video

THE DOCTRINE OF THE N.A.F.T.A. GLOBALIST DEMOCRATS IS TO SERVE THE BILLIONAIRE CLASS WITH ENDLESS WAVES OF INVADING 'CHEAP' LABOR SUBSIDIZED WITH WELFARE FUNDED BY TAXES ON MIDDLE AMERICA. In many speeches, Mayorkas says he is building a mass migration system to deliver workers to wealthy employers and investors and “equity” to poor foreigners. The nation’s border laws are subordinate to elites’ opinion about “the values of our country,” Mayorkas claims.

video

BLOG LAUGH OF THE DAY: THEY CAN NEVER STOP LYING TO US!

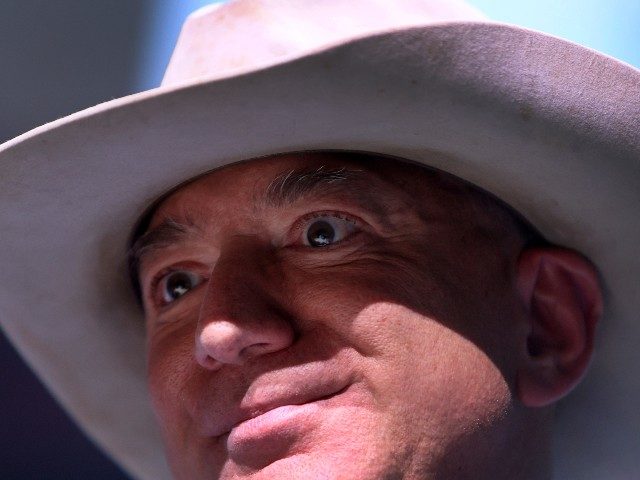

E-commerce giant Amazon has suffered a significant drop in share value following a recently reported loss in the first quarter of 2022 of $3.8 billion. As of Friday afternoon, Amazon shares are down more than 15 percent in intraday trading.

CNBC reports that shares of Amazon dropped by as much as 15 percent on Friday following a poor revenue outlook and major losses reported in the first quarter of 2022. The company projects revenue between $116 billion and $121 billion in the second quarter, lagging behind the $125.5 billion average analyst estimate. The second-quarter revenue growth forecast predicts a dip to a range of three to seven percent from a year earlier, another slowdown compared to a year earlier when revenue increased by seven percent.

Amazon lost $3.8 billion in the first quarter compared to a profit of $8.1 billion at this time last year. Amazon’s investment in the electric SUV firm Rivian reportedly weighed heavily on its profits. William Blair analysts, who have an outperform rating on Amazon shares, said in a note to clients on Thursday:

While sales were short of expectations by a mere $6 million, the bigger headline was the company’s first quarterly loss since 2015, at a loss per share of $7.56, or nearly $16.00 shy of the Street’s earnings per share expectations

Under the hood, the company reported an $8 billion pretax loss related to its investment in Rivian Automotive. Recall the company reported a $12 billion benefit in the prior quarter related to the investment. We estimate the company’s earnings per share excluding the investment-related loss would be roughly $3.40, still 60% below consensus as the company continues to face headwinds related to shipping, labor, excess capacity, and tough prior-year comparisons.

Truist Securities analyst Youssef Squali remains positive on the future of the company, however, stating: “We should start seeing material improvement to labor and fixed cost efficiency in 2H22, starting with Prime Day in July and then in the seasonally strong 4Q22.”

Read more at CNBC here.

Lucas Nolan is a reporter for Breitbart News covering issues of free speech and online censorship. Follow him on Twitter @LucasNolan or contact via secure email at the address lucasnolan@protonmail.com

April was a painful month for investors in the U.S. stock market, climaxing with a brutal sell-off in the final hour of trading Friday.

The Nasdaq composite fell by nearly 4.2 percent on Friday, falling by 536 points. More than 100 points of that decline came in the final half hour of trading. For the month, the tech-heavy index is down by more than 13 percent, the worst monthly performance since October 2008.

The Dow Jones Industrial Average fell 939 points, a 2.8 percent decline, on Friday, bringing its full month decline to 4.9 percent. Two hundred and 12 points of that decline came in the final half-hour.

The S&P 500 dropped by 3.6 percent and has now been down for four straight weeks. Its total decline for the month amounts to 8.8 percent.

Tech stocks, which were some of the biggest winners in recent years, have seen the worst of the recent declines.

Collectively, the so-called FAANG stocks—Facebook, Apple, Amazon.com, Netflix, and Google—have shed more than $1 trillion in market value in April. Shares of Facebook are down 12 percent. Apple shares have fallen 11.2 percent. Netflix shares crashed a jaw-dropping 50 percent. Google shares nosedived 19.6 percent.

Investors have been rattled by the Federal Reserves’ plans to hike interest rates rapidly in the coming months and by forecasts that these hikes could push the economy into a recession next year. Inflation has proved much stronger than many expected, which means the Fed will likely have to make financial conditions very tight to bring it under control. A surge of infections in China has triggered lockdowns of entire cities, giving rise to worries of renewed supply chain disruptions, and ongoing war in Ukraine has fostered fear over shortages of food, metals, and energy commodities.

Search This Blog |