Why are 42 percent of US high school students experiencing persistent feelings of sadness and hopelessness?

The US Centers for Disease Control and Prevention this month released its “Youth Risk Behavior Survey [YRBS] Data Summary & Trends Report: 2011-2021.” The CDC’s findings are both shocking and disturbing.

Among US high school students in 2021:

- 42 percent experienced persistent feelings of sadness or hopelessness

- 29 percent experienced poor mental health during the previous 30 days

- 22 percent seriously considered attempting suicide

- 18 percent made a suicide plan

- 10 percent attempted suicide

- 3 percent were injured in a suicide attempt that had to be treated by a doctor or nurse

There were approximately 17 million students enrolled in private and public high schools in the US in 2021 (Statistica). Extrapolating from the CDC data, this means that more than 7 million of these students experienced persistent feelings of sadness or hopelessness, and 1.7 million attempted suicide. Suicide is the second-leading cause of death among 15- to 24-year-olds in the US.

What is behind this devastating picture of the mental health of teenagers in America? While the CDC offers few answers or solutions, they can be pointed to in the life experiences of this young segment of the population in the second year of the COVID-19 pandemic, which served to amplify the ills and mental health struggles in a society already wracked by poverty, social inequality, police violence and war.

Consider some of the conditions young people confront:

- 238,500 young people in the US have lost a primary caregiver in the pandemic—becoming COVID-19 orphans—according to Imperial College London.

Losing a parent is one of the most destabilizing and stressful events of the human experience, placing bereaved children at increased risk of mental ill-health and psychosocial problems. Orphans are at increased risk of substance abuse, dropping out of school, and almost twice as likely as non-orphans to die by suicide.

Adding to the pressure on children was the mounting incidence of mental health issues among their parents. 71 percent of parents surveyed in 2020 said they believed the pandemic had hurt their mental health.

A 2021 study found that 34 percent of parents reported elevated anxiety symptoms and 28 percent of them reported depression symptoms at the point of clinical concern, reports Lucy (Kathleen) McGoron, assistant professor of Child and Family Development at Wayne State University.

In October 2021, the American Academy of Pediatrics declared a national emergency in child mental health, citing “soaring” rates of child mental health.

The US government has committed only $300 million to a national response to the child mental health crisis, a pittance compared to the $25 billion in “security assistance” given to Ukraine since the beginning of the Biden administration.

Breaking down the statistics

The YRBS survey found that poor mental health and suicidality were worse for certain sections of the high school population.

Fifty-seven percent of female students experienced persistent feelings of sadness or hopelessness, and 41 percent said they experienced poor mental health during the previous 30 days. Over the previous year, 30 percent of high school girls considered attempting suicide, 24 percent made a suicide plan, 13 percent attempted suicide and 4 percent were injured in a suicide attempt.

LGBQ+ students fared the worst in all mental-health-related categories. (YRBS did not have a question assessing gender identity, so did not specifically include students who identify as transgender.) A staggering 69 percent of LGBQ+ students experienced persistent feelings of hopelessness in 2021; 52 percent experienced poor mental health during the previous 30 days, 45 seriously considered attempting suicide, 37 percent made a suicide plan, 22 percent attempted suicide, and 7 percent were injured in a suicide attempt.

In 2021, 31 percent of American Indian and Alaska Native students experienced high levels of poor mental health, 27 percent seriously considered suicide, 22 percent made a suicide plan, and 16 percent attempted suicide. Forty-nine percent of students identifying as multiracial experienced persistent feelings of sadness or hopelessness, 33 percent experienced poor mental health over the previous 30 days, and 24 percent seriously considered attempting suicide.

Black, Hispanic, white and Native Hawaiian and Pacific Islander students showed similar rates of feeling persistently sad or hopeless (39–41 percent), experiences poor mental health (20–30 percent), seriously considered suicide (21–23 percent) or made a suicide plan (17–20). Asian students fared somewhat better than other demographics.

The survey considered race and sexual identity to the exclusion of questions of class or socioeconomic status. One survey question did ask whether, over the previous 30 days, students experienced unstable housing—living in a shelter or emergency housing, being homeless, doubling up with family or friends, living in a shelter or emergency housing, or in motel, car, campground or other public place—which would indicate students living in a household experiencing unemployment, poverty or abusive conditions.

The overall total of students experiencing unstable housing was 3 percent, with the highest rates among American Indian or Alaska Natives (8 percent) and Native Hawaiian or Pacific Islanders (10 percent). The survey’s preoccupation with race and sexual identity is reflected in its inability to offer any understanding of why high school students are experiencing a mental health crisis or what can be done about it.

Results from other Focus Areas of the survey mirror the advanced stage of the social crisis in America as experienced by young people.

Substance use

The CDC’s YRBS survey found that among all US high school students in 2021:

- 23 percent drank alcohol during the previous 30 days

- 16 percent used cannabis during the previous 30 days

- 12 percent had ever misused prescription opioids

US overdose deaths rose by 15 percent to record levels in 2021, nearing 108,000, fueled mainly by fentanyl. Deaths involving synthetic opioids rose to 71,000 in 2021, up from 58,000 in 2020, the first year of the pandemic.

Experiencing violence

Among all high school students in 2021:

- 7 percent were threatened or injured with a weapon at school

- 15 reported being bullied at school

- 16 percent were electronically bullied

- 11 percent of all students, 18 percent of females, and 39 percent of students who reported any same-sex sexual contacts experienced sexual violence.

So far this year, as of February 19, the Gun Violence Archive reports 5,789 gun violence deaths of all causes, including 2,489 homicides/unintentional shootings and 3,300 suicides.

Seventy-nine mass shootings resulted in the deaths of 32 children (age 0-11) and 212 teenagers (age 12-17).

There were 183 police-involved shootings, resulting in 112 deaths; murder/suicides claimed 102 lives.

Youth are witness to this non-stop slaughter at home as well as the violence of the US-NATO proxy war in Ukraine against Russia. The US ruling elite is hurtling now toward war with nuclear power Russia, raising the threat of millions of deaths in a Third World War.

US life expectancy in the US decreased for the second year in a row in 2021, according to the CDC, leading to a decline in life expectancy from 77 years to 76.4 years. If this trend continues, a child born in the US today is expected to live a shorter life than his or her grandparents.

The mental health emergency plaguing America’s high school students is above all a social crisis that must be confronted by workers and youth in a struggle against a wealthy elite that is prepared to drive millions into poverty as prices soar, real wages plunge and job prospects for young people dwindle.

The latest CDC survey shows that the soaring death count from COVID-19, mass shootings and police violence is exacting a heavy mental toll on the nation’s high school students. It is also provoking anger and outrage, as the upsurge of workers struggles, both in the US and internationally, is now demonstrating. Young people must turn to the working class, the only force that has the power and position in society to fight for socialism in opposition to the murderous policies of the ruling class.

CBO Director: We’re Facing ‘Weakening Economy with High Inflation’ in First Half of 2023 and ‘Large Deficit That’s Set to Persist’

On Friday’s broadcast of the Fox Business Network’s “Cavuto: Coast to Coast,” Congressional Budget Office (CBO) Director Phillip Swagel stated that while it is mathematically possible to balance the federal budget within ten years without touching Social Security and other entitlement programs, the Congress “has inherited a very difficult” fiscal situation, because, in addition to the U.S. having “a very large deficit that’s set to persist,” it’s facing “a weakening economy with high inflation” in the first half of the year.

Swagel said, [relevant remarks begin around 4:35] “[I]t’s a very challenging situation. And at CBO — I appreciate what you said at the beginning — at CBO we do our work with impartiality, we’re non-partisan and we do it with integrity…it’s mathematically possible to balance the budget within ten years and leave Social Security and other entitlements aside. It’s very challenging. And there’s a sense in which policymakers today, the Congress today, has inherited a very difficult situation, a very large deficit that’s set to persist, at the same time, the economy in the first half of this year is facing a weakening economy with high inflation, so it’s a — the fiscal situation is very challenging.”

Follow Ian Hanchett on Twitter @IanHanchett

Bankers And Tech Executives Know The Collapse Of Society Is Coming And Feverishly Prepare For It

15 Things That Became Priceless For The Average American Families

BIDENOMICS = THE RICH GET MUCH RICHER AND ILLEGALS GET THE JOBS TO KEEP WAGES DEPRESSED

This Is Really Bad News - WH: Appalling Action Proves Economic Collapse

First it Was the Fake Payroll Report, Now the BLS is Making Changes to Another Key Report

WAL-MARTS CLOSING AFTER SURGE IN THEFT! SELF CHECK-OUT TO BLAME OR FINANCIAL DESPAIR THE CULPRIT?

30 Million Americans Face Hunger As They Can't Afford Insane Grocery Prices

PIG BIDEN CAN'T OPEN HIS MOUTH WITHOUT LYING OR SUCKING BRIBES!

Joe Biden Falsely Claims Food Prices Are ‘Continuing to Come Down’

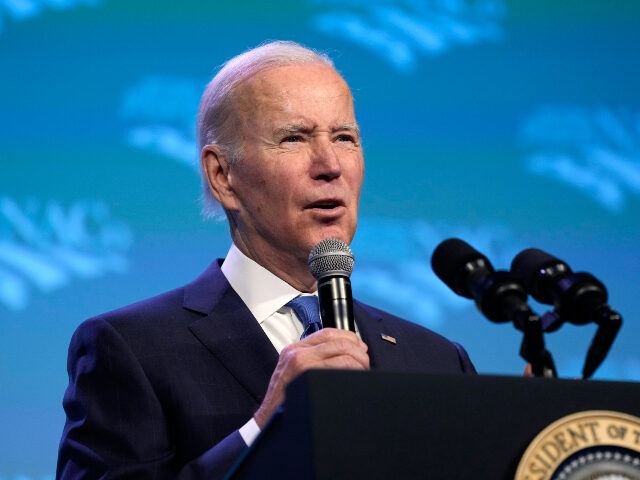

President Joe Biden falsely claimed food prices are coming down after Tuesday’s inflation report revealed prices at the grocery store actually increased in January.

Delivering a Tuesday afternoon keynote address at the National Association of Counties, Biden falsely claimed inflation, including food prices, is coming down.

“Today’s report on inflation shows the good is that inflation in America is continuing to come down,” Biden claimed. “Food prices at the grocery store are coming down.”

But according to the consumer price index report released Tuesday morning, the price of food at home jumped 0.5 percent compared with December. Over the past 12 months, grocery prices have gone up 10.1 percent, the numbers reflecting the month of January show.

Many common grocery items dramatically increased in price, including eggs prices up 70 percent, cereals up 15.6 percent, and coffee up 12.6 percent.

Overall, the consumer price index, which measures inflation, soared 0.5 percent in January compared with a month earlier. In previous months, the index had increased by one-tenth of a point in December after rising two-tenths in November.

Tuesday’s report appeared to surprise experts. Economists forecasted the index rising 0.4 percent from January and 6.2 percent from a year ago, Econoday reported.

A Moody’s report in 2022 projected Biden’s 40-year-high inflation would cost American households on average an extra $5,520 in 2022, or $460 per month.

Follow Wendell Husebø on Twitter @WendellHusebø. He is the author of Politics of Slave Morality.

Report of higher than expected price rises in January points to continued rate hikes

The month-to-month inflation rate increased in January to 0.5 percent, compared with 0.1 percent in December, even as year-on-year inflation ticked down slightly to 6.4 percent. Despite the fact that the annualized inflation rate was the lowest since October 2021, it was higher than anticipated and further increased the likelihood that the program of rate increases by the US Federal Reserve will continue.

The stock market dropped sharply following the release of the report but recovered somewhat later in the day. The US central bank has already raised interest rates 4.5 percent in the last year. Prior to the release of the January inflation data, rates had been expected to rise to 5.1 percent this year. However, Fed Chairman Jerome Powell said last week that rates could go even higher if inflation persisted.

Housing costs were the largest contributor to the inflation surge in January. Rent was up 0.7 percent from December and up 8.6 percent from one year ago. The price of piped natural gas was up a whopping 6.7 percent month on month in January, while gasoline rose 2.4 percent. Motor vehicle maintenance and repairs rose 1.3 percent, as did basic food items, which were up 0.5 percent overall. Cereal and bakery products were up 1.0 percent and eggs were up 8.5 percent.

Overall food prices have risen 10.1 percent year over year, and electricity is up 11.9 percent. Home natural gas is up 26.7 percent, and fuel oil is up 27.7 percent, making it increasingly impossible for workers to adequately heat their homes.

The Core Consumer Price Index rose 0.4 percent in January on a monthly basis. The Core CPI is a measure that excludes “volatile” food and energy prices. It currently stands at 5.6 percent.

While the official inflation rate is down from its peak of about 9 percent last summer, it is still running at the fastest pace since 1981. Articles in the financial press warned that the inflation rate was likely to remain elevated for some time. The New York Times quoted Jason Furman, an economist at Harvard University and a former economic adviser in the Obama administration, who said, “The whole perspective we have on inflation is much worse than it was a month ago.”

An economist quoted by the Washington Post said, “The moral of the story is that inflation is not cooling as rapidly as the Fed would like, especially core inflation. And that is something that is just going to affirm their commitment to continue raising rates at least two times.”

The impact of inflation on workers has been devastating, with real wages declining over the past year, as meager wage gains are outstripped by price increases across the board. Meanwhile, major corporations have inflated their already bloated profits through price-gouging. Leading the pack have been the energy companies, led by ExxonMobil, Shell and Chevron, which have all posted record profit numbers.

This has not stopped the Federal Reserve, and with it, the Biden administration, from declaring war not on excess profits, but on jobs and wages. Driving the policy of interest rate increases, the goal of which is to provoke a recession to increase unemployment, is the utterly false claim that wage rises, due to a supposedly tight labor market, are behind the surge in prices.

This was spelled out explicitly in remarks Tuesday by Lorie Logan, head of the Dallas Federal Reserve. Responding to the January inflation report, she said in remarks at Prairie View A&M University: “Broad-based and persistent services inflation is not the result of special circumstances like supply-chain disruptions that will eventually go away. Rather, I see it as a symptom of an overheated economy, particularly a tight labor market, which will have to be brought into better balance for the overall inflation rate to return sustainably to 2 percent.”

The Wall Street Journal noted that prices often run higher in January. One economic analyst it quoted said the price rises might be in anticipation of recession ahead. “If you think the economy is going into a recession in the summer, this is probably your last chance to take a bite of the apple before the economy slows,” he said. “It’s sort of the last hurrah for price setters.”

The Journal reported that the January inflation figures included various adjustments that showed inflation eased less than initially thought in the last few months of 2022.

In remarks Tuesday at a gathering of county officials, President Joe Biden hailed the continued fall in the year-over-year inflation rate, while warning of “bumps in the road” and “setbacks” ahead.

House Republicans blamed continuing inflation on excess government spending under the Biden administration, using the report to push for massive cuts in social spending in negotiations with the White House over the debt ceiling. House Budget Committee Chairman Jody Arrington blamed Biden for refusing to “change his spending habits and negotiate a responsible debt ceiling deal with Republicans.”

It is not government spending on social programs or “excess” wage demands that are driving inflation, but the pumping of trillions of dollars into the financial markets, resulting in a massive asset bubble. The bailout of the corporations and banks under the CARES Act during the pandemic accelerated this process. At the same time, the refusal of governments to contain and eliminate the COVID-19 virus led to supply chain breakdowns and further exacerbated inflation. The US/NATO-provoked proxy war with Russia in Ukraine and massive increases in military spending have further fueled inflationary tendencies.

Now the ruling class is attempting to make the working class pay for this crisis created by the capitalist system. Governments all over the world view with fear and alarm the rising tide of class struggle in country after country. That is behind the push to tip the economy into recession and drive up the unemployment to weaken the working class.

CUT AND PASTE YOUTUBE LINKS

It's Worse Than 2009 as Delinquencies Surge and Bankruptcies are Back

They're Trying To Fool You "Great Depression Warning Sign"

The Housing Market Is Crashing & The FED Can't Do Nothing About It Danielle DiMartino Booth

Biden wants to scare the American people: GOP lawmaker

GREAT DEPRESSION WARNING HIDDEN IN THE GDP, CREDIT CARD LIMITS WILL DROP, WAL-MART RAISES

WAGES'

cut and paste youtub links

Everything is BROKEN Right Now (Economy, Real Estate, Business

BE WARNED: 4 MAJOR US Banks Will Declare Bankruptcy Soon After The Fed Does This - Peter Schiff

Why Americans Feel So Poor | CNBC Marathon

15 Facts Which Prove That A Massive Economic Meltdown Is Already Happening Right Now

We Are Witnessing An Enormous Wave Of Bankruptcies And Layoffs During The Early Stages Of 2023

BIDENOMICS

BANKS SEND WARNING! LAYOFFS WILL SURGE, FINANCIAL IMPLOSION, MASSES TRAPPED IN

FINANCIAL SCHEME

Wave Of Mass Layoffs - Job Losses "Foreshadow" More Layoffs Coming

Recession Looms: Index of Leading Indicators Dropped Sharply Again in December

A key measure of the health of the U.S. economy declined for the tenth straight month in December, pointing to a recession in the near future.

The Conference Board’s index of leading economic indicators (LEI) declined one percent compared with the previous month. The prior month’s figure was revised to show a 1.1 percent decline, worse than the one percent initially reported.

The drop is steeper than expected. Analysts polled by Econoday had expected the index to fall between 0.6 percent and 0.8 percent, with the median forecast at 0.7 percent.

“The US LEI fell sharply again in December—continuing to signal recession for the US economy in the near term,” said Ataman Ozyildirim, Senior Director, Economics, at The Conference Board. “There was widespread weakness among leading indicators in December, indicating deteriorating conditions for labor markets, manufacturing, housing construction, and financial markets in the months ahead.”

The index is comprised of 10 indicators that are thought to provide information about the direction of the economy. Nearly every one of the indicators posted a decline in December. For the six months from June through December, most of the indicators made negative contributions to the index. The exceptions were the financial components, including stock prices and bond spreads, as well as new orders for manufactured consumer goods.

The index fell 4.2 percent over the second half of 2022—a much steeper rate of decline than its 1.9 percent contraction in the first half.

The Conference Board also tracks what it calls the Coincident Economic Index. This is a measure of current activity rather than one that forecasts turns in the economy. This rose increased 0.1 percent in December.

“Meanwhile, the coincident economic index (CEI) has not weakened in the same fashion as the LEI because labor market related indicators (employment and personal income) remain robust. Nonetheless, industrial production— also a component of the CEI—fell for the third straight month. Overall economic activity is likely to turn negative in the coming quarters before picking up again in the final quarter of 2023,” Ozyildirim said.

70% + OF ALL SILICON VALLEY TECH WORKERS WERE FOREIGN BORN!

The tech industry can no longer be left in the hands of billionaire private owners

like Jeff Bezos, Bill Gates and Elon Musk. Instead, these monopolies must be

transformed into a public utility, collectively owned and democratically controlled

by the working class, as part of the socialist reorganization of economic life. Only in

this way can the industry be run for the benefit of society as a whole and ensure

free, democratic access to the Internet and other critical technologies.

Google lays off 12,000 workers as tech jobs bloodbath intensifies

With the announcement by Google parent Alphabet of 12,000 layoffs, the attack on jobs in the technology industry has been taken to a new level. The number of tech jobs eliminated in the first three weeks of the new year has already reached one third of the total of more than 241,000 industrywide layoffs in 2022.

While many of these job cuts are concentrated in the US, the assault on tech workers is global in character. In an email sent to Google employees on Friday, CEO Sundar Pichai wrote that the layoff of 6 percent of the workforce would impact jobs internationally and “cut across Alphabet, product areas, functions, levels and regions.”

Pichai also said the layoffs were made “to ensure that our people and roles are aligned with our highest priorities as a company.” In other words, as demanded by the financial oligarchy, the jobs of Alphabet employees are being sacrificed to ensure the profitability of the $1.27 trillion global technology conglomerate.

No one should underestimate the ruthlessness with which the corporate elite is pursuing its attack on jobs and living standards. While Pichai wrote, “We’ve already sent a separate email to employees in the US who are affected,” workers in New York City reported they learned about being laid off when they arrived at work on Friday morning and were denied entry into the company’s corporate offices.

With the Alphabet announcement, the number of tech job cuts this year reached more than 75,000, according to the Tech Layoff Tracker maintained by TrueUp. Among the other mass layoffs announced in 2023 are Amazon (18,000 jobs), Microsoft (10,000 jobs), Salesforce (7,000 jobs) and Cloud Software Group (2,000 jobs).

The layoffs at more than 200 other tech firms— including 1,100 jobs at Capital One, 950 jobs at CoinBase, 900 jobs at game company Black Shark and 800 jobs at Crypto.com—make up the balance of 50,000 eliminated positions.

The growing wave of tech layoffs are both shocking and devastating. A report in the New York Times on Friday said, “Millennials and Generation Z, born between 1981 and 2012, started tech careers during a decade-long expansion when jobs multiplied as fast as iPhone sales. … Few of them had experienced widespread layoffs.”

Meanwhile, it is taking laid-off workers in all economic sectors longer to find new jobs. According to the US Labor Department, the number of unemployed workers who have been without a job for 3-1/2 to 6 months increased in December to 826,000, up from 526,000 in April.

The jobs massacre in the tech industry is the spearhead of a conscious policy by the ruling establishment to impose the inflation crisis on the backs of the working class. The Biden administration and the Federal Reserve Bank—along with capitalist governments and central banks internationally—have been raising interest rates at an unprecedented pace to instigate a recession, increase unemployment and beat back the demands of workers for wage increases that keep up with the rising cost of living.

Jerome Powell, U.S. Federal Reserve chairman, stated this policy explicitly in a speech on January 10, when he said, “Restoring price stability when inflation is high can require measures that are not popular in the short term as we raise interest rates to slow the economy.”

The tight monetary policy is being felt most directly in the technology sector because the industry is being hit by the combined impact of increased borrowing costs, collapsing stock market values and a reduction in business volume from the overall economic slowdown.

Alongside the assault on jobs is also a shift in workplace practices that attack the conditions of tech workers. In a comment in the New York Times on Sunday, entitled “The Era of Happy Tech Workers is Over,” Nadia Rawlinson, former chief people officer at Slack, wrote, “The layoffs are part of new age of bossism, the notion that management has given up too much control and must wrest it back.”

While tech workers have been considered a relatively better-off section of the labor force, the fact is, just like every sector of capitalism, the high tech industry is subject to the very same laws of the profit system as the other sectors.

As Rawlinson writes, “After two decades of fighting for talent, chief executives are using this period to adjust for years of management indulgence that left them with a generation of entitled workers.” The days of remote work, WiFi compensation, meal stipends and other incentives are over, she insists, and “tech chief executives are now optimizing more for profitability than for growth, sometimes at the expense of long-held organizational beliefs.”

Behind these changes, Rawlinson says, are “activist investors” who have taken “prominent positions in their stocks” and have “called for the companies to slash costs, reduce nonstrategic investments and, notably in Meta’s case, aggressively reduce its workforce.” There is no question that the layoffs and attack on working conditions are being demanded by the billionaires on Wall Street who are seeking to extract the combined $4 trillion in stock valuations they lost in 2022 from the working class.

As one Google employee tweeted, “Imagine being 24 years and ten months at a company that has a 5 year stock vest schedule that fully vest on your 25 year... and being let go a month and change before 25... and the company that cut you made $198 billion last year. I HATE CAPITALISM.”

In every industry, the corporate and financial oligarchy wants the working class to pay for the global crisis of capitalism. In the auto industry, the electric vehicle manufacturer Rivian has announced the layoff of 6 percent of its workforce as part of a restructuring plan. EV manufacturer Tesla has also announced a hiring freeze with layoffs to come soon.

In December, Stellantis announced the indefinite shutdown of its Jeep engine plant in Belvidere, Illinois, laying off 1,350 workers. Shortly afterwards, CEO Carlos Tavares’ threatened that further job cuts “will happen everywhere as long as we see high inflation of variable costs.” This has already started, with workers at the Dundee, Michigan engine plant informing the WSWS that more than 100 workers are being laid off.

Layoffs have also been announced at Intel Corporation, Goldman Sachs, Bed Bath & Beyond and BlackRock and job cuts are expected to be announced at the Washington Post any day now.

The pro-corporate trade union apparatus is doing nothing to oppose the jobs massacre. The Communications Workers of America (CWA), which has recently made a push to organize tech workers, has responded with nothing but a tweet decrying the job cuts. In fact, the CWA bureaucracy has spent decades collaborating in the slashing of telecom workers’ jobs.

The Socialist Equality Party advocates the development of rank-and-file committees in every workplace, which are controlled democratically by workers themselves and committed to the needs of the working class, not corporate profit. The International Workers Alliance of Rank-and-File Committees has been established to coordinate and unify the struggles of workers in the United States and throughout the world against the attack on jobs, living standards and work conditions.

This must be connected to a struggle against the capitalist system. Google, Facebook, Twitter and other tech giants exercise enormous power and control over the Internet. They are deeply integrated into capitalist governments and have collaborated in state censorship, especially of left-wing publications including the World Socialist Web Site.

The tech industry can no longer be left in the hands of billionaire private owners like Jeff Bezos, Bill Gates and Elon Musk. Instead, these monopolies must be transformed into a public utility, collectively owned and democratically controlled by the working class, as part of the socialist reorganization of economic life. Only in this way can the industry be run for the benefit of society as a whole and ensure free, democratic access to the Internet and other critical technologies.

Study: More than 7-in-10 California Immigrant

Welfare

More than 7-in-10 households headed by immigrants in the state of California are on taxpayer-funded welfare, a new study reveals.

More than 7-in-10 households headed by immigrants in the state of California are on taxpayer-funded welfare, a new study reveals.

“More than 750 million people want to migrate to another country permanently, according to Gallup research published Monday, as 150 world leaders sign up to the controversial UN global compact which critics say makes migration a human right.” VIRGINIA HALE

The Inevitable Housing Crisis Is Killing The American Dream

WAGE DEPRESSION AND THE BIDEN DEPRESSION

VIDEO

15 Signs That American Family Budgets Will Be Blown Through In 2023

https://www.youtube.com/watch?v=4FQQQetflEE

As Republicans discuss attacks on Social Security and Medicare

Debt ceiling “clash” will lead to major cuts in social spending

The Biden administration and the Republican-controlled House of Representatives have begun a series of political maneuvers and backroom discussions on raising the federal debt ceiling, which now stands at $31.4 trillion. Federal authority to borrow has run out, and the Treasury will exhaust short-term financial manipulations to avert a default on debt by early June, according to Treasury Secretary Janet Yellen.

A public debate has ensued in Washington and in the corporate media, with House Republicans demanding that any resolution to raise the debt ceiling be accompanied by severe cuts in domestic social spending, reportedly in the neighborhood of $130 billion, about 8 percent of current levels. The White House and congressional Democrats, who control the Senate, are demanding a “clean” bill to raise the debt ceiling, one that does not include any cuts or other extraneous provisions.

The Washington Post reported Tuesday that the discussion in the Republican Party has gone well beyond the immediate cuts that are likely to accompany a bipartisan deal to raise or suspend the debt ceiling:

In recent days, a group of GOP lawmakers has called for the creation of special panels that might recommend changes to Social Security and Medicare, which face genuine solvency issues that could result in benefit cuts within the next decade. Others in the party have resurfaced more detailed plans to cut costs, including by raising the Social Security retirement age to 70, targeting younger Americans who have yet to obtain federal benefits.

“We have no choice but to make hard decisions,” said Rep. Kevin Hern (R-Okla.), the leader of the Republican Study Committee, a bloc of more than 160 conservative lawmakers that endorsed raising the retirement age and other changes last year. “Everybody has to look at everything.”

These comments reveal the direction of ruling class policy as a whole. Hern is not an outlier but a top ally of House Speaker Kevin McCarthy. In the mechanism of capitalist politics, the fascist Freedom Caucus, which blocked McCarthy’s election as Speaker for 15 ballots, pushes the Republican House majority further to the right, as signaled by the concessions extracted, particularly on debt and spending. The House majority in turn pushes the Biden administration further to the right, expressed in McCarthy’s demand for direct negotiations with the White House over the debt ceiling. Biden has already made his first concession, agreeing to meet with McCarthy before the February 7 State of the Union speech.

In all of the public commentary on the debt ceiling, neither of the two capitalist parties nor the media deal with the more fundamental questions: Where did the national debt come from, and who is to pay for it? That is because they seek to conceal the basic class issues in the fiscal crisis. It is true that American capitalism faces bankruptcy. But why should working people, who did not cause the crisis and are not responsible for it, be made to pay the price through the evisceration of social benefits?

The debt crisis is real enough, as the accompanying graph demonstrates. Total US government debt was $5.6 trillion in 2001, when George W. Bush entered the White House. Eight years later, after a massive tax cut for the wealthy and the launching of major wars in Afghanistan and Iraq, the national debt was $11.7 trillion, more than double, an increase of $6.1 trillion.

The national debt increased another $8 trillion under the Obama administration, from $11.7 trillion to $19.8 trillion. Major extraordinary outlays included the bailout of the US financial system and the auto industry in 2009, after the Wall Street collapse, the continuing wars in Afghanistan and Iraq, and the new wars in Libya and by proxy in Syria. There was also the continuing cost of the Bush tax cuts, most of which were retained as part of a bipartisan deal between Obama and the Republican-controlled Congress.

The Trump administration racked up as much debt in four years as Obama had in eight years, largely due to further tax cuts for the wealthy in 2017, as well as a continuing gusher of new spending for the Pentagon to prepare for future wars with Russia and China. A huge round of corporate bailouts during the first year of the COVID-19 pandemic brought the total new debt to $8.3 trillion.

In the first two years of the Biden administration, the national debt has risen by a further $3 trillion, mainly through the continuing COVID-19 bailouts and other spending to prevent economic collapse, now supplemented by a rapid rise in military spending, focused on the proxy war against Russia in Ukraine.

Proposals to reduce the deficit by raising taxes on the superrich have gone nowhere in Congress. As Biden promised an audience of wealthy backers before the 2020 election, they would not suffer with a Democrat in the White House, despite his populist rhetoric. “No one’s standard of living will change. Nothing would fundamentally change,” he said.

To sum up: The US national debt has risen from $5.6 trillion to $31.4 trillion since 2001. Of this massive $25.8 trillion increase, the wars in Afghanistan and Iraq and the overall “war on terror” account for $8.3 trillion, according to the “cost of war” study by Brown University. The tax cuts by Bush and Trump, largely retained under Obama and Biden, cost at least $5.3 trillion. The bailouts of Wall Street in 2008-2009 and 2020 cost an estimated $8 trillion more.

How is any of this the responsibility of the working class? The American people were not consulted on the wars, which were launched without even a formal declaration. They were not consulted on the two massive financial bailouts, pushed through Congress as “emergency” measures in only a few days’ time. They were not consulted on the tax cuts, which were presented as benefiting all Americans, although 90 percent of the financial windfall, or even more, went to the top 1 percent.

While the Democrats and Republicans focus on Social Security, Medicare and other “entitlement” programs—so-called because their recipients are entitled by law to receive the benefits—these are not the cause of the nearly six-fold increase in the national debt over the last two decades. On the contrary, as this graph shows, the assets held by the Social Security Trust Fund have increased steadily over a 30-year period, only turning down slightly in the last two. These assets remain close to $3 trillion.

The incessant calls for “reform” of Social Security stem from the desire of the financial vultures on Wall Street to get their hands on this pile of cash and turn it into a source of profit. George W. Bush tried to do this in 2005 but faced such a political firestorm, accompanied by rising opposition to the war in Iraq, that he had to abandon the effort. In the present crisis there are renewed efforts to loot the Trust Fund and place 66 million retired Americans at the mercy of the financial markets.

Even more endangered is the younger generation of the working class. This is the real meaning of the language now used by Republican leaders in the House, like Majority Leader Steve Scalise, who claims that his party wants Social Security “strengthened for seniors who paid into it.” That means non-seniors, and particularly young people, should not expect benefits and will not get them.

Right-wing Democrats like Senator Joe Manchin use similar wording. He called for the establishment of a special committee of the House and Senate to review options for “strengthening” Social Security, while ruling out cuts in current benefit levels. So future benefit levels for future retirees are on the table, as well as the retirement age, now 67 but likely to be pushed higher, and changes in how the program calculates the amount of cost-of-living rises.

Neither party will discuss a solution to the financial crisis that makes the capitalist financial oligarchy, not working people, bear the burden. This is a cost they are eminently able to bear. A report by Oxfam published earlier this month, on the eve of the World Economic Forum in Davos, Switzerland, which brought together billionaires and leading capitalist politicians from throughout the world, gave a glimpse of the enormous accumulation of wealth by the superrich.

In what it called an “explosion of inequality,” Oxfam reported that since 2020, the richest 1 percent have captured almost two-thirds of all new wealth—nearly twice as much money as the bottom 99 percent of the world’s population. Billionaire fortunes are increasing by $2.7 billion a day, even as inflation outpaces the wages of at least 1.7 billion workers. The pandemic, while a catastrophe for working people, the main victims of infection, death and economic collapse, has been a bonanza for the rich.

Working people should oppose all attempts by the politicians of both corporate-controlled parties, the Democrats and the Republicans, to make them pay for the debt crisis, which is one expression of the colossal decline in the world position of American capitalism. And they must reject all efforts by the unions and their pseudoleft allies to straitjacket this opposition within the confines of the Democratic Party. Only the independent political mobilization of the working class can defend the social benefits which are the byproduct of many decades of working class struggle.

Look At The Extreme Social Insanity That Is Spreading All Over America