Silicon Valley Bank spent billions on green energy, millions on Black Lives Matter and other leftist causes, until it finally ran out of ‘other people’s money’.

That’s when the Biden administration decided to bail out its depositors.

At a dinner hosted by Peter Orszag, Obama’s former budget director, Wally Adeyemo, Obama’s Nigerian assistant treasury secretary and Biden’s deputy treasury secretary, chatted with Blair Effron, an influential Biden donor, serving on Biden’s Intelligence Advisory Board, who had been hired as an advisor by SVB to deal with its financial crisis. The outcome was inevitable.

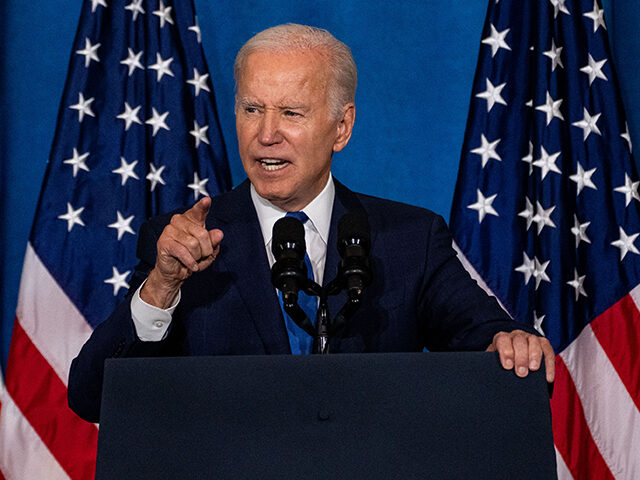

“Because of the actions that our regulators have already taken, every American should feel confident that their deposits will be there if and when they need them,” Biden lied.

The deposits of ordinary Americans were already protected up to $250,000.

But unlike banks that serve ordinary customers, the vast majority of SVB’s clients held over $250,000 and were not protected by FDIC insurance. Rather than risk its political donors and allies having to take a 10% loss on their funds, the Biden administration illegally bailed them out while unilaterally transforming FDIC insurance into a protection plan for its political allies.

The Biden bailout was not there to protect Americans, but leftist and even Chinese interests.

SVB was the embodiment of Environmental, Social, and Governance or ESG investing which prioritizes leftist politics over profitability. The Biden administration recently announced that it would allow 401(k) pension plans to be put into ESG instead of reliable investments potentially endangering the retirements of tens of millions of Americans which might also get ‘SVB’d.’

While SVB focused on “climate change” and “diversity”, it ignored rising interest rates. The woke bank was too busy with its politics to deal with the math. SVB had no risk officer for 8 crucial months, but its risk officer for Europe, Africa and the Middle East focused on sharing her “experiences as a lesbian of color” and “moderating SVB’s EMEA Pride townhall.”

CEO Greg Becker led quarterly diversity, equity and inclusion town halls instead of figuring out that startups squeezed by rising interest rates would need money that the bank didn’t have.

Silicon Valley Bank directed over $73 million to Black Lives Matter and other causes. It put millions into, among others, the Accion Opportunity Fund which describes its mission as advancing “racial, gender and economic justice”. It focused on “building a culture of Diversity, Equity and Inclusion” and advancing the “transition to a low-carbon world.”

SVB’s mission was to force 100% of its employees to participate in DEI indoctrination.

Newsweek named SVB one of “America’s Most Responsible Companies”: not because the woke bank managed its money well, but because it had the right politics.

Now one of “America’s Most Responsible Companies” is responsible for economic devastation.

SVB mastered wokeness, but failed economics 101. And that was by design. Its real business was politics. By financing leftist causes, SVB had become politically too big to fail. While its own finances are wrecked, the Biden administration quickly stepped in to protect its woke depositors.

The SVB bailout was an announcement that the Biden administration would stand behind woke financial institutions and instruments, socializing the pain by spreading it to more stable financial systems, no matter how irresponsibly they put funds at risk in the pursuit of their politics.

SVB’s clients included California Gov. Newsom’s wine companies as well as assorted politically connected figures, and “1,550 climate tech and sustainability” companies and churned out billions in loans for the woke companies pitching government-subsidized ‘green’ tech.

The woke bank hoovered up subsidies and tax breaks to worthless wind and solar programs and its collapse will leave a “hole” in the green industry. The intersection between the Biden administration’s special interests and SVB was made clear in the Washington Post’s headline, “Biden Boosted Clean Tech. How Much Will SVB Set It Back?”

Last year, Pink Energy, a solar company, shut down after multiple complaints about lying to customers about how much money they would save by switching to worthless solar. The Ohio Attorney General finally issued an injunction against Pink. And Pink’s financing came through Sunlight Financial Holdings which kept the majority of its money in an SVB account.

That’s the sort of junk ‘green’ businesses that the Biden bailout was meant to reward.

SVB was a key element in a woke economy that moved money to political causes with no fiscal responsibility. Its board of directors was short on banking officials, but included major Democrat donors, including a Pelosi neighbor, as well as Janet Yellen’s protege: Mary J. Miller, who had implemented the Dodd-Frank reform package and also chaired the San Francisco Fed’s Diversity and Inclusion Council. Meanwhile, SVB CEO Greg Becker sat on the Fed’s board.

The San Francisco Fed should have monitored SVB’s books and spotted the trouble, but instead it focused instead on fighting “systemic racism” and making banking more “inclusive”.

Going out of business is inclusive.

Not satisfied with bailing out their own supporters, the Biden administration also set out to bail out our enemies.

One of SVB’s major client bases was in China. Chinese companies were able to open an account in a week while “mainstream traditional banks, such as Standard Chartered, HSBC, Citi have strict compliance and it takes a long time to start a bank account with them.”

It’s unclear how many of these Chinese businesses, some likely linked to the Communist Party, Biden has chosen to bail out at the expense of bank customers and while further feeding the inflation that is destroying American families and wiping out the remains of the middle class.

Silicon Valley Bank also maintained a joint venture with China’s Communist state owned

Shanghai Pudong Development Bank which has been under investigation for aiding North Korea’s nuclear program meant to kill millions of Americans. That venture however does not appear to be affected by SVB’s collapse or the illegal Biden bailout of woke capital.

Like SVB, Signature Bank, the second ESG bank that failed, had social impact reports and provided climate disclosures. Its boss led a seminar on gender neutral pronouns and former Rep. Barney Frank (half of Dodd-Frank’s regulatory regime) served on its board. Meanwhile, the DOJ was conducting a criminal investigation involving money laundering by its clients.

ESG is a disaster causing the third largest bank failure in America in just two days.

But ESG is too big to fail because it is at the heart of the leftist scheme to divert money into its causes and to fund its activism. The SVB disaster revealed how fiscally unsound these economic schemes are and how the Democrats will abuse their power to protect them anyway.

Even as the Fed pushes interest rates higher to slow down the economy and inflation, the Democrats have plenty of money on tap for their political allies. American families may not be able to afford to buy eggs, but the cash keeps on flowing for woke capital.

Go woke, go broke and if you support him, Biden will still bail you out.

No comments:

Post a Comment