CLINTON – OBAMA – TRUMPERNOMICS:

STEAL FROM THE AMERICAN MIDDLE-CLASS and

HAND IT TO THE SUPER RICH ON A SILVER

PLATTER!

http://mexicanoccupation.blogspot.com/2018/05/clinton-obama-trumpernomics-rich-get.html

"The Wealth-X report shows that the world’s billionaire population has grown by 15 percent, to 2,754 people, since 2016, and that the wealth of these billionaires “surged by 24 percent to a record level of $9.2 trillion,” equivalent to 12 percent of the gross domestic product of the entire planet."

The legislation has been shaped entirely by the class interests of the capitalist ruling elite, which demands both a continued supply of cash from the Treasury and a stepped-up supply of low-wage labor in the midst of the pandemic. In the course of these “negotiations,” measures that provide subsidies to businesses or promote the entry of more workers into the labor force have advanced, while measures that cost business money, sustain working people while they are not actively employed, or simply improve their lives, have been killed.

Biden opened the border, flooding our nation with millions of unemployed, unvetted, often terribly sick people who have no knowledge of or respect for our institutions. Most plan to get the welfare and health care Biden promised. Nothing stops terrorists and serious criminals, including killers; rapists; pedophiles; and traffickers of women, children, and drugs. America receives no benefit from opening our border to impoverished, illiterate people from over 120 countries. To add insult to injury, while Americans are being destroyed over the vaccine mandate, illegal aliens need not be vaccinated.

Yellen: Inflation Is ‘Temporary,’ It Will ‘Begin to Decline’ to ‘More Normal Level’ ‘By the Second Half’ of 2022

During an interview aired on Friday’s broadcast of CNN’s “Situation Room,” Treasury Secretary Janet Yellen said that she still thinks inflation is “temporary, although, I don’t mean just a matter of a month or two.” And “by the second half of the year, annual inflation rates will begin to decline toward their more normal level of around 2%.”

Yellen said, “I still would say it’s temporary, although, I don’t mean just a matter of a month or two. Although, monthly inflation rates are — have substantially declined from where they were just four or five months ago. But what we’re really seeing is the impact of the COVID pandemic has severely disrupted economic activity. It’s hugely boosted spending on products, on goods and diminished spending on services. It’s created an enormous demand for semiconductors and these supplies, although they’ve increased, are — have encountered bottlenecks and it’s really caused some inflationary increase in recent months. As people get back to work, as we defeat the pandemic, and as demand shifts back to services and as supply has a chance to adjust, I believe that price increases will normalize and we’ll see lower monthly inflation rates, I think, by the second half of the year, annual inflation rates will begin to decline toward their more normal level of around 2%.”

She added that while there will be “some continued shortages,” she thinks there will be a moderation of energy prices “in the months ahead.”

Follow Ian Hanchett on Twitter @IanHanchett

Trouble Won’t Be “Transitory”

Mounting problems with inflation, the supply chain, and energy shortages are not likely to resolve themselves quickly.October 24, 2021Authorities in Washington—President Joe Biden, Federal Reserve Chairman Jerome Powell, and Treasury Secretary Janet Yellen—have told the public not to worry over the recent inflation, which they insist is “transitory.” They link the problem to supply-chain constraints that they suggest will soon lift. Supply problems have certainly contributed to inflation, but early relief seems unlikely. Even Transportation Secretary Pete Buttigieg expects problems until mid-2022 at the earliest. That will put a damper on holiday gift-giving and makes the word “transitory” sound misleading.

The current inflation is worrisome for more fundamental reasons. Widespread supply-chain problems are clearly a global reality and part of America’s inflation story. Though many factors have contributed to the supply-chain woes, the heart of the matter is the post-pandemic buying surge. Consumers in the United States and around the world, having spent little during the lockdowns and quarantines and with sometimes-generous government checks in hand, have ratcheted up buying a wide range of goods and services. Those demands have filtered back from retailers to producers, who, having stopped or curtailed activity during the lockdowns, have had to scramble to catch up. Delays, shortages, and rising prices result.

Evidence of this surging demand abounds across all product areas and economies. The American consumer’s behavior is typical, and illustrative of what is happening everywhere. According to the Commerce Department, overall consumer spending in the U.S. has grown 11.6 percent over the past 12 months, a rate of increase surpassed only by the initial buying surge during the summer of 2020, when pandemic restrictions first began to lift. As of August 2021, the most recent month for which data are available, consumers bought goods and services at an annual rate of $15.9 trillion. A year ago, that figure equaled $14.3 trillion. It should be easy to see how a demand jump of more than $1.5 trillion in a relatively short time has strained producers. They not only have had to ramp up from the curtailed levels engendered by the pandemic restrictions but also have had to accommodate the mix of products demanded by consumers. Each delay at each level of production has spread through the landscape of assembling goods and getting them to where people want them.

A shortage of workers has worsened the strain and slowed the catchup. An underlying demographic of an aging population is at work here, but that is only part of it. Fears of infection have kept many people away from the workplace, while government polices—in the United States and elsewhere—have encouraged others not to work. Until recently, the United States offered especially generous unemployment benefits, making it more profitable for some to stay home than get jobs—especially workers with childcare responsibilities, who not only collected generous benefits but also saved on childcare expenses. As of September, the combined effect of these influences had brought work participation to a mere 61.6 percent of the civilian population. Before the pandemic, participation averaged over 63.5 percent. The percentage change looks small, but it constitutes a decline of 5.5 million people available for work.

Because the extra unemployment benefit expired only last month, little data exist on the public response. Other generous benefits may yet keep potential workers at home, however, and vaccine mandates have further curtailed the nation’s workforce. Some workers have quit their job rather than comply, while others have been fired or placed on leave. An absence of comprehensive data makes it hard to know exactly how much the mandates will further shrink the workforce, but it is certain that they will not ease the labor shortfall. Washington State, for instance, recently announced that it has lost some 2,000 government workers due to its vaccine mandate. Using Washington State’s experience as a baseline for other states, the federal government, and the many companies planning to enforce a vaccine mandate, the loss to the labor force could climb considerably above a million.

Strike activity has contributed to the problem as well, albeit only marginally so far. The latest data provided by Cornell University’s Labor Action Trackers record almost 200 strikes so far in 2021–the most in some years. This is hardly surprising. The worker shortage provides leverage for organized labor, and the inflation gives workers ample motivation to demand higher wages. True, striking workers are still technically employed, but they are not producing.

Since President Biden has inserted himself into the delays at the Port of Los Angeles, it has gained notoriety as the epicenter of the shortages problem. In truth, L.A.’s port is only one part of a much bigger picture, but it does show how these difficulties have converged. The sudden flood of shipping from Asia aimed at meeting American demands has overwhelmed the port’s ability to unload cargoes in a timely manner. A shortage of dock workers combined with lack of maintenance and upgrade work to the port during the pandemic left it incapable of handling the new shipping volumes. Because the worker shortage strengthened the union’s hand, the port barely considered expanding activity beyond the typical five-day workweek to run 24 hours a day, seven days a week, as other ports around the world do. The worker shortage would have stymied such an effort, anyway, though the president’s insistence has now inspired at least an effort. Even if the port can expand its hours and days of operation, it has warned that a shortage of truck drivers and rail workers will prevent unloaded goods from flowing out of dockside warehouses to where they are in demand, either from consumers or as inputs to other production processes.

The spring and summer rise in Covid infections has added its ill effect to supply chain problems. The Delta variant has slowed production only marginally in the United States and Europe, but it has had a more profound effect in Asia. China’s zero-tolerance policy quickly shut down factories and shipping centers at the first sign of renewed infections. Governments elsewhere in Asia are less draconian, but rising infections have also brought shutdowns in other important exporters such as Vietnam and Indonesia. Their diminished production has cut off additional flows of products to the West—consumer goods, largely, but also parts needed for both American and European production efforts. It’s not certain that the Port of Los Angeles could have unloaded them anyway. This interruption has done particular damage to the delivery of holiday gifts, especially toys.

Perhaps most significant in this mélange of trouble is the worldwide energy shortage. The post-pandemic demand surge would have strained production potentials in the best of circumstances, but policy actions have made matters worse. Biden began his term by shutting down the Keystone Pipeline and doing what he could to stop the fracking revolution. His actions have contributed to a 14 percent drop in North American fossil-fuel production from pre-pandemic highs. The absence of this production has returned monopoly-like power to OPEC and Russia, both of which have every incentive to keep the price of oil high by constraining how much they pump. And both do better by getting more per barrel than from selling more barrels.

Green initiatives to replace fossil fuels with wind, solar, and hydro power, which started well before the pandemic, have also contributed. Coal was a primary target but not the only one. Mines in the United States and elsewhere shut down or severely curtailed operations. Some marginal supplies of oil and natural gas were shut off as well. Now, amid a surge in demand and huge portions of North American production taken offline, it has become difficult if not impossible to restart the closed operations. If anything, it is even harder to ramp up wind, solar, and hydro to meet heightened energy demands. Far from ramping up, Europe has suffered a lack of wind power, while in China droughts have reduced the output from hydro power sources. It has been all but impossible to restart the coal mining that has been shut down; the resulting shortfall in China’s electricity generation has idled other factories and transport facilities not already affected by the rise in Covid infections.

These are not problems that dissipate quickly, regardless of whatever Biden, Powell, and Yellen might claim. Indeed, as falling temperatures increase energy demands in the months ahead, intensified energy shortages will likely filter through all production efforts and make the shortages still more intense. Even if Biden were to reverse his positions on fracking and the Keystone Pipeline, it would take months for the associated energy sources to reach users. It may turn out that Secretary Buttigieg’s forecast of mid-2022 stands on the optimistic side of likelihoods. And once supply-chain problems ease, it will take even longer to see a reflection in inflationary pressures. Washington’s original claims of “transitory” effect look increasingly risible.

And there’s still more: beneath the supply-chain effects lies a more fundamental inflationary concern. For years now—since the 2008–09 financial crisis, in fact—most of the developed world has followed what can only be described as inflationary fiscal and monetary policies. Governments, including Washington, have run unprecedented budget deficits. Worse, from an inflationary standpoint, easy monetary policies have inflated money supplies. Effectively, these expansive monetary policies have financed government budget deficits with the electronic equivalent of the printing press. In the United States, the Fed has purchased over $5 trillion in newly issued federal debt since 2008—over $3 trillion of it in the past year. Both history and economic theory identify such behavior as a primary cause of inflation. Even if the president’s huge spending programs fail to become law, the stage seems set for still more inflation. To be sure, history shows that the lags from policy to inflation are often long and always variable, but supply-chain considerations aside, it’s beginning to look as though these lags have run their course and the inflation has arrived.

Unlikely as it seems now, it is still possible that the supply-chain problems will ease quickly. A slowdown in the economy could ease some of the pressure on production and shipping. It’s also possible that experience and economic theory have missed the mark, and that this time overly expansive fiscal and monetary policies will not produce inflation, or that the long and variable lags will buy more time. But if these happy events are possible, they do not look likely. Instead, probabilities suggest that inflation will persist for months even after supply-chain problems dissipate—and then likely go on longer, in response to years of inflationary fiscal and monetary policies.

Apple & Amazon's Big Warning to Investors

Amazon Reports Drop in Profits, Expects Holidays Woes

Amazon recently reported a surprising drop in profits in the third quarter that it expects to continue through the holiday quarter.

Reuters reports that Amazon reported a surprising drop in profits on Thursday that it believes will continue through the holiday quarter. Amazon reportedly plans to introduce higher pay to attract workers and predicts that other operational disruptions will diminish the company’s profits from online shopping.

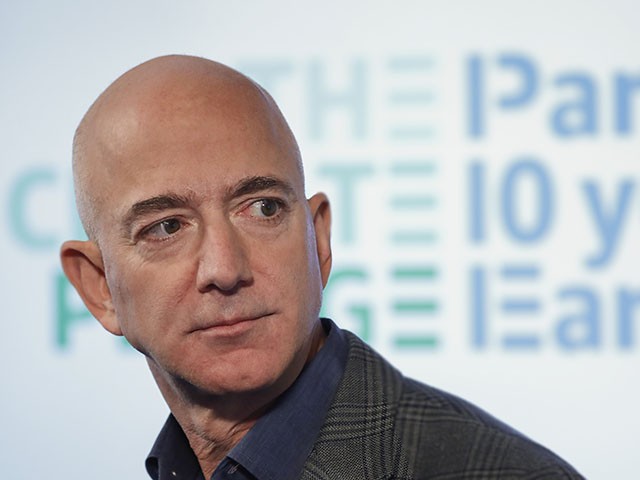

FILE – In this Sept. 19, 2019, file photo, Amazon CEO Jeff Bezos speaks during his news conference at the National Press Club in Washington. Amazon said Tuesday, Feb. 2, 2021, that Bezos is stepping down as CEO later in the year, a role he’s had since he founded the company nearly 30 years ago. (AP Photo/Pablo Martinez Monsivais, File)

Amazon saw its net income fall by around 50 percent to $3.16 billion at the end of the third quarter, a first major drop in profits for the company since the start of the coronavirus pandemic. Amazon CEO Andy Jassy said in a statement that Amazon is dealing with higher shipping costs, increases wages, and worker shortages. These issues combined with lost productivity and cost inflation added $2 billion to the company’s expenses in the quarter.

It seems that these problems are expected to extend through the holiday season. Jassy stated that Amazon is “doing whatever it takes to minimize the impact on customers and selling partners this holiday season.” He added: “It’ll be expensive for us in the short term, but it’s the right prioritization for our customers and partners.”

Amazon has posted impressive financial results for the past year but may be facing tougher times ahead. It has boosted the average U.S. warehouse pay to $18 per hour and marketed larger signing bonuses to attract more blue-collar staff that the company needs to keep its high-turnover business running.

Amazon is also dealing with global supply chain challenges and claims to have doubled its container processing ability. The company has expanded its delivery partner program and ramped up its warehouse investments, all of which are extremely expensive. The company expects operating profit for the current quarter to be between $0 and $3.0 billion, much less than the $6.9 billion the company posted at the same time last year.

Read more at Reuters here.

Lucas Nolan is a reporter for Breitbart News covering issues of free speech and online censorship. Follow him on Twitter @LucasNolan or contact via secure email at the address lucasnolan@protonmail.com

The Real Reason the Economy Might Collapse | Robert Reich

THIS IS WHAT JOE BIDEN, NANCY PELOSI, CHUCK SCHUMER AND KAMALA HARRIS IS DOING TO AMERICA

No comments:

Post a Comment