Can Amazon Be Stopped?

The story of the e-commerce giant is the story of America’s economic unraveling.

About two and a half years ago, as media speculation about where Amazon would locate its second headquarters reached a fever pitch, The Onion, a satirical website, decided to make its own projection. “‘You Are All Inside Amazon’s Second Headquarters,’ Jeff Bezos Announces to Horrified Americans as Massive Dome Envelops Nation,” the site declared. The story described a world in which Amazon divided the United States into segments of its supply chain. “The entire state of Texas will be replaced with a 269,000-square-mile facility used exclusively to house cardboard boxes, tape, and inflatable packaging materials,” the authors wrote. “A large swath of the Midwest will soon be razed to make way for a single enormous Amazon Fulfillment Center.”

Fulfillment: Winning and Losing in One-Click America

by Alec MacGillis

MacMillan, 400 pp.

It was, of course, a joke. But based on reporting from the veteran ProPublica journalist Alec MacGillis, it’s a joke with more than just a ring of truth. In Fulfillment: Winning and Losing in One–Click America, MacGillis argues that Amazon’s dramatic expansion is Exhibit A for America’s economic unraveling. Armed with stark statistics and moving anecdotes, MacGillis illustrates how the retail giant pushes regional stores out of business. He shows how the company extracts tax incentives from desperate local governments in exchange for poor-paying warehouse jobs. Amazon has “segmented the country into different sorts of places, each with their assigned rank, income, and purpose,” he writes. It has altered “the landscape of opportunity in America—the options that lay before people, what they could aspire to do with their lives.”

It is a damning and powerful assessment. But Amazon isn’t MacGillis’s only, or even most fundamental, subject. Instead, he treats the company as both a cause and a symptom of a bigger problem: skyrocketing regional inequality in the United States.

Over the past 40 years, certain parts of America—mostly along the coasts—have become far more prosperous than others. This trend has not received as much attention as rising income disparities, but its political consequences have been similarly grave. Regional inequality has fueled authoritarian nationalism in the U.S. It has concentrated well-educated liberals in economically vibrant, overwhelmingly Democratic states. It has left white working-class voters elsewhere embittered and detached from mainstream politics. After decades of job losses and wage stagnation, it’s not surprising that some people in struggling counties embraced a candidate who promised to restore a halcyon era (“Make America great again”) and blamed their challenges on groups many were already prejudiced against (minorities). Donald Trump’s path to the presidency was paved in part by declining economic opportunity in the Midwest.

MacGillis provides readers with a useful primer on how this happened. Beginning in the late 1970s, politicians gradually stopped enforcing fair competition policies: the many laws designed to create an even economic playing field for different businesses and different parts of the country. Regulators started neglecting antitrust statutes, allowing a few companies in each sector to expand rapidly by purchasing or crushing their competitors. They loosened restrictions that had prevented chain stores, like CVS and Walmart, from dramatically underselling smaller rivals. And they eliminated regulations that made it equally easy to transport goods to and from all parts of America. “Profits and growth opportunities once spread across the country,” MacGillis writes. Now, they cluster in places where the dominant companies are based.

These trends are all bigger than any one business. But it’s easy to see why MacGillis chose to focus on Amazon specifically. The company owns a third of the country’s data storage market. It controls somewhere between roughly 40 and 50 percent of America’s e-commerce market, more than five times the share of its nearest rival. That makes Amazon both singularly powerful among U.S. businesses and representative of winner-takes-all corporate America at large. Together, Facebook and Google control more than 50 percent of the online advertising market. Like Amazon and its neighboring company Microsoft, they are headquartered only a few towns apart. Comcast and Charter, both located along the Acela corridor, collectively own a majority of the U.S. cable market.

These companies haven’t just survived the current recession. They’ve thrived. While the employment rate has gone down since COVID-19 arrived in America, the S&P 500 has gone up by more than 15 percent. All but one of the five richest companies have seen their value grow, including Amazon. Indeed, Amazon’s stock has increased by an astonishing 80 percent over the past 12 months. MacGillis writes that the company is reporting record profits.

The distribution of Amazon’s newfound wealth, however, has been deeply uneven. The company is hiring warehouse workers across America, but these low-paying jobs require famously long shifts, involve strenuous and monotonous work, and offer little autonomy. Meanwhile, Amazon is also expanding its Seattle and Washington, D.C., offices—adding well-paid, white-collar jobs in elaborately sculpted buildings with rooftop dog parks, onsite botanical gardens, and discounted child care.

Geographically, the United States was once an equitable place. Between the 1930s and the late 1970s, per capita earnings in almost every part of the country gradually converged. In 1933, the average income in the southwestern United States was roughly 60 percent of the national average. By 1979, it was approximately the same. During the same period, New England fell from being 1.4 times richer than the rest of the country to just above average. In 1978, the average income in the Detroit metro area was on par with that of New York City and its suburbs. Drawing on findings from this magazine, MacGillis notes that the 25 richest metropolitan areas in 1980 included Milwaukee, Des Moines, and Cleveland.

This equality was hard won. Starting at the turn of the twentieth century and accelerating during the New Deal, the federal government enacted antimonopoly laws to prevent extreme regional inequality. Throughout the middle of the twentieth century, it blocked mergers that today wouldn’t draw any attention—including one between two shoe companies that, together, controlled just over 2 percent of the nation’s footwear market—in order to keep chain stores from colonizing the country. It prohibited wholesalers and manufacturers from giving bulk discounts to these chains, which would put community retailers at a serious disadvantage. When national politicians spoke about the need to help small businesses, they meant it.

But like anything achieved through vigilant enforcement, this parity was easily erased. Beginning under Gerald Ford and Jimmy Carter and continuing under Ronald Reagan, the federal government started ignoring or outright repealing fair competition regulations. As a result, the fortunes of America’s regions diverged. The St. Louis metro area, for example, had 23 Fortune 500 companies in 1980, but in recent decades most have been acquired by larger corporations or otherwise pushed off the list. Today, it has only eight. By contrast, New York’s per capita income in 1980 was 80 percent higher than the national average. By 2013, after years of mergers in banking and finance, that figure was 172 percent. In 2018, 20 of the top 25 wealthiest cities were on the coasts.

As businesses departed from large swaths of the interior, many Americans were left without good economic options. Fewer businesses meant less competition among employers to drive up pay. The main employers that have moved in as most companies moved out—retailers like Walmart, Dollar Tree, Family Dollar, and Dollar General—are notorious for their low-wage business models. The bulk of the money each store makes flows out of the local community and into the company’s headquarters, almost always located far away.

But perhaps no growing employer is as notorious as Amazon. According to MacGillis, the company has hired hundreds of thousands of new warehouse workers in the past five years. It has added more than 175,000 during the pandemic alone, even as thousands of small retailers have shut down. The indignity of life in the company’s warehouses is well documented, but MacGillis makes space to describe the dangers. He recounts how one worker was killed after being crushed by a forklift, and how another was killed by a tractor. He covers various attempts by warehouse workers, some with past union experience, to organize for safer conditions. None of those attempts go well. (Hopefully, the ongoing union drive in Alabama will end with more success.)

Massive retailers with low prices, like Amazon, are not just a poor replacement for local employers. They are part of why local employers shut down. Inexpensive products are nice for customers, but they drive community stores straight out of business. And Amazon has tools beyond low pricing that it uses to squeeze competitors. The company is the main, and for many small businesses the only, way to sell products online. It capitalizes on this by forcing vendors on its platform to hand over a hefty percentage of their profits—usually 15 percent—for every sale, a transaction fee that MacGillis compares to a tax. Amazon also manufactures goods itself, often copying its vendors’ most popular products based on its privileged look at their sales data. Free of the same fee (the company doesn’t tax itself), Amazon sells these knockoffs at a lower price than the originals, driving the real creators into insolvency. As a result, money that would have gone to small businesses instead winds up with Amazon.

While consolidation has devastated most of America, it has been a boon for Amazon’s hometown. Once a manufacturing city as distressed as present-day Detroit, Seattle has become a rich tech mecca. The metro area has a median household income of $94,000, making it the ninth wealthiest in the country. Its population has roughly doubled since 1970. Not all of this can be attributed to Amazon; Boeing drew engineers to the area, and the city’s growth began in earnest when Bill Gates and Paul Allen set up shop to build Microsoft. But there’s no doubt that Amazon is now the city’s crowning jewel. It has accounted for 30 percent of all new jobs in Seattle over the past decade, most of which are well paid.

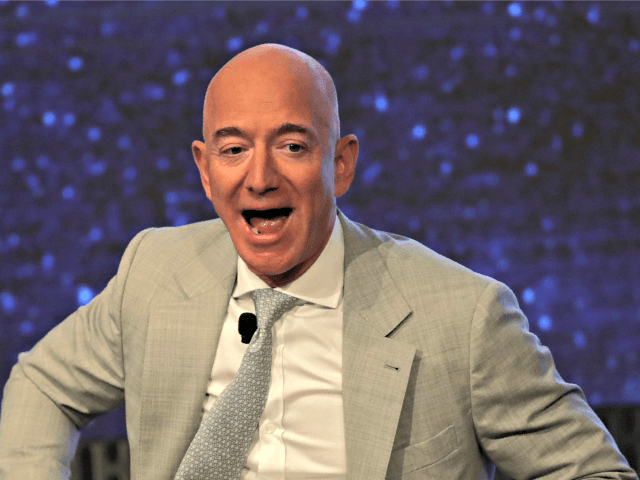

For Seattle’s boosters, this growth is a testament to the city’s inherent virtues. “From its beginning, Seattle showed a do-whatever-it-takes resilience,” the Seattle Times columnist Ron Judd wrote in 2016. He acknowledged that there was “a little bit of dumb luck” involved in the city’s success, but ultimately praised its location, lifestyle, and innovative spirit for attracting people like Jeff Bezos. The success of Seattle, Judd wrote, is heavily tied to “history, geography, education and, yes, some creative capitalizing on all the gifts the place was given.”

MacGillis implicitly rebuts such arguments. Baltimore’s Atlantic waterfront, he points out, could not save it from postindustrial economic erosion, nor could St. Louis’s central location. The author outlines the careers of retailer entrepreneurs from overlooked metros—like El Paso, Texas—who clearly possess the enterprising talents that libertarians believe made Bezos a billionaire. They were eventually brought to heel, in no small part because of Amazon.

The truth is that Seattle has prospered because Gates and Allen, both Seattle natives, set up their company in the area during the late 1970s, when it was still possible to build a successful corporation in most American cities. And once Seattle had Microsoft, it became easier to attract other tech companies. But now, without fair competition rules, other cities don’t have the same opportunities Seattle once had. It’s hard for new retailers to grow when they have to contend with Amazon.

Yet even Seattle is suffering. Its housing and living costs have skyrocketed, pushing many middle-class and working-class residents out. Soaring rents have pushed some of them onto the street. By the end of 2017, Seattle had the third-largest homeless population in the country, after Los Angeles and New York City. The changes have disproportionately harmed Black residents, whose median income has fallen since 2000 even without accounting for inflation. Seattle, MacGillis writes, is “proof that extreme regional inequality was unhealthy not only for places that were losing out in the winner-take-all economy, but also for those who were the runaway victors.”

The author chronicles the city’s hapless attempts to fix the nasty side effects of its hyper-prosperity. It passed a tiny income tax followed by a tiny tax on large businesses in order to address housing shortages and improve public transportation. The first was successfully challenged in court by coalitions representing the city’s rich. The latter was attacked by a collection of big companies, including Amazon, which threatened to cancel a planned Seattle building expansion if the law wasn’t repealed. Amazon also helped bankroll an expensive ballot initiative to eliminate the tax. Ultimately, the city council repealed it first.

The tax exemptions that less prosperous cities offer Amazon in exchange for becoming the site of a new fulfillment center are even more degrading. While local authorities view the subsidies as the price of keeping their economies alive, MacGillis suggests that the tax cuts may ultimately cost cities more than the new jobs are worth. Emergency service departments in two Ohio counties, for example, have had to contend with a steady stream of 911 calls for warehouse injuries, an expense that Amazon creates but does not pay for, because it is exempt from each county’s property taxes. The company’s distribution centers build up truck traffic on nearby highways, but Amazon is excused from paying the taxes that fund roadway maintenance.

That so many local governments kowtow to Amazon is a depressing statement about political power in America. But even if these places—be they Seattle or Dayton—could muster the political will to take on the company, they simply don’t have the tools to win. The affordability crisis threatening rich metros and the hollowing out of poor ones are both by-products of concentrating economic power in a handful of cities. And that’s something that only the federal government can fix.

The good news is that there are national policies that could rebalance our economy. By reviving underused competition policies, the Biden administration has the power to distribute wealth much more fairly. There’s no shortage of consolidation in the American economy, from gigantic agribusinesses to hospital chains. But for any would-be trustbuster, Amazon must be at the top of the list. At a minimum, the administration should fight to prohibit the company from both owning America’s dominant online marketplace and selling its own products in it. Better yet, it could spin off Amazon’s data storage business, its smart home business, and its many other non-search components into independent companies. Better still, it could break up Amazon’s marketplace outright.

The government has many other tools it can use to better distribute opportunity. It could bring back regulations that made it impossible for big businesses to get better deals from suppliers than small ones could. It could reconstruct the dismantled Civil Aeronautics Board, an institution that kept airfare prices roughly the same on a per-mile basis wherever one went and made sure small and midsize cities received adequate service. It can re-create the Interstate Commerce Commission, which did the same thing for passenger trains and freight transportation. Those transit regulations enabled new small businesses to thrive in midsize heartland cities rather than just existing economic hubs.

Some of these steps require new legislation. But many are possible through executive action under existing, if currently unenforced, competition statutes. Either way, there’s hope. Democrats have unified control of the government, and progressives are increasingly concerned about concentrated economic power. The U.S. House of Representatives, multiple state attorneys general, and the Department of Justice are all investigating anticompetitive practices by Amazon. The latter two are already suing Facebook and Google.

But the Democratic Party does not have the best recent track record when it comes to curbing corporate power. Democrats dominate Seattle’s government, and they ultimately killed a law that mildly inconvenienced Amazon. The Obama administration did virtually nothing to stop the mergers, acquisitions, and other actions that fueled retail consolidation and helped give rise to Big Tech. As MacGillis points out, many of Obama’s officials went on to prominent, powerful roles in major tech companies. Jay Carney, one of the former president’s press secretaries, now heads public policy for Amazon.

It is still too soon to say whether Joe Biden will take the aggressive antitrust positions favored by progressive activists or the lenient approach of the president he served beside. His first Federal Trade Commission nominee, Lina Khan, is an antitrust expert who advocates for curbing the power of large corporations. Her selection was a promising sign. So was choosing the Big Tech critic Tim Wu to work on technology and competition policy at the National Economic Council.

But the most important positions are yet to be filled, and progressives are worried that his early choices will soon be counterbalanced by monopoly-friendly personnel. Should Biden ultimately opt to follow Obama’s path, it might be because he simply does not recognize the economic damage oligopolistic companies have caused. If so, he would do well to read MacGillis’s book. But it is also possible that Biden and his team are aware, but their interest in fighting back will be tempered by fund-raising concerns, a belief that challenging monopolists would be too risky for the economy, or simply a desire to tackle other priorities.

If that is the case, the administration should consider the political consequences of continuing on our current path. The steady draining of wealth and opportunity from large parts of America is part of why many onetime Democratic strongholds, like Michigan, are now swing states, and why many onetime swing states, like Missouri, are now Republican strongholds. Well-educated liberals will not move to these places unless there are economic opportunities. The remaining white, non-college-educated residents will continue to feel economically embittered.

With thin congressional majorities, competition policy may be one of the few tools Biden can really wield to restructure America’s political economy. He must use it.

Fighting the Big Grocery Monopoly

Why independent grocery stores look to antitrust law to battle big retailers like Walmart and Amazon.

In March, the National Grocers Association (NGA), a trade association representing independent grocery stores, released a white paper detailing the ways dominant retailers abuse their market power over suppliers and marginalize small grocers. The pandemic exacerbated these abuses, the group argues, citing practices such as Big Box retailers demanding priority access to products in short supply, while smaller stores were frozen out. The group calls for enforcing antimonopoly laws, including the long-dormant Robinson-Patman Act, to address what it deems “economic discrimination.”

Passed in 1936, Robinson-Patman was intended to preserve the viability and diversity of smaller retailers by ensuring that the big chain stores did not engage in price discrimination and other unfair business practices. For example, it makes it illegal for suppliers to charge small retailers more than they charge the big chains for the same product.

The NGA argues that it is time to revive Robinson-Patman and other antimonopoly statutes. “The lack of antitrust enforcement has handicapped competition in the grocery sector and harmed American consumers,” said Chris Jones, NGA’s senior vice president of government relations. “Economic discrimination is, in fact, a problem that extends well beyond our industry … [We’re calling] on Congress and the federal government to modernize and enforce the antitrust laws.”

Smaller, family- or employee-owned grocery stores sell 25 percent of all groceries and play a unique role in the grocery market. According to the USDA, rural areas and low-income communities left behind by chain stores tend to rely more on these independent food retailers. New or local food suppliers may also get their start selling to independent grocers before growing into larger distribution, the NGA’s white paper argues.

While studies find that independent grocers can offer competitive or even lower prices on fresh produce compared to Big Box stores, their packaged goods tend to be more expensive. This partially stems from the fact the largest retailers, called “power buyers,” can negotiate price concessions from packaged goods manufacturers.

This discrepancy in buyer power has dramatically expanded with grocery consolidation. As recently as 1997, Americans bought 20 percent of all groceries from the top four retailers. By 2019, the top four retailers claimed 43 percent of all sales, with Walmart alone capturing 1 in every 4 dollars spent on groceries. Amazon’s online grocery sales also tripled during the pandemic, just as the e-commerce goliath expands its network of brick-and-mortar Amazon Fresh grocery stores.

At a certain point, suppliers feel pressure to accept less favorable terms or offer special perks to dominant buyers because they cannot afford to lose their business. These deals go beyond justifiable bulk discounts that reflect genuine savings from say, delivering an order large enough to fill a truck.

“The heart and soul of this whole issue of economic discrimination is the notion that corporations can win solely on the basis of their size, not by competing in a better way, but simply by being larger,” explains Stacy Mitchell, the co-director of the Institute for Local Self-Reliance. “The vast majority of the superior pricing and terms that Walmart is getting are a product of its muscle, not of superior efficiency.”

Both Mitchell and the NGA emphasized that independent grocers often join buying clubs to buy goods by the truckload, thereby creating efficient volumes for suppliers. But even then, they cannot get the same deals as Big Box stores with gatekeeper power. Suppliers need to be on Walmart’s shelves or Amazon’s marketplace to access customers; they don’t need to have a presence in a smattering of local shops in the same way.

“Under the threat of losing business from those power buyers, which in some cases have 35 to 40 percent or more of the manufacturer’s total sales, … those [suppliers] are being forced to their demands,” said David Smith, president of Associated Wholesale Grocers. “Because demand squeezes those suppliers, higher prices and less product availability are forced upon those that remain.” In other words, smaller grocers not only miss out on better deals, but they sometimes pay higher prices or receive worse treatment as manufacturers make up the difference of concessions made to power buyers.

For instance, in September 2020 during the middle of the pandemic and widespread product shortages, Walmart implemented a 3% cost-of-goods penalty on any supplier that did not deliver 98% of its order in full and on time. “This was at a time when overall industry service level inbound was only about 85%,” explained Smith. “So, if you are a supplier that can only provide 85% of what your customers are ordering and your most significant customer … demands 98%, where does that improvement come from? Well, we know that it amounts to a shortage to the others that are out there.”

Indeed, CNN reported this spring that smaller grocers still struggle to secure a sufficient supply of highly demanded products, including toilet paper, canned goods, and cleaning supplies.

“During the pandemic, providing for our friends and neighbors got even harder, because our larger competitors were illegally taking away our access to important stock items,” said Jimmy Wright, owner of Wright’s Market in Opelika, Ala. “Opelikans were forced to make an extra trip to the nearest big chain when they preferred to shop locally … and wanted to limit their trips to public places.”

Here, Wright alleges that this differential treatment of small stores by suppliers violates the long-unused Robinson-Patman Act. Under Robinson-Patman, suppliers cannot offer preferential prices or terms to dominant customers, unless they reflect a genuine difference in the cost of doing business with them.

But price discrimination persists because federal agencies have not enforced the law for decades. “The FTC and the DOJ quietly put [the Robinson-Patman Act] up on a shelf somewhere,” said Mitchell. “They overturned a law without involving Congress.”

Since the 1970s, a growing body of antitrust scholars have argued that the anti-discrimination statutes in Robinson-Patman are inefficient and prevent retailers from offering the lowest possible prices. In 2007, a congressionally chartered commission even recommended repealing the law entirely.

To be sure, even proponents of Robinson-Patman have acknowledged in congressional hearings over the years that the law contains critical ambiguities and should be improved. But the NGA argues that the low prices power buyers receive are “sub-competitive,” or below those that would exist in a competitive market, since they are set by domination, rather than fair negotiation. This ultimately harms grocery market competition by putting some stores at a disadvantage solely because of their size.

NGA’s report calls on Congress to investigate discriminatory and anti-competitive conduct in the grocery sector and to restore the original intent of the Robinson-Patman Act to make it enforceable again. “It has been almost 100 years since the last law was passed here, so it could need some updating in the long run,” said Jones.

Democrat Senator for Amazon’s Home State Seeks $10B Giveaway for Jeff Bezos’ Space Company

Sen. Maria Cantwell, a Democrat who represents the state of Washington where Amazon’s world headquarters is located, is pushing for NASA to reopen a competition for third-party contractors to build its next lunar lander, after Jeff Bezos’s Blue Origin lost out to Elon Musk’s SpaceX in the competition for the contract last month.

Earlier this week, Sen. Cantwell proposed an amendment to the Endless Frontier Act, a bill that funds NASA’s Artemis Program, to land U.S. astronauts on the moon within the next five years.

The amendment would force NASA to reopen the competition for a lunar landing contract and allow the agency to use up to $10 billion of its budget to select a second lunar lander contractor.

This comes after Blue Origin, the space exploration company founded by Amazon co-founder Jeff Bezos, lost out to SpaceX last month.

If Sen. Cantwell’s amendment is successful, it would mean almost $10 billion in taxpayer funds could go to the company owned by Bezos, the richest man in the world. Cantwell represents the State of Washington, where Amazon is headquartered, and the tech monopoly has given her $59,000 in the 2020 election cycle alone.

Via the Verge:

A senior lawmaker proposed a controversial piece of legislation on Wednesday that directs NASA to pick a second company to build the agency’s next Moon landers — in addition to Elon Musk’s SpaceX, which was awarded a $2.9 billion NASA contract to build a lander earlier this year. The bill hasn’t passed the full Senate yet, but it marks a new front in an ongoing effort to overturn or rejig NASA’s decision. It also sets up the first political challenge for NASA’s new administrator, former Sen. Bill Nelson.

NASA’s choice of SpaceX last month to build the agency’s first lunar lander since 1972 spawned a wave of opposition from some lawmakers and the two losing companies in the running: Jeff Bezos’ space firm Blue Origin and Dynetics. Those companies lodged formal protests against NASA’s decision, triggering a procedural pause on SpaceX’s new contract. Among other things, the protests maintain that NASA should have picked two firms instead of one.

Amid a lobbying effort from Blue Origin, those calls have found their way into a NASA authorization bill, proposed as an amendment to the Endless Frontier Act by Sen. Maria Cantwell (D-WA), chair of the Senate Commerce Committee overseeing NASA. Cantwell represents Blue Origin’s home state of Washington. Under Cantwell’s language, NASA would be required to reopen the competition within 30 days and allow it to use $10 billion of its budget to pick a second lunar lander provider.

Under the terms of last month’s agreement, SpaceX is the sole contractor for NASA’s next two flights to the moon. These flights would use Starship, the company’s reusable rocket system. Bezos’ Blue Origin has received hundreds of millions of dollars in NASA and defense grants, despite never reaching orbit with a spacecraft.

Allum Bokhari is the senior technology correspondent at Breitbart News. He is the author of #DELETED: Big Tech’s Battle to Erase the Trump Movement and Steal The Election.

No comments:

Post a Comment