Economic vs. Cultural Marxism: The Most Important Distinction

Many on both ends of the political spectrum are aware of the fact that social justice is simply Marxism, masquerading as a new ideological movement. Like Marxism, social justice's goal is to make the world a more balanced and equitable place.

As Marx phrased it in Das Kapital, "[i]n order to establish equality, we must first establish inequality" (1). By finding the inequalities of the world, the Marxist can then begin eliminating the obstacles that impede equality. The more of these sources of inequality the Marxist eliminates, the closer we move to an equitable socialist utopia. This is why Marx was so adamant about abolishing certain fixtures of society.

Among the ills of society perpetuating inequality that need abolition, according to Marx, were history, private property, the family, eternal truths, nations and borders, and religion (2). By destroying these sources of inequality, the Marxist is one step closer to the equitable world the Marxist knows is possible. Marx believed that economic issues are the driving force of conflict in the world (3). Eliminating class structure was the central goal of Marx's Communist Manifesto.

Marx's Manifesto influenced a group of intellectuals known as "The Frankfurt School" (4), who expanded on Marx's foundational premises. They shifted the front from class to cultural struggle. One of these intellectuals, György Lukács, is credited as the first person to advocate for the application of Marx's economic principles to cultural struggles: "he justified culture to the Marxists by showing how to condemn it in Marxist terms. And in doing so ... he provided crucial concepts to ... the thinkers of the Frankfurt School" (5).

The Frankfurt Schoolers elaborated on and furthered Lukács's cultural Marxism. While the foundational tenets of economic Marxism are still present in their cultural Marxist works, there is a tenet that militates more with cultural than economic Marxism. In shifting fronts from class to culture, a different aspect of Marxism mandates emphasis.

That aspect is Marx's desire to abolish individuality. As Marx himself wrote: "And the abolition of this state of things is called by the bourgeois, abolition of individuality and freedom!" (6). The social justice warriors of today are using this tenet of Marxism most frequently and strongly in their quest to create an equitable society.

The modern social justice advocate uses the abolition of individuality as a tool to strip human beings of their individuality and bifurcate society. A bifurcation is a logical fallacy where a person makes things one or another, with no area in between. For example, a bifurcation would be the faulty assumption of saying a person is either a Trump-supporter or a Hillary-supporter. What about those who like Bernie Sanders or Ted Cruz? What about those who like both Trump and Hillary? What about those who like neither?

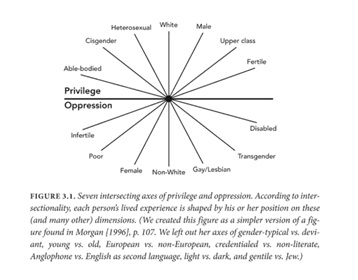

For Marx, his bifurcation was the bourgeois versus the proletariat. You were either a rich person or a working stiff. There was no in between. For the social justice warrior, you are either privileged or oppressed. Look at the diagram below for a visual interpretation of the bifurcation the social justice warrior uses (7):

This diagram is the axis of privilege versus oppression. You're either privileged or oppressed, with little to no in between. The more demographic characteristics one has from the privilege side, the more unfair advantages he has in life that are unearned (8). These unearned advantages must be taken from the privileged and given to the oppressed (9). This is where the abolition of individuality really comes into the picture.

Thomas Sowell, visionary economist, referred to social justice as "the quest for cosmic justice" (1999) (10). He articulated that:

One of the many contrasts between traditional justice and cosmic justice is that traditional justice involves the rules under which flesh-and-blood human beings interact, while cosmic justice encompasses not only contemporary individuals and groups, but also group abstractions extending over generations, or even centuries. (11)

Social justice is not just about living individuals involved in the current world; rather, it is about abstractions, generalizations, and the past. Sowell explained that "cosmic justice must be hand-made by holders of power who impose their own decision on how these flesh-and-blood individuals should be categorized into abstraction, and how these abstractions should then be forcibly configured to fit the vision of the power-holders" (12).

The social justice–Marxist strips the individual of individuality and then turns the person into an abstraction. If a human being is an individual, then we can be held accountable only for our own actions; we cannot be held accountable for the actions of another person, let alone the actions of a group of people who lived and died long before our time. If we are not individuals, then we can be turned into abstractions. As abstractions, we can then be blamed for the actions of others who classify as members of these abstractions. Those in power are the ones dictating the terms of these abstractions.

For an example of this, take race relations. If I am an individual, I had nothing to do with slavery, Jim Crow, waging war with the American Indians, or anyone who did anything hundreds of years before I was born. However, if my individuality is abolished, I am not a unique individual with specific characteristics. I can be broken down into an abstraction designated by those in power.

When the rubber meets the road between theory and practice, it looks something like this: "you're a straight white male, and straight white males have committed crimes against people of color, therefore you have committed crimes against people color." Knowing the Marxist tenet driving this, the implicit basis for stripping white males of privilege and then assigning those privileges to people of color is no longer camouflaged.

Sowell really understood the latent heart of the issue: "It is about putting particular segments of society in the position that they would have been in but for some undeserved misfortune" (13). Sowell astutely recognized that it is not about real justice, but rather about an ideological matrix built to take things away from one segment of the population and give them to another. Sowell concluded this thought by saying, "This conception of fairness requires that third parties must wield the power to control outcomes" (14).

These third parties are the politicians, academics, movie stars, and athletes. These people are using Marxism, many without even knowing it, to advance certain peoples and ideas, while simultaneously penalizing others for issues they are not responsible for.

This is possible only by abolishing individuality. In a world with individuals, we are responsible only for our own actions. In a world without individuality, we, as individuals, can be held accountable for the actions of others. It does not matter if these crimes and abuses were committed by the dead against the dead from hundreds of years before either party was born.

The next time you hear someone advocating to rectify injustices committed by the dead against other dead people, pay attention. This is merely the Marxist charade to abolish individuality.

Endnotes

1. Marx, as quoted by Kirk, 1954, p. 264.

2. Marx, 1848.

3. Ibid.

4. Scruton, 2015; Walsh, 2015; and Kengor, 2015.

5. Scruton, pp. 117–118.

6. Marx, 1848.

7. Haidt, and Lukianoff, 2018.

8. Macintosh

9. Ibid.

10. Sowell, 1999.

11. Ibid, p. 31.

12. Ibid, p. 46.

13. Ibid, p. 12.

14. Ibid, p. 12.

2. Marx, 1848.

3. Ibid.

4. Scruton, 2015; Walsh, 2015; and Kengor, 2015.

5. Scruton, pp. 117–118.

6. Marx, 1848.

7. Haidt, and Lukianoff, 2018.

8. Macintosh

9. Ibid.

10. Sowell, 1999.

11. Ibid, p. 31.

12. Ibid, p. 46.

13. Ibid, p. 12.

14. Ibid, p. 12.

References

Haidt, J. & Lukianoff, G. (2018). The coddling of the American mind: how good intentions and bad ideas are setting up a generation for failure. New York, NY: Penguin Books.

Kirk, R. (1953). The conservative mind: from Burke to Elliot. Wilmington, DE: ISI Books.

Kengor, P. (2015). Takedown: from communists to progressives, how the left has sabotaged family and marriage. Washington, D.C.: WND Books.

McIntosh, P. (1989). White privilege: unpacking the invisible knapsack. Retrieved from: https://www.racialequitytools.org/resourcefiles/mcintosh.pdf

Marx, K. (1848). The communist manifesto. Retrieved from: https://www.marxists.org/archive/marx/works/1848/communist-manifesto/ch02.htm

Scruton, R. (2015). Fools, frauds and firebrands: Thinkers of the new left. New York, NY: Bloomsbury Continuum.

Sowell, T. (1999). The quest for cosmic justice. New York, NY: Touchstone Books.

Walsh, Michael. (2015). The Devil's pleasure palace: the cult of critical theory and the subversion of the West. New York, NY: Encounter Books.

"At the same

time, the tax cuts for big business are fueling the federal deficit, which will

be used by both Democratic and Republican politicians to call for further cuts

in social spending. The February monthly federal deficit hit an all-time high

of $234 billion this year, as a result of a 20 percent drop in corporate tax

revenue. The deficit for the first half of 2019 is projected at $961 billion,

and the deficit for the fiscal year ending September 30 is expected to reach

$1.1 trillion, as bad as the deficits posted in the immediate aftermath of the

2008 financial crash."

US Tax Day 2019: Sixty giant corporations pay

zero income tax

The number of U.S. companies paying zero federal taxes DOUBLED when

Trump's tax plan took effect in 2018

White House,

congressional Republicans accelerate drive for corporate tax cut worth

trillions

Bloomberg

Flashback: Tax Hikes on Poor ‘Good’ Because They Cannot Afford Things that Will

Kill Them

Former New York

City mayor and Democrat presidential candidate Michael Bloomberg once described tax hikes on the poor as a “good

thing,” arguing that it essentially prevents lower-income individuals from

purchasing things that would be detrimental to their health.

The

Triumph of Injustice, by Emmanuel Saez and Gabriel Zucman: How

tax cuts for the rich fuel inequality

"At the same

time, the tax cuts for big business are fueling the federal deficit, which will

be used by both Democratic and Republican politicians to call for further cuts

in social spending. The February monthly federal deficit hit an all-time high

of $234 billion this year, as a result of a 20 percent drop in corporate tax

revenue. The deficit for the first half of 2019 is projected at $961 billion,

and the deficit for the fiscal year ending September 30 is expected to reach

$1.1 trillion, as bad as the deficits posted in the immediate aftermath of the

2008 financial crash."

US Tax Day 2019: Sixty giant corporations pay

zero income tax

Dozens of giant US

corporations, including 60 of the Fortune 500, used deductions, credits and

other tax loopholes to avoid paying any federal income tax for 2018, according

to an analysis issued by the Institute on Taxation and Economic Policy (ITEP).

The report was published April 11, just in time for the April 15 deadline for

most American working people to file their tax returns.

The 60 companies in the

Fortune 500 who paid no federal income tax had net incomes just from US

operations of nearly $80 billion ($79,025,000,000, to be exact). They include

such household names as Amazon, Chevron, Deere, Delta Air Lines, General

Motors, Goodyear, Halliburton, Honeywell, IBM, Eli Lilly, Netflix, Occidental

Petroleum, Prudential Financial and US Steel.

Meanwhile, millions of

moderate-income families are finding that their income taxes have either

increased or their expected tax refunds have evaporated because of restrictions

on the itemization of tax deductions, the imposition of a $10,000 cap on state

and local tax deductions and a cut in the mortgage interest deduction.

Nearly all of the 60

companies that paid no taxes qualified to receive a refund from the US

Treasury, although most will not collect a check, instead using the credit to

offset future taxes. But whatever the bookkeeping process, American taxpayers

are effectively paying money to them, despite their vast profits.

The biggest refunds include those going to Prudential, $346 million (added to

its $1.44 billion in profits); Duke Energy, a whopping $647 million (added to

$3.02 billion in profits); and Deere, $268 million (added to $2.15 billion in

profits).

Among the report’s most

outrageous findings:

Amazon more than

zeroed-out its tax bill on $10.8 billion in profits, making use of accelerated

depreciation deductions on equipment as well as favorable tax treatment of

stock-based compensation for executives like CEO Jeff Bezos, the wealthiest man

in the world. The stock compensation deduction alone was worth $1 billion.

Amazon will actually show a credit of $129 million from the US Treasury, not

paying one cent in federal income taxes.

IBM is another corporate

giant that has gamed the tax system by shifting earnings to its foreign

operations to escape US taxation. The company reported worldwide profits of

$8.7 billion, but only $500 million in the United States. It will reap a $342

million credit from the Treasury.

Delta Airlines accumulated $17.1

billion in federal pre-tax net losses as of 2010, partly as a consequence of a

protracted crisis of the airline industry, partly as a result of the 2008 Wall

Street crash. It has used these losses as well as the accelerated depreciation

credit for purchase of new planes to “dramatically reduce their tax rates,”

according to the ITEP report, receiving a credit of $187 million in 2018

despite net profits of more than $5 billion. According to Delta’s chief

financial officer, the actual tax rate the company expects to pay going forward

is between 10 and 13 percent, far below what a typical Delta worker pays on his

or her income.

EOG Resources, a renamed remnant of

Enron, perpetrator of the biggest corporate fraud in American history, can

collect $304 million from US taxpayers on top of $4.07 billion in profits.

For one company, the

federal tax refund would actually exceed net profits. Gannett made

a $7 million profit, while showing an additional $11 million credit from the

Treasury, giving the newspaper publishing giant an effective tax rate of

negative 164 percent.

IBM’s tax rate was a

negative 68 percent, while software maker Activision Blizzard and construction

company AECOM Technology both posted effective tax rates of negative 51

percent.

Sixteen of the 60

companies made more than a billion dollars in net income on their US

operations, to say nothing of foreign subsidiaries. Oil and gas producers and

utilities comprised more than one-third of the total, led by Chevron and

Occidental among the oil companies, and DTE Energy, American Electric Power,

Duke Energy and Dominion Resources among the utilities.

The 60 companies

profited enormously because the Trump tax cut bill cut the basic rate for

corporations from 35 percent to 21 percent, while not eliminating the loopholes

they had previously used to keep their taxes low. They had the best of both

worlds, paying lower rates while still enjoying loopholes.

Overall, according to

the Joint Committee on Taxation, an arm of Congress, the cut in the corporate

tax rate alone will pump $1.35 trillion into the pockets of the corporations

over the next 10 years. For this year alone, corporate taxes have been cut by

31 percent.

For the 60 companies in

the ITEP report, “Instead of paying $16.4 billion in taxes, as the new 21

percent corporate tax rate requires, these companies enjoyed a net corporate

tax rebate of $4.3 billion, blowing a $20.7 billion hole in the federal budget

last year.”

This figure by itself

is an irrefutable answer to all the bogus claims—made to workers in every part

of the United States—that there is “no money” to pay for needed social

programs, for wage and benefit increases, or to hire additional workers to

reduce overwork and understaffing. The $20.7 billion would pay for a $7,000

bonus to every public school teacher in America.

The bonanza that these

60 corporations are enjoying is three times the amount that Trump proposes to

cut from the budget of the Department of Education. It is 10 times the total

amount budgeted for the Bureau of Indian Affairs, which provides services for

more than 2 million Native Americans. It is nearly 20 times the budget of the

Occupational Safety and Health Administration, which conducts workplace safety

inspections.

The ITEP report, issued

by a group with close ties to the Center on Budget and Policy Priorities, a

liberal Washington think tank, warns of the explosive political consequences of

the corporate plundering of the Treasury. “The specter of big corporations

avoiding all income taxes on billions in profits sends a strong and corrosive

signal to Americans: that the tax system is stacked against them, in favor of

corporations and the wealthiest Americans,” the report says.

At the same time, the

tax cuts for big business are fueling the federal deficit, which will be used

by both Democratic and Republican politicians to call for further cuts in

social spending. The February monthly federal deficit hit an all-time high of

$234 billion this year, as a result of a 20 percent drop in corporate tax

revenue. The deficit for the first half of 2019 is projected at $961 billion,

and the deficit for the fiscal year ending September 30 is expected to reach

$1.1 trillion, as bad as the deficits posted in the immediate aftermath of the

2008 financial crash.

The number of U.S. companies paying zero federal taxes DOUBLED when

Trump's tax plan took effect in 2018

·

60 large companies managed to escape 2018

taxes under Trump's new plan

·

Many of those corporations actually received

tax rebates totaling $4.3 billion

·

The businesses include: Amazon, Netflix,

Chevron, Delta Airlines, JetBlue Airways, IBM, General Motors, Goodyear, Eli

Lilly and United States Steel

·

The result is a $20.7 billion budget hole

that is adding to America's federal debt

President Donald

Trump's tax policy doubled the number of highly

profitable companies that were able to avoid paying any federal taxes in 2018,

according to a new report.

Amazon, Netflix,

Chevron, Delta Airlines, IBM, General Motors and Eli Lilly were among those who

managed to escape taxes for last year, according to the study by the

Institute on Taxation and Economic Policy.

'Instead

of paying $16.4 billion in taxes, as the new 21 percent corporate tax rate

requires, these companies enjoyed a net corporate tax rebate of $4.3 billion, blowing

a $20.7 billion hole in the federal budget last year,' the report says.

The

Washington, D.C. think tank analyzed America's 560 largest publicly held

companies, finding that 60 of them paid nothing in taxes for last year – double

the average of roughly 30 companies that got away scot-free each year from

2008-2015.

Republicans

in Congress pushed through the tax law signed by Trump in 2017, and its

policies favoring the richest Americans and most valuable U.S. companies took

effect in 2018.

Scroll down for the full list of companies and rebates

·

This graph illustrates the amount of money that 60 of America's largest

companies were billed for taxes last year - along with the actual money they

ended up getting back instead of having to pay. Source: Institute on

Taxation and Economic Policy

The

change cut the tax rate from 35 percent to 21 percent and allowed companies to

take advantage of deductions, tax credits and rebates. That change alone is

projected to save corporations $1.35 trillion over the next decade, according

to the Joint Committee on Taxation.

'We

know that there's this pretty glaring contrast between what the proponents of

this tax law promised back in 2017 and what it's delivering now,' lead

author Matthew Gardner told DailyMail.com.

'The whole

argument was that the reason companies were avoiding taxes is because tax rates

are so high,' he added. 'What we're seeing is that isn't coming to pass.'

Collectively, the 60 companies that avoided

all taxes last year managed 'to zero out their federal income taxes on $79

billion in U.S. pretax income,' according to the study, which was first

reported on by the Center for Public Integrity and

NBC News.

For

example, the John Deer farm equipment company earned $2.15 billion before

taxes, yet owed no U.S. taxes and used deductions and credits to extract $268

million from the federal government.

Nationally,

corporate tax revenues decreased 31 percent in 2018 to $204 billion.

'This

was a more precipitous decline than in any year of normal economic growth in

U.S. history,' wrote Gardner, a senior fellow for the Institute on Taxation and

Economic Policy, in the report.

We know that there's this pretty

glaring contrast between what the proponents of this tax law promised back in

2017 and what it's delivering now.

-Matthew Gardner, Institute on Taxation and Economic Policy

Trump

had said that the corporate tax cut would pay for itself by sparking a business

boom that would create more jobs, thus generating growing income tax revenues

for the nation.

That

reality hasn't emerged. Instead the nation's budget deficit is higher than it's

ever been in this nation's history.

That's

despite Trump's campaign promise to eliminate the $19.9 trillion national debt

in eight years. So far it has ballooned 41.8 percent in the first four months

of the 2019 fiscal year (which runs October 1 – September 30.

The

Government Accountability Office announced in April that the 'federal

government's current fiscal path … (is) unsustainable.'

Presidential

economic adviser Larry Kudlow has said that 'economic growth' has 'paid for a

good chunk' of the tax cuts, and that the budget's outlook is 'not as bad' as

it's perceived.

+2

·

This table lists the amount of money that 60 of America's largest

companies were billed for taxes last year - along with the actual money they

ended up getting back instead of having to pay. Source: Institute on

Taxation and Economic Policy

White House,

congressional Republicans accelerate drive for corporate tax cut worth

trillions

The push is accelerating for an overhaul of the US tax system that

will divert trillions of additional dollars to the corporate aristocracy, widen

the gap between the rich and the working class and set the stage for the

destruction of basic social programs.

On Thursday, the Republican-controlled House Ways and Means

Committee passed a White House-backed tax bill on a party-line vote, after

which House leaders said the measure would come to the House floor for a vote

next week. On the same day, the Republican-controlled Senate released its

version of the measure, with plans for a floor vote in the upper chamber before

the Thanksgiving holiday later this month.

If passed, the two versions will be reconciled and a final bill

will be moved through the two chambers and signed into law by President Trump.

The Trump administration and congressional Republicans are pushing

for passage of the handout to the richest 5 percent by Christmas. The Democrats

are putting on a show of opposition that is cynical to the core. They are

denouncing the Republican bills for skewing the tax benefits to the wealthy,

while fully supporting the centerpiece of the legislation, a huge tax cut for

US corporations.

While there are differences between the House and Senate bills,

both versions adhere to the same basic framework. The corporate tax rate is to

be permanently reduced from the current level of 35 percent to 20 percent,

saving US corporations $2 trillion in taxes and generating an additional $6.7

trillion in revenues over the next decade. The House bill enacts the corporate

tax cut in 2018, while the Senate bill, in order to reduce the projected

deficit from lost federal revenues, delays the corporate tax cut one year,

until 2019.

The House bill keeps the top federal tax bracket at 39.6 percent

(down from 70 percent in 1980), but applies it to households making more than

$1 million a year, as compared to the current threshold of $500,000. The Senate

version provides a bigger windfall for the very rich by reducing the top

bracket to 38.5 percent.

Both bills eliminate the alternative minimum tax, which almost

exclusively impacts the wealthy, and they both slash the tax rate on so-called

“pass-through” income reported by business owners.

Each bill allows corporations that have stashed hundreds of

billions of dollars overseas to avoid US taxes, such as Apple and Amazon, to

repatriate their profits at a sharply discounted tax rate even lower than the

new 20 percent corporate rate.

The bills either sharply restrict or eliminate outright the estate

tax, which is currently paid by the wealthiest 0.2 percent of households. The

House bill doubles the exemption for an individual to $11 million and eliminates

the estate tax entirely in 2025. The Senate version doubles the exemption but

does not repeal the tax.

Either way, the change underwrites the right of the richest

households to pass on their wealth to succeeding generations,

institutionalizing the transformation of the United States into an oligarchy,

presided over by a semi-hereditary dynastic caste.

Other boons to business are included in both bills, including an

immediate 100 percent tax write-off for capital investments. Neither bill

eliminates or reduces the so-called “carried interest” loophole that allows

hedge fund, private equity and real estate speculators (such as Donald Trump)

to pay only 20 percent on their income instead of the normal tax rate,

currently almost twice as high.

This is in line with the legislation as whole. While shifting the

tax code to further redistribute the social wealth from the bottom to the top,

it particularly favors the most parasitic sections of the ruling class, those

engaged in financial manipulation.

In order to promote the fiction that the overhaul is geared to the

“middle class,” the bills include certain tax breaks, such as a doubling of the

standard deduction for taxpayers who do not itemize and an increase in the

child tax credit. However, they also rein in or eliminate existing tax

deductions that benefit working class and middle class households.

This is driven above all by the need to keep the total ten-year

deficit resulting from the legislation to $1.5 trillion. That limit must be met

in order to move the tax overhaul on an expedited basis through the Senate,

where the Republicans have only a 52 to 48 majority, ruling out a filibuster

and enabling passage by a simple majority.

The House bill eliminates the federal tax credit for state and

local income and sales taxes, but continues the write-off for state and local

property taxes, capping it at $10,000. It reduces the existing tax reduction on

mortgage interest payments as well as a tax break on medical expenses. It also

eliminates tax credits for student loan payments and imposes a tax on graduate

student stipends. These measures amount to a tax surcharge on workers, young

people and the elderly to help pay for the tax boondoggle for the rich.

The Senate version calls for a somewhat different package of added

tax burdens for the working class and middle class. It eliminates all state and

local tax deductions but retains the tax credits for mortgage interest, student

loan payments and medical expenses.

The Republicans are resorting to brazen

lying to present the legislation as a boon to “hard-working middle class

Americans.” Typical is an op-ed column published Friday in the Washington Post by Orrin Hatch of Utah, the

chairman of the Senate Finance Committee. “For too long, middle-class Americans

have struggled with stagnant wages, sluggish labor markets and economic growth

well below the historic average,” he writes. “It is time to pay attention to

those Americans who have felt left behind in economic stagnation, by providing

tax relief and economic opportunity.”

The line is that corporate America will use the trillions in tax

savings to buy new equipment, build new factories, hire more workers and raise

wages. This ignores the fact that US corporations already have access to cheap

credit, are making bumper profits, and are sitting on trillions of dollars in

cash. It also ignores the past record of tax cuts for big business, whether

under Reagan or George W. Bush, which pushed up stocks and the wealth of the

ruling elite while accelerating the destruction of jobs and working class

living standards. The same lying pretext was used to justify Obama’s bailout of

the banks.

In fact, the extra trillions will be used to buy more and bigger

yachts, private planes, mansions, penthouses, private islands and gated communities

and bribe more politicians to do the bidding of the oligarchs.

One indication of the two-faced character of the Democrats’

opposition is the fact that interest groups backed by Republican billionaires

such as the Koch brothers and Sheldon Adelson have thus far spent almost $25

million on TV ads to promote the Republican tax plan, while Democratic groups

have spent less than $5 million to oppose the plan.

An updated analysis of the House bill published Wednesday by the

non-partisan tax center spells out in detail how the tax overhaul is designed

to sharply increase the wealth of the richest 5 percent, and especially the

richest 1 percent and 0.1 percent, and vastly increase over the next decade the

concentration of wealth at the very top.

Under the so-called “Tax Cuts and Jobs Act,” in 2018, taxpayers in

the top 1 percent (with income above $730,000) will receive nearly 21 percent

of the total tax cut, an average of about $37,000, or 2.5 percent of after-tax

income.

Those in the top 5 percent income bracket, and especially the top

1 percent and top 0.1 percent, will get by far the biggest percentage gains in

after-tax income. In other words, if you are among the very rich, the rate of

increase you receive will be far higher than for the lower 95 percent. That

means the plan is designed to widen the gap between the very rich and everybody

else.

In 2018, the top 20 percent of income earners will get 56.6

percent of the total federal tax cut. Within the top 10 percent, the 90-95

percent group will get 7.4 percent of the total, the 95-99 percent group will

receive 14.8 percent, the top 1 percent will get 20.6 percent and the top 0.1

percent will receive 10 percent. In other words, within the richest 10 percent,

the benefits are skewed dramatically to the richest of the rich.

One decade out, by 2027, the transfer of social wealth to the very

rich will be even more pronounced. In 2027, taxpayers in the bottom two

quintiles (those with income less than about $55,000) will see little change in

their taxes, with a tax decrease of $10-$40. Taxpayers in the middle of the

income distribution will see their after-tax incomes increase by only 0.4

percent. Taxpayers in the top 1 percent will receive nearly 50 percent of the

total benefit.

Someone in the top 1 percent will get a break of $52,780. Someone

in the top 0.1 percent will get a tax cut of $278,370.

In total, 12.8 million households will

have a bigger tax bill in 2018 under the law,

including more than three million earning between $48,600 and $86,100. By 2027,

more than 11 million households in this income group will see their tax bills

increase. Overall, by 2027, 47.5 million households, a quarter of the total,

will have a tax increase.

Bloomberg

Flashback: Tax Hikes on Poor ‘Good’ Because They Cannot Afford Things that Will

Kill Them

Former New York

City mayor and Democrat presidential candidate Michael Bloomberg once described tax hikes on the poor as a “good

thing,” arguing that it essentially prevents lower-income individuals from

purchasing things that would be detrimental to their health.

The billionaire spoke at the

International Monetary Fund’s Spring Meeting last year and spoke glowingly of

raising taxes on the poor, arguing that it is a “good thing” and should have a

“bigger impact on their behavior and how they deal with themselves”:

“Some people say, well, taxes are

regressive. But in this case, yes they are. That’s the good thing about them

because the problem is in people that don’t have a lot of money,” he said.

“And so, higher taxes should have a

bigger impact on their behavior and how they deal with themselves,” he

continued, explaining that people who say they do not want to tax the poor

should look at it differently.

The behavioral changes the poor

would be forced to make, he argued, would ultimately help them “live longer.”

“So, I listen to people saying, ‘Oh,

we don’t want to tax the poor.’ Well, we want the poor to live longer so that

they can get an education and enjoy life. And that’s why you do want to do

exactly what a lot of people say you don’t want to do,” he said, arguing in

favor of the nanny state and using sugary drinks — something he desperately

tried to tackle as the mayor of New York City — as an example.

The question is do you want to

pander to those people? Or do you want to get them to live longer? There’s just

no question. If you raise taxes on full sugary drinks, for example, they will

drink less and there’s just no question that full sugar drinks are one of the

major contributors to obesity, and obesity is one of the major contributors to

heart disease and cancer and a variety of other things.

So, it’s like saying, ‘I don’t want

to stop using coal because coal miners will go out of work, will lose their

jobs.’ We have a lot of soldiers in the United States in the U.S. Army, but we

don’t want to go start a war just to give them something to do and that’s

exactly what you’re saying when you say, ‘Well, let’s keep coal killing people

because we don’t want coal miners to lose their jobs.’ The truth of the matter

is that there aren’t very many coal miners left anyways, and we can find other

things for them to do. But the comparison is: a life or a job. Or, taxes or

life? Which do you want to do? Take your poison.

This is far from the first time

Bloomberg has openly articulated an elitist view of the middle class and poor.

He made waves in 2012 after rolling out his plans for a ban on sugary beverages

above 16 ounces in the city under the guise of preventing obesity.

“Obesity is a nationwide problem,

and all over the United States, public health officials are wringing their

hands saying, ‘Oh, this is terrible,’” Bloomberg said at the time.

“New York City is not about wringing

your hands; it’s about doing something,” he added. “I think that’s what the

public wants the mayor to do.”

Nevertheless, a federal court killed

Bloomberg’s nanny state plan in 2014, determining that the New York City Board of Health, “in adopting the

‘Sugary Drinks Portion Cap Rule,’ exceeded the scope of its regulatory

authority.”

Bloomberg’s campaign website touts

his experience as the mayor of New York City, which became “a pioneer in the

fight against poverty” under his leadership, it claims. While details on his

plans to reduce poverty nationwide are minimal, his campaign highlights his previous efforts to reduce the “tax burden” for

working families in New York City.

“Mike reduced the tax burden for New

York City’s working families through a Child Care Tax Credit and Earned Income

Tax Credit initiative,” his campaign website states.

It does not, however, address his

previous remarks on hiking taxes on the poor for what he once considered their

own good.

The

Triumph of Injustice, by Emmanuel Saez and Gabriel Zucman: How

tax cuts for the rich fuel inequality

The Triumph of

Injustice, by economists Emmanuel Saez and Gabriel Zucman (2019, W. W.

Norton), documents how governments have systematically allowed the wealthy to

dodge taxes, and then cut corporate tax rates in the name of “closing tax

loopholes,” helping to fuel runaway inequality.

Saez and Zucman are world-renowned

experts in the economics of social inequality. In recent years, they have

turned their attention to documenting the prevalence of tax evasion by the

super-rich. The results of this research are condensed into a 232-page volume.

The two economists

demonstrate that for the first time in modern US history, the very rich in 2018

paid a lower percentage of their income in taxes than the average worker, and

that the US tax system, far from being progressive, as commonly claimed, is

regressive.

The second half of the

book consists of policy proposals. Saez and Zucman advocate a form of

capitalist reformism similar to that of Bernie Sanders and Elizabeth Warren,

who consulted the two economists in formulating portions of her program.

We do not share the

view of Saez and Zucman that social inequality can be fought outside of a

struggle against the capitalist social order. But their presentation of the

growth of social inequality in the United States and the role that tax policy

has played is vital and should be widely read.

The book begins with a

description of the scale of social inequality in the United States:

In 1980, the top 1

percent earned a bit more than 10 percent of the nation’s income, before

government taxes and transfers, while the bottom 50 percent share was around 20

percent. Today, it’s almost the opposite: the top 1 percent captures more than

20 percent of national income and the working class barely 12 percent. In other

words, the 1 percent earns almost twice as much income as the entire working

class population, a group fifty times larger demographically. And the increase

in the share of the pie going to 2.4 million adults has been similar in

magnitude to the loss suffered by more than 100 million Americans.

The book proceeds to

describe the incomes of the various sections of American society:

Let’s start with the

working class, the 122 million adults in the lower half of the income pyramid.

For them, the average income is $18,500 before taxes and transfers in 2019.

Yes, you are reading this correctly: half of the US adult population lives on

an annual income of $18,500.

This contrasts sharply

with the lives of the affluent upper-middle class—those in the 90th to 91st

percentile:

With an average income

of $220,000 and everything that goes with it—spacious suburban houses,

expensive private schools for their children, well-funded pensions, and good

health insurance—they are not struggling.

At the top are the 2.4

million wealthiest people in the United States, part of the top 1 percent, “whose

members make $1.5 million in income a year on average.”

Saez and Zucman argue

that this level of social inequality is the outcome of deliberate policy

choices on the part of lawmakers. They describe how for decades, successive

administrations have slashed taxes on the wealthy and corporations, leading to

a massive increase in social inequality.

They note that

“confiscatory” taxes levied on the very wealthy under the New Deal helped rein

in the social inequality of the 1920s, leading to a more equitable distribution

of wealth in the middle of the 20th century:

From 1930 to 1980, the

top marginal income tax rate in the United States averaged 78 percent. This top

rate reached as much as 91 percent from 1951 to 1963. Large bequests were taxed

at quasi-confiscatory rates during the middle of the twentieth century, with

rates nearing 80 percent from 1941 to 1976 for the wealthiest Americans.

They continue:

In 1970, the richest

Americans paid, all taxes included, more than 50 percent of their income in

taxes, twice as much as working-class individuals. In 2018, following the Trump

tax reform, and for the first time in the last hundred years, billionaires have

paid less than steel workers, schoolteachers, and retirees.

In fact,

The wealthy have seen

their taxes rolled back to levels last seen in the 1910s, when the government

was only a quarter of the size it is today.

They argue that, more

and more, the capitalist class is being exempted from taxation:

The explosive cocktail

that is undermining America’s system of taxation is simple: capital income, in

varying degrees, is becoming tax-free.

Such a social order has

much in common with the tax collection practices of the French monarchy, which

are described in detail:

French kings pampered

the affluent and bludgeoned the populace. France had an income tax (taille),

whose main claim to fame was that it exempted almost all privileged groups: the

aristocracy, the clergy, judges, professors, doctors, the residents of big

cities, including Paris, and, of course, the tax collectors themselves—known as

the fermiers généraux (tax farmers). The most destitute members of society, at

the same time, were heavily hit by salt duties—the dreaded gabelle—and

sprawling levies (entrées and octrois) on the commodities entering the cities,

including food, beverages, and building materials.

The perpetual lowering

of taxes on the wealthy has had a symbiotic relationship with the systematic

toleration of tax evasion by the rich on the part of the US government, which

is particularly evident in the effective elimination of the estate tax.

While estate and gift

tax revenues amounted to 0.20 percent of household net wealth in the early

1970s, since 2010 they have barely reached 0.03 percent–0.04 percent annually—a

reduction by a factor of more than five.

The authors provide

further documentation of this “collapse in enforcement:”

In 1975, the IRS

audited 65 percent of the 29,000 largest estate tax returns filed in 1974. By

2018, only 8.6 percent of the 34,000 estate tax returns filed in 2017 were

examined.

The capitulation has

been so severe that if we take seriously the wealth reported on estate tax

returns nowadays, it looks like rich people are either almost nonexistent in

America or that they never die.

Saez and Zucman

document the extent to which US corporations dodge taxes by booking profits in

offshore tax havens.

Today, close to 60

percent of the—large and rising—amount of profits made by US multinationals

abroad are booked in low-tax countries. Where exactly? Primarily in Ireland and

Bermuda.

They explain how a

massive industry exists to help companies evade taxes, making clear that most

of these tax dodges are illegal because US law prohibits any investment

decision whose sole aim is to evade taxes.

For decades, systematic

tax evasion by major corporations was used as a pretext for lowering corporate

tax rates, in the name of supposedly “closing loopholes.” The claim that

“closing loopholes” would compensate for lost tax revenues resulting from lower

corporate tax rates, while supposedly accelerating economic growth, has

constituted the bipartisan consensus on tax policy, and remains so to this day.

The authors write:

For the majority of the

nation’s political, economic, and intellectual elites, slashing the corporate

tax rate was the right thing to do. During his presidency, Barack Obama had

advocated in favor of reducing it to 28 percent, with a lower rate of 25

percent for manufacturers.

The capstone of this

was Trump’s 2018 tax bill, which slashed the corporate income tax rate from 35

percent to 21 percent. This was part of an international process:

As Trump’s bill passed,

French president Emmanuel Macron vowed to cut the corporate tax from 33 percent

to 25 percent between 2018 and 2022. The United Kingdom was ahead of the curve:

it had started slashing its rate under Labour Prime Minister Gordon Brown in

2008 and was aiming for 17 percent in 2020. On that issue, the Browns, Macrons,

and Trumps of the world agree.

Having presented this

analysis, Saez and Zucman explain what they propose to do about it. They argue

for increasing taxes on the wealthy, including a tax on wealth, increasing the

top income tax bracket, and raising the corporate tax rate.

While taxation would be

used broadly to redistribute income to the level of inequality that existed in

the 1930s, the vast bulk of the cost of constructing a social welfare state

would be borne by an effective tax increase on working people.

The majority of tax

revenue would be raised with a flat “national income tax,” affecting workers

and capitalists alike. This “national income tax,” falling disproportionately

on workers, would then be used to finance a government-run health insurance

program, public child care and free education.

The authors write:

The good news is that

we can fix tax injustice, right now. There is nothing inherent in globalization

that destroys our ability to tax big companies and the wealthy. The choice is

ours…

When it comes to the

future of taxation, everything is possible. From the disappearance of the

income tax—a plausible outcome if the trend of the last four decades is

sustained—to levels of progressivity never seen before, there is an infinity of

possible futures ahead of us.

But this “infinity of

possible futures” does not include the overthrow of capitalism. Saez and Zucman

argue on the basis of a premise which they never state, much less seek to

defend: that private ownership of the means of production should be continued

and maintained.

They want to treat the

symptom (inequality) of the disease (capitalism) without attempting to argue

against those who say that the symptom cannot be treated outside of eradicating

the disease.

The word “capitalism”

appears only twice throughout the book. This is not surprising, because the

volume treats the capitalist socioeconomic order as effectively the fixed basis

of analysis.

Saez and Zucman never

attempt to answer the most important question: What happens when the wealthy

resist paying more in taxes? What political means are

required to end inequality?

The unstated premise is

that this change can be carried out through the Democratic Party, including

candidates such as Elizabeth Warren and Bernie Sanders who advocate policies

similar to those of the authors.

But since Saez and

Zucman don’t argue for this course of action, they don’t have to deal with the

myriad problems that arise from it. How will the Democrats, the party that

first cut taxes on the rich (under Johnson) and presided over the deregulation

of Wall Street (under Clinton), then bailed out the banks (Obama), be made into

the instrument of, as the authors call it, “confiscatory” taxation?

Within the book’s

analytical framework, if governments reduced taxes on the rich, it was because

opinions changed. If opinions can be changed back, then governments can undo

the policies that led to the growth of inequality.

Except, there must have

been some reason that opinions changed. Saez and Zucman do

not attempt to root the phenomenal processes they discuss in broader historical

changes.

What, after all, is the

relationship between the fact that the 20th century was viewed as the so-called

“American century,” based on American global economic hegemony, and the

socially redistributive character of the New Deal, as well as the

“confiscatory” tax policy of Roosevelt and Eisenhower? Leon Trotsky did not

beat around the bush when he declared, “America’s wealth permits Roosevelt his

experiments.”

The fact is that a

return to the New Deal is simply not possible. The financial oligarchy would

fight such a plan tooth and nail. There is no wing of the ruling elite, as

there was in Roosevelt’s day, which argues that US capitalism should reduce

social inequality to head off revolution.

There is, of course, is

an enormous constituency for social redistribution: the working class. But its

struggles will be animated in the coming period not by a desire to put patches

on capitalism, but to do away with it altogether.

No comments:

Post a Comment