VIDEO:

THE PELOSI CRIME FAMILY - Worse than the Biden, Clinton or Obama crime families?

Jesse Watters: If you thought Hunter Biden's business deals were shady, just wait

Watters: The Five (CRIME) Families of the Democrat Party

Most of the media have never given a damn about the Clinton (LAWYER), Obama (LAWYER) or Biden (LAWYER) corruption, which is massive. JACK HELLNER

Laura Ingraham: President Xi is an evil dictator....but joe loves all

dictators, particularly those who are generous to crackhead hunter!

https://www.youtube.com/watch?v=XWAU-wFqhkQ

THE ENTIRE BIDEN FAMILY IN BED WITH RED CHINA

Jesse Watters: Joe Biden just proved he's compromised

New details further link Hunter Biden to China’s payroll

https://www.youtube.com/watch?v=XgVOirLNWpw

The author of Red-Handed: How American Elites Get Rich Helping China Win, explained, “This started out as a Hunter Biden story and is now with Joe Biden story. He is at the center. He is the planet which the moons in the family Hunter Biden and James Biden revolve.”

From Schweizer’s NY Post article:

For those wondering why Joe Biden is soft on China, consider this never-before-reported revelation: The Biden family has done five deals in China totaling some $31 million arranged by individuals with direct ties to Chinese intelligence — some reaching the very top of China’s spy agency.

Joe Biden collects $400,000 a year in salary as president. According to the New York Post, Biden and his family have collected $31 million from China. Jesus said we cannot serve two masters. If Biden has collected $31 million from China, that raises the question: what do the Chinese want in return? Does that $31 million make China his biggest concern? Could it be that his primary job is serving the interests of China, while his role as president is a moonlighting gig?

DO A SEARCH FOR WAR PROFITEER DIANNE FEINSTEIN AND RED CHINA!

BIDEN KLEPTOCRACY

RIDING THE DRAGON: The Bidens' Chinese Secrets (Full Documentary)

https://www.youtube.com/watch?v=JRmlcEBAiIs

THE BIDEN KLEPTOCRACY

American people deserve to know what China was up to with Joe Biden, especially when Beijing had already shelled out millions of dollars to Biden family members — including millions in set-asides for “the big guy.” What else is on that infamous Hunter Biden laptop? The conflicted Biden Justice Department cannot be trusted to engage in any meaningful oversight on this issue. We need a special counsel now.

The Biden family's corruption 'spans the globe': Schweizer

Watters: The Five (CRIME) Families of the Democrat Party

https://www.youtube.com/watch?v=BBpvvHethg0

HOW MANY ARE LAWYERS???

Schweizer: ‘It’s Going to Be Business as Usual’ for Hunter’s Dealings

Joe Biden, the corrupt, unaccomplished 47-year career politician, with a reputation of having been a proud segregationist, an unabashed plagiarist and liar, a resolute tale-teller, and a serial flip-flopper, is pretending to head up a radical social-democratic ticket for President of the United States that includes as his running mate the ambitious, disagreeable junior senator from California: Kamala Harris.

Private Equity Giant Taps Schumer’s Son-in-Law as Lobbyist

Michael Shapiro joins Blackstone from the Department of Transportation

Senate Majority Leader Chuck Schumer's son-in-law has joined private equity giant Blackstone as a "managing director of government affairs," the latest addition to the New York Democrat's family lobbying empire.

Michael Shapiro, who recently served as President Joe Biden's deputy assistant secretary for economic policy at the Department of Transportation, will focus on infrastructure investments and projects at Blackstone, according to the firm. Shapiro lands the new gig as Schumer is poised to decide the fate of legislation on infrastructure spending and tax loopholes of interest to Blackstone. The move was first reported by Capitol Account, a newsletter founded by two former Bloomberg reporters devoted to covering the intersection of Wall Street and Washington.

Schumer is already under fire for blocking a vote on legislation opposed by companies that employ other members of his family. Progressive groups and Republicans have unsuccessfully pressured Schumer to schedule a vote on antitrust legislation that would rein in Big Tech firms. Schumer's daughters, Jessica and Alison, are lobbyists for Amazon and Facebook's parent company Meta, respectively. Shapiro married Jessica Schumer in 2016, after meeting at the Obama White House. The New York Times described their courtship as a "real West Wing romance."

Blackstone said Shapiro, who advised Hillary Clinton's failed 2016 presidential campaign, will not lobby his father-in-law on issues related to the firm. But the private equity behemoth, which manages nearly $900 billion in assets, has lobbied the Senate on the Build Back Better Act, the massive infrastructure spending program. Blackstone also lobbied the Senate on carried interest, the loophole by which private equity firms obtain lower tax rates for income. Schumer is leading negotiations on the Inflation Reduction Act, which includes language to close the carried interest loophole.

Schumer has ties to other lobbyists for Blackstone. Steve Elmendorf, a prominent Democratic donor who runs the firm Subject Matter, in the past has defended Schumer over the senator's ties to Wall Street. "In working with him for 25 years, he very aggressively represents the state of New York. Sometimes that means he's representing one interest over another," Elmendorf said in 2015.

Schumer's office did not respond to a request for comment.

Mark Kelly Says Lawmakers Shouldn’t Use Their Offices for Profit. He May Have Done Just That.

Sen. Mark Kelly (D., Ariz.) says he wants to stop lawmakers from exploiting their office for personal gain. But his investment in an aerospace company awarded a lucrative Pentagon contract is the kind of conflict of interest he’s claimed to oppose.

Kelly owns as much as $250,000 in non-public stock in Boom Technology, according to his most recent financial disclosure. The former astronaut served on Boom’s board of advisers until 2019 and had up to $50,000 in stock options in the company that expired in February. In January, Boom Technology announced a strategic partnership with the Air Force worth up to $60 million, one of the military branch’s "largest investments" into research of supersonic aviation. The three-year partnership marked a "substantial increase" over an Air Force contract with Boom Technology from 2020, before Kelly entered the Senate.

Kelly’s stake in Boom poses a potential conflict of interest because of his position on the Senate Armed Services Committee, which oversees the Pentagon’s budget. He is also on the Airland Subcommittee, which has oversight of the Air Force’s research budget. Kelly has introduced multiple bills to prohibit members of Congress from profiting off their office, including bans on lawmakers from trading stocks and receiving campaign contributions from corporate PACs. Kelly, who has said he wants to "root out corruption and increase transparency in Washington," exercised stock options in Boom Technology in April 2021.

Kelly placed his assets in a blind trust in July 2021 to ensure "transparency and accountability." He has since proposed legislation to require all members of Congress to do the same. But other lawmakers have cast doubt on the practicality of blind trusts to curb conflicts of interests. "You know what you put in, so it’s not really blind," said Rep. Zoe Lofgren (D., Calif.).

Asked for comment, Kelly’s office denied his investments pose a conflict of interest, saying that senators and congressional committees do not award contracts to individual companies. But Boom Technology lobbies the Senate on defense appropriations and noise pollution, the main hurdle to commercially viable supersonic flight. The federal government banned supersonic commercial flight in the 1970s because of the "sonic boom" airplanes emit when flying faster than the speed of sound. Boom Technology and its competitors claim they can drastically reduce the noise pollution in their airplanes.

As a Boom adviser, Kelly helped the company land one of its earliest commercial wins. According to Boom CEO Blake Scholl, Kelly arranged a key meeting between the company and his friend, Virgin Galactic founder Richard Branson. The billionaire later pledged to buy 10 of Boom’s supersonic planes. Emerson Collective, the investment firm founded by Apple heiress Laurene Powell Jobs, is also a major investor in Boom. The Apple heiress gave maximum campaign contributions to Kelly in 2019 and 2021.

Boom has touted its technology for potential use by the American military, but the company has also worked with Chinese companies to "bring supersonic flight to China," the Washington Free Beacon has reported.

Kelly has faced scrutiny before over his business dealings. He cofounded a space tourism company, World View Enterprises, that partnered with Tencent, a Chinese technology behemoth that helps Beijing censor the Internet.

Wolf of Washington: Pelosi Is Poised To Score Big From Semiconductor Bill

A bill that provides more than $50 billion in subsidies for domestic semiconductor production is set to hit the House floor roughly a month after Speaker Nancy Pelosi's (D., Calif.) husband purchased up to $5 million in a company that could benefit from the legislation.

Paul Pelosi on June 17 exercised options worth between $1 million and $5 million in Nvidia, a company involved in the semiconductor industry, according to congressional filings. Nvidia's value has increased by about 11 percent since Pelosi purchased the stock, netting him and his wife up to half a million dollars in a month. Nvidia's stock on Tuesday climbed an additional 4 percent as news broke on the subsidies bill.

Pelosi has a long history of making "timely" purchases in companies that his wife has worked to subsidize. Just this year, he cashed in on millions of dollars in Tesla stock as the speaker lobbied for electric vehicle subsidies, the Washington Free Beacon reported. Internet stock traders have made a recurring joke out of the Pelosis' frequent windfalls, with some suggesting the speaker is "making the big bucks off of insider information," Business Insider reported in December.

Nancy Pelosi, who long opposed a congressional stock-trading ban, in February reluctantly expressed support for one after bipartisan pushback. While around 70 percent of Americans support such bans for both lawmakers and their spouses, legislation has stalled on Capitol Hill.

Pelosi's office responded to press inquiries by playing down her involvement in the trades.

"The speaker does not own any stocks," a spokesman told Fox Business. "As you can see from the required disclosures, with which the speaker fully cooperates, these transactions are marked ‘SP' for spouse. The speaker has no prior knowledge or subsequent involvement in any transactions."

Virginia Dem Defends Multimillion-Dollar Stock Holding That Even Pelosi Thinks Is Too Controversial

Elaine Luria calls criticism over Nvidia holding 'hollow political attack' days after Pelosi sells

Virginia Democratic congresswoman Elaine Luria is defending her multimillion-dollar stake in a company that even prolific stock trader Nancy Pelosi (D., Calif.) thinks is too controversial.

Luria holds up to $25 million in computer chip designer Nvidia, the same company Pelosi's husband invested up to $5 million in June as Congress moved forward on legislation that would provide billions of dollars in subsidies to the chip industry. On Tuesday—the day before the Senate passed that legislation—the Pelosis quietly sold their $5 million stake amid conflict of interest concerns. Luria, however, is not following suit. In a Friday interview with Norfolk's NBC affiliate, the Democrat defended her stake in Nvidia just one day after she voted for the chip subsidy bill, even though the company's stock shot up more than 10 points after Congress approved the legislation.

Luria joined Congress in 2019 and is a top Republican target in November, when she will face state legislator and fellow Navy veteran Jen Kiggans. Kiggans called on Luria to sell her Nvidia holding in a Thursday press release, which accused the Democrat of putting "her bottom line ahead of her constituents' well-being."

"Elaine Luria has used her power to enrich herself by tens of millions of dollars since taking office," Kiggans said. "If Elaine is serious about reforming Washington, she should lead by example and immediately sell her stocks in the Nvidia Corporation after her vote."

Luria's defense of her stock portfolio comes just months after she called a bipartisan push to ban lawmakers from trading stocks "bullshit" and dismissed the notion that members of Congress are "inherently bad or corrupt."

"I think this whole concept is bullshit, because I think that, why would you assume that members of Congress are going to be inherently bad or corrupt?" Luria told Punchbowl News. "I mean, the people that you're electing to represent you, it makes no sense that you're going to automatically assume that they're going to use their position for some nefarious means or to benefit themselves. So I'm very strongly opposed to any legislation like that."

Three in four voters support banning lawmakers from trading stocks while in office, according to a December Trafalgar Group poll.

During her Friday interview, Luria called criticism of her Nvidia holding a "hollow political attack." She claimed the company does not benefit from the chip legislation as it is not directly eligible for the subsidies offered through the bill—those subsidies are for chip manufacturers, not chip designers. But Nvidia's increase in value after Congress passed the Luria-backed chip bill is a reflection of the fact that the company will indeed benefit from the legislation, a Republican congressional aide with knowledge of the bill told the Washington Free Beacon.

"If there's a higher demand for chips there will obviously be a higher demand for chip designers," the aide said. "Luria's excuse is like saying if the government gave a lot of money to shoe manufacturers, shoe designers wouldn't also benefit. That's pretty dumb."

Still, Luria spokesman Jayce Genco told the Free Beacon Luria's vote in favor of the chip bill had nothing to do with her portfolio.

"To suggest that her vote on the anti-China bill is anything but for strengthening our national security is absurd," Genco said. "Our national defense remains one of Rep. Luria's top priorities as a member of Congress."

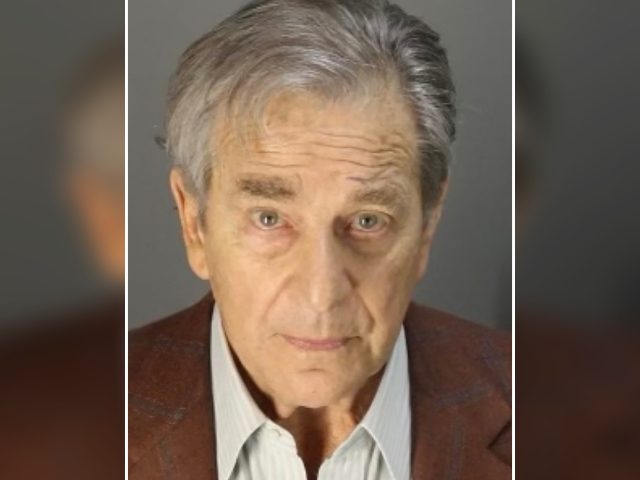

Napa Prosecutors Walk Back ‘Boilerplate’ Drug Allegation on Paul Pelosi

Prosecutors in Napa County, California, have walked back what they call a “boilerplate” drug allegation in the DUI complaint against House Speaker Nancy Pelosi’s husband, Paul Pelosi.

As Breitbart News reported on Tuesday, Napa prosecutors released the criminal complaint against Paul Pelosi in which it stated he had injured a driver “while under the influence of an alcoholic beverage and a drug and under their combined influence.” On Wednesday, the prosecutors clarified that the word “drug” was simply boilerplate language.

“I believe that the drug reference is part of the statutory boilerplate language in the complaint,” Pelosi’s attorney Amanda Bevins told Fox News.

The “boilerplate” assertion was confirmed by the Napa County District Attorney’s Office office on Wednesday.

“She is correct. It is boilerplate language auto-generated in the complaint. Our theory is alcohol,” Assistant District Attorney Paul Gero confirmed to the outlet.

On May 28, police arrested Paul Pelosi after his 2021 Porsche collided with a 2014 Jeep on a Highway 29 intersection. His blood alcohol level stood at .082 percent; the California legal limit is .08 percent. The two charges filed by the Napa district attorney include “driving under the influence of alcohol causing injury and driving with a .08% blood alcohol level or higher and causing injury,” according to the Napa Valley Register.

Both Pelosi and the driver, identified only as John Doe, denied medical treatment at the scene, but Doe later told Napa prosecutors that he had suffered pain in his upper right arm and neck the day after the crash.

Paul Pelosi has pleaded “not guilty” to the charges.

The California Highway Patrol (CHP) has yet to release the bodycam footage of Pelosi’s arrest, charging that doing so could “jeopardize” the investigation.

“The Public Records Unit (PRU) has determined the Department possesses records responsive to your request,” the CHP said in response to a query from Fox News. “However, the Napa County District Attorney’s Office has advised the release of records would jeopardize an ongoing investigation. As such, records are being withheld pursuant to Government Code section 6254 (f).”