 15 percent increase to SNAP benefits at the end of last year, which it later extended, this is set to expire September 30, the end of FY 2021. A reassessment of the USDA’s “Thrifty Food Plan,” which is used to determine SNAP benefits, is set to take effect October 1 as a result of the 2018 Farm Bill, passed under the Trump administration, which stipulates a readjustment of payments for the first time since 2006 according to the USDA.

The Thrifty Food Plan will translate into an average $11 monthly increase over the current assistance program, from $240 to $251, despite the end of some federal benefits to SNAP, though with inflation factored in, using 2020 to 2021 numbers on the Minneapolis Fed’s inflation calculator, it will actually amount to a 68 cent decrease. The average amount will drastically decrease in 2022 to $169 a month before inflation if remaining federal pandemic assistance provisions for SNAP are allowed to expire according to USDA, though the decrease in real terms is likely to be far larger as inflation is expected to continue and accelerate.

According to the key findings section on a USDA study released before July 4 this year “88 percent of SNAP participants reported facing some type of barrier to achieving a healthy diet throughout the month.”

The second point states that, “The most common barrier overall, reported by 61 percent of SNAP participants, was the affordability of foods that are part of a healthy diet.”

The annual projected cost of the Thrifty Food Plan is a mere $20 billion, one-sixth the cost of the $120 billion transferred every month from the Fed to Wall Street, or about 2.8 percent of the $715 billion 2022 US military budget being requested by the Biden administration.

Furthermore, food prices are skyrocketing. The Consumer Price Index for food has increased to 2.7 percent for 2021 compared to 2020, with large increases seen in some food groups.

USDA forecasts for wholesale beef, farm-level eggs, farm-level wheat and flour prices were revised upwards this month. Beef is predicted to increase between 17 and 20 percent in 2021 based on data currently available this month, with the same for pork, with wheat rising between 33 and 36 percent and poultry with a 16 to 19 percent increase.

This, along with the disastrous job situation where upwards of 7.5 million unemployed workers have been cut off jobless benefits, millions are at risk of being thrown out of their homes with the lapsing of the national eviction moratorium, accompanied with skyrocketing home and rental costs that are bound to drive both an immiseration and radicalization of the working class.

The growth of hunger during the pandemic is a damning exposure of the incapability of capitalism to provide for even the most basic of social needs and an objective expression of the need for the working class to expropriate the wealth of the capitalist oligarchs and to put it towards the needs of the vast majority of the population.

JOE BIDEN’S GLOBALIST AGENDA FOR MORE DEM VOTING ‘CHEAP’ LABOR ILLEGALS

https://mexicanoccupation.blogspot.com/2020/12/joe-bidens-open-borders-and-dhs-nominee.html

Under Obama, Alejandro Mayorkas ran the citizenship agency and was promoted to the deputy DHS job as officials gradually dismantled border protections and triggered a wage-cutting mass migration from Central American. NEIL MUNRO

Sen Cruz and GOP senators hold a press conference on immigration & border issues

IT'S WHY THEY INVADE!

At current legal immigration levels, the Census Bureau projects that about 1-in-6 U.S. residents will be foreign-born by 2060 with the foreign-born population hitting a record 69 million. JOHN BINDER

“The Democrats had abandoned their working-class base to chase what they pretended was a racial group when what they were actually chasing was the momentum of unlimited migration”.

DANIEL GREENFIELD

A DACA amnesty would put more citizen children of illegal aliens — known as “anchor babies” — on federal welfare, as Breitbart News reported , while American taxpayers would be left potentially with a $26 billion bill.

Additionally, about one-in-five DACA illegal aliens, after an amnesty, would end up on food stamps, while at least one-in-seven would go on Medicaid. JOHN BINDER

Unsustainable The Biden administration’s new immigration-enforcement guidelines will have bad practical and political effects.

Unsustainable The Biden administration’s new immigration-enforcement guidelines will have bad practical and political effects.

Fred Bauer

October 4, 2021

Politics and law

The Social Order

At the end of September, Secretary of Homeland Security Alejandro Mayorkas issued a memo to Immigration and Customs Enforcement officials laying out new guidelines for enforcing immigration law. Mayorkas’s memo would exempt from deportation most illegal immigrants who entered the United States before November 2020 unless they had some connection to terrorism or had engaged in serious criminal conduct. The new approach could both worsen problems at the southern border and make a badly needed political settlement on immigration harder to attain.

The word “immigrant” does not occur once in Mayorkas’s memo. Instead, he classifies illegal immigrants as “undocumented noncitizens.” Mayorkas declares that “the fact an individual is a removable noncitizen therefore should not alone be the basis of an enforcement action against them.” Under the terms of the memo, someone being in the country illegally would not be sufficient reason for the federal government to pursue deportation.

This memo thus places a number of serious restrictions on immigration enforcement. Deportation efforts would be initiated only for individuals falling into one of three categories: a threat to border security, a threat to national security, or a threat to public safety. Under the “threat to border security” classification are people currently trying to cross the border or who “unlawfully enter[ed]” the United States after November 1, 2020. (It seems unclear whether those who illegally overstay a visa even after November 2020 would be eligible for deportation; they did not enter the country illegally in the first place.) “Threat to national security” covers individuals engaged in terrorism or espionage. The “threat to public safety” standard is relatively vague, though it usually involves “serious criminal conduct.”

The memo offers many justifications for not deporting even those convicted of serious crimes. Mayorkas lists “mitigating factors” that might mean enforcement should not be pursued, including whether the illegal immigrant had been in the country for a long period or whether his family members had served in the military. It also outlines a training program and “review process” to ensure that these restrictions on enforcement are rigorously followed, a feature Mayorkas stressed to media outlets.

Former president Barack Obama recently called “open borders” an “unsustainable” policy, and the Biden administration’s dialing back of immigration enforcement raises its own questions about sustainability. Since the administration terminated many of Donald Trump’s immigration policies, the American Southwest has witnessed an explosion of migrants making the dangerous journey to the border. The Biden administration has considered reinstating or at least maintaining certain Trump policies in an effort to stem the tide. But if Secretary Mayorkas publicly says “do not come” to those without legal authorization, his memo strongly suggests: But if you do come, you can stay .

This strategy of blanket non-enforcement may help the Biden administration achieve some policy objectives, at least in the short term. The White House so far has not been able to muster 60 votes in the Senate for a mass legalization, and congressional Democrats have not convinced the Senate parliamentarian that an amnesty provision somehow belongs in a reconciliation bill. Mayorkas’s memo laments the past failure of bills that would have offered a “path to citizenship or other lawful status,” so the administration will now take executive action where legislation has stalled.

But this approach has broader civic costs and reinforces malign dynamics that have transformed American politics over the past 20 years. The calculated refusal to enforce immigration law is of a piece with the broader politics of bad faith that have become endemic in American life. This refusal has nourished a shadow economy and created fertile conditions for smugglers and human traffickers.

The Biden administration has encouraged immigration flows in a way that further polarizes public debates. Its border policies and non-enforcement encourage further waves of unauthorized migration at the border and elsewhere. The greater the waves, the more overwhelmed American officials look, which encourages even more unauthorized migration. The mass encampments at the southern border worry many Americans; a recent Associated Press poll put Biden’s approval on immigration at 35 percent.

This spectacle of incapacity also makes developing a legislative consensus for immigration reform even harder. The failure of enforcement after the 1986 amnesty poisoned the well for future legislative compromises. Reviving the possibility of a consensus, especially for an amnesty, would require building trust that the law would ultimately be enforced—but such trust is not likely when the executive branch is unilaterally waiving enforcement efforts against the vast majority of illegal immigrants.

Under the right conditions, immigration policy can help energize a country, manifest the self-confidence of a political regime, and extend an open hand to the world. However, on both sides of the Atlantic, immigration has become a deeply divisive issue and helped spur the rise of populist movements. Reinforcing polarizing policies risks further political disruption.

Fred Bauer is a writer from New England.

HOW MUCH IS IN THE BILL FOR AMERICA'S ONE MILLION HOMELESS?

Washington, D.C. (October 5, 2021) - A new analysis by the Center for Immigration Studies finds illegal immigrants will receive $8.2 billion annually, or roughly $80 billion over ten years, in cash payments from the new Child Tax Credit, which is part of the stalled budget reconciliation bill.

The new program replaces the Additional Child Tax Credit (ACTC), which paid cash to low-income workers with children. The new Child Tax Credit (CTC), resembles traditional cash welfare because it drops the old ACTC’s work requirement, while significantly increasing payments. Like the old ACTC, any illegal immigrant with a U.S.-born child is eligible for cash payments from the new CTC. Our analysis shows that legal immigrants will receive $17.2 billion from the new CTC. While it is sometimes called a “refundable credit” it is in fact a direct cash grant to those who do not pay any federal income tax.

Dr. Steven Camarota, the Center’s director of research, said, “Giving much larger cash payments may help to alleviate the high rates of poverty in immigrant families, but it also means that any immigrant allowed into the country, legal or illegal, to fill lower-wage jobs potentially has a larger negative impact on taxpayers. Moreover, the decision to give illegal immigrants access to the program is likely to encourage more illegal immigration.”

Among the findings:

Based on their income and number of dependents, we estimate that 63 percent of all immigrant-headed families (legal and illegal) with children will receive the new cash grant — 57 percent for legal immigrants and 79 percent for illegal immigrants. In comparison, 52 percent of native families with children will receive payments. Legal and illegal immigrant parents who qualify for the program are eligible for somewhat larger payments on average than the native-born — about $5,100 for illegal immigrants and $4,800 for legal immigrants. This compares to about $4,600 for the native-born. The larger share of immigrants with children accessing the program and the more generous payments they will receive primarily reflect their lower average incomes. We estimate that all immigrants (legal and illegal) will receive $25.4 billion from the new program annually, accounting for 27 percent of its total costs, with legal immigrants receiving $17.2 billion, and illegal immigrants receiving $8.2 billion. Though a larger percentage of illegal immigrants are poor and qualify for the new program, the total amount paid out to legal immigrants is much larger because there are more low-income legal immigrants in the country. Relative to the old ACTC, illegal immigrants with children will be receiving larger payments not only because the program is much more generous for everyone, but also because the old work requirements made it difficult for some illegal immigrants who worked off the books to demonstrate employment. Dropping the work requirement makes it easier for all illegal immigrants with U.S.-born children to access the new program, even those who do not work.

Magnet! Joe Biden's $3.5 trillion bill hands cash to illegals worth more than annual per capita income of 74 countries

Imagine you are a Honduran. If you make the average Honduran per capita income of $2,405.70 a year, and suddenly learn from a relative up in el norte that Joe Biden is handing out $3,600 a year to anyone in the U.S., legally present or not, for nothing more than having kids, what would you do?

According to the Washington Free Beacon :

President Joe Biden’s budget includes a provision that provides billions of dollars in cash to illegal aliens with children.

...

Families, regardless of their legal status, would be eligible to receive checks of $3,600 per year per child. The Democratic bill would amount to a universal basic income for parents residing in the country. Under U.S. law, illegal immigrants are barred from enjoying the benefits of federal entitlements.

Proportionally, that cash would be the equivalent of a $95,089.56 free ride, based on the U.S. average per capita annual income of $63,543.60 .

You'd weigh your options, and decide what your best ones were. One, you could be breaking your back to earn the $2,405.70 a year back in Tegucigalpa, assuming you were earning the average (and at least half the country earns less). Or two, you could go to the states illegally, get a federal tax I.D. and the $3,600 would be yours. And as a bonus, you'd qualify it the minute you broke into the country illegally, and you wouldn't have to lift a finger to work for it. All you'd have to do is bring the kids. You'd also be get free health care, free education, other cash benefits for the kids, and this doesn't even include the benefits handed out by states such as California, such as free housing and cash transfers. You'd also free to earn more if you wanted, legally or illegally, since under Biden, there'd be no possibility of deportation once you break in.

What would you do?

Seems like only a fool wouldn't hotfoot it over to the states and take the free stuff.

That's what's set to come should Joe Biden's $3.5 trillion "budget reconciliation" somehow pass in Congress. The cost to U.S. taxpayers, according to the Washington Free Beacon , should be "between $2.025 billion to $2.43 billion" a year, assuming no one else comes. What's on offer here is an absolute magnet for illegal immigration from across the world, as if there weren't already enough such incentives already laid down by Joe Biden in what illegal migrants are reading as his invitation to come.

I use the example of Honduras because there is so much illegal immigration coming in from that country already without the free cash from Biden. But there actually are 57 countries whose per capita income is less than that of Honduras, according to the World Bank , which make the incentive to come even greater.

Worldwide, there are 74 nations with per capita incomes below the $3,600 level. Another five nations have per capita incomes below $4,000, including migrant-exporting Ukraine and El Salvador, as well as very large Indonesia. Large numbers of these countries (Pakistan, Philippines, Vietnam, Iran, Nigeria, Cambodia, Haiti, India, Sudan, Somalia ) have large family immigrant networks already settled in the states. For would-be illegals, it wouldn't be much trouble to come on over on a visit if not overland with the coyotes, situate with a relative, and then take the big gringo's free $3,200.

The Beacon notes that the cash pretty much amounts to a universal basic income. Because many migrants can live on that amount, it may well be just that for the less motivated. But for the more motivated, there's the prospect of working in the U.S. illegally, papers or not, and the cash from Uncle Sam means they can take very low wage jobs --- lower than the minimum in fact -- to raise their standards of living. That amounts to downward pressure on American workers' wages as new competition comes into the job marketplace that can work for less. Sound like a good deal for American workers? It's not just a goody bag for foreign lawbreakers, it's a shiv to the side for the American worker.

That's appalling, and one more reason why this $3.5 trillion monstrosity must be sunk to the bottom of the sea by Congress -- with cement shoes.

Image: Pixabay / Pixabay License

It is too easy to spend other people’s money

As I write in early October 2021, the U.S. National Debt Clock exceeds an utterly sickening $28.8 trillion. That is the number 28 with 12— twelve — more numbers behind it!

Let’s try a little exercise using some of the numbers from the debt clock, but let’s lop off eight zeros — a “household number.” It also makes it easier because those eight numbers furthest to the right on the clock are increasing so rapidly as to make the number inaccurate in just a few minutes.

Use the link, try it at home with your family, too! Consider all this:

Annual income stated as U.S. Federal Tax Revenue ($3.8675 trillion). For our purposes, our annual income is $38,675. Our annual spending, represented by official (not actual) U.S. Federal Spending is $6.8679 trillion; we will consider the number $68,679. Our annual budget deficit is over $3.0004 trillion, or, for us, $30,004. We can immediately see that we have a major issue here because we are spending almost double our annual income and increasing our debt by massive amounts every year.

It gets worse.

Because we have been on a perpetual, unbridled spending spree and appear committed to buying everything the “sales team” shows us, our total household debt for all years exceeds $288,370. The actual number is almost $29 trillion—$28,837,062,000,000.

Please closely examine that number. That is 28 trillion, 837 billion, 62 million dollars...and growing so quickly the numbers on the right side of the counter are a blur.

Now let’s review:

on a household income of $38,675, we spend almost twice what we earn, over-spending by over three-quarters (77.5%). our debt just this year will exceed $30,000. our total “household” debt is rapidly approaching $289,000. With those facts in place, let’s try to answer some simple, honest questions:

What bank would give us another credit card, with a household income of less than $40,000 and an already existing debt approaching $289,000? How many American families qualify for a mortgage of $289,000 on less than $40,000 in family income? What if the “children” knew what Mom and Dad had done to their inheritance? As it is, it no longer exists, and our progeny will have only a cavernous, ruinous, hole from which neither we nor our children nor their children will ever be able to free themselves. So, let me ask again (yes, I believe the repetition and redundancy in making the same points are absolutely necessary): With that profit-and-loss statement, with that balance sheet, with proof of income and the abysmal credit rating that assuredly accompanies the reality that has been presented, what bank would issue us a new credit card? And at what interest rate?

The current White House resident, Joe Biden, went to the microphones and read the teleprompter on Monday, to scold those wascally wepuplicans because they will not go along with his and his Democrat party’s request for more credit cards. Refusing to give him and his Democrat party big spenders more credit with which to further sink future generations would be “reckless and dangerous” he says. “We have to pay what we owe,” he says, and it is “not anything new.”

“Raising the debt limit is about paying off our old debts,” he says. Rriiiiigghhtt…

Just imagine for a moment what you might say to your teenage or even young adult children if they came to you with that load of manure. What would probably make me the angriest, and what would concern me the most, would be the complete lack of respect and utter faithlessness which they just demonstrated in me, that they thought I was that effing stupid to believe that...malodorous pile of...manure.

Well, that is apparently where we are. The White House’s installed teleprompter reader apparently believes we are that stupid. We need more credit cards to pay for the overwhelming pile of debt we acquired with our now-maxed-out credit cards.

If the feds confiscate everything that we earn next year and every penny of what our economy produces, it wouldn’t be enough to pay for the debt and wipe the slate clean. They will never be able to tax us enough to pay for all the...manure...under which they want to bury us.

Here are some ideas for the next 3,000-plus page bill they want everyone to approve but not read:

term limits. a balanced budget or no pay for members of Congress. (add your own list here.) Gear up, and let’s get started. Generations yet unborn are depending on us to put an end to this insanity.

Jeff Lewis is a Christian, a husband and father, a Veteran, and a self-employed small business owner.

Sec. Alejandro Mayorkas announces new immigration priorities

Idaho feels impact of drug trafficking from border

The Biden administration has responded to pressure from a right-wing minority among House and Senate Democrats by slashing its proposed social spending increase nearly in half.

Biden delivered the news to a closed-door meeting of the House Democratic caucus Friday afternoon, telling them the overall cost of the reconciliation bill would come down from the $3.5 trillion proposed by the White House to between $1.9 trillion and $2.3 trillion, far closer to the $1.5 trillion ceiling backed by West Virginia Democratic Senator Joe Manchin.

Manchin and Arizona Democratic Senator Kyrsten Sinema have opposed passage of the social spending legislation by means of the reconciliation procedure, which allows the Democrats to bypass a Republican filibuster in the closely divided Senate. The procedure can only be used on a spending bill, and only once in a fiscal year.

House Speaker Nancy Pelosi, D-Calif., walks at the Capitol in Washington, Wednesday, Sept. 29, 2021. (AP Photo/J. Scott Applewhite) The House Progressive Caucus, which comprises nearly half the 220 Democrats in the House of Representatives, has blocked passage of the bipartisan infrastructure bill, approved in August by the Senate, until the two right-wing Senate Democrats reach agreement with the White House on the reconciliation package.

Their opposition forced House Speaker Nancy Pelosi to push back a planned September 27 vote on the infrastructure bill, agreed to with another small right-wing faction of Democrats in the House, first until October 1, and then until October 31, a decision she announced in a letter made public Saturday.

Biden made his in-person visit to the Capitol, his first since delivering a nationally televised address last April, to discuss the deadlock with the Democratic caucus. He brought something for both factions: a fig-leaf concession on procedure to the “progressives” and a near-total victory on substance to the right-wing.

Biden endorsed Pelosi’s delay in the infrastructure vote, despite grumbling from some of the House right-wingers, explaining that it was necessary to reach a deal with Manchin and Sinema on the reconciliation bill so the two pieces of legislation could be passed “in tandem.” But he went much more than halfway towards Manchin on substance, giving him an effective veto over the top-line number.

This cave-in to a small minority—two out of 50 Democrats in the Senate, eight out of 220 in the House—cannot be explained by parliamentary arithmetic in a closely divided Congress. The power of Manchin, Sinema and their counterparts in the House is explained by their voicing most clearly the demands of corporate America, particularly in their opposition to tax increases on the wealthy and big business, as well as any significant expansion of the social safety net.

The decision by the White House to accept a much lower price tag for the social spending bill now sets in motion a Hunger Games-style competition between the various social programs that were components of the reconciliation bill: making the child tax credit permanent; adding vision, hearing and dental care to Medicare; expanding Medicaid in states where Republican governors have blocked it; providing paid home health care for the elderly; expanding Head Start through universal pre-kindergarten for three- and four-year-olds; one week of paid family and medical leave; initiating a policy of free tuition for community colleges; and spending on a number of programs to combat climate change.

There is reportedly now debate in the White House and among congressional Democrats involving whether to fully fund some of these programs and eliminate others, or to fund some of the programs for less than the full 10 years provided in the original bill, or some combination of the two methods. Manchin has proposed means-testing some of the programs, although this is supposedly not under consideration.

“The whole shrinking of the pie pits Medicare recipients against poor families against home care workers against victims of climate change,” Faiz Shakir, former campaign manager for Bernie Sanders, told the Washington Post. “It makes the working class of America fight over the scraps.”

Shakir’s former boss, however, was enthusiastic about Biden’s intervention and praised it to the skies in several appearances on the Sunday television interview programs. Interviewed on “Meet the Press” on NBC in his capacity as chairman of the Senate Budget Committee, Senator Sanders said that he did not believe Biden had given any specific number in his remarks to the House Democrats.

“What he said is there’s going to have to be give and take on both sides,” Sanders said. “I’m not clear that he did bring forth a specific number. But what the president also said, and what all of us are saying, is that maybe the time is now for us to stand up to powerful special interests who are currently spending hundreds of millions of dollars trying to prevent us from doing what the American people want.”

On the ABC program “This Week” Sanders said, “Three and a half trillion should be a minimum, but I accept that there’s gonna have to be give and take.” He then went on to make an extraordinary tribute to the Democratic leadership, headed by Biden: “We are not just taking on or dealing with Senators Manchin or Senator Sinema. We’re taking on the entire ruling class of this country. Right now the drug companies, the health care—the health insurance companies, the fossil fuel industry are spending hundreds and hundreds of millions of dollars to prevent us from doing what the American people want. And this really is a test of whether or not American democracy can work.”

One would think that the red flag had been raised above the White House! Joe Biden was a six-term senator who protected the interests of the credit card industry and the corporations headquartered in Delaware, while Senate Democratic Leader Chuck Schumer has long been known as the “Senator from Wall Street” for his close ties to the stock exchange and major banks. To claim that they are “taking on the entire ruling class” is to lie without scruple or remorse.

The former co-chair of the Sanders campaign, Representative Ro Khanna of California, was equally effusive in his embrace of Biden. Appearing on “Fox News Sunday,” he said he relied on the White House to sort out which social policy proposals would survive the reduction from $3.5 trillion to $2 trillion or even less. “Ultimately the president is an honest broker,” he said. “He’s going to bring all of the stakeholders together. And I trust his judgment to get a compromise.”

Asked whether blocking the infrastructure bill constituted opposition to the White House, he replied, “I would not have contradicted the president’s vision. What I have said—consistently what most progressives have said is we want to do what the president wants.”

Perhaps the most abject display came from Representative Alexandria Ocasio-Cortez, a member of the Democratic Socialists of America (DSA), who told CBS that the Democrats were already beginning to sort out how to implement the cuts in proposed social spending needed to meet the demands of senators Manchin and Sinema. “I think it’s unfortunate that we have to compromise with ourselves for an ambitious agenda for working people,” she said, then urged people to “reach out to their elected officials to let them know what programs they want to make sure are kept.”

Asked about her statement last year that in any other country she and Biden would be in different parties, she said, “I think that President Biden has been a good faith partner to the entire Democratic Party. He is in fact a moderate and we disagree on certain issues. But he reaches out and he actually tries to understand our perspective, and that is why I am fighting for his agenda with the Build Back Better Act.”

The contempt with which the real powers in the Democratic Party regard their left-talking colleagues was expressed in another comment on “Meet the Press,” by Jeh Johnson, former secretary of the Department of Homeland Security in the Obama administration, the enforcer of mass deportations and counter-terrorism policies.

Host Chuck Todd asked him about the headline on the Democratic Party crisis in Sunday’s edition of the New York Times , “Biden Throws In With Left, Leaving His Agenda in Doubt.” Johnson dismissed the newspaper’s claim that Biden siding with the progressives. “Let’s not forget that the bill the progressives are pushing for is Biden's bill,” he said. “It’s his domestic agenda.”

Johnson continued, “It’s not as if it’s some wild-eyed far-left socialist piece of legislation. This is Joe Biden’s Build Back Better domestic agenda. And the progressives are carrying his water on Capitol Hill and appear to be doing it rather effectively right now.”

Water boys (and girls) for Biden and the Democratic Party: A fitting political epitaph for Sanders, Ocasio-Cortez and their DSA and pseudo-left cheerleaders.

Dems Tuck Multibillion-Dollar Handout to Illegal Immigrants Into Reconciliation Biden's $3.5 trillion spending bill gives migrants same child benefits as Americans

Getty Images Joseph Simonson • October 4, 2021 5:00 amPresident Joe Biden’s budget includes a provision that provides billions of dollars in cash to illegal aliens with children.

The $3.5 trillion reconciliation bill extends the Child Tax Credit to anyone in the United States who provides an Individual Taxpayer Identification Number, overturning a crucial safeguard against fraud. Federal law required a valid Social Security number to receive the cash transfer from the federal government. The potential payout for illegal immigrants is massive, with each family receiving a monthly payment of $250 to $300 per child.

A survey from the Pew Research Center found that roughly 675,000 children are not eligible for a Social Security number, making the tax credit expansion for illegal aliens cost between $2.025 billion to $2.43 billion a year. Other estimates put the total number of illegal children residing in the United States at more than 800,000.

Families, regardless of their legal status, would be eligible to receive checks of $3,600 per year per child. The Democratic bill would amount to a universal basic income for parents residing in the country. Under U.S. law, illegal immigrants are barred from enjoying the benefits of federal entitlements.

The Alarm Bells are Ringing for American Citizenship

The Dying Citizen

Basic Books, October, 2021

Victor Davis Hanson, the classics scholar and military historian, has written or co-authored two dozen books and many hundreds of articles. His latest book , The Dying Citizen , is a powerful and carefully developed argument for preserving American citizenship, a unique patrimony now under attack in many ways from many sources, and from all appearances, a losing battle.

Hanson provides a history of the concept of citizenship dating back to the Greeks and Romans and makes clear how rare the American experience has been in creating a modern citizenry with both rights and responsibilities. Hanson’s book was mostly written from 2018 through early 2020, and contains a final chapter which updates the impact of the calamitous last year on the citizenship issue, dominated by the coronavirus, racial unrest and a bitterly fought presidential election. Hanson argues that the Trump presidency pushed back against the forces diminishing American citizenship with some modest success from 2017 to 2019, but the events of the past year led to a reversal of those gains, and the prospect of greater threats than existed before.

Hanson’s book contains six primary chapters, each addressing a specific threat to American citizenship, as it was understood in our founding documents, and expanded through political participation for women and races and ethnicities different from the original predominant majority culture.

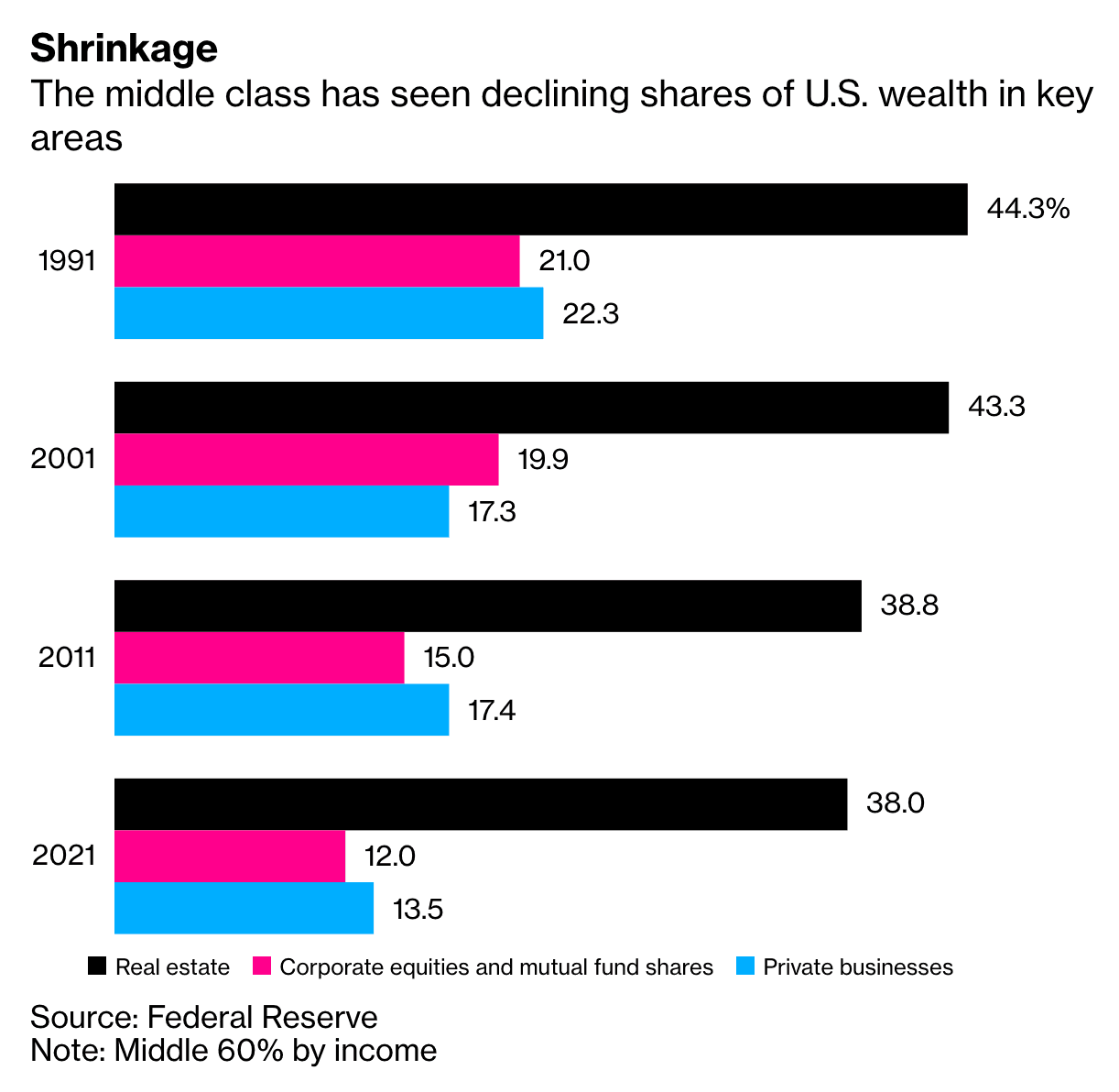

The first chapter, “Peasants,” maintains that for a people to be self-governing, they must be economically autonomous. In essence, they need to avoid dependency on either the “private wealthy or the state.” A healthy middle class enables economic self-reliance and autonomy. Politicians from both parties are always claiming they are fighting for the middle class, but if they have been doing this, they have been failing on their promises, as evidenced by a hollowing out of much of America as its industrial and manufacturing base faltered, and major parts moved overseas and the failure to replace the lost opportunities with “good jobs with good wages.”

Without a sustainable and thriving middle class, society becomes divided between “modern masters and peasants.” In this circumstance, government assumes a responsibility to subsidize the poor to dampen any possibility of revolution, and exempt the wealthy, who respond by enriching and empowering the governing classes. The current attempt by Democrats in Congress to pass a massive “human infrastructure” bill is part of developing a cradle-to-grave dependency for much of the citizenry (and non-citizens as well) on government welfare programs.

Chapter 2, “Residents,” argues for privileging citizens over non-citizens (residents). Citizens live within “delineated and established borders.” Citizens share values, and they assimilate and integrate into what becomes a national character. But today, many argue for a borderless world, and opening America to the world’s 8 billion people. They ask, “Why should those fortunate enough to have been born here, or been legally allowed to enter under various quotas or other limits, be privileged above those others who would also benefit from living here rather than where they are now living and fleeing?”

The collapse of the American southern border under the current Biden administration was not an accident, but a plan. It fits an ideology that more people moving here, from wherever they may have come, is better for America, since it makes us look more like the rest of the world going forward. Naturally, there is a political dimension to this ideology, since it assumes that when the new residents become citizens at some point, they will align with the political party favoring mass immigration and open borders.

Hanson argues that people will naturally want to move to a country with political rights, a Bill of Rights, economic opportunity, and a generous welfare system to tide them over in the short term or forever. Immigrants don’t see America in the critical fashion of many of its current citizens, but as better than the places they left, but will they accept the responsibility of citizenship, as well as its bounty?

Chapter 3, “Tribes,” argues for American citizenship, not tribal identification -- whether racial, ethnic, religious, or a former nationality. Regrettably, America is on a different course in this area, and the exit velocity away from Hanson’s ideal is accelerating. In pretty much every sphere of American society, we have moved away from individualism and rewarding achievement and accomplishment to counting participation rates by group shares, striving towards some ideal of equalizing results in every aspect of modern life.

Rather than encouraging citizens to compete for society’s rewards, we are moving to having them distributed based on race or group size. Immigration plays a role in this since it is part of a strategy for some to reduce one group’s size and share and power. In addition, our modern-day overseers feel free to tarnish all those who came before who failed to achieve the perfection of racial and ethnic distribution -- equity as it is now called. Why study American history when the country has been so flawed? If everyone sees themselves first as members of a group, rather than citizens of a country, then Hanson argues, a constitutional republic cannot exist. ,

Chapter 4, “Unelected” describes how an unelected, appointed and permanent and rapidly growing federal bureaucracy has become the political power center of America . New rules issued by myriad federal agencies dwarf the output of Congress, even with the mammoth omnibus spending bills written by lobbyists and congressional staff and unread by the representatives who vote to make them laws.

Congress members are first and foremost concerned with their future electoral prospects. The bureaucrats survive changes in administration and party control of the White House or Congress. Bureaucrats are the experts who believe they know better than the masses what is good for them, but they also are always on guard to prevent any elected newcomer who seems to operate outside the established lines observed by most elected officials from both parties. Donald Trump was a threat since he did not come to office pledging allegiance to the established unelected power structure and various federal intelligence agencies took it upon themselves to destroy his Presidency from the start with the crafting of a Russia collusion narrative, which was nonsense.

Chapter 5, ”Evolutionaries,” documents those who think our founding documents, and constitutional framework, with its balance of enumerated powers, federalism , and individual rights, has outlived its usefulness. They say that a modern constitution is required, which at its heart is majoritarian in all ways -- 50% plus 1 shall determine the direction of the country. This is playing out as enormous programs of social change and redistribution are on the agenda for a single party to use tiny majorities in Congress to get its way.

But it is not enough, to have a single budget reconciliation bill passed each fiscal year. The left would prefer the Senate to become like the House: shares by population, rather than 2 per state, though this would require an amendment to the Constitution, not possible under current party shares. So, the workaround is to add new states, each with 2 Democrats in places like DC and Puerto Rico.

They want the Electoral College eliminated, also not likely to happen by constitutional amendment, so instead, by a compact among various states to vote for electors of the winning national popular vote ticket. The filibuster should no longer restrain majorities with less than 60 votes and must be tossed into the dustbin of history. Democrats are frighteningly close to being able to do that now, and with a few Senate pickups in 2022, won’t be blocked by a Joe Manchin and Kirsten Sinema.

New justices need to be appointed to the Supreme Court, since it has a conservative majority, and the progressives are always in the plpanned new order to dominate every decision-making body. New voting rules are to be established at the federal level, bypassing a long history of state control of this process.

The Biden administration is ignoring court orders on evictions, and immigration policy. At the city and state level, governments have made rules which defy federal authority, such as Democrats’ creation of sanctuary cities, and other cities which will not observe federal gun laws. So much for the rule of law.

Perhaps a mandatory reading of the Federalist Papers should be part of every Congress member’s first week in office so that those who want to eliminate or change a process that has worked quite well for over 230 years would begin to understand the reasoning behind the choices which were made in Philadelphia during the Constitutional Convention, even if that makes progressive shifts more difficult.

Chapter 6, “Globalists,” describes the attempt by those who have reached the pinnacle of power and wealth to move the country and its citizens towards an international or global membership, rather than something as narrow as national citizenship. The world needs to come together (by private jets to Davos) to talk about saving the planet from climate catastrophe and plastic bags. New rules which benefit those who trade and sell across the planet will trump protections for workers and individual nations, and as a result, jobs and entire industries can move from one country to another, many to China. The globalists are certain of course that their preferred political and social currency of unrestrained democracy, and liberal tolerance, are what people around the world want.

Hanson’s final chapter, “Epilogue,” details how the Trump administration pushed back against the destruction of the middle class, open borders, the bureaucracy (the “deep state”), and the effort to privilege racial and ethnic groups over individuals. Concern for an economic class rather than a racial or ethnic group turned out to have appeal to members of these groups, when their economic condition improved as the economy responded to tax cuts, deregulation, and pushback against Chinese trade practices. President Trump appeared to have a good chance for a second term, as 2020 began with record low unemployment rates for members of various minority groups and strong national economic growth.

Covid 19 quickly changed that scenario. Large sections of the economy were shut down. Governors applied stringent lockdowns on vast sectors of their state economies. In person school ended, preventing family members from working if their jobs were still available. People were frightened with mixed and rapidly changing, advice from the “health professionals.”

States changed their voting rules, often in ways that violated their own established state policies and constitutions, making the election process less secure. Many Americans also came face to face with the fact that many drugs, facemasks, respirators, and other basic medical supplies were not produced in America, but in China or other lower wage locations. Our managing through the pandemic required their provision of goods, until any replacement manufacturing could begin again here.

Americans, the once rugged individualists of old, seemed often to want to cuddle up under their warm state governors’ blankets and follow all the rules, since they knew best. Those who spoke up or challenged the orthodoxy were silenced or lost their jobs. This included election news, with major social networking companies and cloud computing hosts prohibiting viewpoints or news stories which threatened the approved party line and could endanger the Democratic ticket before the November election. This development has become much more of a problem under the Biden administration. “Following the science” became following the determinations of political players, who made political decisions more than scientific ones.

If citizens lose their freedom of speech, if the press becomes a politically compliant advocate for one party, if jobs are at risk based on vaccination status (anything to lift sagging poll numbers), if election rules can be changed overnight and not by those who are given the legal power to do so, then we are at a crisis point in the country, and citizens will have lost their authority and ability to select the government that is supposed to serve them.

Hanson‘s subtitle reads: “How Progressive elites, tribalism and globalization are destroying the idea of America.” American citizens will preserve their Republic or they will lose it. There are lots of countries, but only one America.

Study: Over Half of Migrants Are on American Taxpayer-Funded Welfare JOHN BINDER

More than half of the nation’s non-citizen population — including legal immigrants, foreign visa workers, and illegal aliens — use American taxpayer-funded welfare after arriving in the United States, a new analysis reveals.

Research by Center for Immigration Studies Director of Research Steven Camarota finds that about 55 percent of non-citizen households in the U.S. use at least one form of welfare compared to just 32 percent of households headed by native-born Americans.

Camarota’s research analyzes the U.S. Census Bureau’s Survey of Income and Program Participation data from 2018, showing that 49 percent of households headed by foreign-born residents, including naturalized American citizens, use at least one welfare program.

In 2017, economist George Borjas called the U.S. immigration system “the largest anti-poverty program in the world” at the expense of America’s working and middle class.

Specifically, foreign-born residents used vastly more Medicaid compared to native-born Americans and food stamps. For example, while 33 percent of foreign-born residents use Medicaid, just 20 percent of native-born Americans do so.

Likewise, while 31 percent of foreign-born residents are on food stamps, only 19 percent of native-born Americans use the program.

Camarota’s research reveals that even after years and years of residing in the U.S., foreign-born resident households continue to use high levels of welfare.

About 44 percent of foreign-born residents who resided in the U.S. for 10 years or less use at least one form of welfare. Roughly 50 percent of those who resided in the U.S. for more than 10 years are on welfare.

When naturalized Americans are excluded from that count, the level of welfare use rises significantly for those who have resided in the U.S. for a while. For example, among non-citizen households who resided in the U.S. for 10 years or less, 40 percent use welfare. For those in the U.S. for more than 10 years, about 62 percent are on welfare.

The latest data comes after similar numbers were released in March 2019 that showed that, in 2014, non-citizen households used nearly twice as much welfare as native-born Americans.

Currently, there is an estimated record high of 44.5 million foreign-born residents living in the U.S. This is nearly quadruple the immigrant population in 2000. The vast majority of those arriving in the country every year — more than 1.5 million annually — are low-skilled foreign nationals who go on to compete for jobs against working class Americans.

At current legal immigration levels, the Census Bureau projects that about 1-in-6 U.S. residents will be foreign-born by 2060 with the foreign-born population hitting a record 69 million.

John Binder is a reporter for Breitbart News. Email him at jbinder@breitbart.com. Follow him on Twitter here .

THE STAGGERING COST OF THE WELFARE STATE MEXICO AND THE LA RAZA SUPREMACY DEMOCRAT PARTY HAVE BUILT BORDER to OPEN BORDER’ http://mexicanoccupation.blogspot.com/2017/10/spencer-p-morrison-devastating-cost-of.html

According to the Federation for American Immigration Reform’s 2017 report, illegal immigrants, and their children, cost American taxpayers a net $116 billion annually -- roughly $7,000 per alien annually. While high, this number is not an outlier: a recent study by the Heritage Foundation found that low-skilled immigrants (including those here illegally) cost Americans trillions over the course of their lifetimes, and a study from the National Economics Editorial found that illegal immigration costs America over $140 billion annually. As it stands, illegal immigrants are a massive burden on American taxpayers.

Study: 14.5M Illegal Aliens Living in U.S., Costing Americans $134B a Year …. THE NUMBER OF ILLEGALS EXCEEDS 40 MILLION WITH THOUSANDS JUMPING OUR OPEN BORDERS AND JOBS DAILY. NOW DO THE MATH! Joe Raedle/Getty Images

JOHN BINDER

Roughly 14.5 million illegal aliens live across the United States, costing American taxpayers about $134 billion every year, a new study reveals.

An annual study released by the Federation for American Immigration Reform (FAIR) finds that the illegal alien population in the U.S. has grown by at least 200,000 since 2019 and has cost taxpayers an additional $2 billion since last year.

Though the number of illegal aliens in the U.S. has increased, the FAIR study states that growth among the illegal alien population has slowed over the last year because of the Chinese coronavirus crisis and because of former President Donald Trump’s “Remain in Mexico” policy, which stopped the practice of border crossers being released into the interior of the country.

“As many as 60 percent of all new illegal aliens in any given year are those who have overstayed visas,” FAIR researchers write. “Thanks to a timely travel freeze implemented by the Trump administration to stop the spread of the virus, far fewer people entered the United States in recent months, so far fewer people had the opportunity to overstay their visas. ”

The growth of the illegal alien population and its fiscal burden on taxpayers has been enormous over the last decade, though. In 2010, for instance, FAIR estimated the illegal alien population stood at just over 11 million, indicating a more than 31 percent increase in the population in just ten years.

THE NEW PRIVILEGED CLASS: Illegals!

This is why you work From Jan - May paying taxes to the government ....with the rest of the calendar year is money for you and your family.

Take, for example, an illegal alien with a wife and five children. He takes a job for $5.00 or 6.00/hour. At that wage, with six dependents, he pays no income tax, yet at the end of the year, if he files an Income Tax Return, with his fake Social Security number, he gets an "earned income credit" of up to $3,200..... free.

He qualifies for Section 8 housing and subsidized rent.

He qualifies for food stamps.

He qualifies for free (no deductible, no co-pay) health care.

His children get free breakfasts and lunches at school.

He requires bilingual teachers and books.

He qualifies for relief from high energy bills.

If they are or become, aged, blind or disabled, they qualify for SSI.

Once qualified for SSI they can qualify for Medicare. All of this is at (our) taxpayer's expense.

He doesn't worry about car insurance, life insurance, or homeowners insurance.

Taxpayers provide Spanish language signs, bulletins and printed material.

He and his family receive the equivalent of $20.00 to $30.00/hour in benefits.

Working Americans are lucky to have $5.00 or $6.00/hour left after Paying their bills and his.

The American taxpayers also pay for increased crime, graffiti and trash clean-up.

http://mexicanoccupation.blogspot.com/2018/08/californias-privileged-class-mexican.html

Cheap labor? YEAH RIGHT! Wake up people!

JOE LEGAL v LA RAZA JOSE ILLEGAL

Here’s how it breaks down; will make you want to be an illegal!

http://mexicanoccupation.blogspot.com/2011/05/joe-american-legal-vs-la-raza-jose.html

THE TAX-FREE MEXICAN UNDERGROUND ECONOMY IN LOS ANGELES COUNTY IS ESTIMATED TO BE IN EXCESS OF $2 BILLION YEARLY!

Staggering expensive "cheap" Mexican labor did not build this once great nation! Look what it has done to Mexico. It's all about keeping wages depressed and passing along the true cost of the invasion, their welfare, and crime tidal wave costs to the backs of the American people!

AMERICA: YOU’RE BETTER OFF BEING AN ILLEGAL!!!

http://mexicanoccupation.blogspot.com/2018/06/in-america-it-is-better-to-be-illegal.html

This annual income for an impoverished American family is $10,000 less than the more than $34,500 in federal funds which are spent on each unaccompanied minor border crosser.

A study by Tom Wong of the University of California at San Diego discovered that more than 25 percent of DACA-enrolled illegal aliens in the program have anchor babies. That totals about 200,000 anchor babies who are the children of DACA-enrolled illegal aliens. This does not include the anchor babies of DACA-qualified illegal aliens. JOHN BINDER

“The Democrats had abandoned their working-class base to chase what they pretended was a racial group when what they were actually chasing was the momentum of unlimited migration”. DANIEL GREENFIELD / FRONT PAGE MAGAZINE

As Breitbart News has reported , U.S. households headed by foreign-born residents use nearly twice the welfare of households headed by native-born Americans. Simultaneously, illegal immigration next year is on track to soar to the highest level in a decade, with a potential 600,000 border crossers expected.

“More than 750 million people want to migrate to another country permanently, according to Gallup research published Monday, as 150 world leaders sign up to the controversial UN global compact which critics say makes migration a human right.” VIRGINIA HALE

For example, a DACA amnesty would cost American taxpayers about $26 billion , more than the border wall, and that does not include the money taxpayers would have to fork up to subsidize the legal immigrant relatives of DACA illegal aliens.

Exclusive–Steve Camarota: Every Illegal Alien Costs Americans $70K Over Their Lifetime

https://www.breitbart.com/politics/2019/04/11/exclusive-steve-camarota-every-illegal-alien-costs-americans-70k-over-their-lifetime/

JOHN BINDER

Every illegal alien, over the course of their lifetime, costs American taxpayers about $70,000, Center for Immigration Studies Director of Research Steve Camarota says.

During an interview with SiriusXM Patriot’s Breitbart News Daily , Camarota said his research has revealed the enormous financial burden that illegal immigration has on America’s working and middle class taxpayers in terms of public services, depressed wages, and welfare.

“In a person’s lifetime, I’ve estimated that an illegal border crosser might cost taxpayers … maybe over $70,000 a year as a net cost,” Camarota said. “And that excludes the cost of their U.S.-born children, which gets pretty big when you add that in.”

LISTEN:

“Once [an illegal alien] has a child, they can receive cash welfare on behalf of their U.S.-born children,” Camarota explained. “Once they have a child, they can live in public housing. Once they have a child, they can receive food stamps on behalf of that child. That’s how that works.”

Camarota said the education levels of illegal aliens, border crossers, and legal immigrants are largely to blame for the high level of welfare usage by the f0reign-born population in the U.S., noting that new arrivals tend to compete for jobs against America’s poor and working class communities.

In past waves of mass immigration, Camarota said, the U.S. did not have an expansive welfare system. Today’s ever-growing welfare system, coupled with mass illegal and legal immigration levels, is “extremely problematic,” according to Camarota, for American taxpayers.

The RAISE Act — reintroduced in the Senate by Senators Tom Cotton (R-AR), David Perdue (R-GA), and Josh Hawley (R-MO) — would cut legal immigration levels in half and convert the immigration system to favor well-educated foreign nationals, thus relieving American workers and taxpayers of the nearly five-decade-long wave of booming immigration. Currently, mass legal immigration redistributes the wealth of working and middle class Americans to the country’s top earners.

“Virtually none of that existed in 1900 during the last great wave of immigration, when we also took in a number of poor people. We didn’t have a well-developed welfare state,” Camarota continued:

We’re not going to stop [the welfare state] tomorrow. So in that context, bringing in less educated people who are poor is extremely problematic for public coffers, for taxpayers in a way that it wasn’t in 1900 because the roads weren’t even paved between the cities in 1900 . It’s just a totally different world. And that’s the point of the RAISE Act is to sort of bring in line immigration policy with the reality say of a large government … and a welfare state . [Emphasis added]

The immigrants are not all coming to get welfare and they don’t immediately sign up, but over time, an enormous fraction sign their children up . It’s likely the case that of the U.S.-born children of illegal immigrants, more than half are signed up for Medicaid — which is our most expensive program. [Emphasis added]

As Breitbart News has reported , U.S. households headed by foreign-born residents use nearly twice the welfare of households headed by native-born Americans.

Every year the U.S. admits more than 1.5 million foreign nationals, with the vast majority deriving from chain migration. In 2017, the foreign-born population reached a record high of 44.5 million. By 2023, the Center for Immigration Studies estimates that the legal and illegal immigrant population of the U.S. will make up nearly 15 percent of the entire U.S. population.

Breitbart News Daily airs on SiriusXM Patriot 125 weekdays from 6:00 a.m. to 9:00 a.m. Eastern.

John Binder is a reporter for Breitbart News. Follow him on Twitter at @JxhnBinder .

Biden Administration Issues Report on Threats of Climate Change: Airlines Grounded, Food Shortages, New Global Conflicts AP Photo/Evan Vucci 5:34

President Joe Biden wasted no time in making fighting so-called climate change a priority, including issuing an executive order on January 27, 2020, tasking several federal agencies with developing plans to address the issue. And now those agencies have released a report citing the most pressing threats facing the United States.

The order said:

It is the policy of my administration that climate considerations shall be an essential element of United States foreign policy and national security. The United States will work with other countries and partners, both bilaterally and multilaterally, to put the world on a sustainable climate pathway. The United States will also move quickly to build resilience, both at home and abroad, against the impacts of climate change that are already manifest and will continue to intensify according to current trajectories.

His order directed the U.S. Treasury, Defense, the U.S. Attorney General, Interior, Agriculture, Commerce, Labor, Health and Human Services, Housing and Urban Development, Transportation, Energy, Homeland Security, and other agency personnel to develop plans.

The New York Times praised the development, criticizing President Donald Trump “whose disdain for climate science led most agencies to either shelve their planning for climate change or stop talking about it.” The report went on:

Within weeks of taking office, President Biden directed officials to quickly resume the work. Stressing the urgency of the threat, the president gave agencies four months to come up with plans that listed their main vulnerabilities to climate change and strategies to address them.

“Nearly every service that the government provides will be impacted by climate change sooner or later,” Jesse Keenan, a professor at Tulane University and advises federal agencies said in the Times report.

The Times is supportive of Biden after four years of reporting negatively on Trump’s policies:

The plans released Thursday are brief, many of them fewer than 30 pages. They include core themes: ensuring that new facilities meet tougher construction standards, using less energy and water at existing buildings, better protecting workers against extreme heat, educating staff about climate science, and creating supply chains that are less likely to be disrupted by storms or other shocks.

The documents also reflect Mr. Biden’s emphasis on racial equity, looking at the effects of climate change on minority and low-income communities and how agencies can address them. For example, the Department of Health and Human Services said it will focus research grants on the health effects on those communities.

But the most revealing information in the newly released plans could be their description, sometimes in frank terms, of the dangers that climate change holds.

The Department of Agriculture predicts food shortages — “changes in temperature and precipitation patterns, more pests and disease, reduced soil quality, fewer pollinating insects and more storms and wildfires will combine to reduce crops and livestock.”

The Department of Transportation:

…notes that rising temperatures will make it more expensive to build and maintain roads and bridges” and that “severe weather events will ‘require flight cancellations, sometimes for extended periods of time,’ and more heat will force planes to fly shorter distances and carry less weight.

“Even the quality of driving could get worse,” the Times reported. “The plan warns of ‘decreased driver/operator performance and decision-making skills, due to driver fatigue as a result of adverse weather.’

The Department of Homeland Security reported that climate change “means the risk of large numbers of climate refugees — people reaching the U.S. border, pushed out of their countries by a mix of long-term challenges like drought or sudden shocks like a tsunami,” the Times reported, adding:

Climate change is likely to increase population movements from Mexico, Central America, South America, and the Caribbean,” the department’s plan reads. The department is trying to develop “a responsive and coordinated operational plan for mass migration events.

The Defense Department said climate change could lead to new conflict and also will make it harder for the military to operate:

Water shortages could even become a new source of tension between the U.S. military overseas and the countries where troops are based. But learning to operate during extreme weather should also be viewed as a new type of weapon, the plan says, one that can help the United States prevail over enemies.

“This enables U.S. forces to gain distinct advantages over potential adversaries,” the report said. “If our forces can operate in conditions where others must take shelter or go to ground.”

The Commerce Department said it expects “a surge in applications for patents for ‘climate change adaptation-related technologies,’” the Times reported.

The report said the this “would impact the department’s ability to process such applications in a timely manner, having a direct impact on U.S. competitiveness and economic growth.”

The report said the department would expedite patent applications that deal with climate change.

Follow Penny Starr on Twitter or send news tips to pstarr@breitbart.com.

No comments:

Post a Comment