KAMALA HARRIS - I CAN CON THEM! I'M A LAWYER, IT'S WHAT I HAVE DONE MY ENTIRE BRIBES SUCKING LEGAL CAREER!

https://kamala-harris-sociopath.blogspot.com/2020/09/kamala-harrs-i-can-con-them-im-lawyer.html

All of this is, if we can be permitted to use Biden’s catchphrase, “malarkey.” Harris has already proven herself as a trusted servant of the interests of the rich and powerful at the expense of the working class. The Wall Street Journal wrote last week that Wall Street financers had breathed a “sigh of relief” at Biden’s pick of Harris. Industry publication American Banker noted that her steadiest stream of campaign funding has come from financial industry professionals and their most trusted law firms.

There is something fitting in the selection of Harris to co-lead the Democrats’ ticket. The response of the Democrats to the mass multi-racial and multi-ethnic protests against police violence that erupted earlier this year was to divert them into the politics of racial division, using the reactionary and false claim that what was involved was a conflict between “white America” and “black America,” rather than a conflict between the working class and capitalism.

Nervous opening expected for Wall Street

The key questions that will be uppermost when Wall Street opens today are whether the speculative frenzy in GameStop and other companies, whose shares have been shorted by hedge funds, will continue, and whether the downturn in the broader market, evidenced by significant falls at the end of last week, will deepen.

The two phenomena are interconnected. There are fears the surge in shorted stocks, which has resulted in a 1600 percent rise in GameStop shares since the start of the year, coupled with rises in others, such as AMC, up by 300 percent, is a sign that the Wall Street bubble may be about to collapse.

As the Financial Times noted: “The frenzied trading of the past week has fuelled concerns that a speculative bubble … could trigger a sharp market pullback.”

The reason is that the GameStop frenzy is only the most egregious expression of the speculative bubble that is Wall Street as a whole.

The surge in GameStop and other targeted companies represents the complete divorce of the market value of their shares from the underlying economic reality. GameStop, a retailer of video games, had seen its revenues halved in the last 10 years and then experienced a 31 percent fall in sales in the first nine months of last year. But its market value as a result of the speculation makes it a $25 billion company.

What could be called the “GameStop strategy” involves buying up the shares of companies that have been “shorted” by major hedge funds. Shorting is a process in which a hedge fund borrows the shares of a company, sells them in anticipation they will fall—a result which can result from the shorting action itself—and then buys the shares at the lower price, returns them to the original holder, making a profit on the deal.

But if the share price rises, as has happened with the targeting by retail investors of shorted stocks using a Reddit platform, the hedge fund has to buy the shares at a higher price, thereby making a loss.

The extent of the losses by the hedge fund Melvin Capital, a significant shorting player, as a result of last week’s GameStop surge, is now being revealed.

According to a report in the Wall Street Journal, Melvin, which had previously been regarded as successful, started the year with about $12.5 billion on hand, but lost 53 percent in January. It now has capital of around $8 billion, which includes $2.75 billion of emergency funds injected into it by two other funds, Citadel and Point72 Asset Management.

The extent of the losses at Melvin, together with the possibility that other hedge funds could also lose large amounts, has sparked the concern of the Securities and Exchange Commission, the Wall Street regulator.

In a statement issued on Friday, the SEC said it was closely monitoring and evaluating the extreme volatility of a number of the stocks.

The statement began with an assurance that the “core market infrastructure” had proven “resilient” under the impact of the “extraordinary” weight of last week’s trading volumes, but then added:

“Nevertheless, extreme stock price volatility has the potential to expose investors to rapid and severe losses and undermine market confidence.”

The concern of the SEC is not the fate of the hundreds of thousands of small retail investors and individual stock market players who have been caught up in the frenzy. It fears that if there are further major losses by hedge funds, defaults on debts and a major sell-off, this could set off a crisis.

No doubt the SEC has in mind the experience of 1998, when the bankruptcy of the hedge fund Long Term Capital Management, threatened the entire market, prompting a rescue operation by the New York Federal Reserve.

The speculation in GameStop and other shorted stocks is not only the result of the activity of retail investors.

Long-time hedge fund operator and noted short seller Jim Chanos told the Financial Times that the events of the past 10 days were “surreal,” unlike anything he had witnessed in his 40 years in finance.

He poured cold water on the claim, widely circulated on Reddit and on other platforms, that the speculation hitting hedge funds was “sticking it to the suits,” noting that besides some retail investors “a bunch of hedge funds have made a lot of money.”

On Thursday, an angry social media storm arose over the decision by the sharebroker Robinhood, the main firm through which the retail surge has taken place, to suspend purchases of GameStop shares and other shorted stocks with the claim that this was the result of intervention by major hedge funds to protect their positions.

While it cannot be ruled out that Robinhood was leant on, the real reason for the suspension in trading appears to be that the brokerage firm could not finance the increased volume of deals. Share trades pass through a clearing-house before they are finalised, in a process that can take as long as two days.

Clearing-houses require that brokerages post collateral for their trades in case there is a default. Because of the increased volume of its deals, Robinhood was forced to obtain a cash infusion of more than $1 billion. Lenders included JP Morgan Chase and Goldman Sachs.

In a series of interviews explaining the suspension, Robinhood CEO Vlad Tenev said it was “not negotiable” for the firm to “comply with our financial requirements and our clearing house deposits.”

The Depository Trust and Clearing House Corp has not provided details of how much money individual firms are required to supply to cover their trades, but on Friday it was revealed that the total capital it required to be placed under its jurisdiction had increased from $26 billion to $33.5 billion.

In a statement, the DTCC said that the frenzied trading in stocks, such as GameStop and the movie chain AMC, “generated substantial risk exposure at firms that clear these trades ... particularly if the clearing member or its clients are predominantly on one side of the market.”

Under normal circumstances the activities of the DTCC pass unnoticed, in the background. But in times of great turbulence, calls for increased money to be placed with it as collateral can have a major impact. In reporting on this development, the Financial Times noted that, during the market crisis in mid-March, one US bank was required to find $9.6 billion in the course of an hour to finance derivative trades.

Cutting through the hype on social media that the surge is some kind of rebellion or even a “revolution” against the titans of Wall Street and a movement to “democratize finance,” the essential reason can only be found in the most fundamental feature of the entire financial system.

This is the divorce between the market value of shares and other financial assets, and the underlying real economy. This process, which began 40 years ago, was accelerated first by government bailouts and the provision of ultra-cheap money by the Fed, after the 2008 crisis, and was given a further boost when the government and the Fed injected trillions of dollars into the financial system as a result of the market crisis in mid-March last year.

Since then, amid the worst economic contraction since the Great Depression and the loss of millions of jobs, Wall Street is up more than 66 percent, with stocks such as Tesla, which returns only a relatively small profit, escalating by 900 percent. The escalation of the stocks of companies that are either in bankruptcy or on the road to it, was first seen immediately after the Fed’s March intervention, when the stocks of the car hire firm Hertz spiked 900 percent after it had filed for bankruptcy.

In an editorial last week entitled, “The Reddit Wolves of Wall Street” the Wall Street Journal referred to the present situation as one of “high financial drama.” It then offered a reassurance to its readers and to itself that: “This may be a new example of the power of social media, but it isn’t a crisis of capitalism or the stock market.”

The editorial went on to point to the underlying driving force of this speculation.

“The government body that should come in for more introspection is the Federal Reserve. The central bank may be feeding the asset frenzy as it holds interest rates near zero and crushes the long bond yield curve so it doesn’t send accurate price signals. As investors search for yield they move into commodities, real estate, junk bonds, foreign currencies – and stocks.”

But that analysis only raises another question, which the WSJ does not care to probe. Why does the Fed not end this policy which, as the editorial implicitly acknowledges, can only lead to a disaster?

The short answer is that it is incapable of doing so. It is locked into the escalation of financial assets by the injection of ever-greater amounts of money, because to end it would bring about a collapse of the financial house of cards with devastating economic and financial consequences.

That, by any definition, signifies a crisis of capitalism. The fact that the WSJ raises this prospect, only to immediately rule it out, is a sure sign that it smells the odour of death wafting up from the open grave of the system it so strenuously defends.

But the ending of the capitalist profit system, no matter how deep its crisis, will not come about automatically. Rather, its death agony will result in social destruction and the eruption of the class struggle, for which the ruling class is making its preparation through the cultivation and development of fascist forms of rule, as revealed by the events in Washington of January 6.

The capitalist system is caught in the coils of an ever-tightening crisis. But it can only be overturned, and a higher form of socio-economic organisation developed, through the conscious political struggle by the working class to take power in its own hands—a struggle for which the crisis on Wall Street must provide further impetus.

Hawley: Dems Want Big Corporations Acting as ‘the Hand of the Government’

During Sunday’s “Life, Liberty & Levin” on Fox News Channel, Sen. Josh Hawley (R-MO) warned of big corporations acting as “the hand of the government.”

According to Hawley, Democrats are cheering on big tech companies and big corporations to use their “unprecedented concentration of power” to impose their viewpoints on the American public.

“What we have is an unprecedented concentration of power by these corporate monopolies working in league with the left,” Hawley told host Mark Levin. “I call them the woke capitalists. You know, they are only interested in capitalism in so far as they can control it and use it to impose their viewpoints on the American public. You know, our founders, they were against monopolies. They really hated monopolies. They were very wary of monopolies, and rightfully so because when you concentrate power in a few hands, bad things always happen. And that’s what’s happening now, Mark.”

“You’ve got these big tech companies who effectively control more and more speech in America,” he continued. “We have seen how they want to use that. They want to shut down conservatives, they want to shut down libertarians, they want to take down competitors like Parler, they want to tell you what you can and cannot say. And it’s not just the tech companies. It’s also the corporate monopolies in other areas.”

Hawley went on to say this is something that has not been seen in America before.

“We’re dealing with a party now that loves the idea of concentrated power, that loves the idea of power gathered into a few hands. I mean … they are the party of the powerful. I mean, there is no doubt about it. They are a party of biggest monopoly corporations, they’re the party of big tech, they are a party of Hollywood, of course — and have been for years,” he advised.

“The Democrats, they love what tech is doing,” Hawley added. “When … tech destroyed Parler, destroyed a competitor, you talk about an antitrust violation, the Democrats cheered them on. They thought that was wonderful. When tech is out there censoring conservatives, kicking them off the platform, they thought that was wonderful. They want them to do more. What they basically want to do is use these corporations as the hand of government.”

Follow Trent Baker on Twitter @MagnifiTrent

For the last 70+ years, the U.S. has inundated the American people with the message that capitalism is a magic formula for economic well being. This ideology thrives even despite clear indications over the last few decades that the profit system that once boosted the United States economy has been abandoning Americans.

What are these messages that keep this unjustified faith in capitalism so strong? Professor Wolff talked about some of them in a recent article entitled “How Capitalism’s Dogged Defenders and Propagandists Defend It From Criticism.”

In this piece, Professor Wolff discusses one particular technique used by defenders of capitalism: "For defenders, placing adjectives before the word ‘capitalism’ removes its core ‘relations of production’ from criticism. The focus of analytical attention becomes the adjective, not the noun."

Two examples: “crony capitalism” or “conscious capitalism.” Does this sound familiar to you? With a grammatical twist, your attention is diverted away from the root of the matter. It’s as easy as that.

“[Capitalism’s defenders] increasingly resort to attaching qualifying adjectives to capitalism and deflecting criticisms onto them. They say that the capitalism they support is a particular kind of capitalism… Many defenders go a step further: kinds of capitalism lacking those adjectives are not “really” capitalism at all. ”

Such tactics have been used time and time again. Those desperate to hold onto slavery argued the important differences between “harsh” versus “compassionate” slavery. Those clinging to monarchies would denounce “bad” Kings while arguing on behalf of “good” ones.

“The placing of qualifying adjectives to differentiate among kinds of capitalism allows defenders to accept some of the rising chorus of criticisms of capitalism. Those criticisms, defenders say, apply only to certain kinds of capitalism that defenders also reject in favor of some other, preferred kind of capitalism.”

This suffocating indoctrination is being unravelled, albeit slowly. The more we can clarify these distractions and hold the debate to the root of the matter, the more quickly we can move beyond the exploitation inherent in capitalism.

“Our current debates about our society’s problems and prospects need to refocus beyond the different adjectives for a common noun they qualify. It is time to expose and challenge capitalism’s core: that employer-employee organization of enterprises, private and state.”

Read the full article on Prof Wolff’s website, where you can also see up to date postings of some of his most recent media appearances.

NO ONE COULD GET A JOB IN THE LAWLESS OBOMB BANKSTER REGIME WHO HAD NOT DEMONSTRATED A LONG HISTORY OF SERVICING BANKSTERS. THAT IS WHY JOE BIDEN WAS SELECTED AS OBOMB'S V.P. THAT IS WHY BOTH OBOMB'S A.G. CAME FROM LAW FIRMS THAT PROTECTED CRIMINAL BANKSTERS, THAT IS WHY JOE BIDEN SELECTED BANK BRIBES SUCKER KAMALA HARRIS AS VP. SHE PROTECTED WELLS FARGO, THE BANKSTERS WHO BROUGHT CALIFORNIA REAL ESTATE TO MELTDOWN. SHE SAW HOW OBOMB-BIDEN-HOLDER SERVICED BANKSTERS AND THEN PROTECTED 'KING OF FORECLOSURE, FILTHY GOLDMAN SACHS BANKER STEVEN MNUCHIN. JUST FOLLOW THE MONEY WITH THESE FILTHY SLUTS FOR BANKSTERS!

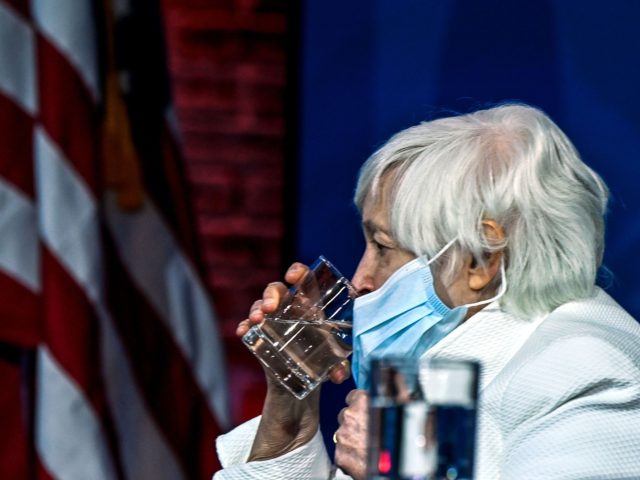

Janet Yellen Briefs Joe Biden on the Economy After Populist Trading Movement Shakes Wall Street

Treasury Secretary Janet Yellen will brief President Joe Biden on the economy Friday after a populist trading group on Reddit shocked the major Wall Street hedge funds.

Yellen will meet the president on Friday morning, according to the president’s schedule.

The trading app Robinhood infuriated users on Thursday for blocking purchases of stocks popularized by Reddit such as GameStop.

The hedge fund Citadel helped bail out Melvin Capital after the hedge fund lost billions by betting against GameStop before Reddit traders rallied to boost the stock price to unprecedented heights.

Several of the biggest online stock trading companies experienced outages on Wednesday as shares of GameStop, AMC, Nokia, Blackberry, and Koss surged higher. https://t.co/YxvGtZTybb

— Breitbart News (@BreitbartNews) January 27, 2021

Reddit traders, however, remain skeptical of Yellen’s monitoring of the situation, after receiving more than $800,000 in speaking fees from Citadel before she was appointed by Biden as treasury secretary.

White House press secretary Jen Psaki dodged questions about whether Yellen would recuse herself from the issue.

“I don’t think I have anything more for you on it, other than to say, separate from the GameStop issue, the Secretary of Treasury is one of the world-renowned experts on markets, on the economy,” she said. “It shouldn’t be a surprise to anyone she was paid to give her perspective and advice before she came into office.”

Nolte: Bribes and Payoffs Disguised as ‘Speaking Fees’ for Treasury Secretary Janet Yellen

Janet Yellen, the former chairwoman of the Federal Reserve who is now His Fraudulency Joe Biden’s Treasury Secretary, made millions off Wall Street “speaking fees” over the past two years.

In some cases, she didn’t even have to show up to speak. Her appearance was “virtual.”

In just two years, according to the Wall Street Journal, Yellen pulled in “more than $7 million in speaking fees during more than 50 in-person and virtual engagements … according to financial disclosures[.]”

The far-left Politico adds:

Yellen listed $952,200 in income from speeches to Citi, one of the nation’s largest banks. She also disclosed speaking fees from PIMCO, Barclays (BCS), Citadel, BNP Paribas, UBS (UBS), Credit Suisse (CS), ING, Standard Chartered Bank and City National Bank.

Nearly a million bucks … from one bank!

Fox Business reports:

Other companies shelling out big bucks for Yellen’s words of wisdom have included Goldman Sachs, Google, City National Bank, UBS, Citadel LLC, Barclays and Salesforce, according to the report.

So when the White House was asked this week if Yellen’s speaking fees have created a painfully obvious conflict of interest as it relates to this Gamestop/Robinhood/Reddit story, Press Secretary Lyin’ Ginger sputtered:

I don’t have anything further for you on it, except for to say, separate from this Gamestop issue, the Treasury Secretary is a world-renowned expert on the economy.

It should not be a surprise to anyone that she was paid to give her expert advice before she came into office.

Oh, well, that certainly puts the issue to rest!

I mean the fact that (as Real Clear Politics perfectly summarized it) “Citadel, the firm that bailed out the first hedge fund to be bankrupted by the crowd-sourced stock-buying bonanza this week, has paid Yellen more than $800,000 in speaking fees in recent years,” is nothing to be concerned about! Not even as we watch a countless number of everyday retail investors getting shut down in an effort to protect Yellen’s billionaire pals at Citadel and elsewhere.

If you want a look at how this grift works, Jack Posobiec tweeted out a bare bones list of Yellen’s Wall Street speaking fees, and this simple list is more striking than any newspaper write-up. The numbers are outrageous. Why would anyone drop hundreds of thousands of dollars to have some former fed chair come in to tell tired war stories and do some punditry?

What I mean by that is: What’s the benefit to the financial firm shelling out all this money (plus airfare and fancy accommodations)?

Even more, what’s the benefit if she appears virtually from her kitchen at home?

Does the presence of a 74-year-old former-Fed Chair bring these financial firms more customers? Does the prestige and star power of such an appearance increase the firm’s client list?

Of course not.

You wouldn’t walk across the street to see Janet Yellen for free, even if free lunch was served.

So what does this tell us about these speaking fees?

Sorry, but these speaking fees are nothing more than America’s elites figuring out a way to legalize bribes and payoffs. That’s it. That’s all that’s going on here.

While it may not be legal for me to hand you an envelope full of cash, it’s perfectly legal for me to fly you out in a private plane (or first class), put you up in a suite, wine you and dine you, and then hand you a gazillion dollar check for an hour’s work because wink-wink-nod-nod-knowwhatImean-knowwhatImean?

We see the same thing all the time with book advances.

Some pol is paid an exorbitant amount of money to write a ghost-written book no one reads…

Get this…

In 2014, Gov. Andrew “Grandma Slayer” Cuomo (D-NY) was paid a $783,000 advance by Harper Collins to write his memoirs, which sold exactly 3,800 total copies. Harper Collins lost a fortune.

So why did the company do it?

Why would a publisher be willing to take a beating like that?

Gee, could it be that Harper Collins is New York-based and Cuomo is New York’s governor and this was a legal way to funnel him close to a million dollars in the form of legalized graft?

It gets worse…

Cuomo has so far refused to disclose how much Penguin Random House paid for his 2020 book American Crisis: Leadership Lessons from the COVID-19 Pandemic last year, but what we do know is that another major publisher gave this proven-failure of an author a second money grab.

The whole system is rigged, y’all.

The political media, the politicians, the government, and the financial media all attack who? The robber barons in these hedge funds who organize to make billions by destroying a company? No, they illegally shut down and smear the everyday guys on Reddit who had the temerity to play the same game and win.

Funnel a few million to Yellen, give CNNLOL and CNBC some nifty stock tips… That’s all it costs Wall Street to protect its billions and destroy the Reddit barbarians, whose only sin is outsmarting you.

And it’s all legal.

Rigged. Rigged. Rigged.

Follow John Nolte on Twitter @NolteNC. Follow his Facebook Page here.

Capitalism vs. Socialism: The Pandemic and the Global Class Struggle

It is one year since the World Health Organization (WHO), on January 30, 2020, declared that the outbreak of COVID-19 constituted a Public Health Emergency of International Concern (PHEIC).

WHO Director-General Tedros Adhanom Ghebreyesus issued a statement accompanying the declaration noting that 98 cases had been reported in 18 countries outside of China. “Although these numbers are still relatively small compared to the number of cases in China,” he said, “we must all act together now to limit further spread.”

One year later, the total number of cases has passed 100 million. The total number of deaths has reached 2,225,000. The daily death toll is the highest it has ever been, with more than 14,000 people succumbing to the virus every day.

In the United States, there have been 26,107,110 cases, according to the Johns Hopkins Coronavirus Research Center, and the death toll has reached 440,000. In India, there are more than 10 million reported cases and 154,000 deaths. In Brazil, more than 9 million cases and 223,000 deaths. In the United Kingdom, nearly 4 million cases and 106,000 deaths. In Italy, 2.5 million cases and more than 88,000 deaths.

The International Committee of the Fourth International, at the earliest stages of the crisis, identified the pandemic as a “trigger event,” comparable to World War I, that would intensify and accelerate the profound contradictions of the global capitalist system. The health crisis would evolve inevitably into a global social and political crisis. Medical measures alone would not bring the pandemic under control.

Rather, the struggle to contain the pandemic would develop into a class struggle, as it became increasingly clear that the major classes in society—the capitalist class and the working class—have irreconcilably opposed interests. These antagonistic positions find expression in the conflict between the capitalist and socialist programs.

The positions of the ruling class proceed from the defense of capitalist property: the private ownership of the means of production and the geostrategic interests of the nation state. The positions of the working class strive objectively toward socialism: the ending of the profit system and exploitation of labor, and its replacement with the scientifically planned reorganization of economic life on the basis of human needs and the global unification of mankind through the abolition of the nation-state system.

One year into the crisis, the pandemic has starkly revealed the class divide that separates the capitalist and socialist programs.

1. The capitalist program insists that the response to the pandemic must prioritize saving the financial markets over saving lives.

The socialist program insists that the response to the pandemic must prioritize saving lives over saving the financial markets.

2. The capitalist program asserts that pandemic policy must be driven by profit interests.

The socialist program advocates that medical policy must be guided by science.

3. The capitalist program advocates a program of “herd immunity,” allowing the virus to spread with as few restrictions as possible while vaccinations are produced and distributed.

The socialist program calls for all measures to impede virus transmission until the necessary number of people to stop community spread of the virus has been inoculated.

4. The capitalist program insists, in accordance with its “herd immunity” strategy, that factories and other workplaces be kept open for business.

The socialist program insists that all nonessential workplaces be closed down until inoculated workers can safely return to their jobs.

5. The capitalist program demands that schools be reopened, claiming falsely that there is little risk to students and teachers.

The socialist program, based on scientific evidence that schools are a major source of virus transmission, demands that schools remain closed until the pandemic has been brought under control.

6. The capitalist program seeks to restrict social expenditures aimed at counteracting the economic impact of the pandemic on the great mass of the people, while demanding that central banks provide unlimited support for the financial markets and large corporations.

The socialist program demands full income compensation to workers and small businesses for the duration of the crisis. The resources for this critical social rescue plan will be obtained through the immediate restitution of the trillions of dollars extended to the large corporations under the provisions of the CARES Act, and the expropriation of the Pandemic Profiteers who have made tens of millions and even billions of dollars as a result of unlimited Federal Reserve support for the financial markets.

7. The capitalist program promotes a policy of vaccination nationalism, restricting and opposing equitable distribution of vaccines throughout the world.

The socialist program, recognizing that the coronavirus can be eradicated only through a scientifically directed international strategy, calls for a globally coordinated inoculation program.

The divergent class interests in responding to the coronavirus pandemic are behind the increasingly sharp political divisions. The ruling class, fearful of mounting opposition to its profit-driven program of herd immunity, is encouraging the growth of fascist organizations.

The working class, in developing its own response to the pandemic, is recognizing the need for class unity, militant class action and, above all, an international socialist and revolutionary political strategy.

No comments:

Post a Comment