The U.S. stock market roared into election day, sending the Dow Jones Industrial Average over 450 points higher.

The Dow climbed by more than 680 points, or around 2.5 percent Tuesday morning, before retreating from their highs.

With two hours of trading left, the Dow is up 460 points, or 1.74 percent. The Nasdaq Composite is up 1.5 percent. The S&P 500 is also up 1.5 percent. The small-cap Russell 2000 is up 2 percent.

Ten of the 11 sectors of the S&P 500 were up. The Energy sector was down 1.2 percent. The Financials sector was the best performing, up 2.3 percent for the day, lead higher by the bank component’s 2.7 percent gain and the consumer finance subsector’s 2.8 percent gain. The KBW Nasdaq Bank Index, which tracks the stocks of the biggest banks, rose 2.5 percent.

Donald Trump’s victory for 2016 set off an explosive rally in stocks, defying widespread predictions that he would lose or that if he won it would cause the market to crash.

Many of the big Wall Street firms have Joe Biden as the runaway favorite to win the presidency, just as they had Hillary Clinton the favorite four years ago. Morgan Stanley said in a note to clients Tuesday that they estimate a 76 percent chance that Biden wins and the Democrats take control of the Senate. They estimate just an eight percent chance that Trump wins and GOP holds the Senate. The Wall Street firm gives just a thirteen percent chance of a mixed result with Biden winning but the GOP holding the Senate.

Biden has raised tens of millions of dollars from Wall Street. During his time as a U.S. Senator from Delaware, Biden earned the nickname “Plastic Joe” for his willingness to promote legislation friendly to credit card issuers, including a law that made it harder for bankrupt customers to get debt relief.

Most analysts think the economy and the stock market could get a big boost if Democrats sweep the election. A unified government would be more likely to quickly pass a stimulus bill, likely giving stocks a short-term boost and ameliorating the drag from new restrictions aimed at stemming the pandemic’s surge.

Biden’s immigration and visa programs would likely import enough workers to ease wage pressure, boosting corporate profits by lowering compensation costs. An increase in foreign workers also generates new customers for U.S. companies, especially U.S. banks and large retailers. Biden is viewed as likely to lift tariffs on China, allowing U.S. companies to send more jobs to cheaper overseas labor markets.

Biden has promised a rush of higher taxes and new regulations, including climate change schemes that would make energy more costly and damage U.S. manufacturing.

Fear and uncertainty dominate Jackson Hole central bankers’ meeting The annual Jackson Hole conclave of central bankers, which concluded over the weekend, underscored the incapacity of global financial authorities to devise any policies either to bring about economic growth or counter the mounting contradictions in the financial system.

Reporting on the meeting, held in virtual format this year because of the COVID-19 pandemic, the Financial Times

“‘We’re not going back to the same world,’ Tharman Shanmugaratnam warned.’”

The central initiative at the gathering was the decision by the Fed’s key policy-making body to maintain interest rates at their ultra-low levels for an indefinite period and keep pumping money into the financial system.

The decision, announced by the Federal Open Market Committee as the conclave opened and elaborated on in a keynote speech by Fed Chair Jerome Powell, was in effect a guarantee to Wall Street that its demand for “forward guidance”—lower interest rates for longer—would be met.

The Fed said it would no longer be guided by a 2 percent inflation rate limit in determining its interest policy, but would instead focus on an “average” rate of 2 percent, meaning that the cheap money regime could continue even if prices rose above that level.

As for dealing with the slump in the global economy—the most serious since the Great Depression—and combating the potential for further storms in the financial system following the market meltdown in mid-March, there were no answers, as underscored by the remarks of the Singapore finance minister.

“We’ve got to avoid a prolonged period of high levels of unemployment, and it’s a very real prospect,” he said. “It is not at all assured that we will get a return of tight labour markets even with traditional macroeconomic policy being properly applied.”

It was a significant comment because one of main themes in remarks by central bank chiefs was that monetary policy alone would not be sufficient to restore growth, and government intervention was needed to boost the economy. But, as Shanmugaratnam noted, even if “properly applied,” there were no guarantees of success.

According to the Financial Times

One of the most frequently cited academic papers produced for the meeting was prepared earlier this month by Colombia University academic Laura Veldkamp on the long-term effects of the COVID-19 pandemic.

The paper said that the biggest economic effects of the pandemic “could arise from changes in behaviour long after the immediate health crisis is resolved.” A potential source of such a long-lived change was a shift in the “perceived probability of an extreme, negative shock in the future,” and that “long-run cost for the US economy from this channel is many times higher than the estimates of the short-run losses in output.”

The paper continued: “This suggests that, even if a vaccine cures everyone in a year, the COVID-19 crisis will leave its mark on the US economy for many years to come.”

In other words, the pandemic was not only a trigger event, acting on the contradictions that had built up in the economy and financial system, but a transformative one as well.

With the Fed now having formally committed itself to the endless supply of cheap money to Wall Street, attention will turn to the European Central Bank (ECB), which is also conducting a strategic policy review, to see whether it goes down the same road.

While the governing council, under the presidency of Christine Lagarde, may be inclined to move in the same direction as the Fed, it would face certain opposition from Germany’s Bundesbank, which has expressed opposition to the easing of monetary policy.

A member of the governing council told the Financial Times

“We are not out of firepower by any means, and to be honest, it looks from today’s vantage point that we were too cautious about our remaining firepower pre-COVID,” he said, adding that there are times when we “need to go big and go fast.”

The actions of the Fed have done nothing to boost the real economy, as an increasing number of companies announce that temporary layoffs will be made permanent.

The Wall Street Journal

This indicates that the pandemic has been a trigger for a major restructuring of employment conditions.

The effects of the Fed’s policies and the further monetary easing to come are focused on the stock market, with Wall Street indexes rising to the record levels they achieved in February. The main beneficiaries have been the high tech companies—Apple, Microsoft, Alphabet (the owner of Google) and Facebook—which together comprise more than a fifth of the Nasdaq index.

The extent of their rise and growing financial and monopoly power is indicated by the results of an analysis carried out by Bank of America Global Research, reported by the business channel CNBC. It found that the market capitalization of the major US tech firms, now standing at $9.1 trillion, was greater than the market capitalization of the entire European market, including the UK and Switzerland, at $8.9 trillion. In an indication of the massive shift that has taken place, the research note pointed out that in 2007, total European market capitalization was four times that of US technology stocks.

Trump vs.

the $1.6 Billion Man Dems have already outspent the 2016 total presidential

candidate donor spending.

Tue Nov 3, 2020

Daniel Greenfield

42

Daniel Greenfield, a Shillman Journalism Fellow at the Freedom Center,

is an investigative journalist and writer focusing on the radical Left and

Islamic terrorism.

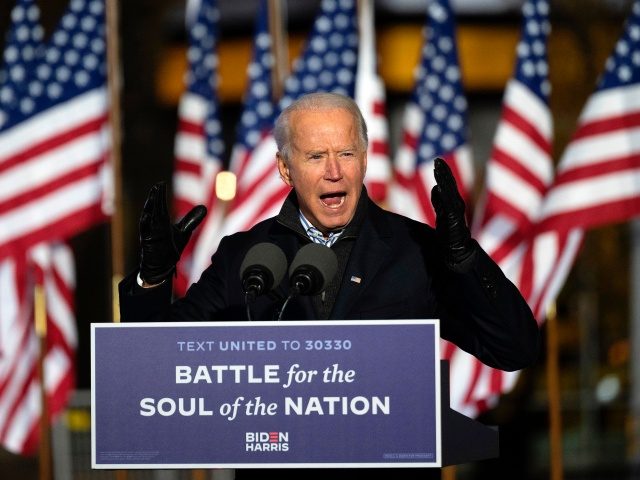

The 2020 presidential election comes down to places like Pittsburgh. While

Hillary Clinton held the city, President Trump won the Pittsburgh metropolitan

area. This time around, both Trump and Biden are holding rallies in Pittsburgh,

an actual rally for Trump, and a drive-in for Biden.

President Trump is betting that enthusiasm matters more than money because

Democrats are spending more than twice the annual budget of Pittsburgh to buy

the White House.

Biden, by the numbers, is expected to break the $1 billion fundraising

record. Almost $400 million is coming through in outside spending for Biden and

over $300 million against Trump.

44% of federal donations have

Biden’s current total of $1.6 billion will almost certainly fall short of

the staggering final number.

To put that number into perspective, Obama and McCain, together, spent $1

billion and that was considered a shocking number only twelve years ago. Every

election since then has not only been more expensive, but has broken records in

election spending. And it seemed to work.

Obama outraised McCain by over 3 to 1, pulling in $750 million to McCain's

partly $238 million. Romney's own wealth and ability to tap into big donors

brought closer parity, but Obama still beat Romney by $1.1 to $1 billion.

Until the last election, fundraising totals were a much more practical

bellwether of victory than a bakery’s cookies or any of the other gimmicks that

press veterans trot out before Election Day.

And then, even though Hillary Clinton was able to

Hillary Clinton spent $969 million and Trump spent $531 million for a total

of $1.5 billion.

At $1.6 billion, Biden and his backers,

many of them shadowy, some injecting dark money into the race, have already

outspent the 2016 total presidential candidate donor spending.

And when the election bill finally comes due, it’s likely that Biden and his

outside backers will have spent more money than both candidates and their PACs

combined.

The staggering scale of the spending is more than a strategy, it’s a

worldview.

The Democrats and the special interests

behind them are spending an insane fortune, one that could keep Pittsburgh and

many swing counties going for years, to buy the White House. And they’re doing

it because they believe that the 2016 election was an implausible fluke.

The 2020 election is about more than personalities: it’s about power. And

the powerful are betting that this is the election that will assert the power

of campaign spending over populism.

The central theory of political campaigns is that most people are stupid.

Otherwise why spend billions trying to lie to them? The Democrats and their

media allies concluded that Trump only won last time around because he was able

to outshout them. They began the 2020 campaign three years ago, long before

Biden’s run or the Democrat primaries, on three simple strategies to silence

Trump and achieve messaging supremacy in order to win with any candidate.

The first was to transform the media into a megaphone for attacking

President Trump and touting Democrats. The media had been shamelessly corrupt

in 2016, by 2020 its programming is entirely indistinguishable from a PAC’s ad

campaigns for Biden and against Trump.

And what that really means is that the Democrats aren’t spending a mere $1.6

billion to elect Biden, they’re also spending the budgets of nearly every cable

news network, newspaper, digital media site, and the rest of the massive media

infrastructure. Cable news budgets alone take us into the billions. Operating

expenses for the New York Times ’ parent company were $1.6

billion.

Throw in the various corporate “comedy” shows from Saturday Night Live to

John Oliver, who operate as little more than thinly disguised ad campaigns for

Democrats, PBS, NPR, and every publicly funded media outlet, and the actual

messaging spending is in the tens of billions.

At least.

The second was to shut out President Trump and Republicans from social

media, especially Facebook which reaches the most persuadable voters, at the

crucial period before Election Day.

Democrats blamed Trump’s 2016 victory on his reach on Facebook. They spent

years prepping the emergency red button. This time Big Tech was ready to shut

down the Hunter Biden story.

Meanwhile, Twitter not only clumsily

suppressed the Hunter Biden story, its trending topics became little more than

election ads for the Democrats. What would it cost a campaign to buy a spot on

Twitter’s trending topics, day after day before an election? That’s what Jack’s

donating.

Finally, having achieved spectrum dominance, the Democrats would ram their

message home, outraising and outspending Republicans to achieve total messaging

superiority.

Biden’s underwhelming nature as a candidate, his incoherent speeches, limited

campaigning, and lack of enthusiasm is a perfect test to see whether total

messaging dominance is enough.

If they can buy an election

for Biden, the theory is, they can buy it for anyone.

Now imagine Rep. Alexandria Ocasio Cortez or Rep. Ilhan Omar running for the

White House.

But it’s also the ultimate attack on the Electoral College. Blue state power

bases like California and New York have long chafed at having the course of the

nation be determined by some farmers in flyover country. But while they haven’t

succeeded in actually getting rid of rule by a union of states, instead of by

New York City, Los Angeles, Boston, Seattle, and San Francisco, the oligarchy

is doing the next best thing by using its vast wealth to buy elections

nationwide.

Behind ActBlue’s posturing about small donors is a machine for moving money

from wealthy lefties in major urban areas to races in places they wouldn’t set

foot in. The Democrats want Senate seats and to get at them, $100 million from

out of state poured into the campaign fund for Jamie Harrison. Less than 10% of

the Democrat's money came from South Carolina.

Behind the racial appeals and claims of empowering voters, it’s about

disempowering them.

And about empowering the oligarchy based out

of a small number of powerful urban areas.

As the New York Times noted

The Democrat pulled in over $85 million in New York City alone. All that

from a city that may be large but accounts for less than 2% of the nation’s

population. And it isn’t all the millions of New Yorkers giving that money.

Instead it’s coming from select zip codes with one Upper West Side zip code

delivering over $8 million, more than some entire states, for the Biden

campaign.

The ultimate question on the 2020 ballot, beyond any of the candidates, is

whether this massive concentration of power and wealth that is behind Biden

will be allowed to run the country.

Biden is not the real candidate. He’s just a name on the ballot. That’s what

many Trump supporters instinctively understand. It’s why Trump’s populism

struck a chord. Populism isn’t, as the media would like you to believe, a way

of manipulating stupid people. That’s the media.

Populism doesn’t work unless it articulates what many people feel, but that

few actually say.

"I think it is fair to say that in many ways the Democratic Party has

become a party of the coastal elites, folks who have a lot of money,"

Bernie Sanders, a coastal millionaire with three homes, recently admitted on a

late night talk show.

Those elites are spending over $1.6 billion not to elect a doddering hack,

but to elect themselves. The woke movement is just the successor to generations

of radical waves coming out of the wealthiest places in the country whose real

message is their own moral superiority.

The Elect believe that they are the only ones who ought to be running the

country.

This election is their latest effort to bully, buy, and browbeat the rest of

the country into submitting to them. And they can spend $1.6 billion or $1.6

trillion to take over the country.

Oligarchies always have lots of money even

when workers go hungry and lose their homes. And they get that money by seizing

the centers of power and consuming the wealth of nations.

This is the latest and may be the final showdown between an oligarchy’s lies

and a free nation.

No comments:

Post a Comment