Paul Pelosi sold $3 million worth of Google stock a month prior to the DOJ’s antitrust lawsuit

Just yesterday the Washington Free Beacon reported that former Speaker of the House Nancy Pelosi and her husband Paul may have used privileged information to cut their losses in the stock market.

Financial disclosure filings that Nancy submitted to the House Ethics Committee revealed that Paul sold 30,000 shares of Google worth approximately $3 million between Dec. 20 and Dec. 28.

A month later, on Jan. 24, 2023, the Justice Department and attorneys general from eight states—including Pelosi's home state of California—sued Google for monopolizing digital advertising technologies via serial acquisitions and engaging in other anti-competitive practices.

The lawsuit may compel Google to break up into smaller units and have other restrictions instituted.

The news of the lawsuit caused the price of Google's stock to plummet by 6 percent.

This trade is the latest in a string of questionable transactions by the Pelosi couple.

A Washington Free Beacon analysis revealed that the Pelosi couple have seen their fortune grow to $140 million since 2008, due to Paul's stock trades.

Pelosi's stock market charades have sparked calls for tougher regulations on members of Congress cashing in on their positions of power.

A House Speaker's disclosure report from last year revealed that Paul invested $5 million in 20,000 shares of NVIDIA, a firm known for designing and manufacturing graphics-processing chips.

The Daily Caller revealed that Paul's stock purchase was prior to a vote on a bill that would deliver massive grants, subsidies, and tax credits to chip manufacturing.

Clearly, Speaker Pelosi was aware of the contents of the bill and the fact that it was heading for a vote in the Senate.

Paul and Nancy saved roughly $600,000 in June by selling shares of microchip maker NVIDIA weeks before the U.S. government placed restrictions on the company's business in China and Russia.

Back in 2021, Paul made over $5 million after trading stocks in Google parent company Alphabet Inc, Amazon, and Apple, prior to the House Judiciary Committee's vote to advance five antitrust bills against the tech giants.

Paul is not the only offender.

Lawmakers from both parties invested in sectors whose importance was elevated following the COVID-19 pandemic. They also sold investments from sectors adversely affected by the pandemic. Their investments were obviously based on prior knowledge of the emergency bills scheduled to be passed during the pandemic.

Business Insider’s Conflicted Congress investigation report from December 2021 revealed dozens of STOCK Act violations, numerous potential conflicts of interest driven by lawmakers' stock holdings, and measly enforcement of anti-insider trading rules.

Forty-nine members of Congress and 182 senior congressional staffers were found to have violated laws aimed at preventing insider trading, but they received no punishment.

What happens beyond D.C.?

A Netflix employee was sentenced to 14 months in prison and $10,000 in fines for insider trading, while the husband of a former Amazon employee was sentenced to 26 months in prison for the same offense.

In 2004, Martha Stewart was sentenced to five months in prison and two years of supervised release along with $30,000 in fines for similar offenses.

The laws do not apply to those who make the laws.

So what is being done to combat this?

Last September, House Democrat Rep. Abigail Spanberger of Virginia and GOP Rep. Chip Roy of Texas introduced a bill that banned members of Congress and other government officials, including Supreme Court justices from owning or trading stocks.

But the vote on the bill was delayed, by then-House Majority Leader Steny Hoyer, known to be a close Pelosi ally. The excuse for the postponement was that there was not enough time to read the 26-page bill.

The same House passed an omnibus spending bill last December that runs into 4,155 pagesm in a matter of hours.

Pelosi, who initially rejected the idea of a stock trading ban, claimed to have had a change of mind. But instead of simply supporting Rep. Spanberger’s bill, Pelosi engaged in the usual skulduggery and subterfuge to kill the legislation.

So why should elected leaders and other government officials be banned from trading?

Shouldn’t every individual regardless of the organization they work for be allowed to invest as they please in a free market economy?

A free market economy works only when it is grounded in fairness.

The stock markets are fair only when all potential investors have identical access to the same information and some among them apply acumen to reap profits.

Government officials both elected and unelected, often have access to information about actions to be taken by the government or laws to be passed that could affect certain sectors of business. Engaging in trade after this prior knowledge gives them an unfair advantage and is tantamount to abuse of office.

In light of the ongoing failure of even laws to police them, they must now refrain from misusing their position in government to reap profits.

They are always free to resign from their positions and dedicate their lives to making millions in the stock market.

But hope for fairness may be on the way.

GOP Sen. Josh Hawley from Missouri recently introduced the Preventing Elected Leaders from Owning Securities and Investments Act also aptly named the PELOSI Act.

The goal behind the act is to prohibit members of Congress and their spouses from ‘holding, acquiring, or selling stocks or equivalent economic interests during their tenure in elected office.’

Hawley said the following:

"For too long, politicians in Washington have taken advantage of the economic system they write the rules for, turning profits for themselves at the expense of the American people."

"As members of Congress, both Senators and Representatives are tasked with providing oversight of the same companies they invest in, yet they continually buy and sell stocks, outperforming the market time and again."

There are some major challenges to the bill.

Passing it through the House and Senate and getting signed by Biden is not going to be easy. There must be numerous rogue lawmakers in both parties who will be keen to kill the bill.

It will take some astute stewardship from House Speaker Kevin McCarthy and other leading members of the House to pass the bill. The previously failed legislation aimed to prevent insider trading by government officials had 71 co-sponsors, from MAGA Republican Rep. Matt Gaetz of Florida to squad member Rep. Ilhan Omar of Minnesota. Hence, there may be scope for bipartisanship here.

Will Senate Majority Leader Chuck Schumer and Minority Leader Mitch McConnell lead the way to get the bill passed in the Senate, and most importantly, will Joe Biden sign the bill to make it a law?

Experience would suggest that we don’t hold our breath for that to occur.

If by some miracle the bill is passed, the challenge is to ensure that these laws and other existing laws are enforced to punish the offenders.

Still, the fact that another attempt is being made to ensure order, fairness, and accountability in D.C., must be lauded.

Convenient Timing: Pelosi Sold $3 Million of Google Stock Weeks Before DOJ Launched Antitrust Probe

Rep. Nancy Pelosi (D., Calif.) and her multimillionaire husband sold up to $3 million in shares of Google in recent weeks—just before the Biden Justice Department launched an antitrust probe of the tech giant.

Paul Pelosi sold 30,000 shares of Google from Dec. 20 to Dec. 28, according to a financial disclosure filing the former House speaker submitted to the House Ethics Committee. The Pelosis made an undisclosed profit from the investments, according to the filing.

The trade proved timely. On Monday, the Justice Department and attorneys general from eight states—including California—sued Google over its monopoly on the digital ad market. The lawsuit could force Google to break up its online ad business, which generated nearly $55 billion in revenue for the company in the most recent quarter. Google's stock has dropped around 6 percent since the Justice Department announced the lawsuit.

The trades are the latest in a string of questionable transactions for Paul and Nancy.

They saved roughly $600,000 in June by selling shares of microchip maker Nvidia weeks before the U.S. government placed restrictions on the company's business in China and Russia. The Pelosis have seen their fortune grow $140 million since 2008, thanks largely to Paul Pelosi's stock trades, according to a Washington Free Beacon analysis.

Pelosi's stock market charades have sparked calls for tougher regulations on members of Congress cashing in on their positions of power.

Sen. Josh Hawley (R., Mo.) on Tuesday introduced the Preventing Elected Leaders from Owning Securities and Investments Act—the PELOSI Act—to prohibit members of Congress and their spouses from owning or trading individual stocks.

"For too long, politicians in Washington have taken advantage of the economic system they write the rules for, turning profits for themselves at the expense of the American people," Hawley said. "As members of Congress, both Senators and Representatives are tasked with providing oversight of the same companies they invest in, yet they continually buy and sell stocks, outperforming the market time and again."

Pelosi’s office did not return a request for comment.

CUT AND PASTE YOUTUBE LINKS

Watters: The Five (CRIME) Families of the Democrat Party

https://www.youtube.com/watch?v=BBpvvHethg0

Congress Are Becoming Filthy Rich From Manipulating The Stock Market & Insider Trading

https://www.youtube.com/watch?v=lExO6GHn8sc

Elon Musk Gets up and RIPS Nancy Pelosi to SHREDS, Evidence in showing Pelosi's Lies and Corruption!

https://www.youtube.com/watch?v=qv19kmZw8lc

Hawley: Pelosi ‘a Perfect Example of How Rich People Can Get’ by Using Insider Congressional Information

Thursday, during an appearance on FNC’s “Hannity,” Sen. Josh Hawley (R-MO) discussed his so-called PELOSI Act, which according to the Missouri Republican, would end members of Congress using the inside information they receive through their office.

Hawley’s effort would end stock trades and ownership by members of Congress.

“My next guest is vowing to put an end to insider trading, public corruption in the swamp, in Washington, D.C., with a bill that he calls the PELOSI Act,” Hannity said. “Here with more, Missouri Senator Josh Hawley is with us. Senator, tell us about this bill.”

“Well, listen, Sean, you’ve laid it out perfectly, which is that when people sent, when a voter sent members of Congress to Washington, they expect them to do the people’s business, not to be day trading on the stock market, not to be using the information that they get from briefings to go and make a quick buck on Wall Street,” Hawley replied. “So here’s what my bill does: It says no more trading of stocks by members of Congress. In fact, no more ownership of stocks by members of Congress. If you want to save, fine, put it in a mutual fund like most Americans do. But Nancy Pelosi is the perfect example of what should not be happening in D.C., which is people getting rich out in the stock market, off of information they know because they’re a member of Congress.”

“And Pelosi, what, traded between $1 million and $5 million in stocks for semiconductors only days before Congress allocated $52 million to the industry?” Hannity said. “Am I right on that, Senator?”

“That’s the report, Sean, and there’s lots of reports like that with her, with her family and other members of Congress,” Hawley said. “I mean, this is a problem that has been going on fo,r years, and she is just a perfect example of how rich people can get by using their information. Listen, insider trading is already illegal, and we’re talking here about members of Congress, the briefings that they get, the information that we have from he. It’s, it’s information that most Americans don’t have because, of course, that’s why they send us to Congress is to do their business, not to turn that around and to get rich off of it. That’s why I call it the PELOSI Act. We need to act right now.”

Follow Jeff Poor on Twitter @jeff_poor

Pelosi: "Dr. King Wrote: ‘God Never Intended for One Group of People to Live in Superfluous Inordinate Wealth’"

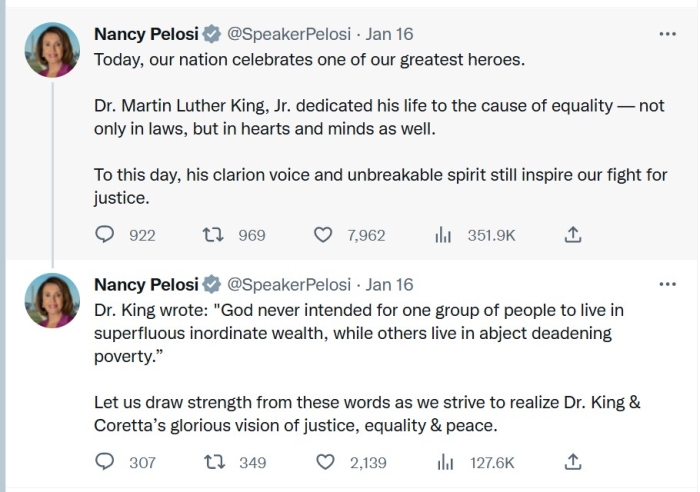

(CNSNews.com) - Former House Speaker Nancy Pelosi (D.-Calif.) sent out a pair of tweets on Martin Luther King Day in which she quoted King as saying that God did not intend for a one class “of people to live in superfluous inordinate wealth.”

“Today, our nation celebrates on of our greatest heroes,” Pelosi said.

“Dr. Martin Luther King, Jr., dedicated his life to the cause of equality—not only in laws, but in hearts and minds as well,” she said.

“To this day, his clarion voice and unbreakable spirit still inspire our fight for justice,” she said.

Earlier that day, Pelosi had sent out a tweet that said: “Dr. King wrote: ‘God never intended for one group of people to live in superfluous inordinate wealth, while others live in abject deadening poverty.’

“Let us draw strength from these words,” Pelosi said, “as we strive to realize Dr. King & Coretta’s glorious vision of justice, equality & peace.”

Josh Hawley Introduces ‘PELOSI Act’ to Ban Congress from Trading Stocks

Sen. Josh Hawley (R-MO) has introduced the “PELOSI Act” which would ban members of Congress, as well as their family members, from holding or trading stocks.

The legislation, known as the Preventing Elected Leaders from Owning Securities and Investments (PELOSI) Act, references former House Speaker Nancy Pelosi (D-CA) who was called out last year after her husband, Paul Pelosi, bought up to $5 million in stock in a semiconductor company right as the Senate was passing legislation to massively subsidize the semiconductor industry.

Pelosi was also among a group of Republicans and Democrats who beat the market in 2021 with hundreds of millions of dollars in stock trades. Others who faired the best include Reps. Austin Scott (R-GA), Brian Mast (R-FL), French Hill (R-AR), John Curtis (R-UT), and Dan Crenshaw (R-TX).

Hawley, who introduced similar legislation last year, said the practice must end.

“For too long, politicians in Washington have taken advantage of the economic system they write the rules for, turning profits for themselves at the expense of the American people,” Hawley said in a statement.

“As members of Congress, both Senators and Representatives are tasked with providing oversight of the same companies they invest in, yet they continually buy and sell stocks, outperforming the market time and again,” he continued.

Hawley’s PELOSI Act would ban members of Congress and their spouses from holding, acquiring, or selling stocks while in office. The legislation gives members and their spouses six months after taking office to divest stocks they hold or put them in a blind trust.

If members of Congress or their spouses are found to be in violation of the legislation’s rules, they would have to forfeit any profits to the United States Treasury. Violators would also be prohibited from deducting those losses on their income taxes.

The legislation gives the House and Senate ethics committees full power to fine members of Congress for such violations and would be required to publicize them to the American people. In accordance with the bill, the Government Accountability Office (GAO) would be required to audit members of Congress to ensure they are complying with the rules.

“While Wall Street and Big Tech work hand-in-hand with elected officials to enrich each other, hardworking Americans pay the price,” Hawley said. “The solution is clear: we must immediately and permanently ban all members of Congress from trading stocks.”

Banning members of Congress and their family members from trading stocks is hugely popular among likely American voters.

Last year, a Trafalgar Group survey revealed that 76 percent believe Congress has an “unfair advantage” when it comes to the stock market. Only five percent support permitting congressional stock trading.

John Binder is a reporter for Breitbart News. Email him at jbinder@breitbart.com. Follow him on Twitter here.

No comments:

Post a Comment