Fear and uncertainty dominate Jackson Hole central bankers’ meeting The annual Jackson Hole conclave of central bankers, which concluded over the weekend, underscored the incapacity of global financial authorities to devise any policies either to bring about economic growth or counter the mounting contradictions in the financial system.

Reporting on the meeting, held in virtual format this year because of the COVID-19 pandemic, the Financial Times

“‘We’re not going back to the same world,’ Tharman Shanmugaratnam warned.’”

The central initiative at the gathering was the decision by the Fed’s key policy-making body to maintain interest rates at their ultra-low levels for an indefinite period and keep pumping money into the financial system.

The decision, announced by the Federal Open Market Committee as the conclave opened and elaborated on in a keynote speech by Fed Chair Jerome Powell, was in effect a guarantee to Wall Street that its demand for “forward guidance”—lower interest rates for longer—would be met.

The Fed said it would no longer be guided by a 2 percent inflation rate limit in determining its interest policy, but would instead focus on an “average” rate of 2 percent, meaning that the cheap money regime could continue even if prices rose above that level.

As for dealing with the slump in the global economy—the most serious since the Great Depression—and combating the potential for further storms in the financial system following the market meltdown in mid-March, there were no answers, as underscored by the remarks of the Singapore finance minister.

“We’ve got to avoid a prolonged period of high levels of unemployment, and it’s a very real prospect,” he said. “It is not at all assured that we will get a return of tight labour markets even with traditional macroeconomic policy being properly applied.”

It was a significant comment because one of main themes in remarks by central bank chiefs was that monetary policy alone would not be sufficient to restore growth, and government intervention was needed to boost the economy. But, as Shanmugaratnam noted, even if “properly applied,” there were no guarantees of success.

According to the Financial Times

One of the most frequently cited academic papers produced for the meeting was prepared earlier this month by Colombia University academic Laura Veldkamp on the long-term effects of the COVID-19 pandemic.

The paper said that the biggest economic effects of the pandemic “could arise from changes in behaviour long after the immediate health crisis is resolved.” A potential source of such a long-lived change was a shift in the “perceived probability of an extreme, negative shock in the future,” and that “long-run cost for the US economy from this channel is many times higher than the estimates of the short-run losses in output.”

The paper continued: “This suggests that, even if a vaccine cures everyone in a year, the COVID-19 crisis will leave its mark on the US economy for many years to come.”

In other words, the pandemic was not only a trigger event, acting on the contradictions that had built up in the economy and financial system, but a transformative one as well.

With the Fed now having formally committed itself to the endless supply of cheap money to Wall Street, attention will turn to the European Central Bank (ECB), which is also conducting a strategic policy review, to see whether it goes down the same road.

While the governing council, under the presidency of Christine Lagarde, may be inclined to move in the same direction as the Fed, it would face certain opposition from Germany’s Bundesbank, which has expressed opposition to the easing of monetary policy.

A member of the governing council told the Financial Times

“We are not out of firepower by any means, and to be honest, it looks from today’s vantage point that we were too cautious about our remaining firepower pre-COVID,” he said, adding that there are times when we “need to go big and go fast.”

The actions of the Fed have done nothing to boost the real economy, as an increasing number of companies announce that temporary layoffs will be made permanent.

The Wall Street Journal

This indicates that the pandemic has been a trigger for a major restructuring of employment conditions.

The effects of the Fed’s policies and the further monetary easing to come are focused on the stock market, with Wall Street indexes rising to the record levels they achieved in February. The main beneficiaries have been the high tech companies—Apple, Microsoft, Alphabet (the owner of Google) and Facebook—which together comprise more than a fifth of the Nasdaq index.

The extent of their rise and growing financial and monopoly power is indicated by the results of an analysis carried out by Bank of America Global Research, reported by the business channel CNBC. It found that the market capitalization of the major US tech firms, now standing at $9.1 trillion, was greater than the market capitalization of the entire European market, including the UK and Switzerland, at $8.9 trillion. In an indication of the massive shift that has taken place, the research note pointed out that in 2007, total European market capitalization was four times that of US technology stocks.

Trump vs. the $1.6 Billion Man Dems have already outspent the 2016 total presidential candidate donor spending.

Tue Nov 3, 2020

Daniel Greenfield

42

Daniel Greenfield, a Shillman Journalism Fellow at the Freedom Center, is an investigative journalist and writer focusing on the radical Left and Islamic terrorism.

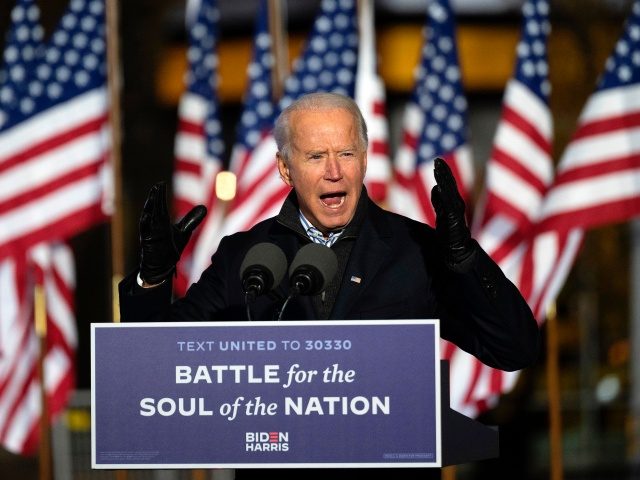

The 2020 presidential election comes down to places like Pittsburgh. While Hillary Clinton held the city, President Trump won the Pittsburgh metropolitan area. This time around, both Trump and Biden are holding rallies in Pittsburgh, an actual rally for Trump, and a drive-in for Biden.

President Trump is betting that enthusiasm matters more than money because Democrats are spending more than twice the annual budget of Pittsburgh to buy the White House.

Biden, by the numbers, is expected to break the $1 billion fundraising record. Almost $400 million is coming through in outside spending for Biden and over $300 million against Trump.

44% of federal donations have

Biden’s current total of $1.6 billion will almost certainly fall short of the staggering final number.

To put that number into perspective, Obama and McCain, together, spent $1 billion and that was considered a shocking number only twelve years ago. Every election since then has not only been more expensive, but has broken records in election spending. And it seemed to work.

Obama outraised McCain by over 3 to 1, pulling in $750 million to McCain's partly $238 million. Romney's own wealth and ability to tap into big donors brought closer parity, but Obama still beat Romney by $1.1 to $1 billion.

Until the last election, fundraising totals were a much more practical bellwether of victory than a bakery’s cookies or any of the other gimmicks that press veterans trot out before Election Day.

And then, even though Hillary Clinton was able to

Hillary Clinton spent $969 million and Trump spent $531 million for a total of $1.5 billion.

At $1.6 billion, Biden and his backers, many of them shadowy, some injecting dark money into the race, have already outspent the 2016 total presidential candidate donor spending.

And when the election bill finally comes due, it’s likely that Biden and his outside backers will have spent more money than both candidates and their PACs combined.

The staggering scale of the spending is more than a strategy, it’s a worldview.

The Democrats and the special interests behind them are spending an insane fortune, one that could keep Pittsburgh and many swing counties going for years, to buy the White House. And they’re doing it because they believe that the 2016 election was an implausible fluke.

The 2020 election is about more than personalities: it’s about power. And the powerful are betting that this is the election that will assert the power of campaign spending over populism.

The central theory of political campaigns is that most people are stupid. Otherwise why spend billions trying to lie to them? The Democrats and their media allies concluded that Trump only won last time around because he was able to outshout them. They began the 2020 campaign three years ago, long before Biden’s run or the Democrat primaries, on three simple strategies to silence Trump and achieve messaging supremacy in order to win with any candidate.

The first was to transform the media into a megaphone for attacking President Trump and touting Democrats. The media had been shamelessly corrupt in 2016, by 2020 its programming is entirely indistinguishable from a PAC’s ad campaigns for Biden and against Trump.

And what that really means is that the Democrats aren’t spending a mere $1.6 billion to elect Biden, they’re also spending the budgets of nearly every cable news network, newspaper, digital media site, and the rest of the massive media infrastructure. Cable news budgets alone take us into the billions. Operating expenses for the New York Times ’ parent company were $1.6 billion.

Throw in the various corporate “comedy” shows from Saturday Night Live to John Oliver, who operate as little more than thinly disguised ad campaigns for Democrats, PBS, NPR, and every publicly funded media outlet, and the actual messaging spending is in the tens of billions.

At least.

The second was to shut out President Trump and Republicans from social media, especially Facebook which reaches the most persuadable voters, at the crucial period before Election Day.

Democrats blamed Trump’s 2016 victory on his reach on Facebook. They spent years prepping the emergency red button. This time Big Tech was ready to shut down the Hunter Biden story.

Meanwhile, Twitter not only clumsily suppressed the Hunter Biden story, its trending topics became little more than election ads for the Democrats. What would it cost a campaign to buy a spot on Twitter’s trending topics, day after day before an election? That’s what Jack’s donating.

Finally, having achieved spectrum dominance, the Democrats would ram their message home, outraising and outspending Republicans to achieve total messaging superiority.

Biden’s underwhelming nature as a candidate, his incoherent speeches, limited campaigning, and lack of enthusiasm is a perfect test to see whether total messaging dominance is enough.

If they can buy an election for Biden, the theory is, they can buy it for anyone.

Now imagine Rep. Alexandria Ocasio Cortez or Rep. Ilhan Omar running for the White House.

But it’s also the ultimate attack on the Electoral College. Blue state power bases like California and New York have long chafed at having the course of the nation be determined by some farmers in flyover country. But while they haven’t succeeded in actually getting rid of rule by a union of states, instead of by New York City, Los Angeles, Boston, Seattle, and San Francisco, the oligarchy is doing the next best thing by using its vast wealth to buy elections nationwide.

Behind ActBlue’s posturing about small donors is a machine for moving money from wealthy lefties in major urban areas to races in places they wouldn’t set foot in. The Democrats want Senate seats and to get at them, $100 million from out of state poured into the campaign fund for Jamie Harrison. Less than 10% of the Democrat's money came from South Carolina.

Behind the racial appeals and claims of empowering voters, it’s about disempowering them.

And about empowering the oligarchy based out of a small number of powerful urban areas.

As the New York Times noted

The Democrat pulled in over $85 million in New York City alone. All that from a city that may be large but accounts for less than 2% of the nation’s population. And it isn’t all the millions of New Yorkers giving that money. Instead it’s coming from select zip codes with one Upper West Side zip code delivering over $8 million, more than some entire states, for the Biden campaign.

The ultimate question on the 2020 ballot, beyond any of the candidates, is whether this massive concentration of power and wealth that is behind Biden will be allowed to run the country.

Biden is not the real candidate. He’s just a name on the ballot. That’s what many Trump supporters instinctively understand. It’s why Trump’s populism struck a chord. Populism isn’t, as the media would like you to believe, a way of manipulating stupid people. That’s the media.

Populism doesn’t work unless it articulates what many people feel, but that few actually say.

"I think it is fair to say that in many ways the Democratic Party has become a party of the coastal elites, folks who have a lot of money," Bernie Sanders, a coastal millionaire with three homes, recently admitted on a late night talk show.

Those elites are spending over $1.6 billion not to elect a doddering hack, but to elect themselves. The woke movement is just the successor to generations of radical waves coming out of the wealthiest places in the country whose real message is their own moral superiority.

The Elect believe that they are the only ones who ought to be running the country.

This election is their latest effort to bully, buy, and browbeat the rest of the country into submitting to them. And they can spend $1.6 billion or $1.6 trillion to take over the country.

Oligarchies always have lots of money even when workers go hungry and lose their homes. And they get that money by seizing the centers of power and consuming the wealth of nations.

This is the latest and may be the final showdown between an oligarchy’s lies and a free nation.

JOHN CARNEY 3 Nov 2020 20

3:01

The U.S. stock market roared into election day, sending the Dow Jones Industrial Average over 450 points higher.

The Dow climbed by more than 680 points, or around 2.5 percent Tuesday morning, before retreating from their highs.

With two hours of trading left, the Dow is up 460 points, or 1.74 percent. The Nasdaq Composite is up 1.5 percent. The S&P 500 is also up 1.5 percent. The small-cap Russell 2000 is up 2 percent.

Ten of the 11 sectors of the S&P 500 were up. The Energy sector was down 1.2 percent. The Financials sector was the best performing, up 2.3 percent for the day, lead higher by the bank component’s 2.7 percent gain and the consumer finance subsector’s 2.8 percent gain. The KBW Nasdaq Bank Index, which tracks the stocks of the biggest banks, rose 2.5 percent.

Donald Trump’s victory for 2016 set off an explosive rally in stocks, defying widespread predictions that he would lose or that if he won it would cause the market to crash.

Many of the big Wall Street firms have Joe Biden as the runaway favorite to win the presidency, just as they had Hillary Clinton the favorite four years ago. Morgan Stanley said in a note to clients Tuesday that they estimate a 76 percent chance that Biden wins and the Democrats take control of the Senate. They estimate just an eight percent chance that Trump wins and GOP holds the Senate. The Wall Street firm gives just a thirteen percent chance of a mixed result with Biden winning but the GOP holding the Senate.

Biden has raised tens of millions of dollars from Wall Street. During his time as a U.S. Senator from Delaware, Biden earned the nickname “Plastic Joe” for his willingness to promote legislation friendly to credit card issuers, including a law that made it harder for bankrupt customers to get debt relief.

Most analysts think the economy and the stock market could get a big boost if Democrats sweep the election. A unified government would be more likely to quickly pass a stimulus bill, likely giving stocks a short-term boost and ameliorating the drag from new restrictions aimed at stemming the pandemic’s surge.

Biden’s immigration and visa programs would likely import enough workers to ease wage pressure, boosting corporate profits by lowering compensation costs. An increase in foreign workers also generates new customers for U.S. companies, especially U.S. banks and large retailers. Biden is viewed as likely to lift tariffs on China, allowing U.S. companies to send more jobs to cheaper overseas labor markets.

Biden has promised a rush of higher taxes and new regulations, including climate change schemes that would make energy more costly and damage U.S. manufacturing.

Patriotism vs. Globalism in 2020: A Country Is at Stake BY VERONIKA KYRLENDO Given the extraordinary pace of events in America and the world this year, it is not hard to imagine that a bystander — perhaps a bug-eyed alien who has been following the series "The Earth" — would be pleased with the dynamics of the show. But he also would be puzzled at the rapid twists of the plot. The U.S., for example, enters a 2020 season in all its might and glory, with the strong economy, where unemployment for everyone is low, where reduced taxes and regulations promise further growth, and the basic indices of economic activity spell "victory" for the funny-looking guy who made it happen. Then — BAM! — a "deadly virus" hits — eh, unimpressive...the mortality rate would have been much higher for the sake of the show; 2 percent is a rookie number (would be even lower if the infected were not placed in the nursing homes). Nonetheless, America goes into lockdown, losing trillions of dollars. Unemployment soars. Then — BAM! — massive protests accompanied by rioting, looting, arson, vandalism, and sheer violence erupt as a response to the incident of police brutality. The whole system is declared evil and beyond repair. The crime rate soars. American flags are burned — not in Iran or North Korea, but in Washington, D.C. Some parts of the country that were the envy of the world look like a war zone. Whoa, a startled viewer would think — what just happened?

What is happening is that November gets closer, and the country finds itself in a situation that may be described with a mathematical catastrophe theory used to study discontinuous processes. An example of a discontinuous process would be an arched bridge to which more and more weight is added. At first, little effect is seen as the weight on the bridge is increased — the bridge begins to bend almost imperceptibly. At a certain point, however, enough weight is added to the bridge that it collapses. A sudden change in a discontinuous process is called a catastrophe.

The American model right now has one active variable, the economic model, and one active parameter, a necessity to choose one out of two courses of its development. Speaking scientifically, we have reached a divergence point that requires a system to follow one of the two possible paths that are mutually exclusive. At this point, both of them are equally probable, and the system "freezes" — to land on one of the paths, it needs a push. It is difficult to accurately prognosticate the system's behavior at this point, but one can model it. Once the choice is made, the return to the divergence point is impossible — if you stand before the abyss, you may either walk around it or take a step into it.

Which paths lie before America? The first one is presented — and has been practiced for the last 20 years — by the globalism aimed to secure America's leading place in monopolar world. The main tools of it are supranational entities such as international organizations, multinational corporations, and financial institutions like the IMF and the World Bank. Even though globalization has been pictured by academia and media as an endless pool of growth, opportunities, and progress, it has been marked by substantial shortcomings. For example, under the new regime of enhanced financial mobility and power, with greater volatility of financial markets and increased risk, real interest rates have risen substantially. This has discouraged long-term investment in new plants and equipment and stimulated spending on the re-equipment of old facilities along with a large volume of essentially financial transactions — mergers, buybacks of stocks, financial maneuvers, and speculative activities. This explains why overall productivity growth in the member-countries of the Organization for Economic Co-operation and Development fell . So did gross fixed investment, and so did GDP growth. But the elites have done well despite the slackened productivity. Because globalization has helped keep wages down, while increasing real interest rates, the upper 5 percent of households have been able to skim off a large fraction of the reduced productivity gains, thereby permitting elite incomes and stock market values to rise rapidly. For the multinational corporations that shaped foreign policy by engaging in lobbyism, globalization has also been great. One of their main objectives that they achieved was cheaper labor sources. Labor is often cheapest, and least prone to cause employer problems, in authoritarian states. Capital moves to such friendly investment climes, shifting resources from the more expensive to the less costly locale. (That is why the MNCs have vocally opposed the Trump administration's escalation of trade tensions, tightening of immigration restrictions, and disruption of global value chains.)

For the global majority, globalization has been a whole different story. Income inequality rose markedly both within and among countries. In the United States, despite a great increase in productivity thanks to new technologies, inequality rose . Underemployment , job insecurity, benefit loss — all increased .

The Trump administration disdains globalization and practices a healthy and much needed protectionism. It withdrew from free trade and other deals and viciously attacked globalization structures nurtured by the previous administrations: U.N., NATO, WTO, International Criminal Court, and now WHO, which proved shockingly unprofessional and frankly hostile to the U.S. interests.

If Trump gets four more years as a president, he may get to the holy of holies of the economic globalism — the IMF and the World Bank — which will undoubtedly face a debt crisis due to the downfall of the world economy. Ironically, the COVID-19 hysteria that became an act of desperation for the Democrats — whether it was a projected event or a natural crisis that would have been a shame to waste — now plays against the global financial leviathan and its masters. According to none other than George Soros , the COVID-19 pandemic is a one-two financial punch for developing economies. Not only has it put extraordinary pressure on budgets worldwide, but it has also caused a sharp exodus of capital from emerging markets. JPMorgan Chase & Co. predicts that 1 in 5 emerging-market countries will default on their debt obligations — meaning that the core banks may collapse. If some federal reserve banks fail, the government may nationalize them — but no doubt Trump would not save them, as Obama did in 2008. That would fatally undermine the economic foundation of the Democrats for good; that's why Trump's victory is not an option for them.

If Biden wins, he, as a true O'Biden-Bama Democrat, will have to save the failing banking system by unprecedentedly increasing the national debt in a weakened economy. The previous model that balanced emission with trade deals would not be possible to execute in a severely damaged global economy. That is why Biden's victory would lead to a delayed catastrophe, but with lower chances of surviving it, because the condition of the country will deteriorate — his leftist policies will make sure of it.

The choice we as a country will make in November is clear: Trump and patriotism or Biden and globalism. Development or decline. It is just that simple.

Follow Veronika Kyrylenko, Ph.D. on Twitter or LinkedIn .

Image: Fox News via YouTube.

WALL STREET BANKSTERS KNOW HOW WELL OBAMA-BIDEN-HOLDER SERVED AND PROTECTED THEM DURING THE ECONOMIC MELTDOWN THEY CAUSED. A remarkable article in The American Prospect —a liberal publication that supports Biden against Trump—makes a devastating exposure of these militarists for Biden, under the headline, “How Biden’s Foreign Policy Team Got Rich.”

In other words, Wall Street favored Biden by better than four to one , and Biden’s $23 million lead among the financial elite accounted for more than his entire $16 million edge over Trump in fundraising in May and June.

“According to figures released this week by the Center for Responsive Politics, Wall Street in particular is favoring Biden’s campaign over Trump’s. The group found that Biden has raised $52.4 million from the finance, insurance and real estate industries, of which $32.2 million came from “securities and investment.”

Wall Street, Republicans and militarists back Biden campaign 9 July 2020 Anyone who wants to know what type of policies will be pursued by a Biden administration in the event the Democrats win the November 3 presidential election has only to look at the social and political forces that are rallying to his campaign.

BLOG EDITOR: BIDEN WAS ENDORSED VERY EARLY BY WAR PROFITEER AND PARTNER FOR RED CHINA SEN. DIANNE FEINSTEIN.

They include Wall Street, prominent Republicans and veterans of the Obama national security team.

Thanks to strong support from big business, the presidential campaign of the former vice president outraised President Trump’s reelection campaign in June, according to figures announced by the two campaigns last week. Joe Biden raked in $141 million, while Trump’s campaign took in $131 million.

It was the second consecutive month that Biden collected more in campaign contributions than Trump, following a $6 million edge in May, $80.8 million to $74 million, according to reports filed with the Federal Election Commission.

The Trump campaign still leads in cash in the bank, with $295 million on hand as of July 1, as it had few expenses during the Republican primaries, where Trump had only token opposition. Biden’s campaign was effectively broke at the time of his breakthrough victories in the Super Tuesday primaries on March 3, but he now has amassed a war chest of at least $125 million, according to published estimates.

ActBlue, the online fundraising vehicle for the Democratic Party as a whole, took in $392 million in June, shattering all previous records, the bulk of it in smaller donations and contributions from first-time donors. This is an indication of the widespread popular hostility to Trump, exacerbated by his vitriolic attacks on the mass protests against police violence that took place throughout the month, as well as his refusal to take any serious action to stem the coronavirus pandemic.

BLOG EDITOR: THE RICH KNOW WHO WILL SERVE THEM BEST! ALL BILLIONAIRES ARE DEMOCRATS. THE GREATEST TRANSFER OF WEALTH TO THE RICH IN AMERICAN HISTORY OCCURRED DURING THE BANKSTER REGIME OF OBAMA-BIDEN-HOLDER.

But a major factor in Biden’s fundraising surge has been a series of virtual events featuring former President Obama, Senator Elizabeth Warren and Senator Kamala Harris, at which wealthy contributors were invited to give the maximum donation of $5,600 directly to Biden as well as much larger sums to the Democratic National Committee (DNC) and the political action committee favored by the Biden campaign, Priorities USA, which expects to spend $200 million by itself to support his election.

Under the terms of an agreement between the Biden campaign and the DNC, the Biden Victory Fund can receive checks as large as $620,600 from wealthy donors. The money is then distributed in smaller amounts to the campaign, the DNC and various state parties in order to comply with campaign finance regulations.

According to figures released this week by the Center for Responsive Politics, Wall Street in particular is favoring Biden’s campaign over Trump’s. The group found that Biden has raised $52.4 million from the finance, insurance and real estate industries, of which $32.2 million came from “securities and investment.”

Trump raised $33.5 million from the broader category of finance, insurance and real estate. He was competitive with Biden among the real estate moguls, who view Trump as one of their own, but trailed badly, with only $7.8 million, from the “securities and investment” subcategory.

In other words, Wall Street favored Biden by better than four to one , and Biden’s $23 million lead among the financial elite accounted for more than his entire $16 million edge over Trump in fundraising in May and June.

Along with the support of the stock exchange and financial institutions, Biden is winning support from sections of the Republican Party. This includes the well publicized Lincoln Project, established by former Republican campaign operatives Reed Galen, John Weaver, Rick Wilson and Steve Schmidt, with the support of other former party officials like Jennifer Horn, former chair of the New Hampshire Republican Party, and George Conway, a prominent Republican lawyer and husband of Trump adviser Kellyanne Conway.

The Lincoln Project began running television and internet commercials denouncing Trump from a right-wing foreign policy standpoint, criticizing him as soft on China and Russia. One ad, released after the New York Times launched its fabricated and unsubstantiated charge that Russia paid bounties to Taliban fighters to kill American soldiers in Afghanistan, features a former Navy SEAL who attacks Trump for not ordering military action to kill Russians. The ad is titled “Betrayal.”

BLOG EDITOR: BOTH BIDEN AND GEORGE W BUSH ARE GLOBALIST FOR OPEN BORDERS AND ENDLESS WAR. THE BUSH FAMILY, LONG PARTNERED WITH THE 9-11 INVADING SAUDIS, STARTED TWO WARS AGAINST IRAQ WHICH ARE STILL FILLING THEIR POCKETS.

Another political action committee, “43 Alumni for Biden,” consists of hundreds of former officials in the Republican administration of George W. Bush (the 43rd US president). They declare they are “choosing country over party” in the November election, stating: “We believe that a Biden administration will adhere to the rule of law ... and restore dignity and integrity to the White House.” As a Super PAC, the group can raise unlimited sums of money to run ads attacking Trump or boosting Biden.

The final component in the rapidly coalescing coalition of reactionaries supporting the Biden campaign consists of former military-intelligence officials of the Obama administration, who have made a killing in the lucrative business of “strategic consulting” and now hope to return to power in a Biden administration. Several of them, including former deputy defense secretary Michele Flournoy and former deputy national security adviser and deputy secretary of state Anthony Blinken, have signed on as Biden’s top national security advisers.

A remarkable article in The American Prospect —a liberal publication that supports Biden against Trump—makes a devastating exposure of these militarists for Biden, under the headline, “How Biden’s Foreign Policy Team Got Rich.”

It documents the creation of a strategic consulting firm called WestExec Advisors (named after West Executive Avenue, the street outside the West Wing of the White House in Washington D.C.). WestExec was founded by two lesser operatives, Sergio Aguirre, former chief of staff to Samantha Power, UN ambassador under Obama, and Nitin Chadda, a former aide to Obama Secretary of Defense Ashton Carter.

These two recruited Flournoy and Blinken to serve as the group’s biggest “names.” Flournoy was widely expected to become secretary of defense if Hillary Clinton won the 2016 election and she is once again at the top of the list for Pentagon boss under Biden.

Under Trump, Flournoy served on the Pentagon’s Defense Policy Board, the President’s Intelligence Advisory Board and the CIA director’s External Advisory Board, before leaving once the 2020 presidential campaign heated up. She is a notorious warmonger, and The American Prospect article details her role in advocating continued US military support to Saudi Arabia in its war in Yemen, which has resulted in $3 billion in weapons contracts for Raytheon. WestExec principal Robert Work, a former deputy defense secretary, is a member of Raytheon’s board of directors.

WestExec quickly made a splash in Washington with its launch party attended by top former Obama national security aides such as Susan Rice, Tom Donilon and Denis McDonough. It lined up a list of clients so potent that neither WestExec nor the Biden campaign would release the names, for fear of exposing the fact that Biden’s foreign policy advisory group is a wholly owned subsidiary of the big military contractors.

One particularly noxious principal at WestExec is former Deputy CIA Director Avril Haines, who, as The American Prospect put it, “helped design Obama’s program of using drones for extrajudicial killings.” In June, the Biden campaign announced that Haines would oversee foreign policy for the Biden transition team.

While the former drone missile chief prepares plans for the future Biden administration, the current advisers, with their lucrative “consulting” affiliations, are listed by The American Prospect as follows: “Nicholas Burns (The Cohen Group), Kurt Campbell (The Asia Group), Tom Donilon (BlackRock Investment Institute), Wendy Sherman (Albright Stonebridge Group), Julianne Smith (WestExec Advisors) and Jake Sullivan (Macro Advisory Partners). They rarely discuss their connections to corporate power, defense contractors, private equity, and hedge funds, let alone disclose them.”

This is what Senator Bernie Sanders, Senator Elizabeth Warren and their various liberal and pseudo-left apologists have embraced as the alternative to the fascistic Trump administration—a government of warmongers and corporate shills, no less committed to the defense of the interests of the American ruling elite.

Fear and uncertainty dominate Jackson Hole central bankers’ meeting The annual Jackson Hole conclave of central bankers, which concluded over the weekend, underscored the incapacity of global financial authorities to devise any policies either to bring about economic growth or counter the mounting contradictions in the financial system.

Reporting on the meeting, held in virtual format this year because of the COVID-19 pandemic, the Financial Times noted: “It was the head of Singapore’s monetary authority who best summed up the biggest fear gripping the virtual Jackson Hole conference this year.

“‘We’re not going back to the same world,’ Tharman Shanmugaratnam warned.’”

The central initiative at the gathering was the decision by the Fed’s key policy-making body to maintain interest rates at their ultra-low levels for an indefinite period and keep pumping money into the financial system.

The decision, announced by the Federal Open Market Committee as the conclave opened and elaborated on in a keynote speech by Fed Chair Jerome Powell, was in effect a guarantee to Wall Street that its demand for “forward guidance”—lower interest rates for longer—would be met.

The Fed said it would no longer be guided by a 2 percent inflation rate limit in determining its interest policy, but would instead focus on an “average” rate of 2 percent, meaning that the cheap money regime could continue even if prices rose above that level.

As for dealing with the slump in the global economy—the most serious since the Great Depression—and combating the potential for further storms in the financial system following the market meltdown in mid-March, there were no answers, as underscored by the remarks of the Singapore finance minister.

“We’ve got to avoid a prolonged period of high levels of unemployment, and it’s a very real prospect,” he said. “It is not at all assured that we will get a return of tight labour markets even with traditional macroeconomic policy being properly applied.”

It was a significant comment because one of main themes in remarks by central bank chiefs was that monetary policy alone would not be sufficient to restore growth, and government intervention was needed to boost the economy. But, as Shanmugaratnam noted, even if “properly applied,” there were no guarantees of success.

According to the Financial Times , the notion that central bankers “need to face the reality of permanent upheaval and long-term economic damage” was the “main theme” of the event.

One of the most frequently cited academic papers produced for the meeting was prepared earlier this month by Colombia University academic Laura Veldkamp on the long-term effects of the COVID-19 pandemic.

The paper said that the biggest economic effects of the pandemic “could arise from changes in behaviour long after the immediate health crisis is resolved.” A potential source of such a long-lived change was a shift in the “perceived probability of an extreme, negative shock in the future,” and that “long-run cost for the US economy from this channel is many times higher than the estimates of the short-run losses in output.”

The paper continued: “This suggests that, even if a vaccine cures everyone in a year, the COVID-19 crisis will leave its mark on the US economy for many years to come.”

In other words, the pandemic was not only a trigger event, acting on the contradictions that had built up in the economy and financial system, but a transformative one as well.

With the Fed now having formally committed itself to the endless supply of cheap money to Wall Street, attention will turn to the European Central Bank (ECB), which is also conducting a strategic policy review, to see whether it goes down the same road.

While the governing council, under the presidency of Christine Lagarde, may be inclined to move in the same direction as the Fed, it would face certain opposition from Germany’s Bundesbank, which has expressed opposition to the easing of monetary policy.

A member of the governing council told the Financial Times , “we will look at it,” but the Bundesbank would be “very nervous” about it.

“We are not out of firepower by any means, and to be honest, it looks from today’s vantage point that we were too cautious about our remaining firepower pre-COVID,” he said, adding that there are times when we “need to go big and go fast.”

The actions of the Fed have done nothing to boost the real economy, as an increasing number of companies announce that temporary layoffs will be made permanent.

The Wall Street Journal reported Saturday that a survey conducted by Randstad RiseSmart found that “nearly half of US employers that had furloughed or laid off staff because of COVID-19 are considering additional workplace cuts in the next 12 months.”

This indicates that the pandemic has been a trigger for a major restructuring of employment conditions.

The effects of the Fed’s policies and the further monetary easing to come are focused on the stock market, with Wall Street indexes rising to the record levels they achieved in February. The main beneficiaries have been the high tech companies—Apple, Microsoft, Alphabet (the owner of Google) and Facebook—which together comprise more than a fifth of the Nasdaq index.

The extent of their rise and growing financial and monopoly power is indicated by the results of an analysis carried out by Bank of America Global Research, reported by the business channel CNBC. It found that the market capitalization of the major US tech firms, now standing at $9.1 trillion, was greater than the market capitalization of the entire European market, including the UK and Switzerland, at $8.9 trillion. In an indication of the massive shift that has taken place, the research note pointed out that in 2007, total European market capitalization was four times that of US technology stocks.

No comments:

Post a Comment