Prof. Richard Wolff: The Truth About Inflation

Ask Prof Wolff: The Municipal Bond Racket

https://www.youtube.com/watch?v=QKcSp5ByPiA

During the 2020 Democratic primaries, every candidate pledged to repeal the Trump tax cut for the rich. Biden has repeatedly called his domestic agenda a “blue collar” program. While declaring ad nauseam that “I am a capitalist,” who has nothing against people becoming billionaires, he has called on Wall Street to “pay their fair share.”

Now it is perfectly clear what this actually means. Under conditions where the Democrats control the White House and both houses of Congress, they have dropped any attempt to raise corporate or personal income tax rates for the wealthy The only significant change Biden and the Democrats are seeking to make to Trump’s multitrillion-dollar tax giveaway to the oligarchy is to increase its scale.

Bond market turmoil as Wall Street speculation reaches new heights

A conference of US economic and financial regulators to be held tomorrow may have more on its agenda than was originally planned as signs of turbulence in financial markets continue to grow.

The 2021 US Treasury Market Conference, which is being held virtually, will hear a series of reports from Fed officials, representatives of the US Treasury and the stock market regulator, the Securities and Exchange Commission.

The conference, an annual event, was first convened in 2015 following a “flash rally” in the US Treasury market in 2014. Bond prices rose sharply during a 12-minute period, sending yields plummeting, and then reversed with no apparent trigger—an event that was not supposed to take place in the world’s biggest debt market.

The agenda for tomorrow’s meeting is to consider “proposals to improve overall market functioning and reliance.”

It is being held in the shadow of the events of March 2020 when the Treasury market froze. No buyers could be found for US government debt at one point, an extraordinary occurrence in what is supposed to be the deepest and most liquid financial market in the world.

The crisis was only halted through the intervention of the Fed which injected more than $4 trillion into the financial system and initiated a program of buying $120 billion of financial assets a month.

At its last meeting the Fed decided to taper its purchases by $15 billion a month. There is uncertainty about what effect this will have under conditions where the rise in inflation over the past months has completely changed the financial landscape. Price rises hit a 30-year high of 6.2 percent for October, the fifth straight month the inflation rate has topped 5 percent.

With the Fed’s assurances that inflation is “transitory” having been blown out of the water, there are indications of growing instability.

Last week, as the latest inflation figures were announced, yields on the two-year Treasury note climbed nearly 10 basis points—0.1 percent—as bond prices fell in the biggest movement since March of last year. The downward movement went across the board with a government auction of $25 billion of 30-year debt reported to have met only “weak demand” from buyers.

The uncertainty in the debt markets was articulated by Peter Tchir, head of macro strategy at Academy Securities, in comments to Bloomberg.

“The current structure enables the markets to function well when volumes are running around average levels,” he said. “But it leads to these periods of large and aggressive moves that seem inexplicable relative to the data. It also makes it hard for asset managers to manage their risks.”

Bloomberg reported that an index it has constructed to measure liquidity in the government debt markets “showed conditions were the worst since March 2020.”

In comments to Bloomberg, the weakness in demand for the 30-year Treasury bond last Wednesday was described by Michael Cloherty, head of US rates strategy at UBS Group AG, as a “clear sign of illiquidity.”

“For the past two weeks the market’s been extraordinarily erratic and is having difficulty in handling large transfers of risk,” he said.

The volatility has gone against expectations that markets would calm somewhat following statements by Fed chair Jerome Powell. He said that he was not going to raise interest rates any time soon following the central bank’s decision to begin tapering its asset purchases. These assurances are being overwhelmed by the belief that the Fed will have to move because of the continued rise in inflation.

Writing in the Financial Times (FT) last week, economic commentator Mohamed El-Erian repeated his warnings that the Fed’s monetary policy, based on the claim that inflation is “transitory,” was continuing “to fall behind realities on the ground.”

“The lack of a credible central bank voice on inflation also leaves markets in somewhat of a muddled middle. Witness the high volatility in government bond markets that is managing to whipsaw even the most sophisticated and seasoned investors,” he wrote.

El-Erian voiced some of the most significant fears in financial circles, noting that “wage demands are going up across more sectors, as is the threat of strikes.”

Asked on the CBS program “Face the Nation” on Sunday whether price rises would be down in a year’s time, US Treasury Secretary Janet Yellen said: “It really depends on the pandemic. The pandemic has been calling the shots for the economy and for inflation. And if we want to get inflation down, I think continuing to make progress against the pandemic is the most important thing we can do.”

However, the policies of the Biden administration, like its counterparts around the world, are going in the opposite direction as virtually all public health measures are scrapped.

Yet, even as a new surge of COVID infections develops, financial speculation continues to accelerate, driven not by improving economic conditions but by what the FT characterised as the “fear of missing out.”

In an article published at the weekend, the FT noted that the MSCI All-World Market share index had almost doubled since its lowest point in March 2020 and the crypto currency market was valued at $3 trillion compared to $500 billion this time last year.

It reported that on November 5, a record $2.6 trillion of stock options changed hands in the US, the highest trading volume on record, according to Goldman Sachs. The majority of these options were “calls,” a derivative that allows investors, using large amounts of borrowed money, to make bets that share prices will continue to rise.

This allows the making of massive profits if the prediction is met, but large losses if it is not.

Goldman Sachs has estimated that option trading volumes are greater by about 50 percent in dollar terms than all actual stock trading.

While the general sentiment is the rise in share prices will continue and may even become more ferocious, warnings are being sounded about when the speculative binge will end.

“There’s more volume in options than in actual equities,” one unnamed senior executive at a big trading firm told the FT. “I don’t think this can go on forever.”

Erik Knutzen, chief investment officer at the investment management firm Neuberger Berman, told the newspaper: “Everything seems crazy, there are bubbles here, bubbles there, everywhere. It’s become a cliché, but we are really in uncharted waters, very unusual territory.”

Inflation surge to intensify financial turmoil

The latest inflation figures from the US and the surge in prices around the world have blown apart the claim of central banks and government authorities that inflation was “transitory” and would pass once problems with the re-opening of the economy had passed.

On Wednesday it was announced that the US consumer price index (CPI) had risen by 6.2 percent in October compared to a year ago—the fastest annual rise since 1990 and a considerable jump from the 5.4 percent increase recorded in September.

So-called core inflation, after stripping out volatile items such as food and energy, rose by 4.6 percent, the highest level since 1991, and a clear indication that the price surge is spreading throughout the economy.

And the inflation surge is set to continue. As one financial analyst told the Financial Times: “Transitory is dead and buried. There is a good chance we will see core CPI close to 6 percent over the next few months.”

The global character of the inflation surge is reflected in rising CPI figures elsewhere. The eurozone inflation rate was 3.4 percent in September, the highest level since before the global financial crisis, and well beyond the European Central Bank’s target of 2 percent. In the UK the inflation rate is expected to reach 5 percent in the first months of next year.

Data coming out of China this week showed that factory gate prices rose by 13.5 percent in October, their highest increase in 26 years. The increase exceeded economists’ forecast of a rise of 12.4 percent and was well above the level of 10.7 percent in September.

The price surge in China is the result of rising commodity prices, particularly in energy and other raw materials. At the same time, manufacturing activity has been declining, prompting fears of stagflation in the world’s second largest economy.

The surge in inflation, particularly in the US, will add to the deepening turmoil in global financial markets, pushing up yields on Treasury bonds, especially at the short end of the markets and adding pressure on central banks to start tightening their monetary policies.

In response to Wednesday’s figures the yield on two-year US Treasury bonds rose to 0.503 percent from 0.409 percent the day before. This was the biggest movement since the market turmoil since March 2020 at the start of the pandemic.

The yield on the 10-year Treasury rose to 1.558 percent from 1.431 percent as bonds were sold off and their prices fell. Yields, that is interest rates, and bond prices have an inverse relationship.

It remains to be seen what effect the rise in yields will have on the rest of Wall Street where the stock market has been powering to record highs over the past two months. It experienced a slight fall on Wednesday on the back of the inflation number and remained steady yesterday.

The stock market has been lifted to ever-greater heights by the flow of cheap money from the Fed and the expectations of higher earnings by the largest firms. Higher interest rates tend to depress stock values because they mean that the present value of future cash flows is discounted at a higher rate and is thereby lowered.

So far, the main financial impact of the higher inflation over the past months has been in the bond market where those investors, very often major hedge funds using billions of dollars of borrowed money, who bought into the Fed scenario of “transitory” inflation have lost large amounts of money.

The situation is being compounded by uncertainty about the direction of the policies of the Fed and other central banks. So far Fed chair Jerome Powell has insisted that there will be no increase in the Fed base interest rate at least until the process of tapering its purchases of Treasury bonds and mortgage-backed securities is completed in the middle of next year.

But there are fears that with inflation continuing to rise it may have to act before then and slam on the brakes. The problem of uncertainty was highlighted last week when the Bank of England decided not to lift its base rate after its governor, Andrew Bailey, had given clear indications that it would.

Uncertainty means large losses for hedge funds and other speculators who make bets based on forecasts that turn out to be wrong.

There are also clear indications the problems that beset the $22 trillion US Treasury market in March 2020 have not gone away. The market faced a profound liquidity crisis when, at one point, no buyers could be found for US government debt.

This was contrary to previous experience when, in times of turmoil, there is a rush for the “safe haven” of government debt. Instead, Treasury bonds were sold off in a dash for cash, requiring a massive intervention by the Fed, to the tune of $4 trillion, to stabilise the market.

This week, the FT reported that trading conditions in the Treasury market had become “less hospitable” in recent weeks and pointed to “choppy” movements in the prices of securities.

Liquidity, that is the ease with which an investor can buy or sell an asset, had deteriorated in recent weeks, it said.

A working group of US financial authorities set up to probe the events of March 2020 produced a report this week on top of those made in the past but added few insights and did not advance any proposals to prevent a recurrence.

In its report on the group’s findings the FT cited critical comments by Yesha Yardav, a professor at Vanderbilt Law School who researches Treasury markets regulation.

“The report does not go far enough to support the plumbing of the Treasury market and to assure that liquidity providers will remain trading when conditions become stressed,” he said.

The report, however, did contain one significant statistic which shows the extent of the problems with which regulators are now seeking to grapple.

At the end of 2007, just before the global financial crisis, US Treasury debt held by the public totalled $5.1 trillion, or 35 percent of gross domestic product (GDP). At the end of 2020, the debt had reached $21.6 trillion or 101 percent of GDP. The very increase in its size and the increasing complexity in financial transactions creates greater regulatory problems.

Furthermore, almost all trading is carried out electronically, most often using algorithms.

The report noted that because of electronic trading, firms “access multiple markets over ever-shorter time-frames” and markets have become increasingly interconnected, “resulting in significantly faster risk and information transmission.”

This has two consequences. In “normal” times it means that greater profits can be made more rapidly. But it also means that in times of financial stress problems in one area are more rapidly transmitted to the rest of the market, creating the conditions for a generalised crisis.

House Democrats pass stripped-down social welfare bill with massive tax cut for the rich

On Friday morning, the House of Representatives passed its version of President Joe Biden’s $1.75 trillion “Build Back Better” social welfare and climate bill. As expected, the measure was approved on a party-line vote, with 220 Democrats voting “Yes” and all 212 Republicans voting “No.” One Democrat, Jared Golden of Maine, a conservative former Marine who served tours of duty in Iraq and Afghanistan, broke ranks and voted in opposition to the bill.

Golden had announced that he would oppose the bill because it included a massive tax break for the wealthy. The outcome of months of internal Democratic Party wrangling was the decision of the Biden White House and the party leadership to strip the bill of all major tax increases opposed by big business and slash the top line figure for social programs and climate protection in half, from $3.25 trillion to $1.75 trillion over 10 years.

That, however, did not satisfy the Wall Street and corporate interests that dictate government policy and control both major parties. Earlier this month, House Speaker Nancy Pelosi incorporated into the bill a measure demanded by wealthy donors in high-tax states such as New York, New Jersey and California. It was the lifting of a $10,000 cap on deductions on federal income taxes to compensate for state and local taxes. The cap was imposed as part of the Trump tax bill passed in December of 2017, which slashed taxes for corporations and the wealthy.

Until then, there was no limit on the amount of federal tax deductions for state and local taxes that wealthy people in generally pro-Democratic high-tax states could claim by itemizing their federal tax returns. In imposing the limit, Trump and the Republicans were targeting states that historically vote “blue” in federal elections.

This infuriated the Democrats’ wealthy backers, who demanded that the Biden budget bill raise the limit on so-called SALT (state and local tax) deductions. The Democrats acceded by adding to the bill a provision raising the limit to $80,000 for each of the next nine years.

The Congressional Budget Office estimates that this tax windfall for the wealthy will cost the federal government $285 billion over the 10-year span covered by the bill, making it the second most costly item in the legislation. It is topped only by a combined $390 billion for universal pre-school for three- and four-year-old children and limited subsidies for child care.

It is considerably higher than the allocation for clean energy and climate resilience ($220 billion), four weeks of paid family and medical leave ($195 billion), clean energy and electricity tax credits ($190 billion), affordable housing ($170 billion), Medicaid home- and community-based services ($150 billion), a one-year extension of the expanded child tax credit ($130 billion), and tax credits for health insurance premiums under Obamacare ($125 billion).

It would help pay for programs that were severely cut or dropped outright from the bill under pressure from big business and its most open mouthpieces in the Democratic Party, such as senators Joe Manchin of West Virginia and Kyrsten Sinema of Arizona. These include free community college (eliminated); the ability of Medicare to negotiate drug prices with the pharmaceutical industry, thereby lowering their costs (reduced to a shell program affecting only a handful of drugs and not even starting until 2024); and Medicare coverage for dental, hearing and vision (reduced to limited subsidies for hearing aids).

According to an analysis by the Tax Policy Center, the SALT tax provision will overwhelmingly benefit the top 10 percent of income earners, with virtually nothing going to the remaining 90 percent, i.e., the working class and lower-middle class. The measure will particularly benefit the top one percent, those who make over $867,000 a year. They will see a tax cut in the tens of thousands of dollars.

“Anything you do to eliminate the SALT cap is going to be regressive, because that tax is overwhelmingly paid by very high-income people,” said Howard Gleckman of the Tax Policy Center. “Anything you do to lower that tax doesn’t matter for most people.”

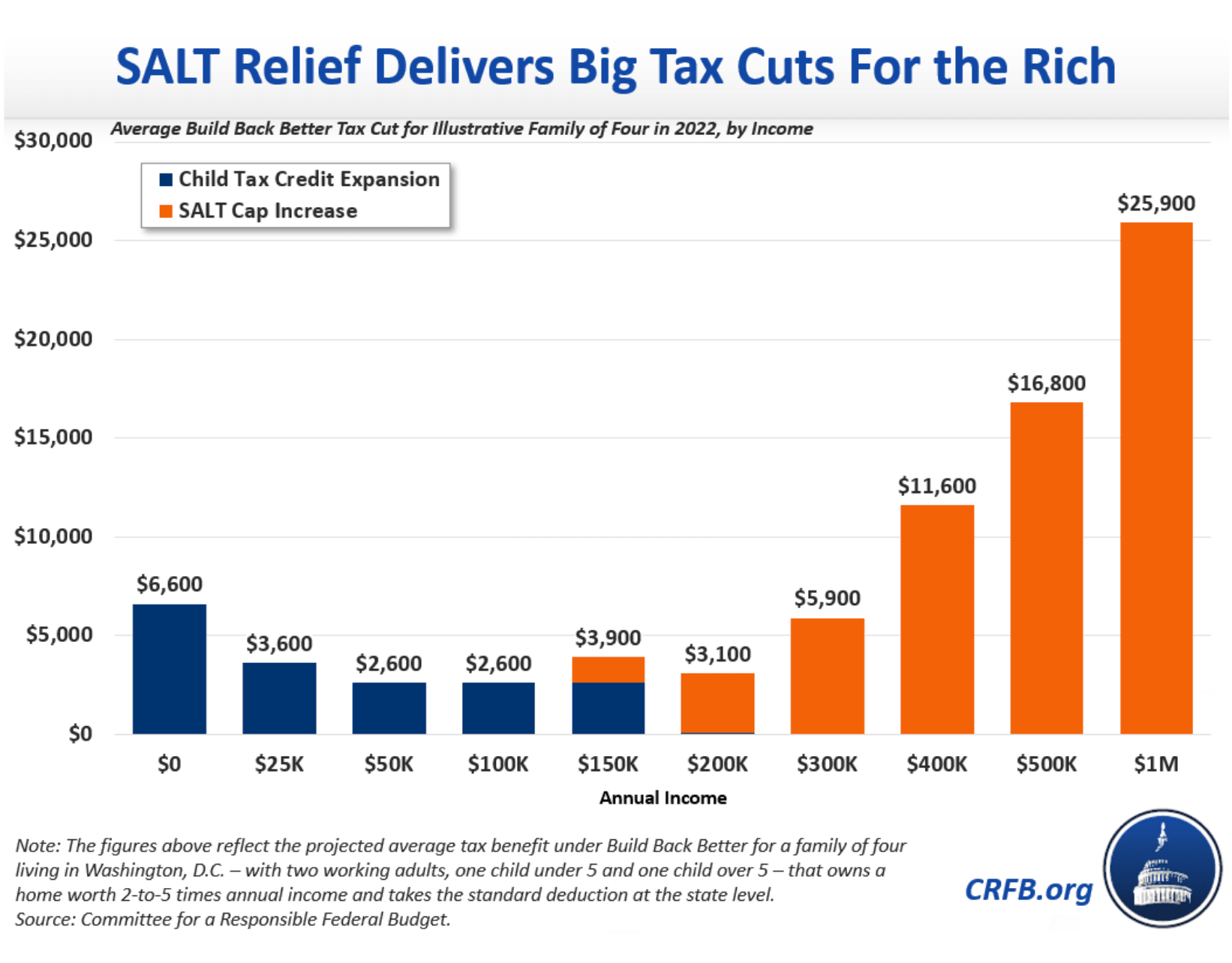

The Committee for a Responsible Federal Budget (CRFB) reported that a family of four in Washington D.C. making $1 million per year would receive 10 times as much tax relief next year from expanding the state and local tax deductions as a middle-class family would receive from an expansion of the child tax credit. The CRFB said that two-thirds of households making more than $1 million a year would get a tax cut under the legislation because of the increase in the state and local property tax deduction.

Pointing to the brazen hypocrisy of Biden and the Democratic Party, Marx Goldwein, senior policy director at the CRFB, said, “We’re debating about whether to give lower- and middle-class families a thousand dollars more a year through the child tax credit, while giving upper-class families $10,000 or more through SALT. That’s counter to everything the Democrats have been saying Build Back Better is about and everything they said about the Trump tax cuts.”

According to a report from the Tax Foundation, raising the SALT cap would more than offset other tax increases for the wealthy in 2022 included in the House bill. These include a 15 percent minimum corporate tax, a 1 percent tax on stock buybacks, increased taxes on US companies’ foreign profits, and a surtax of 5 percent on those with adjusted gross income over $10 million and 8 percent on those making more than $25 million.

In a column in the Financial Times on Thursday, Edward Luce alluded to the Democrats’ obsession with identity politics and linked it to the Build Back Better bill:

The result is a bill that caters best to the most powerful slice of Americans—the very wealthy. They can sleep easy now that the carried interest loophole, which allows private equity partners to be taxed at lower than ordinary income rates—as Warren Buffett pointed out, they pay a lower tax rate than their secretaries—is probably safe. As it stands, the bill will also give wealthy Americans a bigger tax cut than they got from Trump’s big 2017 tax bill.

Even this miserable travesty of social reform will be further gutted if not blocked outright in the Senate, where passage will require the support of all 50 Democrats. Neither Manchin nor Sinema has signed on to the bill, the former having declared his opposition to even a completely inadequate a four-week paid leave provision, while calling for means testing and work requirements for other social benefits.

The so-called “progressives”—Bernie Sanders, Elizabeth Warren in the Senate, the more than 100-strong House Progressive Caucus—capitulated to the demand of Biden and the most right-wing factions in the Democratic caucuses to pass the $1 trillion bipartisan infrastructure bill. This bill was backed by virtually every corporate lobby group, without having secured the agreement of Manchin and Sinema to support Senate passage of the broader “Build Back Better” social spending bill, against which the corporations have waged a massive lobbying campaign.

Sanders, for his part, has denounced the inclusion of the SALT provision in the House bill but is supporting a modified version in the Senate bill, according to which eligibility for expanded tax deductions would be limited to people making less than $400,000 a year. On the other hand, Senate Majority Leader Chuck Schumer, widely known as the “senator from Wall Street,” is supporting an even bigger deduction than that provided by the House.

He has announced that he will bring up the National Defense Authorization Act, which allocates $778 billion for the military in a single year (nearly half the 10-year Build Back Better budget) and the anti-China United States Innovation and Competition Act before taking up the social/climate measure passed by the House. This could delay consideration of Build Back Better until next year, something Manchin has hinted at, likely killing the legislation.

All of the so-called “progressives” promoted by the pseudo-left, including Democratic Socialists of America (DSA) members Alexandria Ocasio-Cortez, Jamaal Bowman, Ilhan Omar and Cori Bush, voted for the House bill on Friday, demonstrating the DSA’s role as an arm of one of the two main parties of US imperialism.

During the 2020 Democratic primaries, every candidate pledged to repeal the Trump tax cut for the rich. Biden has repeatedly called his domestic agenda a “blue collar” program. While declaring ad nauseam that “I am a capitalist,” who has nothing against people becoming billionaires, he has called on Wall Street to “pay their fair share.”

Now it is perfectly clear what this actually means. Under conditions where the Democrats control the White House and both houses of Congress, they have dropped any attempt to raise corporate or personal income tax rates for the wealthy The only significant change Biden and the Democrats are seeking to make to Trump’s multitrillion-dollar tax giveaway to the oligarchy is to increase its scale.

This is a devastating exposure of the fraudulent claims of the DSA and similar organizations of the upper-middle class that progressive change is possible within the framework of the capitalist two-party system and that the Democratic Party can serve as an instrument of social change.

Wolff Responds: Capitalism's False Defenses

Ten Years Ago: Corporate & Household Debt [10th Anniversary of Economic Update with Richard

Wolff]

CEO RESIGNATIONS INCREASE, ECONOMIC COLLAPSE GAINS SPEED, YOU CAN'T PRINT\

PROSPERITY

Insiders Just Exposed That A Terrifying Stock Market Crash Forecast Is About To Come True

Democrats Approve Billion-Dollar Tax Cut for Their Rich, Blue State Donors

House Democrats approved hundreds of billions of dollars in tax cuts for their wealthy, blue state donors with the passage of President Joe Biden’s “Build Back Better Act.”

On Monday, House Speaker Nancy Pelosi (D-CA) oversaw the passage of the filibuster-proof $1.75 billion budget reconciliation package that would deliver billions in tax breaks to the wealthiest residents of blue states if approved by the Senate and signed by Biden.

As part of the package, the State and Local Tax (SALT) deduction cap would be increased from its current $10,000 to $80,000 which would effectively amount to a $625 billion tax cut for the wealthiest Americans living in blue states — paid for by working and middle class Americans.

The Committee for a Responsible Federal Budget (CRFB) has noted that “a household making $1 million per year will receive ten times as much from SALT cap relief as a middle-class family will receive from the child tax credit expansion.”

“Roughly 98 percent of the benefit from the increase would accrue to those making more than $100,000 per year, with more than 80 percent going to those making over $200,000,” CRFB analysis has found.

The left-wing Tax Policy Center has assailed the tax cuts for billionaires, comparing it to the package’s tax increases on middle class Americans.

For instance, the package gives a tax cut to 66 percent of Americans earning more than $1 million annually while 78 percent of Americans earning $500,000 to $1 million will get a tax cut. At the same time, 27 percent of Americans earning $75,000 to $100,000 would see a tax increase along with 19 percent of Americans earning $50,000 to $75,000.

John Binder is a reporter for Breitbart News. Email him at jbinder@breitbart.com. Follow him on Twitter here.

No comments:

Post a Comment