Survey: Less than Half of Democrats Say Capitalism Is Better than Socialism

By Craig Bannister | April 30, 2021 | 4:05pm EDT

By Craig Bannister | April 30, 2021 | 4:05pm EDT

Less than half of Democrat voters believe that Capitalism “is a better system” than Socialism, a new Rasmussen survey finds.

In a national poll of 1,000 U.S. likely voters, conducted April 27-28, 2021, Rasmussen found that more than three times as many Americans prefer Capitalism (65%) over Socialism (18%). Another 17% say they’re not sure which system is better.

But, among Democrats, just 46% favor Capitalism, compared to 84% of Republicans and 66% of other political affiliations. Only 2% of all U.S. voters who “strongly disapprove” of Democrat President Joe Biden say Socialism’s a better system, while 26% of those who strongly approve of Biden prefer Socialism.

Democrats are far more likely than Republicans to think that the current U.S. economy is a “free market economy,” rather than a “Socialist economy.” Fully 75% of Democrats consider the U.S. economy to be either “generally” (41%) or “partially” (34%) free market.

Conversely, barely half (51%) of Republicans say today’s economy is either generally (18%) or partially (33%) free market. Among all voters, 28% say the economy is generally free and 33% consider it partially so, while 30% see it as being either somewhat (23%) or mostly (7%) driven by socialism.

By age, the youngest U.S. voters are the most likely to believe Socialism is superior to Capitalism. Thirty-one percent (31%) of voters 18-39 years old pick Socialism, compared to 13% of those 40-64 and just 9% of those 65 years and older.

Less than half of those 18-39 (48%) favor Capitalism, compared to more than seventy percent of older Americans.

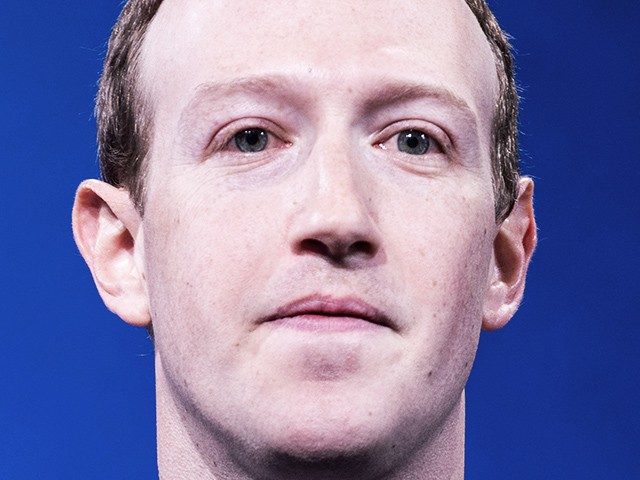

Land Grab: Mark Zuckerberg Almost Doubles His Hawaii Real Estate Holdings

Facebook CEO Mark Zuckerberg and his wife Priscilla Chan have nearly doubled the size of their real estate empire in Hawaii, buying another 595.4 acres on Kauai from Waioli Corporation, a nonprofit established by a local family with roots going back to the era of the Hawaiian kingdom.

Zuckerberg and Chan are now the owners of 1,300 acres of land in Hawaii after closing on a $53 million purchase of three parcels of nearly 600 acres on March 19, according to a report by Pacific Business News.

The purchase, which includes land fronting Larsen’s Beach, does not include the beach access road, which is owned by the county, and remains open to the public.

The Facebook CEO bought the land through an LLC registered in Delaware whose member is San Francisco-based Square Seven Management LLC. Square Seven is managed by wealth manager Iconiq Capital LLC, of which Zuckerberg is a client.

The report added that Zuckerberg began amassing the Kauai estate in 2014 when he bought the 357-acre Kahuaina Plantation from California investment firm Falko Partners. After that, the Facebook CEO bought another 384 acres from the late Hawaii auto dealer James Pflueger, and then added more in 2018 for a total of nearly 750 acres.

Zuckerberg’s entities also acquired titles to dozens of smaller lots within the larger parcels that were known as kuleana lands, the report adds.

The couple has reportedly been building residential and agricultural structures on the properties, which are being used for ranching.

Building permits — which total to more than $83 million — show that the largest permit was the 2018 application for a 57,059-square-foot single-family home, which includes a connected accessory building or dwelling with a total of eight bedrooms, nine full baths, and 16 half baths.

“The decision provides Waioli with the financial ability to be able to continue our critical conservation and historical work and ensure that Kauai’s cultural history continues to be shared in the community for years to come,” said Waioli Corp. president Sam Pratt.

Waioli is a nonprofit organization established by members of Kauai’s kamaaina Wilcox family, who are descended from missionary schoolteachers Abner and Lucy Wilcox, from the Kingdom of Hawaii era.

Pratt added that Waioli chose Zuckerberg and Chan after seeing their “dedication over the years to land conservation, protecting native species and working to preserve the natural beauty of Kauai.”

“We know that this land will remain in their trusted hands and that Mark and Priscilla will act as responsible stewards of Lepeuli today and in the future,” he said.

You can follow Alana Mastrangelo on Facebook and Twitter at @ARmastrangelo, on Parler @alana, and on Instagram.

No comments:

Post a Comment