Warning that Wall Street bubble may burst

The Wall Street surge, which last year saw hundreds of billions of dollars poured into the coffers of the financial oligarchy making Tesla chief Elon Musk the world’s richest man, has continued into the new year. So far this month the Dow has hit a record high three times.

Not even the events of January 6, when fascist forces at the urging of President Trump stormed the Capitol building in the attempt to carry out a coup, could halt its rise.

Amid the rising death and infection toll from the COVID-19 pandemic, the chief reason for the market surge, since the market plunged in mid-March, is the knowledge that any serious downturn will see the Fed intervene with billions of dollars to prop it up. The Fed has is already pumping in $120 billion a month—more than $1.4 trillion a year—and has pledged to keep interest rates at near-zero for the indefinite future.

A new factor has now entered into market calculations. It is anticipated that a Biden administration, assuming it takes office, will provide a further boost with increased stimulus packages to aid the corporations.

The nomination of former Fed chief Janet Yellen as Treasury secretary, regarded as a friend of Wall Street in her time at the central bank and the recipient of more than $7 million in speaking fees from major financial firms in 2018 and 2019, has been another boost for markets.

But concerns are starting to be voiced that the orgy of speculation, literally feeding off the death and destruction of the pandemic because of the actions of the Fed, could end in a major crash.

There has been commentary in the financial media over the warnings issued by Jeremy Grantham head of the investment firm GMO that the speculative bubble could be about to burst.

In a comment posted on January 5, he wrote: “The long bull market since 2009 has finally matured into a fully-fledged epic bubble. Featuring extreme over-valuation, explosive price increases, frenzied issuance, and hysterically speculative investment behaviour, I believe this event will be regarded as one of the great bubbles of financial history, right along with the South Sea bubble, 1929 and 2000.”

Grantham pointed to a number of indicators in support of his warning. He noted that one of the features the last stages of all previous bubbles was “really crazy behaviour.” In the first ten years of the latest bull-run “we lacked such wild speculation” but “now we have it in record amounts.”

Another indicator is the record number of initial public offerings (IPOs) this year as start-up companies seek to jump on the stock market escalator by going public. In 2020 there were 480 IPOs, compared to 406 in 2019. One of the most significant features was that 249 of these were special purpose acquisition companies (SPACs). These are shell companies set up to take over another company which is looking to come onto the share market, enabling it to bypass the usual, sometimes lengthy procedures involved in a traditional IPO.

An even better measure of “speculative intensity” than the prevalence of SPACs, he wrote, was the character of the present bull market, which made it totally different from any previous bubble that all took place when the underlying economy appeared to be enjoying rapid growth.

The present-day “wounded economy” was “only partly recovered, possibly facing a double-dip, probably facing a slowdown, and certainly facing a very high degree of uncertainty.”

While the price-earnings ratio in the stock market is in the top few percent of the historical range, he noted, the economy is in the worst few percent. “This time, more than in any previous bubble, investors are relying on accommodative monetary conditions and zero real [interest] rates extrapolated indefinitely.”

While the markets have received a boost from the prospect of increased spending from a Biden administration, this is something of a two-edged sword. Increased government spending means an increased issuance of government bonds thereby tending to bring about a fall in their price and a rise in their yield or interest rate.

There are signs of this phenomenon with the interest rate on the 10-year US Treasury bond rising to above 1 percent for the first time in months.

This is being hailed in some quarters as evidence that investors expect there will be a revival of economic growth and profits. That might have been the case in days gone by when financial markets bore some relation to the underlying real economy. But this is not the case now because corporate profit is increasingly dependent on the maintenance of ultra-low interest rates to prevent a rise in their debt burden and to finance their increasingly speculative operations such as share buybacks.

If the yield on 10-year Treasuries continues to rise, pushing up the cost of money throughout the economy, the Fed will move to intervene with further bond purchases, lifting their price, and keeping interest rates down. It has already been discussing so-called yield curve targeting in which it intervenes to keep the interest on selected bonds within a target range.

The massive increase in debt, both corporate and government, has meant that financial markets are extremely sensitive to even small rises in interest rates. According to one estimate, a 1 percentage point rise in interest rates today would have the same impact as a 3 to 4 percentage point rise of 20 years ago.

The only way that further money can be handed out to the corporations, without provoking an interest rate rise, is for the Fed to buy up the new government debt as it is issued—a further stateisation of the economy and the financial system for the benefit of speculators and the super-rich.

The present situation is the outcome of long-term trends in US economy. As the editor of the Financial Times, Rana Foroohar, noted in a recent comment: “Low interest rates have encouraged a massive flood of debt, little of which is productive. Since 1980, total US debt rose from 142 percent of gross domestic product to 254 percent in 2019.”

She cited research by economist Atif Mifan who noted that, if all this additional credit had been used for productive purposes, “we should have seen an explosion of investment. Instead, the investment share of national output declined from an average of 24 percent during the 1980s to 21 percent during the 2010s.”

This signifies that an increasing amount of debt has been used for speculative purposes such as share buy backs, once regarded as rigging the market but now standard practice for major banks and corporations, as well as the financing of mergers and acquisitions.

Mifan also noted that the rise in finance despite stagnation could “only be understood in light of arguably the most important ‘structural break’ in American society: the rising share of income going to the top 1 percent.”

That is, the financial house of cards is the outcome of the institutionalisation of financial mechanisms through which increasing amounts of the wealth of society is transferred to its upper echelons.

Herein lie the objective roots of the fascist coup attempt launched by Trump and the Republican party. As the WSWS perspective of January 7 explained: “Above all, workers must understand that the disintegration of American democracy is rooted in the crisis of capitalism. In a society riven by staggering levels of social inequality, it is impossible to preserve democracy.”

Democracy can therefore only be maintained through the mobilisation of the working class on the basis of a socialist program as the only antidote to the growing fascist threat.

Retail Sales Unexpectedly Crashed in December

U.S. retail sales declined sharply in December, as holiday shoppers stayed away amid surging coronavirus infections and the aftermath of Joe Biden’s presidential victory.

Excluding car and gasoline sales, retail sales fell 2.1 percent in the final month of 2020, data from the Commerce Department showed Friday. The prior month’s figure was revised down to show a 1.8 percent decline from the initial estimate of 0.8 percent, which means December was a bigger decline from a lower starting point.

The size of the downturn in sales caught economists by surprise. The consensus estimate was for just a 3-tenths of a percentage point decline.

Overall retail sales also declined by more than expected. These fell 0.7 percent for the month, worse than the flat to one-tenth of a point decline forecast. The prior month was revised down from a drop of 1.1 percent to a 1.4 percent decline.

Excluding vehicles but including gas, sales fell 1.4 percent, below the one-tenth expected decline. The prior month was revised down from of 0.9 percent decline to a 1.3 percent contraction.

Sales in the so-called “control group”—which excludes sales at auto dealers, building-materials retailers, gas stations, office supply stores, mobile homes, and tobacco stores—fell 2 percent, worse than the 0.2 percent decline expected. Many economists and investors consider the control group figure a more precise measure of consumer spending. This figure is a component of the personal consumption expenditure gauge used to calculate GDP.

As has frequently been the case throughout the pandemic, the economic effects have been uneven. Sales of autos and parts rose 1.9 percent in December and were 10.1 percent higher than the year ago level. Sales at electronics and appliance stores fell 4.9 percent and were 16.6 percent lower than December 2019, an indication that the pandemic took a steep toll on holiday shopping in these stores.

Sales in non-store retailers fell 5.8 percent but were 19.2 percent above last December. Sales were down on a monthly basis in November as well but 26.2 percent above the prior November.

Sales are bars and restaurants fell 4.5 percent in December and were down 21.2 percent from last year, the second worst year-over-year decline.

The worst year over year decline was in department stores, where sales were down 21.4 percent. Compared with the prior month, sales fell 3.8 percent.

Sales at home improvement and garden stores rose 0.9 percent and were up 17 percent compared with the year-ago figure. Sales at furniture stores fell 0.6 percent but were 3.1 percent from a year ago. Grocery store sales dipped 1.4 percent for the month but they are up 8.9 percent compared with last year.

Rep. Jason Smith: Joe Biden’s Budget Will Expose His Plan to ‘Significantly Raise Taxes on Working-Class Americans’

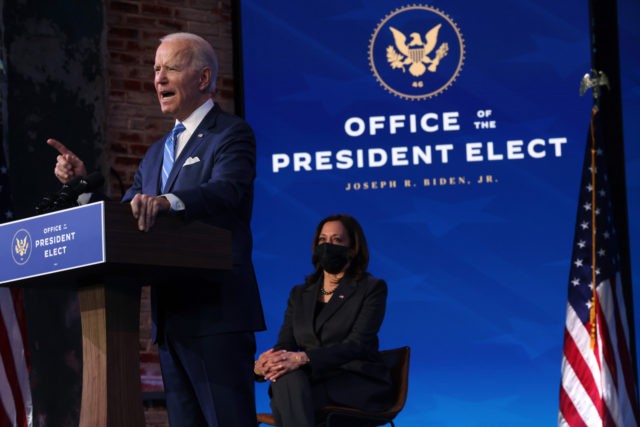

Rep. Jason Smith (R-MO), the House Budget Committee ranking member, sent a letter to Joe Biden transition chair Ted Kaufman, noting Biden’s first budget will expose the 46th president’s plans to raise taxes on working-class Americans.

In his letter to Kaufman, Smith noted the statutory deadline for the incoming administration to submit the fiscal year 2022 budget is February 1.

What are his plans? How will he fund them? What is the price tag? Does he intend to meet this deadline of transparency? If not, how long should we plan to wait? pic.twitter.com/JE6YAsy7w5

— Rep. Jason Smith (@RepJasonSmith) January 14, 2021

Recent media reports have suggested the Trump White House has “refused to direct staff and resources to help with the incoming Biden administration’s spending plans.” However, Office of Management and Budget (OMB) Director Russ Vought has fought back against these accusations.

“Our system of government has one President and one Administration at a time,” Vought noted in a December letter to Kaufman.

Smith noted in his letter to Kaufman that the OMB has “fully complied with the laws in advising” the Biden Transition Team (BTT), including:

- Providing all pertinent, factual information on ongoing programs as requested by the BTT, in addition to taking over 45 meetings with BTT staff.

- Fully apportioning the requested $9.9 million for transition activities by the General Services Administration (GSA) within hours of the GSA providing ascertainment on November 23, 2020.

- Briefing BTT on funding streams concerning Operation Warp Speed and other COVID [Chinese coronavirus] relief efforts.

Further, Smith noted Biden’s planned proposal will be the “first true chance for the American people to see how the Biden Administration plans to pay for campaign promises and its plan to significantly raise taxes on working-class Americans to fund its agenda.”

As the highest-ranking Republican on the Budget Committee, Smith has called out Democrats’ removal of a budgetary restraint on government spending, known as the pay-as-you-go provision, or PAYGO. This would enable Democrats to spend further on climate change proposals such as the Green New Deal.

“On only day two of the 117th Congress, House Democrats are already attempting to strip Americans of the transparency they deserve in order to push through an expensive progressive wish-list,” Smith said.

“This exemption was designed as a mechanism to ram through socialist policies like the Green New Deal and other ideas aimed at hurting American workers, families, and farmers,” he added.

Sean Moran is a congressional reporter for Breitbart News. Follow him on Twitter @SeanMoran3.

No comments:

Post a Comment