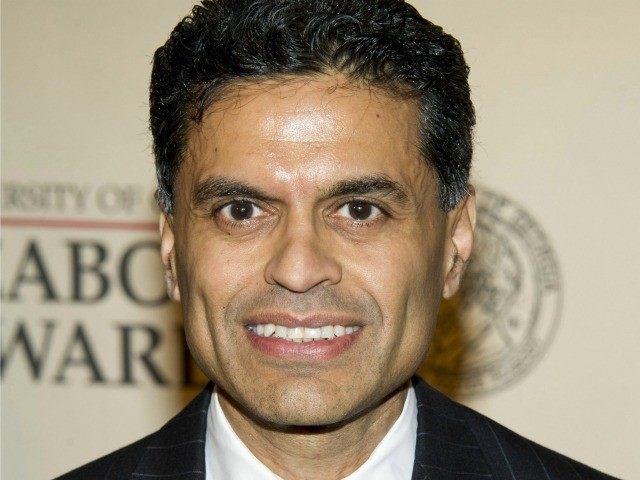

Plagiarist Fareed Zakaria Celebrates: White People are Dying and Trump Can’t Save You!

THE OBAMA PLAN:

FIRST LET HIS CRONY BANKSTERS DESTROY THE AMERICAN MIDDLE CLASS FINANCIALLY.

THEN OPEN THE BORDERS FOR ENDLESS HORDES OF MEXICANS TO LOOT, BREED ANCHOR BABIES FOR WELFARE, STEAL JOBS WITH STOLEN SOCIAL SECURITY NUMBERS AND VOTE DEM FOR MORE.

IS IT WORKING?

FIRST LET HIS CRONY BANKSTERS DESTROY THE AMERICAN MIDDLE CLASS FINANCIALLY.

THEN OPEN THE BORDERS FOR ENDLESS HORDES OF MEXICANS TO LOOT, BREED ANCHOR BABIES FOR WELFARE, STEAL JOBS WITH STOLEN SOCIAL SECURITY NUMBERS AND VOTE DEM FOR MORE.

IS IT WORKING?

Citing a study that shows Middle American whites are dying in increasing numbers, like a twisted and bitter eugenicist, serial-plagiarist Fareed Zakaria doesn’t even attempt to contain his glee. By painting those who are supposedly dying as useless, drug-addicted ragers, he paints a picture of a weak, angry, and ultimately stupid ethnic group getting what it deserves.

If this were any other group, Zakaria would not be using the pages of the Washington Post for a victory dance. Instead, he would be launching an emotional blackmail campaign to cure this “epidemic” with hundreds of billions of federal dollars. Like most of the elite media, though, Zakaria despises Middle America, so he joyously assumes the study is accurate and bloodlessly screams “Told You So!”The headline says it all: “America’s Self-Destructive Whites,” and naturally the opening paragraph contains the words “Donald” and “Trump.”

Why is Middle America killing itself? The fact itself is probably the most important social science finding in years. It is already reshaping American politics. The Post’s Jeff Guo notes that the people who make up this cohort are “largely responsible for Donald Trump’s lead in the race for the Republican nomination for president.”What does this “epidemic” mean to Zakaria?

That it’s time for compassion?

Time for government action?

Time for understanding?

No. It means “more rage” from creepy Middle America:

The key question is why, and exploring it provides answers that suggest that the rage dominating U.S. politics will only get worse.Zakaria hints that the study’s numbers are a tad shaky, but that doesn’t stop him from doing a happy dance around the fact that…

Middle America’s Got It Coming….

The main causes of death are as striking as the fact itself: suicide, alcoholism, and overdoses of prescription and illegal drugs. “People seem to be killing themselves, slowly or quickly,” Deaton told me. These circumstances are usually caused by stress, depression and despair.Middle America’s a Bunch of Wussies….

A conventional explanation for this middle-class stress and anxiety is that globalization and technological change have placed increasing pressures on the average worker in industrialized nations. But the trend is absent in any other Western country — it’s an exclusively American phenomenon. And the United States is actually relatively insulated from the pressures of globalization, having a vast, self-contained internal market.Stupid Middle America Should Stop Voting Against the Welfare State…

Deaton speculated to me that perhaps Europe’s more generous welfare state might ease some of the fears associated with the rapid change.Middle America’s Spoiled By White Privilege…

[O]ther groups might not expect that their income, standard of living and social status are destined to steadily improve. They don’t have the same confidence that if they work hard, they will surely get ahead. In fact, Rouse said that after hundreds of years of slavery, segregation and racism, blacks have developed ways to cope with disappointment and the unfairness of life[.]Donald Trump Can’t Save You!

They do not assume that the system is set up for them. They try hard and hope to succeed, but they do not expect it as the norm.

Mwuh, huh, huh, huh…

Donald Trump has promised that he will change this and make them win again. But he can’t. No one can. And deep down, they know it.Speaking only for myself, I’d rather die young in Middle America than as an old metrosexual, content-thieving, throne-sniffing, left-wing elitist so lacking in humanity that I not only gloat over racially-focused studies involving premature death, but like Joseph Goebbels, I openly spread the word that this is good news.

<em>The Big Short</em>: The criminality of Wall Street and the crash of 2008

DEATH OF THE AMERICAN MIDDLE-CLASS

This government-driven, crony-capitalist economy defined by job scarcity and wage stagnation is the reason college graduates are burdened by $1.3 trillion debt, living with parents, can’t afford to marry or buy homes, and working as waitresses and bartenders. Job scarcity and low wages are the reasons we’re becoming a nation of renters rather than homeowners. They are the reasons that 51 percent of workers earn less than $30,000 a year. They are the reasons for the demise of the middle class and the burgeoning welfare rolls, the modern-day equivalent of slavery.

Never have the rich increased their wealth so

quickly as in America since the financial crash

of 2008. But side by side with the amassing

of previously unthinkable private fortunes,

the infrastructure of America is crumbling,

education, health care and other social

services are starved of funding, and the living

standards of the vast majority of the

population, the working people who produce

the wealth, are declining.

NO PRESIDENT IN HISTORY HAS TAKEN MORE DIRTY BANKSTER MONEY THAN BARACK OBAMA WHO PROMISED THAT HIS CRONIES WOULD NEVER BE "PUNISHED".

IF FACT, THEIR LOOTING ONLY RATCHETED UP AFTER THE 2008 BAILOUT.

OBAMA'S CRONY BANKSTERS ARE NOW HEAVILY INVESTED IN HILLARY CLINTON. BILLARY AND HILLARY HAVE SUCKED UP A VAST FORTUNE IN "SPEECH" BRIBES FROM THE BANKSTERS THAT OWN OBAMA!

The calamity was further deepened by the use of hundreds of billions of dollars in taxpayer money to bail out the biggest Wall Street firms. For millions of people in the US and around the world, the 2008 collapse was a social tragedy from which there has been no meaningful recovery. Yet, as The Big Short points out, the bankers and speculators––who ought to be sitting in prison––are richer and more powerful today than ever.

The Big Short: The criminality of Wall Street and the crash of 2008

By Joanne Laurier

31 December 2015

Directed by Adam McKay; screenplay by McKay and Charles Randolph, based on the book by Michael LewisAdam McKay’s new film The Big Short is a hard-hitting comedy-drama about the historic collapse of the US housing bubble in 2008.

Based on Michael Lewis’s book, The Big Short: Inside The

Doomsday Machine (2010), the film offers a picture of rampant

criminality on the part of the financial establishment and its

government co-conspirators who, while systematically looting the

American economy, created a financial disaster.

The calamity was further deepened by the use of hundreds of billions of dollars in taxpayer money to bail out the biggest Wall Street firms. For millions of people in the US and around the world, the 2008 collapse was a social tragedy from which there has been no meaningful recovery. Yet, as The Big Short points out, the bankers and speculators––who ought to be sitting in prison––are richer and more powerful today than ever.

McKay’s The Big Short centers on a number of Wall Street “outliers” who, despite the efforts of the banks, government regulators and media lackeys, uncover the truth about the explosive market for bonds based on subprime mortgages: that the latter are “junk” and a rotten foundation for an economic boom.

The film takes the form of a series of vignettes involving these figures, a number of whose paths cross at critical moments.

Bankers, The Big Short’s narrator (Ryan Gosling) explains at the outset, were once perceived as staid and conservative. Now, as the trade in mortgage-backed securities mushrooms and a vast housing bubble develops, they have gone “from the country club to the strip club,” a function of the degree of parasitism and degeneracy in the system.

Christian Bale plays the real-life San Jose, California neurosurgeon-turned-money manager Michael Burry, who sports a glass eye and has a penchant for heavy metal. With a manic focus, he spends the end of 2004 and early 2005 scanning hundreds of home loans that are packaged into mortgage bonds, eventually discovering an alarming pattern. As opposed to the prevailing wisdom that “the housing market is rock solid,” Burry comes to believe it is a flimsy house of cards.

Burry approaches Goldman Sachs, seeking to purchase hundreds of millions of dollars in credit default swaps (a form of insurance against a loan default or other credit event) that amount to a bet against the housing market. His hedge fund’s owners and investors are apoplectic, but the eccentric, anti-social Burry is convinced that patience is the key as he waits for the bottom to drop out and his assumptions to pay off. (According to Lewis’s book, Burry explained, “I’m not making a bet against a bond, I’m making a bet against a system.”)

He admonishes his skeptics: “[Federal Reserve Chairman] Alan Greenspan assures us that home prices are not prone to bubbles––or major deflations––on any national scale. This is ridiculous, of course…. In 1933, during the fourth year of the Great Depression, the United States found itself in the midst of a housing crisis that put housing starts at 10 percent of the level of 1925. Roughly half of all mortgage debt was in default. During the 1930s, housing prices collapsed nationwide by roughly 80 percent.”

Jared “Chicken Little” Vennett (Gosling, playing a fictionalized Greg Lippman), a Deutsche Bank subprime mortgage bond manager, gets wind of Burry’s astonishing gamble. Vennett, slick, sleazy and smart, crunches the numbers and sees a potential gold mine.

Vennett solicits financial backing from Wall Street-bashing Mark Baum (Steve Carell, based on Steve Eisman), head of FrontPoint Partners, a unit of Morgan Stanley. Vennett explains the certainty of a housing catastrophe. The irascible Baum, who continues to suffer from his brother’s suicide, is chronically appalled by the banks’ shenanigans.

To investigate Vennett’s claims, Baum sends his colleagues to a subdivision in Florida, where they discover homes in foreclosure, delinquent mortgages that were purchased in the name of family pets, and a stripper who owns several properties—all with adjustable rate mortgages (ARMs)—and was told that continuous refinancing would always work in her favor. In one abandoned south Florida home, an alligator has taken over the swimming pool. One of Baum’s associates says, “It’s like Chernobyl.”

Baum also talks to cocky young mortgage brokers who inform him, with a laugh, that they have made millions selling subprime mortgages to poor people and immigrants. He subsequently meets with a Standard & Poor’s representative (Melissa Leo), who tells Baum she has to rate all the banks’ financial vehicles at AAA (the top rate) to keep their business.

Another of The Big Shor t’s plot strands involves young, inexperienced money managers, Jamie Shipley (Finn Wittrock) and Charlie Geller (John Magaro), who parlay $110,000 of their own money into a $30 million fund. Also seeing the writing on the wall for the housing market, they enlist the help of retired guru/trader and drop-out Ben Rickert (Brad Pitt, based on Ben Hockett), whose connections help them secure an agreement enabling them to work directly with the banks.

The filmmakers intersperse the narrative with comic interludes featuring what they call “celebrity explainers,” brought in to help make the complicated terminology comprehensible. In the movie’s production notes, director McKay elaborates: “Bankers do everything they can to make these transactions seem really complicated, so we came up with the idea of having celebrities pop up on the screen throughout the movie and explain things directly to the audience.”

Sipping champagne in a bubble bath, actress Margot Robbie discusses mortgage-backed securities, while chef Anthony Bourdain compares a “toxic financial asset” to a seafood stew. (McKay recruited Bourdain after reading the latter’s recommendation that no one should “order seafood stew because it’s where cooks put all the crap they couldn’t sell.”

The director goes on, “I thought, ‘Oh my God that’s a perfect metaphor for a collateralized debt obligation, where the banks bundle a bunch of bad mortgages and sell it as a triple-A rated financial product.’”)

Economist Dr. Richard Thaler and actress Selena Gomez take part in a casino sequence to demonstrate how synthetic Credit Default Obligations (CDOs)––essentially groups of bad mortgages bundled together to hide the real likelihood of default––are the means of arranging numerous layers of speculation. Says McKay: “It was investors making those kinds of side bets on mortgage-backed securities through CDOs that drove the whole world economy to where it was poised to crash.”

The film’s tipping point comes when Vennett convinces Baum to attend the American Securities Forum in Las Vegas, an event whose out of control goings-on prove to the latter that the housing market is a gigantic Ponzi scheme.

The vindication of the nay-sayers is delayed when the housing market begins to collapse, but the value of the CDOs remains steady. Only then do the protagonists realize that the banks are concealing the toxicity of their holdings on a massive scale.

As the meltdown approaches, the mood of The Big Short markedly darkens. Baum starts to believe the “party’s over” and that “the world economy will collapse.” He is convinced the bankers “are crooks and should be in jail.”

This is effectively highlighted by a scene where Baum debates a representative of Bear Stearns. The latter sings the praises of the housing market even as the firm’s stock price falls off the cliff.

The Big Short’s approach to the run-up to one of the greatest financial crises in history, despite its comic-absurdist mode, is a serious one. The filmmakers do their best to bring this crisis and its human dimensions to life.

The film touches upon the systemic and far-reaching character of the 2008 crash. McKay and his collaborators are obviously appalled by its outcome and consequences, and even invent an alternative scenario in which the bankers responsible for the crash are jailed and the banks become regulated. They point the finger at not only those who issued the mortgages, but those who sliced and diced them into rotten products and the credit agencies that gave them top ratings. They conclude that the financial establishment made super profits through the immiseration of the population. The various actors, as clearly demonstrated by their performances, were fully committed to the project.

Of course, dramatizing something as complex as the 2008 financial collapse is an immense undertaking, involving a mass of historical and social questions. The Big Short’s makers have chosen one means of treating it. This film is clearly not the final word. While McKay and the others involved obviously feel sympathy for those devastated by the crisis, the mass of the population is largely absent. Their attitude to capitalism is a critical one, but they are not opponents of the profit system.

However, at a time when most filmmakers seem obsessed with gender, sexuality and race (and themselves), McKay and the others have chosen to treat—and treat trenchantly—one of the critical events in recent times. Genuine credit is due them.

"During the past year, the wealth of the world’s billionaires surged past $7 trillion and the top 1 percent now controls half of the world’s wealth."

Income inequality grows FOUR TIMES FASTER under Obama than Bush.

"In the sphere of world economy, any expectation of an upturn has given way to the reality of permanent crisis. In the United States, six years into the so-called economic “recovery,” real unemployment remains at near-record highs, wages are under attack, and health care and pensions for millions of Americans are being wiped out."

"The essential and intended consequence of government policy over the past seven years has been to vastly increase social inequality. During the past year, the wealth of the world’s billionaires surged past $7 trillion and the top 1 percent now controls half of the world’s wealth. In the US, the scale of social inequality—and therefore political inequality—is so great that one recent scientific study concluded that “the preferences of the vast majority of Americans appear to have essentially no impact on which policies the government does or doesn’t adopt."

On the threshold of the New Year

On the threshold of the New Year

31 December 2015

As the year 2015 ends, a general mood of fear and foreboding predominates in ruling circles. It is hard to find a trace of optimism. Commentators in the bourgeois media look back on the past year and recognize that it has been a year of deepening crisis. They look forward to 2016 with apprehension. The general sense in government offices and corporate boardrooms is that the coming year will be one of deep shocks, with unexpected consequences.The Financial Times’ Gideon Rachman gives expression to this pervasive feeling in his end-of-the-year assessment published on Tuesday. “In 2015, a sense of unease and foreboding seemed to settle on all the world’s power centers,” he writes. “All the big players seem uncertain—even fearful.” China “feels much less stable.” In Europe, the mood is “bleak.” In the US, public sentiment is “sour.”

Significantly, Rachman singles out as the “biggest common factor” in the world situation “a bubbling anti-elite sentiment, combining anxiety about inequality and rage about corruption that is visible in countries as different as France, Brazil, China and the US.” This observation reflects a growing recognition within the corporate media that the coming period will be one of immense social upheavals.

Rachman’s comment and others like it that have appeared in recent days confirm the assessment made by the World Socialist Web Site during the first week of 2015. The intervals between the eruption of major geopolitical, economic and social crises have “become so short that they can hardly be described as intervals,” we wrote. Crises “appear not as isolated ‘episodes,’ but as more or less permanent features of contemporary reality. The pattern of perpetual crisis that characterized 2014—an essential indicator of the advanced state of global capitalist disequilibrium—will continue with even greater intensity in 2015.”

In defending its rule, the ruling class seeks to cover over the reality of capitalism beneath a mass of lies and hypocrisy. War is cloaked in the language of freedom and democracy; antisocial domestic policy is portrayed as the pursuit of equality and freedom. But—and this is characteristic of a period of crisis—more and more, the essential nature of capitalism—a system of exploitation, inequality, war and repression—comes into alignment with the everyday experiences of broad masses of people. Illusions are dispelled; the essence appears.

In the sphere of world economy, any expectation of an upturn has given way to the reality of permanent crisis. In the United States, six years into the so-called economic “recovery,” real unemployment remains at near-record highs, wages are under attack, and health care and pensions for millions of Americans are being wiped out. Europe is growing at less than 2 percent a year, and large parts of the European economy—including Greece, the target of brutal austerity measures demanded by the European banks—are in deep recession. China, presented as a possible engine of world economic growth, is slowing sharply. Brazil and much of Latin America are in deep slump. Russia is in recession.

BLOG: OBAMA'S CRONY BANKSTERS HAVE BEEN BUSY BEAVERS SINCE THE LAST MELTDOWN THEY CAUSED!

Meanwhile, the easy-money policy of the world’s central banks has produced a new wave of speculative investment, centered in junk bonds and other forms of debt, which is beginning to unravel in a process that parallels the crisis in subprime mortgages prior to 2008.

The essential and intended consequence of government policy over the past seven years has been to vastly increase social inequality. During the past year, the wealth of the world’s billionaires surged past $7 trillion and the top 1 percent now controls half of the world’s wealth. In the US, the scale of social inequality—and therefore political inequality—is so great that one recent scientific study concluded that “the preferences of the vast majority of Americans appear to have essentially no impact on which policies the government does or doesn’t adopt.”

Joseph Kishore

Trade agreements are one cause of job and wage reduction. Over the last twenty years, we’ve amassed $10 trillion in trade deficits and exported 12 million manufacturing jobs, forcing workers to move into lower-wage service jobs. Government brags about the free trade agreements, CAFTA, NAFTA, KORUS, and TPP. But the “free” applies only to the foreign trading partners, which manipulate their currencies, pay sweatshop workers low wages, manufacture under environmentally-toxic conditions, and restrict U.S. imports. We hand over our technology, good-paying jobs, product labeling, and safety guarantees -- all to enrich multinational corporations and foreign industry. Industrial research and development have been decimated as companies move overseas or outsource jobs, leaving the nation a future of little technological innovation. The U.S. is left with hollowed-out industries and service jobs.

ObamaCare influences, and will influence to greater degrees, the lowering of incomes for Americans as healthcare costs rise. Higher premiums and deductions for health insurance are being shifted to employees, reducing benefits and wages. Medical care costs already have risen much faster than wages, leaving many struggling to pay for necessities. Ever-higher deductions mean that people can’t afford to use the insurance they are forced to buy because they can’t even pay the deductions.

Another contributor to job deficiency and wage stagnation is the increased regulation and taxation of small businesses instituted by Obama’s executive orders, EPA overreach, and ObamaCare. Small businesses traditionally have created two-thirds of new jobs annually. The bright spot in the economy, small businesses have created 78.7 percent of new jobs since the recession. Today, faced with these government anti-business policies, small businesses are closing their doors at a faster rate than new businesses are opening. The small businesses that remain open often don’t expand because of Obamacare and government regulations.

Income inequality is greatly impacted by the Federal Reserve’s policies of money-printing and zero interest rates, which have led to the funding of the financial and corporate markets while ignoring the needs of smaller businesses. The money supply and cheap lending has gone to the government, large corporations, and Wall Street, leaving the rest of the economy to sputter along with little capital and fewer jobs. The Fed’s policies of crony capitalism favor big business and big banks over that of smaller entities and are responsible for the increasing number of big business deals such as Walgreen's purchase of Rite Aid.

This government-driven, crony-capitalist economy defined by job scarcity and wage stagnation is the reason college graduates are burdened by $1.3 trillion debt, living with parents, can’t afford to marry or buy homes, and working as waitresses and bartenders. Job scarcity and low wages are the reasons we’re becoming a nation of renters rather than homeowners. They are the reasons that 51 percent of workers earn less than $30,000 a year. They are the reasons for the demise of the middle class and the burgeoning welfare rolls, the modern-day equivalent of slavery.

Income inequality and its devastating consequences are seldom mentioned on the nightly news. The media and bogus government statistics paint rosy pictures about economic recovery, and government masks the bad economy with welfare so that we don’t see Great Depression bread lines. But the only recovery has been in the Federal Reserve’s inflated stock market, not in the main street economy, where 94 million working-age adults are unemployed and 47 million are on some welfare program. The “Made in America” displays weekly touted by ABC news are the few exceptions, rather than the rule, in an American economy of boarded-up stores and factories.

The political implications of income inequality are most evident in the increasing rise and entrenchment of career politicians, supported by big donor funding and media favoritism. The integrity of the electoral process is endangered as election propaganda, funded by big money and hyped by corporate media bias, become more prominent in spreading lies, distortions, and innuendos to the voting public. Unrestricted campaign funding has given the moneyed elites first access to elected officials. At the same time, private-sector unions, small businesses, and citizens find their influence dwindling or irrelevant. This crony capitalism, resembling dictatorships and communist oligarchies, seriously threatens our democracy because money, power, and media control are consolidated in the hands of a few at the top. Voter apathy prevails, as voters feel increasingly powerless to change the course of events.

The United States, a once great economic powerhouse and the largest creditor nation, has become the largest debtor nation, and is fast becoming a banana republic. Past and present elected authorities and public officials have stripped bare our industries, put the nation under a mountain of debt, and turned the U.S. into a welfare depository. Government leaders have intentionally failed to protect our borders, jobs, and freedoms. These public “servants” and the wealthy elites have garnered riches for themselves, and purposely impoverished citizens and future generations. The greatest threats to our economy and national security are not foreign countries or terrorists; they are the enemies inside, corrupt government leaders and the money masters they serve.

Trade agreements are one cause of job and wage reduction. Over the last twenty years, we’ve amassed $10 trillion in trade deficits and exported 12 million manufacturing jobs, forcing workers to move into lower-wage service jobs. Government brags about the free trade agreements, CAFTA, NAFTA, KORUS, and TPP. But the “free” applies only to the foreign trading partners, which manipulate their currencies, pay sweatshop workers low wages, manufacture under environmentally-toxic conditions, and restrict U.S. imports. We hand over our technology, good-paying jobs, product labeling, and safety guarantees -- all to enrich multinational corporations and foreign industry. Industrial research and development have been decimated as companies move overseas or outsource jobs, leaving the nation a future of little technological innovation. The U.S. is left with hollowed-out industries and service jobs.

The federal government encourages the massive illegal and legal immigration that plays a huge role in job scarcity and income suppression for American workers. To paraphrase Milton Friedman, a viable economy cannot exist with open borders and unrestricted immigration. An oversupply of workers willing to work for less pay, the outsourcing of jobs, and visa-immigrant hiring allow companies to replace American workers with immigrants for reduced labor and benefit costs. A well-known example is that of Disney IT workers who were forced to train their cheaper immigrant replacements. It is no coincidence that the rise in immigration has occurred simultaneously with the rise of the welfare state. People unemployed, or in low-wage and part-time jobs, rely on government subsidies. The result is larger national debt, more corporate wealth, and declining wages.

ObamaCare influences, and will influence to greater degrees, the lowering of incomes for Americans as healthcare costs rise. Higher premiums and deductions for health insurance are being shifted to employees, reducing benefits and wages. Medical care costs already have risen much faster than wages, leaving many struggling to pay for necessities. Ever-higher deductions mean that people can’t afford to use the insurance they are forced to buy because they can’t even pay the deductions.

Another contributor to job deficiency and wage stagnation is the increased regulation and taxation of small businesses instituted by Obama’s executive orders, EPA overreach, and ObamaCare. Small businesses traditionally have created two-thirds of new jobs annually. The bright spot in the economy, small businesses have created 78.7 percent of new jobs since the recession. Today, faced with these government anti-business policies, small businesses are closing their doors at a faster rate than new businesses are opening. The small businesses that remain open often don’t expand because of Obamacare and government regulations.

Income inequality is greatly impacted by the Federal Reserve’s policies of money-printing and zero interest rates, which have led to the funding of the financial and corporate markets while ignoring the needs of smaller businesses. The money supply and cheap lending has gone to the government, large corporations, and Wall Street, leaving the rest of the economy to sputter along with little capital and fewer jobs. The Fed’s policies of crony capitalism favor big business and big banks over that of smaller entities and are responsible for the increasing number of big business deals such as Walgreen's purchase of Rite Aid.

This government-driven, crony-capitalist economy defined by job scarcity and wage stagnation is the reason college graduates are burdened by $1.3 trillion debt, living with parents, can’t afford to marry or buy homes, and working as waitresses and bartenders. Job scarcity and low wages are the reasons we’re becoming a nation of renters rather than homeowners. They are the reasons that 51 percent of workers earn less than $30,000 a year. They are the reasons for the demise of the middle class and the burgeoning welfare rolls, the modern-day equivalent of slavery.

Income inequality and its devastating consequences are seldom mentioned on the nightly news. The media and bogus government statistics paint rosy pictures about economic recovery, and government masks the bad economy with welfare so that we don’t see Great Depression bread lines. But the only recovery has been in the Federal Reserve’s inflated stock market, not in the main street economy, where 94 million working-age adults are unemployed and 47 million are on some welfare program. The “Made in America” displays weekly touted by ABC news are the few exceptions, rather than the rule, in an American economy of boarded-up stores and factories.

The political implications of income inequality are most evident in the increasing rise and entrenchment of career politicians, supported by big donor funding and media favoritism. The integrity of the electoral process is endangered as election propaganda, funded by big money and hyped by corporate media bias, become more prominent in spreading lies, distortions, and innuendos to the voting public. Unrestricted campaign funding has given the moneyed elites first access to elected officials. At the same time, private-sector unions, small businesses, and citizens find their influence dwindling or irrelevant. This crony capitalism, resembling dictatorships and communist oligarchies, seriously threatens our democracy because money, power, and media control are consolidated in the hands of a few at the top. Voter apathy prevails, as voters feel increasingly powerless to change the course of events.

The United States, a once great economic powerhouse and the largest creditor nation, has become the largest debtor nation, and is fast becoming a banana republic. Past and present elected authorities and public officials have stripped bare our industries, put the nation under a mountain of debt, and turned the U.S. into a welfare depository. Government leaders have intentionally failed to protect our borders, jobs, and freedoms. These public “servants” and the wealthy elites have garnered riches for themselves, and purposely impoverished citizens and future generations. The greatest threats to our economy and national security are not foreign countries or terrorists; they are the enemies inside, corrupt government leaders and the money masters they serve.

http://www.americanthinker.com/articles/2015/11/the_causes_of_income_inequality.html#ixzz3qSBDYQVs

AMNESTY: THE HOAX TO KEEP WAGES DEPRESSED AND PASS ALONG THE REAL COST OF WELFARE FOR ILLEGALS TO THE AMERICAN PEOPLE

"The U.S. now ranks at, or near, the top of developed countries for income inequality. Job creation has lagged far behind population growth. Automation has erased some jobs, but corrupt, inept government leadership is responsible for the deplorable job- deficit-low wage situation."

"It is clear that the overarching goal of a succession of administrations and many members of Congress, irrespective of political party affiliation, is to keep our borders open and take no meaningful action to stop that flow of aliens into the United States."

326,000 Native-Born Americans Lost Their Job in November: Why This Remains the Most Important Jobs Chart

By Tyler Durden

ZeroHedge.com, December 5, 2015

. . .

We are confident that one can make the case that there are considerations on both the labor demand-side (whether US employers have a natural tendency to hire foreign-born workers is open to debate) as well as on the supply-side: it may be easier to obtain wage-equivalent welfare compensation for native-born Americans than for their foreign-born peers, forcing the latter group to be much more engaged and active in finding a wage-paying job.

However, the underlying economics of this trend are largely irrelevant: as the presidential primary race hits a crescendo all that will matter is the soundbite that over the past 8 years, 2.7 million foreign-born Americans have found a job compared to only 747,000 native-born. The result is a combustible mess that will lead to serious fireworks during each and every subsequent GOP primary debate, especially if Trump remains solidly in the lead.

. . .

http://www.zerohedge.com/news/2015-12-05/326000-native-born-americans-lost-their-job-november-why-remains-most-important-jobs

Placating Americans with Fake Immigration Law Enforcement

How our leaders create fantasy 'solutions' for our immigration-related vulnerabilities.

By Michael Cutler

FrontPageMag.com, December 4, 2015

. . .

Therefore the Visa Waiver Program should have been terminated after the terror attacks of 9/11 yet it has continually been expanded.

It is clear that the overarching goal of a succession of administrations and many members of Congress, irrespective of political party affiliation, is to keep our borders open and take no meaningful action to stop that flow of aliens into the United States.

. . .

The obvious question is why the Visa Waiver Program is considered so sacrosanct that even though it defies the advice and findings of the 9/11 Commission no one has the moral fortitude to call for simply terminating this dangerous program. The answer can be found in the incestuous relationship between the Chamber of Commerce and its subsidiary, the Corporation for Travel Promotion, now doing business as Brand USA. The Chamber of Commerce has arguably been the strongest supporter of the Visa Waiver Program, which currently enables aliens from 38 countries to enter the United States without first obtaining a visa.

The U.S. State Department provides a thorough explanation of the Visa Waiver Program on its website.

Incredibly, the official State Department website also provides a link, “Discover America,” on that website which relates to the website of The Corporation for Travel Promotion, which is affiliated with the travel industries that are a part of the “Discover America Partnership.”

. . .http://www.frontpagemag.com/fpm/261005/placating-americans-fake-immigration-law-michael-cutler

MIDDLE-CLASS.

EQUITY, HIS ILLEGALS HAVE BUILT A TRILLION DOLLAR LA

RAZA WELFARE STATE ON OUR BACKS…. AND ALL JOBS GO TO

NON-AMERICANS!

2014

By Niles Williamson

19 September 2015

http://mexicanoccupation.blogspot.com/2015/09/millions-of-jobs-for-illegals-along.html

"In the midst of the deepest slump since the Great Depression, the administration starved state and city governments of resources, leading to the destruction of hundreds of thousands of education and public-sector jobs and the gutting of workers’ pensions. Obama’s Affordable Care Act set in motion the dismantling of employer-paid health insurance and massive cuts in the Medicare insurance system for the elderly."

Ultimately, the continual infusion of asset bubbles is the form taken by a massive transfer of wealth, from the working class to the banks, investors and super-rich. The corollary to rise of the stock market is the endless demands, all over the world, for austerity, cuts in wages, attacks on health care and pensions."

Top 1 percent own more than half of world’s wealth

By Patrick Martin

14 October 2015

quickly as in America since the financial crash

of 2008. But side by side with the amassing

of previously unthinkable private fortunes,

the infrastructure of America is crumbling,

education, health care and other social

services are starved of funding, and the living

standards of the vast majority of the

population, the working people who produce

the wealth, are declining.