CUT AND PASTE YOUTUBE LINKS

Richard Wolff | ELITES BLEED the MASSES DRY.... you mean like a pack of parasite lawyers???

https://www.youtube.com/watch?v=7g7RuxYiSPc&t=2s

Judicial Watch investigated the scandal and obtained documents from the U.S. Treasury related to the controversial bailout. The famously remiss House Ethics Committee, which is charged with investigating and punishing corrupt lawmakers like Waters, found that she committed no wrongdoing. The panel bought Waters’ absurd story that she allocated the money as part of her longtime work to promote opportunity for minority-owned businesses and lending in underserved communities even though her husband’s bank was located thousands of miles away from the south Los Angeles neighborhoods she represents in Congress.

Rather than Hope and Change, Obama is delivering corporate socialism to America, all while claiming he’s battling corporate America. It’s corporate welfare and regulatory robbery—it’s Obamanomic

“Records show that four out of Obama's top five contributors are employees of financial industry giants - Goldman Sachs ($571,330), UBS AG ($364,806), JPMorgan Chase ($362,207) and Citigroup ($358,054).”

Why aren’t the Wall Street criminals prosecuted?

In May 2012, only days after JPMorgan Chase’s Jamie Dimon revealed that his bank had lost billions of dollars in speculative bets, President Barack Obama publicly defended the multi-millionaire CEO, calling him “one of the smartest bankers we’ve got.” What Obama did not mention is that Dimon is a criminal.

http://mexicanoccupation.blogspot.com/2014/01/why-arent-wall-street-criminals.html

JPMorgan is not the exception; it is the rule. Virtually every major bank that operates on Wall Street has settled charges of fraud and criminality on a staggering scale. In 2011, the Senate Permanent Subcommittee on Investigations released a 630-page report on the financial crash of 2008 documenting what the committee chairman called “a financial snake pit rife with greed, conflicts of interest and wrongdoing.”

These multiple crimes by serial lawbreakers have had very real and very destructive consequences. The entire world has been plunged into an economic slump that has already lasted more than five years and shows no signs of abating. Tens of millions of families have lost their homes as a result of predatory mortgages pushed by JPMorgan and other Wall Street banks.

Biden Admin Abandons Opposition to Bank Mergers After First Republic Collapse

WASHINGTON (Reuters)—JPMorgan Chase & Co's deal to buy First Republic Bank pushed the Biden administration into a corner, leaving officials scrambling to explain how their stance against mergers squared with allowing the largest U.S. bank to get even bigger.

At a White House event on small business on Monday, President Joe Biden hailed the sale of the troubled San Francisco-based lender, saying it would protect all depositors and avert a government bailout. He did not mention JPMorgan and underscored his call for stronger banking regulations.

Senator Elizabeth Warren, a Democrat and member of the Senate Banking Committee who has been pushing for tighter banking regulations, blasted the decision, sounding a theme that could hound Biden, who last week announced his bid to win another term in the White House and has struggled with low approval ratings.

"A poorly supervised bank was snapped up by an even bigger bank — ultimately taxpayers will be on the hook," Warren tweeted.

White House press secretary Karine Jean-Pierre said JPMorgan's acquisition of First Republic's assets was necessary to ensure continued resilience of the banking system and came at no cost to taxpayers.

"No recent administration has done more to promote competition, address (the) concentration process across industries," she told a White House briefing.

Jean-Pierre added that Biden administration officials valued the fact that community banks offer services to those who might not otherwise have banking access.

The deal for the failed lender comes amid increased discussion among U.S. regulators about tightening rules on bank mergers, with officials growing worried that consolidation could undermine financial stability and leave communities wanting for services.

Administration officials, mindful of the impact of a JPMorgan takeover on the banking sector, prodded smaller lenders to submit bids and worked hard to find a different solution, but the size of JPMorgan's offer ultimately gave it an edge, according to sources familiar with the process.

Current law means the Federal Deposit Insurance Corp was legally bound to choose the offer that cost the least, said Aaron Klein, a former Treasury official and Senate staffer who helped craft the Dodd-Frank reform law passed in the wake of the global financial crisis.

In the end, the need to avert contagion in the banking sector trumped worries about JPMorgan's becoming more powerful, former officials said.

"Too big to fail is obviously a worry, but right now you've got to put out the hottest fire first," said Ben Harris, who left his post as Treasury assistant secretary for economic policy at the end of March and had served as chief economist to Biden when he was President Barack Obama's vice president.

(Reporting by Andrea Shalal and Pete Schroeder; additional reporting by David Lawder, Sruthi Shankar, Chris Prentice and Douglas Gillison; Editing by Leslie Adler)

Internet stock traders often follow Nancy Pelosi's purchases and selloffs for investing tips, Business Insider reported, with some suggesting "she's making the big bucks off of insider information."

Silicon Valley Bank Board Included Barack Obama, Hillary Clinton Donors

(Reuters)—Shares of First Republic Bank plunged to a record low on Friday, losing nearly half of their value after a CNBC report said the troubled lender was most likely headed for receivership under the U.S. Federal Deposit Insurance Corporation (FDIC).

The stock fell as much as 46% to $3.33, giving it a market capitalization of $620 million. Trading in the bank's shares was halted multiple times.

A Reuters report of a government-brokered rescue deal for First Republic had pushed its shares up as much 6.6% earlier in the session.

According to the report, the FDIC, the Treasury Department and the Federal Reserve are among government bodies that have started to orchestrate meetings with financial companies about a lifeline for the bank.

The government's involvement was helping bring more parties, including banks and private equity firms, to the negotiating table, one of the sources for the report had told Reuters.

Still, concerns remained that deposit declines at First Republic could worsen and spark a fresh meltdown in the U.S. banking industry even as it recovers from the collapse of two regional lenders last month.

First Republic earlier this week said its deposits had slumped by more than $100 billion in the first quarter.

"The potential worst-case scenario stemming from the collapse of Silicon Valley Bank appears to have been averted," said Mark Haefele, chief investment officer at UBS Global Wealth Management, in a note.

"But the problems at First Republic are a reminder that further problems remain possible."

The San Francisco-based lender's stock has more than halved so far this week. Since the start of the year, it has lost nearly 97% in value, making it the worst-performing S&P 500 stock.

(Reporting by Medha Singh and Niket Nishant in Bengaluru; Editing by Saumyadeb Chakrabarty and Devika Syamnath)

Dem Rep Sold Stock in Collapsing Bank and Picked Up JPMorgan Shares Right Before Acquisition, Disclosures Show

Rep. Lois Frankel sold her First Republic Bank stock weeks before bank's collapse

Florida Democratic representative Lois Frankel is capitalizing on First Republic Bank's collapse and subsequent buyout by JP Morgan Chase & Co, according to congressional financial disclosures reported on by Newsweek.

Frankel sold her stock in the San Francisco-based bank on March 16, weeks before the value of its shares dropped 75 percent and U.S. regulators seized the failing bank's assets, Newsweek reported. A few days later, on March 22, Frankel bought stock in JP Morgan Chase & Co, which on Monday bought most of First Republic Bank's assets. The exact amount of stock Frankel traded is unknown, but according to the filing, the value for each trade was between $1,001 and $15,000, Newsweek reported.

Frankel's shrewd trading fuels mounting criticism of members of Congress buying and selling stocks, which allows them to profit from industries they are supposed to regulate. Reps. Earl Blumenauer (D., Ore.) and John Curtis (R., Utah) also reported trading First Republic Bank stocks before its collapse. Several members of Congress have introduced legislation to ban congressional stock trading.

"My account is managed independently by a money manager who buys and sells stocks at his discretion," Frankel said in a statement to Newsweek

Watters: The Five (CRIME) Families of the Democrat Party

https://www.youtube.com/watch?v=BBpvvHethg0

Elon Musk Gets up and RIPS Nancy Pelosi to SHREDS, Evidence in showing Pelosi's Lies and Corruption!

https://www.youtube.com/watch?v=qv19kmZw8lc

DEMOCRATS RIG EVERYTHING TO PROTECT THEIR CRIMINALITY

“Our job as elected officials is to serve the people — not ourselves,” the Virginia Democrat said in a statement on Friday.

Nancy Pelosi Sits in SILENCE as Lauren Boebert UNVEIL New Facts on her in Congress

https://www.youtube.com/watch?v=49fs72UqZ6k

Watters: The Five (CRIME) Families of the Democrat Party

https://www.youtube.com/watch?v=BBpvvHethg0

Internet stock traders often follow Nancy Pelosi's purchases and selloffs for investing tips, Business Insider reported, with some suggesting "she's making the big bucks off of insider information."

HISTORY NEVER STOPS REPEATING ITSELF WITH THE WALL STREET DEMS!

President Obama agrees: Abysmal failure should be rewarded with promotion. He's leaving no shady banking buddy behind.

Banks can get away with murder

Yesterday, I expected to submit an article entitled "In business, bigger is not necessarily better" for American Thinker. The ink wasn't dry on my article before the government took bids on First Republic Bank (FRB). JPMorgan Chase, the largest bank in the U.S., was the winner. The biggest gets bigger.

What? Does the Fed have the legal right to put a distressed bank on the market and effectively sell it to the highest bidder? In doing this, isn't the Fed playing favorites with the bank leadership that created the problem in the first place? Have FRB bank leaders been selling their FRB stock the way Silicon Valley Bank leaders did?

Since when has it become law that banks cannot go bankrupt? Troubled banks can be auctioned off, instead of going through bankruptcy like all other small, medium, and big companies.

Bankruptcy is a healthy thing. Using the court system, the debtor is responsible for developing a reorganization plan within 120 days. The plan includes how creditors will be repaid using assets and other items of value in the company. Often, the company can remain viable after bankruptcy, although much reduced in size. The plan must be approved by the court and the creditors.

Many large companies have gone through bankruptcy, including Delta Airlines. Why should banks be different?

In the 1970s, the U.S. Congress passed legislation encouraging financing for affordable housing. Then, in 1999, parts of the Glass-Steagall legislation in 1933 were repealed, which allowed financial institutions to commingle their commercial (risk-averse) and proprietary trading (risk-taking) operations. This led many banks to make loans with little or no down payments to homeowners. Within seven years, the portfolios of many large banks were overstated as many mortgages defaulted and banks left these assets overstated. Banks most affected were primarily investment banks.

To better understand the greed present in investment banks, I recommend reading Too Big to Fail by Andrew Ross Sorkin. This should be a good eye-opener on how the government always makes decisions on a short-term basis.

After the 2007–2008 banking crisis, the Fed, for the first time, pitched in $50 billion to settle the markets. And yet the Fed indirectly caused the crisis! More short-term thinking.

So where are we today? My take: If you are a bank, take all the risk you want. Do not worry. Uncle Sam will save you — up until there is only one bank left to buy up the spoils!

Dann E. Kroeger is a long-term thinker.

Image: pasja1000 via Pixabay, Pixabay License.

Dem Rep. Boyle: We ‘Don’t Know the Full Extent of the Banking Crisis’

On Tuesday’s broadcast of MSNBC’s “Andrea Mitchell Reports,” Rep. Brendan Boyle (D-PA) stated that there is a “banking crisis” that we still do not know the true extent of.

While discussing a letter from Democrats in Congress urging the Federal Reserve to pause interest rate hikes, Boyle stated, “I respect the independence of the Fed. They are obviously going to independently make that decision. But it doesn’t preclude me or any other member of Congress or any other citizen from speaking up and pointing out that the Fed has raised rates so steeply, so quickly that that is having a profound effect on our economy. By their own measures, they are going to cause unemployment as a result of what they’re doing, an increase in unemployment, for which they have no real response. So, I believe a pause here is appropriate. We still, as we’ve been reminded today, don’t know the full extent of the banking crisis. So, I think a pause would be a wise decision. We do not want to have a mistake of going so extreme in the rate hikes that we end up bringing about a recession that is completely unnecessary.”

Follow Ian Hanchett on Twitter @IanHanchett

Durbin: Taxpayers Are Paying $13 Billion to Save First Republic Bank

On Monday’s broadcast of “CNN News Central,” Senate Majority Whip Sen. Dick Durbin (D-IL) stated that the $13 billion loss that the FDIC is taking on the seizure of First Republic Bank is “$13 billion in taxpayers’ money” that the federal government put into First Republic Bank to ensure that it “did not fail and cause some recession in this economy.”

While discussing the debate over raising the debt ceiling between President Joe Biden and House Speaker Rep. Kevin McCarthy (R-CA), Durbin said, “Speaker McCarthy is playing a dangerous game. Look at this First Republic Bank, we put $13 billion in taxpayers’ money there to make sure that this bank did not fail and cause some recession in this economy. There’s a lot at stake here, with a small — literally small bank in comparison to the national economy, $23 trillion, and the debt ceiling debate that McCarthy is trying to use for political purposes. This is totally irresponsible. If he defaults, if he even gets close to default, if there’s a serious threat of default, it’s going to have an impact on this economy, on business, on growth, as well as the number of jobs across America. We shouldn’t play this dangerous game. The President’s right.”

Follow Ian Hanchett on Twitter @IanHanchett

President Obama agrees: Abysmal failure should be rewarded with promotion. He's leaving no shady banking buddy behind.

In May 2012, only days after JPMorgan Chase’s Jamie Dimon revealed that his bank had lost billions of dollars in speculative bets, President Barack Obama publicly defended the multi-millionaire CEO, calling him “one of the smartest bankers we’ve got.” What

Obama did not mention is that Dimon is a criminal.

“This was not because of difficulties in securing indictments or

convictions. On the contrary, Attorney General Eric Holder

told a Senate committee in March of 2013 that the Obama

administration chose not to prosecute the big banks or their

CEOs because to do so might “have a negative impact on the

national economy.”

CUT AND PASTE YOUTUBE LINKS

Jamie Dimon - The Most Powerful Banker in America | Full Documentary

https://www.youtube.com/watch?v=AkHbB9GuCkE

Obama’s Favorite Bank Gives January 6 Committee Trump Aide’s Private Records

17 AP/Haraz N. Ghanbari

AP/Haraz N. Ghanbari

30 Dec 20210

2:58

JP Morgan Chase, which then-President Barack Obama singled out for praise in 2012, has delivered the banking records of Trump spokesman Taylor Budowich to the January 6 committee, despite his objections and pending lawsuit against the bank.

Budowich, according to the Washington Times, was only informed Wednesday that the bank had complied with a committee subpoena. As Breitbart News reported earlier this week, Budowich only found out about the subpoena on December 23, and filed a lawsuit on December 24 challenging the legality and constitutionality of the committee’s subpoena. The bank and the committee did not wait for the courts to rule, and the bank–represented by former Obama administration Attorney General Loretta Lynch — complied with the subpoena, with Budowich only learning about that fact from the federal judge in his case.

Lynch is remembered for a secretive meeting with former President Bill Clinton on the tarmac at an Arizona airport in 2016 while the Department of Justice was investigating his wife, Hillary Clinton, over her handling of State Department emails. That suggested a conflict of interest that eventually caused Lynch to step back from — but not recuse herself from — the case.

Budowich is now filing another lawsuit to force the committee to “disgorge” the financial documents it seized from him. He notes that he had already cooperated voluntarily with the committee until it began pursuing his private banking information.

Several other former Trump aides have sued the committee, which has tried to subpoena their private banking and telephone records without any clear reason for doing so. They have argued that the committee is exceeding its constitutional duty, that it is trying to perform a law enforcement function disguised as a legislative inquiry, and that it has violated the terms of its own enabling resolution by denying Republicans the ability to nominate their own chosen representatives to the committee.

In a statement to the Times, Budowch accused the committee and JP Morgan Chase of a “collaborated strategy” against him.

Obama called JP Morgan Chase “one of the best-managed banks there is,” and praised CEO Jamie Dimon — statements that became even more controversial when it was revealed that he personally had up to $1 million invested in the bank.

Joel B. Pollak is Senior Editor-at-Large at Breitbart News and the host of Breitbart News Sunday on Sirius XM Patriot on Sunday evenings from 7 p.m. to 10 p.m. ET (4 p.m. to 7 p.m. PT). He is the author of the recent e-book, Neither Free nor Fair: The 2020 U.S. Presidential Election. His recent book, RED NOVEMBER, tells the story of the 2020 Democratic presidential primary from a conservative perspective. He is a winner of the 2018 Robert Novak Journalism Alumni Fellowship. Follow him on Twitter at @joelpollak.

(Reuters)—JPMorgan Chase & Co, the biggest U.S. bank by assets, said on Monday it will buy most of First Republic Bank's assets after U.S. regulators seized the troubled bank.

The collapse marks the third major U.S. lender to fail in less than two months, after a week of panic which saw First Republic lose 75% of its market value as its future turned murkier.

Here is what analysts are saying about the rescue deal:

JAMEEL AHMAD, CHIEF ANALYST AT COMPAREBROKER.IO

"Confidence in the banking sector has now weakened further, which means that investors should expect for financial markets to remain on the defensive."

"Assets such as the U.S. dollar and Japanese yen will be on the radar as traders look for an asset of safety. Gold prices in particular have been on a gradual incline for much of 2023 so far, and such worrying indications of more stress in the banking sector can be viewed as a potential catalyst to add the needed fuel to a rally that has run out of fumes in recent weeks."

"As controversial as it will be, bitcoin price reaction should also be watched in the event that this confidence crisis leads traders to seek an unconventional asset."

"This development will most likely not prevent the Fed from raising U.S. interest rates this week as largely expected. However, what investors will want to hear from the U.S Federal Reserve and Chair Jerome Powell specifically is what the central bank really thinks about the clear stresses visible within the banking sector."

BARCLAYS

"For JPM, we believe the purchase is modestly accretive to EPS and tangible book value, has manageable risk and can be additive to its wealth management franchise."

"This marks second largest failure on record. Still, unlike Silicon Valley Bank and Signature Bank, the FDIC had a buy waiting in the wings. In fact, the FDIC noted it was a highly competitive bidding process."

"In addition, the FDIC estimates that the cost to the Deposit Insurance Fund (DIF) of FRC will be about $13 billion. This appears less than expected ... while it's never a good thing to see a bank fail, this process appears much smoother than the prior two."

R. SCOTT SIEFERS, MANAGING DIRECTOR, AND FRANK WILLIAMS, RESEARCH ANALYST AT PIPER SANDLER

"The deal includes modest financial benefits, but to us it is more significant for the reputational benefits insofar as it further solidifies JPM as the go-to industry leader in times of turmoil."

"JPM has now positioned itself as an industry champion through two crises (buying Bear Stearns and Washington Mutual during the financial crisis, and now FRC this time around). It had already been the go-to deposit destination for nervous customers, and now it is officially taking a problem institution out of the game and easing concerns again."

"The only worry we have is the at-present unknowable. JPM was already a hugely significant player that has now managed to make itself even more so at a time when 'too-big-to-fail' is still a political concern. We have a tough time imagining what one might find to criticize about an enormously strong bank that was apparently the best-positioned name in the country to deal with turmoil, but we would not be surprised to see some sort of unfortunate blow-back at some point."

THOMAS HAYES, CHAIRMAN AND MANAGING MEMBER AT GREAT HILL CAPITAL

"When it was just SVB, it was easy to blame management. However, now that we see the pattern it is evident that the Fed has moved too far, too fast and is breaking things."

"While the market has priced in another hike this week, we think the developments over the weekend will cause the FOMC (Federal Open Market Committee) to be more prudent with their guidance and respect the message of the market."

"We would not be surprised to see a 'pause' after this final hike. Markets should take today's news in stride knowing that the repeated bank failures should now have the Fed back on its heels and defanged moving forward."

(Reporting by Manya Saini, Siddarth S, Reshma Rockie George and Arpan Varghese in Bengaluru; Compiled by Niket Nishant; Edited by Shounak Dasgupta)

Both of Obama’s Attorney Generals, Eric Holder and Loretta Lynch, were chosen by the banks because they were from law firms that had long protected big banks from their victims.

A key factor in Obama’s newfound and growing

wealth are those who profited from his

presidency. A number of his public speeches

have been given to big Wall Street firms and

investors. Obama has given at least nine

speeches to Cantor Fitzgerald, a large

investment and commercial real estate firm, and

other high-end corporations. According to

records, each speech has been at least $400,000 a

clip.

OBAMA CRONY DONORS Goldman Sachs, JPMorgan Chase, Bank of America and every other major US bank have been implicated in a web of scandals, including the sale of toxic mortgage securities on false pretenses, the rigging of international interest rates and global foreign exchange markets, the laundering of Mexican drug money, accounting fraud and lying to bank regulators, illegally foreclosing on the homes of delinquent borrowers, credit card fraud, illegal debt-collection practices, rigging of energy markets, and complicity in the Bernie Madoff Ponzi scheme.

THE LONG HISTORY of BARACK OBAMA and HIS CRIMINAL

BANKSTER DONORS JP MORGAN… STILL LOOTING AMERICA

AND THE WORLD!

http://mexicanoccupation.blogspot.com/2013/06/president-barack-obamas-crony-bankster.html

This is the unadulterated voice of finance capital speaking. It should be recalled that JPMorgan is deeply implicated in the speculative operations that have devastated the lives of hundreds of millions of workers around the world. In March of this year, a US Senate committee released a 300-page report documenting the criminal practices and fraud carried out by JPMorgan, the largest bank in the US and the world’s biggest dealer in derivatives. Despite the detailed revelations in the report, no action will be taken against the bank’s CEO, Jamie who enjoys the personal confidence of the US president.

assault on America – THE OBAMA – JP MORGAN

Rather than Hope and Change, Obama is delivering corporate socialism to America, all while claiming he’s battling corporate America. It’s corporate welfare and regulatory robbery—it’s Obamanomics.

“Records show that four out of Obama's top five contributors are employees of financial industry giants - Goldman Sachs ($571,330), UBS AG ($364,806), JPMorgan Chase ($362,207) and Citigroup ($358,054).”

Why aren’t the Wall Street criminals prosecuted?

In May 2012, only days after JPMorgan Chase’s Jamie Dimon revealed that his bank had lost billions of dollars in speculative bets, President Barack Obama publicly defended the multi-millionaire CEO, calling him “one of the smartest bankers we’ve got.” What Obama did not mention is that Dimon is a criminal.

http://mexicanoccupation.blogspot.com/2014/01/why-arent-wall-street-criminals.html

JPMorgan is not the exception; it is the rule. Virtually every major bank that operates on Wall Street has settled charges of fraud and criminality on a staggering scale. In 2011, the Senate Permanent Subcommittee on Investigations released a 630-page report on the financial crash of 2008 documenting what the committee chairman called “a financial snake pit rife with greed, conflicts of interest and wrongdoing.”

These multiple crimes by serial lawbreakers have had very real and very destructive consequences. The entire world has been plunged into an economic slump that has already lasted more than five years and shows no signs of abating. Tens of millions of families have lost their homes as a result of predatory mortgages pushed by JPMorgan and other Wall Street banks.

INCEST! The case of bankster-owned Barack

Obama and crony Jamie Dimon of JP

MORGAN… their looting continues!

http://mexicanoccupation.blogspot.com/2014/02/incest-case-of-bankster-owned-barack.html

INCEST! THE CASE OF BANKSTER-OWNED BARACK OBAMA and CRONY JAMIE DIMON

- White House sued for covering up crimes of JPMorgan

White House sued for covering up crimes of JPMorgan

OBAMA’S CRONY BANKSTERS PARTY UP AND STILL GIVE THE AMERICAN PEOPLE THE MIDDLE FINGER

http://mexicanoccupation.blogspot.com/2014/02/obamas-crony-banksters-give-american.html

'Not when those foibles had resulted in real harm to millions of people in the form of foreclosures, wrecked 401(k)s, and a devastating unemployment crisis.'

For much of Obama’s tenure, Jamie Dimon was known as the White House’s “favorite banker.” According to White House logs, Dimon visited the White House at least 18 times, often to talk to his former subordinate at JPMorgan, William Daley, who had been named White House chief of staff by Obama after the Democratic rout in the 2010 elections.

Sanders called JPMorgan’s CEO America’s "biggest corporate socialist" — here’s why he has a point

Sen. Bernie Sanders called JPMorgan CEO Jamie Dimon the “biggest corporate socialist in America today” in recent ad

PAUL ADLER

FEBRUARY 13, 2020 9:59AM (UTC)

This article was originally published on The Conversation.![]()

Sen. Bernie Sanders called JPMorgan Chase CEO Jamie Dimon the "biggest corporate socialist in America today" in a recent ad.

He may have a point — beyond what he intended.

With his Dimon ad, Sanders is referring specifically to the bailouts JPMorgan and other banks took from the government during the 2008 financial crisis. But accepting government bailouts and corporate welfare is not the only way I believe American companies behave like closet socialists despite their professed love of free markets.

In reality, most big U.S. companies operate internally in ways Karl Marx would applaud as remarkably close to socialist-style central planning. Not only that, corporate America has arguably become a laboratory of innovation in socialist governance, as I show in my own research.

Closet socialists

In public, CEOs like Dimon attack socialist planning while defending free markets.

But inside JPMorgan and most other big corporations, market competition is subordinated to planning. These big companies often contain dozens of business units and sometimes thousands. Instead of letting these units compete among themselves, CEOs typically direct a strategic planning process to ensure they cooperate to achieve the best outcomes for the corporation as a whole.

This is just how a socialist economy is intended to operate. The government would conduct economy-wide planning and set goals for each industry and enterprise, aiming to achieve the best outcome for society as a whole.

And just as companies rely internally on planned cooperation to meet goals and overcome challenges, the U.S. economy could use this harmony to overcome the existential crisis of our age — climate change. It's a challenge so massive and urgent that it will require every part of the economy to work together with government in order to address it.

Overcoming socialism's past problems

But, of course, socialism doesn't have a good track record.

One of the reasons socialist planning failed in the old Soviet Union, for example, was that it was so top-down that it lacked the kind of popular legitimacy that democracy grants a government. As a result, bureaucrats overseeing the planning process could not get reliable information about the real opportunities and challenges experienced by enterprises or citizens.

Moreover, enterprises had little incentive to strive to meet their assigned objectives, especially when they had so little involvement in formulating them.

A second reason the USSR didn't survive was that its authoritarian system failed to motivate either workers or entrepreneurs. As a result, even though the government funded basic science generously, Soviet industry was a laggard in innovation.

Ironically, corporations — those singular products of capitalism — are showing how these and other problems of socialist planning can be surmounted.

Take the problem of democratic legitimacy. Some companies, such as General Electric, Kaiser Permanente and General Motors, have developed innovative ways to avoid the dysfunctions of autocratic planning by using techniques that enable lower-level personnel to participate actively in the strategy process.

Although profit pressures often force top managers to short-circuit the promised participation, when successfully integrated it not only provides top management with more reliable bottom-up input for strategic planning but also makes all employees more reliable partners in carrying it out.

So here we have centralization — not in the more familiar, autocratic model, but rather in a form I call "participative centralization." In a socialist system, this approach could be adopted, adapted and scaled up to support economy-wide planning, ensuring that it was both democratic and effective.

As for motivating innovation, America's big businesses face a challenge similar to that of socialism. They need employees to be collectivist, so they willingly comply with policies and procedures. But they need them to be simultaneously individualistic, to fuel divergent thinking and creativity.

One common solution in much of corporate America, as in the old Soviet Union, is to specialize those roles, with most people relegated to routine tasks while the privileged few work on innovation tasks. That approach, however, overlooks the creative capacities of the vast majority and leads to widespread employee disengagement and sub-par business performance.

Smarter businesses have found ways to overcome this dilemma by creating cultures and reward systems that support a synthesis of individualism and collectivism that I call "interdependent individualism." In my research, I have found this kind of motivation in settings as diverse as Kaiser Permanent physicians, assembly-line workers at Toyota's NUMMI plant and software developers at Computer Sciences Corp. These companies do this, in part, by rewarding both individual contributions to the organization's goals as well as collaboration in achieving them.

While socialists have often recoiled against the idea individual performance-based rewards, these more sophisticated policies could be scaled up to the entire economy to help meet socialism's innovation and motivation challenge.

Big problems require big government

The idea of such a socialist transformation in the U.S. may seem remote today.

But this can change, particularly as more Americans, especially young ones, embrace socialism. One reason they are doing so is because the current capitalist system has so manifestly failed to deal with climate change.

Looking inside these companies suggests a better way forward — and hope for society's ability to avert catastrophe.

Paul Adler, Professor of Management and Organization, Sociology and Environmental Studies, University of Southern California

This article is republished from The Conversation under a Creative Commons license.

Why aren’t the Wall Street criminals prosecuted?

In May 2012, only days after JPMorgan Chase’s Jamie Dimon revealed that his bank had lost billions of dollars in speculative bets, President Barack Obama publicly defended the multi-millionaire CEO, calling him “one of the smartest bankers we’ve got.” What Obama did not mention is that Dimon is a criminal.

http://mexicanoccupation.blogspot.com/2014/01/why-arent-wall-street-criminals.html

JPMorgan is not the exception; it is the rule. Virtually every major bank that operates on Wall Street has settled charges of fraud and criminality on a staggering scale. In 2011, the Senate Permanent Subcommittee on Investigations released a 630-page report on the financial crash of 2008 documenting what the committee chairman called “a financial snake pit rife with greed, conflicts of interest and wrongdoing.”

These multiple crimes by serial lawbreakers have had very real and very destructive consequences. The entire world has been plunged into an economic slump that has already lasted more than five years and shows no signs of abating. Tens of millions of families have lost their homes as a result of predatory mortgages pushed by JPMorgan and other Wall Street banks.

Amid poverty wages and tax cuts for the rich

"This decades-long ruling class offensive was accelerated in response to the 2008 financial crisis. President Barack Obama oversaw the channeling of trillions of dollars to the banks and financial markets in order to pay off the debts of the bankers and speculators, whose reckless and criminal activities had led to the crisis, and make them richer than ever. At the same time, he imposed a restructuring of the auto industry based on a 50 percent across-the-board pay cut for new-hires and an expansion of temporary and part-time labor,"

The devastating human cost of the plundering of society by the corporate-financial oligarchy is registered in declining life expectancy, rising mortality and record suicide and drug addiction rates.

BARACK OBAMA AND HIS CRONY BANKSTERS set themselves on America’s pensions next!

http://mexicanoccupation.blogspot.com/2015/04/obamanomics-assault-on-american-middle.html

The new aristocrats, like the lords of old, are not bound by the laws that apply to the lower orders. Voluminous reports have been issued by Congress and government panels documenting systematic fraud and law breaking carried out by the biggest banks both before and after the Wall Street crash of 2008.

Goldman Sachs, JPMorgan Chase, Bank of America and every other major US bank have been implicated in a web of scandals, including the sale of toxic mortgage securities on false pretenses, the rigging of international interest rates and global foreign exchange markets, the laundering of Mexican drug money, accounting fraud and lying to bank regulators, illegally foreclosing on the homes of delinquent borrowers, credit card fraud, illegal debt-collection practices, rigging of energy markets, and complicity in the Bernie Madoff Ponzi scheme.

JPMorgan Chase records the biggest profit of any bank in US history

JPMorgan Chase, the most valuable private bank in the world, made $36.4 billion in 2019, the biggest annual profit of any bank in American history. The news, reported Tuesday, sent the company’s stock up by 2 percent. In the fourth quarter of 2019, the company took in $8.5 billion, also a record, making it the tenth largest publicly traded company in the world, with a market cap of $437 billion.

JPMorgan Chase’s record profits were joined by Morgan Stanley, which also reported both record profits and record revenues for 2019, sending its stock price surging 6.6 percent on Thursday.

News of these record gains came as the six largest US banks revealed that they saved a combined $32 billion last year from President Donald Trump’s 2017 corporate tax cut. The tax windfall was up from 2018 for all but one of the banks. JPMorgan’s tax cut went from $3.7 billion in 2018 to $5 billion last year.

At Wednesday’s signing ceremony for the phase one trade deal with China, attended by an array of corporate executives, Trump turned to Mary Erdoes, a top executive at JPMorgan Chase. Calling the bank’s earnings report “incredible,” he joked, “Will you say, ‘Thank you, Mr. President,’ at least?”

The tax cuts for the corporations and the rich,

enacted with only token opposition from the

Democrats, are only one factor in the surge

in profits over the past year. When stocks

plunged at the end of 2018, Trump stepped

up his demand that the Federal Reserve

reverse its policy of gradually raising interest

rates to more normal levels, following years

of near-zero rates in the aftermath of the 2008

financial crisis. Acting as the mouthpiece of

Wall Street, he demanded that the Fed begin

cutting rates once again in order to pump

more cash into the financial markets.

Fed Chairman Jerome Powell dutifully complied, cutting interest rates three times in 2018 and assuring the markets that he had no intention of raising them again any time soon. Then, beginning in the late fall, the Fed began pumping tens of billions of dollars a week into the so-called “repo” overnight loan market, resuming the money-printing operation known as “quantitative easing.”

This de facto guarantee of unlimited public funds to backstop stock prices has produced record highs on all of the major US indexes, sending billions more into the private coffers of the rich and the super-rich.

These measures are a continuation and intensification of policies carried out on a bipartisan basis for four decades to redistribute wealth from the working class to the corporations and the financial elite. They have effected a fundamental restructuring of class relations in America, drastically lowering the social position of the working class. Decent-paying, secure jobs have been wiped out and largely replaced by poverty-wage, part-time, temporary and contingent employment—the so-called “gig” economy exemplified by corporations such as Amazon and Uber.

This decades-long ruling class offensive was accelerated in response to the 2008 financial crisis. President Barack Obama oversaw the channeling of trillions of dollars to the banks and financial markets in order to pay off the debts of the bankers and speculators, whose reckless and criminal activities had led to the crisis, and make them richer than ever. At the same time, he imposed a restructuring of the auto industry based on a 50 percent across-the-board pay cut for new-hires and an expansion of temporary and part-time labor.

The United Auto Workers (UAW) has actively participated in this process, enshrining the new “flexible” labor system in sellout contracts in 2015 and 2019. This template of expendable, benefits-free labor has become the new norm for labor relations across the country and throughout the world.

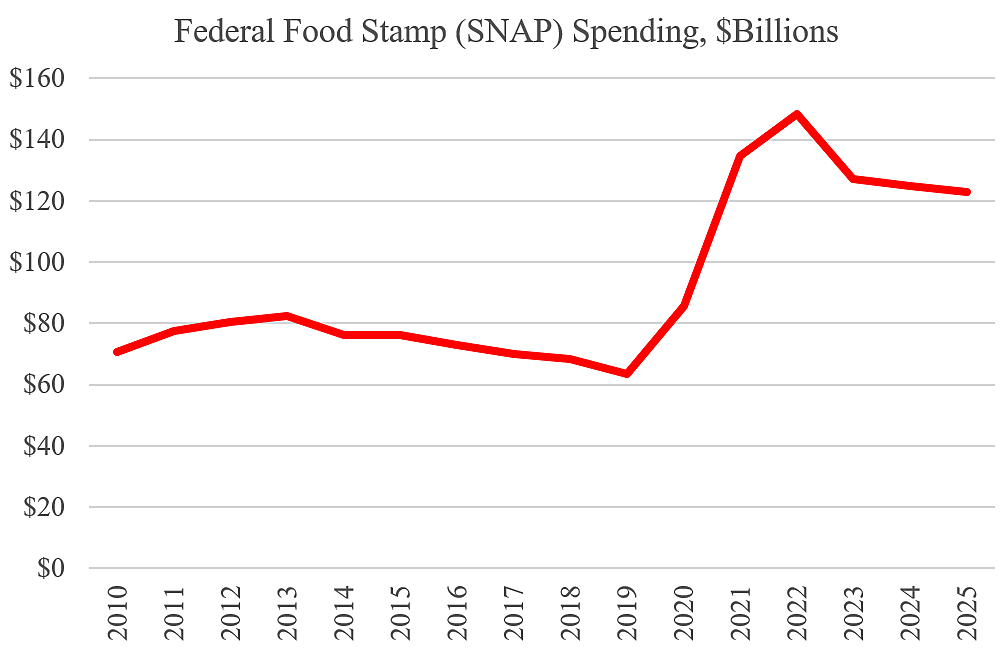

Meanwhile, state, local and federal government programs have been dramatically slashed. Education, housing, Medicaid and food stamps have been particularly hard hit. This process has been accelerated under Trump, along with the removal of occupational safety and environmental regulations, with no opposition from the Democrats, who represent sections of the financial elite and wealthy upper-middle class.

The devastating human cost of the plundering

of society by the corporate-financial oligarchy

is registered in declining life expectancy,

rising mortality and record suicide and drug

addiction rates. A recent study by the Brookings

Institution found that 53 million people in the US—44 percent of

all workers—“earn barely enough to live on.” The study found that

the median pay of this group was $10.22 per hour, around

$18,000 a year. Thirty seven percent of those making $10 an

hour have children. More than half are the primary earners or

“contribute substantially” to family income.

Similarly, a Reuters report from 2018 found that the average income of the bottom 40 percent of workers in the United States was $11,600.

A recent study by Trust for America’s Health found that in 2017 “more than 152,000 Americans died from alcohol- and drug-induced fatalities and suicide.” This was highest number ever recorded and more than double the figure for 1999. Among those in their 20s and early 30s, the prime working life age, drug deaths have increased more than 400 percent in the last 20 years.

At the other pole of society, the Dow Jones Industrial index is now double what it was at its peak in 2007, prior to the implosion of the financial system. Between March 2009 and today, the Dow has risen from 6,500 to over 29,000. The stock market, buttressed by central bank and government policy, has become the central instrument for funneling wealth from the bottom of society to the top. As a result, the top 10 percent of society now owns about 70 percent of all wealth, whereas the bottom 50 percent has, effectively, nothing.

In the midst of this orgy of wealth accumulation at the very top of society, every demand of workers for jobs, decent pay, education, housing, health care and pensions is met with the universal response: “There is no money.” Hundreds of thousands of teachers have struck over the past two years to demand the restoration of funds cut from the public schools and substantial increases in pay and benefits. None of their demands have been met. The same applies to auto workers who struck for 40 days last fall to demand an end to two-tier pay systems and the defense of jobs.

JPMorgan’s $36.4 billion profit in 2019 is more than half the education budget of the US federal government.

Meanwhile, Americans are deeper in debt to JPMorgan and the other banks than at any time in history. Collective consumer debt in the United States approached $14 trillion last year. Credit card debt has surpassed $1 trillion for the first time. Auto debt is at $1.3 trillion and mortgage debt is now $9.4 trillion. Student loan debt has increased the fastest, surging from $500 billion in 2006 to $1.6 trillion today.

These are the conditions, rooted in the historical bankruptcy and crisis of the capitalist system, that have sparked a global upsurge in the class struggle and the growth of anti-capitalist and pro-socialist sentiment. The past year has seen a dramatic expansion of working class struggle that is only a glimpse of what is to come. India, Hong Kong, Mexico, the United States, Puerto Rico, Lebanon, Iraq, France, Chile and Brazil are only some of the places where mass struggles have erupted.

What is becoming increasingly clear to hundreds of millions of people around the world is that the social problems confronting humanity in the 21st century—poverty, debt, disease, global warming, war, fascism, the assault on democratic rights—cannot be solved so long as this parasitic and oligarchical financial elite continues to rule. The turn is to the American and international working class—to unite, take power and seize control of the wealth which it produces to ensure peace, prosperity and equality for all people.

PRITZKER - OBAMA ADDS TO HIS HAREM OF CORRUPT BANKSTERS

THE BANKSTER-OWNED PRESIDENT

(THE LIST BELOW, WHICH DOESN’T MENTION TIM GEITHNER IS ONLY A DROP ON THE BOTTOMLESS BUCKET OF BANKSTER CRIMINALS EMPLOYED BY BARACK OBAMA)

If confirmed, Pritzker will join a cabinet that includes Kerry and Treasury Secretary Jacob Lew, who earned millions of dollars as an executive at Citigroup by betting against the housing market as it collapsed. Mary Jo White, Obama’s chairman of the Security and Exchange Commission (SEC)—the federal agency tasked with regulating the exchange of stocks and other securities—made millions as an attorney for banks including Bank of America and JP Morgan during the financial crash

“Obama gave his own personal seal of ethical approval, telling deep-pocketed donors this week: "I appreciate his strong sense of advocacy for ordinary Americans. You can trust him -- you can count on him." Uh-huh. And I've got a bridge to Hope and Change to sell you.”

PRITZKER - OBAMA ADDS TO HIS HAREM OF CORRUPT BANKSTERS

THE BANKSTER-OWNED PRESIDENT

(THE LIST BELOW, WHICH DOESN’T MENTION TIM GEITHNER IS ONLY A DROP ON THE BOTTOMLESS BUCKET OF BANKSTER CRIMINALS EMPLOYED BY BARACK OBAMA)

If confirmed, Pritzker will join a cabinet that includes Kerry and Treasury Secretary Jacob Lew, who earned millions of dollars as an executive at Citigroup by betting against the housing market as it collapsed. Mary Jo White, Obama’s chairman of the Security and Exchange Commission (SEC)—the federal agency tasked with regulating the exchange of stocks and other securities—made millions as an attorney for banks including Bank of America and JP Morgan during the financial crash

OBAMA’S CRONY CAPITALISM – A NATION RULED BY CRIMINAL WALL STREET BANKSTERS AND OBAMA DONORS

Culture of Corruption: Obama and His Team of Tax Cheats, Crooks, and Cronies

by Michelle Malkin

Editorial Reviews

In her shocking new book, Malkin digs deep into the records of President Obama's staff, revealing corrupt dealings, questionable pasts, and abuses of power throughout his administration.

OBAMA HAS ALWAYS SERVED THE BILLIONAIRES AND BANKSTERS CLASS. It’s the rest of us who get the tax bills for their crimes, bailouts and handouts!

Senators forgive Penny Pritzker’s $80 million “mistake”

By Zac Corrigan

On the eve of her confirmation hearing, President Obama’s nominee for commerce secretary, Penny Pritzker, admitted that she had underreported her 2012 income to the tune of $80 million, blaming a clerical error. Pritzker is worth an estimated $1.85 billion and would become the wealthiest US cabinet member in history. Her nomination underscores the increasingly plutocratic character of the Obama administration and the US government at large.

The $80 million in earnings that had been omitted were related to Pritzker’s role managing trust funds—financial instruments used by wealthy families to control vast sums of money across generations—and $54 million of it was related to an offshore fund based in the Bahamas. This admission comes in the wake of a recent study showing that as of 2012, wealthy Americans are hoarding up to $32 trillion in offshore accounts to avoid paying taxes.

Pritzker has played an important role in the Democratic Party’s own finances for years. She was the chair of Obama’s 2008 campaign finance team, which raised over $778 million, a record at the time. She went on to co-chair—along with Chicago Mayor and former Obama chief of staff Rahm Emanuel—the president’s 2012 re-election campaign, which raised over $1 billion. She contributed $250,000 to Obama’s 2013 inauguration festivities. She is also a member of Obama’s Jobs Council, which advises the president on economic matters.

Pritzker’s record shows that Obama could hardly have picked someone more versed in the intricacies of modern financial swindling, nor more deeply immersed in the opulent world of the global elite, to “foster, promote, and develop the foreign and domestic commerce”—such is the stated mission of the US Department of Commerce which she will head, pending congressional approval.

To begin with, Pritzker’s family is one of the wealthiest in Chicago. She is heiress to the Hyatt hotels fortune. She is a director of Hyatt Hotels Corp, which operates the luxury hotel chain and nursing homes, and whose profits are based on low-wage service work. A 53-year-old Hyatt hotel housekeeper who attended the hearing told the Chicago Tribune that she cleans 16 rooms a day for $14.60 an hour with no paid lunch break, and is working under an expired contract.

Especially scandalous is Pritzker’s involvement in the 2001 collapse of Superior Bank of Chicago, where as CEO she pioneered the predatory subprime lending practices that would lead to the financial crash of 2008. In May of 2001, Pritzker told bank employees in a written letter, “Our commitment to subprime lending has never been stronger and we are fully expecting to participate in restoring the bank’s presence.”

Two months later, Superior was closed and its $1.1 billion in paper assets were sold for $52 million to Charter One Financial, Inc. Depositors collectively lost millions of dollars that will never be repaid, while Pritzker and family nonetheless pocketed close to $200 million during their ownership of the bank.

When Senator John Thune (R-South Dakota) broached the subject of Superior at Thursday’s confirmation hearing, Pritzker’s crocodile tears seemed to satisfy. “I regret the failure of Superior Bank,” she said, calling it a situation she felt “very badly about.” Thune later commented, “I’m very impressed with her qualifications,” and told reporters he expected the committee to vote in favor of her nomination.

Pritzker was treated with kid gloves by senators at the hearing. When Illinois senators Dick Durbin (D) and Mark Kirk (R ) introduced her to the committee before the hearing, Kirk called her “a vibrant part of the Jewish world,” and Durbin noted admiringly that not only had she “inherited a few dollars,” but also she had “made a few dollars in her life.” Other senators who praised Pritzker during and after the hearing include Ted Cruz (R-Texas) who called her an “enthusiastic and unapologetic advocate of free trade,” and Roy Blunt (R-Missouri) who told the hotel heiress, “You know more about [foreign tourism] than most anyone else in this room.”

It is no mystery why senators from both parties are so enamored. Over half of them are millionaires, some many times over. In 2011, the median net worth of the Senate was $2.63 million. The chair of the Senate committee reviewing her nomination is Jay Rockefeller (D-West Virginia), great-grandson of Standard Oil tycoon John D. Rockefeller, net worth $86 million. John Kerry, who left the senate in February to become Obama’s new secretary of state, is worth many hundreds of millions through his wife’s inheritance of the Heinz Foods fortune.

This is a government of and for the rich. In an epoch of historic and ever-increasing levels of social inequality, profit is more and more acquired through risky financial speculation increasingly divorced from the production of real value. In politics, the ruling elite no longer feels it necessary to give lip service to government “of, by and for the people,” and multimillionaires and billionaires take on direct responsibility for running the government, setting policy and making and enforcing regulations.

THE BANKSTER-OWNED PRESIDENT

If confirmed, Pritzker will join a cabinet that includes Kerry and Treasury Secretary Jacob Lew, who earned millions of dollars as an executive at Citigroup by betting against the housing market as it collapsed. Mary Jo White, Obama’s chairman of the Security and Exchange Commission (SEC)—the federal agency tasked with regulating the exchange of stocks and other securities—made millions as an attorney for banks including Bank of America and JP Morgan during the financial crash

Pritzker of the 1% serving Obama serve the 1%. THE INCEST OF OBAMA AND HIS CRONY CAPITALIST

http://mexicanoccupation.blogspot.com/2013/05/pritzker-of-1-serving-obama-serving-1.html

OBAMA and his culture of BANKSTER LOOTING of America.

Is Penny Pritzker Obama’s newest BRIBESTER BANKSTER?

Obama warns against “cynicism” at Ohio State commencement address

http://mexicanoccupation.blogspot.com/2013/05/obama-warns-against-cynicismat-ohio.html

“Pritzker has garnered broad support from Democrats and groups such as the U.S. Chamber of Commerce and the Business Roundtable.”... these entities endorse Obama's assault on the American worker, our borders for more illegals, the Obama amnesty hoax to keep wages depressed and NO E-VERIFY!

PRITZKER IS ALL THE ABOVE!

“Pritzker has garnered broad support from Democrats and groups such as the U.S. Chamber of Commerce and the Business Roundtable.”

OBAMA’S BILLIONAIRE NOMINEE FOR COMMERCE, PENNY PRITZKER… BILLION$$$$ MADE OFF HIRING CHEAP ILLEGAL LABOR??? show me even one dem billionaire that does not push for Obama’s agenda of OPEN BORDERS, NO E-VERIFY and NO ENFORCEMENT of LAWS PROHIBITING THE EMPLOYMENT of ILLEGALS…even one!

http://mexicanoccupation.blogspot.com/2013/05/crony-capitalism-obama-nominates.html

Based in Chicago, Pritzker operates an international empire based on low-wage service work in Hyatt-operated hotels and nursing homes, along with several investment firms.

Pritzker has garnered broad support from Democrats and groups such as the U.S. Chamber of Commerce and the Business Roundtable.”... these entities endorse Obama's assault on the American worker, our borders for more illegals, the Obama amnesty hoax to keep wages depressed and NO E-VERIFY!

PRITZKER IS ALL THE ABOVE!

ARE AMAZED AT HOW UTTERLY BRAZEN THESE CORPORATE OWNED POLITICIANS ARE?

GET THIS BOOK!

Culture of Corruption: Obama and His Team of Tax Cheats, Crooks, and Cronies

by Michelle Malkin

Editorial Reviews

In her shocking new book, Malkin digs deep into the records of President Obama's staff, revealing corrupt dealings, questionable pasts, and abuses of power throughout his administration.

From the Inside Flap

The era of hope and change is dead....and it only took six months in office to kill it.

Never has an administration taken office with more inflated expectations of turning Washington around. Never have a media-anointed American Idol and his entourage fallen so fast and hard. In her latest investigative tour de force, New York Times bestselling author Michelle Malkin delivers a powerful, damning, and comprehensive indictment of the culture of corruption that surrounds Team Obama's brazen tax evaders, Wall Street cronies, petty crooks, slum lords, and business-as-usual influence peddlers. In Culture of Corruption, Malkin reveals:

* Why nepotism beneficiaries First Lady Michelle Obama and Vice President Joe Biden are Team Obama's biggest liberal hypocrites--bashing the corporate world and influence-peddling industries from which they and their relatives have benefited mightily

* What secrets the ethics-deficient members of Obama's cabinet--including Hillary Clinton--are trying to hide

* Why the Obama White House has more power-hungry, unaccountable "czars" than any other administration

* How Team Obama's first one hundred days of appointments became a litany of embarrassments as would-be appointee after would-be appointee was exposed as a tax cheat or had to withdraw for other reasons

* How Obama's old ACORN and union cronies have squandered millions of taxpayer dollars and dues money to enrich themselves and expand their power

* How Obama's Wall Street money men and corporate lobbyists are ruining the economy and helping their friends In Culture of Corruption, Michelle Malkin lays bare the Obama administration's seamy underside that the liberal media would rather keep hidden.

• ISBN-10: 1596981091

• ISBN-13: 978-1596981096

Michelle Malkin

No Shady Banking Buddy Left Behind

First Lady Michelle Obama's latest overseas jaunt is getting all the headlines. But President Obama's money-grubbing junket to Chicago may cost taxpayers far more in the long run. With his Gaultier-clad wife sashaying around the Spanish seaside, the lonely fundraiser-in-chief returned to Illinois to take care of some birthday-week business. Job One: Filling the Senate campaign coffers of his corruption-tainted political protege Alexi Giannoulias.

Mission accomplished. Obama's Thursday afternoon campaign event for Giannoulias, the beleaguered state treasurer of Illinois, reportedly raked in $1 million. Lagging behind his GOP opponent, liberal Republican Rep. Mark Kirk, Giannoulias has coveted one-on-one, grip-and-grin time with Obama for months. In addition to the cash, photo-ops and video of the Obama fundraising event that Giannoulias will milk from now until Election Day, the White House has dispatched Vice President Joe Biden, White House senior adviser David Axelrod and White House campaign management guru David Plouffe to boost Giannoulias' bid. Plouffe proclaimed Democrats "all in" for Giannoulias, whom he described as "a great progressive champion."

Obama gave his own personal seal of ethical approval, telling deep-pocketed donors this week: "I appreciate his strong sense of advocacy for ordinary Americans. You can trust him -- you can count on him." Uh-huh. And I've got a bridge to Hope and Change to sell you.

What would Giannoulias know about "ordinary Americans"? Giannoulias, 34, befriended Obama during pickup basketball games with an elite group that also included Michelle Obama's brother, Craig; Chicago edu-crat Arne Duncan (now Education Secretary); and hedge fund manager John Rogers (the ex-husband of the Obamas' ex-White House social secretary, Desiree Rogers). He spread his wealth and influence around early and often to support Obama's fledgling political career. He pitched in $7,000 in 2003-2004 to Obama's Illinois State Senate bids. He hosted fundraisers for Obama's U.S. Senate campaign in 2004 and for his presidential campaign in 2007.

Where'd the cash come from? Giannoulias' Greek immigrant family founded Chicago-based Broadway Bank, a now-defunct financial institution that loaned tens of millions of dollars to convicted mafia felons and faced bankruptcy after decades of engaging in risky, high-flying behavior. It's the place where Obama parked his 2004 U.S. Senate campaign funds. And it's the same place where a mutual friend of Obama and Giannoulias -- convicted Obama fundraiser/slum lord Tony Rezko -- used to bounce nearly $500,000 in bad checks written to Las Vegas casinos. This week, the Chicago Sun-Times revealed an additional $22.75 million Broadway Bank loan to a Rezko-owned business in 2006. Giannoulias held an ownership stake in the bank at the time.

Giannoulias served as Broadway Bank vice president and senior loan officer for four years. According to the Chicago Tribune, during Giannoulias' tenure, some $27 million of Broadway Bank's funny money went to mob crooks Michael "Jaws" Giorango and Demitri Stavropoulos. Giorango is a hustler who fronted a nationwide prostitution ring and was sentenced to six months in prison; Stavropoulos is behind bars for operating a multistate bookmaking ring. Giorango ran the $400-an-hour call girl operation out of high-rise luxury apartments in Chicago with the infamous "Gold Coast Madam," Rose Laws. Giorango and Stavropoulos used their Broadway Bank loans to start their own risky lending business for nontraditional borrowers unable to secure traditional bank financing.

Despite Giorango's criminal record exposed by the Tribune in 2004, Broadway Bank approved massive mortgages for him. Giannoulias' brother, Demetris, explained that as a "relationship bank," Broadway wouldn't just throw someone under the bus because of a "bad article." Instead, the bank went ahead and rubber-stamped a September 2005 loan for $3.4 million to buy a 32-unit Los Angeles apartment complex. The application falsely stated that the borrower, Giorango, had "not been convicted of a felony." Giannoulias oversaw the servicing of such shady loans totaling $11 million. Remember: He was no low-level staffer. He was, as he reminded supporters when he needed to deflect attention away from his youth, top management at Broadway Bank.

In January 2010, the bank entered a consent decree with federal and Illinois state regulators. It required Broadway Bank "to raise tens of millions in capital, stop paying dividends to the family without regulatory approval, and hire an outside party to evaluate the bank's senior management." The city's former inspector general blasted Giannoulias and his family for tapping $70 million worth of dividends in 2007 and 2008 as the real estate crash loomed. Broadway Bank was sitting on an estimated $250 million in bad loans. In late April, federal regulators shut it down. Cost to taxpayers: an estimated $390 million. Giannoulias refused to drop out of the race -- and instead used the company failure to argue that it made him (SET ITAL) more (END ITAL) qualified to serve in office: "I have a renewed vigor and a new perspective on just how horrible it is out there for so many people."

President Obama agrees: Abysmal failure should be rewarded with promotion. He's leaving no shady banking buddy behind.

All of this is, if we can be permitted to use Biden’s catchphrase, “malarkey.” Harris has already proven herself as a trusted servant of the interests of the rich and powerful at the expense of the working class. The Wall Street Journal wrote last week that Wall Street financers had breathed a “sigh of relief” at Biden’s pick of Harris. Industry publication American Banker noted that her steadiest stream of campaign funding has come from financial industry professionals and their most trusted law firms.

.jpg)

.jpg)

Kevin O'Leary: Janet Yellen is facing a moral crisis