Biden, long known as Delaware’s “senator from DuPont,” Biden served on committees that were most sensitive to the interests of the ruling class, including the Judiciary Committee and the Foreign Relations Committee. He supported the repeal of the Glass-Steagall Act in 1999, a milestone in the deregulation of the banks, and other right-wing measures. After nearly four decades in the Senate, Biden became Obama’s vice president, helping to oversee the massive bailout of Wall Street following the 2008 financial crisis and the subsequent restructuring of class relations to benefit the rich. That included the bailout of General Motors and Chrysler, based on a 50 percent cut in the pay of all newly hired autoworkers. JERRY WHITE, JOESEPH KISHORE

CUT AND PASTE YOUTUBE LINKS

WHAT TO DO WITH BIDEN?

VICTOR DAVIS HANSEN

everyone will be WIPED out in 1 week.

https://www.youtube.com/watch?v=F8ZWnJShcW4

Biden is, and has always been, a pathological liar of the worst kind, the kind who lies to boost his own ego no matter how easy it is to prove his dishonesty. PATRICIA McCARTHY

Are You Better Off Today Than You Were Four Years Ago?

What a great question going into the 2024 presidential election!

It was asked over 40 years ago and led to one of the biggest landslide elections in U.S. history.

As the Harvard Kennedy School summarized:

In the final week of the 1980 presidential campaign between Democratic President Jimmy Carter and Republican nominee Ronald Reagan, the two candidates held their only debate. Going into the Oct. 28 event, Carter had managed to turn a dismal summer into a close race for a second term. And then, during the debate, Reagan posed what has become one of the most important campaign questions of all time: “Are you better off today than you were four years ago?” Carter’s answer was a resounding “NO,” and in the final, crucial days of the campaign, his numbers tanked. On Election Day, Reagan won a huge popular vote and electoral victory. The “better off” question has been with us ever since. It’s simple common sense makes it a great way to think about elections. And yet the answers are rarely simple.

This is the question that Donald Trump, or whoever is the ultimate GOP nominee, should be constantly asking. At the next GOP debate, rather than debating Trump’s temperament and fitness to serve, while he is leading the GOP pack by 50 points, they should be hammering the question of whether average Americans are better or worse off than they were four years ago.

Let’s look at some specific metrics.

Start with microeconomic issues hitting Americans in the wallet, beginning with retail gasoline prices. Despite the push for EVs, most Americans drive gasoline fueled vehicles and visit the gas station every week. Are they better off compared to four years ago?

According to the U.S. Energy Information Administration, gas is currently per gallon $3.84 compared to $2.62 four years ago, about a 27 percent increase.

Add the fact that in 2019, four years ago, the U.S. was energy independent for the first time since 1957. In 2022, the U.S. imported 8.32 million barrels per day of petroleum, hardly energy independent. The strategic petroleum reserve is depleted, and the Biden administration is doing nothing to rein in rising gas prices.

In fact they are making it worse. Biden just cancelled oil and gas leases in the Alaskan National Wildlife Refuge. Biden also stopped the transport of fossil fuels by train, preferring far less efficient and more polluting trucks.

Another metric is food inflation as all Americans need to purchase and consume food. Food inflation currently sits at 4.9 percent compared to 1.8 percent four years ago. It has more than doubled in the past four years, with no sign of slowing down.

At a macroeconomic level, is our national debt higher or lower compared to four years ago? In 2022, the national debt was $30.8 trillion. Four years ago in 2018 it was $21.4 trillion. In four short years it increased by almost $10 trillion. It took America until 2008 to even reach $10 trillion in debt and in four short years we added 230 years’ worth of debt to our ledger.

That’s what America owes. How about what America spends? The annual U.S. budget deficit was $665 billion in 2017, rising to $2,772 billion in 2021. This is more than a fourfold increase in spending money we don’t have.

Budget deficits used to be measured in the billions. Under Biden they are in the trillions. Are Americans better or worse off because of their country heading further and further toward insolvency?

Most Americans live in a home that they purchased or are renting. As most homeowners have a mortgage, the monthly payment is an expense to most as either a mortgage or rent payment. This is another major cost of living, except for the homeless gracing our once-clean and beautiful cities.

How are mortgage rates compared to four years ago? The current 30-year fixed mortgage rate is 7.18 percent as of the end of last month. Four years ago, it was 3.58 percent, half of the current rate.

As most of a mortgage payment, particularly in the early years of the mortgage, is interest, doubling the interest rate means doubling the monthly payment. And that’s on top of higher food and gas prices as already noted.

Before worrying about a mortgage payment on a house, one must purchase it. As per the St Louis Fed, the average sales price of houses sold in the US for quarter two in 2023 was $495K. Four years ago, it was $377K, more than a $100K difference.

That’s great for home sellers but not for buyers. Individuals or families, looking for a bigger home, already paying more for food and gasoline, will now pay significantly more for a new home and for a mortgage compared to four years ago. How’s that “Build Back Better” plan working out?

Many of those other costs are charged on credit cards. U.S. credit card debt second quarter of 2023 was $1.03 trillion, compared to four years ago, second quarter 2019 at $848 billion, about $150 billion more. How will Americans pay off that debt? How will America pay off its national debt?

Purchasing power is another metric that continues to decline. The purchasing power of $100 in 2000 declined to about $68 in 2018 and by 2022 is down to $59. Are consumers better or worse off over the past four years?

How about foreign affairs? Four years ago we were not in a proxy war with Russia, the largest nuclear power in the world. Four years ago we weren’t sending depleted uranium shells to Ukraine to fire at Russia, causing death and destruction and contaminating the land, Chernobyl-style.

Four years ago, Afghanistan wasn’t fully controlled by the Taliban and 13 service members serving in Kabul were still alive. Four years ago, BRICS were something one built a house with, not an international anti-western geopolitical bloc representing, “almost half of the global population…and nearly one third of global GDP.” Are we better or worse off?

Aside from costs and spending, what about events of despair, such as drug overdose deaths? In 2017, there were 61 thousand overdose deaths. Four years later in 2021, the most recent data available, there were 98 thousand overdose deaths, almost a 50 percent increase. How many Americans know of someone who died of an overdose?

Look at the southern border which the current administration is hell bent on keeping wide open? As quantified by Pew Research, there were 1.7 million encounters at the US-Mexico border in 2021. As an aside, how many more crossers were not encountered? Four years ago, this number was only 304 thousand. That’s over a 5-fold increase over the past four years.

These are but a few important metrics, covering finances at a personal and national level, as well as important social issues that touch most Americans. Clearly based on these measures, Americans are worse off compared to four years ago.

Trump and Republicans at all levels should be asking this question constantly, during stump speeches, at rallies, or during interviews. “Are you better off today than you were four years ago?”

It is a simple and common-sense question and no matter how much the Democrats and their corporate media campaign arm tries to deny, deflect, or obfuscate, the answer is clear.

Pound that question home every day between now and November 2024.

Brian C. Joondeph, M.D., is a physician and writer. Follow me on Twitter @retinaldoctor, Substack Dr. Brian’s Substack, Truth Social @BrianJoondeph, and LinkedIn @Brian Joondeph.

Image: Screen shot from NJLoetz video, via YouTube

The Ingraham Angle on Joe's senility with videos

https://www.youtube.com/watch?v=8kfbKfm1vHo

Breitbart Business Digest: Bidenomics Summer Ends with Americans More Pessimistic About Their Finances

The Bidenomics Summer Gambit Goes Bust

If Joe Biden was hoping this would be a hot Bidenomics summer, he has got to be feeling pretty disappointed right now.

The best way to think about the Bidenomics push from the White House is as a bet on a strengthening economy and cooling inflation. In some ways, this was an outlandish gambit because the odds were always against what Wall Street has been calling “immaculate disinflation.“ The most likely outcomes were that inflation would remain persistently high or the economy would significantly slow down.

Most economists saw the latter outcome—sluggish growth or even an outright recession—as the most likely. A few analysts—including the folks who bring you Breitbart Business Digest—argued that we were most likely to see high inflation paired with an economy that would continue to grow at a pace that Federal Reserve officials describe as “above trend.”

The trouble for Biden was that neither of these outcomes looked particularly pleasant in terms of the 2024 election. If the economy fell into a recession in the second half of this year or early next year, Biden would be making a plea for another four years amid rising unemployment. If inflation stayed hot, Biden would look ineffectual on what poll after poll shows to be the top issue for voters.

So, the Biden gambit was to shoot the moon: bet on the improbable outcome and claim credit for it. It was never likely to pay off, but there was little downside because if the economy did not improve, Biden was likely to suffer in November. Might as well try for the maximum upside.

The Economy Did “Immaculately Disinflate” a Bit

Earlier this summer, the improbable outcome was looking increasingly less improbable. Inflation made a big climb down, helped in part by the fact that prices rose so much last year that the year-over-year numbers were always going to look flattering. The economy actually accelerated from the first quarter’s two percent rate of growth to the second quarter’s 2.1 percent rate. Now it looks as if the economy could grow at a better than three percent rate in the third quarter.

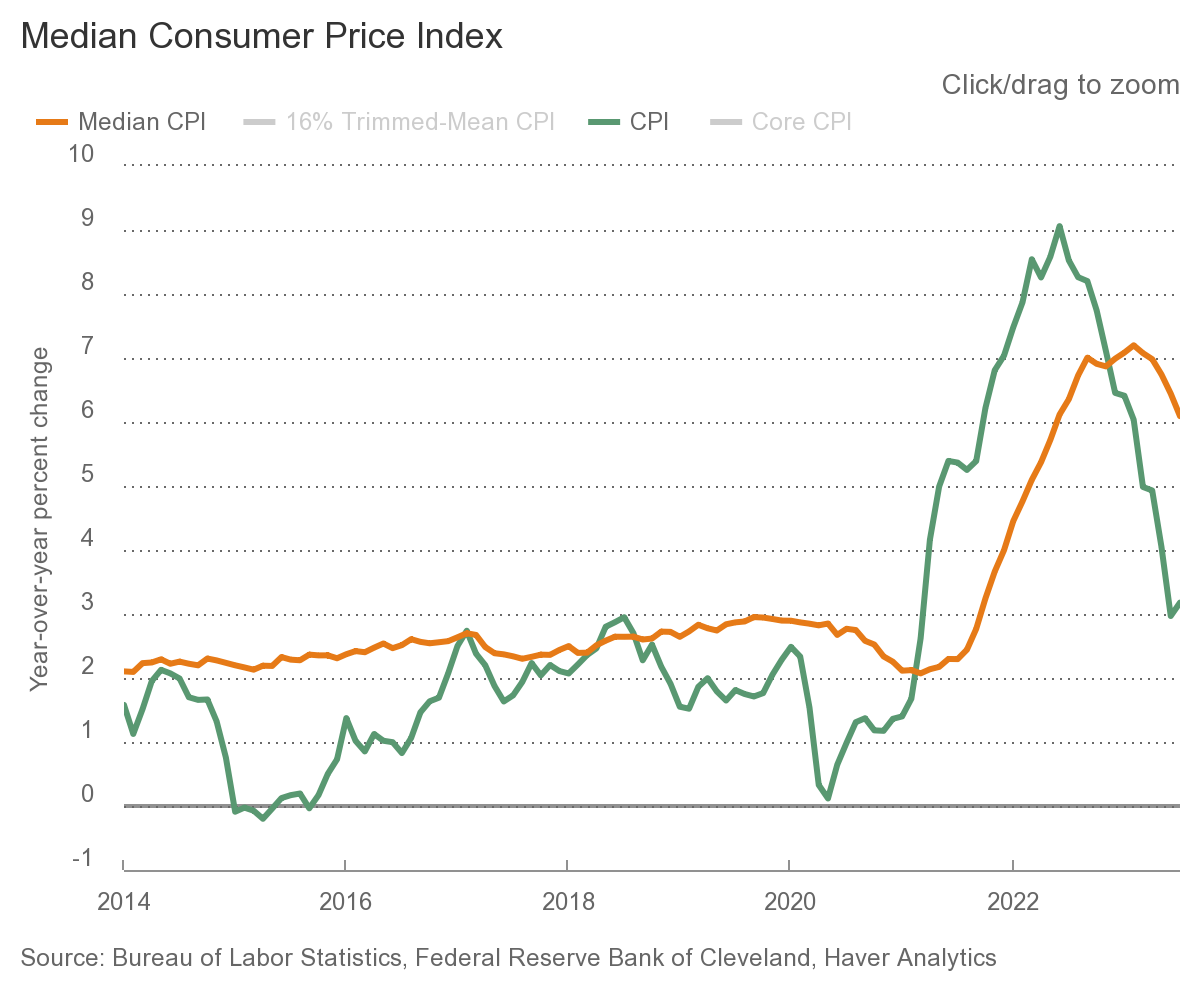

However, there have been signs that the inflation story was not as benevolent as it appeared to be. Underlying inflation, for example, has remained even more persistent than headline inflation. While the headline consumer price index (CPI) peaked at 9.06 percent in June of last year, median CPI did not peak until February of this year. Where headline CPI fell all the way from nine percent down to around three percent in June of this year, median CPI has only declined from February’s seven percent to July’s 6.1 percent.

Looking at the month-to-month changes in median CPI, we see that there has been no downward trend at all. After registering 0.6 percent in February, median CPI clocked in at 0.4 percent for four months in a row. It fell in July down to a more moderate 0.2 percent but is likely to climb again when the August numbers are released later this week.

Inflation, in other words, has proven stickier than most economists expected or the Biden administration hoped.

Increasing Public Pessimism

The public clearly views Bidenomics as a flop. On Monday, the Federal Reserve Bank of New York released the results from its monthly survey of consumer expectations. This showed that consumers are increasingly pessimistic about the labor market and household finances. On inflation, the public’s views were largely unchanged.

The share of the public that says it expects their own household financial situation to be “much better” a year from now slipped from 3.9 percent in July to 3.5 percent in August. The share expecting things to be “somewhat better” dropped from 25.4 percent to 20.3 percent, a significant slide.

Those expecting their household financial situation to be about the same climbed from 44.1 to 46.9 percent. Those expecting things to be somewhat worse fell from 27.7 percent to 24.9 percent (a thin silver lining for Biden), but those expecting things to get much worse climbed to 4.4 percent from 3.9 percent.

The New York Fed’s survey also asks consumers to compare how they are now to a year ago. The share saying things have gotten much better dipped from 3.3 percent to 3.1 percent. The share saying things are “somewhat better” fell to 14.9 percent from 18.2 percent. The share saying they expect no change rose to 41.9 percent from 38.7 percent.

In the retrospective question, there was a dip in the “somewhat worse” response: from 32.7 percent to 29.5 percent. Unfortunately for Biden, all of that change is explained by those moving down into the category of people who say things are much worse now than a year ago. This rose from 7.1 percent to 10.6 percent from July to August.

A recent poll by the Wall Street Journal found that around three in five voters disapprove of Biden’s handling of the economy. Sixty-three percent say they do not like how Biden has handled the issue of inflation.

Of course, the last hand in the game has not been dealt. There’s still a chance that the Bidenomics bet pays off. But from the perspective of September 2023, that still looks like a long shot.

Congress reconvenes amid budget crisis as US federal deficit doubles

Members of the US House of Representatives return to Washington on Tuesday with only three weeks, including 12 days of scheduled legislative sessions, before the end of the 2023 fiscal year on September 30. At that point, unless a new budget is passed, or a “continuing resolution” to authorize further government spending, the federal government will begin a partial shutdown.

The stage has been set for yet another round of political theater over the budget deficit, in which the Republicans will posture as the defenders of “fiscal responsibility” (which never includes cuts in the bloated Pentagon budget), while Democrats posture as advocates of “fairness” and “compassion” (knowing that any proposed tax increases on the wealthy or social spending for the poor can never be enacted because of Republican opposition).

This degraded process will end, as it always does, with further cuts in social spending, while the military and the super-rich, the two principal clients of both capitalist parties, go entirely unscathed.

The political conflict over the budget has been exacerbated by two reports released on September 6 indicating that the federal deficit for the current fiscal year will double, from $1 trillion in fiscal 2022 (October 1, 2021 through September 30, 2022) to $2 trillion in fiscal 2023.

The Congressional Budget Office (CBO) reported that the US Treasury had already borrowed $1.6 trillion in the current fiscal year, with nearly two months to go. The CBO projected a full-year deficit of $1.7 trillion, with spending up 10 percent over fiscal 2022 and revenues down 10 percent.

The same day, the right-wing think tank Committee for a Responsible Federal Budget said that it was projecting a $2 trillion deficit by September 30. The group said that by its calculations, federal spending was up 16 percent compared to a year ago, while revenues were down 7 percent.

The CBO estimated that individual income and payroll taxes would drop by $313 billion this year, largely due to the decline in the stock market last year, which slashed capital gains taxes and reduced taxable income for corporations. At the same time, remittances from the Federal Reserve to the Treasury—effectively, profits from its lending to banks—fell by $98 billion. This is largely due to the effect of higher interest rates on the home mortgage market.

The main components of the increase in spending from FY 2022 to FY 2023 included:

$244 billion from a 12 percent rise in the total cost of the three main entitlement programs—Social Security, Medicare and Medicaid. This had two main contributing factors: continued high rates of retirement among the “baby boom” generation, and a continuing pandemic-related ban on states removing Medicaid recipients from the rolls—a prohibition that the Biden administration allowed to expire in May.

$146 billion from a 34 percent increase in interest payments on federal debt, largely due to the extremely rapid rise in interest rates. The CBO now estimates that the federal government will pay $10 trillion in interest over the next ten years, a staggering sum that will go largely to wealthy investors and big banks.

$100 billion or more in military spending. There is an increase of $67 billion for the regular Pentagon budget. A further sum, not yet estimated but perhaps as large, is due to increased military and financial aid to Ukraine and other fiscal consequences of the US-NATO proxy war against Russia.

$91 billion from a one-time increase in spending by the Department of Education. This is a budget anomaly, as the Biden administration chose to record the entire long-term cost of its reduction in student loan debt in the month of July. This sum amounts to just over 5 percent of the $1.7 trillion in total student loan debt.

The latest figures have fueled demands from the Republican Party and the corporate media—including publications closely aligned with the Democratic Party—for urgent action to slash the deficit through major cuts in domestic social spending, particularly in the entitlement programs that constitute the major social support for the elderly, disabled and sick.

There are few calls within the capitalist political establishment for cuts in military spending, and none at all for cuts in interest payments, although these constitute a form of tribute paid by the federal government to the billionaires. In effect, after repeatedly slashing taxes for the wealthy, most recently in the 2017 Trump tax cut, the federal government is now compelled to borrow from the super-rich to make up the lost revenue, and pay them billions in interest.

On August 31, the Biden administration threw its support behind an effort to pass a continuing resolution, after concluding that it would be impossible for both houses of Congress to approve 12 separate budget bills, one for each major department or group of departments, by September 30.

Budget Director Shalanda Young indicated that there had to be some spending increases within the framework of a continuing resolution to avoid the crippling of several key programs, including $1.4 billion for the Women, Infants and Children nutrition program, whose budget has been depleted by record high food prices. She warned that without new funding, WIC would have to cut benefits and implement waiting lists in October.

The House Freedom Caucus, the fascistic wing of the House Republicans, is spearheading the demands for massive spending cuts. The group recently demanded that the discretionary spending level set last May in the debt ceiling deal between President Biden and House Speaker Kevin McCarthy be lowered from $1.59 trillion to $1.47 trillion, a cut of $120 billion, or about 8 percent.

Members of the caucus declared that they would vote against any budget or continuing resolution unless it included a series of ultra-right proposals, including billions in funding to resume building Trump’s wall on the US-Mexico border, the restoration of Trump’s “remain in Mexico” policy toward asylum seekers, and a measure to address “the unprecedented weaponization of the Justice Department and FBI”—effectively a demand for the dropping of federal charges against ex-president Trump.

Last week, fascist Georgia Congresswoman Marjorie Taylor Greene added a new demand: “I’ve already decided I will not vote to fund the government unless we have passed an impeachment inquiry on Joe Biden.”

Such demands might appear delusional for a group that controls fewer than 10 percent of the seats in one house of Congress, but in capitalist politics, it is the fascist tail that wags the legislative dog. Any member of the Freedom Caucus can force a new election for House speaker, under the procedure that McCarthy was compelled to accept in January as a condition for a handful of ultra-right members dropping their blockade of his election.

McCarthy is now faced with the threat that unless he embraces the Freedom Caucus demands, he could lose his post. He has already voiced support for the spending cuts called for by the Freedom Caucus, claiming that the debt ceiling deal only set a ceiling on spending, not a floor. “We can always go lower,” he said.

Meanwhile, senators in both parties are seeking to add several special appropriations to any continuing resolution or budget bill, including $24 billion more for the war in Ukraine, and $16 billion for states like Hawaii and Florida that have been devastated by fires, heat waves, hurricanes or floods. McCarthy suggested he would back the disaster aid, but not the additional money for Ukraine, which led to a public rebuke by Senate Republican leader Mitch McConnell, an all-out supporter of the war with Russia.

In the increasingly likely event of a deadlock on the budget, the federal government would begin a partial shutdown on October 1. Many federal workers would be furloughed or instructed to come to work without paychecks if they are deemed “essential.” There would be no immediate effect on the military or paramilitary police forces like the Border Patrol and Immigration and Customs Enforcement, but most civilian Pentagon workers would be sent home.

Biden Gets Confused for 13 Seconds, Takes Question After Saying It’s Bedtime – Then Is Shut Down Mid-Sentence by Press Sec.

After fumbling for 13 seconds to collect his thoughts, and struggling desperately to finish answering a reporter’s question, Pres. Joe Biden declared it was time for him to go to bed – but, stayed to take another question, prompting Press Sec. Karine Jean-Pierre to cut him off in mid-sentence after he confuses two parts of the world.

Speaking in Hanoi on Sunday, Pres. Biden had just finished smearing people who refute his climate-doom ideology as “lying, dog-faced pony soldiers,” when he became confused for 13 seconds as he tried to figure out what his next “orders” were. Finally, his staff told him what to do next:

Pres. Biden: “Well, there’s a lot of lying, dog-faced pony soldiers out there about — about global warming, but not anymore. All of a sudden, they’re all realizing it’s a problem. And there’s nothing like seeing the light.

“For — and let’s see…I’m just following my orders here.

“Uh…

“Staff, is there anybody I haven’t spoken to?

(Cross-talk.)

“No, I ain’t calling on you. I’m calling on — I said there were five questions.

Karine Jean-Pierre: “Anita — Anita from VOA.”

Pres. Biden: “Anita from VOA.”

Biden then appeared to become exhausted and gasped to get words out as he fought to finish a sentence about U.S.-China relations, after which he told his audience that he needed to go to bed:

“I just think that there are other things on leaders’ minds, and they respond to what’s needed at the time.

“And look, nobody…likes….having…celebrated…international meetings if you don’t know what you want…at the meeting, if you don’t have a gameplan. He may have a gameplan; he just hasn’t shared it with me.

“But I tell you what: I don’t know about you, but I’m going to go to bed.”

But, Biden didn’t go to bed. Instead, he stayed and began to answer another question.

After the president confused the “Third World” with the “Southern Hemisphere,” his press secretary cut him off and called an end to the event as exit-music swelled:

Pres. Biden: “We talked about what we talked about at the conference overall. We talked about stability. We talked about making sure that the Third World — the — excuse me — ‘Third World’ — the — the — the Southern Hemisphere had access to change, it had access —

“We — it wasn’t confrontational at all. He came up to me. He said (cut off)

Jean-Pierre: “Thank — thank you, everybody. This ends the press conference. Thank you.”

Ironically, while Biden’s talk began at 9 p.m. Indonesia Time (ICT), he was actually speaking before noon U.S. Eastern Time.

No comments:

Post a Comment