AMERICA IS A NATION FOR THE RICH AND 'CHEAP' ILLEGAL LABOR THAT THE RICH DEMAND

AMERICA IS A NATION FOR THE RICH AND 'CHEAP' ILLEGAL LABOR THAT THE RICH DEMAND

25 Facts About The Explosive Growth Of Poverty In America That Will Blow Your Mind

https://www.youtube.com/watch?v=ANm7FAKuCw0

The rest of the world sees America as the wealthiest nation on the entire planet. But when we take a closer look at the hardships our population is facing, we can rapidly realize that there's a tremendous amount of financial suffering in the United States, and that's getting dramatically worse with each passing year. Today, more money goes towards the pockets of the rich than ever before. Over the past few decades, we've been witnessing the greatest event of wealth transfer in the history of our nation without even realizing it. While billionaire CEOs like Mark Zuckenberg make over a million times more than the average American worker every year, many families out there, whose parents work themselves to the bone every single day, will still struggle to find what to eat and where to sleep with their children tonight. Extreme poverty continues to grow all across the country. According to an analysis released by the University of Chicago, at least 336,000 households with children live on less than two dollars a day. That’s a group known as the ultra-poor. Amid skyrocketing housing and rent prices, at least 600,000 Americans remain in a group known as the “unhoused”. “Right now, we are still trending in the wrong direction,” explained Anthony Love, interim executive director at the United States Interagency Council on Homelessness. “When the public is told that one particular policy is going to end homelessness, what they’re expecting is that they’re going to see fewer homeless people around,” added Stephen Eide, a senior fellow at the Manhattan Institute. What they haven’t considered yet is that housing has to come first, Eide stressed. Meanwhile, the gap between the rich and the rest of the population is worsening. On average, the top 1% of earners make 20 times more than the bottom 90% every year. The wealth disparity grows the higher up the ladder we climb. Even the mid-level one-percenters can’t reach the gigantic amounts earned by the ultra-rich. These disparities, make us question whether the US is indeed a rich nation or a nation for the rich. The answer is up to interpretation, but you can have a clearer picture about this issue at the end of this video. Today, we gathered some staggering stats that expose that poverty in the United States is wildly out of control. Here are 25 Facts About The Explosive Growth Of Poverty In America That Will Blow Your Mind. For more info, find us on: https://www.epiceconomist.com/

15 Facts That Show Rising Prices Are Absolutely Eviscerating America’s Shrinking

Middle Class

https://www.youtube.com/watch?v=wb_1NSFYpgY

The United States used to have the largest and strongest middle class in the entire world... but those times are long gone. Now, the American middle class is rapidly shrinking, and the current economic conditions are accelerating that process even further. We've never seen prices reach stratospheric levels so rapidly, and a series of economic trends show that this is just the beginning. Amid soaring prices for virtually everything, consumer sentiment plunged again last month, hitting its lowest level since August 2011, according to the University of Michigan. At this point, two-thirds of Americans say higher prices have been difficult or even a hardship, and they’re now forcing many to make cutbacks.

According to Laura Wronski, the senior manager of research science at Momentive, “people making six-figure incomes are almost as worried about inflation as people making half as much —and they are just as likely to be taking steps to mitigate its effect on their lives. Inflation is a problem that compounds over time, and even middle and upper-income individuals won’t be insulated from the second and third-order effects of price increases,” she said. A new study by Wells Fargo discovered that the middle class is getting more financially squeezed by rampant prices than any other income group in the United States. And it is going to get “worse before it gets better,” according to Moody’s Analytics. Meanwhile, home prices are absolutely exploding. Over the past two years, they went up by a staggering 32.6%. The latest jump in mortgage rates has effectively put homebuyers in the worst position since 2007.

At the same time, most people are barely scraping by from month to month, and the meteoric rise in the price of consumer goods is certainly not helping matters. And if you think things are bad right now, in a couple of months, they could be a whole lot worse. Even the White House is warning that consumers should brace for some painful price hikes in the coming weeks and months.

It’s getting harder and harder for millions of middle-class families to keep their heads above the water as inflation eats up a larger share of their monthly incomes. That's compromising the purchasing power of hard-working Americans who dedicate their lives to building a comfortable lifestyle. As the price of everything reaches new record-highs, this situation is rapidly becoming unsustainable.

We’re on the verge of another economic recession, and all of the facts we share with you in this video are proof of that. Americans have never experienced so much financial suffering since the 2008 Great Recession and the Great Depression of the 1930s.

Unfortunately, as we're being told, a lot more pain is ahead, and given that our leaders continue to overlook our worsening problems, we should start doing whatever we can to protect ourselves and our families from the coming chaos because it is crystal clear now that we're on our own. That's why today, we compiled several stats that uncover the distressing effect of soaring prices in the lives of millions of middle-class families all across the country. Here are 15 Facts That Show Rising Prices Are Absolutely Eviscerating America’s Shrinking Middle Class.

For more info, find us on: https://www.epiceconomist.com/ And visit: http://theeconomiccollapseblog.com/

Economic Update: Capitalism & Its Self-Delusions

https://www.youtube.com/watch?v=rbdJ-LuVZqI

In the first half of this week's show, Wolff evaluates US capitalism as a system of production and distribution of goods and services. In the second half, he compares the evaluation with the very different self-image of dominant voices within US capitalism. His conclusion: US capitalism has peaked and finding it very difficult to face its decline. **Economic Update with Richard D. Wolff is@Democracy At Work production. We make it a point to provide the show free of ads. Please consider supporting our work. Become an EU patron on Patreon: https://www.patreon.com/economicupdate and help us spread Prof. Wolff's message to a larger audience. Every donation counts!

20 Signs That American Families Are Being Economically Destroyed

https://www.youtube.com/watch?v=PN9pMwQEKog

The systematic destruction of the American way of life is happening all around us. But still, most part of our population has no idea what is happening. Once upon a time in America, if you worked hard and managed your spending, you could support a middle-class lifestyle for your entire family with one good-paying job, even if you only had a high school education. We can't say that things were perfect, but back then almost everyone in the country was able to take care of themselves without the need for government assistance. We worked hard, we played hard, and our seemingly boundless prosperity was inspiring for many other economies around the world. But things started to go downhill over the past few decades. We started to consume far more wealth than we produced, we shipped about 50 million good-paying jobs to foreign countries, we accumulated the biggest mountain of debt in the history of the world, and we kept voting for politicians that did not care at all about the long-term future of this nation. Today, dependence on the government is at an all-time high, and that leaves millions of Americans in a very vulnerable position because we're at the precipice of the next great economic recession. Inequality is soaring. All of the gains from economic growth over the last half-century went to the top one percent of income earners, and incomes in the bottom half of the U.S. income distribution have actually declined when adjusted to the current inflation levels. Kaitlyn Henderson, senior research adviser at Oxfam America, highlighted that "it's shameful that at a time when many US companies are boasting record profits, some of the hardest working people in this country -- especially people who keep our economy and society functioning -- are struggling to get by and falling behind." On the same note, according to Allison Sesso, executive director of RIP Medical Debt, a nonprofit organization that buys consumer debt from healthcare providers or aggregators for pennies on the dollar, “the system is rigged against the American worker. Medical debt is uniquely American and it’s a by-product of the broken financing of our healthcare system. The majority of medical debt is owned by people who don’t have the money to pay for it,” Sesso explained. These are incredibly hard times for millions of us - and as opposed to what some say, most people are not in such distressing situations because they want to. Rather, they are victims of our long-term economic decline. The downfall of our system has just begun, and the next recession is going to unleash widespread financial suffering in our country. As we enter that time, we will need a whole lot more empathy and compassion than we are exhibiting right now. Everything is falling apart at the seams in our nation, and life in America is about to change in an irreversible manner. The numbers we're about to share with you are staggering, and you probably fit into one of these categories or faced some of these challenges yourself. Here are 20 Signs That American Families Are Being Economically Destroyed. For more info, find us on: https://www.epiceconomist.com/ And visit: http://theeconomiccollapseblog.com/

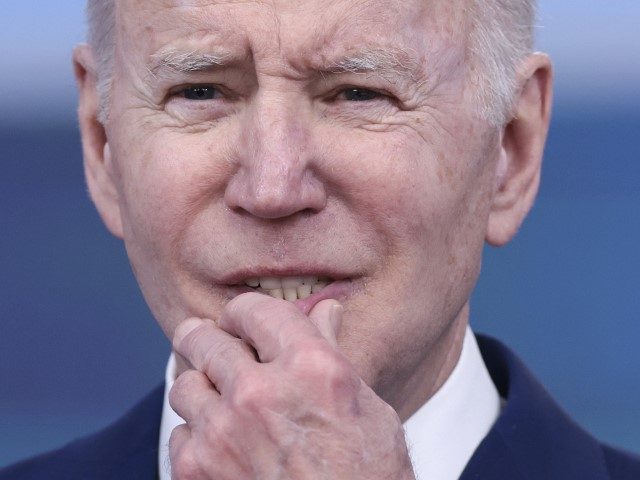

Poll: Just 16 Percent Strongly Approve of Joe Biden

Just 16 percent of Americans strongly approve of President Joe Biden, a Wednesday Morning Consult/Politico poll reveals.

Meanwhile, 40 percent strongly disapprove of Biden, a 24-percent gap.

Overall, the poll marks Biden’s approval at just 41 percent. A massive 55 percent disapprove of Biden. Biden’s approval numbers have remained about the same for the last couple of weeks.

The lowest approval rating Biden has ever received was 33 percent, according to a Quinnipiac poll in January.

Biden’s approval rating mirrors respondents’ opinions on whether the nation is headed in the wrong or correct direction. Only 31 percent said the nation is headed in the right direction. Sixty-nine percent said the nation is headed in the wrong direction, a 38-point gap.

Biden’s sagging poll numbers are bleeding into the midterms. Respondents trusted Republicans more than Democrats to handle the most important issues, according to the poll:

- Economy (48 percent trusted Republicans -34 percent trusted Democrats)

- Jobs (48-37 percent)

- Inflation (48-30 percent)

- Immigration (47-36 percent)

- Energy (42-40 percent)

- National Security (49-33 percent)

- Gun Policy, (45-36 percent)

The poll numbers reveal that Republicans may have a huge election victory in November. And the Democrats’ position could become worse.

According to the poll, Americans’ top concerns are inflation, jobs, and wages. But Democrats are struggling to reduce inflation and increase wages. As a result, Americans’ jobs may be impacted by a recession. Deutsche Bank Economists are predicting a recession within the next two years.

“Two shocks in recent months, the war in Ukraine and the build-up of momentum in elevated U.S. and European inflation, have caused us to revise down our forecast for global growth significantly,” they wrote. “We are now projecting a recession in the U.S. and a growth recession in the euro area within the next two years.”

On Tuesday, Labor Department numbers showed the consumer price index has soared 8.5 percent in one year, the largest year-over-year increase since 1981. The inflated prices will reportedly cost consumers an extra $5,200 in 2022, or $433 per month. Inflation already cost consumers an estimated $3,500 in 2021, impacting low-income families the hardest, according to the University of Pennsylvania’s Wharton School.

Biden’s High-Migration Economy: Wages Crash by Almost 3 Percent

Americans’ wages have dropped by almost 3 percent under President Joe Biden’s high migration, big-spending policies, according to data presented by one of President Barack Obama’s top economists.

“Inflation ran 8.5% in the year ending last month, while nominal wages grew only 5.6%, a decline in inflation-adjusted wages of 2.7%,” Jason Furman at Harvard University wrote in a Wall Street Journal article.

“That [2.7 percent] is a larger decline than any pre-pandemic year in the last forty years,” he said in an April 12 tweet.

Americans’ disposable income fell because prices inflated faster than wages rose. Prices rose by a shocking 8.5 percent, while wages rose by an impressive 5.6 percent.

Republicans are spotlighting the economic damage. For example, a message from the Republican National Committee pointed out:

FACT: Real average hourly earnings are down 2.7% and real average weekly earnings are down 3.6%.

FACT: Bidenflation is costing Americans $433 per month just to maintain the same level of living.

But establishment experts rarely mention the impact of mass migration on Americans’ wages and housing. Furman, for example, keeps a narrow focus on dollar inflation — not the impact of Biden’s other economic policies.

Since January 2020, Biden has largely opened the nation’s borders to a wave of roughly 2 million migrant workers and families. That huge inflow of legal immigrants, illegal immigrants, quasi-legal asylum seekers, and visa workers inflates the U.S. economy for investors, CEOs, and tax collectors. That policy will re-inflate the two-decade-long cheap labor bubble that was burst in 2020 by President Donald Trump’s policies.

For example, the new migrants need homes, so they are helping to inflate rents and revenues for housing investors. “Nationwide rent prices have increased significantly year-over-year,” said a report by Rent.com, released March 15. “One- and two-bedroom rents were up 24.4 percent and 21.8 percent, respectively.”

The inflow of job-seeking migrants also reduces wage growth because employers no longer have to offer wages increases to find willing American workers, said Rob Law, the director of regulatory affairs and policy for the Center for Immigration Studies.

“If you have a tight labor market, then wages go up,” because employers must outbid each other to hire willing Americans, he said. But “employers have a government subsidy [from Biden] in the form of a basically unlimited combination of legal, pseudo-legal, and just blatantly illegal workers,” he said.

“Inflation and immigration are the one-two punch that cripples American workers’ take-home pay,” Law said.

Cheap labor migration also reduces high-tech investment by companies and farms. The result is that some U.S. companies use stoop labor instead of American-made machines:

Economists and reporters ignore the economic impact of the government’s long-standing economic policy of inflating the economy with imported workers, renters, and consumers, Law said:

It’s an across-the-board economic impact when you have a surplus of workers. There’s an increase in demand for housing in certain areas. There is a decrease in the ability to get certain preferred supplies or food stock when you are importing a whole new wave of people. Across the board, Americans are finding themselves worse off with their pay, their job opportunities, their housing, even healthcare in the form of longer lines.

The professional class likes to pretend that immigration is really only about humanitarian stuff and naturalizations. Immigration has a direct impact on every aspect of our American society, from the economy, from taxes, from public services. Which is why it’s so critically important that you consider what the levels are … too much of it — legal or illegal– is collectively a net loss to communities.

Furman recognized the value of a tight labor market where employers must compete for workers, saying:

There are good reasons to run a hot economy. Bringing in [American] workers whom employers would normally be reluctant to hire—those with, say, a past felony conviction, a disability or lower educational attainment—is genuinely wonderful. But in economics all good things don’t always go together. Millions of new jobs don’t necessarily lead to higher pay for the 150 million workers who are already employed.

Hot economies allow inflation because employers can easily and quickly raise prices faster than wages, he argued. “With so many eager customers, businesses can charge higher prices. Which goes up more—the bargaining power of workers or the pricing power of businesses—is theoretically ambiguous,” he said. The lesson, he said, is that federal policy should not overheat the economy by piling on spending programs.

Back in 2016, when he was working for Obama, Furman admitted that government policy had a devastating impact on Americans because it pushed many millions of Americans — perhaps 20 million men — out of the labor market, into poverty, and onto charity and welfare.

“This [dropout] is caused by policies and institutions, not by technology,” admitted Jason Furman, an economist who chairs the president’s Council of Economic Advisors. “We shouldn’t accept it as inevitable,” he told a Brookings Institute expert, Dave Wessel, on August 10.

The activists who want more immigration seized on the bad inflation news to argue that the government should extract more migrants from poor countries.

Catherine Rampell, for example, is a pro-migration op-ed writer for the Washington Post, who tried to argue on April 11 that more immigration would make Biden less unpopular:

Democrats are terrified that a coming border surge might tank their midterm chances.

But they have largely ignored a much more serious immigration-related political risk. The problem in the months ahead isn’t that the United States will allow in too many immigrants; it’s that we’ll admit too few, particularly the kinds of workers who can fill critical labor-market shortages.

Rampell, Princeton ’07, is a persistent advocate for the colonization-style extraction of human resources from foreign countries for use in the U.S. economy. That is good for CEOs but especially good for clever investors, such as her Harvard-graduate brother, who works for Andreessen Horowitz, an investment firm in Silicon Valley.

Meanwhile, polls show that immigration is helping to wreck the Democrats’ standing in the polls. Breitbart News reported on April 11:

A CBS News/YouGov Poll shows that even when Americans are not told the current level of overall immigration to the U.S. — where more than a million green cards are awarded, more than a million temporary visas are allotted, and hundreds of thousands of illegal aliens are added to the population annually — they continue to back reductions and limits over expansions and uncontrolled migration.

The poll asks Americans, “What do you think U.S. immigration policy should generally be?” About 61 percent of Americans said “some immigration” should be allowed but “based on strict criteria,” suggesting an overall reduction with a more rigorous vetting and assimilation policy.

About 19 percent of Americans said they want to “stop most or all immigration” to the U.S., while 20 percent said “allow a lot of immigration, including most or all people who want to enter,” suggesting support for an open border policy.

RealClearPolitics.com reported on April 12 that a sample of recent polls shows that Biden’s immigration policy is backed by just 35 percent of Americans, and is opposed by 59 percent.

Also, multiple Democratic legislators are protesting as Biden is scheduled to open the southern border on May 23 to all economic migrants who claim they are seeking asylum.

No comments:

Post a Comment