"Along with Obama, Pelosi and Schumer are responsible for incalculable damage done to this country over the eight years of that administration." PATRICIA McCARTHY

WaPo Columnist Slams the Inflation Reduction Act as ‘No Such Thing’

Washington Post columnist Steven Pearlstein torched the Democrats’ so-called “Inflation Reduction Act” as being “no such thing” because politicians cannot simply turn a dial “to control employment, output, inflation — even the price of gasoline.”

Pearlstein said the economy is a complicated organism, and any politician who claims to be able to fix the economy by adjusting a dial “just right” is doing so based on a false premise.

“Democrats in Congress are embracing the same fallacy as they ram through a package of climate, tax and health-care initiatives fancifully marketed as the ‘Inflation Reduction Act of 2022,'” he wrote:

No less specious, of course, is the Democrats’ claim that inflation will be significantly reined in by a slimmed-down tax and spending bill that closes corporate tax loopholes, extends and expands clean energy tax credits, extends health insurance subsidies to the working class and gives Medicare the power to negotiate prices on a dozen overpriced drugs.

The Congressional Budget Office estimates that, over the next two years, the Inflation Reduction Act is likely to change the inflation rate by less than one tenth of one percent — but it isn’t sure whether the change would be up or down.

Even over the next five years, according to the Committee for a Responsible Federal Budget, the package moving through Congress would reduce the federal budget deficit by a piddling $25 billion — a rounding error in a $23 trillion economy. Regardless of the final number, the measure will hardly dent an annual federal budget deficit projected to run at the unsustainable rate of 5 percent of GDP over the next 10 years.

Pearlstein’s Sunday column came on the same day the Senate passed the “Inflation Reduction Act.” The act purportedly aims to extend Obamacare subsidies, reduce climate change, and allow Medicare to negotiate drug prices.

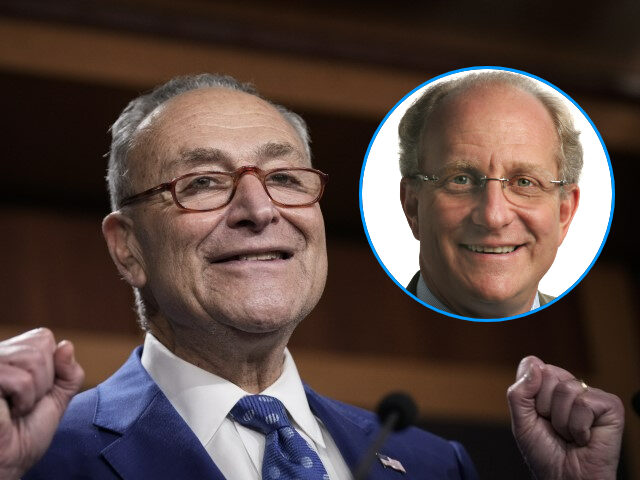

But the act will further exacerbate Joe Biden’s 40-year-high inflation. “The supposedly game-changing legislative breakthrough that brought together Sen. Joe Manchin (D-WV) and Senate Majority Leader Chuck Schumer (D-NY) after months of negotiations over Build Back Better failed is cynically branded as a measure to counter the budget deficit,” Breitbart News reported. “This makes sense in a crass political way because inflation is the number one issue facing American families and is plunging the economy into a stagflationary recession.”

Breitbart News’s John Carney explained:

The first hint that this is not going to be an inflation reducing piece of legislation is that the bill includes a massive expansion of government spending. There is roughly $385 billion in spending on energy and climate change, according to the nonpartisan Committee for a Responsible Budget. There is $100 billion of new spending for health care in the form of expanded Obamacare subsidies and expanded prescription drug and vaccine coverage.

Senate Democrats passed the bill with the rules of reconciliation, thereby circumventing the 60-vote filibuster that Republicans can use with a 50-50 split Senate. Vice President Kamala Harris cast the tie-breaking vote. The bill will now head to the House to be voted upon, likely on Friday.

Vice President Kamala Harris speaks to reporters while departing the Senate Chamber at the US Capitol in Washington, DC, on August 6, 2022. (STEFANI REYNOLDS/AFP via Getty Images)

Follow Wendell Husebø on Twitter @WendellHusebø. He is the author of Politics of Slave Morality.

Senate Passes $700 Billion ‘Inflation Reduction’ Bill

The Senate on Sunday passed the $700 billion Inflation Reduction Act, a scaled-down version of the Build Back Better Act.

The Senate voted to pass H.R. 5376, otherwise known as the Inflation Reduction Act, 51-50. The legislation passed on a party-line vote, with Vice President Kamala Harris breaking the tie.

The Inflation Reduction Act arose after Schumer and Sen. Joe Manchin (D-WV) struck a deal on a slimmed-down version of the Build Back Better Act. The Inflation Reduction Act focuses on reducing the deficit and curbing inflation, extending enhanced Obamacare subsidies, spending more than $300 billion on climate change programs, and allowing Medicare to negotiate the price of drugs.

Sen. Joe Manchin, D-W.Va., talks with reporters as the Capitol in Washington, Aug. 1, 2022. (AP Photo/J. Scott Applewhite)

House Republican Study Committee (RSC) Chairman Jim Banks (R-IN) has detailed the 50 most radical aspects of the legislation.

Perhaps ironically for Manchin, the bill would not reduce inflation, according to the Penn Wharton Budget Model and the Congressional Budget Office (CBO).

The legislation would also hit manufacturers hardest with a 15 percent corporate minimum tax, according to the Joint Committee on Taxation (JCT).

The Inflation Reduction Act would also add more “fuel” to the “inflation fire,” according to Rep. Jason Smith (R-MO), the ranking member of the House Budget Committee. He explained that the Inflation Reduction Act utilizes budget gimmicks and fake offsets to mask the true cost of the bill. Smith said the bill would add $114 billion to the debt when accounting for Manchin’s fake gimmicks.

The bill goes to the House, where it will likely pass, barring any major disputes that have yet to arise.

The House Freedom Caucus released a statement after the vote, declaring their opposition to the Inflation Reduction Act:

The fact is that Democrats’ latest spending bonanza has far more to do with enacting their socialist ‘Green New Deal’ agenda than truly helping Americans suffering from staggering 9.1% inflation. A host of non-partisan experts all agree that this legislation will not decrease inflation, and many forecast that it will have the opposite impact. Worse still, not only does this bill direct $369 billion in handouts to climate change special interests, but it does so on the backs of the American taxpayer. To finance their socialist agenda, Democrats are supersizing the Internal Revenue Service with $80 billion (six times the agency’s annual budget) to create an army of 87,000 new enforcement agents to target Americans with as many as one million additional audits per year on taxpayers earning less than $200,000 – the same middle-class suffering the most from the skyrocketing inflation of Bidenomics.

The Freedom Caucus added, “The misnamed ‘Inflation Reduction Act’ is a disaster from every perspective and it must be defeated.”

Sean Moran is a congressional reporter for Breitbart News. Follow him on Twitter @SeanMoran3.

Democrats Poised to Spend $3.5 Trillion During Historic Inflation with Republican Help

President Joe Biden and congressional Democrats, with Republican help, are poised to spend $3.5 trillion during decades-high inflation.

“Passage of the Inflation Reduction Act will make Biden one of the most legislatively successful presidents of the modern era,” Politico Playbook writers Ryan Lizza and Eugene Daniels wrote.

Although congressional Democrats have only a four-member majority in the House and a one-member majority in the Senate, Biden has been able to pass a substantial legislative agenda. It is also notable that Biden has spent so much during the first half of his term in office. This includes:

- The $1.9 trillion American Recovery Act, Biden’s coronavirus relief bill

- The $550 billion so-called Infrastructure Investment and Jobs Act

- The $280 billion Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act

- $700 billion Inflation Reduction Act

As Politico noted, these expenditures amount to roughly $3.5 trillion and address many leftist priorities such as “the pandemic and its economic fallout, highways, bridges, broadband, rail, manufacturing, science, prescription drug prices, health insurance, climate change, deficit reduction and tax equity.”

This spending has followed as Americans continue to reel from record-high inflation

Biden has also expanded NATO to include Sweden and Finland and passed gun control legislation.

Although congressional Democrats bear much of the responsibility for passing Biden’s legislation, congressional Republicans often gave Biden the necessary votes to advance the 46th president’s agenda.

For instance, 13 House Republicans and 19 Senate Republicans gave Democrats the necessary votes to pass the so-called infrastructure bill.

Fourteen Senate Republicans and many House Republicans voted for the CHIPS Act.

Believing that a reconciliation bill was not being negotiated, Senate Republicans voted to pass the CHIPS Act. This eliminated any leverage Republicans had to block the Inflation Reduction Act.

With no remaining obstacles, Sens. Joe Manchin (D-WV) and Chuck Schumer (D-NY) announced their legislative framework and now stand poised to pass the bill in the Senate. The bill will likely be voted on this coming week.

This failed strategy led many Republicans to admit they lost to Democrats.

“We got our ass kicked. It’s just that simple. Looks to me like we got rinky-doo’d. That’s a Louisiana word for ‘screwed.’ And we got our ass kicked. That’s the way my people back home see it,” Sen. John Kennedy (R-LA) said.

Sen. Rick Scott (R-FL) said, “Yesterday’s announcement by Joe Manchin and Chuck Schumer showed again that too many Senate Republicans unfortunately trusted Democrats and got duped. Some are pretending to be shocked. It’s not shocking at all.”

Republicans’ cooperation with Democrats’ agenda also extends to major domestic and foreign policy.

Fifteen Senate Republicans and 14 House Republicans voted with Democrats to pass gun control.

Only two Senate Republicans, Sens. Josh Hawley (R-MO) and Rand Paul (R-KY) opposed expanding NATO to include Finland and Sweden.

Politico compared Biden’s legislative success during the first two years of his presidency to that of the president who passed the Civil Rights Act and the Great Society welfare programs.

“There’s not much debate anymore over whether Biden has been a consequential president. In the long run, his first two years may be remembered as akin to LBJ when it comes to moving his agenda through Congress,” Politico wrote.

Sean Moran is a congressional reporter for Breitbart News. Follow him on Twitter @SeanMoran3.

Democrats Reject Ban on Middle-Class Tax Hikes in ‘Inflation Reduction Act’

Senate Democrats, on a party-line vote, rejected an amendment to their “Inflation Reduction Act” that would ban Internal Revenue Service (IRS) funds from being used to go after working and middle-class Americans with audits and tax hikes.

On Sunday, Senate Democrats passed the Inflation Reduction Act which includes $80 billion for the IRS to target mostly working and middle-class American households, squeezed by inflation, with more audits.

The Joint Committee on Taxation has reported that 78 to 90 percent of the taxpayer money raised via new audits and investigations as a result of the legislation would come from American households earning less than $200,000 a year. Meanwhile, just four to nine percent is expected to come from households earning more than $500,000 a year.

Sen. Mike Crapo (R-ID) offered an amendment that would ban any of the new IRS funds from being used to target Americans earning less than $400,000 annually. Crapo said the amendment ensured that President Joe Biden would not break his promise to not raise taxes on Americans earning less than $400,000 a year.

The amendment, though, was rejected by all Senate Democrats on a party-line vote. The passed legislation, instead, only suggests that Congress does not “intend” to raise taxes on households with annual incomes of less than $400,000.

The Inflation Reduction Act is seemingly a violation of a promise Biden made to American taxpayers in his most recent State of the Union (SOTU) address in March.

“And under my plan, nobody earning less than $400,000 a year will pay an additional penny in new taxes. Nobody,” Biden said at the time.

John Binder is a reporter for Breitbart News. Email him at jbinder@breitbart.com. Follow him on Twitter here.

Senate passes Democrats’ fraudulent climate and “tax fairness” bill

On Sunday, following a 27-hour exercise in political posturing by both sides, the US Senate passed the Biden administration’s misnamed “Inflation Reduction Act of 2022” by a party-line vote of 51 to 50. Vice President Kamala Harris cast the tie-breaking vote in her capacity as president of the Senate.

“The Senate is making history,” declared Senate Majority Leader Chuck Schumer, otherwise known as the senator from Wall Street, as Democratic senators and their staff members rose for a standing ovation.

“To Americans who’ve lost faith that Congress can do big things, this bill is for you,” Schumer said, adding, “This bill is going to change America for decades.” He went on to call the legislation “the boldest clean energy package in American history,” one that would reduce consumer costs for energy and medicines.

The staged celebration reflected not the actual content of the bill—a miserable climb-down from earlier iterations of the Biden administration’s domestic agenda, purged of any significant social measures, restrictions on greenhouse gas emissions or corporate tax hikes—but rather the desperation of the Democratic Party to create the illusion of progressive reform and register a legislative “win” in advance of the November midterm elections.

It is unlikely to fool the masses of working people, who face brutal inflation and a deliberate policy of increasing unemployment to halt a growing wages movement.

The final version of the bill that emerged from the so-called budget reconciliation process, which blocked a Republican filibuster and allowed the measure to pass by a simple majority in the evenly divided chamber, allocates some $430 billion for climate measures and a three-year extension of increased subsidies for health insurance purchased on private exchanges under the Affordable Care Act.

The $369 billion over 10 years nominally devoted to fighting climate change consists entirely of tax credits to private energy corporations, both non-carbon and fossil-fuel. It is, as some commentators have noted, “all carrot and no stick,” i.e., all corporate welfare and no penalties for belching greenhouse gases into the atmosphere.

There is good reason to believe, despite the hype from Democrats and media outlets friendly to the Democratic Party, that the bill will worsen the climate crisis. One expression of the complete subordination of both parties to the corporate-financial oligarchy, including Big Oil, is the insertion into the bill of provisions massively expanding exploration and drilling for oil and gas on federal lands and offshore regions, including both the Gulf of Mexico and the waters off of Alaska.

These provisions were added at the insistence of West Virginia Democrat Joe Manchin, a coal business multi-millionaire and the Senate’s biggest recipient of campaign cash from the fossil fuel industry. Manchin chairs the Senate Energy and Natural Resources Committee.

Manchin also secured from Schumer, House Speaker Nancy Pelosi and the Biden White House a commitment to vote on a separate measure in the fall—which could not be passed under the budget reconciliation procedure—that would dramatically weaken the role of environmental agencies in approving permits for energy pipelines and other fossil fuel installations. That measure is likely to win a large number of Republican votes, boosting its chances for passage by Congress.

Manchin has a direct interest in this gift to greenhouse gas emitters. He has been fighting protests by environmental groups and small landowners in his home state opposing the completion of the Mountain Valley Pipeline, a 300-mile pipeline for the transport of Appalachian shale gas from West Virginia through Virginia.

Included in the bill is a little-noted provision that will shift judicial review of suits lodged against the pipeline project from the Fourth Circuit Court of Appeals, which has upheld some of the protests, to the US Court of Appeals for the D.C Circuit, deemed more friendly to the fossil fuel industry.

Last week, in a quarterly conference call with analysts, Exxon CEO Darren Woods called the bill “a step in the right direction,” and the US arms of both BP and Shell on Friday signed on with 38 other companies in a letter supporting quick passage of the bill.

The open support for the “clean energy” bill from major oil producers—which are raking in record profits by jacking up prices in the midst of the US/NATO war against Russia in Ukraine and supply disruptions linked to the COVID-19 pandemic—angered Republican lawmakers, who put pressure on the industry to come out publicly against the bill. After saying little about the bill for a week, the American Petroleum Institute issued a statement opposing it on Friday.

Driving the three-year extension of increased Obamacare subsidies (at a cost of $64 billion) were cynical electoral calculations. The Democrats, already facing the prospect of losing control of the House and possibly the Senate in the November 8 elections, were aghast that voters would be informed of sharp rises in insurance premiums in the run-up to Election Day unless the benefits were extended. Assuming the bill is passed by the House later this week, the benefits will now continue until after the 2024 elections.

The other much-trumpeted health care benefit in the bill is a reduction in the price of prescription drugs, to be secured by allowing Medicare for the first time to negotiate drug prices with the pharmaceutical corporations. This program is projected to save $288 billion over 10 years and is included in the estimated $760 billion in additional revenues, mainly from tax increases and increased enforcement by the Internal Revenue Service (IRS).

However, the bill allows Medicare to negotiate the prices of only a small number of drugs, beginning in 2026, and excludes drugs that already compete with generic versions. It also includes provisions that will allow the drug giants to charge even higher prices for new drugs that are brought onto the market.

The Byzantine and undemocratic character of the entire process was underscored by the final disposition of a proposed $35 monthly cap on out-of-pocket costs for insulin. The Senate parliamentarian, the unelected arbiter of what can and cannot be passed under the budget reconciliation procedure, ruled that the insulin price cap could apply only to Medicare enrollees, and not to those who purchase the life-saving drug on the commercial market.

A more substantive benefit that managed to make its way through the Senate bill is a $2,000 cap on annual out-of-pocket prescription drug outlays by Medicare enrollees. This, however, is projected to benefit something less than 2 million seniors, a small fraction of the elderly who rely on the Medicare Part D drug program.

The assertion that the bill will reduce consumer prices is entirely bogus. It is based on the claim that the net result of the bill will be a reduction in the federal deficit of $300 billion over 10 years—a drop in the bucket of government indebtedness. Even the $300 billion figure has been reduced to $102 billion by the Congressional Budget Office, based on the bill as it emerged from the Senate debate.

There are no price controls and no penalties on companies that engage in price gouging. The parliamentarian ruled that rebates to the government from drug companies that raise prices above the inflation rate can be collected only on drugs purchased by Medicare, not on drugs bought on the commercial market.

The same prostration to corporate interests applies to the so-called “tax fairness” provisions in the bill. The more than $1 trillion in tax cuts for corporations and the rich in the 2017 tax overhaul under Trump remain in place. There is no increase in either the corporate income tax rate or the tax rate for the wealthy.

Last week, the proposed ending of the notorious “carried interest” loophole, which allows hedge fund and private equity managers to pay taxes at barely half the normal rate charged to high earners, was stripped from the bill. This was the price demanded by Arizona Democrat Kyrsten Sinema for lending her support, without which the bill would fail.

In place of the ending of the carried interest loophole, the Democrats included a 1 percent excise tax on stock buybacks. As the Wall Street Journal reported in an article headlined “Plan Isn’t Expected To Affect Buybacks,” financial analysts are confident that the minor tax will not end the record pace of an entirely parasitic corporate practice aimed at further enriching executives and big investors.

Sinema, after a private call with the National Manufacturers Association and the Arizona Chamber of Commerce, also demanded the gutting of a second proposed tax hike on business: a 15 percent minimum tax on corporations reporting income of more than $1 billion to their shareholders. Sinema demanded that manufacturers be allowed to continue applying an accelerated depreciation tax dodge that enables companies that report billions in profits to pay little or no federal taxes.

This too was incorporated into the final bill, even though the previous day the chair of the Senate Finance Committee released data showing that the average income reported on financial statements by corporations making more than $1 billion was nearly $9 billion, but they paid an average effective tax rate of just 1.1 percent, in large part through the use of accelerated depreciation.

Sinema is a well-known shill for the hedge fund and finance industry, having received over $2.3 million in campaign cash from these sources since 2017—more than any other senator.

However, it would be very mistaken to believe that Manchin and Sinema are outliers when it comes to whoring for big business.

The Wall Street Journal reported on Sunday that Blackstone Chief Executive Stephen Schwarzman personally received nearly $150 million in carried interest and incentive-fee compensation in 2021 alone, according to securities filings. The managing director of government relations at Blackstone is Alex Katz, who for five years served as a senior adviser to—Chuck Schumer.

One must not neglect to include in the ranks of this illustrious company the blowhard Bernie Sanders.

As expected, Sanders took advantage of the hours of amendments to the bill from the Senate floor—the so-called “vote-a-rama”—to demagogue as the supposed tribune of the working man. Knowing that his proposals would be voted down by his fellow Democrats, as well as the Republicans, and having already pledged to vote for the final bill regardless, he delivered lengthy speeches calling for the restoration of social measures in earlier versions of the Biden bill—dubbed Build Back Better—which he had hailed as the most progressive legislation by the most progressive administration since Roosevelt’s New Deal.

Indeed, the list of social measures discarded over the past year seems impressive: free community college, extended and expanded child tax credits, universal pre-kindergarten, paid sick and family care leave, Medicare expansion to cover dental, vision and hearing, major tax increases on the rich.

These were, as Sanders well knew, empty promises designed to delude the masses while the administration prepared for war against Russia and China, the dropping of all public health measures to contain COVID-19 and the propping up of the corporatist unions to suppress the movement by workers for wage increases and decent working conditions.

Sanders implored his fellow Democrats, saying, “We must show them that we are capable of representing the needs of ordinary Americans and not just wealthy campaign contributors.” They answered by joining with the Republicans to unanimously vote down all of his amendments.

WHEN THE DEMOCRAT PARTY DOES ANYTHING IT'S FOR BANKSTERS, AND BILLIONAIRES FOR WIDER OPEN BORDERS. DITTO REPUBLICANS.

Naming it the Inflation Reduction Act was false advertising

On Sunday, the United States Senate passed what was imprudently named the Inflation Reduction Act—with Kamala Harris breaking the tie, literally snickering as she condemned America to further economic carnage, and working-class citizens to utter financial strangulation. See the video below:

JUST IN - U.S. Senate passes $340 billion "Inflation Reduction" Act. Kamala Harris casts tie-breaking vote.pic.twitter.com/C5Dc63U94r

— Disclose.tv (@disclosetv) August 7, 2022

Writing for Forbes, Kelly Anne Smith described the legislation as a “slimmed down Build Back Better bill,” and said:

According to the Congressional Budget Office (CBO), a federal agency that provides budget and economic information to Congress, the bill would barely make a dent on inflation in the near term—and could even nudge it upward.

Could. Yeah, okay. For goodness’ sake, even Bernie Sanders said it wouldn’t lower inflation.

BERNIE SANDERS: The “so-called Inflation Reduction Act...will, in fact, have a minimal impact on inflation.”pic.twitter.com/gE9H2cJIgg

— RNC Research (@RNCResearch) August 7, 2022

So what does a “slimmed down” version of Build Back Better environmental communism with a $739 billion price tag look like? Well, it provides for the hiring of 87,000 new agents for a weaponized Internal Revenue Service, includes provisions that will advance economic death at the altar of “planet-heating emissions” and the World Economic Forum, and The Wilderness Society said it is, “the most important climate bill in history by a huge margin[.]”

Interesting to note is that the mockingbird media—nothing more than a propaganda machine at the behest of the Democrat-Marxists driving the country into the ground—referred to the bill as the Inflation Reduction Act, but only until it passed. Now the headlines read:

Senate passes $739bn healthcare and climate bill after months of wrangling

Senate passes Democrats’ sweeping health care and climate bill

U.S. Senate approves bill to fight climate change, cut drug costs in win for Biden

Senate Democrats passed an election-year economic bill package focused on climate, taxes and health care with a tie-breaking vote from Vice President Kamala Harris.

One might say the linguistic craftiness was all political theater between collaborative mafias—the government and the media—complicit in treason, for the purpose of soliciting public approval and support from the most useful of American idiots, of which there is unfortunately, no shortage. And, regrettably, it worked. The bill is set to return to the House, where it is expected to pass, before it's off to Dementia Joe's desk. Will these anesthetized fools ever wake up?

Analysis: Latest Version of Senate Democrats’ Reconciliation Bill Raises Taxes on Small Businesses

The latest iteration of the Senate Democrats’ reconciliation bill, known as the “Inflation Reduction Act,” would raise taxes on thousands of small and mid-sized businesses across the country, according to Americans for Tax Reform (ATR).

Senate Democrats changed the language of their new minimum corporate book tax, which would now hit small and midsized businesses well below the $1 billion profit threshold the tax intended to hit.

The new tax would impose a 15 percent minimum tax on the book income of “applicable corporations.” However, the latest change to the book tax would impact any business with private equity in its capital structure.

As John Kartch, vice president of ATR’s communications, said, “Any business that has [private equity] in its capital structure is now considered a subsidiary of that firm and thus subject to 15% book tax.”

s ATR explained:

As written, the provision now appears restructured to define any company with private equity in its capital structure to be considered a subsidiary of that private equity firm for purposes of the tax. This means that these companies would now be swept up in the new 15 percent tax on book income.

This provision would greatly expand the reach of the book minimum tax to apply to small and midsize companies that require capital investment to grow their business.

More than 18,000 businesses held by investment funds and partnerships that employ close to 11.7 million people would be targeted by the new tax increase, according to ATR’s Kartch.

If enacted, this provision would violate President Joe Biden’s campaign pledge to small businesses when he said, “no, taxes on small businesses won’t go up.”

Kartch called on Arizona Sen. Kyrsten Sinema (D) to “remove herself from the bill” in light of her announcement on Thursday that she would vote in favor of the reconciliation bill.

“In Sinema’s Arizona, this Dem tax hike would target [374] companies employing 229,000 people,” Kartch tweeted.

Arizona Republican Senate nominee Blake Masters, who is running against Sen. Mark Kelly (D), blasted Kelly for supporting the reconciliation bill after the small business tax was added:

Masters said:

So we’ve got this Senator, Mark Kelly, he says he loves small business. But we’ve got inflation, and it’s killing business. We’ve got this inflation because of spending that Mark Kelly voted for. And now he’s voting again for, you guessed it, he’s gonna raise taxes on small businesses. Small businesses will have to pay more, 18,000 businesses across the country, hundreds in Arizona, affecting hundreds of thousands of employees soon.

“Thanks to Mark Kelly. They’re all going to have a bigger tax bill. Mark Kelly’s doing more than anyone, literally anyone in Arizona to drag this country further in the wrong direction. It’s got to stop,” Masters continued.

LAWYER JOE BIDEN AND THE GAMER LAWYER INFESTED DEMOCRAT PARTY'S FIRST PRIORITY IS TO PROTECT THE RICH AND CORPORATE CRIMINALS ON WALL STREET.

THERE IS A REASON WHY JOE BIDEN GOT MORE CAMPAIGN MONEY FROM BIG BUSINESS AND BANKSTERS THAN EVEN THE REPUBLICAN ORANGE BABOON TRUMPER!

VIDEO

Ralph Nader: Biden's First Year Proves He Is Still a "Corporate Socialist" Beholden to Big Business

Democrats' new campaign slogan: 'A bigger IRS is a better IRS'

Democrats got a twofer with the cave-in of Democrat Sen. Kyrsten Sinema on their badly misnamed "Inflation Reduction Act" of 2022, paving the way for the $700 billion bill's passage in Congress -- the joy of taxing, and the joy of spending.

Now they are hailing this as some kind of achievement, something that could save their bacon come the November midterms, or else trash the economy enough as Republicans take over to make voters cry out for the Democrats' return.

The crowing for this disastrous bill, badly misnamed as the "Inflation Reduction Act," is incredible.

"It will reduce inflation. It will lower prescription drug costs. It will fight climate change. It will close tax loopholes and it will reduce and reduce the deficit," Senate Majority Leader Chuck Schumer, a Democrat of New York, said of the package. "It will help every citizen in this country and make America a much better place."

Which is entirely garbage.

Half the nightmare bill, some $369 billion, will be dedicated to green new deal boondoggles, subsidies for the rich, and crony shovel-outs of the kind that brought us Solyndra.

Concerned that EVs are too expensive? The Inflation Reduction Act would lower their cost, so that more Americans can choose to go electric and save money on maintenance and fuel. pic.twitter.com/WS0HPVN0uY

— Secretary Pete Buttigieg (@SecretaryPete) August 6, 2022

The other half, some $300 billion, will be dedicated to IRS enforcement, surveillance upgrades, and audits against small businesses, who have now been re-labeled "the rich."

Sinema got her demand to not close the carried interest tax loophole which is what her hedge fund donors wanted. Democrats replaced that with a provision to tax businesses even more. Imported oil will get new taxes, too. But not to support increased domestic production. Look forward to higher prices at the pump.

The Washington Post, though, is leading the cheers, with this incredible headline:

Democrats’ $80 billion wager: A bigger IRS will be a better IRS

What?

It gets worse when you read further:

IRS Commissioner Charles Rettig wrote to lawmakers on Thursday that his agency was committed to upping enforcement “in areas of challenge for the agency — large corporate and global high-net-worth taxpayers.” He added, “These resources are absolutely not about increasing audit scrutiny on small businesses or middle-income Americans.”

Oh, what piffle. There's not a word in that bill about who can get targeted -- the IRS, money in hand. can target any taxpayer they like, quite unlike the Department of Homeland Security which "prioritizes" only certain illegal aliens for enforcement action and not others. The Post notes that Biden is going to get rid of Rettig, a Trump appointee, soon, and appoint a leftist. This will be a guy who will lie like Alejandro Mayorkas, or else go naked in his advocacy of an IRS enforcer behind every small business.

The IRS makes most of its money going after small business owners who don't have the money to defend themselves with lawyers and specially carved out loopholes -- it gets a $10 per $1 spent return according to the Post.

The result is that the IRS’s prolific enforcement capabilities — which bring in on average better than $10 in revenue for every $1 spent pursuing audits — are often trained on the most economically vulnerable taxpayers.

More than half of the agency’s audits in 2021 were directed at taxpayers with incomes less than $75,000, according to IRS data.

Those little guys, by the way, according to one chart (coming soon) disproportionately target Latino taxpayers in the Southwest, places like the Texas borderlands corridors and southern Arizona, while completely ignoring the northeast as if nobody would dream of cheating on taxes in some place like New York.

Understand why those places are suddenly turning bright red? Understand why Sinema and all the other Democrat cavers in that region are beyond stupid, targeting their own voters?

Meanwhile, the IRS expects to claw back less than half of that from its newly targeted wealthier taxpayers.

The Post reports the IRS expects a much lower return on all those "rich" people they claim they are going to audit with those 87,000 new agents, which is an eightfold increase in their budget, with $4.50 gained for all those federal dollars "invested." That's way less than the $10 per $1 they are making now with the little guy taxpayers. Yet still, somehow, we are supposed to believe that once they have the congressionally appropriated money, that they will only target "the rich."

With 87,000 newly minted agents, and all of them under pressure from their bosses to "produce" for the government, who are they going to go for? Where is the money at, as a famous bank robber once put it? When you're shooting fish in a barrel, and the target can't fight back, and you have all the power to dictate who's a bad guy and show their new bosses how wonderful they are at bringing home the bacon, who are the newly minted IRS agent going to target? The Wall Street Journal's persuasive editorial titled "The IRS is About to Go Beast Mode" pretty well tells us what's in store with this horrendous bill.

Democrats, though, are still touting it, and likely for the most cynical of reasons.

They know they are going to be thrown out of office come November. They also know that the GOP is spineless and they expect it to be spineless by not repealing this bill the minute it gets a chance to. The GOP, like they themselves, are as addicted to government spending as the Democrats are. So the bill will stay in place. Meanwhile, the bill will trash the economy, raise gas prices, raise inflation, and sic hordes of IRS agents onto small businesses and other low income taxpayers who can't fight back. As the nightmare filters through society and things get worse and worse, who will voters then blame for it? The GOP, of course. Gee, things have gotten so much worse than they were even under the Democrats!

Democrats know how these stink bombs work. They've sent out a new one for the GOP to claim ownership of and are betting that the GOP will fall for it. They've got it baked in the cake.

JUDICIAL WATCH’S TEN MOST CORRUPT LIST

NO ONE HAS SUCKED OFF BIG BANKSTERS MORE THAN BARACK OBAMA AND NOT ONE EVER WENT TO PRISON! AND 'CREDIT CARD' JOE WAS THE OBOMB'S V.P. BECAUSE OF HIS LONG HISTORY OF SUCKING OFF BANKSTERS.

President Barack Obama: During his presidential campaign, President Obama promised to run an ethical and transparent administration. However, in his first year in office, the President has delivered corruption and secrecy, bringing Chicago-style political corruption to the White House. JUDICIAL WATCH

ON THE VERY LAST DAY OF AMERICA, THE PIG POLITICIANS WILL BE SUCKING BRIBES FROM THE CRIMINALS ON WALL STREET AND BANKSTERS.

THE COUNTRY IS NOW SO PROFOUNDLY CORRUPT THAT THE BANKSTERS WILL PUT THEIR OWN IN THE WHITE HOUSE AS PRESIDENT. CANDIDATES MUST BE A GAMER LAWYER WITH A LONG HISTORY OF PROTECTING CRIMINAL BANKSTERS!

NEO-FASCIST MARK ZUCKERBERG SAYS HE WILL ELECT OBOMB FOR A THIRD TERM!

Barack Obama Calls for More Censorship: First Amendment ‘Does Not Apply to Facebook and Twitter’

JUDICIAL WATCH’S TEN MOST CORRUPT LIST

President Barack Obama: During his presidential campaign, President Obama promised to run an ethical and transparent administration. However, in his first year in office, the President has delivered corruption and secrecy, bringing Chicago-style political corruption to the White House. JUDICIAL WATCH

https://ca-judicial-performance-hoax.blogspot.com/2022/04/lawless-lawyers-bankster-regime-of.html

THE IMAGE OF TWO GAMER LAWYERS OWNED BY BIG BANKSTERS: BANKSTER-BOUGHT BARACK OBAMA'S 'CREDIT CARD' JOE AND WALL STREET CHUCKY!

Hauser also didn’t like the prevalence of Big Law talent on the Department of Justice team, which signaled to him that the Biden administration could go soft on corporate malefactors. Alexander Nazaryan

Congress Approves Corporate Welfare Scheme in Undisputed Victory for Democrats

-

Never underestimate Congress’s ability to revive dead bills, and bad ideas, if enough money is used to revive them.

Such is the case with the revival and swift passage of a massive subsidy bill for the computer chip industry that, on its own, would have taken corporate welfare to bizarre new heights. This being Congress – and it also being an election year – the price tag ballooned with an extra $200 billion or so in federal spending, grants, giveaways and old-fashioned pork.

It’s enough to make even the most cynical of us think we are starry-eyed optimists when it comes to pols spending other people’s money (that being taxpayer money, of course). Consider this gem:

According to various reports, the subsidies would not only provide a financial windfall for semiconductor companies in [Sen. Chuck] Schumer’s home state of New York (something he openly admits), but also reportedly constitute one of the few “political wins” that the Democrats can deliver to President Biden and candidates in key battleground states like Arizona and Ohio ahead of the midterm elections in November—“huge leverage” that chipmakers and other subsidy supporters are perfectly willing to exploit today. Meanwhile, several of the congressional Republicans who support the subsidies—smaller in number than Democratic supporters but essential to the subsidies’ legislative success—also host semiconductor companies or large semiconductor consumers in their states or districts.

In other words, it’s vote-buying, but the perfectly legal, above-board, in broad daylight kind that Congress mastered even before the ink on the Constitution was dry.

And just when you think it couldn’t get any more tawdry:

Congress appears intent on subsidizing an industry making record profits, already building facilities here, and even facing a potential glut—not because doing so makes good economic sense but because the Democratic leadership and the White House need a “political win” and are under serious pressure from powerful domestic interest groups to deliver the cash. Indeed, even as the subsidies’ economic justifications dwindled, the subsidy amounts increased.

It might, possibly be a little funny…were Uncle Sam not flat broke. But hey – those bills don’t come due until long after the current crop of time servers has gone to the great campaign fundraiser in the sky.

The opinions expressed in this article are those of the author and do not necessarily reflect the positions of American Liberty News.

Josh Hawley: FBI colluded with Big Tech to bury Hunter Biden story

https://www.youtube.com/watch?v=pnC0cxOBCfc

VIDEO

Ralph Nader: Biden's First Year Proves He Is Still a "Corporate Socialist" Beholden to Big Business

https://www.youtube.com/watch?v=2jTIUtjkDss&t=28s

Hauser also didn’t like the prevalence of Big Law talent on the Department of Justice team, which signaled to him that the Biden administration could go soft on corporate malefactors. Alexander Nazaryan

The Biden family's corruption 'spans the globe': Schweizer

Watters: The Five (CRIME) Families of the Democrat Party

https://www.youtube.com/watch?v=BBpvvHethg0

HOW MANY ARE LAWYERS???

Schweizer: ‘It’s Going to Be Business as Usual’ for Hunter’s Dealings

Joe Biden, the corrupt, unaccomplished 47-year career politician, with a reputation of having been a proud segregationist, an unabashed plagiarist and liar, a resolute tale-teller, and a serial flip-flopper, is pretending to head up a radical social-democratic ticket for President of the United States that includes as his running mate the ambitious, disagreeable junior senator from California: Kamala Harris.

What's behind the Biden family's 'opulent' lifestyle?

https://www.youtube.com/watch?v=3OKIvDDNAC8

THE BIDEN CRIME FAMILY OF PARASITE LAWYERS IN THE MIDDLE EAST

JAMES BIDEN RAKES IT IN!

Jesse Watters Primetime

https://www.youtube.com/watch?v=Vt0iMhgtBmI

With no moral code, no center, nothing matters. You just read what’s in the teleprompter and hit the sack by 7:00 while your degenerate son collects piles of cash for the family until you’re free to do it on your own. All you have to do is what you’re told, your handlers and the media will take care of the rest. DEREK HUNTER

WHERE DID ALL OF GAMER LAWYER JOE BIDEN’S BIG BUCKS COME FROM?

video

Where did Biden's millions come from?

https://www.youtube.com/watch?v=ZlS88MKI-DA

There it is. That's the issue. To begin, you have the corrupt family Biden. They've been scamming us and our system well for almost fifty years. The man is supposedly worth over 250 million dollars. How is this possible on his salary? It's not. So where did his wealth come from? Not from being a brilliant businessman. DAVID PRENTICE

Watters: The Five (CRIME) Families of the Democrat Party

https://www.youtube.com/watch?v=BBpvvHethg0

HOW MANY ARE LAWYERS???

Schweizer: ‘It’s Going to Be Business as Usual’ for Hunter’s Dealings

Joe Biden, the corrupt, unaccomplished 47-year career politician, with a reputation of having been a proud segregationist, an unabashed plagiarist and liar, a resolute tale-teller, and a serial flip-flopper, is pretending to head up a radical social-democratic ticket for President of the United States that includes as his running mate the ambitious, disagreeable junior senator from California: Kamala Harris.

Watchdogs Sound Alarm as Biden Tires to Strong Arm Tech Companies to Censor Green New Deal Critics

-

Today, House Committee on Oversight and Reform Ranking Member James Comer (R-Ky.) and Subcommittee on the Environment Ranking Member Yvette Herrell (R-N.M.) raised serious concerns over the Biden administration’s ongoing efforts to suppress free speech and silence any who criticize the administration’s unpopular Green New Deal agenda. In a letter to White House National Climate Advisor Gina McCarthy, the Republican lawmakers highlighted how McCarthy is actively pushing Big Tech to censor legitimate criticism of Green New Deal policies and emphasized how this administration is seeking to discredit disagreement over its failed policies by blaming disinformation on social media. To conduct oversight over possible collusion of top administration officials with Big Tech companies, the lawmakers are requesting all documents and communications between White House employees and Big Tech companies regarding the censorship of climate-related information on social platforms.

“Your call to censor those who disagree with the Biden administration is troubling, particularly given recent plans at the Department of Homeland Security to form a Disinformation Governance Board. Committee Republicans request documents and other information regarding the use of your government office to pressure Big Tech companies to censor individuals who disagree with you,” wrote the lawmakers. “President Biden’s decision to cancel the Keystone Pipeline, attack domestic oil and gas producers, and enact other progressive Green New Deal style initiatives have led to disastrous and unpopular consequences for the American people. Instead of taking responsibility for these failed policies, the Biden Administration is blaming private companies for surging gas prices, soaring inflation, and skyrocketing utility costs. Now, the Administration’s climate team is deflecting and discrediting legitimate criticism and disagreement over its failed policies by blaming disinformation on social media. This attack on free speech is troubling.”

In a June 9, 2022, interview, McCarthy described how the Biden Administration is pushing for tech companies to monitor climate debate on social platforms and stop allowing specific individuals to spread so-called disinformation regarding climate issues. The move appears to be an effort to silence those who criticize Green New Deal style policies that are raising the cost of energy for all Americans.

“Instead of working for the American people on solutions to bring prices down, such as streamlining the permitting process, the Administration itself promotes disinformation by blaming high gas prices on the conflict in Ukraine, even though prices were rising under President Biden’s failed leadership long before Russia’s invasion. In fact, high energy prices are a direct result of the Administration’s war on domestic energy production. President Biden has refused to even meet with oil and gas companies choosing instead to ask Saudi Arabia for oil and gas,” continued the lawmakers.

Read the letter to McCarthy here.

The opinions expressed in this article are those of the author and do not necessarily reflect the positions of American Liberty News.

Meet the Democrats Who Could Replace Joe Biden

At this moment, in theory, (GAMER PIG LAWYER) Biden is going to run for re-election.

That being said, there is a significant chance he will not. He could decide on his own not to, Dr. Jill could be charged with elder abuse for allowing him to run again, he could lose the TV remote and get permanently lost in the White House while muttering about damn fancy stupid gadgets, the decimal point on all of his prescriptions could be moved one place to the right, he could suffer a grave injury in a game of "pull my finger" that goes horribly awry, or China could just finish the job and invade before the election. The list goes on and on.

With these myriad possibilities floating in the political ether, the few dozen Democrats around the country thinking about having a go at the top spot can hardly be blamed for engaging in just a bit of pre-planning. Can you really fault the kids for stopping by the lawyer's office first while they are driving dad to the home?

The majority of the people mentioned below are mostly in the "first impression" stage of meeting the national electorate. But much can be gleaned from even the glancing-blow candidacies now occurring, as those first impressions — even more so than policies and résumés — are crucial to creating the framework of a successful campaign. Even having a presence that, while not actively horrible, is still just a bit off-putting can sink a politician, especially in a close contest.

It is possible that (GAMER PIG LAWYER) Biden will somehow cobble together the wherewithal to run (at the very least — like John Gill in the original Star Trek Nazi planet episode — be cobbled together by power-hungry staffers and such). If that occurs, the candidates will have to think long and hard about running. Remember, not even Teddy Kennedy could take out Jimmy Carter. But someone will try — guaranteed.

In no particular order — because none is particularly special — here are the Democrat benchwarmers itching to move up to The Show:

- Michigan governor Gretchen Whitmer — Midwest/Rust Belt base is helpful, but her "rules for thee, not for me" COVID activities and what should be a tough re-election campaign this fall are not helpful.

- Minnesota senator (GAMER PIG LAWYER) Amy Klobuchar — Relatively moderate and hung around long enough in 2020 to build a bit of credibility, but there is not much there there — policy or personality-wise — and reports of her "mean boss" ways are a problem.

- New Jersey governor Phil Murphy — His proximity to the media centers in New York is an asset, as is his homespun-ish appearance, but his very, very close re-election (it was not at all supposed to be that way) is a dampener.

- Massachusetts senator (GAMER PIG LAWYER) Elizabeth Warren — Raised her profile with a decent 2020 run, media darling, and somewhat politically astute (at least regarding her base). She will face the headwinds of being a shrill technocrat most recognizable to the public for being Fauxcahontas.

- Illinois governor (JUST A PIG) J.B. Pritzker — He's rich, so there's that, but he's the opposite of telegenic and is presiding over a state government that manages to be simultaneously so incredibly corrupt and disarmingly incompetent that even the national media may actually notice.

- New Jersey senator (GAMER PIG LAWYER) Cory Booker — Nah, not really. Seats on many, many corporate boards and foundations seem to be his future. Sorry.

- Colorado governor Jared Polis — An intriguing liberal/Libertarian mix who would have cross-over appeal in the general election, and he's gay, so that's politically neato. Challenges in his home state and his party's hyper-progressive primary voter base make his road to the nomination nearly impassable.

- California governor Gavin Newsom — The Golden Boy from the Golden State, though, unlike medieval alchemists, he has managed to turn gold into lead. Polished, perfunctory, and pomaded, his shtick appeals to people of a certain class and mindset and repels most others.

- Vice President (GAMER PIG LAWYER AND CLONE OF BIDEN) Kamala Harris — She should have listened to her former boyfriend, (GAMER PIG LAWYER) Willie Brown, and held out for attorney general. At least in that job fewer people would have noticed what an utter train wreck she is.

An aside on Gavin and (GAMER PIG LAWYER) Kamala — they are, politically, the same candidate. They came up in a system in California that custom-makes coddled candidates who can thrive there but nowhere else. Like hothouse orchids, they are un-transplantable and destined to raise and then fail to live up to the hopes of their supporters and well-wishers and craven flacks outside the state. For a more in-depth look at this phenomenon, feel free to click here.

That being said, Newsom is one of the most likely folks to challenge Biden if he does run for re-election. Life — good looks, other people's money, not too many questions asked — has always been easy for Gavin, so why, he thinks, would this be at al different?

Back to Murderers' Row:

- New York congresswoman Alexandria Ocasio-Cortez — The candidate who most keeps Republicans up at night — not in that way (despite her claims of being a siren/victim), but a good way nonetheless. If she wrangled the Democratic nod, it is quite possible that any Republican candidate could be the first person since George Washington to get every single Electoral College vote (and I'm not even forgetting about D.C.). But Republicans will have to wait for that delight, because she'll be only 34 in 2024.

- North Carolina governor Roy Cooper — Moderate, white, straight, Southern, male ice hockey fan? Yeah, good luck with that.

- (GAMER PIG LAWYER) Hilary Rodham Clinton (no job title needed) — Ah, the woman scorned. Instant base, name recognition that is off the charts, access to boatloads of cash, and a burning desire to one-up (GAMER PIG LAWYER) Bill. Downsides? To start, she managed to lose to both Donald Trump and (GAMER PIG LAWYER)Barack Obama and nearly lost to Bernie Sanders — die-hard Democrats might notice that. Add that grisly track record to her many character and policy flaws, and even she might be in trouble. But she would still run, at the very least to jumpstart the fundraising grift of the family foundation (seems all those good-hearted billionaire oligarchs stopped giving after she stopped running — who'da thunk it?).

- Secretary of Transportation Pete Buttigieg — White, but gay, so that won't hurt him too much. A technocrat, a beta male, unprepossessing. Women like him for his nesting tendencies, and he has not obviously completely blowtorched his current gig (such as it is). He was a bit of a "shiny new thing" in 2020 — not exactly true anymore, but he's already beating Biden in the polling, so who knows? Not likely to run against Biden, but rather more likely to be the person chosen by the powers-that-be to replace him.

Oh, there are others — Tom Steyer (skin crawl), Tulsi Gabbard (is she still a Democrat?), Andrew Yang (definitely not still a Democrat), Eric "The Spy Who Loved Me" Swalwell, Gina Raimondo (if you don't live in Rhode Island or follow the Commerce Department on Instagram, you'll have to look that one up), greener-than thou Jay Inslee, etc. are possibly lurking but have no hope of making an impact.

But there are two others whom you will know by their first names alone — (GAMER PIG LAWYER) Michelle and Oprah. They might be the strongest candidates the Democrats have. God help us all, they would be tough to beat.

Thomas Buckley is the former mayor of Lake Elsinore and a former newspaper reporter. He is currently the operator of a small communications and planning consultancy and can be reached directly at planbuckley@gmail.com. You can read more of his work at https://thomas699.substack.com.

Image via Flickr, public domain

Democrats: $625B Tax Cut for Wealthy Elite ‘Essential’ Ahead of Midterms

Democrats say cutting hundreds of billions of dollars in taxes for mostly wealthy income-earners in coastal states is “essential” to getting reelected in this year’s midterm elections.

In November, House Democrats passed President Joe Biden’s “Build Back Better Act” which includes billions in tax breaks to the wealthiest residents of blue states. Specifically, the plan would give a tax cut to about 67 percent of the nation’s richest Americans — those earning more than $885,000 every year — costing taxpayers about $625 billion.

Under Biden’s plan, those in the top one percent would receive an average tax cut of more than $16,000 this year. The tax cuts for the wealthy would be a result of the plan’s increasing the State and Local Tax (SALT) deduction cap.

Ahead of the midterm elections in November, House Democrats are warning their rich donors that they must get out and vote for them to secure the massive tax cut. Rep. Sean Patrick Maloney (D-NY) called the tax cuts for the rich “essential” in an interview with Bloomberg News.

Biden, for instance, had sought to include tax cuts for his billionaire donors in a Chinese coronavirus relief package earlier this year. The plan was ultimately cut from the package. House Speaker Nancy Pelosi (D-CA), in May 2020, also tried to include the plan in a coronavirus relief package. JOHN BINDER

Gaetz: Biden, Democrats Weaponizing the IRS Against Americans

Thursday on FNC’s “Tucker Carlson Tonight,” Rep. Matt Gaetz (R-FL) warned efforts to bolster the Internal Revenue Service (IRS) was an effort by the Biden administration and Democrats to “weaponize” the government against its people.

The Florida Republican congressman said that paired with Democrats’ opposition to firearms, had prompted him to propose legislation.

“Well, Joe Biden is raising taxes, disarming Americans, so of course, they are arming up the IRS like they’re preparing to take Volusia,” he said. “Like you mentioned, five million rounds of ammunition, 4,500 firearms, automatic weapons, and $731,000 of taxpayer money spent this year to quite literally weaponize your government against you.”

“So, it’s not really that Joe Biden and the Democrats hate guns,” Gaetz continued. “They just hate law-abiding Americans having them, and they take the money from the people to go and have their own little private arsenals, and it is particularly egregious from a country that militarizes its bureaucracies and then forces its grandmothers to go and fend for themselves on dangerous streets because they defund the police and have cashless bail and other hug-a-thug woke criminal justice policies. That’s why I’m introducing legislation to stop it.”

THE DEMOCRAT PARTY AND THEIR PIG BILLIONAIRES!

The Schumer-Manchin plan includes billions in green energy tax credits that would be swooped up by billionaires to cut their corporations’ annual tax burdens. Jeff Bezos’s Amazon notoriously employs this strategy to pay close to zero in corporate income taxes.

Breitbart News’s John Carney writes:

Amazon’s tax bills were part of the inspiration for a minimum tax. The company faced no federal corporate income tax liability in 2017 and 2018. In the years since, it has had an effective tax rate that is just a fraction of the 21 percent rate put in place by the Trump administration’s tax reforms. According to the calculations of Matthew Gardner of the Institute on Taxation and Economic Policy, over the past four years Amazon’s effective aggregate tax rate was just 5.1 percent. [Emphasis added]

…

While the alternate minimum tax would prevent companies from using deductions for capital investments or stock-based compensation, it continues to allow them to use tax credits, Daniel Bunn of the Tax Foundation told us. In fact, the bill includes hundreds of billions of dollars worth of new tax credits aimed at fostering green technology adoption. And Amazon plays in beast mode when it comes to using tax credits to reduce its tax bill. [Emphasis added]

Jeff Bezo’s retail giant said in its annual report that tax credits reduced the taxes it would have otherwise owed by $1.1 billion. The company has said that most of those tax credits are federal research and development credits, although it does not give much detail in its annual reports. The Manchin-Schumer tax bill would not touch this. Amazon will lose the benefit of the write-off for stock-based compensation, but the company will most likely at least partially offset that by using the green tech tax credits. The end result could be no change in Amazon’s tax rate. [Emphasis added]

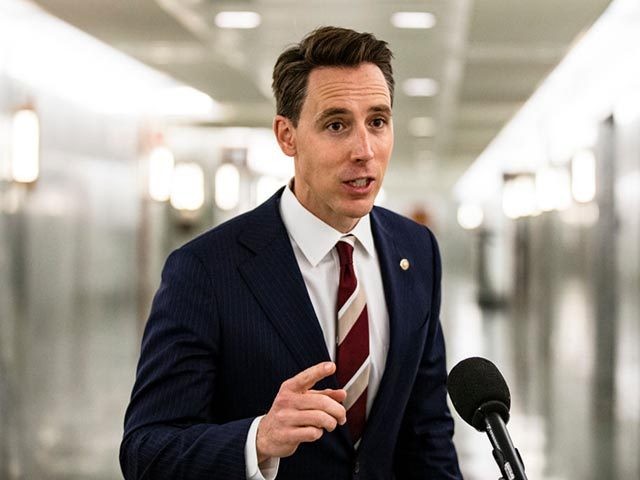

Sen. Josh Hawley Asks FTC to Investigate Amazon Deal to Buy Medical Clinic Chain

Sen. Josh Hawley (R-MO) recently sent a letter to the FTC requesting a review of the proposed $3.9 billion merger between Amazon and One Medical, a chain of medical clinics whose acquisition would mark Amazon’s latest move to take over the healthcare industry.

Sen. Josh Hawley (R-MO) asked the FTC in a recent letter to investigate the proposed $3.9 billion buyout deal between Amazon and One Medical.

Hawley wrote in the letter, “I realize that the FTC is currently engaged in numerous efforts to combat America’s accelerating economic concentration and the power of tech behemoths. Nevertheless, I urge you to prioritize a searching review of this particular transaction.”

Hawley stated that the acquisition would “provide Amazon with access to enormous tranches of patient data,” and while he acknowledged that HIPAA and other privacy laws could “thwart the worst potential abuses,” he noted that “loopholes exist in every legal framework.”

Hawley stated that some privacy-related scenarios “once written off as scaremongering fictions, are now a very real possibility.” Hawley provided one scenario, stating: “For instance, if an individual is diagnosed with high blood pressure by a One Medical doctor, will he later be advertised over-the-counter blood pressure medications whenever he shops at Whole Foods Market?”

Hawley also claimed that the deal would reinforce Amazon’s market dominance and may even reshape the power dynamic of the primary care space.

“It doesn’t matter if the primary care market as such is presently competitive: by having its hand in dozens of smaller markets, Amazon positions itself to eventually emerge as the dominant player in each, as cross-subsidization allows Amazon to offer services at a loss and data-driven network effects allow Amazon to market at a level its competitors cannot match,” Hawley stated.

Lucas Nolan is a reporter for Breitbart News covering issues of free speech and online censorship. Follow him on Twitter @LucasNolan

Democrats Latest Plan: Target Middle Class Americans with IRS Audits, Keep Billionaire Loopholes Open

A bill backed by Senate Majority Leader Chuck Schumer (D-NY) and Joe Manchin (D-WV) would unleash the Internal Revenue Service (IRS) on middle class Americans while keeping tax loopholes open for billionaires and their multinational corporations.

The plan, which Schumer and Manchin have agreed to, would massively bulk up IRS audits and criminal investigations to the sum of tens of billions of dollars — nearly all of which will be dedicated to going after middle class Americans squeezed by inflation.

The Wall Street Journal editorial board details the scheme:

The bill earmarks $45.6 billion for “enforcement,” including “litigation,” “criminal investigations,” “investigative technology,” “digital asset monitoring” and a new fleet of tax-collector cars. The result will be far more audits, civil suits and criminal referrals. [Emphasis added]

The main targets will by necessity be the middle- and upper-middle class because that’s where the money is. The Joint Committee on Taxation, Congress’s official tax scorekeeper, says that from 78% to 90% of the money raised from under-reported income would likely come from those making less than $200,000 a year. Only 4% to 9% would come from those making more than $500,000. [Emphasis added]

The IRS knows the super-wealthy employ lawyers and accountants who make litigation time-consuming and risky. It also knows that Democrats would howl if the agency pursues fraud in the earned-income tax credit program, despite what the IRS has estimated are $18 billion in improper payments each year. [Emphasis added]

At the same time, tax provisions hugely benefitting billionaires and their multinational corporations would go untouched.

The Schumer-Manchin plan includes billions in green energy tax credits that would be swooped up by billionaires to cut their corporations’ annual tax burdens. Jeff Bezos’s Amazon notoriously employs this strategy to pay close to zero in corporate income taxes.

Breitbart News’s John Carney writes:

Amazon’s tax bills were part of the inspiration for a minimum tax. The company faced no federal corporate income tax liability in 2017 and 2018. In the years since, it has had an effective tax rate that is just a fraction of the 21 percent rate put in place by the Trump administration’s tax reforms. According to the calculations of Matthew Gardner of the Institute on Taxation and Economic Policy, over the past four years Amazon’s effective aggregate tax rate was just 5.1 percent. [Emphasis added]

…

While the alternate minimum tax would prevent companies from using deductions for capital investments or stock-based compensation, it continues to allow them to use tax credits, Daniel Bunn of the Tax Foundation told us. In fact, the bill includes hundreds of billions of dollars worth of new tax credits aimed at fostering green technology adoption. And Amazon plays in beast mode when it comes to using tax credits to reduce its tax bill. [Emphasis added]

Jeff Bezo’s retail giant said in its annual report that tax credits reduced the taxes it would have otherwise owed by $1.1 billion. The company has said that most of those tax credits are federal research and development credits, although it does not give much detail in its annual reports. The Manchin-Schumer tax bill would not touch this. Amazon will lose the benefit of the write-off for stock-based compensation, but the company will most likely at least partially offset that by using the green tech tax credits. The end result could be no change in Amazon’s tax rate. [Emphasis added]

President Joe Biden and House Democrats tried to pass a similar tax plan last year as part of the administration’s “Build Back Better” agenda that has failed to catch on in Congress.

That plan would have targeted an additional nearly 600,000 working and middle class Americans earning less than $75,000 a year with IRS audits. Of those new IRS audits, more than 313,000 would have targeted the poorest of Americans who earn $25,000 or less a year.

Similar to the Schumer-Manchin bill, Biden’s plan would have provided a $625 billion tax cut for the wealthiest Americans living in blue states — paid for by working and middle class Americans.

John Binder is a reporter for Breitbart News. Email him at jbinder@breitbart.com. Follow him on Twitter here.

Breitbart Business Digest: Manchin’s Tax Hike Does Not Touch Amazon’s Biggest Tax Break

Amazon is not sweating the corporate tax hike in the Joe Manchin-approved climate spending bill.

The deceptively named Inflation Reduction Act would impose an alternative minimum tax on companies with over $1 billion in financial profits. It levies a 15 percent tax on financial account income, the kind that gets reported to investors in quarterly and annual company filings.

Amazon’s tax bills were part of the inspiration for a minimum tax. The company faced no federal corporate income tax liability in 2017 and 2018. In the years since, it has had an effective tax rate that is just a fraction of the 21 percent rate put in place by the Trump administration’s tax reforms. According to the calculations of Matthew Gardner of the Institute on Taxation and Economic Policy, over the past four years Amazon’s effective aggregate tax rate was just 5.1 percent.

Amazon founder Jeff Bezos (Phil McCarten/UPI)

Last year, President Joe Biden singled out Amazon’s ability to avoid paying more in taxes, saying it was “just wrong” that a company so profitable could pay so little. Sen. Elizabeth Warren (D-MA) has made Amazon her personal tax piñata, frequently saying the company should be required to pay much more in taxes. When Sens. Warren, Ron Wyden (D-OR), and Angus King (I-ME) proposed a similar 15 percent minimum tax last year, they specifically said they were targeting Amazon.

The day Sen. Joe Manchin (D-WV) announced he had reached a deal with Majority Leader Chuck Schumer (D-NY) to raise taxes and hike spending on climate change pork, Amazon’s shares were trading around $121. On Wednesday, they closed above $134, a ten percent gain in less than a week. Amazon reported earnings that beat Wall Street’s expectations during that week, which explains the jump. But it does not seem like investors are worried that Amazon may soon face a tax bill three times larger than in recent years.

There’s good reason for that. While the alternate minimum tax would prevent companies from using deductions for capital investments or stock-based compensation, it continues to allow them to use tax credits, Daniel Bunn of the Tax Foundation told us. In fact, the bill includes hundreds of billions of dollars worth of new tax credits aimed at fostering green technology adoption. And Amazon plays in beast mode when it comes to using tax credits to reduce its tax bill.

Jeff Bezo’s retail giant said in its annual report that tax credits reduced the taxes it would have otherwise owed by $1.1 billion. The company has said that most of those tax credits are federal research and development credits, although it does not give much detail in its annual reports. The Manchin-Schumer tax bill would not touch this. Amazon will lose the benefit of the write-off for stock-based compensation, but the company will most likely at least partially offset that by using the green tech tax credits. The end result could be no change in Amazon’s tax rate.

It’s possible that Amazon’s tax rate could even fall if it aggressively cashes in on the climate change tax credits.

No comments:

Post a Comment