ALL BILLIONAIRES ARE DEMOCRATS FOR OPEN BORDERS TO KEEP WAGES DEPRESSED. JOE BIDEN IS RIGHT THERE RUNNING THEIR SHOW!

There it is. That's the issue. To begin, you have the corrupt family Biden. They've been scamming us and our system well for almost fifty years. The man is supposedly worth over 250 million dollars. How is this possible on his salary? It's not. So where did his wealth come from? Not from being a brilliant businessman. DAVID PRENTICE

The California Dream is DEAD.

Joe Biden didn’t do anything wrong? A time-honored method of taking bribes is having them paid to a family member, usually in exchange for nominal or nonexistent services. It is comical to watch “reporters” pretend not to understand this.

MONICA SHOWALTER

There’s also the little problem of Hillary’s incredible corruption (making her and Biden birds of a feather). And of course, the fact that Hillary’s unsecure server damaged national security in a way that would have seen an ordinary, politically unconnected person spend the rest of her life in prison—which, not coincidentally, is where Papa Joe belongs for using his debauched son Hunter as the bagman for decades of anti-American corruption

ANDREA WIDBURG

From April 2020 to April 2021, more than 100,000 Americans died from drug overdoses, according to data from the National Center for Health Statistics. An overwhelming majority of those deaths came from opioids, and fentanyl smuggling has surged at the southern border since the start of Joe Biden's presidency. Joseph Simonson and Collin Anderson

“Joe Biden is great on immigration. I guess depends on your perspective. If you’re a human trafficker, or drug dealer, you’d give him an A-plus, but theAmerican people would give him an F. The crisis at our border was not only entirely predictable, it was predicted. I predicted that if you campaign all year long on open borders, amnesty, and health care for illegals, you’re going to get more migrants at the border. That’s what’s happened since the election.” SEN. TOM COTTON

Many Democrats understand that the welfare checks for foreign children will encourage more illegal immigration, he said:

They know what’s going on. But they know that they can’t say what their true goal is, which is actual open borders with open, uncontrolled migration both ways. And this is a step toward getting rid of borders.

“It’s a globalist mindset and it welcomes anything that moves toward open borders,” he concluded. NEIL MUNRO

“Protect and enrich.” This is a perfect encapsulation of the Clinton Foundation and the Obama book and television deals. Then there is the Biden family corruption, followed closely behind by similar abuses of power and office by the Warren and Sanders families, as Peter Schweizer described in his recent book “Profiles in Corruption.” These names just scratch the surface of government corruption. BRIAN C JOONDEPH

What’s really baffling is Hunter’s success with women. Despite being a total loser with a terrible drug habit and some weird sexual perversions, Hunter managed to seduce his brother’s widow, her sister, a stripper, and the woman he married, all over the course of four years. It’s enough to make one think that Hunter’s charm had less to do with the man himself and more with the benefits flowing from the Biden family cartel. ANDREA WIDBERG

As a senator, Biden vigorously voted for several similar bills. In short, based on his voting record, Joe Biden is not (and never was) a champion of disadvantaged Americans, unless you consider multi-billion-dollar credit card corporations and millionaires “disadvantaged.” Chris Talgo

Nancy Pelosi, a horrid woman equally as without heart and soul, on Tuesday refused to have the names of the thirteen soldiers killed in Kabul read out on the floor of the House. That should permanently indict her for being the wicked witch she is. She is more devious, more calculating than the irresponsible Biden but every bit as beyond redemption as he is. She will do anything to try to convince the American people, for whom she has only contempt, that whatever she and her party do is righteous no matter how loathsome and totalitarian. PATRICIA McCARTHY

Biden lied about his undergraduate degree and his majors, lied about his rank in law school, lied aboutscholarships and educational aid he had received, lied about his stance toward the Vietnam war while in college, lied about his plagiarism of other politician's writings and speeches, lied about the circumstances around his first wife's fatal accident, lied about how he met his second and current wife, and lied about the affair they were having when they were both married. MARK CHRISTIAN

Most recently and dramatically, Biden lied about his knowledge of his son's shady dealings, lied about his own involvement in corruption and ribery, and lied about his current presidential agenda and what he wants to implement in regards to energy, fracking, court-packing, health care, education, and COVID among other issues.

MARK CHRISTIAN

THE BIDEN KLEPTOCRACY

American people deserve to know what China was up to with Joe Biden, especially when Beijing had already shelled out millions of dollars to Biden family members — including millions in set-asides for “the big guy.” What else is on that infamous Hunter Biden laptop? The conflicted Biden Justice Department cannot be trusted to engage in any meaningful oversight on this issue. We need a special counsel now.

TOM FITTON - JUDICIAL WATCH

’Our entire crony capitalist system, Democrat and Republican alike, has become a kleptocracy approaching par with third-world hell-holes. This is the way a great country is raided by its elite.” ---- Karen McQuillan AMERICAN THINKER.com

"Along with Obama, Pelosi and Schumer are responsible for incalculable damage done to this country over the eight years of that administration (JOE BIDEN WAS OFF SUCKING OFF BANKSTERS AND BRIBES)." PATRICIA McCARTHY

How Wealth Inequality Spiraled Out of Control | Robert Reich

https://www.youtube.com/watch?v=wOI8RuhW7q0

This is because despite all its declarations, the Democratic Party is not a party of workers. It, as Biden’s transition team attests, is a party of Wall Street, big banks, Amazon, and the military-industrial complex.

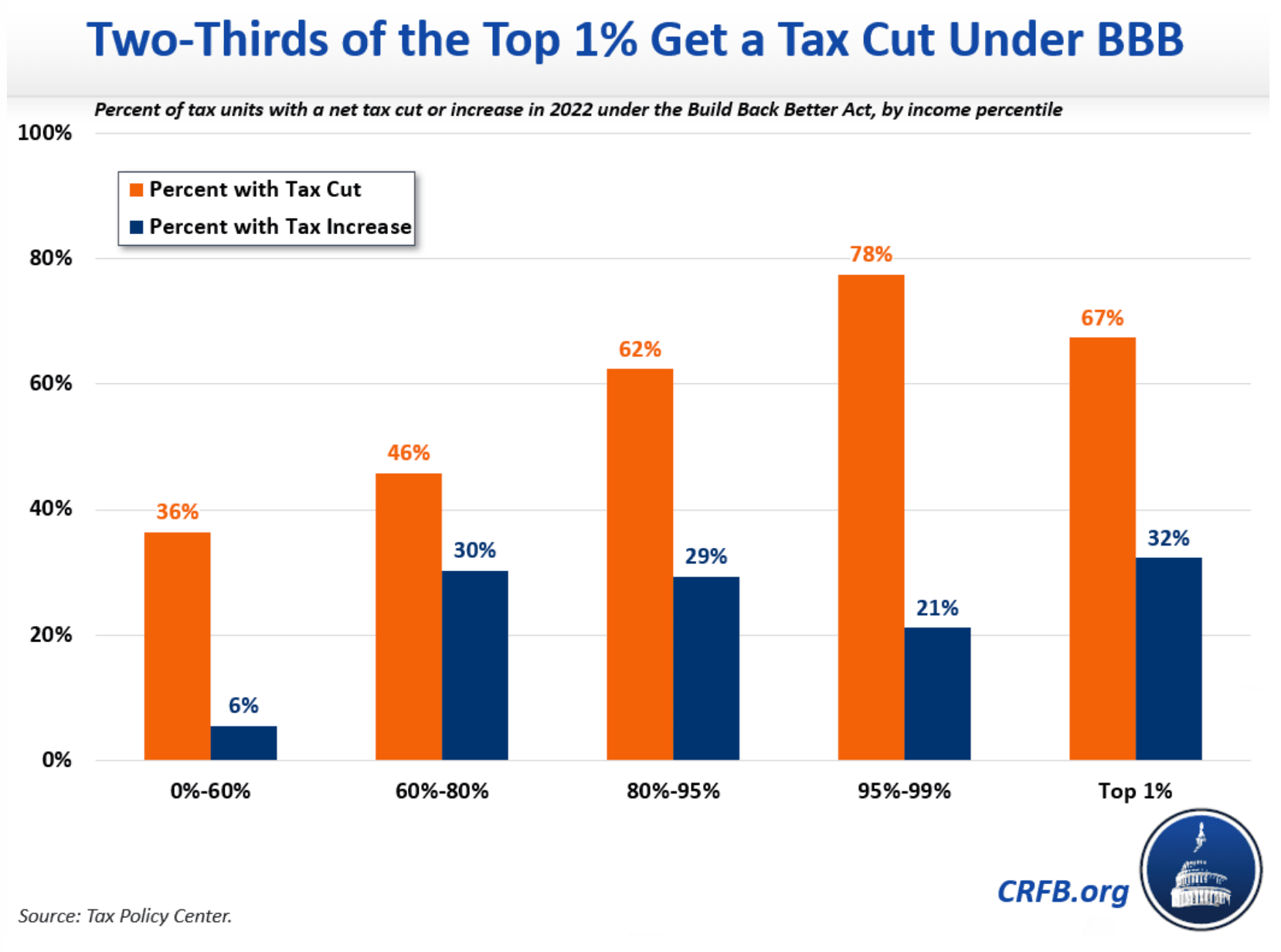

According to an analysis by the Tax Policy Center, the SALT tax provision will overwhelmingly benefit the top 10 percent of income earners, with virtually nothing going to the remaining 90 percent, i.e., the working class and lower-middle class. The measure will particularly benefit the top one percent, those who make over $867,000 a year. They will see a tax cut in the tens of thousands of dollars.

“I don’t know that anybody since John Rockefeller has had as unfeathered power as Mark Zuckerberg has right now where no one stands up to him inside his company, no one stands up to him on the board, no one stands up to him in Congress, no one stands up to him at the White House, no one really stands up to him in the media. He is a robber baron. Elon Musk is a robber baron. These people are robber barons,” Scarborough proclaimed. JOE SCARBOROUGH

PAST THEIR LIES.... THE REAL ECONOMY:

WHY ARE THEY AFRAID? ECONOMIC PERIL IF RATES GO HIGHER, SMALL BUSINESSES FEAR 2022, RENTS HIGHER

Market Chaos is Coming

Tucker: This is how dumb CNN is

Analysis: Joe Biden’s ‘Build Back Better’ Would Make the Rich Even Richer

President Joe Biden’s “Build Back Better Act” is set to give a tax cut to about 67 percent of the nation’s richest Americans — those earning more than $885,000 every year.

A new analysis from the Committee for a Responsible Federal Budget reveals that the filibuster-proof reconciliation package will give a tax cut to two-thirds of the top one percent of earners even as the top one percent now hold more wealth than the entire American middle class.

“This is true despite the fact that Build Back Better would raise taxes substantially for the extremely rich (mainly those making over $10 million per year),” the analysis states.

In effect, those in the top one percent would receive an average tax cut of more than $16,000 in 2022 under Biden’s plan. The tax cuts for the wealthy would be a result of the plan’s increasing the State and Local Tax (SALT) deduction cap.

As Breitbart News has reported, the plan amounts to a $625 billion tax cut for the wealthiest of Americans living primarily in blue states.

“In other words, the largest tax cuts in dollars in Build Back Better would go to households in the top five percent and especially the top one percent,” the analysis continues. “Many make millions of dollars of annual income and tens of millions of dollars in assets.”

At the same time, Biden’s plan would squeeze an extra $200 billion out of American taxpayers by mostly targeting working and middle class earners with more Internal Revenue Services (IRS) audits.

The plan ensures nearly 600,000 more working and middle class Americans earning $75,000 or less a year would be audited by the IRS. Of those new IRS audits, more than 313,000 would target the poorest of Americans who earn $25,000 or less a year.

Biden’s “Build Back Better Act” has already passed the House, thanks entirely to Democrat support, and now awaits scrutiny in the United States Senate.

In 2017, former President Trump had the SALT deduction capped at $10,000. Since then, Democrats have sought to deliver their wealthy, blue state donors with a massive tax cut by eliminating the cap altogether or greatly increasing it.

Biden, for instance, had sought to include tax cuts for his billionaire donors in a Chinese coronavirus relief package earlier this year. The plan was ultimately cut from the package. House Speaker Nancy Pelosi (D-CA), in May 2020, also tried to include the plan in a coronavirus relief package.

John Binder is a reporter for Breitbart News. Email him at jbinder@breitbart.com. Follow him on Twitter here.

House Democrats pass stripped-down social welfare bill with massive tax cut for the rich

On Friday morning, the House of Representatives passed its version of President Joe Biden’s $1.75 trillion “Build Back Better” social welfare and climate bill. As expected, the measure was approved on a party-line vote, with 220 Democrats voting “Yes” and all 212 Republicans voting “No.” One Democrat, Jared Golden of Maine, a conservative former Marine who served tours of duty in Iraq and Afghanistan, broke ranks and voted in opposition to the bill.

Golden had announced that he would oppose the bill because it included a massive tax break for the wealthy. The outcome of months of internal Democratic Party wrangling was the decision of the Biden White House and the party leadership to strip the bill of all major tax increases opposed by big business and slash the top line figure for social programs and climate protection in half, from $3.25 trillion to $1.75 trillion over 10 years.

That, however, did not satisfy the Wall Street and corporate interests that dictate government policy and control both major parties. Earlier this month, House Speaker Nancy Pelosi incorporated into the bill a measure demanded by wealthy donors in high-tax states such as New York, New Jersey and California. It was the lifting of a $10,000 cap on deductions on federal income taxes to compensate for state and local taxes. The cap was imposed as part of the Trump tax bill passed in December of 2017, which slashed taxes for corporations and the wealthy.

Until then, there was no limit on the amount of federal tax deductions for state and local taxes that wealthy people in generally pro-Democratic high-tax states could claim by itemizing their federal tax returns. In imposing the limit, Trump and the Republicans were targeting states that historically vote “blue” in federal elections.

This infuriated the Democrats’ wealthy backers, who demanded that the Biden budget bill raise the limit on so-called SALT (state and local tax) deductions. The Democrats acceded by adding to the bill a provision raising the limit to $80,000 for each of the next nine years.

The Congressional Budget Office estimates that this tax windfall for the wealthy will cost the federal government $285 billion over the 10-year span covered by the bill, making it the second most costly item in the legislation. It is topped only by a combined $390 billion for universal pre-school for three- and four-year-old children and limited subsidies for child care.

It is considerably higher than the allocation for clean energy and climate resilience ($220 billion), four weeks of paid family and medical leave ($195 billion), clean energy and electricity tax credits ($190 billion), affordable housing ($170 billion), Medicaid home- and community-based services ($150 billion), a one-year extension of the expanded child tax credit ($130 billion), and tax credits for health insurance premiums under Obamacare ($125 billion).

It would help pay for programs that were severely cut or dropped outright from the bill under pressure from big business and its most open mouthpieces in the Democratic Party, such as senators Joe Manchin of West Virginia and Kyrsten Sinema of Arizona. These include free community college (eliminated); the ability of Medicare to negotiate drug prices with the pharmaceutical industry, thereby lowering their costs (reduced to a shell program affecting only a handful of drugs and not even starting until 2024); and Medicare coverage for dental, hearing and vision (reduced to limited subsidies for hearing aids).

According to an analysis by the Tax Policy Center, the SALT tax provision will overwhelmingly benefit the top 10 percent of income earners, with virtually nothing going to the remaining 90 percent, i.e., the working class and lower-middle class. The measure will particularly benefit the top one percent, those who make over $867,000 a year. They will see a tax cut in the tens of thousands of dollars.

“Anything you do to eliminate the SALT cap is going to be regressive, because that tax is overwhelmingly paid by very high-income people,” said Howard Gleckman of the Tax Policy Center. “Anything you do to lower that tax doesn’t matter for most people.”

The Committee for a Responsible Federal Budget (CRFB) reported that a family of four in Washington D.C. making $1 million per year would receive 10 times as much tax relief next year from expanding the state and local tax deductions as a middle-class family would receive from an expansion of the child tax credit. The CRFB said that two-thirds of households making more than $1 million a year would get a tax cut under the legislation because of the increase in the state and local property tax deduction.

Pointing to the brazen hypocrisy of Biden and the Democratic Party, Marx Goldwein, senior policy director at the CRFB, said, “We’re debating about whether to give lower- and middle-class families a thousand dollars more a year through the child tax credit, while giving upper-class families $10,000 or more through SALT. That’s counter to everything the Democrats have been saying Build Back Better is about and everything they said about the Trump tax cuts.”

According to a report from the Tax Foundation, raising the SALT cap would more than offset other tax increases for the wealthy in 2022 included in the House bill. These include a 15 percent minimum corporate tax, a 1 percent tax on stock buybacks, increased taxes on US companies’ foreign profits, and a surtax of 5 percent on those with adjusted gross income over $10 million and 8 percent on those making more than $25 million.

In a column in the Financial Times on Thursday, Edward Luce alluded to the Democrats’ obsession with identity politics and linked it to the Build Back Better bill:

The result is a bill that caters best to the most powerful slice of Americans—the very wealthy. They can sleep easy now that the carried interest loophole, which allows private equity partners to be taxed at lower than ordinary income rates—as Warren Buffett pointed out, they pay a lower tax rate than their secretaries—is probably safe. As it stands, the bill will also give wealthy Americans a bigger tax cut than they got from Trump’s big 2017 tax bill.

Even this miserable travesty of social reform will be further gutted if not blocked outright in the Senate, where passage will require the support of all 50 Democrats. Neither Manchin nor Sinema has signed on to the bill, the former having declared his opposition to even a completely inadequate a four-week paid leave provision, while calling for means testing and work requirements for other social benefits.

The so-called “progressives”—Bernie Sanders, Elizabeth Warren in the Senate, the more than 100-strong House Progressive Caucus—capitulated to the demand of Biden and the most right-wing factions in the Democratic caucuses to pass the $1 trillion bipartisan infrastructure bill. This bill was backed by virtually every corporate lobby group, without having secured the agreement of Manchin and Sinema to support Senate passage of the broader “Build Back Better” social spending bill, against which the corporations have waged a massive lobbying campaign.

Sanders, for his part, has denounced the inclusion of the SALT provision in the House bill but is supporting a modified version in the Senate bill, according to which eligibility for expanded tax deductions would be limited to people making less than $400,000 a year. On the other hand, Senate Majority Leader Chuck Schumer, widely known as the “senator from Wall Street,” is supporting an even bigger deduction than that provided by the House.

BEZOSHEAD REDEFINES THE TERM 'CAPITALIST PIG'

Amazon, this year alone, petitioned for nearly 3,000 employment-based green cards for their foreign visa workers and foreign nationals seeking to take high-paying white collar jobs. Microsoft and Google, likewise, petitioned for more than 3,300 employment-based green cards.

WHAT IF THIS PIG HANDED OVER TO THE TORNADO VICTIMS THE SAME

AMOUNT OF LOOT HE SQUANDERED TAKING

A TEN MINUTE JOY RIDE INTO SPACE???

During the 2020 Democratic primaries, every candidate pledged to repeal the Trump tax cut for the rich. Biden has repeatedly called his domestic agenda a “blue collar” program. While declaring ad nauseam that “I am a capitalist,” who has nothing against people becoming billionaires, he has called on Wall Street to “pay their fair share.”

As a senator, Biden vigorously voted for several similar bills. In short, based on his voting record, Joe Biden is not (and never was) a champion of disadvantaged Americans, unless you consider multi-billion-dollar credit card corporations and millionaires “disadvantaged.” Chris Talgo

THE DEMOCRAT PARTY LOVES THEIR

TECH BILLIONAIRES FOR OPEN BORDERS!!!

Scarborough: Zuckerberg, Musk ‘Robber Barons’; Tax Cuts ‘Grotesque’

MSNBC “Morning Joe” host Joe Scarborough blasted Facebook founder and CEO Mark Zuckerberg and Tesla founder and space entrepreneur Elon Musk on Thursday.

Scarborough described the two tech giants as “robber barons.” He also lamented the tax cuts from the 1980s and 1990s, which he supported, as well as the GOP’s 2017 Tax Cuts and Jobs Act, arguing they “created the greatest income redistribution in the history of the planet.”

“I don’t know that anybody since John Rockefeller has had as unfeathered power as Mark Zuckerberg has right now where no one stands up to him inside his company, no one stands up to him on the board, no one stands up to him in Congress, no one stands up to him at the White House, no one really stands up to him in the media. He is a robber baron. Elon Musk is a robber baron. These people are robber barons,” Scarborough proclaimed.

“And we have seen the greatest transfer of wealth, which Republicans love to say, ‘Oh, we don’t like to redistribute income.’ Oh, really? Well, the tax policies that I have supported through the ’80s and ’90s and continued to be supported by Republicans in the 21s century have created the greatest income redistribution in the history of this planet from middle-class Americans to the Elon Musks of the world,” he added. “It’s grotesque.”

Follow Trent Baker on Twitter @MagnifiTrent

Billionaires increased wealth by $3.6 trillion in 2020, as millions died from global pandemic

The World Inequality Report 2022, released by the global research initiative World Inequality Lab, found that the COVID-19 pandemic has widened the financial gap between the rich and poor to a degree not seen since the rosy days of world imperialism at the turn of the 20th century.

The world’s billionaires enjoyed the steepest increase in their share of wealth last year since the World Inequality Lab began keeping records in 1995, according to the study released Tuesday. Billionaires saw their net worth grow by more than $3.6 trillion in 2020 alone, increasing their share of global wealth to 3.5 percent. Meanwhile, the pandemic has pushed approximately 100 million people into extreme poverty, boosting the global total to 711 million in 2021.

“Global inequalities seem to be about as great today as they were at the peak of western imperialism in the early 20th century,” the report said. “Indeed, the share of income presently captured by the poorest half of the world’s people is about half what it was in 1820, before the great divergence between western countries and their colonies.”

The report showed the wealthiest 10 percent of the world’s population takes 52 percent of global income, compared to the 8 percent share of the poorest half. On average, an individual in the top decile earns $122,100 (€87,200) per year, while a person from the poorest half of global earners makes $3,920 (€2,800) a year.

Global wealth inequality is even more pronounced than income inequality. The poorest half of the world’s population only possess 2 percent of the total wealth. In contrast, the wealthiest 10 percent own 76 percent of all wealth, with $771,300 (€550,900) on average.

The ultra-rich have siphoned a disproportionate share of global wealth growth over the last few decades. The top 1 percent took 38 percent of all additional wealth generated since 1995, whereas the bottom 50 percent have only captured 2 percent of it. The wealth of the richest individuals has grown between 6 to 9 percent per year since the mid-1990s, compared to the global 3.2 percent average.

Inequality levels vary across the regions. In Europe, the top decile takes about 36 percent of income share, while it holds 58 percent in the Middle East and North Africa. However, inequalities between countries have declined in the last two decades, whereas inequality within “rich” countries has risen sharply. In the United States, the top 1 percent owned 35 percent of the country’s wealth, approaching Gilded Age levels of inequality.

This massive accumulation of capital has come at the expense of public wealth over the last four decades. The share of wealth held by public actors is close to zero or negative in “rich” countries, indicating that the totality of wealth is privately owned, a trend exacerbated by the coronavirus pandemic.

The report also studied connections between wealth inequality and inequalities in contributions to climate change, showing the top 10 percent of emitters are responsible for close to 50 percent of all greenhouse gas emissions, while the bottom half produces 12 percent of the total. This disparity is also seen within nominally rich countries. The bottom half of the population in Europe, East Asia, and North America is responsible for an average of 3 to 9 metric tons of emissions per person a year. This contrasts sharply with the emissions of the top 10 percent in these regions: 29 metric tons in Europe, 39 in East Asia, and 73 in North America.

Given this diverse and severe inequity, the authors of the report propose a series of “modern progressive taxes” on wealth used to invest in education, health, and ecological restoration.

But such a path is a dead end; All the official and semi-official institutions of government are subordinated to the interests of the financial aristocracy and serve to constrain and block any measure that threatens their hoards of wealth.

This is demonstrated by the disastrous response to the COVID-19 pandemic, with governments around the world declaring the pandemic over and eliminating remaining protective measures. Rather than being driven by concern for public health, the actions of governments have been driven by the effort to protect the wealth and privileges of the upper echelons of society.

The glaring contradiction between the world’s richest people and the precarious circumstances billions are living in is fueling a growing wave of working class militancy. The working class must demand the massive amount of wealth and resources hoarded by the wealthiest layers be seized and directed to fight the global pandemic.

The chief obstacle to solving the world’s burning social questions—whether the devastating impact of COVID-19 or the widespread growth of inequality—is the private profit interests of the capitalist ruling class. To save lives and avert even further disaster, workers must build an international socialist movement based on the interests of the working class.

THERE IS NO GREATER THREAT TO AMERICAN, THE AMERICAN MIDDLE CLASS OR AMERICAN BORDERS THAN AS PERPETRATED BY THE GLOBALIST DEMOCRAT PARTY

BIDEN CRONY JEFF 'BEZOSHEAD' BEZOS RECENTLY HANDED THE PHONY OBAMA LIBRARY A 'GIFT' OF $100 MILLION. JOE LOVES THE SMELL OF THAT! HE'S PLANNING A 'PRESDIENTIAL LIBRARY' AS WELL.

Make Amazon Pay wrote in a list of demands on its website: “The pandemic has exposed how Amazon places profits ahead of workers, society, and our planet. Amazon takes too much and gives back too little. It is time to Make Amazon Pay.”

Pelosi: Dems Are Using Cash for Kids As 'Leverage' to Pass BBB

(CNSNews.com) - Unless Senate Democrats join House Democrats in passing the partisan "Build Back Better Act (BBB)," there will be no more direct cash payments to millions of American families with children.

On Tuesday, a reporter asked House Speaker Nancy Pelosi (D-Calif.) if she would consider a stand-alone bill extending the monthly Child Tax Credit payments so the direct cash infusions can continue in 2022.

Pelosi admitted that she's using the payments as "leverage" to force passage of the Democrat agenda, much of contained in the multi-trillion-dollar BBB:

"Of course, we could pass that in the House," said Pelosi, who repeatedly insists that everything she does is “for the children."

Whether we could pass it in the Senate remains to be seen. But I don't want to let anybody off the hook on the BBB to say, well, we covered that one thing, so now the pressure is off. I think that that is really important leverage in a discussion on BBB that the children and their families will suffer without that payment.

Not everybody gets it on a monthly basis, but those who need it the most do. And so, we're just still optimistic about BBB passing. And perhaps even if it were after the first of the year, which I hope it is not, that it could be retroactive if it's early enough in the first of the year.

The Child Tax Credit gives qualifying families up to $3,600 a year for every child under age six and up to $3,000 a year for every child 6-17.

Normally, the credit is deducted from a family's taxable income. But Democrats, in the American Rescue Plan, raised the amount from $2,000 and delivered the credit in the form of monthly cash payments.

They also made families with little or no income -- those who don't pay any taxes -- eligible for the monthly payments.

Yesterday's (Dec. 15) payment could be the last one of its kind, unless Democrats pass the BBB, which extends the cash infusions for one year -- in addition to establishing other big government programs such as subsidized child care, paid family and medical leave, free pre-school for toddlers, help with home purchases, the green new deal, and much more -- all of it supposedly "fully paid for," as President Biden and his supporters insist.

Republicans on the House Ways and Means Committee argue that "[g]ood jobs and rising paychecks do more to lift Americans out of poverty than dependence on never-ending government checks. There are a number of factors contributing to poverty. Rewarding work and helping the poor become self-sufficient is the surest path out of poverty," they say.

Republicans say Democrats intend to make the monthly cash payments permanent, starting with the one-year extension contained in BBB.

Republicans reject the Democrat claim that the Child Tax Credit has reduced child poverty by 40 percent.

"There is no sound evidence to back up this claim. Democrats cite a flawed study by the Poverty Center at Columbia University that assumes all eligible children are enrolled in the program -– which they are not," they say.

"In July, a left-leaning organization noted that only 720,000 of the approximately 7 million kids that are eligible but not already registered with the IRS were successfully receiving new child tax credit -- and that 90 percent or more of the kids the IRS needed to reach have not been reached."

Republicans also point to studies showing "that many recipients have used the Child Tax Credit to pad their savings or save for retirement. While commendable, that’s not its purpose," they say.

Moreover, the monthly payments are believed to be contributing to the shortage of willing workers.

ALL BILLIONAIRES ARE DEMOCRATS FOR OPEN BORDERS TO KEEP WAGES DEPRESSED. JOE BIDEN IS RIGHT THERE RUNNING THEIR SHOW!

No comments:

Post a Comment