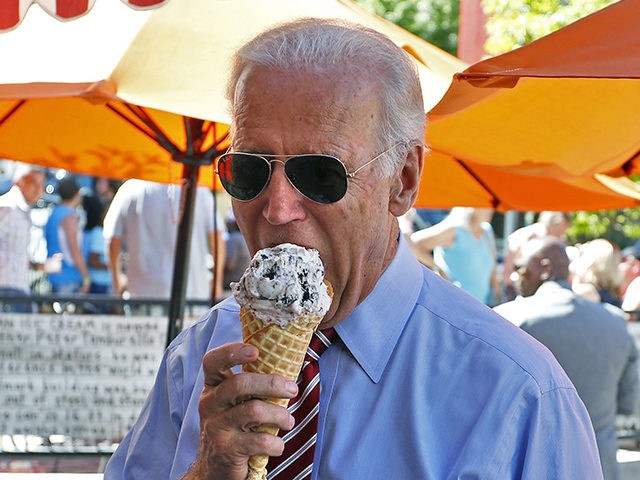

JOE BIDEN: LYING SOCIOPATH GAMER PARASITE LAWYER!

Despite his Wall Street, big business, Big Tech, and billionaire donations, Biden has attempted to portray himself as a small-town fighter from Scranton, Pennsylvania. JOHN BINDER

“This was not because of difficulties in securing indictments or convictions. On the contrary, Attorney General Eric Holder told a Senate committee in March of 2013 that the Obama administration chose not to prosecute the big banks or their CEOs because to do so might “have a negative impact on the national economy.”

“Attorney General Eric Holder's tenure was a low point even within the disgraceful scandal-ridden Obama years.”

DANIEL GREENFIELD / FRONTPAGE MAG

Silicon Valley Bank Board Included Barack Obama, Hillary Clinton Donors

David McNew/Getty Images Several Silicon Valley Bank (SVB) board of directors have donated thousands of dollars or have direct ties to prominent Democrat politicians like Hillary Clinton, former President Barack Obama, and Rep. Nancy Pelosi (D-CA).

Banking Crisis just got WORSE. Fed Reports $400 BILLION in Losses.

Several Silicon Valley Bank (SVB) board of directors have donated thousands of dollars or have direct ties to prominent Democrat politicians like Hillary Clinton, former President Barack Obama, and Rep. Nancy Pelosi (D-CA).

Banking Crisis just got WORSE. Fed Reports $400 BILLION in Losses.

Moody’s Chief Economist: Customers Will Ultimately Pay to Save SVB, Signature Bank Depositors

On Monday’s broadcast of C-SPAN’s “Washington Journal,” Moody’s Analytics Chief Economist Mark Zandi stated that ultimately, “we all bear the cost” of backstopping the depositors of Silicon Valley Bank and Signature Bank because banks will pass part of the cost on to consumers, but he thinks the backstopping was the least bad decision.

Zandi said, “In terms of who pays, most directly, it’s the banks themselves. Because the FDIC — who is coming in to resolve these failed institutions and pay off depositors and other creditors — pulls that money out of the Deposit Insurance Fund, the fund that’s been established where banks contribute into that for this very purpose, to pay for failed institutions. But clearly, the banks will then try to pass at least some of that along to their customers. So, they’ll eat some of it in the form of less earnings, lower profits, it probably affects the pay of their executives and other employees. But, ultimately, it likely also ends up in lower deposit rates for depositors and higher lending costs for lenders. So, ultimately, the cost is borne broadly by the customers of the banking system, which is most of us.”

He continued, “Now, having said that, the calculation you have to do here is, if the FDIC didn’t step in and resolve those institutions and if the government hadn’t provided those — that kind of strong backstop, what was the counterfactual then? What would have happened? And it felt really — a couple of weeks ago, it felt pretty uncomfortable. It felt like the banking system could come under extreme pressure, we could have deposit runs and then, ultimately, the cost to all of us would be even greater, because the government would have had to step in, provide more support, there would be more failures, and the cost to us would be even greater. So, it’s kind of a no good choice here…I think policymakers made the least bad choice that they had. But ultimately, we all bear the cost of that as customers of the bank.”

Follow Ian Hanchett on Twitter @IanHanchett

One can make a good argument that banking is part of global economic problems. The system allows banks to get bigger and bigger, with profits going, not to people who create, but to those who despoil. This is no longer a case of lenders driving capitalism. Instead, it is a closed system that works with the government to police people and entices them into bad financial decisions (think of the 2008 collapse over equity-free housing loans). It promotes spending much of our productivity, national and personal, on banking services.

Dem Rep. Gottheimer: We Still Don’t Know What Regulators Did During SVB Collapse

On Wednesday’s broadcast of CNBC’s “Power Lunch,” Rep. Josh Gottheimer (D-NJ) stated that we still don’t know what regulators did over the weekend that Silicon Valley Bank collapsed.

Co-host Tyler Mathisen asked, “Chairman McHenry was incensed, I guess is a possible way of putting it, over what he described as a lack of transparency over the weekend when SVB was engineered out of existence. He says there are no notes publicly available from the regulators’ emergency meetings over the weekend, and that lack of transparency has a negative effect on the public view of the safety of the financial arena. How do you feel about that? Was there — is there enough transparency about what was going on on that weekend when regulators finally stepped in?”

Gottheimer answered, “Not yet. Which is why I and others have called for an investigation. It starts with this hearing, but it’s got to go a lot deeper. There [were] a lot of question marks. We were all talking over that weekend, and I spoke to the chairman, I spoke to the ranking member, I spoke to a lot of banks, small or medium regional-sized regional banks. We’re all having — and investors and consumers and many non-profits, and we were all having the same discussion of what — they were all panicked, what’s going on. Because it was quiet for a long period, as you know, over that weekend, and a lot of money left small or medium regional banks over the weekend, as we have seen in the numbers. That’s a problem. We should understand why we didn’t have better information, especially those of us on the committee. And we’re going to want to have answers, which is why we’re doing this in-depth investigation.”

Follow Ian Hanchett on Twitter @IanHanchett

BLOG EDITOR: BLACKROCK IS BIDEN'S BIGGEST BRIBESTER. THEY OPERATE OUT OF THE BIDEN WHITE HOUSE UNDER GAMER LAWYER BRIAN DEESE.

Currently, the world is run by moneymen. You only have to look at the way Vanguard and BlackRock own everything between the two of them, even as they use our money to drive those companies into socially destructive and economically wasteful ESG policies (e.g., green energy, DEI, CRT, trans ideology, etc.). (And no, this Reuters article does not debunk the charge, because it ignores the fact that the companies are driven more by ESG policies than by working for their investors. ESG is a huge breach of fiduciary duty.

Australia shows the devastating power that modern banks have over people’s lives

Most Americans cling to the old-fashioned notion that a bank honorably holds their money and pays interest on that money, with the interest coming from the fact that the bank loans that same money to others for an even higher interest rate. We all imagine Jimmy Stewart explaining how banks work to his Bedford Falls neighbors in It’s a Wonderful Life. That’s not true anymore and, Australia’s experience illustrates that, in the 21st century, banks have almost unlimited control over people’s lives.

My parents were loyal to Australia’s Commonwealth Bank way beyond what was logical. It took a lot of evidence from the bank’s own actions for them even to consider changing banks, and even then, it was emotionally painful for them. The reality is that banks have been appalling for a very long time, and their pathology has been progressing exponentially lately, as they no longer try to hide their craven intent.

Here in Australia, for a $10.00 “overdraft” that exists for less than 24 hours, banks charge $25.00. They call this a “fee” because, if they acknowledged that it’s an interest charge, that rate per annum would be over 90,000%!

Banks block our accounts for any number of reasons. My favorite is because a government bureaucracy decides the accountholder transgressed. As we all know, in the world of bureaucracy, everyone is guilty until proven innocent. Getting access to the account again is an uphill battle. You must spend time and money proving that the money you earned and that you put into the bank for safekeeping is, in fact, your property. The costs associated with that proof are yours alone to keep you in your place—and the interest during that time is the bank’s bonus.

Banks devise “products” that promise to pay you interest at a rate that is competitively commercial but build into it certain hoops that you must jump through to achieve that commercial interest rate. They call the hoops a service to help you—to save you time and to focus your energies—but the reality is that they use the fine print to reduce the commercial interest to a theft rate and laugh each month that you fail to comply with the minutiae of their scam.

Banks offer loans that transfer your hard-earned income to their palatial corporate headquarters, where they promote fiscal irresponsibility by lending higher and higher proportions of property value, and they pitch interest rates to reflect risk, even as they assure that they never take a risk. All costs are passed on to the client so that a loan of one million dollars may cost three million by the time the bank forecloses—and it will magically force foreclosure just as the property price and legal fees hit three million dollars. Inflation drives property value increases, and banks help drive that inflation.

One can make a good argument that banking is part of global economic problems. The system allows banks to get bigger and bigger, with profits going, not to people who create, but to those who despoil. This is no longer a case of lenders driving capitalism. Instead, it is a closed system that works with the government to police people and entices them into bad financial decisions (think of the 2008 collapse over equity-free housing loans). It promotes spending much of our productivity, national and personal, on banking services.

Currently, the world is run by moneymen. You only have to look at the way Vanguard and BlackRock own everything between the two of them, even as they use our money to drive those companies into socially destructive and economically wasteful ESG policies (e.g., green energy, DEI, CRT, trans ideology, etc.). (And no, this Reuters article does not debunk the charge, because it ignores the fact that the companies are driven more by ESG policies than by working for their investors. ESG is a huge breach of fiduciary duty.

What the new system means is that we have lost control. We are all working to pay interest on debt that we didn’t need in the first place. Debt investment has created Big Tech, Ukraine, and so much more—unaffordable fads swirling around so-called climate change, unaffordable social programs based on fact-averse policies, all leading to what I’ve heard is 300 trillion in global debt this year (which I suspect underestimates the scope of the problem).

I have a very simple understanding of finance, and probably no understanding of global finance. As I see it, the world works if individuals are in charge of production, innovation, and entrepreneurship, with enterprises functioning at a human level.

The mess we are in is no longer human scale. It is no longer controllable, and to continue to pretend that it is requires short-sighted stupidity at a level no one thought possible two years ago. When we lose human scale, we lose humanity. I’d like to point the finger of blame at a specific person, party, or institution but, basically, it is us. We let it happen.

Nodrog is a pseudonym because Australia is no longer a free country.

Bank TURMOIL Will Make Getting a Mortgage IMPOSSIBLE

Summers: We’ll Either Have ‘Substantially Unsustainable Inflation’ or ‘Fairly Hard’ Downturn Due to Bank Issues

During an interview aired on Friday’s edition of Bloomberg’s “Wall Street Week,” Harvard Professor, economist, Director of the National Economic Council under President Barack Obama, and Treasury Secretary under President Bill Clinton Larry Summers stated that “we are still a substantially unsustainable inflation country unless the economy turns down fairly hard” due to issues in the banking system.

Summers said that while the most recent PCE numbers are better than previous numbers, “I don’t think one should make too much of that. I think we are still a substantially unsustainable inflation country unless the economy turns down fairly hard in response to the credit issues raised by the banking system, and we don’t know yet whether that’s going to happen.”

He added, “So, in a sense, the outcomes here are a bit bifurcated. Either the banking crisis will pass without incident and without large impact on credit, in which case we really do have serious inflation issues and the Fed will have to tighten much more than is priced in, or we’re going to see some kind of real downturn here. And I think both are plausible outcomes and I recognize that there’s a chance we’ll skate through right in between, but I have to say that seems very much odds off to me. Soft landings are very hard, even in the best environment.”

Follow Ian Hanchett on Twitter @IanHanchett

Very Few Are READY For What's Coming!!! (PLEASE PREPARE)

NEXT HUGE BANK FAILURE WILL ROCK THE WORLD? BANKRUPTCIES SURGE, LAYOFFS WORSEN

15 Signs A Massive Car Market Crash Is Already Upon Us

Consumer Sentiment Cracks: First Drop in Four Months

Consumer sentiment unexpectedly worsened in March as worries over a looming recession took hold.

The University of Michigan’s index of consumer sentiment fell to 62.0 in March from 67 in February, an eight percent decline. Compared with a year ago, the index is down four percent.

The midmonth preliminary reading came in at 63.4, so the final number indicates that sentiment continued to deteriorate as March progressed. Economists had expected the final March reading to more or less hold steady with the mid-month score.

Surprisingly, it was not the banking crisis that depressed consumer sentiment.

“This month’s turmoil in the banking sector had limited impact on consumer sentiment, which was already exhibiting downward momentum prior to the collapse of Silicon Valley Bank. Overall, our data revealed multiple signs that consumers increasingly expect a recession ahead,” said Joanne Hsu, the director of the survey.

There were steep declines in both the assessment of current conditions and expectations for the future.

“While sentiment fell across all demographic groups, the declines were sharpest for lower-income, less-educated, and younger consumers, as well as consumers with the top tercile of stock holdings. All five index components declined this month, led by a notably sharp weakening in one-year business conditions,” Hsu said.

Year-ahead inflation expectations fell from 4.1 percent in February to 3.6 percent, the lowest reading since April 2021. Long-run inflation expectations came in at 2.9 percent for the fourth consecutive month.

Walmart Reports A Large Number Of Store Closings As Catastrophic Retail Collapse Intensify

A CLOSE LOOK AT BIDENOMICS

CALIFORNIA HAS THE MOST ILLEGALS IN THE COUNTRY AND THE MOST HOMELESS. NOT HARD TO DO THE MATH ON THAT ONE.

VIDEOS

THE NIGHTMARE BEGINS IN JULY!? FINANCIAL CRISIS 2.0, PAYCHECK TO PAYCHECK CROWD

Bank TURMOIL Will Make Getting a Mortgage IMPOSSIBLE

Wave of Loan Defaults Hit the Real Estate Market (Housing Market Warning)

Middle Class Families Can No Longer Afford Rent As Prices Hit Astronomical Levels

Report: 62% of American Consumers Live Paycheck to Paycheck

A report revealed 62 percent of United States adults live paycheck to paycheck.

A report by PYMNTS and LendingClub, a peer-to-peer lending platform, revealed that as of February, 62 percent of Americans live paycheck to paycheck, including 48 percent of high-income consumers.

The report noted that though inflation is lower than it was in July, consumers are still contending with rising costs.

“Inflation has made life more and more expensive, and consumers have already made moves to cope, such as pulling back on discretionary expenses,” the report read. “But one can only pull back so far on spending, and PYMNTS’ data reveals that consumers are finding another way to navigate their lower purchasing power.”

The report observed that for some people “supplemental income may be the key” and noted that about a quarter of consumers had a side job in addition to 17 percent who had other forms of supplemental income.

The report noted 39 percent of those who lived paycheck to paycheck “with issues paying their bills” mentioned “extraordinary expenses” as their reason for seeking side work.

Some 55% percent of respondents reported their supplemental income grew as a share of their total income over the last 90 days.

The report surveyed 4,125 U.S. consumers from Feb. 7 to Feb. 23 and also considered economic data from other sources.

A February press release from LendingClub indicated that in January 60 percent of consumers were living paycheck to paycheck, two percent lower than in February.

The press release also touched on data about outstanding credit card balances, with the average consumer having credit card debt totaling 35 percent of their savings.

However, this figure varied among different consumer groups. Those who indicated they were living paycheck to paycheck without issues paying their bills maintained credit card balances equaling 62 percent of their savings, and those who were living paycheck to paycheck and had trouble paying their bills had credit card debt exceeding their available savings by more than 50 percent.

Report: 44% of Americans Work a Second Job, 13% Increase Under Biden

Forty-four percent of Americans work a second job, a 13 percent increase relative to the Trump administration, a LendingClub report revealed Tuesday.

The recent increase under President Joe Biden is highlighted by a survey from FlexJobs, which found 69 percent of employed professionals either have a side job or want one.

The desire to work longer hours at a second job comes as Biden’s 40-year-high inflation cost American households an extra $5,200 in 2022 or $433 per month on average, according to Bloomberg.

While many Americans are forced to expand their income by working more hours at a second job, Biden is expanding taxes on the so-called gig economy.

As Breitbart News noted in November, the IRS warned workers that they will be forced to report income over $600 to the IRS on a form called the 1099-K. The warning was a result of Biden’s American Rescue Plan Act of 2021.

The rule is intended to compel American workers to “pay your fair share,” an idea that Biden has pushed for the wealthy but not average Americans — until now.

The LendingClub report also revealed 62 percent of Americans, including 48 percent of high-income consumers, were living paycheck to paycheck in February, up two percentage points from the month prior.

Breitbart News’s Michael Foster reported:

The report noted 39 percent of those who lived paycheck to paycheck “with issues paying their bills” mentioned “extraordinary expenses” as their reason for seeking side work.

Some 55% percent of respondents reported their supplemental income grew as a share of their total income over the last 90 days.

The report polled 4,125 U.S. consumers from February 7 – 23 and considered economic data from other sources as well.

Follow Wendell Husebø on Twitter @WendellHusebø. He is the author of Politics of Slave Morality.

Silicon Valley Bank Board Included Barack Obama, Hillary Clinton Donors

David McNew/Getty Images Several Silicon Valley Bank (SVB) board of directors have donated thousands of dollars or have direct ties to prominent Democrat politicians like Hillary Clinton, former President Barack Obama, and Rep. Nancy Pelosi (D-CA).

Several Silicon Valley Bank (SVB) board of directors have donated thousands of dollars or have direct ties to prominent Democrat politicians like Hillary Clinton, former President Barack Obama, and Rep. Nancy Pelosi (D-CA).

Summers: Taxpayers Will Bear ‘Stunningly’ High Cost of Resolving SVB, Signature Bank

During an interview aired on Friday’s edition of Bloomberg’s “Wall Street Week,” Harvard Professor, economist, Director of the National Economic Council under President Barack Obama, and Treasury Secretary under President Bill Clinton Larry Summers stated that the amount the FDIC spent on bank resolutions is “stunningly” high and that taxpayers will ultimately bear the cost.

Summers stated, “I’m surprised by how much the FDIC has had to spend on these resolutions relative to the things that were being said earlier. They were hoping to sell SVB as a whole entity and then, in order to get somebody to buy it, they had to chip in a set of stuff that was cumulatively worth $20 billion. The arithmetic is similar relative to the scale of the bank at Signature Bank. There are a lot of questions about those transactions. I’m still confused about why the holding company debt of SVB is still being valued in a meaningful way. And I will want to see assurance that no executive there is getting deferred compensation. But these were stunningly expensive transactions. Ultimately, everybody’s going to say, it’s not coming back to taxpayers, but banks are taxpayers on behalf of people, their depositors, their customers, their people they lend to. And the $23 billion the FDIC has spent is $100 per adult American and that’s a fair amount. So, I wonder if we can’t be looking at the procedures that they’re using and finding ways to do better.”

Follow Ian Hanchett on Twitter @IanHanchett

“Attorney General Eric Holder's tenure was a low point even within the disgraceful scandal-ridden Obama years.”

DANIEL GREENFIELD / FRONTPAGE MAG

Schweizer: It’s what you call an incestuous relationship between government and business.

On the latest episode of the Drill Down podcast, Government Accountability Institute President and New York Times bestselling author Peter Schweizer and GAI Vice President Eric Eggers tackle the recent failure of Silicon Valley Bank – and reveal California Gov. Gavin Newsom’s personal interest in the bank’s bailout.

“This was ‘the elite’ —this was the ‘Silicon Valley elite,’ Schweizer says of the SVB depositors, adding that much of SVB’s cash was invested in Environmental Social Governance initiatives which, in many cases, didn’t even make a product.

Dem Rep. Gottheimer: We Still Don’t Know What Regulators Did During SVB Collapse

On Wednesday’s broadcast of CNBC’s “Power Lunch,” Rep. Josh Gottheimer (D-NJ) stated that we still don’t know what regulators did over the weekend that Silicon Valley Bank collapsed.

Co-host Tyler Mathisen asked, “Chairman McHenry was incensed, I guess is a possible way of putting it, over what he described as a lack of transparency over the weekend when SVB was engineered out of existence. He says there are no notes publicly available from the regulators’ emergency meetings over the weekend, and that lack of transparency has a negative effect on the public view of the safety of the financial arena. How do you feel about that? Was there — is there enough transparency about what was going on on that weekend when regulators finally stepped in?”

Gottheimer answered, “Not yet. Which is why I and others have called for an investigation. It starts with this hearing, but it’s got to go a lot deeper. There [were] a lot of question marks. We were all talking over that weekend, and I spoke to the chairman, I spoke to the ranking member, I spoke to a lot of banks, small or medium regional-sized regional banks. We’re all having — and investors and consumers and many non-profits, and we were all having the same discussion of what — they were all panicked, what’s going on. Because it was quiet for a long period, as you know, over that weekend, and a lot of money left small or medium regional banks over the weekend, as we have seen in the numbers. That’s a problem. We should understand why we didn’t have better information, especially those of us on the committee. And we’re going to want to have answers, which is why we’re doing this in-depth investigation.”

Follow Ian Hanchett on Twitter @IanHanchett

'CREDIT CARD' JOE BIDEN PUT YELLEN IN TREASURY BECAUSE SHE HAS SUCKED ABOUT $8MILLION IN BANKSTER SPEECH FEE BRIBES AND WOULD PROTECT THE BIDEN'S NEARLY 150 DIRTY ILLEGAL TAX EVADING MOREY WIRE TRANSFERS FROM FOREIGN DICATORS AND CRIMINALS.

Janet Yellen: Regulators May Have to Tighten Banking Rules in Wake of Crisis

Treasury Secretary Janet Yellen will say on Thursday that regulators may have to tighten banking rules in the wake of the banking crisis.

The Wall Street Journal (WSJ) obtained prepared remarks Yellen will deliver at the National Association for Business Economics, which will present her with an award in memory of former Federal Reserve Chairman Paul Volker, who was famous for cracking down on inflation. Yellen served as a Federal Reserve chair and other top posts at the nation’s central bank.

Yellen will use her remarks to implement more banking regulations that began in the wake of the 2008 financial crisis.

“These events remind us of the urgent need to complete unfinished business: to finalize post-crisis reforms, consider whether deregulation may have gone too far, and repair the cracks in the regulatory perimeter that the recent shocks have revealed,” Yellen will say.

U.S. Secretary of the Treasury Janet Yellen speaks during a hearing before the House Appropriations Committee in the Rayburn House Office Building on Capitol Hill March 29, 2023 in Washington, DC. (Nathan Howard/Getty Images)

The Journal noted some former regulators have said that D.C. regulators have been too focused on America’s largest banks after the 2008 financial crisis, potentially ignoring possible issues with small and medium-sized banks. In 2018, under then-President Donald Trump, Congress passed a bill to roll back regulations that were viewed as too onerous for community banks.

The Fed is now reconsidering rules for medium-sized banks, or those with assets between $100 and $250 billion. The Biden White House will likely issue recommendations for rules to increase scrutiny over medium-sized banks.

“Regulatory requirements have been loosened in recent years. I believe it is appropriate to assess the impact of these deregulatory decisions and take any necessary actions in response,” Yellen will say.

“In large part, this was due to the post-crisis reforms we put in place. But in both cases, the government had to deliver substantial interventions to ease the pressure on certain parts of the financial system. This means that more work must be done,” she will say.

Yellen said the Financial Stability Oversight Council (FSOC), an interagency group created under Dodd-Frank reforms, will change its rules to subject institutions such as money-market funds to more supervision.

Yellen will argue that money-market funds, hedge funds, and stablecoins, or digital assets pegged to the value of a fiat currency such as the United States dollar, could present instability risks.

Yellen’s remarks will also call on Congress to pass legislation to regulate stablecoin issuers more like banks.

Sean Moran is a policy reporter for Breitbart News. Follow him on Twitter @SeanMoran3.

Poll: Growing Numbers of Voters Believe Joe, Hunter Biden Did Something Illegal or Unethical

More voters over the course of four month period are convinced Hunter and President Joe Biden have done something illegal or unethical in relation to his family’s business, a Fox News poll found Wednesday.

The increase comes after the House Oversight Committee Chair James Comer (R-KY) revealed in March the Biden family received a collective $1.3 million cut in 2017 from a Biden family business associate, who was sent a $3 million wire transfer from a Chinese energy company linked to the CCP.

The committee has also discovered unreported funds the Biden family businesses received while Joe Biden was vice president. Overall, the Biden family business has received more than 31 million during his reign as vice president.

Hunter has confirmed the $1.3 million China payout, while Joe Biden falsely denied it.

According to the poll, 64 percent believe Joe Biden did something illegal or unethical, the poll found in March. That number is greater than the poll’s findings in December when 62 percent said the president had done something illegal or unethical in connection with the Biden family business.

Polling data shows the increase of two percent was transferred from those who were recorded as unsure in December. Seven percent in December did not know if Joe Biden did something illegal or unethical. In March, that number shrank two percentage points to five percent.

The number of voters who believe Biden has done nothing wrong has remained constant. Only 31 percent in March said Joe Biden “hasn’t done anything seriously wrong,” mirroring the same number from December’s poll.

The growing belief that Joe Biden has done something wrong is tracing Hunter Biden’s polling data on the same question. Seventy-six percent say Hunter did something illegal or unethical, up from 73 percent in February and 70 percent in December.

Those who did not know if Hunter did something illegal or unethical has also shrunk over four months: 11 percent in March, 9 percent in February, 6 percent in December.

By convincing the undecideds, the polling data suggests Comer is winning the public relations battle against the White House, which has often refused to engage with the media.

Speaking with Bloomberg on Wednesday, Comer vowed to keep investigating the Biden family for nine violations to determine if Joe Biden is compromised by China for legislative purposes.

“We believe the reason the family was receiving this money is because of favors that Joe Biden did as vice president and or as president,” Comer said.

He added the trove of bank documents that revealed the $1.3 million China payout to the Biden family is one set of many more to be disclosed to the public in the coming months:

The poll surveyed 1,007 registered voters from March 24-27 with a 3 point margin of error.

Follow Wendell Husebø on Twitter @WendellHusebø. He is the author of Politics of Slave Morality.

DON'T WORRY BANKSTERS. THEY'RE NEVER GOING TO TAKE BACK SOME OF THE MONEY YOU'VE STOLEN.

A Bank Crisis Is NOT the Collapse | What Comes After is Much Worse

https://www.youtube.com/watch?v=LI2ngfB9f5s

Hawley, Warren Lead Bipartisan Bill to Hold Bank Executives Responsible for Bank Failures

Sens. Josh Hawley (R-MO) and Elizabeth Warren (D-MA) are leading a bipartisan group of senators in introducing legislation that would allow federal regulators to take back “all or part of” the compensation bank executives received in the five years preceding the event of another bank failure.

In the wake of the Silicon Valley Bank (SVB) collapse, the bipartisan legislation, Failed Bank Executives Clawback Act, would ultimately require federal regulators — in the event of bank failures, to take back the compensation bank executives received in the five years preceding the failure.

Sen. Josh Hawley (R-MO) speaks during a Senate Homeland Security Subcommittee on Emerging Threats and Spending Oversight on Capitol Hill August 3, 2022, in Washington, DC. (Photo by Drew Angerer/Getty Images)

While the Federal Deposit Insurance Corporation’s (FDIC) ability to “claw back” compensation from bank executives in case of a bank failure is limited, bipartisan legislation would give regulators the tools they need to hold executives of failed banks responsible. The legislation would:

- Require the FDIC to claw back from bank executives all or part of the compensation they have received over the five-year period preceding a bank’s insolvency or FDIC-resolution as is necessary to prevent unjust enrichment.

- Extend claw back authorities established by Section 204(a)(3) of the Dodd-Frank Wall Street Reform and Consumer Protection Act to apply to any bank entered into FDIC receivership, not only those resolved under the FDIC’s Orderly Liquidation Authority.

- Ensure that, should an insured depository institution affiliated with a bank holding company fail, investors in that holding company should bear the losses of the insured depository institution.

“Bank executives who make risky investments with customers’ money shouldn’t be permitted to profit in the good times, and then avoid financial consequences when things go south,” said Hawley in a statement. “This legislation puts the executives’ own profits on the line, and that’s exactly as it should be.”

Warren, explaining that President Joe Biden wanted Congress to pass legislation to hold bank CEOs responsible, also noted that this gives “the financial cops … additional authority to clawback lavish pay and bonuses when executives explode their bank.”

Sen. Elizabeth Warren (D-MA) questions Federal Reserve Chairman Jerome Powell during the Senate Banking, Housing, and Urban Affairs Committee hearing on March 7, 2023. (Tom Williams/CQ-Roll Call, Inc via Getty Images)

“Americans are sick and tired of fat cat bankers paying themselves handsomely while risking other people’s hard-earned money,” Warren added. “It’s time for Congress to step up and strengthen the law so bank executives bear the cost of failure, not line their pockets and walk away scot-free.”

n addition to Hawley and Warren, the legislation is already supported by Sen. Mike Braun (R-IN) and Catherine Cortez Masto (D-NV).

A Bank Crisis Is NOT the Collapse | What Comes After is Much Worse

https://www.youtube.com/watch?v=LI2ngfB9f5s

HOW MANY ECONOMIC WAVES OF BANKSTER PLUNDER WILL THE AMERICAN PEOPLE PUT UP WITH???

ABOUT EVERY TEN TO TWEENTY YEARS THE BANKSTERS WIPE US OUT AND THEN PUT IT IN THEIR PCOEKETS ALONG WITH A FEW BANKSTER-OWNED POLS!

In every crisis, the two main classes of society align themselves and more and more directly on their fundamental material interests. The program of the ruling class will develop accordingly: rescue operations for the financial oligarchy combined with war and social counterrevolution.

Major Banking Crisis Looms as Study Finds Nearly 200 More Banks Could Potentially Collapse

The following content is sponsored by Monetary Gold, the official gold sponsor of Breitbart News.

The collapse of Silicon Valley Bank, followed by Signature Bank two days later, turned out to be the second largest bank failure in U.S. history. That is no small feat.

A recently published study by the Social Science Research Network found that 186 banks across the United States could collapse if half of their respective uninsured depositors were to withdraw their funds. Meaning you, an American citizen, walk into your bank and ask for what is rightfully yours. That simple act could collapse 186 banks with potentially $300 billion in insured deposits at risk.

The SSRN Study also evaluated banks’ asset books around the United States, and they found that there is an estimated $2 trillion discrepancy in their overall market value. They also said that uninsured depositors are a major source of funding for commercial banks and account for about $9 trillion of bank liabilities. So, if we, the people, were to ask for our money back, these banks could present a “significant risk” of collapsing the banking system.

Do you see 2008 again on the horizon? What’s different now? The bank collapse of 2023-2024 is but a mile away, and we can see it coming. In 2008, we were surprised, but now we are witnessing the same 2008 signals. Today, each one of us can still do something about protecting ourselves.

The banking system is made up of 100 percent paper assets. Money, stocks, bonds, mortgages, contracts, futures, etc. All paper. Just like during the Great Depression, we could all wake up one day to find our paper asset values cut in half—or worthless. With $31 trillion of debt, could that happen again?

There is only one way to protect your assets. That is to take 20 to 30 percent of your cash or paper assets and put them into precious metals. Determining what precious metals are right for you depends on your end game. This is not a “one size fits all” question.

But at the end of the day, it still boils down to “the preservation of capital.” If a $100,000 account has $30,000 in gold and the rest in stocks, and the stocks take a 60 percent hit, you now have $28,000 in stocks. More than likely, based on history, your gold might now be worth $35,000. So, now, after a 60 percent hit to your account, you still have $63,000 left. That’s one-way gold works to protect your portfolio and your retirement accounts.

Benjamin Franklin once said, “An ounce of prevention is worth a pound of cure.” Those words could not be any more true than they are today. Just taking one step towards preventing the loss of your savings will save you countless sleepless nights when the financial system begins crumbling from debt.

That one easy step is to get Monetary Gold’s financial protection guide. It’s yours—absolutely FREE of cost to you. You’ll learn how the super-wealthy protect themselves and shield their assets. It will reveal the secret IRS loophole that could save you thousands of dollars in taxes.

Inside you’ll learn about the world’s most powerful anti-inflation fighter and what you must do now to protect your retirement; and why China, Russia, and other communist countries are hoarding gold.

Please visit our website to get your FREE Monetary Gold financial protection guide today.

Peter Schweizer ‘Drills Down’ on How Bank Bailouts Rescue Clueless Silicon Valley Elites

Schweizer: It’s what you call an incestuous relationship between government and business.

On the latest episode of the Drill Down podcast, Government Accountability Institute President and New York Times bestselling author Peter Schweizer and GAI Vice President Eric Eggers tackle the recent failure of Silicon Valley Bank – and reveal California Gov. Gavin Newsom’s personal interest in the bank’s bailout.

“This was ‘the elite’ —this was the ‘Silicon Valley elite,’ Schweizer says of the SVB depositors, adding that much of SVB’s cash was invested in Environmental Social Governance initiatives which, in many cases, didn’t even make a product.

“Maybe people are right to be worried,” Eggers says of SVB’s demise.

On the other hand, Eggers stresses that if some of the cutting-edge tech companies doing business with the bank were allowed to fail, China could swoop in and buy everything “on the cheap,” putting America in a potentially compromised, weakened position.

“I think we should restrict China from buying up any of these companies,” Schweizer confirms adamantly.

“[ESG] businesses generally don’t make money,” Schweizer says, adding that SVB got caught with its pants down with too much money in too many green businesses.

Schweizer and Eggers expose California Governor Gavin Newsom’s personal interest in bailing out Silicon Valley Bank, including Newsom’s business connections to SVB and his shakedown for his wife’s charity. At Newsom’s request, the bank donated $100,000 to his wife’s charity, the California Partners Project, and later advocated the bank’s bailout. “It’s what you call an incestuous relationship between government and business,” Schweizer says.

To listen to the Drill Down Podcast – click here.

Police State: IRS pays a visit to Matt Taibbi on same day he testifies before Congress on government abuses

What is anyone supposed to think of this?

According to the New York Post:

An IRS agent stopped by the home of Twitter Files journalist Matt Taibbi the same day of his congressional testimony on the weaponization of the government, according to House Judiciary Chairman Jim Jordan, who’s demanding an explanation over the oddly timed visit.Jordan sent a letter to IRS Commissioner Daniel Werfel and the Department of Treasury on Monday in hopes of getting to the bottom of why the federal agent appeared at Taibbi’s New Jersey home on March 9 and left a note, according to an editorial in The Wall Street Journal that cited the letter.The note reportedly instructed Taibbi to call the IRS four days later.When he did, an agent told him his 2018 and 2021 tax returns had both been rejected due to identity theft concerns.

Yellen Calls for Emergency Meeting as Surging Depositor Outflows Threaten to Crash More

https://www.youtube.com/watch?v=XRlWbKOEGXo

“Attorney General Eric Holder's tenure was a low point even within the disgraceful scandal-ridden Obama years.”

DANIEL GREENFIELD / FRONTPAGE MAG

Silicon Valley Bank Board Included Barack Obama, Hillary Clinton Donors

David McNew/Getty Images Several Silicon Valley Bank (SVB) board of directors have donated thousands of dollars or have direct ties to prominent Democrat politicians like Hillary Clinton, former President Barack Obama, and Rep. Nancy Pelosi (D-CA).

CUT AND PASTE YOUTUBE LINKS

Several Silicon Valley Bank (SVB) board of directors have donated thousands of dollars or have direct ties to prominent Democrat politicians like Hillary Clinton, former President Barack Obama, and Rep. Nancy Pelosi (D-CA).

CUT AND PASTE YOUTUBE LINKS

Failed bank's board revealed to be packed with Democrats

AREN'T THEY ALL?

“This was not because of difficulties in securing indictments or

convictions. On the contrary, Attorney General Eric Holder

told a Senate committee in March of 2013 that the Obama

administration chose not to prosecute the big banks or their

CEOs because to do so might “have a negative impact on the

national economy.” AS THEY LOOTED TRILLIONS FROM

THE ECONOMY AND THEN PASSED ALONG SOME OF THE

LOOT IN THE FORM OF 'SPEECH FEE' BRIBES!

During his presidency, Obama bragged that his administration was “the only thing between [Wall Street] and the pitchforks.”

In fact, Obama handed the robber barons and outright criminals responsible for the 2008–09 financial crisis a multi-trillion-dollar bailout. His administration oversaw the largest redistribution of wealth in history from the bottom to the top one percent, spearheading the attack on the living standards of teachers and autoworkers.

The Republican staff of the US House Committee on Financial Services released a report Monday presenting its findings on why the Obama Justice Department and then-Attorney General Eric Holder chose not to prosecute the British-based HSBC bank for laundering billions of dollars for Mexican and Colombian drug cartels.

“This was not because of difficulties in securing indictments or convictions. On the contrary, Attorney General Eric Holder told a Senate committee in March of 2013 that the Obama administration chose not to prosecute the big banks or their CEOs because to do so might “have a negative impact on the national economy.”

As for the release of Democratic Party emails, even if one accepts the unsubstantiated claim that it was Russian operatives who turned them over to WikiLeaks, what the emails revealed were true facts about the operations of Clinton and the Democratic National Committee (DNC)—facts that the electorate had every right to know. Among the documents released were Clinton’s speeches to Goldman Sachs and other banks, for which she was paid hundreds of thousands of dollars. Other leaked emails exposed the corrupt efforts of the DNC to rig the primaries against Bernie Sanders.

HA, HA, HA! YOU BELIEVE THIS SHIT FROM THE RACIST WATERS?

Maxine Waters Plans to Return Donations from Collapsed Silicon Valley Bank’s PAC

Maxine Waters Plans to Return Donations from Collapsed Silicon Valley Bank’s PAC

AP Photo/Evan Vucci Rep. Maxine Waters (D-CA), the ranking member on the House Financial Services Committee, said she plans to give back the campaign donations she received from the political action committee for Silicon Valley Bank.

Rep. Maxine Waters (D-CA), the ranking member on the House Financial Services Committee, said she plans to give back the campaign donations she received from the political action committee for Silicon Valley Bank.

Waters: Raising Interest Rates ‘Has Not Been Working’ and May Cause a Recession, But It’s ‘All that We Have’ to Fight Inflation

On Saturday’s broadcast of MSNBC’s “Velshi,” House Financial Services Committee Ranking Member Rep. Maxine Waters (D-CA) stated that raising interest rates to lower inflation “has not been working in the way that it should.” And “it doesn’t look good right now. We may be in for a recession.” But interest rate hikes are “all that we have as a traditional way of containing inflation” and “We don’t have” an answer to lower inflation.

Waters said, “[R]aising interest rates is the traditional way. It is supposedly the intellectual way. It is the way by which you contain inflation. It has not been working in the way that it should. Now, what he did — what Powell did in this last raise was he tried to keep it low to 25 basis points. But, of course, it doesn’t look good right now. We may be in for a recession. And he’s got to do everything that he possibly can. Everybody’s got to weigh in. If there is a better answer, we’ve got to find it. We’ve got to find that answer. We don’t have it now. This is all that we have as a traditional way of containing inflation, is a rise in interest rates. I don’t like it. My constituents don’t like it. Young people who want to buy a house don’t like it because the interest rates are just too high. There are some people, of course, who make money off of rising interest rates, but the average person does not. And so, no, we’re in a point in time in the history of our economics that the answers do not appear to be there, but we’ve got to do everything that we can to bring down inflation and contain the rise in interest rates.”

Follow Ian Hanchett on Twitter @IanHanchett

Nearly $120 Billion of Deposits Were Pulled From Small Banks as Silicon Valley Failed

Customers of small U.S. banks pulled a record $119.9 billion of deposits in the seven days ending March 15, data released by the Federal Reserve showed Friday.

The decline in deposits at small U.S. banks was the largest in records going back to 1973.

That figure is seasonally adjusted. On a not-seasonally adjusted basis, small banks lost $107.8 billion.

Much of those deposits went to large banks. These saw deposits rise by $66.7 billion on a seasonally adjusted basis and $119.8 billion before seasonal adjustment.

On the whole, deposits at commercial banks in the U.S. fell by a seasonally adjusted $98.4 billion, according to the Fed data. Not seasonally adjusted, the decline was $52.8 billion.

The data cover the seven days that ended on Wednesday, March 15.

Large banks are defined as the top 25 domestically chartered commercial banks, ranked by domestic assets. So Silicon Valley Bank, which was the 18th largest bank by assets, would be counted among the large banks that, as a group, gained deposits. In other words, the decline in deposits among small banks does not include deposits that were withdrawn from Silicon Valley Bank.

...... and the 'speech fee' bribes rolled in!

“Attorney General Eric Holder's tenure was a low point even within the disgraceful scandal-ridden Obama years.”

DANIEL GREENFIELD / FRONTPAGE MAG

Silicon Valley Bank Board Included Barack Obama, Hillary Clinton Donors

Harvard Prof., Fmr. IMF Economist Rogoff: Fed, Treasury Support for Bailouts of Billionaire Depositors Will Incentivize Risk, Create Problems

On Wednesday’s broadcast of “PBS NewsHour,” Harvard University Economics Professor and former Chief Economist at the International Monetary Fund Ken Rogoff said that the Federal Reserve and Treasury Department have signaled that they’ll “protect depositors, even ones with billions of dollars they’ve bailed out with Silicon Valley Bank” and this will lead to bankers engaging in more risky behavior and “bigger problems in the future.”

Rogoff stated, “I feel like the Federal Reserve and the Treasury have kind of broadcast that they’re going to protect depositors, even ones with billions of dollars they’ve bailed out with Silicon Valley Bank. I think they’re going to continue that. That has a lot of problems, because bankers will do more risky things. It’s going to lead to bigger problems in the future. But they’ve really telegraphed that. The problem is, the other side of the coin is that everyone’s worried the banks will not be able to lend as much. The regulators are going to be looking harder. They’re going to have to raise deposit rates, and they’ll have [fewer] profits to lend out. So, for the moment, it looks like they’ve contained the panic. But, longer term, bankers do risky stuff, and they certainly aren’t reining that in. And the more they regulate it, the harder it’s going to be to get loans. So, there are certainly problems ahead.”

Follow Ian Hanchett on Twitter @IanHanchett

Dem Rep. Sherman: FDIC Insurance Used to Backstop SVB Depositors Is ‘Not Free’ and ‘Cost Is Passed on to the Depositor’

On Friday’s broadcast of Bloomberg’s “Balance of Power,” Rep. Brad Sherman (D-CA) stated that the FDIC insurance that was used to backstop depositors at Silicon Valley Bank (SVB) and that federal officials have said could be used in the future to backstop depositors “is not free” and “Ultimately, that cost is passed on to the depositor.”

Sherman said that he supports increasing the deposit insurance limit, and “If you’re using the bank as a utility, as a system to pay your bills, then you shouldn’t have to check to see whether that bank is strong or very strong, you should be able to use it as a utility. A million or even higher might be in order. Whereas, if you’re making a million-dollar investment, there’s some onus on you to determine that you’re investing in a sound bank.”

He continued, “The other thing is that FDIC insurance is not free. Ultimately, that cost is passed on to the depositor. If you’re putting — giving your money to the bank on an interest-free basis in a non-interest-bearing account, there’s no way for them to lower the interest rate any lower and so depositors don’t suffer. On the other hand, if you impose this cost on people buying certificates of deposit or other investment accounts, then the bank is going to pass through the cost of the insurance and there’s going to be a real detriment to depositors.”

Follow Ian Hanchett on Twitter @IanHanchett

Treasury secretary Yellen twists to the power of money

As if caught in an ever more powerful vortex, US treasury secretary Janet Yellen was this week wrenched this way and that over the issue of how much support the government and financial authorities should provide to wealthy uninsured bank depositors.

On Tuesday, she told a meeting of bankers the government was ready to extend the bailout of Silicon Valley Bank and Signature Bank depositors, some of them holding tens of millions of dollars in their accounts, to such depositors at other banks if necessary.

This was correctly recognized as an implicit guarantee by the government that it was backing all the money held in the US banking system, a total of more than $17 trillion, and there was “free market” based criticism, most notably from the Wall Street Journal.

The chief concern of the WSJ is not the handing out of money to the rich and super rich per se but what such a guarantee ultimately means for the stability of government finances and US capitalism as a whole if the market cannot do its work in carrying out necessary purges.

In response to this and other criticism, the next day Yellen told a Senate committee that financial authorities were not contemplating “blanket” coverage for deposits above the limit covered by legislation of $250,000.

Wall Street gave Yellen’s remarks the thumbs down. It fell sharply in the last half hour of trading on Wednesday with the Dow dropping more than 500 points.

The treasury secretary, who, like all government officials, attempts to portray herself as a servant of the mass of the population, got the message from the real powers that be.

On Thursday, she reversed course in remarks to a House of Representatives hearing, going back to what she had told the assembled bankers two days before.

“We have used important tools to act quickly to prevent contagion,” she said. “And they are tools we could use again. The strong actions we have taken ensure that Americans’ deposits are safe. Certainly, we would be prepared to take addition actions if warranted.” Following her remarks Wall Street steadied.

To get a grasp of what is involved in the issue of deposit guarantees it is worthwhile probing behind the immediate figures.

Deposits of up to $250,000 are automatically guaranteed by the Federal Deposit Insurance Corporation based on legislation.

The cut off point is well above the amount held by millions of American families who live from pay check to pay check, often having to resort to their credit cards just to make ends meet.

According to official figures, the median balance held by US citizens in their accounts is just $5,300.

Less than half of US households, around four in ten, said they would be able to cover an unexpected expense of $1,000 in January 2022, and that number has probably fallen since then under the impact of continued wage suppression and rising inflation, especially in basic items.

But the wealthy and super-wealthy occupy an entirely different world, and they are demanding it be protected at all costs.

The “Americans” whose deposits Yellen said she was acting to protect are not ordinary workers and their families who have nowhere near $250,000 in their accounts. They are figures such as the venture capitalist Peter Thiel, who disclosed that he had $50 million deposited with the failed SVB even after advocating that others not continue to use it. Perhaps he regarded the millions he left there as loose change.

The back and forth of Yellen on the issue of support for the ultra-wealthy and the financial elites is by no means an isolated incident.

Rather, it is a particular expression of the central policies of the Fed, regulatory authorities and the government. Whatever acknowledgements they may make on occasions about the need for sound public policy, they always return to their key mission—the protection of the financial oligarchy that dominates the economy.

That was seen in 2008 when the speculative, and at times outright criminal, activities of finance capital brought about a meltdown of the financial system. Banks and corporations were bailed out to the tune of hundreds of billions of dollars and the Fed made available trillions of dollars under its quantitative easing (QE) program, enabling the speculation to continue.

The working class was made to pay as the unemployment rate rose to double digits, homes were repossessed and exploitation in the factories intensified often through the widespread adoption of the two-tier wage system and temporary working.

The 2008 bailout, QE, and the rampant speculation which resulted meant that when the pandemic struck in early 2020, the administration refused to implement a policy of elimination, fearing the necessary public health measures would bring about a collapse of the financial house of cards.

Accordingly, the Trump administration, with the support of the Democrats under the leadership of House Speaker Nancy Pelosi, passed the CARES Act, handing out billions to the corporations while providing some minor concessions to the mass of the population to try to assuage social anger.

The Fed stepped up again and in response to the March 2020 market freeze pumped in another $4 trillion, acting as the guarantor for every section of the financial system.

But these measures had consequences.

The refusal to eliminate COVID created a supply chain crisis, sparking a jump in inflation. Price hikes were intensified by the flood of cheap money, profit gouging by food and energy companies, commodity market speculation financed by the essentially free money provided by the Fed and other central banks, and the consequences of the US-led NATO war against Russia in Ukraine.

The eruption of the highest inflation in four decades changed the landscape. Now the Fed was confronted with its greatest fear—the development of an upsurge of the working class and intensification of the class struggle artificially suppressed over the previous three decades and more.

The Fed then made a turn. It started interest rate hikes in March 2022, under the mantra of the need to fight inflation. It is vital to understand the class dynamic at work here for it is the key to understanding the present situation, what is in store, and what must be the response of the working class.

Its measures—the lifting of interest rates from near zero to more than 4.5 percent over a year—have nothing to do with bringing down prices but are directed to suppressing the wages movement of the working class.

This is to be achieved by ending what Fed chair Jerome Powell continually refers to as the “very tight” labour market, through the slowing of the economy, driving up unemployment and inducing a recession if that is considered necessary.

The interest rate hikes have now set in motion a financial crisis, which was exemplified in the collapse of SVB. Flush with money because of the Fed’s QE policies, it placed its funds in Treasury bonds, supposedly the safest financial asset. But as interest rates were hiked, the market value of those bonds fell below their book value.

As long as money kept flowing in this was not a problem. But when money started to flow out, as depositors drew down on their holdings, the bonds had to be sold and the losses realised.

Powell and others have referred to SVB as an “outlier.” But analysis has revealed that its structure is replicated widely. It has been calculated that the market value of bonds held by American banks is down by $1.7 trillion, not far below their capital base of around $2 trillion, essentially wiping it out if these losses had to be realised.

Moreover, small- and medium-sized banks, such as SVB, also hold a major portion of interest rate-sensitive commercial real estate and property development loans, which are being widely predicted as the next shoe to drop.

The development of this crisis has sent a wave of fear through the ultra-rich monied classes. When the problems of SVB surfaced, hedge fund operator Bill Ackman immediately jumped onto Twitter to call for a major intervention, without which the economy could not function properly.

Such reactions reveal that the fabulously wealthy and super-rich have caught a whiff of death as if rising from a grave opening before them.

But does not mean they will somehow advocate reforms—they have none in any case —or their toxic system will simply collapse of its own accord.

Rather, drawing on their long history of repression and violence, their growing fears mean they will implement ever greater attacks on the working class, just as they did after 2008, and demand the continued supply of money from the capitalist state to maintain their world of wealth and privilege at the expense of society.

For the working class, the developing crisis poses a direct challenge. It is confronted with the task of making a new world, one based on social equality. That can only be realised through a political struggle to end the capitalist profit system, thereby opening the way for the establishment of socialism, a challenge which must be met by building the revolutionary party to lead this fight.

Carney on ‘Kudlow’: Janet Yellen Was More Concerned About Climate Change Than Looming Banking Crisis

Treasury Secretary Janet Yellen was more concerned about climate change than the looming risks to our banking system brought on by the rapid rise of interest rates, Breitbart Economics Editor John Carney told Fox Business host Larry Kudlow.

During a panel discussion with Carney on Kudlow’s Friday show, Fox News contributor Liz Peek noted that Yellen was asleep at the switch in the run-up to the current banking crisis.

“Everybody was watching last year as interest rates went up, by the way, [at] the sharpest rate of ascent in modern times,” Peek said. “So, you would think that the regulators—Janet Yellen and that group that she has [of] the financial organizers of our country—would have been watching to see what the impact was on the banks and in particular on the tech sector, which it completely wiped out… It’s offensive that Janet Yellen acts now like she has a plan. She doesn’t have a plan. We know she doesn’t have a plan. But where was she? Where has she been during this period?”

“Well, we know where she’s been,” Carney interjected. “They’ve been sitting there worried about climate change the whole time. Climate change risk all the way. Interest rate risk, the basics of banking—they weren’t paying any attention to.”

“Larry Summers said this—he said instead of worrying about inflation and interest rates, they are worried about climate change. And that’s not the role of central bankers,” Kudlow added.

“By the way, the Financial Stability Oversight Council—which met today, I guess, because they actually realized they have a problem on their hands—in the February meeting, read the readout. It’s available on their website. They were talking about climate. Their ’22 annual report was about climate. I mean, you really can’t make this up. That’s what they were worried about,” Peek noted.

Kudlow also brought up Yellen’s conflicting statements about whether the uninsured depositors of all or only some banks would get a bailout.

“It sounds to me like we will bail out uninsured deposits and every other damn thing,” Kudlow said.

“We almost have to because we’re setting up the expectation,” Carney replied. “It looks very bad if you say, ‘Yeah, we bailed out Silicon Valley Bank, but you other guys, you’re not going to get the bailout’—because then people will start trying to guess who gets a bailout, who doesn’t. You have more banks fail because people flee when they say, ‘Oh, I’m in the bank that doesn’t get it.’”

Carney highlighted an observation the economist Anna Schwartz made about the destabilizing role uncertainty played in the 2008 financial crisis. Schwartz and fellow economist Milton Friedman co-authored the influential 1963 book A Monetary History of the United States, 1867–1960, which argued that the Federal Reserve’s changing monetary policies played a large role in causing the Great Depression.

“Back in 2008, my brother Brian did an interview with Anna Schwartz, who is a co-author of the book on the Great Depression with Milton Friedman,” Carney said. “One of the things she said was that we were doing things wrong in 2008 because we weren’t following a set rulebook, and we were just doing everything ad hoc. If you do it like that, nobody knows the rules of the road. That creates more instability rather than less.”

Pivoting from the banking crisis, Kudlow asked Carney about the Federal Reserve’s prediction that the economy would contract this year, which, as he noted, was the topic of Thursday’s Breitbart Business Digest.

“If you look at where the Fed thinks growth is going to be this year—full year—it’s 0.4 percent, down a little bit from back in December,” Carney explained. “So, if we’re growing at 2 percent now, we’re probably going to be growing more than one percent in the second quarter… How do you get it all the way down to 0.4? You have to have a pretty steep contraction in the third or fourth quarter. The Fed—they hate to say that. They don’t want to admit it. But that is what those numbers mean. They’re saying we’re predicting a very steep downturn in the second half of this year.”

As Carney noted in Friday’s Breitbart Business Digest:

There are plenty of reasons why Fed officials do not want to forecast a recession. For one thing, [Federal Reserve] Chairman Jerome Powell still maintains that there exists “a path” to a soft landing. For another, the Fed is hesitant to appear to be rooting for a recession and the hardships recessions bring. By admitting that its policy choices are consistent with a recession, the Fed would be confessing to causing one.

Peek agreed with Carney’s analysis and predicted that Powell will pause his rate hiking and abandon his two percent inflation target in the face of a recession.

“We’re going to enter a slowdown,” Peek said. “The political heat on Jay Powell is going to be scorching, and he’s going to change the target by the end of the year… It is two percent. My guess is we’ll start hearing, well, three is pretty reasonable, 3.2, 3.5, which is kind of what the Fed is expecting by the end of the year. They’re not going to go to two percent.”

Changing the target is a “terrible idea,” Carney said. “If the Fed does back off of the two percent target, which they will feel pressured to, I think that’s going to be a disaster because how do you trust the three percent target? Or the four percent target?”

Kudlow offered a succinct history of the last time the nation faced an inflation crisis and how we got out of it—a topic of which he has personal knowledge from his days serving in the Reagan administration.

“This is where I came in professionally in the 1970s because we were always going to ‘Whip Inflation Now,’ but we never did,” he said. “And then the peaks got higher and the troughs got higher, until a guy named Paul Volcker came and just slayed the monster altogether, and we started from scratch, which I might add, with Reagan’s tax cuts, gave us three decades of prosperity.”

Unfortunately, Peek predicted that Powell would not have the same fortitude as his predecessor Paul Volcker, and the pressures of an election year recession might prove too much for him to withstand.

“Jay Powell is proven to be, I think, a very political animal,” Peek said. “Look at already [Massachusetts Democratic Senator] Elizabeth Warren and a lot of senators are coming out and saying, ‘Oh, we can’t raise rates anymore. This is harsh. This is going to lead to unemployment.’ Yes, that’s what Jay Powell has said he wants to do. It’s unacceptable for the Democratic Party trying to keep the Oval Office next year.”

Bank Bailouts and the Chaotic Consequences of Redefining Rules

Referees aren’t supposed to change the rules in the middle of the game, but that’s exactly what federal government officials like Treasury Secretary Janet Yellen have been doing in financial markets over the last two weeks.

The result is a chaotic mess wherein no one knows what the rules will be tomorrow and no one can plan for the future. What is allegedly a highly regulated sector of the economy feels more like a roll of the dice lately. The economy needs stable banks, which requires stable rules.

Silicon Valley Bank’s collapse earlier this month is the second-largest bank failure in American history, and the federal government’s response has been inconsistent at best.

Regulators previously declared the bank not to be a systemic risk to the banking system, meaning the bank’s potential failure would not pose a threat to the rest of the banking system. Yet when it was clear Silicon Valley Bank would fail, the rules changed and the bank was declared a systemic risk.

On that basis, the Department of the Treasury and the Federal Reserve stepped in to prevent the bank’s liquidation. But they decided to change yet another rule in the process—deposit insurance.

Bank customers’ deposits are ordinarily insured by the Federal Deposit Insurance Corp. up to $250,000, and private insurance is available for additional coverage beyond that. Silicon Valley Bank’s customers chose not to avail themselves of that protection, however, despite over 96% of the bank’s depositors having cash at the bank in excess of the $250,000 FDIC guarantee.

To prevent those large depositors from losing any of their money, the Treasury and the Fed decided to guarantee all deposits at Silicon Valley Bank, despite the fact that the FDIC clearly does not offer unlimited deposit coverage. Millionaires who had their money at the bank are now receiving the benefit of insurance even though they never paid for it.

Imagine a person who could buy flood insurance for his home but chooses not to do so and then the home is destroyed in a flood. That person is not entitled to a bailout from the government—at taxpayer expense.

This unprecedented expansion of FDIC coverage was followed by statements from the Biden administration that Americans could rest assured that all deposits are safe.

But the rules were about to change again. Yellen was asked during her Senate testimony a few days ago whether all depositors at regional banks, like Silicon Valley Bank, are covered by the recent change in the rules regarding the FDIC. Shockingly, Yellen said no.

Only deposits at banks deemed systemically important could be guaranteed coverage, regardless of the size of the deposit. Which regional banks are systemically important? Yellen couldn’t say—that determination would be made on a case-by-case basis going forward. She reiterated this vague canon on Tuesday when she told the American Bankers Association, “Similar actions could be warranted if smaller institutions suffer deposit runs that pose the risk of contagion.” That’s hardly black and white.

Not only have the rules changed again, but now the referees can’t even clearly articulate them. The result has been a flood of large deposits fleeing smaller banks for larger banks that have already been declared systemic risks requiring government support. That cash drain from the smaller banks could put them at risk and precipitate even more problems in the already-troubled banking sector.

One of the reasons for these troubles is because banks are holding so many low-interest rate bonds. But that situation is itself a result of the federal government changing the rules of the game. When the Fed kept interest rates too low for too long in order to finance trillions of dollars in government deficit spending, the yield on bonds plummeted, and the banks buying those bonds took on tremendous interest rate risk.

Those banks were encouraged to continue that behavior because the Fed continued offering forward guidance that rates would remain low and that inflation was transitory. But that narrative changed one year ago, in March 2022, and interest rates began to rise. Just a few months after that initial rate hike, Fed Chair Jerome Powell said a larger 75-basis-point hike was “off the table,” and the Fed promptly followed that pronouncement by delivering four such rate hikes in a row.

It’s no fun if a party host randomly changes the rules of a game when everyone is in the middle of playing. But at least the trouble ends there. When the government changes the rules of banking without warning, the results can be financial disaster that cascades through the economy for years to come.

“Attorney General Eric Holder's tenure was a low point even within the disgraceful scandal-ridden Obama years.”

DANIEL GREENFIELD / FRONTPAGE MAG

Silicon Valley Bank Board Included Barack Obama, Hillary Clinton Donors

David McNew/Getty Images Several Silicon Valley Bank (SVB) board of directors have donated thousands of dollars or have direct ties to prominent Democrat politicians like Hillary Clinton, former President Barack Obama, and Rep. Nancy Pelosi (D-CA).

CUT AND PASTE YOUTUBE LINKS

Several Silicon Valley Bank (SVB) board of directors have donated thousands of dollars or have direct ties to prominent Democrat politicians like Hillary Clinton, former President Barack Obama, and Rep. Nancy Pelosi (D-CA).

CUT AND PASTE YOUTUBE LINKS

Failed bank's board revealed to be packed with Democrats

AREN'T THEY ALL?

“This was not because of difficulties in securing indictments or

convictions. On the contrary, Attorney General Eric Holder

told a Senate committee in March of 2013 that the Obama

administration chose not to prosecute the big banks or their

CEOs because to do so might “have a negative impact on the

national economy.” AS THEY LOOTED TRILLIONS FROM

THE ECONOMY AND THEN PASSED ALONG SOME OF THE

LOOT IN THE FORM OF 'SPEECH FEE' BRIBES!

During his presidency, Obama bragged that his administration was “the only thing between [Wall Street] and the pitchforks.”

In fact, Obama handed the robber barons and outright criminals responsible for the 2008–09 financial crisis a multi-trillion-dollar bailout. His administration oversaw the largest redistribution of wealth in history from the bottom to the top one percent, spearheading the attack on the living standards of teachers and autoworkers.

The Republican staff of the US House Committee on Financial Services released a report Monday presenting its findings on why the Obama Justice Department and then-Attorney General Eric Holder chose not to prosecute the British-based HSBC bank for laundering billions of dollars for Mexican and Colombian drug cartels.

“This was not because of difficulties in securing indictments or convictions. On the contrary, Attorney General Eric Holder told a Senate committee in March of 2013 that the Obama administration chose not to prosecute the big banks or their CEOs because to do so might “have a negative impact on the national economy.”

As for the release of Democratic Party emails, even if one accepts the unsubstantiated claim that it was Russian operatives who turned them over to WikiLeaks, what the emails revealed were true facts about the operations of Clinton and the Democratic National Committee (DNC)—facts that the electorate had every right to know. Among the documents released were Clinton’s speeches to Goldman Sachs and other banks, for which she was paid hundreds of thousands of dollars. Other leaked emails exposed the corrupt efforts of the DNC to rig the primaries against Bernie Sanders.

Janet Yellen Raked in $7.2M from Wall Street, Corporations Since 2019

President-elect Joe Biden’s nominee to head the Treasury Department, Janet Yellen, raked in millions from Wall Street firms and multinational corporations for “speaking fees” over just the past two years, financial disclosure reports reveal.

Between 2019 to 2020, Yellen accepted more than $7.2 million from Wall Street firms and big banks like Citibank, Bank of America, Citadel, Barclays, ING, UBS, and Goldman Sachs, as well as multinational corporations like Deloitte, Google, Salesforce, and HSM.

Yellen, former Federal Reserve chair for President Barack Obama, took nearly $1 million to give nine speeches to Citibank — which is one of the largest banks in the United States. Likewise, Yellen accepted more than $800,000 from the hedge fund Citadel.

Yellen’s speaking fees from Wall Street firms and corporations range anywhere between $17,100 to nearly $300,000, according to the financial disclosures. Her latest paid speeches came in November 2020 when she cashed in $67,500 in fees from Deloitte, $72,000 from Daiwa Securities Group, and $45,000 from Magellan Financial Group.

Biden tapped Yellen as his nominee to lead the Treasury Department where she would become the first woman to lead the agency if confirmed by the U.S. Senate. Glenn Greenwald, an independent journalist, called Democrats “a neoliberal party” that “hide” behind diversity to avoid questions regarding cronyism.

“The Dems are a neoliberal party which serves Wall St & corporate power,” Greenwald wrote on Twitter. “They are overwhelmingly led by extremely rich people who serve these power centers. Touting diversity is how they try to hide that, and bad faith bigotry accusations are how they punish those who report it.”

Nolte: Bribes and Payoffs Disguised as ‘Speaking Fees’ for Treasury Secretary Janet Yellen

Janet Yellen, the former chairwoman of the Federal Reserve who is now His Fraudulency Joe Biden’s Treasury Secretary, made millions off Wall Street “speaking fees” over the past two years.

In some cases, she didn’t even have to show up to speak. Her appearance was “virtual.”

In just two years, according to the Wall Street Journal, Yellen pulled in “more than $7 million in speaking fees during more than 50 in-person and virtual engagements … according to financial disclosures[.]”

The far-left Politico adds:

Yellen listed $952,200 in income from speeches to Citi, one of the nation’s largest banks. She also disclosed speaking fees from PIMCO, Barclays (BCS), Citadel, BNP Paribas, UBS (UBS), Credit Suisse (CS), ING, Standard Chartered Bank and City National Bank.

Nearly a million bucks … from one bank!

Fox Business reports:

Other companies shelling out big bucks for Yellen’s words of wisdom have included Goldman Sachs, Google, City National Bank, UBS, Citadel LLC, Barclays and Salesforce, according to the report.

So when the White House was asked this week if Yellen’s speaking fees have created a painfully obvious conflict of interest as it relates to this Gamestop/Robinhood/Reddit story, Press Secretary Lyin’ Ginger sputtered:

I don’t have anything further for you on it, except for to say, separate from this Gamestop issue, the Treasury Secretary is a world-renowned expert on the economy.

It should not be a surprise to anyone that she was paid to give her expert advice before she came into office.

Oh, well, that certainly puts the issue to rest!

I mean the fact that (as Real Clear Politics perfectly summarized it) “Citadel, the firm that bailed out the first hedge fund to be bankrupted by the crowd-sourced stock-buying bonanza this week, has paid Yellen more than $800,000 in speaking fees in recent years,” is nothing to be concerned about! Not even as we watch a countless number of everyday retail investors getting shut down in an effort to protect Yellen’s billionaire pals at Citadel and elsewhere.

If you want a look at how this grift works, Jack Posobiec tweeted out a bare bones list of Yellen’s Wall Street speaking fees, and this simple list is more striking than any newspaper write-up. The numbers are outrageous. Why would anyone drop hundreds of thousands of dollars to have some former fed chair come in to tell tired war stories and do some punditry?