But inflation at the grocery store continues to rise. Prices were up 1.3 percent compared with a month earlier and 13.1 percent compared with a year ago.

The cost of rent also increased by 0.7 percent from the previous month; 6.3 percent from the previous year.

VIDEOS

Richard D. Wolff | How Capitalism RIPS YOU OFF

https://www.youtube.com/watch?v=RX4MV4X6FkE

Richard D. Wolff | Capitalism is SLAVERY and THEFT

Mass Layoffs Are BOOMING! A New Housing Market Crash Is Starting To Pick Up Speed As Well

PHILADELPHIA PENNSYLVANIA WORST AREAS AT NIGHT

'City of a Thousand': Ep. 1 Downtown Phoenix's tent city explodes at alarming rate

Last week, Republican Senator Ron Johnson called for ending Social Security and Medicare as entitlement programs, instead transferring them into the discretionary budget where they would be gutted.

Johnson’s proposal follows a similar call by Florida Senator Rick Scott, who earlier this year called for putting Social Security and Medicare up for renewal every five years.

Social Security and Medicare spending is allocated as mandatory spending, funded by workers’ payroll taxes, to prevent them from being pillaged. Transferring these programs to the discretionary budget would mean their abolition, slashing US life expectancy as millions of retirees die in poverty and from preventable disease.

“If you qualify for the entitlement, you just get it no matter what the cost,” Johnson said. “And our problem in this country is that [mandatory spending takes up] more than 70% of our federal budget, of our federal spending.”

Yes, retired workers are “entitled” to these benefits, because they have been paying for them their entire lives. Out of every dollar workers have earned, they paid eight cents to finance their Social Security and Medicare benefits, matched by equal payments from their employer.

But Johnson and Scott, lackeys for the billionaires that rule over America, are demanding that these funds that workers have been paying into over a lifetime of toil and struggle be stolen from them to make the oligarchy richer and to fund America’s new “forever wars.”

Social Security was created in 1935 as part of President Franklin Roosevelt’s New Deal, in response to a wave of social struggles during the Great Depression. Medicare was created in 1965 during President Lyndon Johnson’s Great Society reforms, against the backdrop of the Civil Rights movement and a strike wave gripping large portions of the country.

With both of these programs, the leaders of American capitalism sought to convince workers that the capitalist system was capable of providing for the needs of society and preventing the mass poverty and early death of millions of elderly people.

Johnson, Scott and their co-conspirators are making the opposite clear: Capitalism means social misery for the workers and the unending enrichment for the capitalist class.

These senators have articulated as a positive proposal what has been a goal of generations of Democratic and Republican politicians, military strategists and leading think tanks. In 2010, Democratic President Barack Obama formed the bipartisan “National Commission on Fiscal Responsibility,” chaired by former Republican Senator Alan Simpson and Democrat Erskine Bowles, a former chief of staff in the Clinton administration.

The commission called for slashing funding for Social Security and Medicare. On the basis of its proposals, the federal government oversaw a squeeze on social spending at the federal, state and local levels, together with significant cuts to Medicare and Social Security.

Now, amid the social crisis triggered by the pandemic, the eruption of war with Russia and the conflict with China, America’s financial oligarchy is renewing its calls for the dismantling of these bedrock social safety net programs.

In March Glenn Hubbard, the former Chair of the Council of Economic Advisers, published an op-ed in the Wall Street Journal calling for slashing Social Security and Medicare to fund a massive surge in military spending, declaring, “NATO Needs More Guns and Less Butter.” Hubbard, a Republican, praised the conclusions of Obama’s 2010 deficit reduction committee and called for the full implementation of its demands.

Hubbard echoed the themes of a 2013 paper by Anthony Cordesman of the Washington think tank Center for Strategic and International Studies (CSIS), which stated: “The US does not face any foreign threat as serious as its failure to come to grips with … the rise in the cost of federal entitlement spending.”

But while there is allegedly no money to pay retirees their retirement benefits, there is no limit to what can be handed out to defense contractors to fund the US conflicts with Russia and China.

In the six months since the outbreak of the US-NATO proxy war against Russia, the United States has pledged over $54 billion to the war effort, equivalent to $2 billion per week. The Senate is currently debating a bill that would send an additional $4.5 billion in weapons to Taiwan as part of the US military standoff with China.

In June, the Senate Armed Services Committee voted to approve a record $858 billion in military spending for Fiscal Year 2023, an increase of $45 billion over the Biden administration’s budget request and nearly $80 billion over the amount appropriated by Congress for the current fiscal year.

This massive surge in military spending is accompanied by a systematic effort to reduce workers’ wages with the aim of further enriching the financial oligarchy.

In June, announcing a surprise 75 basis point increase in the federal funds rate, Federal Reserve Chairman Jerome Powell said, “You have a lot of surplus demand … in the labor market … you have two job vacancies for every person seeking a job, and that has led to a real imbalance in wage negotiations.”

Powell made clear that the Federal Reserve is deliberately seeking to increase the unemployment rate, with the aim of further impoverishing workers, even to the point of triggering a recession.

He complained about the power of workers who are drowning in rising prices, even as corporations rake in the highest levels of corporate profits in years.

Nowhere in any section of the US political establishment is there a single mention of stopping the rampant price-gouging by corporations.

The overwhelming factor driving the increase in prices, according to an April 2022 study by the Economic Policy Institute, has been corporate price-gouging that feeds directly into profit margins. The study found that rising corporate profits contributed six times more to rising prices than rising labor costs, in a significant reversal of the previous period.

In 2021, profits surged 35 percent compared to the previous year, in the highest increase in corporate profitability since 1950.

By contrast, over the past 12 months, average hourly earnings for US workers have increased by just 5.2 percent, meaning that a typical worker makes 4 percent less per hour than he or she did a year ago.

The clear intention of the financial oligarchy that Johnson speaks for is to ensure that the impoverishment of workers taking place throughout the United States is transferred to retirees.

The American financial oligarchy has declared war on the working class. After ending of all restrictions on the spread of COVID-19 and forcing workers back into workplaces that are hotbeds for the transmission of the pandemic, the ruling class is engaged in an all-out effort not only to reduce workers’ wages but to slash whatever remains of America’s badly tattered social safety net.

This policy is creating a wave of social opposition in the United States and throughout the world, taking the form of strikes and protests. The growing mood of militancy and determined struggle has found expression in the campaign of Will Lehman, a socialist worker from Mack Trucks in Macungie, Pennsylvania, for president of the United Auto Workers.

In a letter to UAW members, Lehman demanded “Massive pay increases to make up for decades of givebacks,” “mandatory Cost-of-Living Adjustments (COLA) to keep pace with soaring inflation” and “the re-establishment of the 8-hour day, not on the basis of poverty-level wages, but with wages that allow us to provide for ourselves and our families.”

The financial oligarchy’s ruthless policy of class war, aimed at crushing the working class to dust, cannot be allowed to succeed. Workers must respond with a unified struggle to demand the preservation and expansion of Social Security and Medicare, coupled with double-digit wage increases to make up for decades of declining wages.

Workers must take up a political strategy—linking the fight for livable wages with the fight against war and the defense of democratic rights in the struggle for the socialist transformation of society.

YOU CAN BET THAT BIDEN'S WALL STREET CRONIES, INCLUDING BLACKROCK, HAVE ALREADY WRITTEN OUT THEIR BAILOUTS!

Take care of your family first then if your heart says to help others do it but use wisdom.

“People can hardly afford to eat”: US inflation continues to hammer workers

How are rising prices affecting you and your family? Fill out the form at the bottom of this article to share your story.

Annual price increases for US consumer goods remain at their highest level in nearly 40 years, according to the latest inflation data released Wednesday by the Bureau of Labor Statistics (BLS). Prices for items in the Consumer Price Index rose 8.5 percent in the 12 months ending in July, down slightly from the 9.1 percent rate reported in June, but still the second-largest yearly increase since December 1981.

Food prices in particular have surged in recent months. The BLS’ overall food index rose 10.9 percent year-over-year in July, while the cost of food at home increased 13.1 percent, the biggest increases since May 1979.

Amid a heat wave which has blanketed much of the US this summer and broken records in a number of regions, electricity costs rose 15.2 percent compared to last year, increasing by 1.9 percent over the last month alone.

The cost of shelter also pushed higher, with rent rising 6.3 percent nationally since 2021, with increases far greater in many major metropolitan areas, forcing large numbers of young people to live with their parents, and threatening others with eviction and homelessness. In California, 1.5 million households are behind on their rent, according to Census Bureau data released in late July.

Although the cost of gasoline, which is more volatile, fell somewhat from June, down 7.7 percent, it remained 44 percent higher than a year ago. The national average price for a gallon of gas is hovering near $4, compared to $3.18 in 2021.

The Biden administration and sections of the corporate media nevertheless seized on the latest data to claim that inflation is easing and that a corner being turned, with Biden misleadingly asserting that the BLS report showed “zero percent inflation in the month of July—zero percent.”

In a two-minute appearance, Biden painted a fantastical picture of a booming economy, but the reality facing masses of workers is one of increasing desperate struggle for daily existence. According to a separate BLS release Wednesday, real average hourly earnings for production and non-supervisory employees fell 2.7 percent year-over-year in July.

Rampant inflation and price-gouging by the corporate giants have fueled the growth of working class struggles over the last two years, both in the US and internationally. The trade unions, which have sought to impose company-friendly contracts with sub-inflation raises, have faced a growing rebellion of rank-and-file workers, with workers’ overwhelming rejection of union-backed contracts an increasingly common phenomenon.

“I have not bought chicken in months. Honestly, I can’t afford it”

Workers who spoke to the World Socialist Web Site Wednesday consistently described lowered living standards and a scramble to adjust to higher prices, while voicing outrage over the soaring profits being reaped by corporate America.

“I have cut back to twice a month instead of every week grocery shopping,” a veteran worker at the General Motors Wentzville Assembly plant near St. Louis said. “I haven’t been traveling as much as I usually do. We still haven’t got a cost of living raise in over 10 years.” Cost-of-living adjustments (COLA)—almost universally eliminated with the assistance of the pro-corporate trade unions in recent decades—have been demanded with increasing forcefulness by workers in contract struggles over the last two years, provoking nervousness on Wall Street.

A worker at Dana Inc., an auto parts maker, in Pennsylvania said that they still face a high cost of living despite the relative decrease in gas prices. “Things are going down a few pennies here and there, but our wages are still being eaten up.”

In 2021, Dana workers across the US voted by 90 percent to reject a contract offer that included low wage increases and forced them to increase their contributions to health care. Workers organized a rank-and-file committee in order to oppose the sellout agreement being pushed by the unions. Despite the near-unanimous rejection, Dana workers were kept on the job by the United Steel Workers and United Auto Workers bureaucracies.

The Pennsylvania worker explained to the WSWS that second-tier workers at their plant had been promised retroactive pay increases for the month and a half in which they were kept at work after the previous contract had expired, but that they have still received nothing. “Our rep has told us the UAW is adamant about giving us this back pay, but they say we have to wait at least five to six more months before we get a definite answer.”

An auto parts worker in Indianapolis reported to the WSWS: “They say that inflation has eased up, but it’s unnoticeable. I’m still struggling too hard. At the first of the year, a four pack of drumsticks was $3 and change, now it’s $11 and change. I have not bought chicken in months. Honestly, I can’t afford it.

“I’m living on lunch meat and cheese. I can’t afford a decent meal that I cook at home. I used to buy a can of chili for $2 and a box of spaghetti. Now chili is five bucks, and that meal is out of reach. Cabbage is almost too much. People can hardly afford to eat.

“Gas went up. Water went up. When they have to make improvements to the storm drains, the bill you pay for sewage doubles and triples. ASE is the utility company for both water and gas. I am hardly ever home, but my electric bill jumped from $20 a month to 50 some dollars a month.

“The average person cannot go on vacation. Fuel went up. The airlines went up. There is no break for nobody, nowhere. It’s happening everywhere.”

A worker at the Lear Seating auto parts plant in Hammond, Indiana, told the WSWS that the previous contract pushed through by the UAW in 2018—after two massive votes against it by workers—was wholly inadequate to keep their wages up with inflation. “Definitely not enough, for sure. People are picking up any overtime they can get. With all the layoffs people want more secure work.”

As throughout the auto industry, the UAW has worked with Lear to impose a divisive tier system, with so-called “sub-assembly” workers making less than those categorized as “just-in-time.” Workers “have been fighting the union over this,” the worker said, “but they are okay with it.”

“They don’t want us to be able to tread water anymore”

Workers at the grocery chains themselves, facing poverty wages with few benefits, are finding it increasingly difficult to make ends meet. A Kroger worker in Indiana said, “They don’t want us to be able to tread water anymore. Duke Energy is raising everyone’s bill for no reason in my area.”

This year, workers at Kroger have been engaged in a two-front battle against both the company and the United Food and Commercial Workers union (UFCW), which keeps workers divided via numerous separate local contracts. At Kroger stores in Indianapolis and more recently in Columbus, Ohio, workers also voted to reject UCFW-backed sellout agreements which would keep them mired in poverty.

“It’s ridiculous,” said another Kroger worker in Indiana about inflation, “especially on things you can’t cut back on much, like groceries. I went to Aldi [a discount grocery chain] a few weeks ago for the first time in ages, and found their prices not that much cheaper. I think it’s going to get worse before it gets better as people have less and less to spend on basically anything but the bare necessities, which will then affect jobs overall. I am thinking about asking for extra hours, but it’s hard on me. I hate doing six days and 10 hours, it’s almost too much.”

“The oil companies are raking in the money while the average person can’t get by”

A worker at agricultural equipment giant John Deere in Illinois told the WSWS that the claims that inflation is easing are “ridiculous,” explaining, “The oil companies are raking in the money while the average person can’t get by. It’s all about big corporations and big companies.”

In 2021, workers at Deere carried out a courageous five-week-long strike, twice voting down a UAW-backed contract which failed to meet their demands for major wage increases and the restoration of previous concessions, including retiree health insurance. As at Dana, Deere workers launched a rank-and-file committee in order to break through the information blackout imposed by the UAW.

A retired Deere worker in Iowa described trying to cope with rising prices on a fixed income, saying, “It’s bad. Raises are being lost to inflation. I only drive to town every couple weeks for groceries, supplies. Shop more at discount grocers, eat out less. Made our vacation closer to home. Basic stuff. A grocery cart full at Aldi’s used to cost $50. Now it’s $100.”

KEEPING WAGES DEPRESSED IS MADE EASY BY FLOODING AMERICA WITH 'CHEAP' LABOR ILLEGALS!

VIDEO

Wall Street's RECESSION WARNING: "Big Layoffs are Coming"

One of the leading investors is Eric Schmidt, the former chairman of Google. He is now an investor who wants to maximize his supply of cheap, controllable, skilled labor. In 2013, he helped form the secretive FWD.us lobby group which consists of wealthy West Coast investors, such as Bill Gates and Mark Zuckerberg.

Even as Inflation Cools, Inflation Adjusted Wages Are Still Down From A Year Ago

The easing of inflation in July meant that American workers actually saw average hourly wages rise when adjusted for inflation.

The Consumer Price Index was flat with June while the average hourly and weekly wages climbed 0.5 percent. As a result, real or inflation-adjusted wages rose significantly for the first time this year.

That’s a big improvement over May, when real hourly and weekly wages fell 0.6 percent, and June, when hourly wages fell 0.8 percent and weekly wages fell 0.9 percent.

Compared with a year ago, however, inflation-adjusted wages are still down. The real average hourly wage is down three percent compared with a year ago. The real weekly wage is down 3.6 percent.

The July monthly figure is good news for workers but it may worry Federal Reserve officials. Just as the July jobs figures indicated, the rise in real wages shows demand for labor is red hot. Businesses are likely to try to pass on higher labor costs to prices and increased real wages may translate into increased real demand for goods and services, supporting inflation at a higher level than the Fed would like.

What’s more, the rise in real wages and the economy adding 528,000 workers to payrolls in July was accompanied by a slight decline in the labor force participation rate. This indicates that even plentiful jobs and rising pay are not drawing Americans into the labor force. That could hold back the economy’s ability to grow output, which would add inflationary pressure.

Many economists had been sanguine about a wage-price spiral precisely because wages had not kept up with prices. A lasting decline in real wages creates a downward pressure on inflation, as consumers cut back on spending or trade down to cheaper items. Now the reverse may be getting underway.

Judges OK’s Lawsuit to Curb Migration with Environmental Rules

Immigration reformers have won the first round of a lawsuit that could force the government to protect Americans’ natural environment by curbing legal and illegal migration.

“The policies implemented unilaterally by the Biden Administration, which have encouraged more than a million foreign nationals to enter and settle in the United States [since January 2021], are the quintessential type of action” covered by the 1970 National Environmental Policy Act, said a statement from Julie Axelrod, at the Center for Immigration Studies.

The 1970 law was “passed out of a concern for population growth … The Center looks forward to litigating whether the Biden Administration violated NEPA when it took the actions that have created the ongoing border crisis,” she added.

The first round was won on August 16, when CIS got approval to file the lawsuit from Judge Trevor McFadden of the U.S. District Court for the District of Columbia.

The lawsuit is titled Massachusetts Coalition for Immigration Reform (MCIR) v. Department of Homeland Security, and the judge’s decision said:

The National Environmental Policy Act (NEPA) requires agencies to conduct environmental impact analysis before undertaking “major Federal actions significantly affecting the quality of the human environment.”

…

For now, the Court accepts the [CIS] Coalition’s factual allegations as true and “presum[es] that general allegations embrace those specific facts that are necessary to support [a] claim.” At summary judgment, however, the Coalition must offer admissible evidence affirmatively establishing its standing to proceed and entitlement to vindication on the merits.

On the same day, a government body announced it would sharply reduce the flow of water from the Colorado River to the surrounding states whose populations and water use have been inflated by both legal and illegal migration.

BloombergLaw.com reported:

The Bureau of Reclamation called for all seven Colorado River Basin states [California, Arizona, Nevada, Colorado, New Mexico, Utah and Wyoming] to conserve water over the next four years and said it will withhold 21% of Arizona’s annual allocation of Colorado River water in 2023 as the first-ever water shortage in the Colorado River Basin continues for another year, the agency said.

The establishment, pro-Democrat environmental groups have long ignored the damaging impact of migration. In 2018, the CIS reported;

The Sierra Club, one of America’s largest non-profit environmental organizations, once treated the effects of immigration-driven population growth as among the most serious concerns facing America’s environment.

However, over the past few decades, the organization has continually retreated from that position toward neutrality — and more recently has openly lobbied for higher levels of immigration into the United States. In fact, the club is now starting to launch partisan attacks on the current administration over everything from family separation and detentions along the border to amnesty for illegal aliens to the border wall.

Surveys by Rasmussen Reports show broad public concern about the impact of the government’s immigration policy on the nation’s environment.

For example, a survey of 1,250 likely voters in July 2022 showed that 437 percent of respondents agreed that “immigration-driven population growth [should] be reduced to limit the expansion of cities into U.S. wildlife habitats and farmland.”

Just 23 percent disagreed, and 28 percent said “Not sure.”

Republicans split 57 percent agree, 18 percent disagree.

Democrats split 46 percent agree, 27 percent disagree.

Swing-voting independents split 44 percent to 24 percent.

Extraction Migration

Since at least 1990, the D.C. establishment has extracted tens of millions of legal and illegal migrants — plus temporary visa workers — to serve as workers, managers, consumers, and renters for various U.S. investors and Wall Street.

This Extraction Migration policy tilts the economy against ordinary Americans. It reduces wages, damages career development, reduces family income, and raises the price of homes.

The policy slows innovation and shrinks Americans’ productivity, partly because it rewards investors who build stock values with cheap labor in a consumer economy instead of with high-productivity works in a manufacturing economy.

The policy has shoved at least ten million American men out of the labor force. It undermines employees’ workplace rights, and it widens the regional wealth gaps between the Democrats’ big coastal states and the Republicans’ heartland and southern states.

An economy built on extraction migration also drains Americans’ political clout over elites, alienates young people, and radicalizes Americans’ democratic civic culture because it allows wealthy elites to ignore the replaceable and despairing Americans at the bottom of society.

The economic policy is backed by progressives who wish to transform the U.S. from a society governed by European-origin civic culture into a progressive-directed empire of competitive, resentful identity groups. “We’re trying to become the first multiracial, multi-ethnic superpower in the world,” Rep. Rohit Khanna (D-CA) told the New York Times in March 2022. “It will be an extraordinary achievement … we will ultimately triumph,” he boasted.

Business-backed progressive advocates hide this Extraction Migration economic policy behind a wide variety of noble-sounding explanations and theatrical border security programs. Progressives claim that the U.S. is a “Nation of Immigrants,” that migration is good for migrants, and that the state must renew itself by replacing populations.

Establishment Republicans and major GOP donors hide the wealth shift by focusing conservative media coverage on border chaos, welfare spending, migrant crime, and drugs.

Many polls show the public wants to welcome some immigration — but they also show a deep and broad public opposition to labor migration and the inflow of temporary contract workers into jobs sought by young U.S. graduates.

This “Third Rail” opposition is growing, anti-establishment, multiracial, cross-sex, non-racist, class-based, bipartisan, rational, persistent, and recognizes the solidarity that American citizens owe to one another.

A former lawyer for the Internal Revenue Service (IRS), who accused the agency of going after elderly Americans, says President Joe Biden’s “Inflation Reduction Act” will undoubtedly target working and middle class Americans with new IRS audits.

Biden’s Inflation Reduction Act, signed into law on Tuesday, includes $80 billion for new IRS audits on American taxpayers. The Congressional Budget Office (CBO) estimates that at least $20 billion will be taken from working and middle class Americans earning less than $400,000 a year as a result of the increased IRS audits.

William Henck, a former IRS lawyer, told Fox Business Network that executives at the biggest corporations and billionaires are “sitting back laughing right now” as Biden signs the Inflation Reduction Act.

“The idea that they’re going to open things up and go after these big billionaires and large corporations is quite frankly bulls–t. It’s not going to happen. They’re going to give themselves bonuses and promotions and really nice conferences,” Henck said:

“The big corporations and the billionaires are probably sitting back laughing right now,” he continued. [Emphasis added]

…

“There will be considerable incentive to basically to shake down taxpayers, and the advantage the IRS has is they have basically unlimited resources and no accountability, whereas a taxpayer has to weigh the cost of accountants, tax lawyers — fighting something in tax court,” Henck told FOX Business. [Emphasis added]

Billionaires Bill Gates and Tom Steyer have both voiced support for the Inflation Reduction Act, even as the establishment media has admitted the plan will not cut prices for American consumers “anytime soon.”

Henck said that despite claims from Biden and Democrats in Washington, D.C., that the new IRS audits will target the wealthiest of Americans, he warns that it is small business owners who will be hit the hardest — such as mom and pop shops, roofing companies, and local car dealerships.

An analysis from House Republicans projects that the Inflation Reduction Act will open hundreds of thousands of new IRS audits on working and middle class Americans:

The analysis, which is a conservative estimate based upon recent audit rates and tax filing data, shows that individuals with an annual income of $75,000 or less would be subject to 710,863 additional Internal Revenue Service (IRS) audits while those making more than $1 million would receive 52,295 more audits under the bill. The legislation, the Inflation Reduction Act, would roughly double the IRS’ budget to increase enforcement and, therefore, federal tax revenue. [Emphasis added]

Overall, the IRS would conduct more than 1.2 million more annual audits of Americans’ tax returns, according to the analysis. Another 236,685 of the estimated additional audits would target individuals with an annual income between $75,000 and $200,000. [Emphasis added]

Henck was forced out of his position at the IRS in 2017 after spending 30 years at the agency. He has accused the IRS of specifically targeting elderly Americans, including World War II veterans, with audits, while letting big companies off the hook.

John Binder is a reporter for Breitbart News. Email him at jbinder@breitbart.com. Follow him on Twitter here.

U.S. Retail Sales Indicate The Fed Has A Lot More Work To Do To Bring Down Inflation

The sharp decline in gasoline prices and a fall in sales of motor vehicle purchases left retail sales flat for July but consumer activity at other types of businesses picked up, a troubling sign for the Federal Reserve’s campaign to bring down inflation.

Sales across the retail sector in July were flat with the prior month, the Commerce Department said Wednesday. Compared with a year ago, sales are up 10.1 percent.

A big part of the flat-lining was due to falling sales as gas stations, similar to the way gas prices kept the headline inflation figure announced last week flat. Excluding gas stations, retail sales rose 0.4 percent in July.

Sales of motor vehicles and parts were down 1.7 percent for the month, despite a big increase in the production of cars and trucks reported by the Federal Reserve Tuesday.

Excluding autos and gasoline, sales were up 0.7 percent. Compared with year ago, retail sales minus gas and autos are up 9.3 percent.

Retail sales excluding gas and autos have grown month-to-month in every month this year, an unusually long unbroken period of growth. This has helped feed inflation in consumer prices.

The retail sales figures are seasonally adjusted but not adjusted for inflation.

Sales rose 0.2 percent at furniture stores and 0.4 percent at electronics stores. Sales were up a robust 1.5 percent at home improvement and garden centers.

Grocery store sales rose 0.2 percent, which was less than the 1.3 percent month-to-month inflation reported for the year. This indicates households are paying more but buying less. The annual gain in grocery store sales in 9.2 percent, also below the 13.2 percent year-to-year gain in prices.

Sales were up one-tenth of a point in the category that covers books stores, hobby stores, and sporting goods stores.

Gas station sales fell 1.8 percent in July but they are up 39.8 percent from a year ago.

Sales at general merchandise stores fell 0.7 percent. Within that category, department store sales fell 0.5 percent.

Apparel retailers saw sales drop 0.6 percent. This figure is even worse when viewed in light of prices dropping 0.1 percent. Combined, the figures suggest that sales were extremely weak at clothing stores.

Sales were up one-tenth of a point at bars and restaurants. Compared with a year ago, however, sales are up 11.6 percent.

Sales were strong at nonstore retailers, which includes online sales. These were up 2.7 percent in July, boosted by Amazon’s Prime Day, and are up 20.2 percent compared with last year.

The overall picture indicates that the fall in gas prices has boosted purchases at at home-oriented merchants, including furniture stores, electronic stores, and home improvement stores.

There’s little indication, however, that consumer demand has cooled significantly. That suggests that the Federal Reserve’s rate hikes have not yet put significant downward pressure on consumer inflation. Very likely a robust jobs market—the U.S. economy added 528,000 jobs in July and unemployment fell to 3.5 percent—continues to support consumer spending, even if the appetite for big ticket items like cars and houses is fading. This increases the likelihood that the Fed will have to tighten monetary policy enough to trigger a substantial increase in unemployment to bring down inflation.

Redefining ‘Recession’ for the Little People

On July 28, the Commerce Department announced that in the second quarter U.S. gross domestic product shrank by 0.9%. If that number isn’t revised upwards, it will mean that 2022 has been a year of negative growth. Two back-to-back quarters of negative growth, as we’ve now had, has long been considered the very definition of “recession.”

Preparing for the possibility of a second negative quarter of GDP with its negative implications for the midterm elections, Biden officials issued talking points to their minions that a recession is most definitely not two consecutive quarters of negative growth, but rather a complex combination of other factors that we proles needn’t concern ourselves with. However, “a recession by any other name” would smell as foul.

To be fair, maybe the classical definition of recession is a bit too simplistic. But it’s not as though GDP measures some discrete thing; GDP is whatever economists say it is. If they reconfigure GDP’s components, then its growth will be different.

The reason that the Bidenistas are so intent on redefining the word “recession” is because there is another economic indicator that cannot be redefined, and that’s “price inflation.” Though recession can be debated, the prices of energy and food can’t be; they are what they are, end of story. If a gallon of gasoline is $5, you won’t allow some pointy-headed policy wonk in D.C. to tell you different. That’s why the Democrats are so anxious to say we’re not in a recession, because having both inflation and recession going into an election smells too much like 1980.

Normal people might be a mite miffed at the Democrats for their infernal redefinitions. That’s because the Dems have been so consistently wrong lately about so many things that touch on the economy, especially their assurances that inflation would be transitory. Some analysts say that price inflation will be “sticky,” i.e. it will stick around for a while.

Recessions are officially dated by the National Bureau of Economic Research. Therefore, Biden can continue to deny that the U.S. is in a recession until the NBER chimes in, which, conveniently, won’t be until after the election.

The NBER may well side with Biden and rule that the U.S. was not in a recession during the first half of 2022. After all, it called the March-November period of 2001 a recession, despite its lack of two consecutive quarters of negative GDP. You see, the “Dot-Bomb [sic] Recession” of 2001 occurred under a new Republican president. And not only that, but the 2001 growth decline was only 0.3%, less than what we’ve had this year. One could be forgiven for wondering if the NBER has a bias.

Reminiscent of the stagflation of 40 years ago, Democrats are caught on the same sticky wicket of recession and inflation. But of these two, which is worse?

If one has lost one’s job due to recession and is standing in a breadline, one might think that recession is surely the greater evil. But inflation hits everybody, including those who have managed to retain their job. Inflation is a cancer that can metastasize throughout an economy, and even destroy a nation’s currency.

If one has lost one’s job due to recession and is standing in a breadline, one might think that recession is surely the greater evil. But inflation hits everybody, including those who have managed to retain their job. Inflation is a cancer that can metastasize throughout an economy, and even destroy a nation’s currency.

If inflation is the greater evil, how do we deal with it while creating less pain for folks? To kill inflation, former Fed head Paul Volcker triggered two painful recessions by jacking up the federal funds interest rate to 20%. This writer knows of no one advocating such a stratospheric rate.

On July 28 at CNBC, economics professor Frederic Mishkin suggested that the Fed hike the funds rate to 4%. Mishkin didn’t explain why that number should be the target, but noted that it’s twice the Fed’s desired inflation rate of 2%.

Besides raising interest rates, there are two other ways to tackle inflation. The first is to attack inflation head-on by reducing the money supply, which the Fed does by reducing its balance sheet. We’re talking QT here, quantitative tightening, i.e. withdrawing money from the economy. The Fed hasn’t had much experience at QT nor has it been very good at it.

As this writer noted in July, the Fed acquired assets in the early days of the pandemic at a rate that is more than ten times faster than the rate it plans to reduce its balance sheet. Also, the Fed is unwinding its position passively, by letting securities mature and then run off. It’s called “portfolio runoff,” which means that the proceeds of maturing assets aren’t reinvested, they’re destroyed.

The Fed could be more aggressive in reducing its portfolio. If the Fed tries to control inflation with only interest rate hikes and passive portfolio runoff, we may be in for a more painful recession than is necessary. Given that, shouldn’t the Fed also reduce its balance sheet actively, by selling its assets prior to maturity? That way the Fed would be taking even more money out of the economy to fight inflation, and perhaps have less of a reason to raise interest rates to ruinous heights.

The second way to fight inflation is with the elective branches of government. Congress could end its excessive borrowing and spending, both of which contribute to rising prices. But with the passage of the Inflation Reduction Act, members of Congress seem to think that they can spend their way out of inflation. Indeed, Sen. Chuck Schumer once said that “the Fed is the only game in town.”

The president could help on the inflation front by reversing his disastrous policies on energy, but his handlers might not let him. So neither Congress nor the president are likely to deliver any relief. It seems the Fed really is the only game in town.

In combating inflation, Prof. Mishkin opined that the Fed needs to establish some “credibility,” as it had gotten “behind the curve,” and had been insufficiently “aggressive.” Correctamundo!

The Fed has been wrong and it’s been tardy. With an inflation rate of more than four times the 2% desired rate, the Fed can’t continue to pussyfoot around our inflation problem. To lessen the pain of recession, the Fed shouldn’t rely on passive portfolio runoff. The Fed also needs to actively sell the assets it bought with money it created. And, as with portfolio runoff, the Fed needs to destroy the proceeds of such sales. The Fed should rev up QT to soften the recession.

Recession is the price we pay for living beyond our means. Recession is a necessary corrective. Since the 2008 financial crisis, the federal government has borrowed, printed, and spent trillions of dollars to prop up the economy and asset prices. It needs to end.

If we want to kill inflation, rather than deny that we’re in recession, we should embrace recession, painful though it be. We must disabuse ourselves of the idea that we can continue running trillion-dollar deficits and printing a trillion dollars of new money in a single month.

Normal people should resent the Dems for their transparent attempt to control them by controlling the language and redefining inconvenient terms. They tell us that the invasion at the southern border is not an invasion and that the raid on President Trump’s home was not a raid. Who are these mental defectives trying to take over the mother tongue? If we allow them, the Left may even try to redefine “redefinition.”

Jon N. Hall of ULTRACON OPINION is a programmer from Kansas City.

Image: Public Domain Pictures

New York Fed’s Manufacturing Survey Shows Second Worst Crash Ever

Business activity in New York state suffered a severe and unexpected crash in August, a survey released Monday by the Federal Reserve Bank of New York showed.

The New York Fed’s Empire State Manufacturing Survey index of general business conditions plunged 42.4 points to negative 31.3.

This is the second largest monthly decline on record and among the lowest levels in the survey’s history. Only March and April of 2020 and February and March of 2009 were worse.

Economists had expected the index to dip to 5 from 11 in July.

The index for new orders dropped 35.8 points to negative 29.6, the lowest reading for this gauge outside of the lockdown period of March through May 2020. The index for shipments fell 49.4 points to negative 24.1. This indicates a sharp decline in both orders and shipments.

Unfilled orders dropped 12.7 points to negative 7.5, the third consecutive decline. The inventories index fell to 6.4, indicating that delivery times increased marginally.

Given the plunge in demand, it is not surprising that delivery times held steady. This was the first time in two years that delivery times did not worsen.

The prices paid index moved lower but remained elevated, pointing to a deceleration in input price increases. The prices received index held steady, indicating no let up in inflationary pressures on the sales side despite the crash in demand.

The index for the number of employees fell 11 points to 7.4, suggesting only a small increase in employment. The workweek index dropped, indicating a decline in the hours worked.

The index for future business conditions came in at 2.1, showing that manufacturers are not optimistic about the six-month outlook. Only modest increases in capital spending and technology spending are planned, the New York Fed said. Employment is expected to pick up and delivery times to decline. The indexes for new orders and shipments six-months from now were positive but at very low levels.

The New York Fed’s survey is seen as a bellwether for manufacturing conditions in the U.S. On Thursday, the Philadelphia Fed will release its index. Forecasts by economists issued prior to the New York Fed’s surprisingly deep plunge were for an improvement in the Philly Fed index from a negative 12.3 in July to negative five in August.

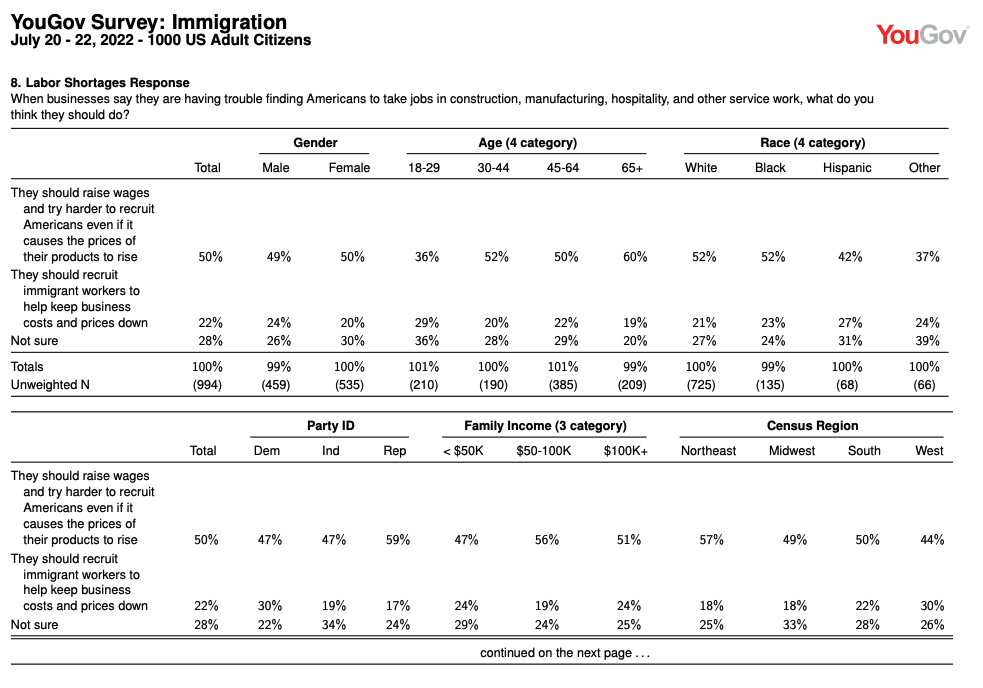

Immigration Poll:

Public Says Hire Americans First

Americans overwhelmingly dismiss corporate demands for more legal and illegal immigrant workers, even at the threatened cost of higher inflation.

Instead, by a factor of more than two to one, Americans agree companies “should raise wages and try harder to recruit Americans even if it causes the prices of their products to rise,” according to a July 20-22 poll by YouGov.com

The poll asked 1,000 citizens: “When businesses say they are having trouble finding Americans to take jobs in construction, manufacturing, hospitality, and other service work, what do you think they should do?”

Just 22 percent agreed with the pro-migration view, that employers “should recruit immigrant workers to help keep business costs and prices down.”

In contrast, 50 percent favored the “raise wages …[and[] recruit Americans” policy.

The remaining 28 percent percent of respondents said they were “not sure.” Their answer suggests those adults did not care about the issue.

So 50 percent “raise wages” group is more than two-thirds of the respondents who had an opinion on the question.

The polls’ crosstabs show the 2:1 favoritism towards fellow American employees in nearly all demographic groups.

The subgroups least favorable to Americans were Democrats, Asians, Hispanics, and younger voters, which includes a disproportionate share of Hispanics and immigrants.

The subgroups most favorable toward fellow Americans were Republicans, older people, and middle-income people.

Republicans split 59 percent for American employees, and 17 percent for employers.

Democrats, however, split 47 percent for employees, and 30 percent for employers.

The data shows a 25-point difference between the two parties.

However, so far, GOP leaders have dodged the jobs and wages issue in their frequent denunciations of the Democratic Party’s growing favoritism for immigrants over Americans.

For example, New York’s Governor recently touted the bussed-in southern economic migrants as ready to replace Americans in the workforce. The inflow of low-wage workers “is good for our economy,” Democratic Gov. Kathy Hochul claimed on August 11. “I just did a farm tour upstate New York — they’re begging for workers,” she told media outlets, according to the New York Post:

“I walked the streets of Manhattan, I walked the streets of Albany — there’s help-wanted signs everywhere. We are a smart, thoughtful country, and can put aside everybody’s passions around this and say: ‘This is actually good for our economy,’” she insisted.

Yet on August 9, GOP leaders released a letter complaining about the migrants’ receipt of aid and welfare while ignoring the widespread pocketbook concerns about the migrants’ impact on jobs, wages, rents, and housing prices:

The Biden Administration’s refusal to secure our nation’s border is resulting in a historic influx of illegal immigrants, who are being transported to their destinations of choice, including New York. This creates a significant stress on state and local resources, and also increases security risks.

However, the YouGov poll showed that Americans in the northeast – including New York — took the strongest position in favor of American employees, 57 percent to 18 percent.

The August 9 GOP letter was signed by the GOP’s gubernatorial candidate, Rep. Lee Zeldin (R-NY), and Rep. Elise Stefanik (R-NY), who chairs the House GOP conference, as well as New York Reps. Andrew Garbarino, Chris Jacobs, Nicole Malliotakis, Claudia Tenney, and retired John Katko.

But the state party is deeply reliant on investors for funding. Those investors stand to gain from an inflow of immigrant workers, consumers, and renters — yet they also stand to lose when Democrats raise taxes and regulations, impose price controls, and skew social status in favor of their diversity coalition.

So far, GOP investors nationwide have insisted on their migration priorities even though the GOP needs to win swing voters and spike turnout by the GOP’s free-market base.

The YouGov results are echoed by prior polls and by Rasmussen Reports.

Since 2019, Rasmussen’s bi-weekly “Immigration Index” polls show a lopsided 3:1 favoritism towards employees over employers who want to hire foreign workers.

From July 31 to August 4, Rasmussen asked 1,250 likely voters:

When businesses say they are having trouble finding Americans to take jobs in construction, manufacturing, hospitality and other service work, what is generally best for the country? Is it better for businesses to raise the pay and try harder to recruit non-working Americans even if it causes prices to rise, or is it better for the government to bring in new foreign workers to help keep business costs and prices down?

Sixty-three percent picked “recruit non-working Americans” and 19 percent picked “being in new foreign workers.”

Republicans split 68 percent for employees to 14 percent for employers, while independent voters split 60 percent to 19 percent.

Extraction Migration

The policy of Extraction Migration is central to the U.S. economy. The policy extracts human material — migrants — from poor countries and uses them as workers, renters, and consumers to shift vast wealth from ordinary people to billionaires and Wall St.

Since at least 1990, the D.C. establishment has extracted tens of millions of legal and illegal migrants — plus temporary visa workers — from poor countries to serve as workers, managers, consumers, and renters for various U.S. investors and CEOs.

This policy of labor inflation makes it difficult for ordinary Americans to get married, advance in their careers, raise families, or buy homes.

Extraction migration slows innovation and shrinks Americans’ productivity, partly because it allows employers to boost stock prices by using cheap stoop labor instead of productivity-boosting technology.

Migration undermines employees’ workplace rights, and it widens the regional wealth gaps between the Democrats’ big coastal states and the Republicans’ heartland and southern states. The flood of cheap labor tilts the economy towards low-productivity jobs and has shoved at least ten million American men out of the labor force.

An economy built on extraction migration also drains Americans’ political clout over elites, alienates young people, and radicalizes Americans’ democratic civic culture because it allows wealthy elites to ignore despairing Americans at the bottom of society.

The economic policy is backed by progressives who wish to transform the U.S. from a society governed by European-origin civic culture into a progressive-directed empire of competitive, resentful identity groups. “We’re trying to become the first multiracial, multi-ethnic superpower in the world,” Rep. Rohit Khanna (D-CA) told the New York Times in March 2022. “It will be an extraordinary achievement … we will ultimately triumph,” he boasted.

Business-backed progressive advocates hide this Extraction Migration economic policy behind a wide variety of noble-sounding explanations and theatrical border security programs. Progressives claim that the U.S. is a “Nation of Immigrants,” that migration is good for migrants, and that the state must renew itself by replacing populations.

Many polls show the public wants to welcome some immigration — but they also show a deep and broad public opposition to labor migration and the inflow of temporary contract workers into jobs sought by young U.S. graduates.

This “Third Rail” opposition is growing, anti-establishment, multiracial, cross-sex, non-racist, class-based, bipartisan, rational, persistent, and recognizes the solidarity that American citizens owe to one another.

U.S. Plunged Into Housing Recession in August, Homebuilders Say

The pandemic housing boom is over. Welcome to the housing recession.

That was the message from the National Association of Home Builders on Monday. The NAHB/Wells Fargo housing market index unexpectedly dropped six points to a reading of 49, below the breakeven point indicating a deteriorating market.

This is the eighth straight monthly decline for the index of homebuilder sentiment. Apart from a brief period at the start of the pandemic, this is the first below 50 reading since 2014.

“Tighter monetary policy from the Federal Reserve and persistently elevated construction costs have brought on a housing recession,’ said NAHB chief economist Robert Dietz.

Economists had expected the index to maintain its July level of 55.

The index is comprised of three components. All three declined in August.

The index of current sales conditions fell 7 points to 57. Sales expectations in the next six months fell two points to 47. Buyer traffic cratered to 32, five points below the depressed level recorded last month. Apart from the spring of 2020, that’s the lowest level of buyer traffic since April of 2014.

“Ongoing growth in construction cots and high mortgage rates continue to weaken market sentiment for single-family home builders,” said NAHB chairman Jerry Konter.

Dietz said that the volume of single-family starts will decline in 2022, the first time housing starts have fallen year-to-year since 2011.

Nearly one-in-five home builders reported cutting prices in the past month to increase sales or limit cancellations. The average price cut among those cutting prices was five percent.

Biden’s America: 95 Percent Say They Have Been Impacted by Inflation

The overwhelming majority of Americans say they have been impacted by inflation, a poll from The Economist/YouGov found.

The survey asked, “How much have you felt the impact of this high inflation in your own life?”

The vast majority, 95 percent, said it has affected them at least a little, but of those, 56 percent said inflation has impacted them “a lot.”

There is a consensus across the board, as 98 percent of Republicans, 95 percent of independents, and 94 percent of Democrats say inflation has impacted them at least “a little.”

The survey was taken August 7-9 among 1,500 United States adult citizens and coincides with the latest report from the Bureau of Labor Statistics showing consumer prices rising 8.5 percent over the last year, as Breitbart News detailed:

Economists had expected CPI to rise at an annual rate of 8.7 percent, down from 9.1 percent in June. They expected a month-over-month increase of 0.2 percent, a sharp decline from the 1.1 percent recorded in June.

Inflation has hit American families hard by raising prices for everyday necessities like food, gasoline, housing, transportation, and utilities. A sizeable decline in the price of gasoline in July, which retreated from record highs hit the prior month, helped bring down the overall rate of inflation. The index for gasoline fell 7.1 percent in July. Compared with a year ago, the gas index is up 44 percent.

However, a closer look at the Consumer Price Index Summary shows prices even higher in some sectors. Food, overall, is up 10.9 percent, but “food away from home,” specifically, is up 13.1 percent.

Energy is up 32.9 percent over the last year, but gasoline, specifically, is up 44 percent. Electricity, per the report, is up 15.2 percent.

President Joe Biden attempted to brag about the latest economic report, touting “zero inflation” in the month of July. However, rising prices continue to impact Americans, including at the grocery store:

But inflation at the grocery store continues to rise. Prices were up 1.3 percent compared with a month earlier and 13.1 percent compared with a year ago.

The cost of rent also increased by 0.7 percent from the previous month; 6.3 percent from the previous year.

The latest report follows the Senate passage of the $700 billion Inflation Reduction Act, which focuses largely on expanding the IRS and enacting Green New Deal policies. Experts say it will not actually reduce inflation.

No comments:

Post a Comment